Distributed Temperature Sensing Market Size, Share, Trends and Forecast by Fiber Type, Operating Principle, Application, and Region, 2025-2033

Distributed Temperature Sensing Market Size and Trends:

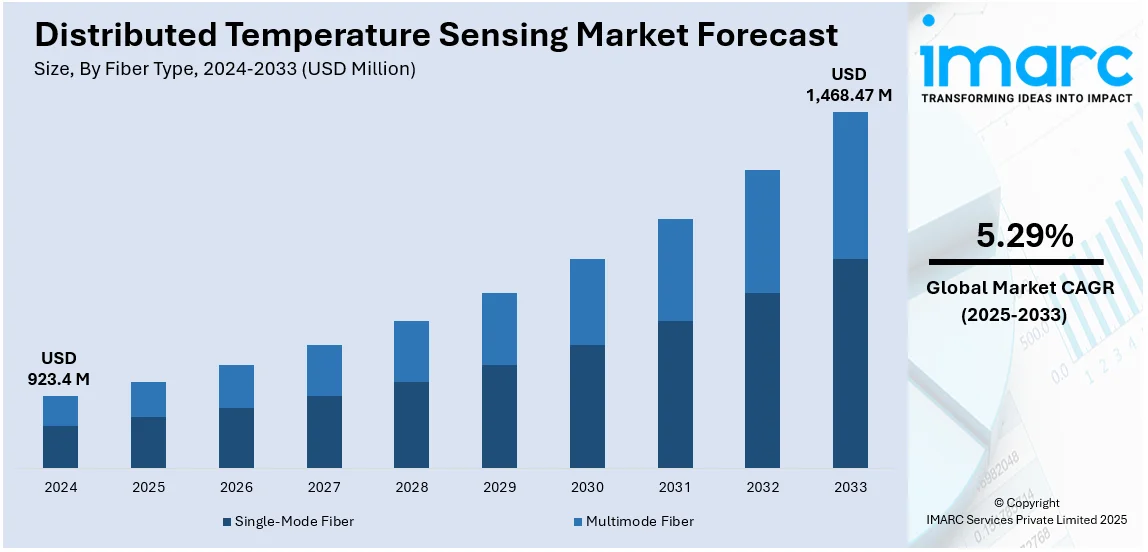

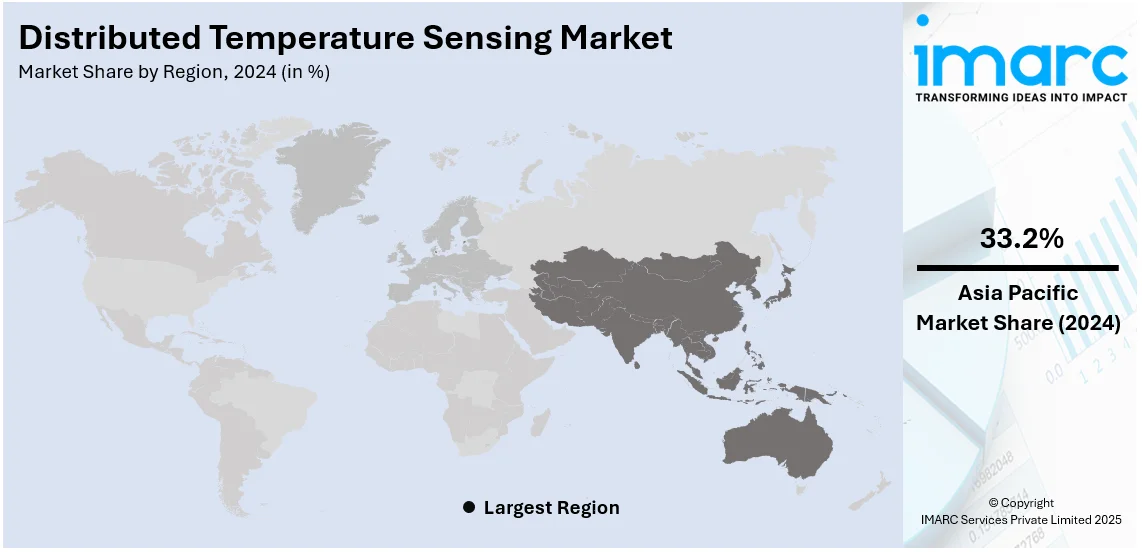

The global distributed temperature sensing market size was valued at USD 923.4 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,468.47 Million by 2033, exhibiting a CAGR of 5.29% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 33.2% in 2024. Significant growth in the oil and gas industry, the implementation of various government initiatives, and extensive research and development (R&D) activities, represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 923.4 Million |

