Direct Fed Microbials Market Report by Product Type (Lactic Acid Bacteria, Bacillus, and Others), Livestock (Swine, Poultry, Ruminants, Aquatic Animals, and Others), Form (Dry, Liquid), and Region 2025-2033

Direct Fed Microbials Market Size:

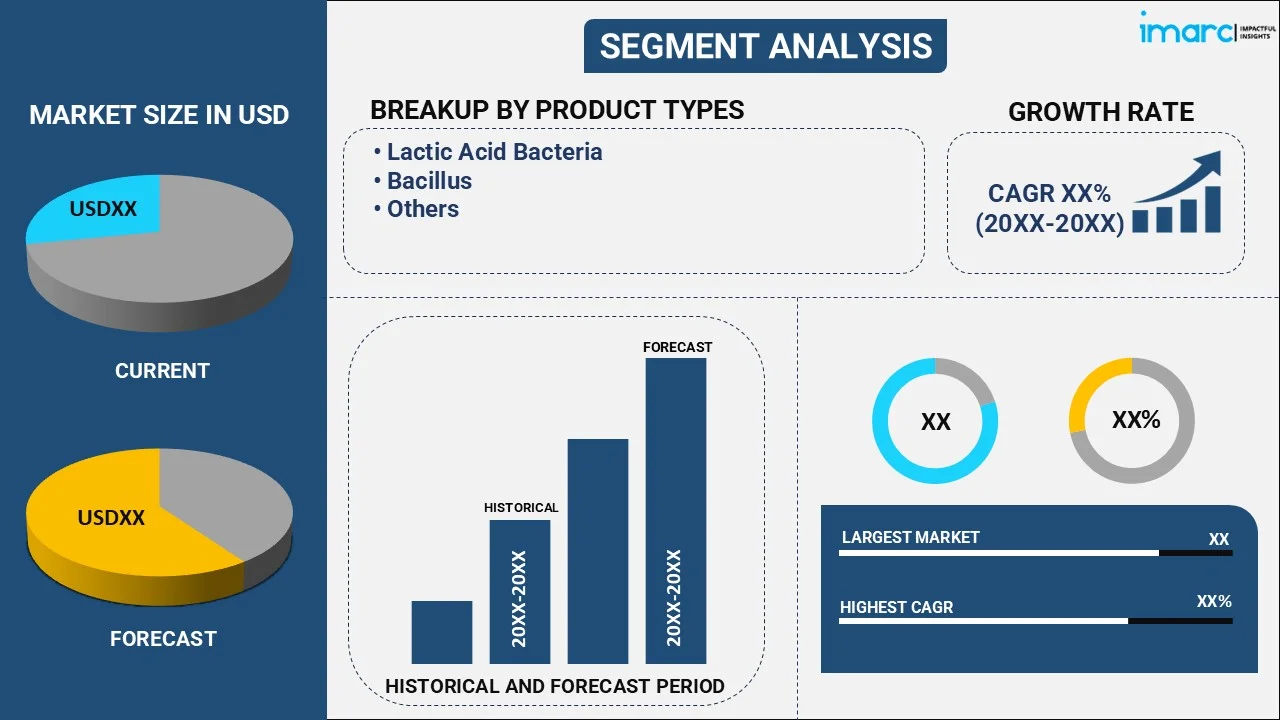

The global direct fed microbials market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.93% during 2025-2033. The market growth is significantly driven by escalating requirement for natural animal feed additives to enhance gut health and overall livestock performance. In addition, increasing awareness regarding antibiotic alternatives in animal feed and sustainable farming method further boosts market expansion across numerous regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Market Growth Rate (2025-2033) | 4.93% |

Direct Fed Microbials Market Analysis:

- Major Market Drivers: The increasing demand for natural and sustainable food additives, coupled with growing consumer awareness of gut health, is driving the growth of the direct fed microbials market.

- Key Market Trends: The trend towards clean label products and functional foods is propelling the adoption of direct fed microbials as natural alternatives to synthetic additives. Additionally, the rising interest in personalized nutrition and probiotics is creating new market opportunities for the market players.

- Geographical Trends: North America currently dominates the market, driven by a strong regulatory framework and consumer acceptance.

- Competitive Landscape: The market is characterized by a mix of established players and emerging startups. Major market players, including Cargill, Chr. Hansen, and ADM among others, compete based on product innovation, geographical reach, and regulatory compliance.

- Challenges and Opportunities: The industry faces challenges related to product standardization, regulatory hurdles, and consumer education. However, the growing demand for natural and functional ingredients presents significant opportunities for companies to expand their market share and develop innovative products.

Direct Fed Microbials Market Trends:

Rising Preference for Natural Feed Additives

The direct fed microbials market analysis indicates a significant shift toward natural feed additives as consumers as well as producers are increasingly focusing on sustainability and health in animal farming. Direct fed microbials, generally composed of beneficial bacteria or yeast, provide an effective alternative to synthetic additives and antibiotics commonly used in livestock production, and are increasingly being preferred for their high protein content. According to a research article published in April 2023, protein content in bacteria ranges between 53% to 80%. Besides, the new generation of animal feed, based on single cell protein, utilizes engineered microorganisms nutritionally tailored to the target animal. Moreover, these natural additives dominantly bolster the direct fed microbials market growth by enhancing digestive efficiency and boosting immunity, thereby reducing the need for antibiotics in animal feed. Furthermore, governments and regulatory bodies worldwide are encouraging the use of natural products in feed formulations to ensure safer meat and dairy products. This trend aligns with the broader consumer demand for cleaner, more natural food sources, thereby driving expansion in the direct fed microbials market. In addition, companies in the sector are capitalizing on this trend by developing new microbial strains and expanding their product portfolios to meet the increasing demand for antibiotic-free animal nutrition solutions.

