Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2025-2033

Digital Health Market 2024, Size and Trends:

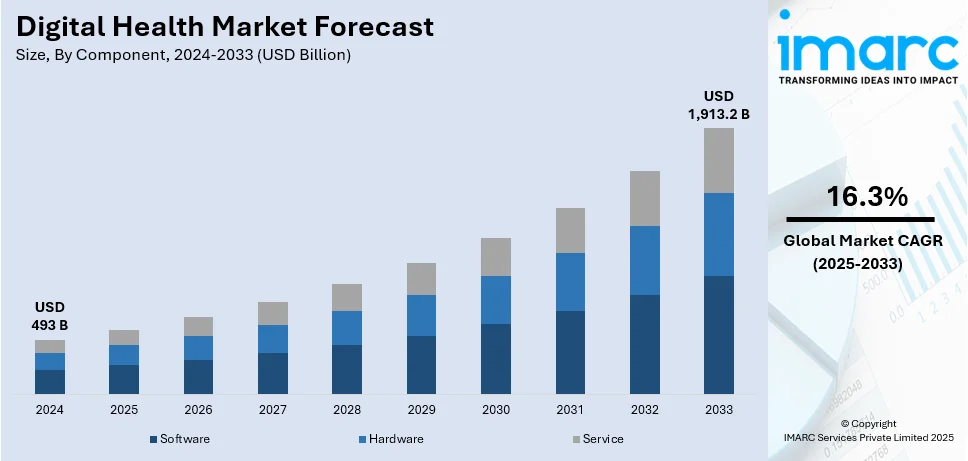

The global digital health market size was valued at USD 493 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,913.2 Billion by 2033, exhibiting a CAGR of 16.3% during 2025-2033. North America currently dominates the digital health market share, holding a significant market share of over 38.6% in 2024. The increasing diagnosis of chronic diseases among individuals, rapid shift toward value-based care, significant technological advancements and innovation, and rising healthcare costs and demand for efficiency, is driving the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 493 Billion |

|

Market Forecast in 2033

|

USD 1,913.2 Billion |

| Market Growth Rate (2025-2033) | 16.3% |

The global digital health market share is booming due to a number of convergent factors such as technological advancements, an aging population, and increasing health awareness among consumers. The growing acceptance of smartphones, wearable devices, and mobile health applications has connected healthcare in many ways, so patients may monitor their health and find care more easily. Artificial intelligence and machine learning advancement in AI are helping with the ability to analyze massive datasets for personalized medicine, predictive analytics, and better diagnosis. Technological integration also enhances the efficiency of healthcare delivery with reduced costs and less human error. Another driving force is an increasing prevalence of chronic conditions, including diabetes, respiratory diseases, and cardiovascular diseases, which require constant monitoring, thus increasing the demand for home-based remote patient monitoring services.

The United States stands out as a key market disruptor, driven by the combination of technological advancements, supportive policies, and evolving consumer expectations. The sophisticated healthcare infrastructure and the extensive adoption of EHRs create an ideal basis for digital health solutions. A major factor is the rising occurrence of chronic illnesses, such as diabetes and heart diseases, which require ongoing monitoring and care. This has increased the demand for wearable gadgets, telehealth services, and systems for remote patient monitoring. The COVID-19 pandemic significantly sped up the adoption of telemedicine, transforming the interactions between patients and providers and making virtual consultations commonplace. Policy initiatives, such as revising telehealth reimbursement and substantial financing via programs such as the Health Information Technology for Economic and Clinical Health (HITECH) Act, have additionally bolstered the market.

Digital Health Market Trends:

Significant technological advancements

Constant technological upgradations in the industry represent a major factor driving the digital health market growth. Significant technological advancements such as the integration of artificial intelligence (AI), Internet of Things (IoT), and cloud computing is propelling the market. These technologies allow the advancement of refined digital health solutions that influence predictive modeling, data analytics, and machine learning algorithms in order to transform the healthcare industry. Other than this, collaborations between digital health companies helps in expansion of the market. For instance, on February 13, 2023 Veradigm and HealthVerify entered into a collaboration to develop real-world evidence and enhance patient care for individuals diagnosed with diabetes and cardiovascular illnesses. This strategic step uses their respective expertise and resources to address complex healthcare challenges and create advancements in the industry.

