Directed Energy Weapons Market Size, Share, Trends and Forecast by Type, Application, Technology, End Use, and Region, 2025-2033

Directed Energy Weapons Market 2024, Size and Trends:

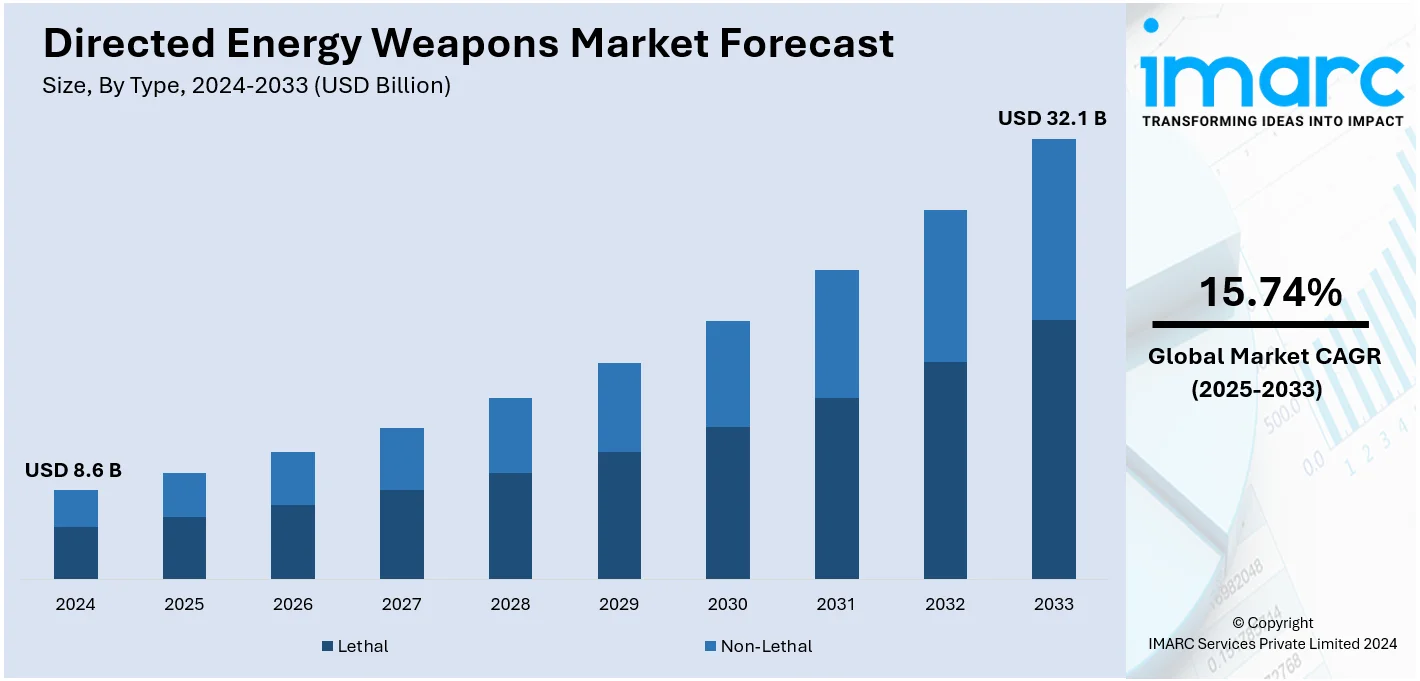

The global directed energy weapons market size was valued at USD 8.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 32.1 Billion by 2033, exhibiting a CAGR of 15.74% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.7% in 2024. The rising geopolitical tensions and global security threats, the need for military operations to minimize collateral damage and increase precision, and ongoing technological developments in high-energy lasers, microwaves, and particle beams are major factors boosting the directed energy weapons market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.6 Billion |

|

Market Forecast in 2033

|

USD 32.1 Billion |

| Market Growth Rate (2025-2033) | 15.74% |

The directed energy weapons (DEW) market is driven by increasing defense budgets, technological advancements, and the growing demand for advanced military systems. DEWs, including high-energy lasers, microwaves, and particle beams, offer precision targeting, minimal collateral damage, and cost-effective operation compared to traditional weaponry. The rising threat of drones, missiles, and other aerial systems has amplified the need for DEWs in air defense and countermeasure applications. Geopolitical tensions and evolving warfare tactics further drive demand for these next-generation weapons. Additionally, DEWs are increasingly used for homeland security, border control, and protecting critical infrastructure. Ongoing innovations in power systems and integration into existing platforms continue to propel the development and adoption of DEWs worldwide.

