Digital Identity Solutions Market Size, Share, Trends and Forecast by Component, Identity Type, Solution Type, Organization Size, Deployment, Vertical, and Region, 2025-2033

Digital Identity Solutions Market Size and Share:

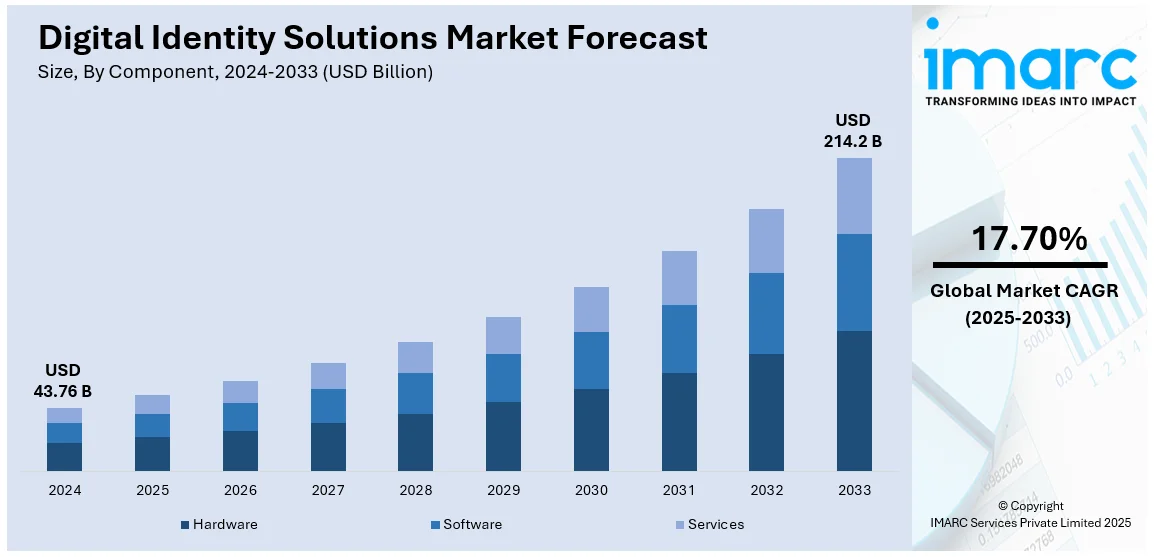

The global digital identity solutions market size was valued at USD 43.76 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 214.2 Billion by 2033, exhibiting a CAGR of 17.70% from 2025-2033. North America currently dominates the market, holding a market share of over 37.5% in 2024. Solutions like Digital Identity deal with technologies safely verifying and managing identities. These are multi-factor authentications (MFA) and decentralizing identity management systems, just to mention a few forms. They increase protection against illegal access so that only legal users have access to specific, sensitive data.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 43.76 Billion |

| Market Forecast in 2033 | USD 214.2 Billion |

| Market Growth Rate (2025-2033) | 17.70% |

The increasing frequency and sophistication of cyberattacks, including ransomware, identity theft, and data breaches, are major drivers of both the cybersecurity and digital identity solutions markets. In 2023, over 72% of cybercrimes were ransomware-related, and small and medium-sized businesses (SMBs) are increasingly targeted, with 61% of SMBs affected by cyberattacks. As a result, the global cybersecurity market is expected to reach $266.2 billion by 2027, driven by an 8.9% CAGR. This surge in cyber threats is prompting businesses and governments to adopt stronger identity verification systems, such as MFA, biometrics, and decentralized identity management. These advanced digital identity solutions provide enhanced protection, ensuring only authorized users can access sensitive data, thereby bolstering the market growth and meeting the need for robust security measures.

The U.S. digital identity solutions market is experiencing significant growth, driven by escalating cybersecurity threats and regulatory requirements. In 2023, 3,122 data breaches were reported, impacting 349 million individuals, highlighting the urgency for secure identity management systems. The cost of data breaches reached a record high of USD 4.88 million in 2024, further fueling the demand for advanced identity verification technologies such as biometrics and MFA. Regulations like GDPR and CCPA are compelling businesses to enhance their identity management practices ensuring compliance. The widespread adoption of digital services, including online banking, healthcare, and government services, is intensifying the need for secure digital identities. With major investments from technology and financial sectors, the U.S. market is set for continued expansion.

