Digital English Language Learning Market Size, Share, Trends and Forecast by Deployment Mode, Business Type, End User, and Region, 2025-2033

Digital English Language Learning Market Size and Share:

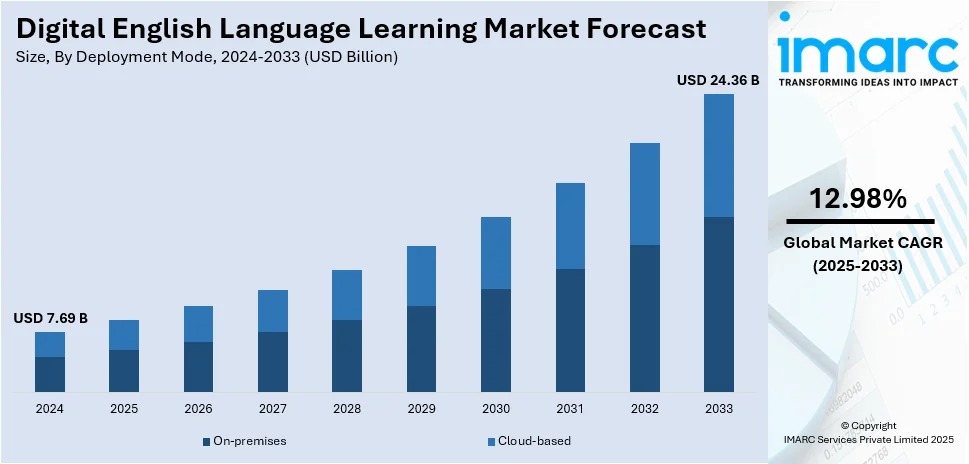

The global digital English language learning market size was valued at USD 7.69 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.36 Billion by 2033, exhibiting a CAGR of 12.98% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 40.0% in 2024. The digital English language learning market share is expanding quickly due to globalization and the higher demand for English skills, notable technological progress, unmatched accessibility and flexibility provided by digital platforms, growing recognition of the affordability of digital solutions, and the increasing use of e-learning in education.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.69 Billion |

|

Market Forecast in 2033

|

USD 24.36 Billion |

| Market Growth Rate (2025-2033) | 12.98% |

Several organizations are embracing the significance of communication in the age of globalization. The need for English in international business, education, and tourism has fueled the demand for affordable learning aids. Advances in technology, such as AI-enabled platforms and tailored learning, have transformed online learning into a more engaging and effective process. Increased mobile device ownership and internet penetration have ensured language learning anywhere and at any time. Moreover, the COVID-19 pandemic hastened the use of online learning, as individuals looked for flexible, remote learning opportunities. Affordable substitutes for conventional methods also drive the digital English language learning market growth, making English learning more accessible and prevalent.

The United States stands out as a key market disruptor, driven by its global influence in technology, business, and education. Besides that, the US is home to some of the major EdTech companies, such as Duolingo, Rosetta Stone, and Coursera. The US has built some of the most innovative digital learning platforms to supplement traditional learning with artificial intelligence, gamification, and personalized learning. These systems help make English learning more engaging and accessible for users worldwide. The rise in demand for English, especially in the tech and international business sectors, adds fuel to the growing market-seeking. The US has the kind of physiognomy of linguistic diversity which, in turn, creates an environment in which digital tools can cater to specific learner needs, further influencing global trends in language acquisition.

Digital English Language Learning Market Trends:

Rapid Globalization and Increasing Demand for English Language Proficiency

According to the United Nations, the global population will reach 8.6 billion in 2030. In 2050, it will rise to 9.8 billion. Globalization is thus significantly contributing toward increasing the demand for English language proficiency in the whole world. Based on this, websites offering English language learning have a broad base of users ranging from career-oriented professionals to students seeking higher education abroad. Apart from this, increasing demand for the English language to be spoken in multinational companies, international business alliances, and global trade negotiations is driving the market. English Proficiency Index (EPI) Report 2024 indicates that approximately 1.3 billion individuals speak English, and 85% of multinational companies utilize English as their business language. Moreover, the growing number of global conferences, symposiums, and seminars held in English, requiring the English language skills of the attendees, is driving the market growth. Besides, the rising inclination for acquiring English language in non-English native speaking countries for developing worldwide prospects is driving the market growth.