Growing Product Applications in Poultry and Aquaculture Sectors

According to the direct fed microbials market forecast, the poultry and aquaculture industries are anticipated to remain key contributors to the growth of the global market. With the rapid elevation in demand for farmed seafood and poultry products globally, producers are actively exploring advanced solutions to optimize animal feed effectiveness as well as improve health. According to the World Wildlife Fund, globally, more than 3 billion individuals depend on farmed and wild-caught seafood as a substantial animal protein source. Direct-fed microbials exhibits a critical role in improving gut health, overall growth rates, and nutrient absorption in fish and poultry, resulting in an amplified interest from these industries. In poultry farming, microbials aid in mitigating general gastrointestinal complications, minimizing dependency on antibiotics and accelerating productivity. Analogously, in aquaculture, the utilization of direct fed microbials enhances both feed conversion ratios and water quality, catering to the magnifying requirement for effective and sustainable farming methods. Furthermore, as these sectors continue to expand, especially in countries with elevated protein consumption, the direct fed microbials market demand is expected to grow significantly.

Increasing Focus on Sustainable Livestock Farming

The direct-fed microbials market is also benefiting from the increasing focus on sustainable livestock farming practices. With rising environmental concerns and regulatory pressures to reduce the ecological footprint of animal agriculture, producers are adopting direct-fed microbials as a part of their strategy to enhance sustainability. As per industry reports, 41% of tropical deforestation is attributed to the conversion of land for cattle grazing purpose. Moreover, such microbials not only improve animal health and productivity but also contribute to better feed efficiency, resulting in reduced feed consumption and waste generation. In addition, the use of direct-fed microbials helps reduced greenhouse gas emissions by improving digestion and reducing methane production in ruminants. Governments and organizations promoting sustainable agriculture are supporting these practices through incentives and regulations, further boosting the adoption of direct-fed microbials. Furthermore, as sustainability becomes a central theme in global agriculture, the demand for eco-friendly and efficient feed additives is expected to grow, contributing to a positive direct fed microbials market outlook.

Direct Fed Microbials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, livestock and form.

Breakup by Product Type:

- Lactic Acid Bacteria

- Bacillus

- Others

Lactic acid bacteria accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lactic acid bacteria, bacillus, and others. According to the report, lactic acid bacteria represented the largest segment.

Breakup by Livestock:

- Swine

- Poultry

- Ruminants

- Aquatic Animals

- Others

Poultry holds the largest share of the industry

A detailed breakup and analysis of the market based on the livestock have also been provided in the report. This includes swine, poultry, ruminants, aquatic animals, and others. According to the report, poultry accounted for the largest market share.

Breakup by Form:

- Dry

- Liquid

Dry represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the form. This includes dry and liquid. According to the report, dry represented the largest segment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest direct fed microbials market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for direct fed microbials.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the direct fed microbials industry include BASF SE, Alltech, American Biosystems Inc, Bayer AG, Bio-Vet, Cargill Incorporated, Chr. Hansen A/S (Chr Hansen Holding A/S), DuPont de Nemours Inc., Kemin Industries, Koninklijke DSM N.V., Lallemand Inc., Novozymes A/S (Novo Holdings A/S), and Novus International Inc. (Mitsui & Co. Ltd).

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Direct Fed Microbials Market News:

- In September 2024, Anpario Inc., a leading producer of sustainable animal feed additives, announced the strategic acquisition of Bio-Vet Inc., a company specializing in direct-fed microbials , for a cash consideration of USD 7.3 million.

- In April 2024, Phibro Animal Health, a direct fed microbials provider, announced its acquisition of Zoetis' medicated feed additive portfolio, designed for poultry, swine, and cattle production. This portfolio encompasses over 37 product lines and generated approximately USD 400 million in revenue during 2023.

Direct Fed Microbials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lactic Acid Bacteria, Bacillus, Others |

| Livestocks Covered | Swine, Poultry, Ruminants, Aquatic Animals, Others |

| Forms Covered | Dry, Liquid |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Alltech, American Biosystems Inc, Bayer AG, Bio-Vet, Cargill Incorporated, Chr. Hansen A/S (Chr Hansen Holding A/S), DuPont de Nemours Inc., Kemin Industries, Koninklijke DSM N.V., Lallemand Inc., Novozymes A/S (Novo Holdings A/S), Novus International Inc. (Mitsui & Co. Ltd), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the direct fed microbials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global direct fed microbials market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the direct fed microbials industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global direct fed microbials market was valued at USD 1.4 Billion in 2024.

We expect the global direct fed microbials market to exhibit a CAGR of 4.93% during 2025-2033.

The rising demand for direct fed microbials as they aid in enhancing metabolism, maintaining microbial flora in the intestine, ammonia production, and neutralizing enterotoxin, is primarily driving the global direct fed microbials market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for direct fed microbials.

Based on the product type, the global direct fed microbials market can be segmented into lactic acid bacteria, bacillus, and others. Currently, lactic acid bacteria holds the largest market share.

Based on the livestock, the global direct fed microbials market has been divided into swine, poultry, ruminants, aquatic animals, and others. Among these, poultry currently exhibits a clear dominance in the market.

Based on the form, the global direct fed microbials market can be categorized into dry and liquid. Currently, dry accounts for the majority of the global market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global direct fed microbials market include BASF SE, Alltech, American Biosystems Inc, Bayer AG, Bio-Vet, Cargill Incorporated, Chr. Hansen A/S (Chr Hansen Holding A/S), DuPont de Nemours Inc., Kemin Industries, Koninklijke DSM N.V., Lallemand Inc., Novozymes A/S (Novo Holdings A/S), and Novus International Inc. (Mitsui & Co. Ltd).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)