Digital Identity Solutions Market Trends:

Increasing demand for biometric authentication

The growing demand for biometric authentication is one of the prominent trends in the digital identity solutions market. With the rise in cybercrime and the need for secure identity verification, organizations are shifting towards biometric solutions like facial recognition, fingerprints, and iris scanning. These methods offer enhanced security by verifying individuals based on unique physiological traits, reducing the chances of identity theft or fraud. Governments, financial institutions, and enterprises are investing in biometric technology for applications in border security, banking, and mobile devices. The trend reflects a broader shift toward frictionless yet robust authentication systems to ensure the privacy and safety of users.

Adoption of blockchain for secure identity management

Blockchain technology is currently in high demand in the digital identity solutions market as a decentralized, immutable ledger. As a result of its feature of creating secure, tamper-proof records, blockchain becomes a perfect solution for the management of digital identity. Individuals can have control over their personal data and share only necessary information with trusted parties through the use of blockchain, thus minimizing the risk of identity theft. This not only gives more safety but also opens up opportunities for increased transparency in verifying identities. Thirdly, blockchain decreases central authority dependence and thus leads to an even more people-centric as well as a low-cost solution to digital identities across areas of finance, healthcare, and government services.

Growth of Identity-as-a-Service (IDaaS)

The IDaaS trend is rising due to the requirement for scalable cloud-based identity solutions. With IDaaS, organizations are able to manage user identities, access controls, and authentication processes without having to make big investments in on-premises infrastructure. It allows business houses to operate more smoothly, improve customer experience, and adhere to regulatory compliance. As the mobility factor increases and remote workforces grow, centralized, secure identity management solutions become a necessity. IDaaS features flexibility, cost-effectiveness and scalability; hence it easily finds applications in any finance, health, and other retail industries, thereby aiding the growth in the digital identity market.

Digital Identity Solutions Industry Segmentation

IMARC Group provides an analysis of the key trends in each segment of the global digital identity solutions market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, identity type, solution type, organization size, deployment, and vertical.

Analysis by Component:

- Hardware

- Software

- Services

Hardware components in digital identity solutions include biometric scanners, fingerprint sensors, and facial recognition devices. These physical devices ensure secure identity verification by capturing biometric data, offering high security and accuracy for authentication in sectors like banking, healthcare, and government.

Additionally, the software components include identity management platforms, authentication systems, and biometric recognition algorithms. These software solutions process and verify identity data, ensuring secure access to digital services, and are crucial in managing user credentials, data storage, and compliance with privacy regulations.

Moreover, the services in digital identity solutions encompass consulting, implementation, maintenance, and support. These services help organizations deploy, integrate, and manage identity verification technologies, ensuring optimal performance, compliance with regulations, and continuous security updates for safeguarding sensitive information.

Analysis by Identity Type:

- Biometric

- Fingerprint Recognition

- Facial Recognition

- Iris Recognition

- Voice Recognition

- Palm/Hand Recognition

- Others

- Non-Biometric

Biometrics leads the market with around 67.6% of market share in 2024 fueled by the rapid adoption of biometric technologies such as facial recognition, fingerprint scanning, and iris scanning among others that provide secure, user-friendly forms of identity verification. As much more secure than password-based systems, biometrics then find themselves best suited in industries that require much better security such as banking, health care, and governments. Cyber threats, such as identity theft and fraud, are on the rise, thus business is increasingly using biometrics to improve authentication processes. The increasing use of biometric-enabled devices, including smartphones and laptops, along with the rising demand for seamless user experiences from consumers, will continue to fuel the adoption of biometric identity solutions.

Analysis by Solution Type:

- Identity Verification

- Authentication

- Single-Factor Authentication

- Multi-Factor Authentication

- Identity Lifecycle Management

- Others

Identity verification leads the market with around 42.5% of market share in 2024, driven by the growing need for secure, reliable methods to authenticate users across various industries. Identity verification technologies are being increasingly adopted as cyber threats, including identity theft and fraud, grow. Technologies such as biometrics, facial recognition, and MFA give great security to keep people from unauthorized access. Also, the increased use of digital services, such as online banking, e-commerce, and portals related to government, is increasing demand for secure identity verification systems. These solutions help organizations meet the requirements set by regulatory compliance for keeping data protected.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium Enterprises

In 2024, large enterprises account for the majority of the market at around 62.5% due to the vast scale of operations, complex security needs, and high volumes of sensitive data handled by large organizations. Strong Identity Management: Enterprises need protection for data, regulatory compliances, and prevention from unauthorized access. With mounting data breaches and fraud, cybersecurity continues its run-up by big organizations focusing aggressively in areas of MFA solutions or in advanced multi-factor authentication processes and decentralization of ID management by the use of biometric authentication. The demand for secure access to digital services, internal systems, and customer data further drives the adoption of digital identity solutions in large enterprises.

