Digital Shipyard Market Size, Share, Trends and Forecast by Type, Technology, Process, Capacity, Digitalization Level, End Use, and Region, 2025-2033

Digital Shipyard Market Size and Share:

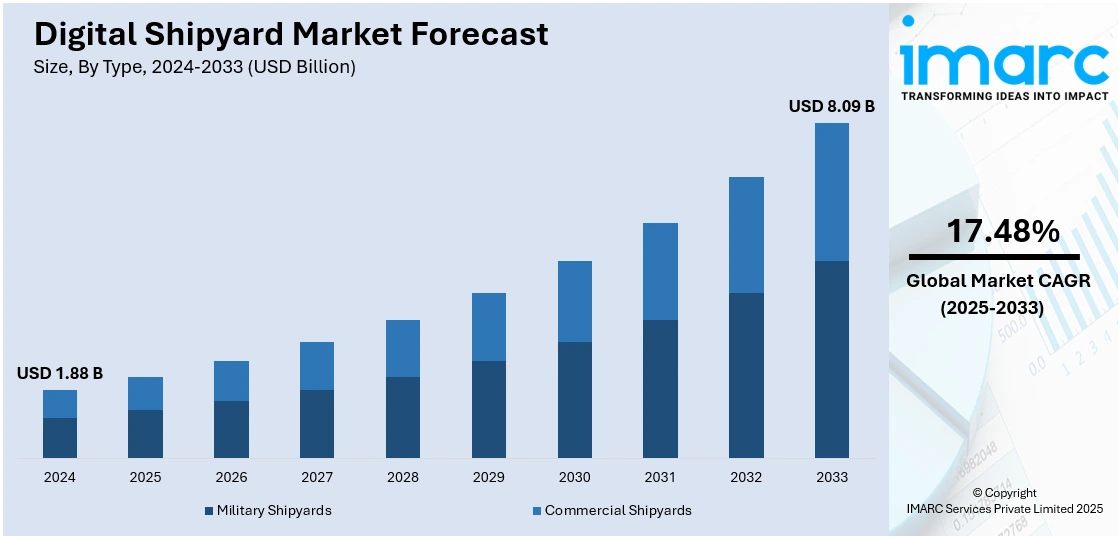

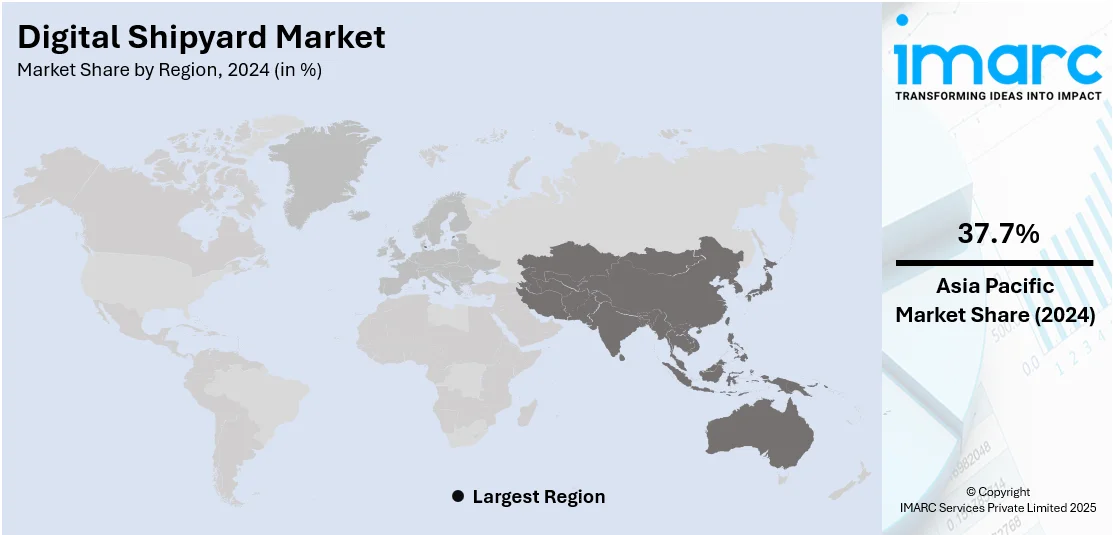

The global digital shipyard market size was valued at USD 1.88 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.09 Billion by 2033, exhibiting a CAGR of 17.48% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 37.7% in 2024. At present, the increasing use of cutting-edge technologies that enable real-time monitoring and control of various shipbuilding operations is positively influencing the market. Besides this, rising environmental concerns are contributing to the expansion of the digital shipyard market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.88 Billion |