The directed energy weapons (DEW) market share in the United States is driven by increasing defense budgets, advancements in military technology, and the need to counter emerging threats such as drones, missiles, and hypersonic weapons. According to industry reports, the Department of Defense's fiscal year 2024 funding bill allocates $824.3 billion, $26.8 billion more than the 2023 budget. Moreover, the U.S. Department of Defense emphasizes DEWs for precision targeting, reduced operational costs, and minimal collateral damage. Rising geopolitical tensions and the demand for advanced air and missile defense systems further boost investment in DEWs. Additionally, U.S.-based defense contractors and research institutions play a pivotal role in innovation, focusing on integrating DEWs into platforms like ships, aircraft, and ground vehicles to enhance national security and military capabilities.

Directed Energy Weapons Market Trends:

Advancements in Technology

Significant advancements in technology primarily drive the directed energy weapons market growth. This includes the development of high-power lasers, microwaves, and particle beams. Furthermore, the development of these technologies is making it possible to develop DEW systems that are more accurate, efficient, and successful. Additionally, these systems are becoming reduced due to ongoing research and development, which increases their adaptability to a range of platforms, such as ground-based, naval, and airborne systems. The integration of AI and machine learning for targeting and operational efficiency is also a key factor. These technological strides are enhancing the capabilities of DEWs, making them an attractive option for defense and security applications.

Recent developments in the field of DEWs have significantly accelerated market growth. Notably, in September 2020, Raytheon Technologies Corporation announced the delivery of a high-energy laser weapon system to the US Air Force, intended for upcoming experiments and training exercises. That same year, Boeing also made a key milestone by delivering its first upgraded Compact Laser Weapon Systems to the US Department of Defense. Furthermore, in February 2021, an MoU was signed between SIGN4L, MBDA, and CILAS to collaborate on the co-development of high-energy laser systems aimed at enhancing counter-unmanned aerial vehicle (C-UAV) capabilities.

Increasing Security Threats and Geopolitical Tensions

The global landscape of security threats and geopolitical tensions plays a significant role in driving the DEW market. Alongside this, countries are spending more money on advanced defense systems to combat growing dangers like terrorism, international wars, and the spread of unmanned systems like drones. Two years into Russia's full-scale invasion, Ukraine has reclaimed 54 percent of the occupied territory, while Russia remains in control of 18 percent of the country. Similarly, intense clashes and skirmishes erupted between Chinese and Indian troops along the Sino-Indian border. These confrontations were particularly concentrated near the disputed Pangong Lake in Ladakh, as well as in the Tibet Autonomous Region and along the Line of Actual Control (LAC). These events highlight the urgent requirement for precision-based, rapid-response defense solutions. Therefore, this is positively influencing the directed energy weapons market demand. Their accuracy, speed-of-light delivery, and potential for low cost per shot in comparison to conventional weapons also provide them a strategic edge. This shift towards advanced, non-conventional weaponry is a response to the evolving nature of warfare and security challenges, leading to increased investment and demand in the DEW sector.

Augmenting Demand for Precision and Reduced Collateral Damage

One of the main factors driving the need for directed energy weapons is the increased focus on reducing collateral damage in military operations. According to an industry report, urban warfare affects more than 50 million civilians worldwide, eight times more than conflicts in rural areas. It is a testament to the need for precision in modern combat. DEWs provide previously unheard-of accuracy and the capacity to eliminate threats with minimal harm to the environment or non-combatants. This precision is particularly crucial in urban warfare and counter-terrorism operations, where traditional explosives can cause extensive collateral damage. In confluence with this, the ability of DEWs to offer controlled, reversible effects, such as disabling electronic systems without destruction, also contributes to their appeal. This focus on precision and reduced collateral damage aligns with the modern doctrines of military engagement and humanitarian considerations, thereby providing a boost to the DEW market growth.