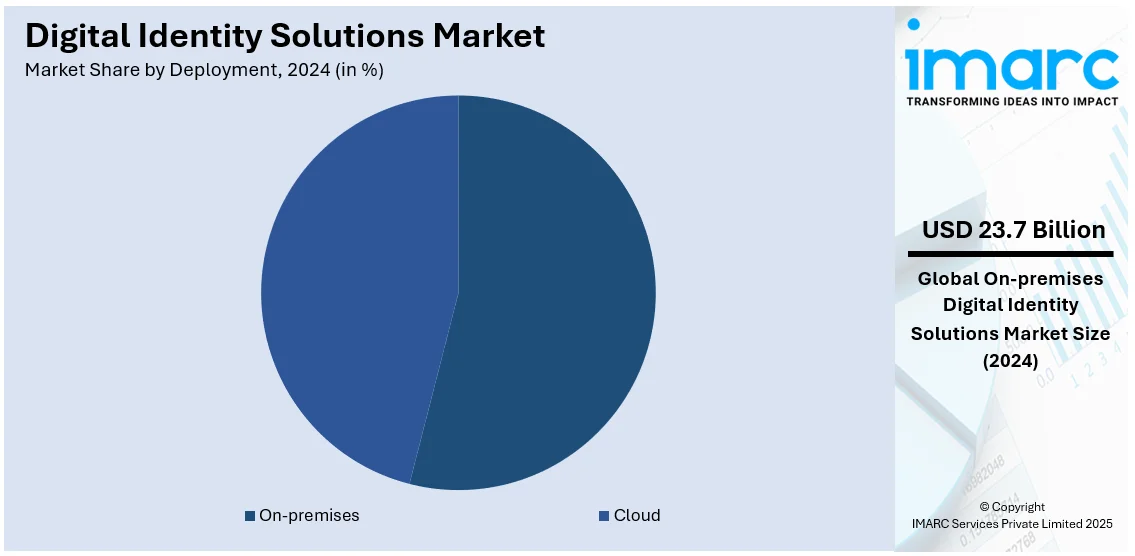

Analysis by Deployment:

- On-premises

- Cloud

On-premises represented the leading market segment, holding 54.2% of the total share driven by organizations' preference for maintaining control over sensitive data and security measures. On-premises solutions provide enhanced data privacy, as businesses can store and manage their identity systems within their own infrastructure. Additionally, they offer greater customization and integration with existing enterprise systems. Industries with stringent regulatory requirements, such as banking, healthcare, and government, prefer on-premises solutions to ensure compliance and secure sensitive information. Despite the increasing adoption of cloud-based solutions, the desire for full control over identity management and security continues to drive the growth of on-premises deployments across various sectors.

Analysis by Vertical

- Banking, Financial Services, and Insurance

- Retail and Ecommerce

- Travel and Hospitality

- Government and Defense

- Healthcare

- IT and Telecommunication

- Energy and Utilities

- Others

Banking, Financial Services, and Insurance demand very strong digital identity solutions that prevent financial transactions from fraudulent actions, prevent frauds, and ensure regulatory compliance. The technologies applied include biometrics and MFA in every possible place in order to secure the account of the customer and its sensitive financial information.

But, at the same time, the increase in online shopping reveals retail and e-commerce. By this growth of online shopping, retailers as well as e-commerce companies secure their transactions, protect customer's information, and save themselves from fraudulent transactions. The processes of MFA and identity verification help establish trust and make customer journeys smoother.

Besides that, digital identity solutions also help in the travel and hospitality industry to improve security in terms of booking, check-in, and customer service. It prevents identity theft and simplifies the process of authentication for a seamless travel experience.