| Market Forecast in 2033 | USD 1,468.47 Million |

| Market Growth Rate (2025-2033) | 5.29% |

The increasing demand for real-time monitoring in critical infrastructure, oil and gas pipelines and power cables to enhance safety and operational efficiency is driving the distributed temperature sensing (DTS) market. Rising adoption in the energy and utilities sector for detecting temperature anomalies and ensuring system reliability boosts distributed temperature sensing market growth. Advancements in optical fiber technology coupled with heightened focus on industrial automation and smart grid systems further accelerate adoption. For instance, in February 2024, Fike Safety Technology exhibited its Distributed Temperature Sensing (DTS) system designed for real-time temperature monitoring along fiber optic cables. Appropriate for diverse environments like tunnels and warehouses it provides early fire detection and precise hazard location ensuring rapid response. Regulatory compliance and safety standards also push DTS implementation across the industries.

Expanding applications in oil and gas, power utilities and industrial automation represents one of the key distributed temperature sensing market trends in the United States. According to the data published by Energy Information Administration, the United States set a new record for crude oil production in 2023 averaging 12.9 million barrels per day. Combined the U.S., Russia and Saudi Arabia made up 40% of global output while OPEC+ cuts affected other producers. The highest areas of investment in pipeline monitoring and shale gas exploration also boost growth. The demand for fire detection systems in commercial and industrial spaces and the adoption of advanced optical fiber technologies both fuel the market. There is also regulatory demand for safety in critical infrastructure as well as increased attention on renewable energy projects that enhance the deployment of DTS systems across sectors.

Distributed Temperature Sensing Market Trends:

Industrial Safety Compliance

Industrial safety compliance is a driving force for adopting DTS in high-risk areas such as the oil and gas, power utility and chemical manufacturing industries. Strict regulatory compliance mandates continuous monitoring of critical assets to prevent pipeline leaks overheating of equipment and other chemical spills. Real-time, accurate temperature data over long distances is presented by DTS technology to help early anomaly detection and avoid risks of accidents. For instance, Equinor’s Q3 2024 safety results show a serious incident frequency (SIF) of 0.3 per million hours consistent with Q2. Total recordable injury frequency (TRIF) rose to 2.4 from 2.2. Seven oil and gas leaks occurred, with no major incidents reported in Q3. Efforts focus on safety training and collaboration. Functioning reliably in extreme temperatures and corrosive conditions the system makes it essential for ensuring operational safety and strict industry standards.

Expansion in Oil and Gas Industry

The significant growth in the oil and gas industry across the globe is one of the key factors creating a positive distributed temperature sensing market outlook. According to the IEA, global investments in upstream oil and gas are expected to rise by approximately 11% in 2023 reaching USD 528 billion. These systems offer real-time, accurate temperature profiles along pipelines thereby allowing early detection of leaks, blockages, and thermal anomalies. DTS technology ensures operational efficiency by reducing downtime, minimizing environmental risks and enhancing safety. In offshore applications DTS supports subsea pipeline monitoring in harsh environments ensuring structural integrity. Onshore it is very instrumental in thermal profiling of flowlines to ensure transportation under optimal conditions. Increased concern over the reliability of operations and conformance to safety standards continues to spur DTS use in this sector.

