Digital Audio Workstation Market Size, Share, Trends and Forecast by Component Type, Type, Operating System, End User, and Region, 2026-2034

Digital Audio Workstation Market Size and Share:

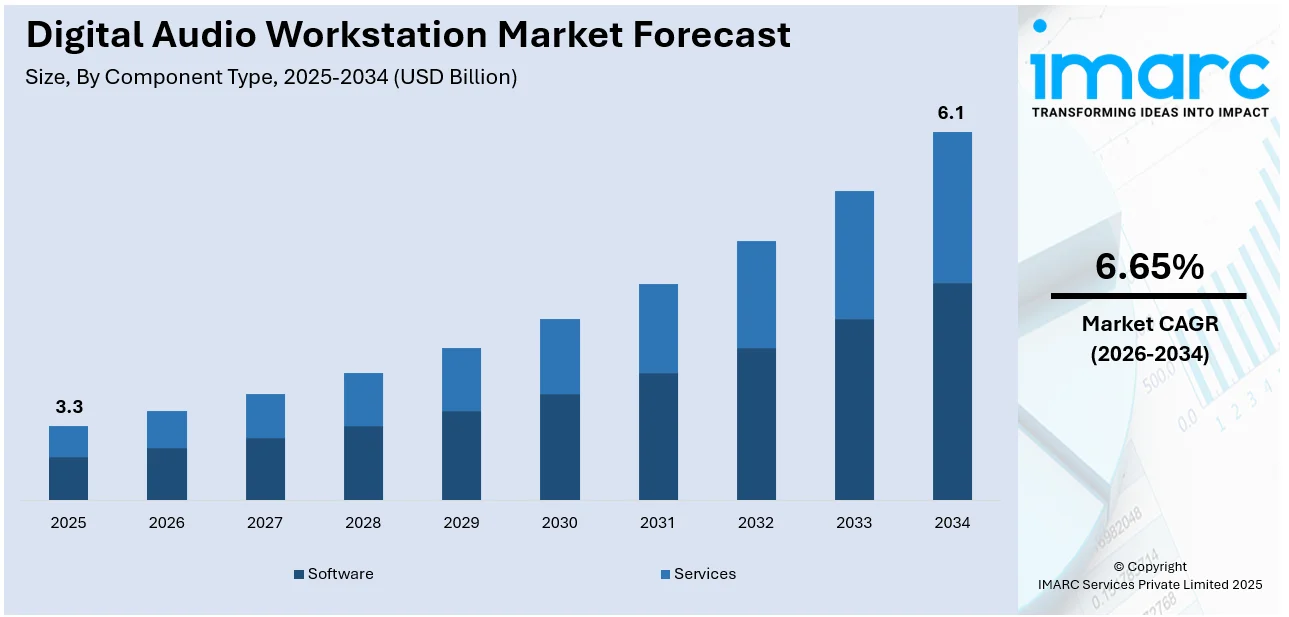

The global digital audio workstation market size was valued at USD 3.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.1 Billion by 2034, exhibiting a CAGR of 6.65% from 2026-2034. North America currently dominates the market, holding a market share of over 32.5% in 2025. The digital audio workstation market share is expanding in the Asia Pacific region, driven by the rising music production, increasing demand for cloud-based solutions, and the growing utilization of artificial intelligence (AI) and machine learning (ML).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.3 Billion |

|

Market Forecast in 2034

|

USD 6.1 Billion |

| Market Growth Rate 2026-2034 | 6.65% |

The rising demand for music production tools, especially among independent artists and home studio users, is fueling the market growth. Apart from this, the ongoing trend of content creation for podcasts, gaming, and other digital platforms is boosting the uptake of modern digital audio workstations (DAWs). Furthermore, features based on AI technology are also enhancing the sound quality of DAWs and improving their user-friendly interfaces, raising productivity for beginners. The burgeoning music streaming industry is motivating artists and musicians to produce content with efficiency. Producers and sound engineers are increasingly using cloud-based solutions, which allow remote collaboration and flexible storage options.

To get more information on this market Request Sample

The United States has emerged as a major region in the digital audio workstation market owing to many factors. The growing investments in professional recording studios and live sound production are offering a favorable digital audio workstation market outlook. The rising demand for content creation across music, podcasting, and video production platforms is also impelling the market growth. Independent musicians, social media influencers, and gamers are employing DAWs to enhance their audio quality and improve content output. The burgeoning entertainment industry, particularly in Hollywood and online streaming services, is further catalyzing the demand for modern sound editing tools. According to the International Trade Administration, the media and entertainment (M&E) sector in the US stood as the biggest at USD 649 Billion in 2024. The market is set to reach USD 808 Billion by 2028, with an average annual growth rate of 4.3%. Additionally, the increasing availability of user-friendly and cost-effective software options is encouraging adoption among beginners and hobbyists.