Directed Energy Weapons Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global directed energy market, along with forecast at the global, regional, and country levels from 2025-2033. Our market has been categorized based on type, application, technology, and end use.

Analysis by Type:

- Lethal

- Non-Lethal

Lethal leads the market with around 59.1% of market share in 2024. The lethal segment of the market holds the largest share, driven by the escalating demand from military and defense sectors globally. These weapons, primarily designed for combat and strategic operations, include high-energy lasers, microwaves, and particle beams capable of inflicting significant damage to targets. Their adoption is largely attributed to their precision, long-range capabilities, and effectiveness in neutralizing various threats, including missiles, aircraft, and enemy infrastructure. In addition, the growing need for advanced weaponry to maintain strategic superiority in increasingly sophisticated warfare scenarios contributes to the dominance of this segment.

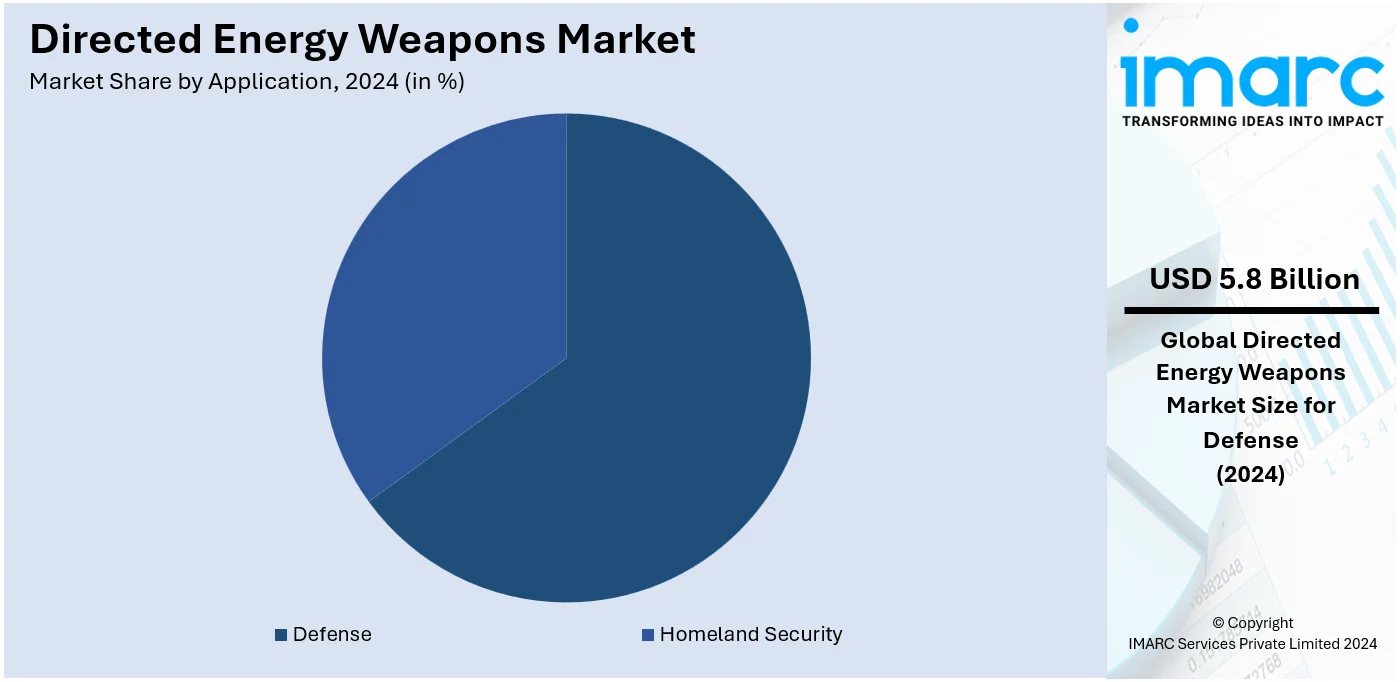

Analysis by Application:

