Digital Oilfield Market Report by Solution (Hardware Solution, Software Solution, and Others), Process (Production Optimization, Drilling Optimization, Reservoir Optimization, Safety Management, and Others), Application (Onshore, Offshore), and Region 2025-2033

Digital Oilfield Market Size:

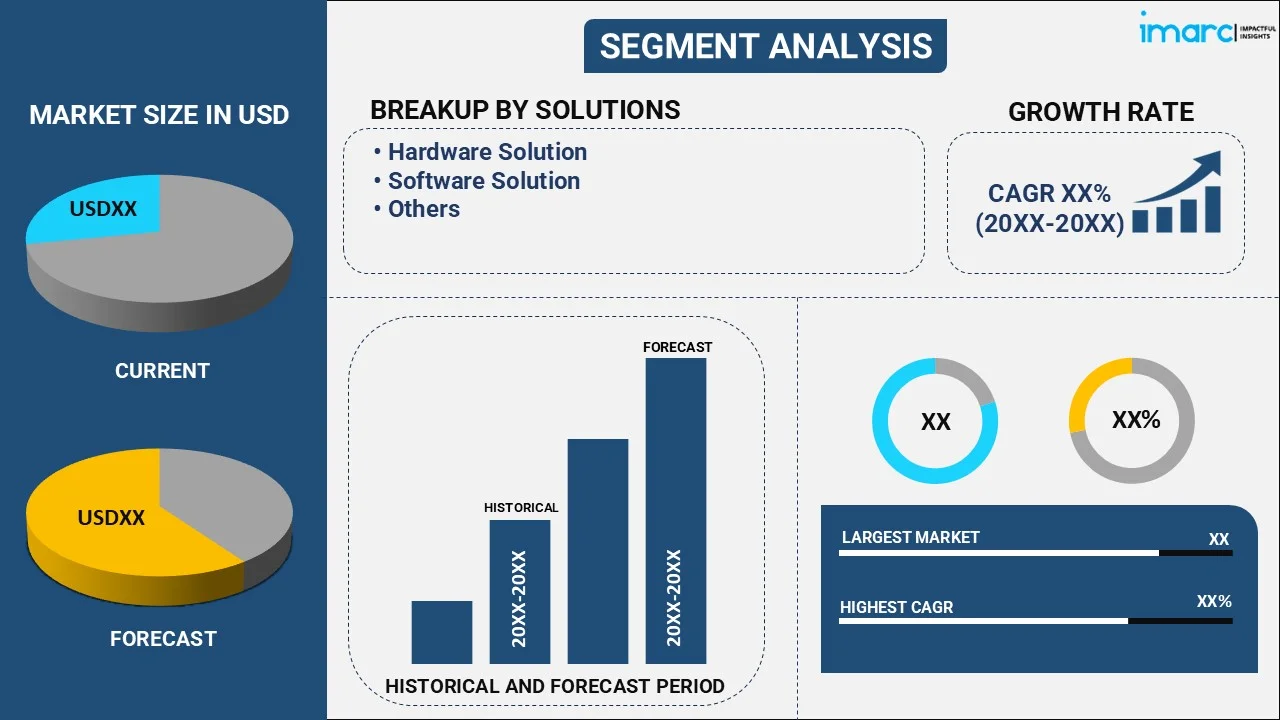

The global digital oilfield market size reached USD 28.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 45.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.81% during 2025-2033. The global digital oilfield market is experiencing significant growth driven by include rising needs for production optimization and cost reduction in oil and gas exploration, ongoing technological advancements such as data analytics and the Internet of Things (IoTs), and efforts to enhance operational efficiency while ensuring minimal environmental impact.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 28.9 Billion |

|

Market Forecast in 2033

|

USD 45.0 Billion |

| Market Growth Rate 2025-2033 | 4.81% |

Digital Oilfield Market Analysis:

- Major Market Drivers: The global digital oilfield market drivers include rising desire an oil and gas production for efficiency and cost reduction. These factors include technology advancement in data analytics and IoT and sustainability being on the top of industry's priority list with a quest for operational excellence and environmental consciousness.

- Key Market Trends: The digital oilfield market trends involve the implementation of AI, machine learning as well as automation technology to improve decision-making capabilities, streamline workflow and optimize production. Moreover, there is a particular sign of strengthening of cybersecurity measures done for the cyber safety of digital oilfield assets.

- Geographical Trends: Digital oilfield market research report highlights the dominance of Europe in the market owing to considerable investment in advanced technology and sturdy regulation put into the digitalization of oil and gas industries. Furthermore, initiatives like the European Green Deal aim for sustainable energy plans so that natural oilfield technologies are made use of to maximize oil practices' efficiency and minimize environmental pollution. Also, the existing oil and gas sector infrastructure and qualified workforce drive the mature market niche in the digital oilfield. Aided by Europe's determination to progress technologically and support environmental sustainability, the prominent position in the international digital oilfield market remains secure for this region.