Significant Technological Advancements

Innovative technologies such as artificial intelligence (AI), machine learning (ML), and enhanced speech recognition are transforming the teaching and learning of languages. AI and ML algorithms provide tailored learning experiences by adapting to each learner's skill level and learning preferences, ensuring that students are neither overstretched nor under-challenged, resulting in a more effective and immersive educational atmosphere. Besides that, the real-time pronunciation correction capability of the speech recognition technology is a vital feature in learning a new language. Also, the adoption of virtual and augmented reality (VR/AR) in language training, which puts learners in real-looking, interactive environments, involving and making learning more efficient, is driving the market growth. In addition, the application of big data analytics, which assists instructors and creators in understanding learning patterns and outcomes, is fueling the market growth. In line with this, KnowBe4, the security awareness training and simulated phishing provider, released the KnowBe4 Mobile Learner App last November 2022. This app allows end users to undergo security awareness and compliance training anywhere, anytime without extra charge, enhancing user adoption and enforcing the security culture, further proving the power of mobile learning solutions in learning.

Unparalleled Accessibility and Flexibility of Digital Platforms

The increase in digital English language learning demand, due to its unmatched accessibility and flexibility, is driving market expansion. Students have access to a variety of resources, such as interactive lessons, video tutorials, and live tutoring sessions, via digital platforms. This is very helpful for busy professionals and students who do not get the time to attend conventional language classes. Online language learning platforms cover all styles of learning and levels of proficiency, thus making English language learning inclusive and personal. In addition, flexibility allows one to adapt to individual lifestyles and makes the journey more continuous and uninterrupted. For example, as reported by DIU, India, in August 2023, around 49.3% students in rural locations have smartphones: out of them around 34% use for downloading studies and about 18% for accessing online learning through the tutorials. This adds more weight to the increasing digital learning that prove useful for accessing English language education in wider rural and underserved areas.

Increasing Awareness About the Cost-Effectiveness of Digital Platforms

Digital platforms' cost-effectiveness is one of the important factors propelling the market growth. Affordable, but high-quality solutions can be acquired with digital learning. The elimination of textbooks, workbooks, and other related facilities cuts down production and distribution costs. Digital platforms also use scalable technology, which could serve huge numbers of audiences without a proportional increase in costs. As a result, the costs are lower for the learners enabling more people to learn the English language. In addition to this, numerous digital platforms for learning English have different pricing options - including free basic versions and premium subscriptions - to satisfy the various finances as well as needs of learners. Moreover, most of the digital platforms provide lifetime access and lifetime updates, ensuring learners long-term returns on their investments. In addition, by 2022, mobile internet penetration in the Asia-Pacific region had increased to 49% from 45% in 2018, according to the GSMA, who noted that affordability and accessibility of digital learning solutions-including those through mobile devices-assisted in the availability of English language schooling.

Rising Adoption of E-Learning in the Education Sector

The inclusion of digital English language learning technologies within educational curricula is one key driver for market growth. The trend is widely influenced by the acknowledgment of English proficiency as an essential skill for the global job markets. Educational institutions, including schools and universities, are continually recognizing the necessity of English as a tool in preparing students to compete in a global environment. In accordance with this, online learning tools provide a new way to learn languages. They integrate interactive features, like quizzes, games, and real-time feedback, making learning fun and efficient over conventional methods. In addition, they tend to feature adaptive learning technologies, which tailor the learning process to every student's skill level and study pace, ensuring more effective advancement. In August 2023, Echo360, a company providing learning engagement outcomes software, released EchoExam, a SaaS summative assessment platform for supporting education and business. Embedding innovative tools into educational settings is becoming one of the trends in the adoption of new English language learning for more efficient educational processes, making it possible for interactive assessments along with real-time feedback to contribute to more personalized and enjoyable learning experiences.

Digital English Language Learning Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global digital English language learning market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on deployment mode, business type, and end user.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based leads the market with around 70.0% of market share in 2024. Cloud-based deployment captures the biggest share of the market, as it provides unmatched ease of access in that learners are able to consume content from anywhere using any internet-enabled device, be it a smartphone, tablet, or desktop computer. Further, cloud-based platforms are greatly scalable, providing providers with increased ease of providing for a multitude of users without substantial cost spikes or performance downturns. This scalability is necessary in addressing the various and increasing global populace interested in English language proficiency. Additionally, cloud platforms usually have lower initial costs than on-premises platforms since they generally rely on a subscription basis.