Digital Audio Workstation Market Trends:

Increasing music production

The rising music production is propelling the market growth. For instance, during Q1 2023,120,000 fresh tracks were being added to music streaming platforms every day. The increasing number of independent artists, supported by digital media platforms, is encouraging more users to adopt DAW solutions for home-based and professional studios. Music production styles in genres like hip-hop, electronic, and pop are evolving, driving the demand for flexible and efficient audio editing tools. Additionally, social media trends, such as viral music challenges and remix culture, are motivating creators to produce content rapidly, thus creating the need for reliable DAW software. With emerging artists and music producers seeking cost-effective and feature-rich solutions, DAWs are becoming vital for seamless music creation, strengthening their market presence.

Growing utilization of AI and ML

The increasing utilization of ML and AI is impelling the digital audio workstation market growth. For instance, in 2018, 40% of organizations actively employing AI allocated more than 5% of their digital budgets to it. This figure rose to 52% in 2023. AI-based tools simplify tasks, such as sound mixing, mastering, and noise reduction, allowing people to produce high-quality audio efficiently. ML algorithms analyze user preferences and suggest optimal settings, streamlining workflow for professionals and beginners alike. These technologies also enable innovative features like automatic beat matching, vocal tuning, and adaptive sound effects, making DAWs more versatile and user-friendly. As content creators, podcasters, and music producers are adopting AI-integrated solutions for faster and improved results, the demand for advanced DAWs is rising. Additionally, AI-oriented virtual assistants and intelligent plugins are expanding creative possibilities, further enhancing DAW usage in both professional and home studios.

Rising investments in entertainment industry

The growing investments in the entertainment industry are positively influencing the market. Film and television producers require advanced audio solutions for sound design and editing. The rise in high-budget projects, especially in streaming platforms, demands sophisticated audio tools for enhancing sound quality, voiceovers, and background scores. Production houses are wagering on modern DAW software to refine workflow efficiency and achieve professional-grade audio outputs. Additionally, the surge in podcasting, web series, and gaming content is driving the demand for DAW solutions, enabling creators to produce immersive audio experiences. As the entertainment industry continues to broaden with high spending on content creation, DAW software adoption is rising to meet the growing demand for high-quality sound production. According to the IBEF, the Indian M&E industry is poised for significant expansion, with an anticipated increase of 10.2%, attaining INR 2.55 Trillion (USD 30.8 Billion) by 2024 and a 10% CAGR, reaching INR 3.08 Trillion (USD 37.2 Billion) by 2026.

Digital Audio Workstation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global digital audio workstation market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component type, type, operating system, and end user.

Analysis by Component Type:

- Software

- Services

- Professional

- Managed

Software held 57.8% of the market share. DAW software enables users to perform recording, editing, mixing, and mastering tasks within a single platform, making it highly efficient for music producers, podcasters, and content creators. Its flexibility allows integration with various hardware devices, ensuring seamless control over audio production. The availability of advanced plugins, virtual instruments, and sound libraries further enhances the software's appeal. DAW software is also compatible with various operating systems, rendering it accessible to users with different preferences. Continuous updates and feature enhancements improve performance and expand creative possibilities, attracting both professionals and beginners. The rising demand for music production, online content creation, and audio editing in sectors like gaming, film, and media further supports the preference for software-based DAW solutions, strengthening its leadership in the market.

Analysis by Type:

- Editing

- Mixing

- Recording

Editing accounts for the biggest market share. Editing requires precise audio modifications across various industries. Music producers, content creators, and filmmakers rely heavily on editing tools to enhance sound quality, adjust timing, and refine recordings. Editing features, such as noise reduction, equalization, and pitch correction, are crucial for yielding professional audio outputs. The rising popularity of podcasts, online videos, and digital advertisements further creates the need for effective audio editing tools. Additionally, editing software offers user-friendly interfaces and automation features that simplify complex tasks, making it accessible to both professionals and beginners. The increasing demand for remixes, mashups, and audio restorations also boosts the use of editing tools. As content creation expands in sectors like media, entertainment, and online education, the demand for digital audio editing solutions continues to grow, solidifying its dominance in the market.

Analysis by Operating System:

- Android

- Mac

- Windows

- Linux

Windows holds 25.6% of the market share. Windows devices are available across a wide range of price points, making them accessible to both professional studios and home-based producers. The platform supports various reliable DAW software options, providing flexibility for users to choose tools that match their needs. Windows systems are also known for their customizable hardware configurations, allowing users to enhance performance with upgraded processors and storage. Moreover, the availability of specialized audio interfaces, plugins, and third-party applications designed for Windows strengthens its dominance. Windows systems are commonly used in educational institutions, making it a familiar platform for aspiring music producers. Continuous updates from Microsoft improve system stability, ensuring smooth performance for audio production tasks. These factors contribute to Windows maintaining its leading position in the market.

