Disposable Syringes Market Size, Share, Trends and Forecast by Product Type, Application, End User, and Region, 2025-2033

Disposable Syringes Market Size and Share:

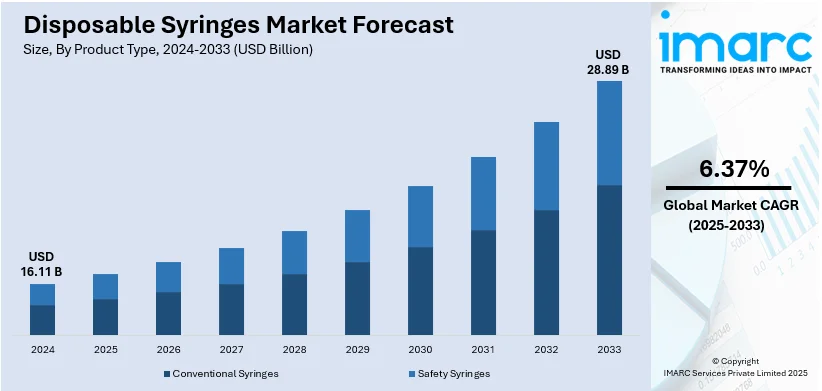

The global disposable syringes market size was valued at USD 16.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.89 Billion by 2033, exhibiting a CAGR of 6.37% during 2025-2033. North America currently dominates the market, holding a significant market share of over 41.6% in 2024. The North American disposable syringes market share is driven by factors such as the growing demand for vaccines, increasing chronic disease prevalence, and rising healthcare investments. Additionally, heightened awareness about infection control, safety regulations, and the adoption of needleless injection systems contribute to the market's growth and innovation in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 16.11 Billion |

|

Market Forecast in 2033

|

USD 28.89 Billion |

| Market Growth Rate (2025-2033) | 6.37% |

The growing incidence of chronic diseases like diabetes, cancer, and cardiovascular diseases has made injectable medications and insulin in greater demand, necessitating disposable syringes. Additionally, the growing international concern regarding cleanliness and infection avoidance has resulted in a shift toward single-use syringes for minimizing cross-contamination and needle-stick injury. Governments and healthcare institutions are also adopting stricter safety guidelines, encouraging the use of disposable syringes to safeguard both healthcare professionals and patients. Furthermore, increased demand for vaccines, especially due to the COVID-19 pandemic, has speeded up the demand for disposable syringes for mass immunizations. Technological advancements, including the creation of auto-disable syringes and pre-filled syringes, are improving patient safety and usability, encouraging innovation along with disposable syringes market growth.

The United States stands out as a key market disruptor, driven by factors such as advanced healthcare infrastructure, innovation, and regulatory standards. The nation's robust emphasis on healthcare coupled with its high prevalence of chronic conditions such as diabetes, cardiovascular diseases, and cancer has fueled high demand for injectable drugs, hence inducing use of disposable syringes. Vaccine delivery in the US is also at the center of the country's activity, especially during the COVID-19 pandemic, further boosting demand for disposable syringes to facilitate mass vaccination. Further, the US is in the vanguard of medical device innovation, such as in the design of pre-filled syringes, auto-disable syringes, and needle-free injectors. More stringent regulatory environments, such as in the form of the FDA, have required increased levels of safety and innovation within the syringe industry. In addition, the mass use of telemedicine and home healthcare services in the US has also increased the need for disposable syringes, further increasing market disruption.

Disposable Syringes Market Trends:

Increasing demand for safety-engineered syringes

The disposable syringes market is witnessing a growing demand for safety-engineered syringes, driven by the need to minimize needle-stick injuries and reduce the transmission of infectious diseases. These syringes are equipped with safety mechanisms that automatically retract or cover the needle after use, enhancing protection for both healthcare workers and patients. Hospitals and clinics are increasingly adopting these syringes, particularly in high-risk environments like emergency care settings. The rising awareness about safety protocols, combined with stricter healthcare regulations, has led to an expansion in the market for safety-engineered disposable syringes, supporting industry growth and contributing to the improvement of overall healthcare safety standards. Recently, Hindustan Syringes and Medical Devices (HMD) introduced Dispojekt single-use syringes equipped with safety needles, enhancing India's role as a global leader in medical devices.

