Distributed Cloud Market Size, Share, Trends and Forecast by Application, Service, Enterprise Size, End Use, and Region, 2025-2033

Distributed Cloud Market 2024, Size and Trends:

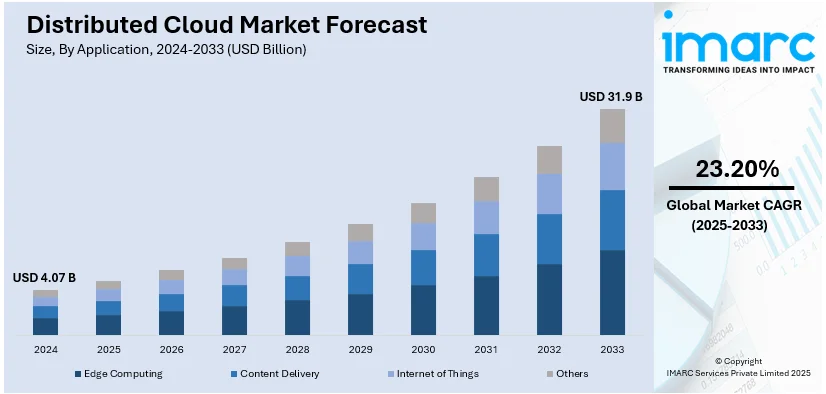

The global distributed cloud market size was valued at USD 4.07 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 31.9 Billion by 2033, exhibiting a CAGR of 23.20% from 2025-2033. North America currently dominates the market, holding a market share of over 33.5% in 2024. The market in this region is driven by the need for data sovereignty and compliance with regional regulations, the integration of edge computing for reduced latency and real-time processing, and the growing adoption of hybrid cloud models for flexibility, scalability, and cost optimization in industries like healthcare, finance, and retail.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.07 Billion |

| Market Forecast in 2033 | USD 31.9 Billion |

| Market Growth Rate (2025-2033) | 23.20% |

One major driver in the distributed cloud market is the increasing demand for data sovereignty and compliance with regional regulations. As organizations expand globally, they face growing pressure to store data in specific regions to comply with local laws, such as the General Data Protection Regulation (GDPR) in Europe or the Central Consumer Protection Authority (CCPA) in California. Distributed cloud solutions enable businesses to maintain data in multiple locations while ensuring compliance with regional data privacy regulations. This flexibility allows organizations to address legal requirements, reduce latency, and improve performance, ultimately fostering trust with customers and driving the adoption of distributed cloud services.

In the U.S., the distributed cloud market is growing rapidly, holding 88.60% of the total market share. This growth is driven by the need for enhanced data privacy, compliance, and performance optimization. With stringent data regulations like CCPA and the growing concerns over data breaches, U.S. organizations are increasingly adopting distributed cloud models to ensure data is stored locally while benefiting from centralized cloud management. The market is also supported by the expansion of industries like healthcare, finance, and government, which require secure, scalable cloud solutions. Additionally, the U.S. boasts a strong technological infrastructure and a highly developed cloud service ecosystem, further bolstering the market growth.

Distributed Cloud Market Trends:

Data sovereignty and regulatory compliance

As the world experiences unprecedented data growth and complexity, organizations face increasing pressure to secure digital ecosystems while complying with evolving global regulations. With over 80% of enterprise data being unstructured and stricter frameworks like GDPR and DPDP in place, effective data management especially for artificial intelligence (AI)-driven large language models (LLMs) is crucial. In this context, data sovereignty is becoming a top priority, with businesses leveraging distributed cloud solutions to ensure compliance. These solutions enable organizations to store data in specific jurisdictions while maintaining centralized control over infrastructure. This approach aligns with regional requirements, reduces latency, and enhances compliance, particularly in sectors like finance, healthcare, and government, where stringent regulations are critical thus reshaping cloud adoption.

Edge computing integration

The rise of edge computing is a significant trend driving the distributed cloud market. Edge computing processes data closer to its source, reducing latency and bandwidth usage while enhancing real-time decision-making. In distributed cloud models, edge computing integrates with cloud infrastructure, enabling data to be processed at the edge while remaining centrally managed. This integration boosts performance for applications like Internet of Things

(IoT), autonomous vehicles (AVs), and smart cities, where fast processing is critical. As the need for low-latency applications increases, the demand for distributed cloud services leveraging edge computing is expected to grow significantly, especially in industries requiring rapid data analysis. For instance, Broadcom, after acquiring VMware, has further advanced this trend by upgrading its Software-Defined Edge portfolio. The updates include enhanced connectivity, deployment, and lifecycle management for Edge AI workloads, with support for Fixed Wireless Access (FWA), satellite connections, and improvements to the VMware Edge Compute Stack, enabling better performance and scalability for edge-driven applications.

