Digital Transformation Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprise Size, End-Use Industry, and Region, 2025-2033

Digital Transformation Market Size and Share:

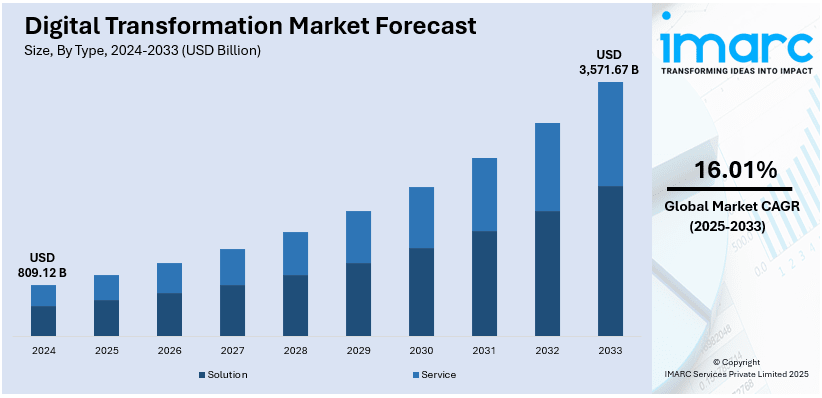

The global digital transformation market size was valued at USD 809.12 Billion in 2024. Looking forward, the market is projected to reach USD 3,571.67 Billion by 2033, exhibiting a CAGR of 16.01% from 2025-2033. North America currently dominates the market, holding a market share of over 44.2% in 2024. The digital transformation market is propelled by increased government spending in digital infrastructure, such as AI, cloud computing, and machine learning. Increased uptake of Industry 4.0 technologies is heightening automation, lowering costs of operations, and facilitating real-time decision-making. The need for scalable, secure, and data-driven solutions continues to increase across industries, further expanding the digital transformation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 809.12 Billion |

| Market Forecast in 2033 | USD 3,571.67 Billion |

| Market Growth Rate 2025-2033 | 16.01% |

The growth in the global digital transformation market is driven by advanced technologies like artificial intelligence (AI), cloud computing, and the Internet of Things (IoT). Businesses are embracing the latest digital tools to help operate in the most efficient manner and with optimal customer experience and to gain innovation. The remote and hybrid work models also increase this demand for digital solutions more rapidly, including platforms and cybersecurity systems. Besides this, rising investments in IT infrastructure by organizations in most sectors such as healthcare, retail, and finance also contribute towards this growth. In addition to this, the government initiatives and support towards digitalization are augmenting the digital transformation industry size.

To get more information on this market, Request Sample

The USA is emerging as a leading market with 70.00% share. Its growth has been mainly fueled by the increased adoption of advanced technologies such as AI, cloud computing, and data analytics across different industries. More organizations are now making efforts to improve customer experience and increase efficiency through more efficient processes with the help of digital tools. In addition, remote work and hybrid work models have enhanced the requirement for digital collaboration and strong cybersecurity solutions, thereby propelling the digital transformation market growth. Significant investments in IT infrastructure by businesses in the healthcare, retail, manufacturing, and finance sectors are further fueling the growth of the market. The U.S. government's focus on digital initiatives, such as smart city projects and the modernization of public services, also supports this growth. As of December 2024, 5G networks in the United States cover over 325 million people, achieving nationwide coverage more rapidly than previous generations. This expanding proliferation of 5G networks is enabling faster and more reliable connectivity, fostering innovation in IoT and automation. A strong entrepreneurial ecosystem and increasing demand for customized, data-driven solutions play a very important role in driving the digital transformation landscape in this country.

Digital Transformation Market Trends:

Increasing Demand for Remote Patient Monitoring

Growing demand for remote patient monitoring (RPM) is majorly driving the market. RPM refers to the use of digital technologies to monitor patients' health remotely, allowing healthcare providers to collect real-time data and track patients' conditions outside traditional clinical settings. As per Clinical Practice Research Datalink (CPRD), this database has 4.4 million active patients, which reflects 6.9% of the UK population. Such factors are expected to drive the digital transformation market in the future years and create a positive digital transformation market outlook.

Integration of Industry 4.0 technologies

The integration of Industry 4.0 principles and technologies is significantly driving the growth in the digital transformation market. Industry 4.0 emphasizes the use of advanced automation and robotics to optimize manufacturing and production processes. Automated systems powered by AI and machine learning enhance efficiency, reduce operational costs, and improve productivity across industries. For instance, in July 2024, Massimo Group, a producer and distributor of power sports vehicles and pontoon boats, launched a new automated car assembly robot line. It will boost assembly efficiency by 50% by reducing manual handling, and labor, and improving safety for assembly line personnel. These factors are further positively influencing the digital transformation market forecast.