The government and defense market also applies digital identity solutions to access sensitive data, services, and communication systems. It provides biometric, digital ID, and secure authentication, thereby safeguarding the citizen's information and upholding the rules of privacy.

Also, the healthcare providers require digital identity solutions to safeguard patient records, protect privacy data, and ensure regulatory compliance with HIPAA. Such technologies prevent unauthorized access to sensitive medical information that ensures both security and increased trust among patients.

Besides, IT and telecommunication employ digital identity solutions for safeguarding networks, customer data, and sensitive information. Multi-factor authentication and identity management systems are significant to ensure secure access for users and protect them from cyber threats.

In addition to that, digital identity solutions protect critical infrastructure and enable the safe operation of systems, which energy and utilities embrace. Identity verification and the management of access rights provide protection from cyberattacks and unauthorized manipulation of the systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.5% due to advanced technological infrastructure, high adoption of digital services, and the increasing need for robust cybersecurity solutions. The rise in data breaches and cyberattacks has pushed businesses and governments to adopt stronger identity verification systems, such as MFA and biometrics. Additionally, stringent data protection regulations like the CCPA and GDPR have fueled the demand for secure digital identity solutions. North America’s established financial, healthcare, and technology sectors continue to drive the market, as organizations invest in innovative identity management technologies to protect sensitive data and comply with regulatory requirements.

Key Regional Takeaways:

United States Digital Identity Solutions Market Analysis

The U.S. digital identity solutions market is witnessing significant growth, driven by rising cybersecurity concerns and the increasing demand for secure digital transactions. A prime example of this trend is T-Mobile's recent $31.5 million settlement with the Federal Communications Commission (FCC) over data breaches that impacted millions of U.S. consumers. The breaches, which occurred in 2021, 2022, and 2023, emphasize the critical need for robust identity verification solutions to protect sensitive consumer data. In response to such incidents, industries like banking, healthcare, and government are increasingly adopting advanced technologies such as biometric authentication, multi-factor authentication (MFA), and identity-as-a-service (IDaaS). These solutions are vital in mitigating the risk of identity fraud and ensuring regulatory compliance with frameworks like the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA). Moreover, as mobile applications and e-commerce platforms continue to rise, there is a growing need for scalable, secure identity solutions, further fueling market expansion in the U.S. as businesses invest heavily in innovation and enhanced security measures.

Europe Digital Identity Solutions Market Analysis

The digital identity solutions market in Europe is experiencing rapid growth, driven by an increasing focus on cybersecurity and regulatory compliance. Strict data privacy laws, such as the General Data Protection Regulation (GDPR), are pushing organizations to adopt more secure identity verification systems. The market is seeing a rise in the adoption of biometric solutions, digital ID cards, and blockchain technology to improve security and streamline authentication processes. Government initiatives in countries like the UK, Germany, and France are also encouraging the adoption of digital identity systems for public services. The growing e-commerce and fintech sectors, combined with an increasing number of cyberattacks, are expected to drive demand for advanced digital identity solutions, positioning Europe as a key player in the global market.

Asia Pacific Digital Identity Solutions Market Analysis

The Asia Pacific digital identity solutions market is experiencing rapid growth, driven by factors such as digital transformation, the rise of e-commerce, and increasing identity fraud incidents. Countries like India and China are leading the adoption of biometric authentication, including facial recognition and fingerprint scanning, to enhance security and streamline processes. Government-backed digital identity initiatives, such as India’s Aadhaar, are also playing a significant role in expanding digital identity solutions. Furthermore, the growing popularity of mobile payment solutions and fintech services is accelerating the need for secure identity verification systems. This demand for digital identity solutions is further fueled by the region’s increasing reliance on digital platforms for various services and transactions.

Latin America Digital Identity Solutions Market Analysis

Latin America is the fastest-growing region in digital identity solutions because of increased security concerns and the digitization of operations. Critical sectors such as finance and healthcare are embracing the solution by countries like Brazil and Mexico to enhance security. Initiatives by governments in adopting unique identification systems such as Brazil's CPF and Mexico's CURP have promoted secure digital identity systems. Moreover, the growing demand for online secure transactions in e-commerce and other digital services is yet another driver for the region's market growth, with the region emerging as one of the most important digital identity solutions players globally.