Technological advancements in syringe design

Innovation in syringe design is a key trend in the disposable syringes market. Manufacturers are incorporating new technologies to enhance syringe performance, ease of use, and patient comfort. One significant advancement is the development of prefilled syringes, which are increasingly preferred for vaccines, biologics, and injectable drugs. Prefilled syringes reduce the risk of dosing errors, improve the efficiency of drug delivery, and ensure a consistent and accurate dose. These syringes also cater to the growing trend of at-home self-administration of medications, especially for chronic conditions such as diabetes, boosting the demand for advanced disposable syringe solutions. Recently, SCHOTT Pharma, a German supplier of drug containment and delivery solutions, introduced the next generation of SCHOTT TOPPAC infuse polymer syringes, a system aimed at enhancing safety and efficiency. In the meantime, researchers at IIT Bombay in India have created a needle-free syringe that uses shockwaves, ensuring safe and painless drug administration while minimizing skin damage and reducing the risk of infection. These developments further continue to fuel the market for disposable syringes.

Growing usage in vaccine administration

The disposable syringes market has experienced significant growth in recent years due to the increased demand for vaccines, especially following the COVID-19 pandemic. Disposable syringes are widely used for vaccine delivery due to their sterility, safety, and convenience. Governments and healthcare organizations are ramping up vaccination campaigns, creating a substantial need for syringes, particularly in large-scale immunization efforts. With the continued global push for vaccination programs, disposable syringes are integral to meeting public health goals. This trend is expected to persist, with continuous investments in syringe production, ensuring a steady supply to meet the growing needs of vaccination drives worldwide.

Disposable Syringes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global disposable syringes market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, and end user.

Analysis by Product Type:

- Conventional Syringes

- Safety Syringes

- Retractable Safety Syringes

- Non-Retractable Safety Syringes

Safety syringes stand as the largest component in 2024, holding around 80.9% of the market. Safety syringes represent a major segment of the disposable syringes market, fueled by the growing need for improved safety features in healthcare environments. Safety syringes are intended to minimize the risk of needle-stick injuries, which can result in the transmission of infectious diseases like HIV, hepatitis, and other bloodborne pathogens. Safety syringes usually have an intrinsic safety mechanism that protects the needle after being used, providing safety to healthcare workers during and after injections. With increasing need for healthcare worker safety and patient health, usage of safety syringes has increased, especially in hospitals, clinics, and other healthcare facilities. Regulatory agencies like the FDA and OSHA have also tightened safety standards, further prompting the use of safety syringes. Increased needle-stick injuries, as well as growing rates of chronic diseases that necessitate repeated injections, have boosted this segment, making safety syringes an integral component of the disposable syringes market.

Analysis by Application:

- Immunization Injections

- Therapeutic Injections

Therapeutic injections lead the market with around 75.1% of market share in 2024. Therapeutic injections account for a major portion of the application segment within the disposable syringes market, fueled by the growing demand for injectable drugs in numerous therapeutic categories. Therapeutic injections are frequently employed for the management of chronic diseases like diabetes, arthritis, cancer, and cardiovascular diseases, which tend to need long-term medication administration. Diabetes management through insulin injections is a key driver in this segment, with the global incidence of diabetes still on the increase. Biologic therapies, such as monoclonal antibodies and other high-value drugs, also depend significantly on injectable formulations, further increasing demand for disposable syringes. The convenience, ease of use, and precision offered by disposable syringes in delivering therapeutic injections make them a critical instrument in healthcare facilities. In addition, the increasing popularity of home-based healthcare and self-injectors, along with emerging trends in pre-filled syringes, has favored the growth of therapeutic injections as a vital application segment in the disposable syringes market outlook.

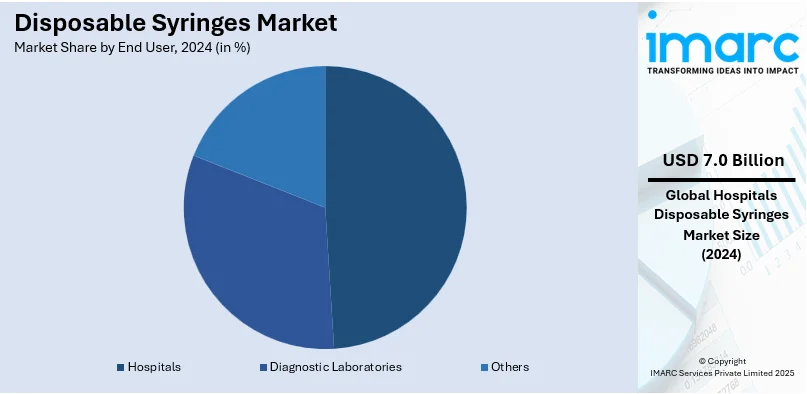

Analysis by End User:

- Hospitals

- Diagnostic Laboratories

- Others

Hospitals leads the market with around 43.7% of market share in 2024. Hospitals form a major segment of the end-user market in disposable syringes due to the demand for safe, efficient, and sterile injection techniques in healthcare. The large patient volume and varied treatment needs in hospitals make them core users of disposable syringes for a range of medical procedures, such as injections, blood withdrawal, and administration of anesthesia. The frequency of high doses of medications given in hospitals, especially for long-term illnesses like diabetes, cancer, and infectious diseases, makes the extensive use of disposable syringes inevitable. Furthermore, hospitals ensure safety to avoid needle-stick injuries and the spread of infection, and this results in the increased use of safety syringes and auto-disable syringes. As hospitals are confronting increasing patient volumes and growing emphasis on infection prevention and patient safety, demand for disposable syringes is projected to keep growing. In addition, the trend toward the use of advanced healthcare technologies, including pre-filled syringes and injectable biologics, continues to grow the demand for disposable syringes in the hospital environment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 41.6%. North America is the leading region for the disposable syringes market, with support from developed healthcare infrastructure, immense healthcare expenditure, and a large incidence of chronic diseases. The United States holds the position of the largest market in this region, with significant demand for disposable syringes supported by widespread injectable medication use for conditions like diabetes, cardiovascular diseases, and cancer. Moreover, the region's well-established healthcare system of hospitals, clinics, and outpatient facilities requires constant use of disposable syringes for procedures such as vaccinations, blood extraction, and therapeutic injections. Increasing emphasis on safety and prevention of needle-stick injury has further promoted the usage of safety syringes in North America. Regulatory authorities such as the FDA also take a key role in maintaining stringent standards of quality and safety in syringes. In addition, the developing trend towards home healthcare and home injection treatments is fueling the demand for North American disposable syringes.

Key Regional Takeaways:

United States Disposable Syringes Market Analysis

In 2024, the United States accounted for over 93.30% of the disposable syringes market in North America. The growth of the disposable syringes market in the United States is significantly influenced by the high prevalence of chronic diseases. An estimated 129 Million people in the U.S. suffer from at least one major chronic condition, such as heart disease, cancer, diabetes, obesity, or hypertension, as defined by the U.S. Department of Health and Human Services. This growing burden of chronic diseases fuels the demand for injectable treatments, driving the need for disposable syringes. Alongside this, advancements in healthcare infrastructure and a shift toward injectable biologics further contribute to market expansion. The increasing focus on hygiene and safety, along with measures to prevent needle-stick injuries, strengthens demand. Government initiatives, such as needle exchange programs and the push for eco-friendly products, further bolster growth. The COVID-19 pandemic also accelerated syringe demand due to mass vaccination efforts. With a rise in home healthcare, where patients self-administer injections, disposable syringes offer convenience and safety, pushing the market forward. Innovations in syringe design, such as safety-engineered and self-destructive syringes, enhance user safety and support continued market growth. Increased outpatient treatments and surgeries also contribute to the higher demand for disposable syringes.

Asia Pacific Disposable Syringes Market Analysis

The disposable syringes market in the Asia-Pacific (APAC) region is propelled by rapid urbanization, rising healthcare spending, and an aging population. According to reports, the number of older persons in Asia and the Pacific is projected to more than double, from 630 Million in 2020 to approximately 1.3 Billion by 2050, further increasing the demand for injectable treatments. Additionally, the cancer incidence in Asia, as reported, was 169.1 per 100,000 in 2020, accounting for 49.3% of global cancer cases, with lung, breast, and colorectal cancers being the most prevalent. These factors drive the need for syringes, as injectable therapies are increasingly utilized in cancer treatment and other chronic conditions. The growing preference for self-administered medications also boosts market demand, with disposable syringes offering convenience and safety. Expanding healthcare infrastructure in developing nations, such as India and China, and government initiatives to improve healthcare standards further support the market's growth in the region.

Europe Disposable Syringes Market Analysis

The disposable syringes market in Europe is primarily driven by the growing incidence of chronic diseases, especially diabetes, and an aging population. According to reports, as of January 1, 2023, the EU population was estimated at 448.8 Million, with more than one-fifth (21.3%) aged 65 years and over. This demographic shift increases the demand for injectable treatments, as the elderly are more prone to chronic conditions that require ongoing medical intervention. The rise in injectable biologics and biosimilars further boosts the market for disposable syringes, which are favored for their safety, affordability, and ease of use. Stringent regulatory frameworks in the region ensure the availability of high-quality products, bolstering consumer trust. Technological innovations, such as retractable and safety-engineered syringes, enhance user safety and contribute to market growth. The increasing number of surgeries, outpatient care services, and vaccination campaigns, particularly during health crises like the COVID-19 pandemic, further support demand. Additionally, Europe’s growing focus on sustainable and eco-friendly medical products aligns with the demand for environmentally conscious disposable syringes. The increasing trend toward home healthcare services, where disposable syringes are widely used for self-administration, is also expected to drive market expansion in the region.