Rising Adoption in Smart Grid

Distributed temperature sensing (DTS) technology is increasingly being adopted in smart grids to monitor power cables in real-time ensuring reliable and efficient grid operations. DTS provides continuous temperature data along the length of cables which can detect hotspots, overload conditions and thermal imbalances before they escalate into failures. This predictive capability enhances fault detection and maintenance scheduling reducing downtime and repair costs. It also enhances grid resilience by optimizing load distribution and preventing power outages. As smart grid infrastructure expands the integration of DTS allows utilities to meet increasing energy demands while maintaining safety and regulatory standards for long-term operational reliability. According to reports, in January 2023, China's State Grid Corporation announced investments of USD 77 Billion in transmission in 2023 and USD 329 Billion over the entire period of the 14th Five-Year Plan (2021-2025).

Distributed Temperature Sensing (DTS) Market Dynamics

Driver: Growing Need for Workplace Safety

Companies prioritize worker and equipment safety, as it affects their reputation. Data from the International Association of Drilling Contractors (IADC) shows that incident rates per 200,000 man-hours increased from 0.46 in 2016 to 0.68 in 2018. DTS systems enhance safety by providing real-time temperature monitoring along entire cables, making them effective for fire detection in hazardous environments. Their ability to function under extreme conditions is a key factor driving market growth.

Opportunity: Stricter Safety Regulations and Government Policies

Urbanization and industrial growth have increased risks, such as fire hazards from electrical wiring and leaks in oil and gas pipelines. Leaking equipment in industries emits volatile organic compounds (VOCs) and hazardous pollutants. DTS systems help detect pipeline leaks, ensuring compliance with stricter emission standards. Organizations like OSHA and NFPA promote fire safety measures, increasing the demand for DTS systems.

Challenge: High Costs of DTS Systems

DTS technology offers accurate real-time data collection in harsh environments, but its high cost limits adoption. Prices vary based on application, cable type, and operating conditions. Installation and maintenance add to the expense, making it less affordable for some companies. Additionally, data security concerns arise as industries rely on cloud-based analytics, increasing the risk of cyberattacks.

Distributed Temperature Sensing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global distributed temperature sensing market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on fiber type, operating principle and application.

Analysis by Fiber Type:

- Single-Mode Fiber

- Multimode Fiber

Single-mode fiber holds the largest distributed temperature sensing market share due to its better performance in long-distance and high-precision temperature monitoring. This offers lower signal attenuation, higher resolution and greater accuracy than multi-mode fiber. This makes it highly suitable for oil and gas, power utilities and industrial sectors. Its data transmission over extended distances without significant loss is particularly valuable in pipeline monitoring and smart grids. Advancements in single-mode fiber technology have led to increased deployment across various sectors.

Analysis by Operating Principle:

- Optical Time Domain Reflectometry (OTDR)

- Optical Frequency Domain Reflectometry (OFDR)

Optical time domain reflectometry (OTDR) dominates the DTS market based on high accuracy and reliability in long-range temperature monitoring. OTDR operates by transmitting laser pulses over fiber optic cables and analyzing backscattered light to detect temperature changes along the cable length. Its ability to give accurate and real-time data over extended distances makes it ideal for use in applications like oil & gas, power and infrastructure. The effectiveness of OTDR in fault detection and ensuring safe operations is the major reason for its widespread use.