| Market Forecast in 2033 | USD 8.09 Billion |

| Market Growth Rate (2025-2033) | 17.48% |

At present, the market is growing due to the increasing need for automation, efficiency, and precision in shipbuilding. To expedite design, production, and maintenance, shipyards are implementing digital technology such as digital twins, 3D modeling, and real-time data analytics. These tools reduce expenses, cut down on mistakes, and expedite delivery. Predictive maintenance, workflow management, and equipment monitoring are enhanced by the employment of artificial intelligence (AI) and the Internet of Things (IoT). To improve operational readiness and modernize naval capabilities, government organizations and the military industry are investing in digital shipyards. Demand is being driven by the promotion of sustainability since digital systems facilitate more efficient use of energy and less waste. Additionally, the adoption of digital shipyards is growing as a result of collaborations between tech companies and shipbuilders.

The United States has emerged as a major region in the digital shipyard market owing to many factors. Rising demand for advanced naval capabilities and modernization of shipbuilding infrastructure is fueling the digital shipyard market growth. To enhance ship design, construction, and maintenance, the US Navy and the defense industry are making significant investments in smart technologies. In complicated projects, digital tools like 3D modeling, digital twins, and real-time data systems lower costs, boost productivity, and guarantee accuracy. Better workflow management and predictive maintenance are supported by the combination of AI, IoT, and automation. According to the IMARC Group, the United States AI market size reached USD 37,029.9 Million in 2024. The US is also focusing on cybersecurity and secure digital operations, which is further driving digital transformation in shipyards.

Digital Shipyard Market Trends:

Technological Advancements

The integration of advanced technologies like AI, machine learning (ML), and the IoT in shipbuilding processes significantly enhances accuracy and speed. These technologies facilitate predictive maintenance and reduce downtime. Firms are investing in advanced tools to enhance operational optimization. In May 2025, Persona AI secured USD 27 Million to speed up the advancement of humanoid robots for shipyards. The firm collaborated with HD Hyundai for initial rollouts within 18 months, tackling labor shortages and improving workplace safety. AI and ML enable more efficient design processes. IoT technologies facilitate real-time monitoring and control of various shipbuilding processes, enhancing productivity and protection. Advanced computer-aided design (CAD) software and simulation tools allow the development of more accurate and reliable ship designs. These tools enable engineers to test and modify designs virtually, minimizing the need for costly physical prototypes.

Rising Demand for Automation

The growing demand for automation to improve productivity and reduce human error is offering a favorable digital shipyard market outlook. Automation streamlines various processes, such as welding, painting, and assembly, leading to faster production times and higher quality outputs. Companies are spending on advanced solutions to optimize workflow. In March 2025, Seaspan Shipyards allocated USD 5 Million to Novarc Technologies to enhance AI-based automated welding solutions. The funding facilitated product development and commercialization while aligning with Seaspan’s commitment to the National Shipbuilding Strategy. Automation ensures a high level of precision and consistency, decreasing the margin of error compared to manual processes. This consistency is crucial in shipbuilding, where even minor defects can have significant consequences. Automation also reduces the reliance on manual labor, which can be a major cost factor in shipbuilding. Automated processes lower the requirement for skilled labor, thereby cutting down labor costs and mitigating the impact of labor shortages.