- Competitive Landscape: Some of the major market players in the digital oilfield industry include Schlumberger, Weatherford International Plc, General Electric, Halliburton, Honeywell International, Siemens AG, Rockwell Automation, Kongsberg Gruppen ASA, Paradigm Group B.V, Pason Systems, Petrolink AS, Accenture PLC, IBM Corporation, EDG Inc, Oleumtech, among many others.

- Challenges and Opportunities: The market faces challenges such as the high initial investment costs, security of the data provided, and the matter of integration complexity. Whereas, the digital oilfield market opportunity lies in ongoing technological development, rapid expansion of digital infrastructure, and the escalating use of cloud-based solutions. Moreover, the integration of data analytics and IoT has given a new possibility for increasing the speed of operations, reducing the down times and therefore improving decision-making in the oil and gas industry.

To get more information on this market, Request Sample

Digital Oilfield Market Trends:

Rising Demand for Efficiency and Cost Reduction:

The digital oilfield market size is expanding due to the escalating demand of the oil and gas industry to operate more efficiently and organize production with minimum expenditures. As per the reports of EIA, the Administration of Energy Statistics of the USA, claims that the industry of oil and gas is going through a rough period and it has to find effective ways to improve its operations under different circumstances like fluctuating oil prices and growing environmental issues. The digital oilfield technology embraces data analytics and Internet things (IoT), amongst others, through which more efficient operations, less downtime, and costs associated with exploration, drilling, and production can be achieved. Therefore, corporations are continuously implementing digitalization activities to boost productivity and competitiveness in the energy market where various aspects are changing fast.

Ongoing Advancements in Technology:

The digital oilfield technology makes the field happen to be at the center of the digital oilfield market development. As per the International Energy Agency (IEA), the latest technologies of AI, machine learning, and automation have become the pioneers who bring real-time monitoring, predictive maintenance, and refined production workflows to the oil and gas sector, the world over, in 2021. These technologies facilitate oil and gas companies to harvest incredible amounts of information from the sensors, equipment, and management processes, drilling out the discernible clues which help them to make better decisions and perform operations to the best of their capacity. Rapidly changing technologies in the digital area allow the oil and gas industry to harvest advantages and enhance productivity in processes via digital oilfield technologies.

Rising Regulatory Pressure and Environmental Concerns:

Regulatory pressure and environmental concerns are major factors that drive the digital oilfield market growth. As per an EPA report that came out in 2021, the oil and gas industry is among the largest sources of carbon footprint globally. Hence, there is an upsurge in the amount of regulatory scrutiny as well as the public request for green energy usage. This trend arranges for the efforts to be made by the industry to cooperate to improve the use of devices for the monitoring of reservoirs, smart wells, and sites of drilling through the internet of things. Regulations, including emission and environmental reporting requirements, encourage oil and gas companies to install cleaner and more efficient technologies and make their operations carbon-neutral. Digital oilfields provide environment-improving methods of emissions monitoring and diminishing, energy consumption efficiency, and environmental preservation. Thus, companies are increasing spending on digitalization to meet environmental regulations, reduce the risk of environmental issues, and to show social responsibility. As a result, the digital oilfield industry is likely to continue to grow.

Digital Oilfield Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on solution, process, and application.

Breakup by Solution:

- Hardware Solution

- Distributed Control Systems (DCS)

- Supervisory Control and Data Acquisition (SCADA)

- Smart Wells

- Safety Systems

- Wireless Sensors

- Software Solution

- IT Outsourcing

- Software

- IT Services and Commissioning

- Collaborative Product Management (CPM)

- Others

- Data Storage Solutions (Hosted)

- Data Storage Solutions (On-Premise)

Hardware solution accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the solution. This includes hardware solution (distributed control systems (DCS), supervisory control and data acquisition (SCADA), smart wells, safety systems, and wireless sensors), software solutions (IT outsourcing, software, IT services and commissioning, collaborative product management (CPM) and others [data storage solutions (hosted) and data storage solutions (on-premise)]. According to the report, Hardware solution represented the largest segment.

Hardware solutions dominate the market as it provide equipment for data acquisition, monitoring, and control knitting systems. As per the report released by the U.S. Department of Energy (DOE) in 2021, sophisticated hardware solutions like sensors, actuators, and control systems are key to the exploitation of real-time data analysis in the oil & gas industry. This hardware layer helps in the integration of digital systems with infrastructure, and this subsequently leads to the improvement in efficiency and productivity. Moreover, hardware offers a substantial contribution to reliability and safety during the oilfield operation as such. The use of digital oilfield technologies worldwide is on the rise, and the demand for hardware solutions will thus keep increasing and hardware will leave behind software on the digital oilfield market.