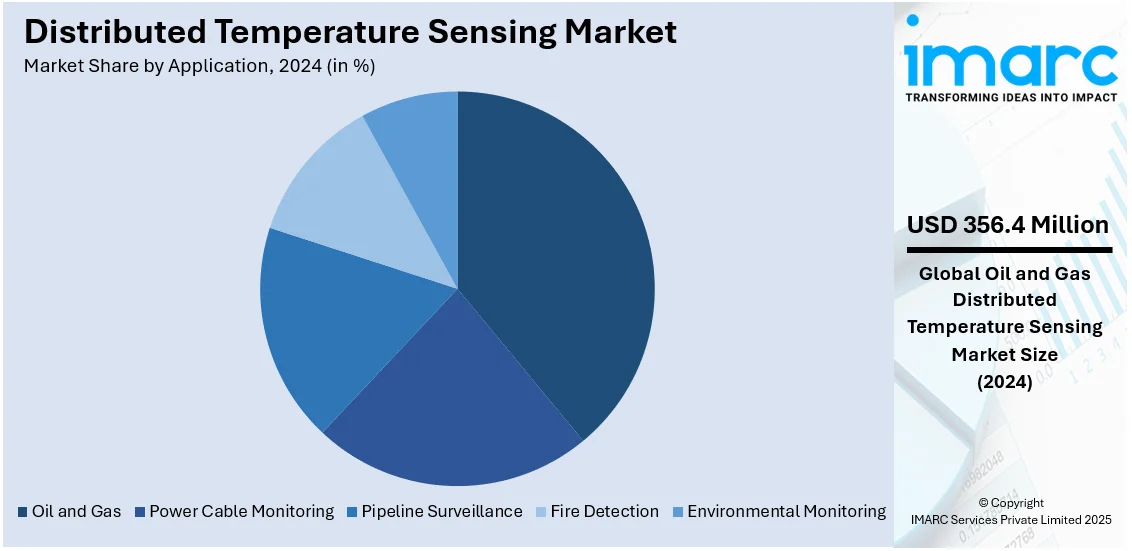

Analysis by Application:

- Oil and Gas

- Power Cable Monitoring

- Pipeline Surveillance

- Fire Detection

- Environmental Monitoring

The oil and gas sector dominates the Distributed Temperature Sensing (DTS) market by application due to the critical need for advanced monitoring systems in exploration, production and transportation. DTS is used for real-time monitoring of pipelines, wellbore integrity and leakage detection thus ensuring operational safety and efficiency. DTS's ability to provide accurate temperature profiling and fault detection in harsh environments makes it indispensable. The investments in oilfield development and pipeline infrastructure are increasingly growing, hence escalating the distributed temperature sensing market demand.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 33.2%. The Asia-Pacific region leads the Distributed Temperature Sensing (DTS) market influenced by rapid industrialization, rising infrastructure projects and enhanced energy demands in countries such as China, India and Japan. Heavy investments in oil & gas exploration, power grid modernization and pipeline infrastructure contribute to the DTS adoption in the region. Increasing focus on industrial safety combined with the developments in fiber optic technology will strengthen the market growth. Growing demand from sectors such as construction and utilities for real-time monitoring boosts the dominance of the Asia-Pacific region.

Key Regional Takeaways:

North America Distributed Temperature Sensing Market Analysis

The North American Distributed Temperature Sensing (DTS) market is primarily driven by the demand for advanced monitoring solutions across critical sectors such as oil and gas, power generation and infrastructure. The region’s robust energy sector relies heavily on DTS systems for pipeline monitoring, leak detection and ensuring operational safety. As infrastructure ages the need for real-time temperature monitoring grows to optimize performance and reduce risks. The expansion of renewable energy projects including wind and solar further supports the adoption of DTS to prevent overheating and enhance system efficiency. The integration of smart grid technologies and advancements in fiber optic solutions are driving the increasing demand for DTS, offering reliable long-range monitoring capabilities for vast areas. These factors collectively position DTS as an essential technology for asset management and operational efficiency in North America.

United States Distributed Temperature Sensing Market Analysis

In 2024, the United States captured 80.00% of revenue in the North American market. The DTS market in the United States is primarily driven by the increasing demand for advanced monitoring technologies in various sectors such as oil and gas, power generation and infrastructure. The U.S. has a well-developed energy sector which heavily relies on DTS systems for pipeline monitoring, leak detection and ensuring operational safety. U.S. total annual energy production has exceeded total annual energy consumption since 2019. In 2023, production was about 102.83 quads and consumption was 93.59 quads as per industry reports. In line with this, as aging infrastructure requires frequent inspections and maintenance the need for real-time temperature monitoring grows positioning DTS as a critical tool for asset management. Besides this the rise in renewable energy projects such as wind and solar power demands reliable temperature sensing solutions for optimizing performance and preventing overheating. Advancements in fiber optic technology have significantly improved the accuracy and reliability of DTS making it more appealing for critical applications. The introduction of advanced multiplexing techniques which allow multiple sensing points along the same fiber without compromising the data's quality. This enables long-range monitoring with high spatial resolution making DTS more suitable for monitoring vast areas. Additionally, environmental concerns and regulatory mandates focusing on reducing operational risks further stimulate market growth while the adoption of smart grid technologies also boosts the demand for these systems.