On-premises deployment supports users who prefer or need their learning content to reside on their local servers. Its key benefit is tighter control over data and security. Additionally, on-premises solutions provide a greater level of security because the data resides within the user's own IT infrastructure. It is especially important for organizations that have strict data security regulations or those in areas with particular data residency needs.

Analysis by Business Type:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

The business-to-business (B2B) division offers services to the requirements of institutions, such as corporations, schools, and government agencies. It offers customized language learning solutions designed to address the particular organizational requirements. The B2B division is also dedicated to developing tailored content that aligns with the professional or educational requirements of the customers.

The consumer-to-business (B2C) market is characterized by its focus on individual language learning needs, such as travel, self-improvement, immigration, or self-betterment. Its products are standardized and directed towards a large audience with diverse learning needs and backgrounds. The content in B2C websites also tends to range across a wide variety of topics, from basic vocabulary, grammar, and advanced conversation skills, to appeal to various levels of proficiency.

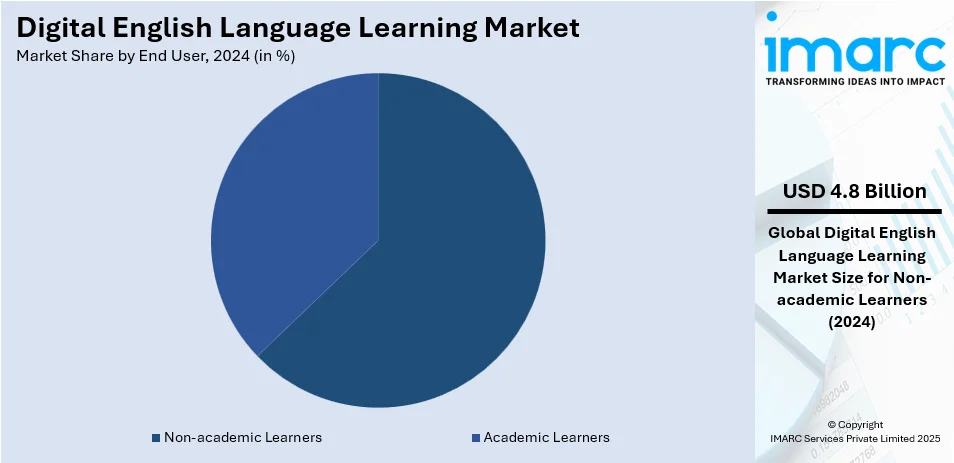

Analysis by End User:

- Non-academic Learners

- Academic Learners

Non-academic learners lead the market with around 62.6% of market share in 2024. The non-academic learners segment commands the biggest market share, and it represents a heterogeneous group of people looking for English proficiency for miscellaneous personal and professional reasons beyond a formal academic environment. It comprises career professionals looking to advance their career opportunities or to communicate better in the international business community, immigrants who require language skills to become more integrated in English-speaking societies, and English learners looking for travel, cultural exploration, or personal interest. Also, the content and design of online English language learning platforms for this segment are generally practical and adaptive, being centered on conversation skills, business English, everyday communication, and everyday situations.

The academic learners segment includes students and those who are pursuing formal education, from school-going children to university students. It emphasizes English language acquisition to fulfill academic needs, take standardized English proficiency tests, or study higher education in English-speaking nations. In addition, computer-based English learning tools for this segment are normally designed to correspond with academic curricula and test preparation requirements.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 40.0%. The Asia Pacific market accounts for the highest market share because it has a big population base as well as quick economic growth. Further, the region's rising focus on the proficiency of English in business, education, and worldwide communication is helping to expand the market. Apart from this, the region's rising middle class with strong ambitions to possess English language capabilities for improving job prospects and entry into international markets is driving the growth of the market. Furthermore, the ongoing educational reforms and government initiatives in many Asia Pacific countries, which emphasize English proficiency, are further fueling the market growth.

In North America, the market for digital English language learning is fueled by drivers such as immigration, professional development needs, and the inclusion of language learning in education systems. Moreover, the availability of multinational companies and the focus on international business communication is fueling the market growth. Apart from this, the increasing trend of using digital English language learning tools in schools and universities to improve the language skills of students is fueling the market growth.

