Digital Music Content Market Report by Type (Permanent Downloads, Music Streaming), Age Group (Below 18 Years, 18-40 Years, 41-60 Years, Above 60 Years), Application (Commercial Use, Household Use), and Region 2025-2033

Market Overview:

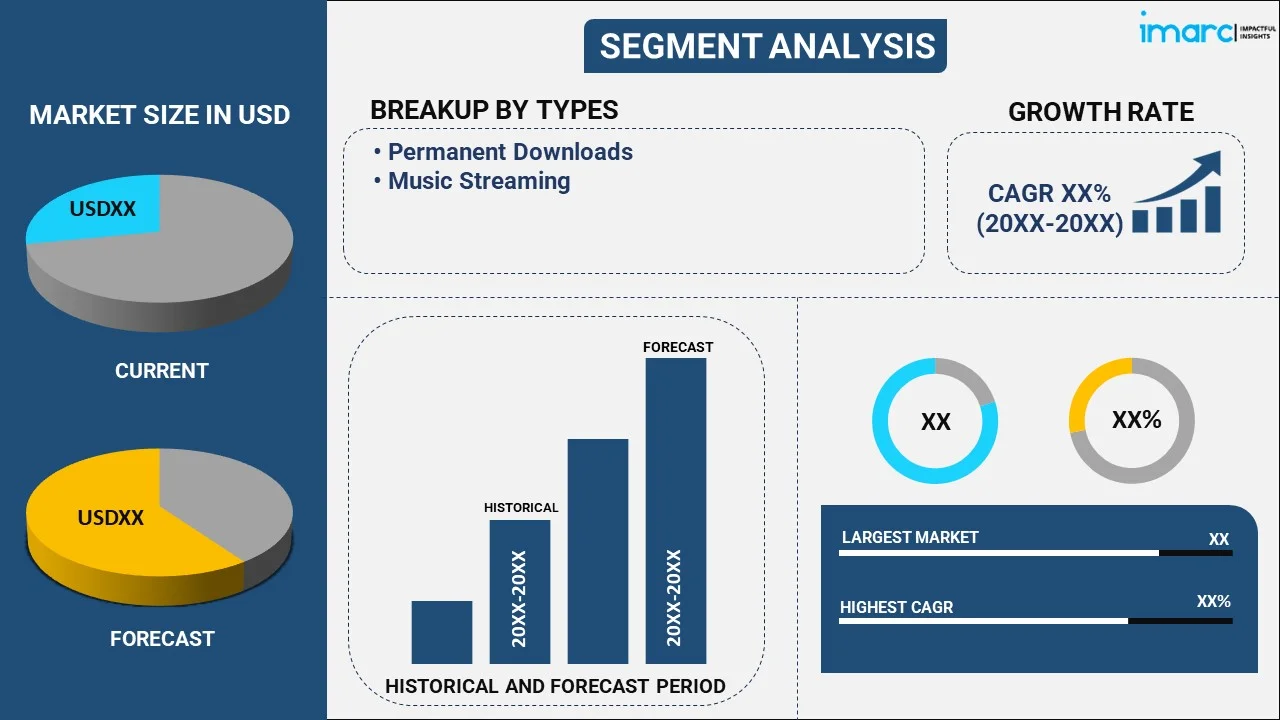

The global digital music content market size reached USD 23.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.6 Billion by 2033, exhibiting a growth rate (CAGR) of 7.88% during 2025-2033. The growing popularity of subscription revenue models that are offering users various incentives, rising inclusion of podcasts within music streaming platforms, and increasing advancement is artificial intelligence (AI) and machine learning (ML) to offer personalization options, are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 23.7 Billion |

|

Market Forecast in 2033

|

USD 48.6 Billion |

| Market Growth Rate (2025-2033) | 7.88% |

Digital music content refers to audio content that has been recorded or converted into digital format and is distributed via the internet to the end-user. There are various encoding formats used to store audio information in digital audio files, which are non-physical sources of the audio. As digital data is converted from analog data, it is supported by various hardware products for playback, such as computers, TVs, smartphones, and Bluetooth devices, for streaming and playing back different sound files. Easy accessibility to various websites, sharing, and easy availability of songs and music online are some of the key benefits of digital music content. Cloud music allows users to stream, save, and download music, as well as share their content across social networking sites. This includes streaming services, whether ad-supported or subscription-based, and paid digital downloads of single tracks or albums/compilations.

Digital Music Content Market Trends:

Growing Inclusion of Podcasts with Music Streaming Platforms

Integrating podcasts into music streaming services is transforming the digital music content by mixing entertainment styles, increasing user interaction, and expanding content variety. Many people are turning to spoken-word forms of content, such as interviews, educational shows, and ongoing stories, which is encouraging music platforms to adapt to this need. The incorporation of podcasts enables users to listen to a variety of audio content without changing apps, ultimately increasing platform engagement. By leveraging data-driven insights, streaming platforms can personalize podcast recommendations, fostering a more customized user experience. Furthermore, securing exclusive podcast agreements with well-known creators or popular series keeps subscribers committed and enhances the quality of premium content. This tactic aids platforms in staying competitive and attracting new users. In 2024, Triton Digital revealed a broader collaboration between its podcasting tool Omny Studio and Headliner, enabling podcasters to automatically generate video clips and transcripts for YouTube. The goal of this integration is to assist podcasters in expanding their audience and monitoring audio downloads and YouTube views using Triton's Podcast Metrics.