Breakup by Process:

- Production Optimization

- Drilling Optimization

- Reservoir Optimization

- Safety Management

- Others

Production optimization holds the largest share of the industry

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes production, drilling optimization, reservoir optimization, safety management, and others. According to the report, production optimization accounted for the largest market share.

Production optimization significantly drives the digital oilfield market growth rate. As per the International Energy Agency (IEA) report in 2021, digital oilfield technologies have had a widespread effect on production optimization which are notably carried out with two main objectives- cost reduction and resource utilization, within the oil and gas industry. Through the application of big data tools, automation, and immediate monitoring, enterprises can refine their processing operations, put an end to outages, and take the most from the ones they own. The attainment of the goal of production optimization as a base brings prosperity to the process of production and helps to reduce the environmental impact by using fewer resources. As a result, the market for the digital oilfield sees the rate of growth pushed faster and the objective of the entire process is to improve production efficiency to remain competitive in the energy sector being the leading priority.

Breakup by Application:

- Onshore

- Offshore

Offshore represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes onshore and offshore. According to the report, offshore represented the largest segment.

The digital oilfield market forecast shows onshore dominates the market due to their closer proximity to infrastructure, lower operational costs, and less regulatory issues, creating a positive digital oilfield industry outlook. As per the Energy Department report of the United States issued in 2021, a major part of the world output relies on onshore oil and gas production which runs the requirement of digital oilfield technologies. For onshore sites, resources and infrastructure are readily available, which in turn easily allows us to implement our digital solutions. Also, because offshore production comes with higher operating costs, funding in digital oilfield technologies are more practical. Alongside, regulatory, and environmental concerns typically result in fewer challenges for onshore operations paving the way for easier integration of digital innovations. Thus, the substantial portion of onshore operations in the digital oilfield market leads to a bright outlook, with anticipated growth as companies turn to raise efficiency, reduce the costs, and ensure environmental sustainability in their onshore operations.

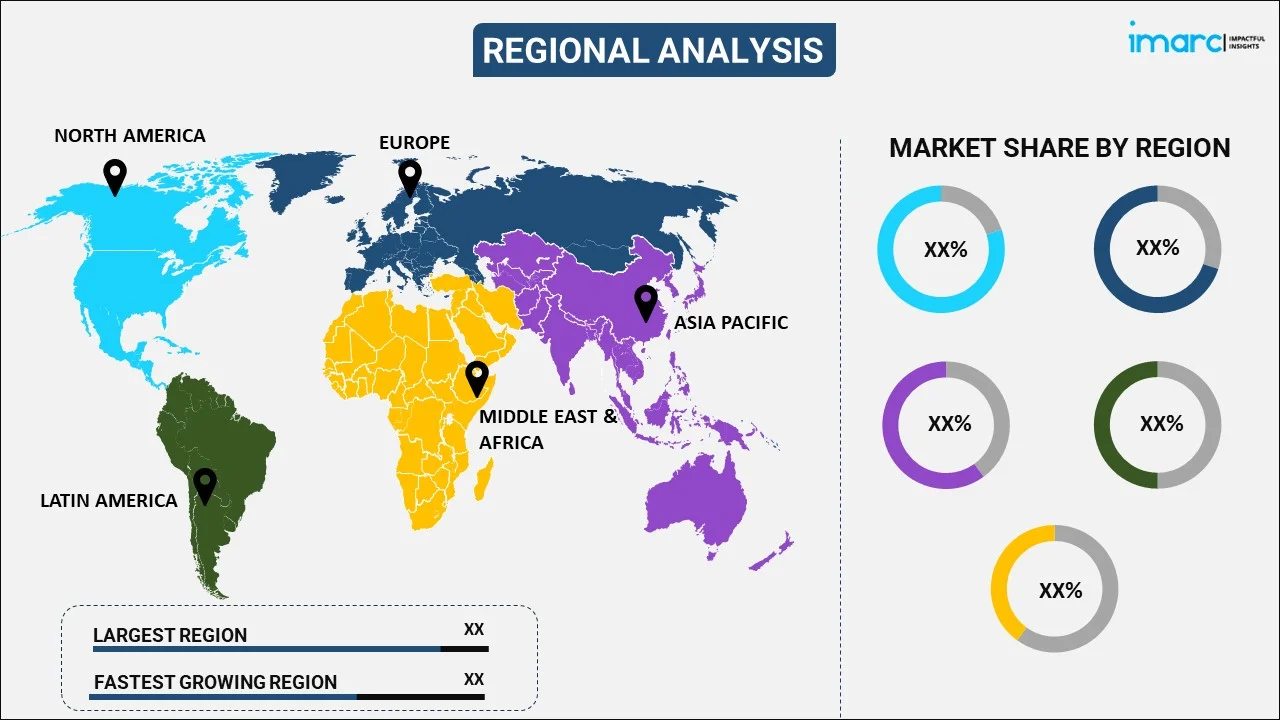

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Europe leads the market, accounting for the largest digital oilfield market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin. According to the report, Europe represented the largest regional market for digital oilfield.