Growing Environmental Concerns

Increasing awareness about environmental issues is leading to the adoption of sustainable and eco-friendly manufacturing practices. The OECD reported that in 2024, 82 shipbuilders created vessels that could use alternative fuels. From 2014 to 2024, the capacity of shipyards to build such ships expanded, with the proportion of operational yards able to construct alternative fuel vessels rising to between 7% and 36% for various ship categories in 2023. Digital shipyards offer solutions like energy-efficient designs, aligning with worldwide efforts to minimize the environmental impact of shipbuilding. Automation and precision technologies in digital shipyards contribute to significant reductions in material waste. Efficient employment of resources not only lowers environmental impact but also decreases costs. Recycling and reusing materials in the shipbuilding process is also gaining traction as an eco-friendly practice.

Increasing Adoption of Regulatory Compliance

The shipbuilding industry is facing stringent regulations regarding safety and environmental standards. Digital shipyards enable better adherence to these regulations through improved monitoring and reporting capabilities, making them an attractive option for companies looking to comply with legal requirements. Environmental regulations in the maritime industry are becoming increasingly stringent, focusing on reducing emissions, waste, and other ecological impacts. Consequently, in April 2025, the IMO sanctioned a net-zero strategy for international shipping, targeting net-zero emissions by 2050. The rules featured a new worldwide fuel standard and greenhouse gas pricing, affecting vessels exceeding 5,000 gross tonnages, accountable for 85% of CO2 emissions in worldwide shipping. Digital shipyards leverage technologies like efficient design tools and data analytics to create eco-friendlier ships that adhere to regulations. Digital technologies also enable shipyards to maintain high standards of quality, which is essential for regulatory compliance. Automated quality control systems, digital inspections, and advanced manufacturing processes ensure that the construction and repair of ships meet the required quality standards.

Digital Shipyard Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global digital shipyard market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, process, capacity, digitalization level, and end use.

Analysis by Type:

- Military Shipyards

- Commercial Shipyards

Commercial shipyards held 66.1% of the market share in 2024. They handle a wide range of vessels, including cargo ships, tankers, and passenger ships, which require precision, speed, and cost-effective operations. Digital technologies like 3D modeling, digital twins, and automation help streamline complex design and manufacturing processes, allowing commercial shipyards to minimize errors and production time. With international trade continuously growing, commercial shipyards are adopting smart solutions to meet tight schedules and ensure timely delivery. They are also using real-time data and analytics to improve workflow, monitor equipment, and perform predictive maintenance, leading to improved safety and reduced downtime. Investments from private companies and global shipping firms are supporting digital upgrades, making commercial shipyards more competitive. The focus on sustainability and fuel efficiency is also encouraging the employment of digital tools for better resource planning.

Analysis by Technology:

- AR/VR

- Digital Twin and Simulation

- Addictive Manufacturing

- Artificial Intelligence and Big Data Analytics

- Robotic Process Automation

- Industrial Internet of Things (IIoT)

- Cybersecurity

- Block Chain

- Cloud and Master Data Management

Artificial intelligence and big data analytics offer powerful tools to enhance efficiency, lower expenses, and boost decision-making. AI helps automate complex tasks, such as design optimization, predictive maintenance, and quality control, allowing shipyards to operate more efficiently. Big data analytics processes large volumes of information from sensors, equipment, and workflows, providing real-time insights that enhance productivity and safety. These technologies enable better planning, resource allocation, and early detection of potential issues, which decreases downtime and errors. AI-based systems can simulate different scenarios to refine design and production strategies. Big data supports continuous monitoring and performance analysis, aiding shipyards in adapting quickly to changing conditions. Together, they improve coordination among departments and create a more responsive and intelligent shipbuilding environment. As shipyards seek to stay competitive and meet rising demands, AI and big data are becoming essential technologies that lead digital transformation in the shipbuilding industry.