Hybrid cloud adoption

With only 8% of businesses using a single cloud deployment model, the hybrid and multi-cloud strategies are on the rise. Hybrid cloud environments combine private and public clouds, which are more flexible and scalable to meet diverse operational needs. Distributed cloud services integrate these private and public environments seamlessly, allowing companies to control sensitive data while leveraging public cloud resources for less critical functions. This model is compelled by the drivers of cost optimization, agility enhancement, and enhanced security. Above all, those sectors that rely on hybrid applications and complex data management and high regulatory requirements would benefit from the advantages of hybrid clouds in terms of balancing security with performance while escaping vendor lock-ins and overall enhanced operational efficiency as well.

Distributed Cloud Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global distributed cloud market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application, service, enterprise size, and end use.

Analysis by Application:

- Edge Computing

- Content Delivery

- Internet of Things

- Others

Edge computing leads the market with around 43.2% of market share in 2024 driven by the increasing need for processing power to handle complex workloads and large volumes of data. As industries like finance, healthcare, and manufacturing rely more on AI, machine learning (ML), and real-time analytics, distributed cloud computing enables organizations to scale their infrastructure dynamically and efficiently. By distributing computing resources across multiple locations, businesses can achieve lower latency, enhance performance, and ensure compliance with data privacy regulations. The rise of edge computing, which processes data closer to the source, further propels the demand for distributed cloud computing solutions. This shift towards decentralized computing allows businesses to innovate faster, improve operational efficiency, and maintain data security, aiding its leadership in the market.

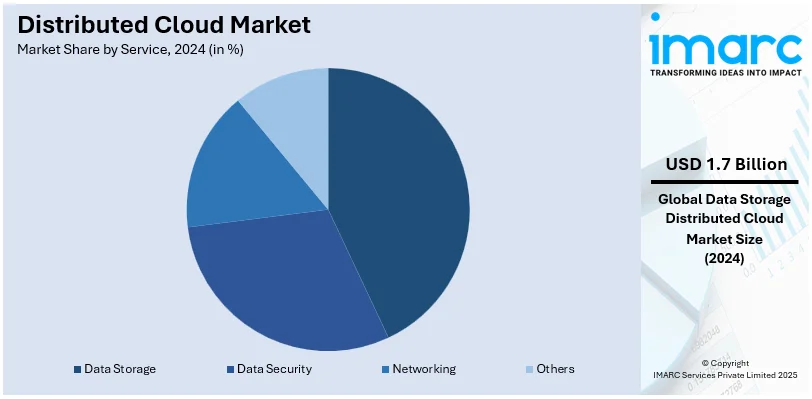

Analysis by Service:

- Data Security

- Data Storage

- Networking

- Others

Data storage represented the leading market segment, holding 42.7% of the total share owing to the growing volume of data generated by businesses, particularly in sectors like finance, healthcare, and retail, is driving the demand for scalable and secure storage solutions. Distributed cloud services offer businesses the ability to store data across multiple locations, ensuring data sovereignty and compliance with regional regulations. Additionally, distributed storage helps reduce latency and optimize access to critical information. As enterprises increasingly adopt AI, IoT, and big data analytics, the need for efficient, flexible, and secure data storage solutions becomes paramount. This trend has made data storage the primary focus of distributed cloud investments, solidifying its leadership in the market.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

In 2024, large enterprises accounted for the majority of the market at around 53.5% driven by the increasing need for scalable, flexible, and secure cloud infrastructure to manage vast volumes of data across multiple locations. Large enterprises in industries such as manufacturing, retail, finance, and healthcare are adopting distributed cloud solutions to streamline operations, enhance data privacy, and comply with regional data sovereignty regulations. These organizations leverage the cloud's ability to support complex workloads, including AI, IoT, and real-time data processing while maintaining control over sensitive information. Furthermore, the rapid adoption of edge computing and AI-driven solutions in large enterprises further boosts their reliance on distributed cloud technologies, enabling them to drive innovation and stay competitive in a rapidly evolving business landscape.