Rising Integration of the Internet of Things (IoT)

One of the crucial factors for the market is the increasing adoption of the Internet of Things (IoT)-enabled devices. Eurostat has reported that more than half of enterprises in Austria (51 %) used IoT devices or systems in 2021. IoT devices can capture real-time sensor data, which can be sent to the cloud for storage, analysis, and processing. Smooth data exchange helps organizations in gaining insights, optimizing operations, and making data-based decisions to bolster revenue.

Market Challenges and Opportunities:

The digital transformation market faces several challenges, including cybersecurity risks, high initial investment costs, integration complexities, and a shortage of digitally skilled professionals. Many organizations, especially in developing regions, struggle with legacy infrastructure, resistance to change, and data privacy compliance. Additionally, inconsistent regulatory frameworks across countries further complicate global implementation. However, these challenges also present unique opportunities. The growing urgency to modernize IT ecosystems and ensure business continuity is prompting companies to increase spending on secure, scalable digital solutions. Government-led smart infrastructure initiatives and favorable policy support for cloud adoption are accelerating transformation in both public and private sectors. Moreover, as hybrid work environments become permanent, demand for digital collaboration, automation tools, and cloud-based infrastructure continues to rise, unlocking new business models across industries.

Digital Transformation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global digital transformation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, deployment mode, enterprise size, and end-use industry.

Analysis by Type:

- Solution

- Analytics

- Cloud Computing

- Mobility

- Social Media

- Others

- Service

- Professional Services

- Integration and Implementation

The solution segment is the most crucial market segment experiencing widespread adoption, driven by the rising demand for digital transformation solutions in the process of modernizing industrial operations. Businesses from various industries look toward these solutions to update their operations, become more efficient, and discover new opportunities for growth as they continue to compete in a world driven by the digital revolution. These solutions include many technologies, such as cloud computing, data analytics, AI, IoT, and automation. These solutions allow organizations to streamline workflows, optimize resource allocation, and gain valuable insights from data, leading to better decision-making and improved customer experiences.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

On-premises is the largest component in 2024, holding around 51.8% of the market. The on-premises deployment mode enjoys a large share of the market because it can offer a customized and controlled network for digital transformation projects. Organizations choose to deploy solutions on-premises to ensure control and ownership over their digital assets and hence tailor them to the requirements and needs of their business. The primary benefit that can be seen through on-premises deployment is increased security over data. Many organizations work in industries dealing with confidential information and therefore must store their data in a safe and secure environment. Thus, this avoids chances of leakage and fulfills rigid requirements for data privacy regulation, thereby boosting its market demand.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises are leading in the market with about 58.8% of market share in 2024. Digital transformation has been extremely popular among large enterprises due to its cost-effectiveness as well as the smooth execution of business processes. Large organizations sense the opportunity for the digitalized solution to improve operations, increase productivity, and hence innovate for better business outputs. More importantly, cost-effectiveness plays an important role in the decision-making of large enterprises. They will be able to optimize business processes, automate labor-intensiveness, and, therefore, cut operational expenses through digital transformation. Long-term cost-cutting occurs because the process and the use of resources are optimized after transformation. As an example, Exploding Topics reported that in February 2024 about 90% of large enterprises implemented a multi-cloud infrastructure.

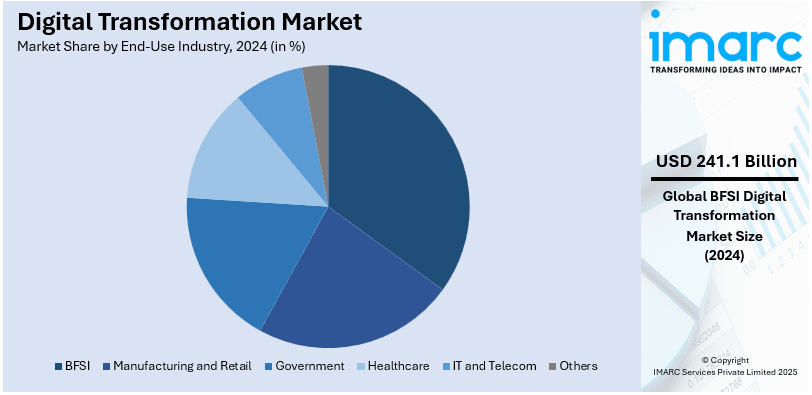

Analysis by End-Use Industry:

- BFSI

- Manufacturing and Retail

- Government

- Healthcare

- IT and Telecom

- Others

BFSI leads the market with around 29.8% of the market share in 2024. The banking, financial services, and insurance (BFSI) sector dominates the market, primarily as banks and financial institutions increasingly focus on a customer-centric approach in order to stay competitive in the digital age. By embracing digital transformation, BFSI companies can offer seamless support and technical assistance to customers in order to improve their banking experience. The increasing availability of digital channels has now made it a norm that customers should have convenient, personalized services at their fingertips. Such solutions enable BFSI companies to provide exactly the same experience for customers with mobile banking applications, online management of accounts, and customized financial advice that data analytics and artificial intelligence make possible. For instance, in January 2022, Bank of America introduced CashPro forecasting software based on AI and ML to accurately forecast its clients' future cash positions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America led with a market share of above 44.2% in 2024. This is because of the high penetration of Internet and an immense amount of digital transformation adopted throughout different sectors of the industries. For example, in June 2023 when the U.S Government projected investment of about USD 42 Billion on new federal subsidies to enable high-speed internet access by all households in the USA. Additionally, with the ever-ready tech-savvy population and advanced digital infrastructure, the USA is rapidly transforming and becoming a hotbed of innovations with various digital transformation initiatives. North American businesses have come to realize the transformation that digital technologies can bring across various sectors, such as retail, manufacturing, healthcare, and many more. These transformations allow their industries to improve customer experience, increase operational efficiency, and unlock new revenue streams. The dynamic and competitive business landscape of the region encourages businesses to be at the forefront of digital change, catalyzing rapid adoption of cloud computing, big data analytics, AI, and IoT. Additionally, the North America market enjoys a healthy ecosystem of technology providers, consultants, and vendors of digital solutions, which offer a wide range of digital solutions offerings to suit different business needs. Consequently, the region remains clear in market dominance and leads the way to fortify innovation and digital progress on the

Key Regional Takeaways:

United States Digital Transformation Market Analysis

The digital transformation market in the United States is booming because companies are adopting cloud technologies for greater operational agility and scalability. Companies are incorporating AI and ML into their systems to automate processes, improve customer experiences, and gain actionable insights from data in real-time. Organizations are increasingly turning to sophisticated data management and cybersecurity solutions due to increased dependence on analytics to safeguard sensitive information against all types of regulations. Businesses today are using Internet of Things (IoT) devices to develop a smarter form of operation or to create supply chain optimizations, especially in manufacturing and logistics. Organizations are also building their workforce capabilities through remote collaboration tools and platforms, in response to the increasing demand for flexible work environments. A US survey found that 94 percent of respondents said they would benefit from work flexibility, with the biggest gains being less stress/improved mental health, and better integration of work and personal life. The shift towards a subscription-based business model is fueling the demand for advanced software solutions, while innovations in 5G networks are creating faster and more reliable connectivity across industries. Startups and established companies alike are beginning to realize the strategic importance of digital transformation to remain competitive in an increasingly rapidly evolving marketplace. The digital transformation journey is getting intensified in the U.S. because of growing investment in technology infrastructure, as organizations are constantly evolving to match customer demands and market expectations.

Europe Digital Transformation Market Analysis

The European digital transformation market is still currently dominated by the embracing of advanced technologies by enterprises in the quest for increased operational efficiency and better customer engagement. Organizations now incorporate AI and ML solutions that can automate workflows, optimize their supply chains, and deliver unique real-time experiences to customers. The need for cloud computing increases because companies shift from being held by legacy systems that have proven not scalable nor flexible enough to meet remote work requirements, improving collaboration, and cutting costs. According to the European Commission, 45.2 % of EU enterprises bought cloud computing services in 2023. Furthermore, Europe’s increasing regulatory landscape, particularly around data protection and privacy laws like GDPR, is pushing businesses to adopt secure digital infrastructures. Companies are also adapting to the demand for improved customer-centric strategies by leveraging data analytics to derive actionable insights and improve decision-making processes. The rise of Industry 4.0 technologies, including IoT (Internet of Things), is enabling manufacturers to connect machinery, collect real-time data, and improve predictive maintenance. As the European workforce becomes more digitally skilled, businesses are investing in digital training to foster innovation and enhance employee productivity. With sustainability concerns becoming increasingly prominent, organizations are also embracing green technologies and eco-friendly digital solutions, further accelerating the digital transformation wave across industries.