The European market for digital English language learning is characterized by the multilingual environment of the region and the dominance of English as a second language. Apart from this, the stress on multilingual education within the European Union and the free movement of students and professionals within the region, fueling high demand for English language skills, is supporting the market growth.

The Latin American English language learning market is expanding, led by Latin America's expanding integration into the world economy and the acceptance of English as a valuable skill for economic development. Also, escalating demand for English language skills among the youth population and the working professionals is fueling the growth of the market.

The Middle East and African digital English language learning market is on the rise, due to various reasons, including growing urbanization, growing youth population, and growing internet and mobile penetration. Additionally, Middle East countries are placing importance on diversifying their economies and growing their global reach, which has added emphasis on English language skills.

Key Regional Takeaways:

United States Digital English Language Learning Market Analysis

In 2024, the United States accounts for over 85.00% of the digital English language learning market in North America. Corporate investment in employee growth and development has become critical for the growth of the United States digital English language learning market. Reports of the industry in 2023 state 94% of the employees in US would want to stay in a company which earnestly invests in their professional growth. As the company expands to international bounds, the English language will require much more knowledge in fields such as finance, healthcare, technology, and customer service.

Companies now include digital English training modules in company training programs for improving communication skills, productivity, and employee retention. AI-assisted learning platforms, mobile courses, or virtual training modules are some prime tools for skill-up training programs within organizations. The shift toward remote and hybrid work has only driven the trend for flexible, digital-first language learning solutions. These are further expected to enhance the investment in corporate English language learning over the next few years.

Europe Digital English Language Learning Market Analysis

The Digital Education Action Plan (2021-2027) is a flagship policy initiative of the European Union (EU), aimed at promoting the sustainable and effective digital transformation of education and training systems across EU member states. This initiative plays a crucial role in driving the growth of the European Digital English Language Learning Market by encouraging the integration of digital tools into learning frameworks. This plan focuses strongly on digital literacy and language proficiency, thereby supporting investments into AI-based language learning systems, virtual classrooms, and mobile-based training programs. English is by far the most commonly spoken language in both the EU and Europe overall. A 2012 study by the European Union (EU) revealed that approximately 4 in 10 EU citizens spoke English. As English remains the most sought-after business, academic, and internationally collaborative language, these initiatives supported by the EU are fast tracking the adoption of digital English learning solutions in schools, universities, and corporate training programs. The initiative will also ensure that inclusivity and accessibility features are in place, allowing students, professionals, and lifelong learners throughout Europe to access flexible, personalized, and technology-based English-language education, thus fuelling the growth of the market over the next few years.

Asia Pacific Digital English Language Learning Market Analysis

Asia-Pacific countries facilitating digital english learning are rapidly developing with government policies, increase in mobile internet access, and adoption of digital learning. India, in its Union Budget 2022, struck an emphasis toward many initiatives that enhance digital education, for example, the Higher Education Commission of India and National Education Policy. It hints at making digital learning easier besides encouraging upskilling. Moreover, according to a recent report from HP India, 63% of Indian respondents think that digital learning positively impacts the children's creativity, thus prompting the online education platforms.

Meanwhile, the digital ecosystem of China is facilitating the mobile language-learning process. According to CNNIC reports, in 2023 almost 99.9% of the users among 1.09 billion smartphones accessed the internet from their mobile devices. The growing dependence in the region on mobile-first education, augmented with AI-powered and gamified learning solutions, drives an accelerated appetite for digital English learning platforms among students, professionals, and lifelong learners in the Asia-Pacific region.

Latin America Digital English Language Learning Market Analysis

The Latin America online English language learning market is expanding at a strong pace, fueled mainly by growing mobile internet penetration. According to industry reports (2024), 65% of the population in Latin America was covered by mobile internet in 2023, and it is expected to grow to 72% by 2030. This growth is making the population more connected and digitally active, which is driving the use of mobile-based English learning platforms.

As the use of smartphones has become the primary platform for online learning, Brazilians, Mexicans, Argentines, and Colombians increasingly look for AI-driven language learning applications and interactive lessons in virtual classrooms to acquire the language. With easily accessible smartphones coupled with upgraded 4G and 5G networks, there are new channels to enhanced English language prospects that may not have had access previously in some parts of the individual countries. Corporate training initiatives and EdTech spending are also leading the market ahead, with increasing numbers of companies embracing English proficiency courses as part of workforce skill improvement in sectors such as BPO, tourism, and foreign trade.