Analysis by Process:

- Research and Development

- Design and Engineering

- Manufacturing and Planning

- Maintenance and Support

- Training and Simulation

Research and development holds 35.0% of the market share. It forms the foundation for innovations and technological advancement. It allows shipyards to design better ships using advanced tools like 3D modeling, digital twins, and simulation software. These technologies help improve accuracy, reduce design flaws, and speed up project timelines. Through research and development, engineers explore new materials, fuel-efficient structures, and environment friendly solutions that meet worldwide standards. It also supports the integration of automation, AI, and data analytics into shipyard operations, making processes smarter and more efficient. It leads to the creation of customized solutions tailored to both commercial and defense needs, enhancing competitiveness in the market. By focusing on innovations during the early stages of shipbuilding, research and development decrease long-term costs and increase quality. Shipbuilders are investing heavily in research and development activities to stay ahead in a fast-evolving industry.

Analysis by Capacity:

- Large Shipyards

- Small Shipyards

- Medium Shipyards

Medium shipyards account for 48.7% of the market share. They balance flexibility, cost-efficiency, and technological adoption better than large and small shipyards. These shipyards handle a diverse range of projects, including mid-sized commercial and naval vessels, which require advanced digital tools for design, construction, and maintenance. Medium shipyards often employ digital technologies, such as 3D modeling, digital twins, and automation, to improve productivity and minimize errors without the high overhead costs faced by larger facilities. They can implement new systems more quickly and adjust to evolving market needs with improved responsiveness. In addition, medium shipyards benefit from investments and partnerships with technology providers eager to showcase scalable digital solutions. Their size allows them to integrate advanced monitoring, predictive maintenance, and workflow management systems effectively, increasing operational optimization.

Analysis by Digitalization Level:

- Fully Digital Shipyard

- Semi Digital Shipyard

- Partially Digital Shipyard

Semi digital shipyard holds 82.8% of the market share. It balances traditional shipbuilding methods with modern digital technologies. The shipyard is adopting key digital tools, such as 3D modeling, basic automation, and data analytics, while relying on manual labor for complex tasks. This hybrid approach allows the shipyard to improve efficiency and accuracy without facing the high costs and risks of a full digital transformation all at once. The shipyard benefits from better project management and real-time monitoring, which help minimize errors and delays. It can also gradually upgrade its technology infrastructure at a manageable pace, making it more adaptable to changes in the industry. By combining the strengths of both traditional and digital methods, the semi-digital shipyard offers a practical and scalable solution. According to the digital shipyard market forecast, with rising dependence on both manual labor and new technologies, semi digital shipyard will continue to dominate the market.

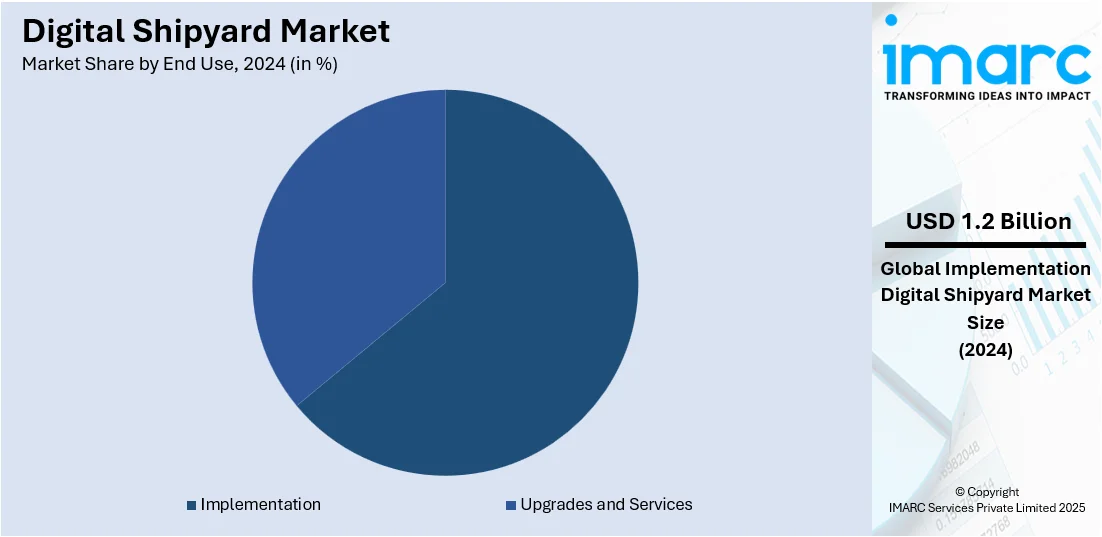

Analysis by End Use:

- Implementation

- Upgrades and Services

Implementation accounts for 63.8% of the market share. It marks the crucial phase where digital technologies move from concept to practical application in shipbuilding. During implementation, shipyards integrate tools like 3D modeling, digital twins, automation, and real-time data analytics into daily operations, improving efficiency and accuracy. This phase helps reduce errors, shorten production timelines, and lower costs by streamlining workflows and enhancing communication among teams. Implementation also involves training personnel to use new technologies effectively, ensuring smooth adoption and maximizing benefits. Shipyards focus on applying digital solutions to design, construction, maintenance, and quality control processes, which directly impact the end products and services. Successful implementation leads to better resource management, predictive maintenance, and improved safety standards. As shipyards worldwide are investing in digital transformation, implementation is becoming the most critical stage, stimulating the market growth by turning innovative technologies into valuable operational shipyard improvements that meet industry demands.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 37.7%, enjoys the leading position in the market. The region is noted for the presence of a strong shipbuilding industry, rising defense budgets, and rapid adoption of advanced technologies. As per industry reports, in 2024, the valuation of the Indian shipbuilding sector stood at USD 1.12 Billion, marking a considerable increase from the USD 90 Million valuation recorded in 2022. Countries like China, South Korea, and Japan are investing heavily in modernizing their naval and commercial shipyards, aiming to boost productivity and worldwide competitiveness. The region’s large coastline and high demand for maritime trade are enabling continuous ship construction, repair, and maintenance activities. Governments and private players in the area are supporting digital transformation to improve operational efficiency, reduce costs, and meet strict timelines. Shipyards in the region are employing automation, digital twins, and IoT-based systems to streamline processes and enhance safety. The availability of skilled labor and strong manufacturing infrastructure is also supporting digital adoption.

Key Regional Takeaways:

United States Digital Shipyard Market Analysis

The United States holds 88.30% of the market share in North America. The market is primarily driven by ongoing advancements in automation technologies, which streamline production processes and improve efficiency. In line with this, the rapid integration of AI and ML, which aids in optimizing design and maintenance procedures, is impelling the market growth. The high demand for green and sustainable ships is further encouraging the utilization of digital tools for energy-efficient designs. As such, in February 2025, Hapag-Lloyd obtained USD 4 Billion in green financing for 24 new container vessels, aimed at decreasing CO2 emissions through low-emission engines. The vessels, expected to be delivered from 2027 to 2029, corresponded with Hapag-Lloyd’s decarbonization objectives, aiming for net-zero emissions by 2045. Furthermore, government regulations and environmental standards are leading shipyards to implement digital technologies to meet stricter emission and energy efficiency targets. The rise of autonomous ships necessitates the development of advanced digital infrastructure for testing, which is fostering market expansion. Additionally, the increasing importance of cybersecurity to protect shipyard operations is stimulating the market growth.

Europe Digital Shipyard Market Analysis

The market in Europe is experiencing growth due to the rising demand for highly customized vessels, such as luxury yachts and specialized ships. Industry reports indicated that Europe led the luxury yacht market in 2023, accounting for 37% of all sales. In accordance with this, the heightened adoption of cloud-based solutions for better collaboration and streamlined operations is further propelling the market growth. Similarly, the increasing focus on predictive maintenance technologies that aid in improving shipbuilding efficiency and extending asset lifecycles is fostering market expansion. The rise in 3D printing and additive manufacturing is reducing production times and material costs, making digital solutions more attractive. Additionally, the increasing commitment to digital transformation in Europe’s maritime sector is encouraging shipyards to integrate smart technologies. Furthermore, the ongoing development of robotic automation in shipyards is strengthening the market.