- Homeland Security

- Defense

As per the directed energy weapons market forecast, defense leads the market with around 67.8% of market share in 2024. The defense segment occupies the largest share of the market, underscoring the significant role these weapons play in modern military strategies. This dominance is primarily due to the increasing adoption of DEWs by armed forces worldwide for a variety of roles including air defense, missile defense, and ground-based combat operations. High-energy lasers, particle beams, and microwave-based weapons are integral in providing strategic advantages such as precision targeting, speed-of-light engagement, and cost-effectiveness per shot. In addition, the demand in this segment is further fueled by the escalating global arms race, technological advancements in warfare, and the need for next-generation defense systems to counter evolving threats. The defense sector's focus on incorporating DEWs into existing and future platforms highlights the segment's continued growth potential and its critical role in shaping the future of military engagements.

Analysis by Technology:

- High Energy Laser

- Chemical Laser

- Fiber Laser

- Free Electron Laser

- Solid -State Laser

- High Power Microwave

- Particle Beam

High energy laser leads the directed energy weapons market share with 50.6% in 2024. The high energy laser (HEL) segment is the most prominent in the market, predominantly due to its diverse applications and technological advancements. This segment encompasses various types of lasers including chemical lasers, fiber lasers, free electron lasers, and solid-state lasers. Their widespread adoption is attributed to their precision, long-range targeting capabilities, and the ability to effectively neutralize a range of threats from drones to missiles. Additionally, the versatility of HEL systems, adaptable across naval, aerial, and ground platforms, further contributes to their dominance. Innovations in this segment, particularly in solid-state and fiber lasers, are continually enhancing power output, efficiency, and operational reliability, making HELs increasingly attractive for both defense and homeland security applications.

Analysis by End Use:

- Ship Based

- Land Vehicles

- Airborne

- Gun Shot

Dominating the market in terms of end-use, the land vehicles segment reflects the growing emphasis on advanced ground-based defense systems. This segment's prominence is driven by the integration of DEWs into armored vehicles, tanks, and mobile platforms, providing forces with enhanced offensive and defensive capabilities. Along with this, the adaptability of DEWs, especially high-energy lasers and microwaves, for land-based operations ensures their effectiveness in various scenarios, from countering drones and missiles to neutralizing ground threats. As per the directed energy weapons market report, the increasing investment in modernizing ground forces with next-generation weaponry, alongside the need for mobile, flexible, and precise defense solutions, positions the land vehicles segment at the forefront of the DEW market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, based on the directed energy weapons market outlook, North America accounted for the largest market share of over 36.7%. North America leads the market, largely due to significant investments in defense and military technology by the United States. The region's dominance is supported by a robust defense industry, extensive R&D initiatives, and a strong presence of key players in the DEW market. The U.S. military's focus on modernizing its arsenal and incorporating advanced warfare technologies has led to substantial funding for DEW development and deployment. Additionally, the presence of established defense contractors and technology firms in this region facilitates innovation and rapid adoption of DEWs. The U.S. government's strategic emphasis on national security and maintaining military superiority, coupled with ongoing geopolitical tensions, continues to drive the growth of the DEW market in North America.

Key Regional Takeaways:

United States Directed Energy Weapons Market Analysis

In 2024, the United States accounted for the market share of over 93.30%. The rapid development and deployment of high-energy laser weapons have emerged as a key response to the growing threat posed by Unmanned Aerial Vehicles (UAVs) and other advanced military threats. In 2021, the integration of high-energy laser weapons into military platforms such as navy ships, airborne systems, and mobile vehicles gained significant momentum, as per an industry report. Another prominent one is the shipment of a high-energy laser weapon system by Raytheon Technologies Corporation to the U.S. Air Force in September 2020 for experiments and training purposes abroad. In addition, the U.S. Air Force Tactical High-power Operational Responder, developed by the Armed Forces Research Laboratory, has been using concentrated microwaves to effectively neutralize airborne threats, especially UAVs. As DEWs progress, it is envisioned that they would form the backbone of future military technologies by the 2030s with increased maturity and sophistication. It is also expected that mid-decade DEWs would reach or even exceed conventional and kinetic energy weapons' performance capabilities. This unceasing evolution places DEWs at the forefront of U.S. defense strategy and thus propels the U.S. directed energy weapons market growth.