Middle East and Africa Digital English Language Learning Market Analysis

Middle East and Africa Digital English Language Learning has a higher growth rate due to extensive rollout of 5G networks in the region. GSMA anticipates covering 95% of the population in the GCC countries by 2030 through the use of 5G technology, which would improve internet connectivity, thereby making digital education platforms more accessible and better. This technological progress will enable students in the Gulf Cooperation Council (GCC) countries, North Africa, and Sub-Saharan Africa to access AI-driven English language learning applications, interactive lessons, and virtual classrooms at faster speeds and greater convenience. Improved mobile connectivity will also narrow the digital divide between rural and remote communities, making digital learning solutions more accessible to those who need them most. Demand for English skills will be further fueled by the demand in and between industries like finance, technology, and global trade. Companies and schools will increasingly digitize their reskilling of workers and students, driving further market expansion.

Competitive Landscape:

Major players in the market for online English language learning have been exerting substantial efforts to boost growth and extend their market reach. Leading firms are heavily investing in cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) to develop customized learning experiences. AI-based platforms like Duolingo and Babbel utilize adaptive algorithms to personalize lessons based on the pace and level of the learner, thereby boosting engagement and results. Besides, gamers are embedding gamification and interactive elements, which are popular with a larger crowd, particularly young students. Most platforms also have speech recognition technology, allowing users to practice their pronunciation and speech in real-time. Additionally, collaborations with schools and engagements with influencers or educators have significantly contributed to increasing brand awareness and market presence. To address the growing need for flexible learning, organizations are providing mobile-friendly applications and offline learning opportunities. With the increasing trend of digital learning worldwide, organizations are emphasizing localization, providing content in various languages and regional dialects to address the needs of varied audiences. With these measures, major players are not only improving the learning process but also opening up English language learning to more learners across the globe.

The report provides a comprehensive analysis of the competitive landscape in the digital English language learning market with detailed profiles of all major companies, including:

- 51Talk English International Inc.

- Berlitz Corporation

- Busuu (Chegg Inc.)

- EF Education First Ltd.

- Inlingua International Ltd.

- Lingoda GmbH

- Pearson plc

- Preply Inc.

- Rosetta Stone Inc. (IXL Learning Inc.)

- Sanako

- VIPKid

- Voxy Inc.

- Yabla Inc.

Recent Developments:

- June 2024: Wildix introduced a new e-learning platform aimed at enhancing MSPs and SI training and certification. The platform now features guest access, enabling partners' clients to join the Collaboration course, among other options.

- November 2023: Busuu introduced AI-driven web and mobile apps to aid in learning languages more quickly and efficiently.

- July 2023: Berlitz Corporation was acknowledged by Microsoft for utilizing AI to enhance language education.

- July 2020: EF Education First revealed significant funding from Permira to enhance its online learning and school network for kids and teens in China.

Digital English Language Learning Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Business Types Covered | Business-to-Business (B2B), Business-to-Consumer (B2C) |

| End Users Covered | Non-academic Learners, Academic Learners |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 51Talk English International Inc., Berlitz Corporation, Busuu (Chegg Inc.), EF Education First Ltd., Inlingua International Ltd., Lingoda GmbH, Pearson plc, Preply Inc., Rosetta Stone Inc. (IXL Learning Inc.), Sanako, VIPKid, Voxy Inc., Yabla Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital English language learning market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global digital English language learning market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital English language learning industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital English language learning market was valued at USD 7.69 Billion in 2024.

The digital English language learning market is projected to exhibit a CAGR of 12.98% during 2025-2033.

Key drivers of the digital English language learning market include technological advancements, such as AI and personalized learning, widespread internet access, and the growing need for English proficiency in global business, education, and travel. Additionally, the rise of mobile devices and cost-effective online options contribute to the market's expansion.

Asia Pacific currently dominates the market driven by rapid internet adoption, mobile device usage, and the region's growing demand for English proficiency in education and business.

Some of the major players in the digital English language learning market include 51Talk English International Inc., Berlitz Corporation, Busuu (Chegg Inc.), EF Education First Ltd., Inlingua International Ltd., Lingoda GmbH, Pearson plc, Preply Inc., Rosetta Stone Inc. (IXL Learning Inc.), Sanako, VIPKid, Voxy Inc., Yabla Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)