Latin America Disposable Syringes Market Analysis

The disposable syringes market in Latin America is driven by the rising prevalence of chronic diseases, which are expected to cause 928,000 deaths annually in Brazil alone, underscoring the growing demand for injectable treatments, including stem cell therapies. The expansion of healthcare access and increasing healthcare expenditure, particularly in countries like Brazil and Mexico, further fuels market growth. Government initiatives to improve healthcare infrastructure and promote awareness are key growth factors. The adoption of injectable therapies and biologics continues to support the increasing demand for disposable syringes across the region.

Middle East and Africa Disposable Syringes Market Analysis

In the Middle East and Africa, the disposable syringes market is influenced by the prevalence of chronic diseases, with 23% of the population in the UAE reporting such conditions. Obesity (12.5%), diabetes (4.2%), and asthma/allergies (3.2%) are among the most common. This growing burden of chronic diseases contributes to the increased need for injectable treatments. Along with healthcare infrastructure improvements, the rising demand for vaccinations and self-administered medications further supports the market. Technological advancements in syringe design and government efforts to improve healthcare access are key drivers of market expansion in the region.

Competitive Landscape:

Several leading companies in the disposable syringes market are aggressively pursuing growth through various strategic initiatives on innovation, safety, and geographic expansion. Top players are heavily investing in research and development to design sophisticated products like safety syringes, pre-filled syringes, and auto-disable syringes that go a long way in ensuring safety and ease of injection procedures. These syringes have safety mechanisms against needle-stick injuries, which tackle key healthcare issues in infection control. To address increasing demand for injectable drugs, especially for long-term conditions such as diabetes, industry stakeholders are also concentrating on creating affordable, high-quality solutions that suit healthcare professionals and patients alike. Further, collaborations with pharmaceutical firms to manufacture specialized syringes for particular drugs, including biologics and vaccines, are also on the rise. Scaling up production capacities and enhancing distribution networks to make disposable syringes widely available, particularly in the emerging markets, is another priority area. Additionally, strategic partnerships with healthcare institutions and adherence to strict regulatory standards, including those of the FDA and WHO, guarantee product safety and quality.

The report provides a comprehensive analysis of the competitive landscape in the disposable syringes market with detailed profiles of all major companies, including:

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton Dickinson and Company

- Cardinal Health Inc.

- Fresenius SE & Co. KGaA

- Henke-Sass Wolf GmbH

- Nipro Corporation

- Novo Nordisk A/S

- Retractable Technologies Inc.

- Terumo Corporation

- Vita Needle Company

Latest News and Developments:

- January 2025: HLB Life Science's Sofject disposable syringe has received FDA pre-market approval (510K), enabling the company to export to the U.S. via Allison Medical starting this month. The approval ensures the syringe and needle meet the FDA's safety and efficacy standards. To meet growing demand, production at its Cheonan and Anseong 2 plants is increasing.

- May 2024: Hindustan Syringes and Medical Devices (HMD) has launched Dispojekt, an indigenous single-use safety syringe aimed at reducing needle stick injuries. Needle stick injuries can transmit blood-borne diseases like Hepatitis B, C, and HIV. HMD targets a 60-70% market share in India's disposable syringes segment, estimated at over 5 Billion units annually.

- May 2024: Sharps Technology, Inc., has signed an enhanced agreement with Nephron Pharmaceuticals to acquire the InjectEZ specialty syringe assets for USD 35 Million. The deal includes a five-year, USD 200 Million sales agreement for Sharps’ disposable syringes, including next-generation copolymer PFS syringes.

Disposable Syringes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Immunization Injections, Therapeutic Injections |

| End Users Coverage | Hospitals, Diagnostic Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun Melsungen AG, Baxter International Inc., Becton Dickinson and Company, Cardinal Health Inc., Fresenius SE & Co. KGaA, Henke-Sass Wolf GmbH, Nipro Corporation, Novo Nordisk A/S, Retractable Technologies Inc., Terumo Corporation, Vita Needle Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the disposable syringes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global disposable syringes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the disposable syringes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The disposable syringes market was valued at USD 16.11 Billion in 2024.

The disposable syringes market is projected to exhibit a CAGR of 6.37% during 2025-2033.

The disposable syringes market is driven by factors such as increasing healthcare needs, rising prevalence of chronic diseases, growing awareness of hygiene and safety standards, and advancements in medical technology. Additionally, the rise in vaccination campaigns, expanding healthcare infrastructure, and government initiatives further boost demand for disposable syringes.

North America currently dominates the market driven by factors such as the growing demand for vaccines, increasing chronic disease prevalence, and rising healthcare investments.

Some of the major players in the disposable syringes market include B. Braun Melsungen AG, Baxter International Inc., Becton Dickinson and Company, Cardinal Health Inc., Fresenius SE & Co. KGaA, Henke-Sass Wolf GmbH, Nipro Corporation, Novo Nordisk A/S, Retractable Technologies Inc., and Terumo Corporation and Vita Needle Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)