Rising number of individuals diagnosed with chronic diseases

The rising prevalence of chronic diseases including cardiovascular diseases, diabetes, and respiratory conditions act as a threat to the healthcare industry globally. According to a report published by the WORLD HEALTH ORGANIZATION, 42 million individuals succumb to chronic illnesses every year, which makes 74% of global deaths. The significant rise in these numbers leads to a high demand for digital healthcare solutions which are able to prevent, manage, and treat these conditions. Technologies in this industry allow better management of these diseases by including mobile health apps, remote patient monitoring, and wearable devices. Other than this, patients suffering with such chronic illnesses are empowered through these technologies as they are able to track their health parameters and receive customized interventions remotely.

Increasing healthcare expenditure

Healthcare expenditures is continuously increasing, particularly in developing nations, on account of factors such as rising chronic diseases, aging population, and significant developments in medical technology, thereby contributing to the digital health market revenue. According to the PRESS INFROMATION BUREAU, the current health expenditure of India is INR 540,246 crores (USD 63.46 Billion). The technologies in this industry act as reliable solutions to combat the rising healthcare prices by maximizing healthcare delivery, improving patient engagement, and minimizing excessive utilization of healthcare services. For instance, telemedicine platforms allow virtual consultations, eliminating the need for in-person-visits and related healthcare expenditures. Moreover, these digital healthcare tools are also capable of identifying areas of inefficiency in within the healthcare structure, thus creating a positive digital health market outlook.

Digital Health Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and component.

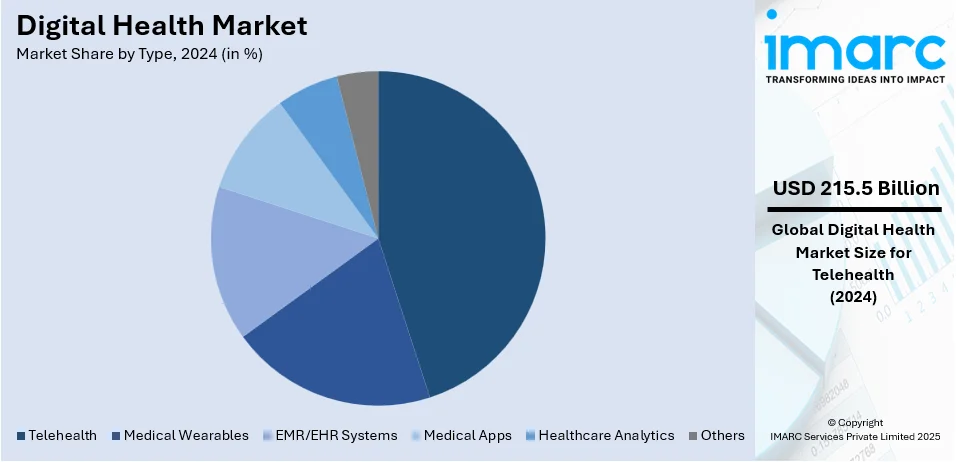

Analysis by Type:

- Telehealth

- Medical Wearables

- EMR/EHR Systems

- Medical Apps

- Healthcare Analytics

- Others

Telehealth leads the market with around 43.7% of market share in 2024 Telehealth dominates the market on account of its vast adoption and versatility in providing remote healthcare services. With constantly rising developments in technology and growing demand for accessible healthcare, telehealth provides patients with an appropriate alternative for traditional in-person consultations. Other than this, the sudden outburst of the COVID-19 pandemic has led to a substantial rise in the adoption of telehealth. As per a report by the IMARC GROUP, the global telehealth market has already reached US$ 19.0 Billion in 2023 and is projected to reach US$ 97.3 Billion by 2032, expanding at a CAGR of 19.7% during 2024-2032.

Analysis by Component:

- Software

- Hardware

- Service

Service leads the market in 2024. Service holds the maximum number of shares on account of its all-encompassing nature which provides a wide array of offerings such as training, implementation, consulting, and maintenance. It offers customized solutions to cater to the specific needs of healthcare companies, ensuring seamless integration. Services is also gaining traction due to the rising health tech industry in developing economies, such as China and India. According to INDIA BRAND EQUITY FOUNDATION (IBEF), the India health-tech market is projected to reach 50 Billion by 2033, exhibiting a CAGR of 39%.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.6%. As per the digital health market forecast, North America is the largest region due to its robust healthcare infrastructure along with significant technological advancements, which promote innovation and adoption of digital health solutions. Other than this, key players are significantly making investment in research and development (R&D) activities, thus creating a positive digital health market overview. Moreover, portable devices such as fitness trackers, smartwatches, and home monitoring devices allow patients to monitor their health metrics, thus propelling the market growth. According to the IMARC GROUP, the North America portable medical and healthcare devices market is projected to grow at a CAGR of 7.98% during 2024-2032.