Analysis by End-Use:

- BFSI

- Healthcare

- Retail and E-commerce

- Manufacturing

- IT and Telecom

- Energy and Utilities

- Media and Entertainment

- Government and Defense

- Others

BFSI leads the market with around 27.1% of the market share in 2024 due to the sector's increasing reliance on cloud technologies to enhance operational efficiency, support digital transformation, and manage vast amounts of data securely. BFSI organizations have embraced distributed cloud solutions to serve strict regulatory needs such as data residency and privacy laws, at the same time harnessing cloud scalability and flexibility for better services delivery. Another aspect is increasing AI usage for fraud detection, risk management, and customer insight that further stimulates the demand for distributed cloud in the BFSI sector. BFSI is primarily an adopter of distributed cloud technologies, fueling its leadership in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.5% driven by the region’s advanced technological infrastructure, high cloud adoption rates, and the growing demand for scalable, low-latency services across industries such as finance, healthcare, and government. Strict data privacy and compliance regulations, including the CCPA and other regional standards, are pushing businesses to implement distributed cloud solutions that ensure data sovereignty while maintaining high performance. Additionally, the rapid integration of edge computing and the increasing reliance on AI technologies in North America further fuel market growth. With key players in cloud services and strong investments in digital transformation, North America continues to lead in driving the adoption of distributed cloud solutions.

Key Regional Takeaways:

United States Distributed Cloud Market Analysis

The U.S. distributed cloud market is experiencing significant growth, driven by the increasing demand for data privacy, regulatory compliance, and low-latency services. With stringent data protection regulations such as the California Consumer Privacy Act (CCPA) and GDPR influencing local businesses, there is a rising need for distributed cloud solutions that can ensure compliance by storing data in specific regions while maintaining high performance. This expansion can be largely linked to edge computing, which means processing data at the source side, thus leading to a very low latency to support real-time applications like IoT, AVs, and smart cities. Second, there has been a move toward hybrid models of cloud deployments as companies adopt flexible, scalable solutions addressing diverse operational requirements, particularly healthcare, finance, and government-related sectors. The U.S. also has a highly advanced cloud infrastructure and technological innovation, making it an excellent environment for the widespread use of distributed cloud solutions. This puts the U.S. in a very strong position in the market.

Europe Distributed Cloud Market Analysis

Europe's distributed cloud market is growing very strong, primarily as a result of the GDPR. These regulations increased the demand from businesses to select cloud solutions which would help the business meet their local data sovereignty requirements, besides offering flexibility and scalability in terms of cloud computing. Many organizations are using distributed cloud services to enable data processing and storage across multiple regions to comply with regulations. The integration of edge computing is another major driver, as it improves performance by processing data closer to the source, especially for latency-sensitive applications such as IoT and real-time analytics. Hybrid cloud environments are being adopted by finance, healthcare, and manufacturing industries to scale operations while ensuring security and regulatory adherence. The growth of the market is also driven by Europe's continued digital transformation efforts and advancements in cloud technologies, especially in countries with strong IT infrastructure.

Asia Pacific Distributed Cloud Market Analysis

The market for distributed cloud is growing rapidly in the Asia Pacific region because of continuous digitalization along with an increasing demand for scalable, low-latency cloud solutions. The leading countries in adopting distributed cloud services, especially for performance enhancement, are Japan, South Korea, and China, especially in different manufacturing industries, retail, and healthcare sectors. The need for sovereignty over data, as well as compliance with the regulations of specific regions, makes organizations localize their storage and processing. This will contribute to the trend of distributed models of cloud deployment. It's more significant for industries that handle data that demands security and follows the regulatory frameworks of a specific region.

Latin America Distributed Cloud Market Analysis

The distributed cloud market in Latin America is expanding due to the interest from businesses operating in sectors like banking, telecommunications, and government seeking safe, scalable, and compliant cloud solutions. Data sovereignty and the pressure of complying with regional regulations have created an urge in organizations to migrate to distributed clouds to keep their data within the boundaries of a country while deriving benefits from cloud flexibility. The best example of this pattern is Brazil, Mexico, and Argentina in adopting cloud services that increase the performance and efficiency, decrease the cost, and develop the operations of that country. Market growth in the region is still promoted by the demand for region-specific secure data storage.