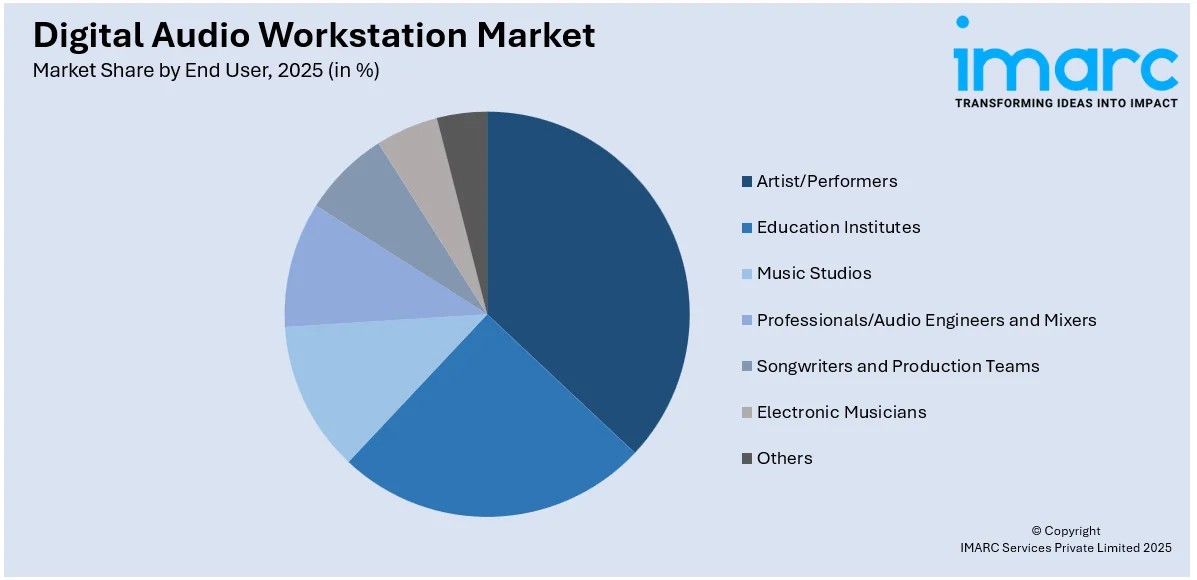

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Artist/Performers

- Education Institutes

- Music Studios

- Professionals/Audio Engineers and Mixers

- Songwriters and Production Teams

- Electronic Musicians

- Others

Professionals/audio engineers and mixers account for 37.5% of the market share. They require precise audio editing, mixing, and mastering tools. These experts rely on advanced DAW features, such as multi-track recording, real-time effects, and high-performance audio engines, to develop industry-standard sound quality. The increasing demand for professional-grade audio in music production, film, gaming, and broadcasting further solidifies their reliance on DAW systems. Professionals also prefer DAW platforms that offer extensive plugin support, customizable workflows, and seamless integration with hardware devices to manage complex audio projects. As the entertainment and media industry continues to thrive, professionals increasingly adopt DAW solutions that enhance production efficiency and deliver superior sound. The rise of independent studios and freelance audio engineers further strengthens this trend, positioning professionals and audio specialists as the dominant end users in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 32.5%, enjoys the leading position in the market. The region is noted due to its well-established entertainment industrial base, which heavily relies on advanced audio production tools. The region hosts a large number of professional recording studios, music producers, and sound engineers who demand high-performance DAW solutions for creating, editing, and mixing audio content. Additionally, the growing popularity of podcasts, online streaming platforms, and independent music production further creates the need for DAW systems. The presence of major DAW software providers and regular software updates catering to professional users is also contributing to the market growth. Moreover, increasing investments in the gaming industry and virtual reality experiences are driving the demand for high-quality audio production, further promoting the employment of DAW systems in the region. Apart from this, North America's well-setup technological infrastructure supports the adoption of advanced DAW features, including cloud integration and remote collaboration tools. Innovations like AI-based music help musicians to streamline production processes and refine sound quality. In September 2024, Spotify, the well-known media service provider, launched its AI Playlist feature in new markets, including the United States and Canada, as part of its initiative to gain more premium subscribers. This application employed generative AI to assist users in forming customized playlists. The AI Playlist function enabled users to create personalized playlists by inputting particular text suggestions.