Asia Pacific Digital Transformation Market Analysis

The Asia Pacific digital transformation market is rapidly expanding as organizations are increasingly adopting cloud-based solutions, automating processes, and integrating advanced technologies like artificial intelligence (AI) and machine learning (ML) to drive operational efficiency. Businesses are prioritizing data-driven decision-making, leveraging big data analytics to uncover insights and enhance customer experiences. The region is witnessing a surge in the implementation of Internet of Things (IoT) devices, enabling companies to gather real-time data and optimize supply chain and resource management. As enterprises focus on enhancing customer engagement, they are embracing omnichannel strategies, integrating digital platforms, and refining mobile-first solutions. Governments in key Asia Pacific countries are actively promoting digital economies through policy reforms and providing financial incentives for innovation and technology adoption. In particular, industries like manufacturing, retail, and finance are transforming their operations to keep pace with the increasing demand for seamless and personalized digital experiences. As cybersecurity threats intensify, businesses are investing in robust digital security measures to protect data and ensure compliance with evolving regulations. According to reports, in 2023, over 400 Million detections across approximately 8.5 Million Endpoints have been detected across India. These ongoing shifts reflect a comprehensive effort to adopt new business models, enhance operational agility, and meet the growing expectations of digital-first consumers.

Latin America Digital Transformation Market Analysis

The digital transformation market in Latin America is witnessing significant growth due to several key drivers that are reshaping the region's technological landscape. Companies are increasingly adopting cloud-based solutions to enhance flexibility and scalability, allowing them to optimize operations and meet the demands of a rapidly evolving business environment. Organizations are also investing heavily in artificial intelligence (AI) and machine learning (ML) to automate processes, improve decision-making, and enhance customer experiences. Governments and enterprises are pushing for stronger cybersecurity measures as digital threats grow, driving investments in advanced security solutions. The rise in mobile internet penetration is fuelling the demand for mobile-first applications, with businesses prioritizing digital channels to engage customers effectively. According to the Brazilian Institute of Geography and Statistics (IBGE), the internet was used in 92.5% of the Brazilian households (72.5 Million) in 2023, a rise of 1.0 pp over 2022. Additionally, industries are embracing big data analytics to gain deeper insights into consumer behaviour, optimize supply chains, and predict market trends. Remote work adoption is accelerating the shift toward digital collaboration tools, leading organizations to enhance their IT infrastructure. The Latin American market is also experiencing an increased focus on digital financial services, with fintech companies leading innovations in payments, lending, and insurance. These factors are collectively driving the region's digital transformation, enabling businesses to stay competitive and meet the demands of a digitally savvy population.

Middle East and Africa Digital Transformation Market Analysis

The digital transformation market in the Middle East and Africa is currently experiencing significant growth, driven by the increasing adoption of cloud computing technologies, which are enabling businesses to scale their operations seamlessly. Governments across the region are actively pushing for smart city initiatives and digital infrastructure upgrades, fostering the growth of digital ecosystems. Enterprises are integrating advanced analytics, AI, and machine learning into their business models to streamline decision-making and enhance operational efficiency. The region's increasing mobile penetration is accelerating the shift towards mobile-first solutions, with businesses leveraging mobile applications to improve customer engagement and reach new markets. According to World Bank Data, internet penetration in the UAE was at 99.15 per cent in 2019. Additionally, industries like oil and gas, retail, and banking are rapidly adopting Internet of Things (IoT) technologies to optimize supply chains and enhance asset management. The growing demand for data security and regulatory compliance is driving the investment in robust cybersecurity solutions. Furthermore, the rise of a digitally-savvy, younger population is pushing organizations to innovate and implement new digital solutions that cater to evolving consumer needs and preferences. As local talent continues to develop digital skills, businesses are increasingly focusing on harnessing the power of digital transformation to gain a competitive advantage and create more agile, future-proof operations.

Competitive Landscape:

The global digital transformation market is highly competitive, characterized by the presence of numerous prominent players alongside emerging startups. Established firms leverage their extensive portfolios in AI, cloud computing, and data analytics to maintain a dominant position, often forming strategic partnerships to expand their offerings. Startups and niche players, on the other hand, focus on innovative solutions tailored to specific industries, driving competition through agility and specialization. Regional players also contribute significantly, catering to localized needs and regulatory requirements. Mergers, acquisitions, and collaborations are frequent, as companies seek to strengthen capabilities and broaden market reach. The increasing demand for customized digital solutions encourages firms to invest heavily in research and development. Competitive pricing, differentiated services, and strong customer relationships are critical strategies in this dynamic market, where technological advancements and customer-centric approaches continue to shape the landscape.