Middle East and Africa Distributed Cloud Market Analysis

The distributed cloud market in the Middle East and Africa is growing as businesses seek improved performance, scalability, and compliance with regional regulations. The demand for digital transformation, especially in sectors like healthcare and finance, is driving market expansion. Countries like the UAE and South Africa are investing in strong IT infrastructure, further supporting the adoption of distributed cloud solutions. These factors contribute to the region's rapid growth, as organizations look to enhance operations while adhering to local data privacy requirements.

Competitive Landscape:

The competitive landscape in the distributed cloud market is highly dynamic, with several key players vying for dominance. Companies are focusing on developing innovative cloud solutions that offer enhanced scalability, flexibility, and compliance with data privacy regulations. Competitive strategies include the development of specialized infrastructure to support edge computing, as well as the integration of advanced AI and ML capabilities to improve data processing and real-time analytics. Firms are also differentiating themselves through their ability to offer hybrid cloud environments, catering to the diverse needs of industries like healthcare, finance, and retail. Partnerships, acquisitions, and technological collaborations are common as companies aim to expand their service offerings and strengthen their market position across various sectors globally.

The report provides a comprehensive analysis of the competitive landscape in the distributed cloud market with detailed profiles of all major companies, including:

- Alibaba Group

- Cubbit Srl

- F5 Inc

- Google LLC

- Oracle Corporation

- Wind River Systems, Inc.

Latest News and Developments:

- In November 2024, Storj launched its Channel First program and portal to enhance support for its expanding network of technology alliance partners and resellers. This launch follows Storj's recognition with the Inc. Power Partner 2024 award. The program aims to help partners tackle challenges such as data growth, GPU availability, and compliance demands, particularly for data retention in a global, remote-first workforce.

- In October 2024, NetApp enhanced its partnership with Google Cloud to incorporate unified data storage and intelligent services into the Google Distributed Cloud architecture. This collaboration enables organizations, particularly in regulated sectors, to leverage AI-ready infrastructure while ensuring security and compliance with data sovereignty and privacy laws. By providing foundational data storage, NetApp helps organizations innovate securely, manage data effectively, and support application development in compliance with emerging regulations.

- In September 2024, At Oracle CloudWorld, Oracle announced new OCI distributed cloud innovations to meet growing global demand for AI and cloud services. These innovations include Oracle Database@AWS, Azure, and Google Cloud, OCI Dedicated Region, and OCI Supercluster. Oracle’s distributed cloud enables customers to deploy AI and cloud services at the edge, in their datacenters, or across multiple clouds, addressing data privacy, sovereignty, and low latency needs, with Oracle Cloud available in 85 regions.

- In July 2024, Google announced that enterprises can now run AI workloads using its cloud infrastructure, both in its data centers and on-premises. The new Google Distributed Cloud (GDC) air-gapped appliance is designed for highly regulated organizations needing to keep data in-house. The appliance runs Google Cloud's infrastructure, security services, and Vertex AI platform, which supports pretrained AI models. While Google develops the software, the hardware is provided by partners like Cisco, HPE, and Dell, with Nvidia GPUs powering the AI models.

Distributed Cloud Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Edge Computing, Content Delivery, Internet of Things, Others |

| Services Covered | Data Security, Data Storage, Networking, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Uses Covered | BFSI, Healthcare, Retail and E-commerce, Manufacturing, IT and Telecom, Energy and Utilities, Media and Entertainment, Government and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alibaba Group, Cubbit Srl, F5 Inc, Google LLC, Oracle Corporation, Wind River Systems, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the distributed cloud market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global distributed cloud market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the distributed cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global distributed cloud market was valued at USD 4.07 Billion in 2024.

The global distributed cloud market is estimated to reach USD 31.9 Billion by 2033, exhibiting a CAGR of 23.20% from 2025-2033.

Key factors driving the global distributed cloud market include increasing data sovereignty and compliance requirements, the rise of edge computing for low-latency services, growing AI and IoT adoption, demand for scalable cloud solutions, and the need for secure, flexible infrastructure in regulated industries and sectors like healthcare and finance.

North America currently dominates the market, holding a market share of over 33.5% in 2024. The market in this region is driven by the need for data sovereignty and compliance with regional regulations, the integration of edge computing for reduced latency and real-time processing, and the growing adoption of hybrid cloud models for flexibility, scalability, and cost optimization in industries like healthcare, finance, and retail.

Some of the major players in the global distributed cloud market include Alibaba Group, Cubbit Srl, F5 Inc, Google LLC, Oracle Corporation, Wind River Systems, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)