Europe Distributed Temperature Sensing Market Analysis

Europe’s DTS market is propelled by the region's strong focus on energy efficiency and environmental sustainability. Many European countries are implementing strict regulations regarding safety, operational efficiency, and environmental impact, especially in the oil, gas, and energy sectors, where DTS technology plays a vital role in monitoring pipelines, cables, and other critical infrastructure. The shift towards renewable energy sources is another key driver for the DTS market in Europe, as these systems are essential for managing energy production and distribution in remote or challenging environments. Renewable energy sources represented an estimated 24.1% of the European Union’s final energy use in 2023, as reported by the European Environment Agency. DTS technology enables real-time temperature monitoring of turbines, solar panels, and transmission lines, helping to detect overheating, inefficiencies, or potential failures early. By ensuring the continuous operation of renewable energy systems and preventing costly downtime, DTS plays a critical role in supporting Europe's transition to a sustainable and resilient energy infrastructure. Additionally, Europe’s aging infrastructure is pushing industries to adopt more efficient and cost-effective solutions for monitoring and maintenance, boosting the demand for DTS. Growing investments in smart grid technologies and the rising emphasis on Industry 4.0 technologies are also contributing to the expanding market for distributed temperature sensing solutions.

Latin America Distributed Temperature Sensing Market Analysis

In Latin America, the DTS market is influenced by the oil and gas sector’s demand for real-time monitoring solutions, given the region’s significant reserves and production activities. As per industry reports, Brazil is Latin America’s top oil producer. The country owns the largest recoverable ultra-deep oil reserves in the world, with 97.6% of Brazil’s oil production produced offshore. DTS technology enables operators to monitor pipeline integrity, detect leaks, and ensure the safety of operations, thus minimizing the environmental impact of potential accidents. Additionally, the push towards modernizing energy infrastructure in countries like Brazil, Mexico, and Argentina is catalyzing the need for advanced monitoring systems. Furthermore, the adoption of renewable energy solutions, such as wind and solar power, is increasing the demand for DTS for performance optimization and maintenance purposes, supporting the region's market growth.

Middle East and Africa Distributed Temperature Sensing Market Analysis

The rising need for DTS in the oil and gas industry for pipeline monitoring, leak detection, and asset management is bolstering the market growth. As oil fields and infrastructure age, there is a growing need for more advanced technologies to ensure safety and optimize operations. The region's commitment to improving energy efficiency and reducing environmental hazards also accelerates the adoption of DTS technology. In line with this, the increasing focus on smart infrastructure and renewable energy projects is likely to further boost the demand for DTS systems as critical monitoring tools for temperature and operational health. By the end of 2023, it is expected that the renewable energy projects currently being developed in Saudi Arabia will have a production capacity exceeding 8 GW, according to reports.

Competitive Landscape:

A highly competitive nature foresees a variety of key players in the market for distributed temperature sensing (DTS). Companies are focused on product development, technological continuance, and expansion of their portfolios towards a higher market presence. The unification of fiber optic technology and the modifications in multiplexing techniques have proven beneficial to the performance enhancement of DTS systems, thereby making them more efficient and reliable. Furthermore, players are exploring various strategies like partnerships, acquisition, and collaboration with industry leaders to foster an easy entrance to emerging markets. The demand for real-time-monitoring and asset management solutions in sectors like oil and gas, power, and infrastructure have fueled market competition, forcing companies to step forward in enhancing product offerings and fulfilling changing customer needs.

The report provides a comprehensive analysis of the competitive landscape in the distributed temperature sensing market with detailed profiles of all major companies, including:

- AP Sensing GmbH

- Bandweaver

- Furukawa Electric Co. Ltd

- Luna Innovations

- Optromix Inc.

- Prysmian Group

- Schlumberger Limited

- Silixa Ltd.

- Tendeka B.V.