The report provides a comprehensive analysis of the competitive landscape in the digital transformation market with detailed profiles of all major companies, including:

- Accenture PLC

- Adobe Inc.

- Capgemini SE

- Cisco Systems, Inc.

- Cognizant

- Dell Inc.

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Marlabs Inc.

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Siemens AG

Latest News and Developments:

- June 2025: HCLTech has been selected by ASISA, a Spanish health insurer with 2.2 million customers, as its strategic IT partner to accelerate digital transformation and regional expansion across Iberia. The initiative includes modernizing ASISA's legacy IT infrastructure and integrating AI-driven solutions to enhance agility, scalability, and operational efficiency. This collaboration underscores growing demand in the global digital transformation market for AI-enabled modernization, especially in highly regulated sectors like healthcare and insurance.

- June 2025: Bel Group, a global leader in healthy snacking with EUR 3.7 Billion (USD 3.97 Billion) in 2024 sales, has partnered with Accenture for a multi-year digital transformation to drive efficiency, sustainability, and innovation across its value chain. The collaboration will implement AI-powered solutions across 11 global factories, optimize logistics and supply chains, and enhance product lifecycle management, supporting Bel's goal to reduce emissions by 25% by 2035.

- May 2025: Steel Authority of India Limited (SAIL) signed a digital transformation agreement with ABB India to deploy digital twins and data-driven optimization at its Rourkela Steel Plant, which produced 4.08 million tons of saleable steel in FY 2024–25. The collaboration will integrate advanced mathematical models to enhance furnace performance, improve operational efficiency, and support SAIL's plan to expand output to 9 million tons by 2030.

- June 2025: Tata Consultancy Services (TCS) has entered a long-term strategic partnership with Salling Group, Denmark’s largest retailer, to accelerate its digital transformation across 2,100 stores and operations in six European countries. The initiative includes AI-enabled cloud migration using TCS’s Cloud Exponence platform, aiming to boost operational efficiency, enhance e-commerce responsiveness, and support Salling’s "Aspire 28" growth strategy.

- July 2024: Whitbread and Cognizant collaborated to include digital transformation services in order to support Whitebread's ongoing digital transformation with product design, product management, and engineering.

- July 2024: Rabobank, a multinational banking and financial services firm located in the Netherlands with over 9.1 Million customers, selected the Zafin platform to power digital transformation efforts with Optimized Product, Pricing and Billing Capabilities.

- July 2024: Liberty General Insurance Bhd, a Malaysian insurance company, received an accolade as the Digital Transformation Initiative of the Year at the Insurance Asia Awards 2024. This accolade underscores Liberty's role in redefining traditional boundaries through innovative solutions that profoundly impact both customers and the industry.

- September 2024: NTT DATA, a global leader in digital business and IT services, revealed a multi-year partnership with Arsenal, becoming the club’s Official Digital Transformation Partner. Renowned for its role in transforming major sports clubs and events worldwide, NTT DATA will introduce innovative technologies aimed at enhancing the experience for Arsenal supporters.

- September 2024: Merck, a leading science and technology company, and Siemens, a leading technology company entered into a strategic partnership and signed a Memorandum of Understanding thereby driving digital transformation through strategic projects across all three business sectors of Merck.

Digital Transformation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End-Use Industries Covered | BFSI, Manufacturing and Retail, Government, Healthcare, IT and Telecom, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture PLC, Adobe Inc., Capgemini SE, Cisco Systems, Inc., Cognizant, Dell Inc., Google LLC (Alphabet Inc.), Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Marlabs Inc., Microsoft Corporation, Oracle Corporation, SAP SE, Siemens AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital transformation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global digital transformation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital transformation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Digital transformation refers to integrating digital technologies into all areas of a business, fundamentally changing how organizations operate and deliver value to customers. It encompasses adopting advanced tools like AI, cloud computing, IoT, and analytics to drive efficiency and innovation.

The global digital transformation market was valued at USD 809.12 Billion in 2024.

IMARC estimates the global digital transformation market to exhibit a CAGR of 16.01% during 2025-2033.

The market is driven by the adoption of AI, IoT, and cloud technologies, and increased demand for efficiency, real-time data insights, and enhanced customer experiences across industries.

In 2024, the solution segment represented the largest by type, driven by escalating demand for AI, IoT, and cloud computing solutions.

On-premises deployment leads the market due to its enhanced data security and control over digital infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)