The digital field market forecast showcases that Europe dominates the market due to its strong investment in cutting-edge technologies and tough regulations that make it necessary to go digital in the oil and gas industry. As per the European Commission's Digital Economy and Society Index (DESI) report for 2021, Europe tops the global digitalization agenda, with substantial input on digital infrastructures and innovation. Furthermore, the Green Deal of the European Union emphasizes the importance of making better use of digital oilfield technologies which in turn can be used to optimize processes and reduce environmental footprints. Lastly, the region's already developed oil and gas infrastructures and personnel with expertise render it the leader in the digital oilfield market. Europe dedicated to the development and advancement of its technologies as well as environmental sustainability is bound to take the lead in the global digital oilfield market which will in turn lead to innovation and growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the digital oilfield industry include Schlumberger, Weatherford International Plc, General Electric, Halliburton, Honeywell International, Siemens AG, Rockwell Automation, Kongsberg Gruppen ASA, Paradigm Group B.V, Pason Systems, Petrolink AS, Accenture PLC, IBM Corporation, EDG Inc, and Oleumtech.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The key players in the digital oilfield industry are undergoing technological development for the improvement of oil and gas production processes. Companies like Schlumberger and Halliburton are heavily investing in digital expertise areas such as web analytics, cloud computing, and the Internet of Things (IoT) to optimize processes, minimize costs, and decrease environmental footprint. For instance, as per the data provided by the U.S. Energy Information Administration (EIA), as of 2021, the implementation of digital oilfield technology appears to be on a steady rise, with digitalization initiatives slated to enhance efficiency in operations across the oil and gas industry. Hence digitalization in modern oil field operations cannot be taken lightly as it emphasizes the role of technology in the operations of these companies to achieve growth and competitiveness.

Digital Oilfield Market News:

- IMay 2021: Schlumberger has been working on digital solutions for the oil and gas industry. They have been collaborating with Amazon Web Services (AWS) to deploy domain-centric digital solutions enabled by the DELFI cognitive E&P environment on the cloud with AWS. This collaboration aims to bring AWS customers to the DELFI Petro technical Suite, which provides advanced digital solutions for the industry.

Digital Oilfield Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Processes Covered | Production Optimization, Drilling Optimization, Reservoir Optimization, Safety Management, Others |

| Applications Covered | Onshore, Offshore |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Schlumberger, Weatherford International Plc, General Electric, Halliburton, Honeywell International, Siemens AG, Rockwell Automation, Kongsberg Gruppen ASA, Paradigm Group B.V, Pason Systems, Petrolink AS, Accenture PLC, IBM Corporation, EDG Inc, Oleumtech, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital oilfield market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global digital oilfield market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital oilfield industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global digital oilfield market was valued at USD 28.9 Billion in 2024.

We expect the global digital oilfield market to exhibit a CAGR of 4.81% during 2025-2033.

The rising integration of Artificial Intelligence (AI), Augmented Reality (AR), Internet of Things (IoT), etc., with digital oilfield solutions as they enable operators to gather, analyze, and interact with production-related information in the field, is primarily driving the global digital oilfield market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous exploration activities, thereby negatively impacting the market for digital oilfield.

Based on the solution, the global digital oilfield market can be segmented into hardware solution, software solution, and others. Currently, hardware solution holds the majority of the total market share.

Based on the process, the global digital oilfield market has been divided into production optimization, drilling optimization, reservoir optimization, safety management, and others. Among these, production optimization currently exhibits a clear dominance in the market.

Based on the application, the global digital oilfield market can be categorized into onshore and offshore. Currently, offshore accounts for the largest market share.

On a regional level, the market has been classified into Asia Pacific, Europe, North America, Middle East and Africa, and Latin America, where Europe currently dominates the global market.

Some of the major players in the global digital oilfield market include Schlumberger, Weatherford International Plc, General Electric, Halliburton, Honeywell International, Siemens AG, Rockwell Automation, Kongsberg Gruppen ASA, Paradigm Group B.V, Pason Systems, Petrolink AS, Accenture PLC, IBM Corporation, EDG Inc, Oleumtech, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)