Rise of Subscription Revenue Models

Subscription-based models are transforming the digital music content market by offering users various incentives to opt for premium services. These models provide a personalized experience with benefits, such as ad-free streaming, exclusive content, and higher sound quality, enhancing the overall listening experience. The flexibility of subscription tiers caters to different user preferences, ranging from individual listeners to families. The reliable, recurring income generated from subscriptions supports the long-term financial stability of platforms, enabling them to invest in content development, artist partnerships, and technological enhancements. Furthermore, discounted plans for students and families make premium services more affordable, helping to broaden the user base and reduce churn. In 2024, JioSaavn introduced Duo and Family 'Pro' subscription options, priced at Rs 129 monthly for two users and Rs 149 for a maximum of six users in India. These subscriptions provide access to music without ads, limitless downloads, and improved sound quality in order to lower the overall cost for users.

Advancements in Music Personalization Technologies

Artificial intelligence (AI) and machine learning (ML) are providing advanced personalization options that exceed simple suggestions. These technologies analyze vast amounts of user data, including listening history, search patterns, and even contextual factors like time of day or location, to deliver highly accurate and relevant suggestions. This individualized method not only exposes users to different music genres but also improves their overall experience by suiting specific moods, activities, or occasions. Additionally, AI-driven features, such as auto-generated playlists and song suggestions for specific events, workouts, or relaxation sessions, provide continuous value, keeping users engaged with the platform. As users engage more with these functionalities, the algorithms improve, enhancing their capability to anticipate and align with personal preferences. In 2024, In 2024, Spotify released AI Playlist in beta, allowing Premium subscribers in the UK and Australia to craft custom playlists by entering specific prompts such as "calming music for allergy season" or "indie folk to comfort my mind." Users can customize playlists on the Spotify mobile app by changing genres or moods, listening to track previews, and organizing their selections. The AI Playlist utilizes Spotify's personalization technology to offer music suggestions.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global digital music content market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on type, age group, and application.

Type Insights

- Permanent Downloads

- Music Streaming

The report has provided a detailed breakup and analysis of the digital music content market based on the type. This includes permanent downloads and music streaming. According to the report, music streaming represented the largest segment.

Age Group Insights

- Below 18 Years

- 18-40 Years

- 41-60 Years

- Above 60 Years

The report has provided a detailed breakup and analysis of the digital music content market based on the age group. This includes below 18 years, 18-40 years, 41-60 years and above 60 years. According to the report, 18-40 years represented the largest segment.

Application Insights

- Commercial Use

- Household Use

A detailed breakup and analysis of the digital music content market based on the application has also been provided in the report. This includes commercial use and household use. According to the report, commercial use accounted for the largest market share.

Regional Insights:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets that include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and Middle East and Africa. According to the report, North America accounts for the majority of the digital music content market share. Some of the factors driving the North America digital music content market include the presence of several key players, rapid digitization, increasing use of cloud computing, etc.

Competitive Landscape

The report has also provided a comprehensive analysis of the competitive landscape in the global digital music content market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Apple Inc.

- Deezer

- Gamma Gaana Ltd

- Hungama Digital Media Entertainment Pvt. Ltd.

- iHeartMedia Inc.

- JB Hi-Fi Limited

- JioSaavn

- Mixcloud

- SoundCloud

- Spotify AB

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Digital Music Content Market News:

- April 2024: Deezer appointed Global UK as its exclusive ad sales partner, integrating Deezer’s audio content into Global’s DAX digital advertising exchange. This partnership aims to enhance Deezer’s ad distribution and monetization in the UK, providing advertisers access to its high-quality music catalog.

- September 2024: Mixcloud acquired Encore, an online music marketplace that has facilitated over 50,000 bookings for live performances. The acquisition aims to expand Mixcloud's live music services, providing more tools for artists to grow their careers and monetize their work, while Encore continues operating independently.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Types Covered | Permanent Downloads, Music Streaming |

| Age Groups Covered | Below 18 Years, 18-40 Years, 41-60 Years, Above 60 Years |

| Applications Covered | Commercial Use, Household Use |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apple Inc., Deezer, Gamma Gaana Ltd, Hungama Digital Media Entertainment Pvt. Ltd., iHeartMedia Inc., JB Hi-Fi Limited, JioSaavn, Mixcloud, SoundCloud, Spotify AB, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global digital music content market performed so far and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global digital music content market?

- What are the key regional markets?

- Which countries represent the most attractive digital music content markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the age group?

- What is the breakup of the market based on application?

- What is the competitive structure of the global digital music content market?

- Who are the key players/companies in the global digital music content market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital music content market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global digital music content market.

- The study maps the leading as well as the fastest growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital music content industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)