Key Regional Takeaways:

United States Digital Health Market Analysis

The US digital health market demand is growing very rapidly due to multiple factors such as increasing prevalence of chronic diseases more frequently, increased penetration of smartphones, and rapid improvements in 5G technology. According to CDC, the cardiovascular disease is still among the killer diseases as it kills one life every 33 seconds, thereby giving 702,880 death reports in the year 2022 or 1 in every 5 deaths in the United States. Besides, 1.7 million new cancer cases are diagnosed annually with an annual death toll of 600,000 individuals, and it puts back the nation by an average of USD 185 Billion per annum to care for. Diabetes presently afflicts 38.4 million Americans; this means 11.6 percent of the population or, out of whom, 38.1 million adults aged 18 years or older made up 14.7 percent of all U.S. adults in 2021.

This again boosts the market. Technological advancements have also resulted in smartphone penetration in the U.S. growing to 83% in 2018 and 91% in 2023 according to Industry Reports. And mobile Economy North America 2023 indicate 53% of North America usage of 5G fall on the field of health services. Given that case network providers now team up with the hospital with purposes of enhancing telehealth together with remote patient monitoring.

Europe Digital Health Market Analysis

The European digital health sector is experiencing considerable acceleration driven by rapid connectivity advancements, a rise in chronic illnesses, and an increased need for telehealth services. According to the Mobile Economy Europe, in 2022, the area had 496 million distinct mobile subscribers, projected to grow to 507 million by 2030, achieving a penetration rate of 92%. European's projections about mobile connections in terms of usage of 5G by the year 2030 are 87% through utilization, so with this technology, smooth digital health platforms and monitoring from a distance will easily find their way. Increased instances of chronic diseases and patients suffering from cancer, diabetes, Alzheimer's and heart disease have created high demands for long-term solutions toward keeping watch over the patients.

ECIS reveals that between 2020 and 2022, the incidence of new cancer cases has increased by 2.3%, which amounts to 2.74 million, whereas the death rate associated with cancer has increased by 2.4%. Shortfalls in healthcare services, such as the lack of health workers and a high trend toward outpatients, will quickly increase the adoption rate of telehealth services to advance this market. All these factors hint at the significant impact digital health is having on changing the health scenario of Europe.

Asia Pacific Digital Health Market Analysis

The Asia-Pacific market for digital health is gaining tremendous growth, and governmental programs, partnerships, as well as technological advancements are all helping enhance this growth. Increased uses of smartphones and tablets, coupled with the improvement in the availability of the 5G network, is helping a lot in the digital health platform's acceptance. For instance, Mobile Economy Asia Pacific 2023 report shows that the growth of 5G in this region is expected to be phenomenal, with India being anticipated to add 10 million connections by 2023. The APAC is expected to hit 1.4 billion connections by 2030, which accounts for 41% of the total mobile connections. The demographic in the area is aging, and there is a rise in chronic illnesses, which enhances the market demand.

As cited in Journal of Medical Internet Research, more than 90 percent of Japanese adults aged above 75 have a chronic condition; around 80 percent are managed with more than one chronic condition. In reference to the World Cancer Research Fund International, Southeast Asia reported 90 million diabetes cases by 2021. In addition, as many as over 2.4 million cases were documented cancer cases of men in China. All these factors illustrate the growing need for patient-centric digital health solutions and telemonitoring technologies across the region.

Latin America Digital Health Market Analysis

The increasing prevalence of diabetes is one of the major drivers in the digital health market of Latin America. According to the NCBI 2021 report, Brazil had an age-adjusted diabetes prevalence of 8.7%, whereas Mexico reported the highest prevalence at 14.7%. Brazil had the third-largest population of undiagnosed diabetics and the fifth-largest group of older adults with diabetes, totaling 4.9 million individuals. This number is expected to increase significantly, reaching 11.9 million by 2045.

These figures demonstrate an imperative need for innovative digital health technologies that encompass early detection, effective treatment, and proper care about diabetes. Among the mentioned technologies that will contribute to enhanced patient outcomes and reduced costs of healthcare services include remote monitoring systems, mobile health applications and telemedicine services. However, acceptance of digital health services is also further triggered by improved access to internet, increasing mobile usage, as well as efforts from the regional government toward improvement of health care availability. This strong demand for digital health solutions is shaping the future of diabetes treatment in Latin America.