Europe Directed Energy Weapons Market Analysis

The Europe DEW market is growing rapidly. Rising defense spending, geopolitical tensions, and strategic focus on advanced technologies are all contributing factors. In 2023, European defense spending rose to a record Euro 279 Billion (USD 289 Billion), an increase of 10% from the previous year, which marks the ninth consecutive year of steady growth, as per an industry report. This rise is due to the escalating security interests following the outbreak of Russia-Ukraine, which set off major geopolitical overhauls and made these nations realize the need to enhance advanced defense systems, one of them being directed energy weapons. On the other hand, 22 EU Member States boosted their defense expenditure, out of which 11 enhanced spending by over 10%. The European Defence Fund (EDF) is also going to play an important part, with some Euro 100 Million (USD 104 Million) being spent on cooperative R&T in 2023 on such advanced arms as DEWs. More and more, as nations become concerned about boosting their defensive capabilities against these emerging threats, such as hypersonic missiles and UAVs, the demand for DEWs would increase in Europe for better safety against emerging security challenges.

Asia Pacific Directed Energy Weapons Market Analysis

The Asia Pacific directed energy weapons (DEW) market share is growing at a robust rate. This is due to rising defense budgets and escalating geopolitical tensions in the region. In 2023, Asia's defense spending reached a record USD 510 Billion, with China leading the way, as per industry reports. Beijing has set aside a defense budget of RMB 1.55 Trillion (USD 219.5 Billion) for this year, representing a 7.2% increase compared with last year, setting an annual growth record that continues unabated for the past 29 years in terms of defense spending increases. The continuous increase reflects a sense of security from potential emerging threats through new missiles and UAVs, etc. Meanwhile, Japan, with similar regional security challenges, published three transformational strategy documents in December 2022, promising to increase its defense budget from 1% to 2% of GDP by 2027. These developments are a clear indication of the region's increasing investment in cutting-edge defense technologies, including directed energy weapons. Asia Pacific nations will seek to develop advanced defense systems as they look to meet emerging threats, and the directed energy weapon market will grow in response to the region's strategic defense endeavors.

Latin America Directed Energy Weapons Market Analysis

The Latin American directed energy weapons market demand is set to grow with an increasing defense budget and emphasis on modernizing military capabilities. According to an industrial report, Brazil has the highest defense budget in the region as of 2024, with an amount of around USD 24.75 Billion, followed by Venezuela at around USD 24.12 Billion. The huge monetary investment signifies that the region will continue to increase its defence infrastructure and integrate the best technologies available on the horizon, including the directed energy systems. Also, in Latin America, the growth in the defense market is likely to be 1.5% yearly from 2022 through 2027, thereby showing rising needs for more effective, inexpensive, and accurate solutions in defence. Because various security challenges will continue to emerge or evolve across the region's countries, directed energy weapon systems are likely to continue to gain prominence in support of efforts to enhance and build strong defense capabilities against those emerging security challenges, significantly increasing demand for DEWs in Latin America.

Middle East and Africa Directed Energy Weapons Market Analysis

The Middle East and Africa directed energy weapons market are growing rapidly as the budget for defense continues to grow and security threats continue to rise. In 2023, defense spending for Middle Eastern states stood at USD 163 Billion, 7.7% of global defense spending, as per industry report. Three out of the world's 20 largest defense budgets can be found in the region, an indication of its priority to military capabilities. Ongoing conflicts like renewed hostilities between Hamas and Israel, heightened militia activities in the region, and state rivalries are seen to intensify demand for advanced defense systems. The recent security challenges in this case saw Israel's defense budget rise by a lot. Regional defense expenditure will likely surge during the following years, reaching a projected total of USD 193.4 Billion by 2028. These trends showcase the increasing interest in modern technologies such as directed energy weapons, which provide practical, precise, and scalable solutions for modern defense. Thus, this trend will shape demand for DEWs in the Middle East and Africa.