Asia-Pacific Digital Shipyard Market Analysis

In the Asia-Pacific region, the market is majorly influenced by the rapid industrialization activities and the growth of the maritime industry in various countries. In 2024, the Chinese shipping sector upheld its leading position, as the country's ship order backlog surpassed USD 123 Billion, based on information from VesselsValue. In addition to this, favorable government initiatives aimed at promoting smart manufacturing and automation are accelerating digital adoption. The rising requirement to reduce operational costs and refine productivity is encouraging shipyards to implement digital solutions for better resource management. Furthermore, the growing demand for eco-friendly and energy-efficient vessels is promoting the utilization of digital technologies to optimize ship designs. In the initial three quarters of 2024, China secured more than 70% of worldwide orders for green ships and attained comprehensive coverage across all major ship categories, as reported by the Ministry of Industry and Information Technology. Moreover, the heightened need for improved supply chain management and data integration across international operations is offering a favorable market outlook.

Latin America Digital Shipyard Market Analysis

In Latin America, the market is progressing due to the region’s expanding shipbuilding industry, particularly in Brazil. Similarly, supportive local government initiatives to modernize maritime infrastructure are supporting the higher adoption of digital shipyard solutions. Furthermore, the growing emphasis on sustainable and energy-efficient vessels, promoting the use of optimized design, is positively influencing the market. Moreover, the rise in international trade and shipping requires improved operational efficiency and enhanced safety measures in their operations, which is expanding the market reach. As per an industry analysis, in 2024, Brazilian ports enhanced their position in international trade, managing 97.2% of overall export and import quantities. The report from the Brazilian Association of Private Port Terminals (ATP) indicated that maritime commerce achieved USD 492.5 Billion, reflecting a 2.24% rise relative to 2023.

Middle East and Africa Digital Shipyard Market Analysis

The market in the Middle East and Africa is expanding on account of significant investments in port and maritime infrastructure. As such, Kazakhstan and the UAE initiated a USD 5 Billion economic collaboration plan, concentrating on port infrastructure, agriculture, and financial integration. Significant investments encompassed the growth of Kuryk and Aktau ports, with 46 companies from the UAE being registered at the Astana International Financial Centre. The increasing demand for high-performance vessels in the oil and gas sector is promoting the integration of advanced digital solutions in shipbuilding. Furthermore, the region’s heightened emphasis on innovation and diversification across industries, encouraging the implementation of smart technologies, is further stimulating market appeal. Besides this, the increasing focus on improving supply chain resilience is leading to the incorporation of digital tools for refined operational coordination and efficiency.

Competitive Landscape:

Key players are developing advanced technologies and offering integrated solutions. They are investing in research and innovations to create digital platforms, 3D modeling tools, and real-time monitoring systems that enhance shipbuilding processes. These companies are collaborating with shipbuilders, defense agencies, and tech firms to deliver customized solutions that improve efficiency, reduce errors, and cut down production time. Key players also provide training and support services to help shipyards transition smoothly to digital operations. Their expertise in automation, IoT, AI, and data analytics ensures that shipyards stay competitive and future-ready. By setting industry standards and launching pilot projects, they are influencing market trends and encouraging wider adoption. Through partnerships and strategic investments, these companies are leading the digital transformation, making shipyards smarter, more connected, and better equipped to handle complex demands. For instance, in September 2024, ST Engineering launched its smart shipyard, Gul Yard, in Singapore, utilizing AI and 5G technology. Purchased for USD 95 Million, the facility aimed to improve efficiency, aid complex projects, and integrate digital infrastructure. It incorporated AI technology, predictive maintenance, and sustainability efforts, such as renewable energy and waste minimization strategies.

The report provides a comprehensive analysis of the competitive landscape in the digital shipyard market with detailed profiles of all major companies, including:

- AVEVA Group plc (Schneider Electric SE)

- BAE Systems Plc

- Dassault Systemes SE

- IFS AB

- Inmarsat Global Limited (Viasat Inc.)

- Navantia

- Pemamek Oy Ltd.