Middle East and Africa Digital Health Market Analysis

A leading catalyst in the digital health market of the Middle East and Africa is the rise in incidence of diabetes. According to IDF, almost one in six adults in the region, around 73 million, suffers from the disease; this accounts for the highest number in all the regions of the IDF. It is anticipated that the prevalence will grow by 86% with a population of 136 million by 2045. This ranks the region the second in terms of growth worldwide. Alarmingly, a third of area residents with diabetes remain undiagnosed, thereby pointing out an important lacuna in early detection and management. In 2021, diabetes was attributed to 796,000 deaths. Of these deaths, 24.5% were among working age and stood at the highest globally. The rising burden necessitates greater investment in digital health, including telemedicine, wearable technologies, and mobile applications, as it contributes to the proper management of diabetes, aids in early diagnosis, and reduces the death toll. This is motivating investment and innovations in digital health technologies targeting diabetes management specifically within the region.

Competitive Landscape:

Major players in the digital health market are aggressively pursuing innovation and strategic partnerships to strengthen their positions. They are leading efforts to integrate AI into medical devices and platforms to improve diagnostics, automate clinical workflows, and manage workforce shortages. Key players are also investing heavily in cloud and AI technologies to enhance patient data security and engagement. Moreover, companies are embedding digital health tools and remote monitoring into physician workflows through collaborations, as well as undergoing strategic realignments to respond to shifting market demands. The focus is further shifting toward delivering secure, AI-compatible network infrastructure to support the broader digital health environment.

The report provides a comprehensive analysis of the competitive landscape in the digital health market with detailed profiles of all major companies, including:

- American Well Corporation (Amwell)

- Apple Inc.

- GE HealthCare

- Johnson & Johnson (J&J)

- Koninklijke Philips N.V.

- Medtronic plc

- Noom, Inc.

- Omron Corporation

- Samsung Group

- Siemens Healthineers AG (Siemens AG)

- Teladoc Health, Inc.

- Veradigm LLC

Recent Developments:

- September 2024: The World Health Organization (WHO) announced an investment in digital health interventions, including telemedicine, chatbot, and mobile messaging. This includes an additional USD 0.24 allocated per patient year. This is aimed at saving more than two million individuals suffering from non-communicable diseases.

- April 2024: The WHO announced the launch of S.A.R.A.H., a prototype of a digital health promoter that is driven by generative AI, with improved empathetic responses.

- May 2023: Medtronic plc acquired of EOFlow Co. Ltd. (South Korea) to expand its footprint and improve its ability to cure patients diagnosed with diabetes.

- In March 2024, Mayo Clinic launched the Solutions Studio program to accelerate the deployment of digital health products in hospitals. The initiative provides access to standardized data, analytic tools, and the Validate product, which tests AI for bias, specificity, and sensitivity, supporting the integration of solutions into electronic health records.

- In June 2023, Eko Health launched its CORE 500™ Digital Stethoscope, combining AI-driven heart disease detection, a 3-lead ECG, and advanced audio technology. The device enhances diagnostic accuracy, enabling quicker identification of cardiac conditions for healthcare professionals.

Digital Health Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Telehealth, Medical Wearables, EMR/EHR Systems, Medical Apps, Healthcare Analytics, Others |

| Components Covered | Software, Hardware, Service |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Well Corporation (Amwell), Apple Inc., GE HealthCare, Johnson & Johnson (J&J), Koninklijke Philips N.V., Medtronic plc, Noom, Inc., Omron Corporation, Samsung Group, Siemens Healthineers AG (Siemens AG), Teladoc Health, Inc., Veradigm LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global digital health market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital health industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital health market was valued at USD 493 Billion in 2024.

IMARC estimates the global digital health market to exhibit a CAGR of 16.3% during 2025-2033.

The global digital health market is driven by technological advancements, increasing prevalence of chronic diseases, growing adoption of telemedicine, rising healthcare costs, and heightened demand for patient-centric and remote care solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global digital health market include American Well Corporation (Amwell), Apple Inc., GE HealthCare, Johnson & Johnson (J&J), Koninklijke Philips N.V., Medtronic plc, Noom, Inc., Omron Corporation, Samsung Group, Siemens Healthineers AG (Siemens AG), Teladoc Health, Inc., Veradigm LLC, etc.

North America's role in the digital health market includes fostering innovation through advanced healthcare infrastructure, driving technological progress with significant R&D investments, and enabling widespread use of portable health devices.

Telehealth, holding 43.7% market share in 2024 is accounted for the largest segment, It dominates due to its adoption and versatility, offering a convenient alternative to in-person consultations amid advancing technology and growing demand for accessible healthcare.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)