Competitive Landscape:

The directed energy weapons market trends highlight that key players in the market are actively engaged in a variety of strategic activities to strengthen their positions and drive market growth. These leading companies are heavily investing in research and development to innovate and enhance the capabilities of DEWs. In confluence with this, collaborations with government defense agencies are commonplace, aimed at aligning product development with military needs and securing lucrative contracts. These firms are also focused on expanding their international presence through strategic partnerships, mergers, and acquisitions, thereby diversifying their market reach. For instance, in November 2024, Thales Australia, a prominent aerospace and defense company, announced tactical partnership with University of Adelaide to develop leading-edge laser DEW to tackle battlespace threats. Additionally, they are involved in extensive testing and trials to demonstrate the efficacy and safety of their DEW systems, crucial for gaining operational approval and building trust among potential customers in the defense sector.

The report provides a comprehensive analysis of the competitive landscape in the directed energy weapons market with detailed profiles of all major companies, including:

- Leonardo SpA

- Lockheed Martin Corporation

- RAFAEL Advanced Defense Systems Ltd.

- RTX Corporation

- The Boeing Company

Latest News and Developments:

- May 2024: BlueHalo was awarded a $95.4 million contract by the U.S. Army Space and Missile Defense Command (SMDC) to develop advanced Directed Energy (DE) prototypes under the Laser technology Research Development and Optimization (LARDO) program. BlueHalo's LOCUST laser systems are currently deployed overseas, contributing to multi-domain mission success in eliminating UAS threats and enhancing national security capabilities.

- December 2023: L3harris Technologies Inc. announced a strategic partnership to develop and bring quantum radio frequency (RF) sensing technologies from the lab to the field with L3Harris, a multinational aerospace and defense firm.

- August 2023: BAE Systems Plc announced the acquisition of Ball Aerospace from Ball Corp. for a cash sum of USD 5.55 Billion, with usual closing adjustments.

- May 2023: Applied Companies announced a historic commitment to construct the most sophisticated and biggest collaborative semiconductor process technology and manufacturing equipment research and development (R&D) facility in the world.

Directed Energy Weapons Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lethal, Non-Lethal |

| Applications Covered | Homeland Security, Defense |

| Technologies Covered |

|

| End Uses Covered | Ship Based, Land Vehicles, Airborne, Gun Shot |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Leonardo SpA, Lockheed Martin Corporation, RAFAEL Advanced Defense Systems Ltd., RTX Corporation, The Boeing Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the directed energy weapons market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global directed energy weapons market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the directed energy weapons industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Directed energy weapons (DEWs) are advanced weapons that use concentrated energy, such as lasers, microwaves, or electromagnetic waves, to damage or disable targets. Unlike conventional weapons, they deliver energy precisely without physical projectiles, making them effective for targeting drones, missiles, and electronic systems. DEWs offer speed, accuracy, and minimal collateral damage.

The directed energy weapons market was valued at USD 8.6 Billion in 2024.

IMARC Group estimates the market to reach USD 32.1 Billion by 2033, exhibiting a CAGR of 15.74% during 2025-2033.

The direct energy weapons market is driven by increasing demand for advanced military technologies, rising geopolitical tensions, and the need for precision targeting with minimal collateral damage. Advancements in laser and microwave technologies, growing defense budgets, and the focus on countering drones, missiles, and cyber threats further boost market growth.

Recent technological advancements in the directed energy weapons market include improved laser power, beam control systems, and thermal management for increased range and precision. Developments in solid-state lasers, fiber lasers, and high-energy microwaves also enhance capabilities for defense applications, such as countering drones and missiles.

According to the report, lethal represented the largest segment by type, due to their effectiveness in neutralizing high-value targets, advanced technological capabilities, and increasing demand for precision strike systems in modern military operations.

The defense sector leads the market by application due to rising military investments, the need for advanced countermeasures against evolving threats, and increasing adoption for air and missile defense.

High-energy lasers are the leading segment by technology, due to their precision targeting, cost-effective operation, scalability, and effectiveness in countering aerial threats, including drones and missiles.

Land vehicles is the leading segment by end use, due to their versatility, ability to support high-energy systems, and deployment for ground-based air defense and counter-drone operations.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the key players in the global directed energy weapons market include Leonardo SpA, Lockheed Martin Corporation, RAFAEL Advanced Defense Systems Ltd., RTX Corporation, The Boeing Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)