- Siemens AG

- SSI

- Wärtsilä Oyj Abp

Latest News and Developments:

- May 2025: HD Hyundai Mipo (HMD) entered into a collaborative development agreement with ABS to enhance smart shipyard technology. The partnership combined AI, digital twins, robotics, and automation to enhance operations in the shipyard. ABS would offer insights on hyper-connectivity, enhanced automation, and data-oriented intelligence for innovative ship construction.

- April 2025: Fincantieri and Accenture unveiled Fincantieri Ingenium, a partnership focused on speeding up digital transformation in shipbuilding, defense, and port logistics. The project combined AI, cybersecurity, IoT, and big data to establish a digital ecosystem for maritime activities, improving connectivity, sustainability, and operational effectiveness in digital shipyards.

- April 2025: Saronic Technologies, a developer of autonomous surface vessels, purchased Gulf Craft, a shipyard based in Louisiana, to speed up its expansion in autonomous shipbuilding. The shipyard was set to act as a center for the development and manufacturing of unmanned boats, with intentions to allocate USD 250 Million to modernization and infrastructure improvements, increasing scalability and efficiency.

- February 2025: HD Hyundai teamed up with Palantir Technologies and Siemens to broaden its ‘Future of Shipyard’ (FOS) project, seeking to transform shipbuilding via digital innovation. The partnership aimed to combine AI, big data analysis, and automation to improve production efficiency and decrease lead times.

- February 2025: Four Japanese firms, K Line, Kyokuyo Shipyard, Mitsui E&S Shipbuilding, and Sumitomo Heavy Industries, became part of the Digital Twin Project. This initiative sought to boost operational efficiency and safety by establishing a secure data-sharing system for digital twins, fostering collaboration between shipyards and shipowners during the entire lifecycle of a ship.

Digital Shipyard Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment

|

| Types Covered | Miliary Shipyards, Commercial Shipyards |

| Technologies Covered | AR/VR, Digital Twin and Simulation, Addictive Manufacturing, Artificial Intelligence and Big Data Analytics, Robotic Process Automation, Industrial Internet of Things (IIoT), Cybersecurity, Blockchain, and Cloud and Master Data Management |

| Processes Covered | Research and Development, Design and Engineering, Manufacturing and Planning, Maintenance and Support, and Training and Simulation |

| Capacities Covered | Large Shipyards, Small Shipyards, Medium Shipyards |

| Digitalization Levels Covered | Fully Digital Shipyard, Semi Digital Shipyard, Partially Digital Shipyard |

| End Uses Covered | Implementation, Upgrades and Services |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AVEVA Group plc (Schneider Electric SE), BAE Systems Plc, Dassault Systemes SE, IFS AB, Inmarsat Global Limited (Viasat Inc.), Navantia, Pemamek Oy Ltd., Siemens AG, SSI, Wärtsilä Oyj Abp, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital shipyard market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global digital shipyard market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital shipyard industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital shipyard market was valued at USD 1.88 Billion in 2024.

The digital shipyard market is projected to exhibit a CAGR of 17.48% during 2025-2033, reaching a value of USD 8.09 Billion by 2033.

The integration of IoT, AI, and cloud computing helps monitor equipment, manage workflows, and predict maintenance needs, resulting in improved productivity and reduced downtime. Governments and defense sectors are investing in modernizing naval infrastructure, further encouraging digital transformation in shipyards. The high demand for sustainable and energy-efficient solutions also plays a role, as digital platforms enable better resource management and environmental compliance.

Asia-Pacific currently dominates the digital shipyard market, accounting for a share of 37.7% in 2024, driven by its strong shipbuilding base, rising defense spending, and rapid technology adoption. Countries like China, South Korea, and Japan are investing in smart shipyards to boost efficiency, competitiveness, and maritime capabilities.

Some of the major players in the digital shipyard market include AVEVA Group plc (Schneider Electric SE), BAE Systems Plc, Dassault Systemes SE, IFS AB, Inmarsat Global Limited (Viasat Inc.), Navantia, Pemamek Oy Ltd., Siemens AG, SSI, Wärtsilä Oyj Abp, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)