Middle East and Africa Digital Identity Solutions Market Analysis

Cash is no longer the favored method of payment at point-of-sale (POS) retail outlets in the countries of Saudi Arabia and the United Arab Emirates; indeed, contactless payments reached a penetration rate of 94% in Saudi Arabia, according to the Saudi Central Bank, and of 84% in the UAE, as reported by Emirates NBD. This change is part of a greater phenomenon of digital transformation of the region, which fosters demand for secure identity solutions in the digital sense. With the growth in mobile payments and e-commerce services, advanced identity verification methods like biometrics and blockchain have become increasingly important to solidify cybersecurity and increase end-user confidence. In the Middle East and Africa, government initiatives in countries like Saudi Arabia and the UAE are supporting the adoption of these technologies, further bolstering the growth of the digital identity solutions market.

Competitive Landscape:

The digital identity solutions market is highly competitive, driven by the increasing demand for secure and efficient authentication methods across industries. Key players focus on innovation, offering advanced biometric, AI-driven, and decentralized identity management systems to address evolving cybersecurity challenges. To strengthen their market presence, companies often employ strategies such as strategic collaborations, acquisitions, and regional expansions. The rise of regulatory frameworks and data privacy concerns has spurred companies to enhance their offerings with compliance-oriented solutions. Additionally, the growing adoption of digital transformation, e-commerce, and fintech services has intensified competition, as providers aim to deliver seamless, scalable, and interoperable identity solutions. Emerging technologies and customer-centric strategies continue to shape the competitive landscape, creating opportunities for market differentiation and growth.

The report provides a comprehensive analysis of the competitive landscape in the digital identity solutions market with detailed profiles of all major companies, including:

- Daon, Inc.

- DXC Technology Company

- GB Group plc

- IDEMIA

- Jumio

- NEC Corporation

- Ping Identity

- SailPoint Technologies, Inc.

- Tessi

- Thales

Latest News and Developments:

- In December 2024, authID® (Nasdaq: AUID), a leader in biometric identity solutions, joined the Accountable Digital Identity Association (ADIA). ADIA promotes a standardized, decentralized framework for secure, reusable digital identities. As a member, authID will support developing ADIA’s interoperability and privacy-driven specifications to enhance user experience, reduce fraud, and safeguard data. This collaboration aims to streamline identity management for users and businesses, ensuring privacy and trust in the digital identity ecosystem.

- In November 2024, AU10TIX, a global identity verification leader, expanded into India with a new Bengaluru office, enhancing access to its AI-powered solutions for the country’s 1.4 billion citizens. With expertise in processing over 3,000 ID types across 150+ countries, AU10TIX aims to support India’s digital economy and global business ambitions. Led by industry expert Bhushan Sawant, the initiative focuses on empowering startups and businesses for seamless cross-border operations and global growth.

Digital Identity Solutions Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Identity Types Covered |

|

| Solution Types Covered |

|

| Organizations Size Covered | Large Enterprises, Small and Medium Enterprises |

| Deployments Covered | On-premises, Cloud |

| Verticals Covered | Banking, Financial Services, and Insurance, Retail and Ecommerce, Travel and Hospitality, Government and Defense, Healthcare, IT and Telecommunication, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Daon, Inc., DXC Technology Company, GB Group plc, IDEMIA, Jumio, NEC Corporation, Ping Identity, SailPoint Technologies, Inc., Tessi, Thales, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital identity solutions market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global digital identity solutions market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital identity solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global digital identity solutions market was valued at USD 43.76 Billion in 2024

The global digital identity solutions market is estimated to reach USD 214.2 Billion by 2033, exhibiting a CAGR of 17.70% from 2025-2033.

Key factors driving the global digital identity solutions market include rising cybersecurity threats, increasing adoption of digital services, regulatory compliance mandates, and advancements in technologies like biometrics and AI. The demand for secure, seamless authentication systems across industries, coupled with growing concerns about identity fraud and data breaches, significantly propels market growth.

North America currently dominates the global digital identity solutions market. The dominance is driven by the widespread adoption of advanced technologies such as biometrics, artificial intelligence, and blockchain, as well as a strong focus on cybersecurity and data protection.

Some of the major players in the global digital identity solutions market include Daon, Inc., DXC Technology Company, GB Group plc, IDEMIA, Jumio, NEC Corporation, Ping Identity, SailPoint Technologies, Inc., Tessi, Thales, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)