- Weatherford International PLC

- Yokogawa Electric Corporation

Latest News and Developments:

- In December 2024: the U.S. Defense Advanced Research Projects Agency (DARPA) awarded a $12 million contract to BAE Systems' FAST Labs™ as part of the High Operational Temperature Sensors (HOTS) program.

- In November 2024: Luna Innovations exhibited at ADIPEC 2024 in Abu Dhabi, showcasing its combined optical sensing solutions for upstream, midstream, and utilities markets. The company highlighted its ATLAS interrogator for pipeline monitoring and its iDAS Intelligent Distributed Acoustic Sensor for seismic and infrastructure applications.

- In September 2024: Bandweaver previewed its DualSentry Distributed Acoustic Sensing (DAS) system that offer complete above and below ground security detection from a single cable. The system provides real-time alerts, precise location accuracy, and a lower total cost of ownership compared to alternative technologies.

- In July 2024: Viavi Solutions Inc. introduced NITRO® Fiber Sensing, a comprehensive real-time monitoring and analytics solution specifically designed for critical infrastructures such as oil, gas, and water pipelines, electrical power transmission, border security, and data center interconnects.

- Also in July 2024: Dickson unveiled the Cordless Smart-Sensor, its newest advancement in environmental monitoring. This innovative sensor is designed to simplify and improve monitoring processes, incorporating advanced technology with user-friendly features, making it an essential tool across various industries. The Cordless Smart-Sensor exemplifies Dickson's commitment to enhancing environmental monitoring, providing reliable and easy-to-use solutions for clients.

- In April 2024: Silixa announced a joint exhibition with Luna Innovations at EAGE 2024 in Oslo, Norway. A Senior Geophysicist from Silixa is scheduled to present on Distributed Fiber Optic Sensing for CO2 storage monitoring during Workshop 1, Session 2. Her presentation will explore how Distributed Acoustic Sensing (DAS), Distributed Temperature Sensing (DTS), and Distributed Strain Sensing (DSS) using fiber-optic cables can create an integrated multi-parameter monitoring system encompassing seismic, acoustic, temperature, and strain measurements.

Distributed Temperature Sensing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered | Single-Mode Fiber, Multimode Fiber |

| Operating Principles Covered | Optical Time Domain Reflectometry (OTDR), Optical Frequency Domain Reflectometry (OFDR) |

| Applications Covered | Oil and Gas, Power Cable Monitoring, Pipeline Surveillance, Fire Detection, Environmental Monitoring |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AP Sensing GmbH, Bandweaver, Furukawa Electric Co. Ltd, Luna Innovations, Optromix Inc., Prysmian Group, Schlumberger Limited, Silixa Ltd.,Tendeka B.V., Weatherford International PLC, Yokogawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the distributed temperature sensing market from 2019-2033.

- The distributed temperature sensing market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the distributed temperature sensing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The distributed temperature sensing market was valued at USD 923.4 Million in 2024.

IMARC estimates the distributed temperature sensing market to reach USD 1,468.47 Million by 2033, exhibiting a CAGR of 5.29% during 2025-2033.

Key factors driving the Distributed Temperature Sensing (DTS) market include increasing demand for real-time monitoring in oil and gas, power generation, and infrastructure sectors. Advancements in fiber optic technology, the rise of renewable energy projects, aging infrastructure, and growing emphasis on safety and operational efficiency further contribute to market growth.

In 2024, Asia-Pacific accounted for the largest market share of over 33.2% in the Distributed Temperature Sensing (DTS) market. The region's dominance is driven by rapid industrialization, significant investments in oil and gas, power generation, and infrastructure, along with growing demand for real-time monitoring systems in emerging economies. Additionally, increasing adoption of renewable energy sources and the need for efficient energy management further fuel DTS market growth in Asia-Pacific.

Some of the major players in the distributed temperature sensing market include AP Sensing GmbH, Bandweaver, Furukawa Electric Co. Ltd, Luna Innovations, Optromix Inc., Prysmian Group, Schlumberger Limited, Silixa Ltd., Tendeka B.V., Weatherford International PLC, Yokogawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)