Key Regional Takeaways:

United States Digital Audio Workstation Market Analysis

The United States holds 89.50% of the market share in North America. United States is experiencing a surge in DAW adoption due to the growing demand for cloud-based solutions, enabling seamless remote collaboration and enhanced workflow efficiency. According to reports, as of February 2023, 98% of US organizations employed cloud technology for business related tasks. The shift towards cloud-oriented solutions supports increased flexibility for professional and amateur music producers, facilitating cross-platform integration and accessibility. As creative professionals seek scalable options, cloud-based solutions provide cost-effective alternatives to traditional hardware setups, allowing higher customization and real-time collaborations. Additionally, the rising trend of subscription-based models enhances accessibility, making DAW usage more appealing. Expanding content creation across industries, such as music, podcasting, and multimedia production, further enables the reliance on cloud-based solutions. The integration of cloud-focused tools with new technologies ensures continuous innovations, refining user experience and production quality. As the demand for cloud-based solutions is increasing, the utilization of DAW remains integral to modern music production. The growing need for secure, scalable, and collaborative platforms is encouraging DAW use, positioning cloud-based solutions as a cornerstone of market growth in the region.

Europe Digital Audio Workstation Market Analysis

Europe is witnessing an upsurge in DAW usage owing to the growing adoption of ML and AI, revolutionizing music composition, editing, and production processes. According to reports, in 2024, 13.48% of EU enterprises employed AI technologies. Advanced ML and AI algorithms enhance audio processing capabilities, automating complex tasks and optimizing workflow efficiency. The integration of ML and AI in DAW tools facilitates intelligent sound design, predictive analytics, and personalized music creation. The growing implementation of these technologies streamlines mastering, mixing, and noise reduction, improving production quality. AI-based virtual instruments and effects enable artists to explore new creative possibilities, expanding the scope of DAW applications. Enhanced automation through ML AND AI reduces manual effort, increasing accessibility for independent musicians and professionals alike.

Asia-Pacific Digital Audio Workstation Market Analysis

Rapid digitalization activities are fueling the market growth, transforming music production and audio editing landscapes in the Asia-Pacific region. For instance, the digital India initiative was supported by a notable expenditure of approximately USD 1.8 Billion between 2021 and 2026. Expanding digital infrastructure fosters seamless integration of innovative tools, supporting independent creators and professional studios. The increasing reliance on digital online for content distribution and monetization enhances DAW adoption, offering enhanced production capabilities. As businesses and entertainment sectors are accelerating digital transformation, ongoing digitalization activities are enabling streamlined workflow processes and cost-effective solutions. Educational institutions incorporate DAW technology into curricula, equipping students with industry-relevant skills. Digital streaming platforms leverage DAW innovations to refine music quality and distribution efficiency.

Latin America Digital Audio Workstation Market Analysis

In Latin America, the market is experiencing expansion because of the rising trends of independent music and do-it-yourself (DIY) culture, supported by increasing disposable incomes. According to reports, Latin America's total disposable income is anticipated to grow by nearly 60% from 2021 to 2040. Independent artists leverage DAW tools to create, produce, and distribute music without traditional studio infrastructure. The DIY culture fosters greater creative control, enabling artists to experiment with diverse soundscapes and production techniques. Rising disposable incomes allow aspiring musicians to invest in professional-grade DAW software, enhancing their music production capabilities. The accessibility of affordable DAW solutions further attracts engagement among independent creators.

Middle East and Africa Digital Audio Workstation Market Analysis

The rising investments in the M&E industry are impelling the market growth in the Middle East and Africa region. For instance, in 2022, Dubai Studio City stood as the premier business hub for film and television production in the area, housing over 270 firms and employing 2,500 individuals. The increasing demand for entertainment is strengthening content creation, enhancing audio editing capabilities, and improving sound quality. The evolution of the M&E industry is enabling efficient workflow automation, streamlining mixing techniques, and fostering advanced sound engineering. The increasing influence of the M&E industry is optimizing resource allocation, advancing real-time collaborations, and promoting high-quality content production.

Competitive Landscape:

Key players work on enhancing software features to meet the high digital audio workstation market demand. They are focusing on improving user interfaces and integrating advanced tools for better sound editing capabilities. Companies are investing in ML and AI applications to offer automated mixing, mastering, and sound correction features, making production easier for both professionals and beginners. These players are also expanding their product portfolios to cater to diverse user needs, ranging from high-end studio production to home-based content creation. Strategic partnerships with hardware manufacturers are refining compatibility with audio interfaces, controllers, and instruments, enhancing user experience. Additionally, key players are emphasizing cloud-based solutions to support remote collaborations, which is gaining traction in the music and media industry. Continuous marketing efforts, educational programs, and free trial offerings are further helping these companies to attract new users and broaden their market presence. For instance, in January 2024, Adobe released an enhanced DAW experience in Premiere Pro (beta) designed to simplify editing for both professionals and novices. The update improved efficiency by providing quicker, more user-friendly tools for audio production and post-processing. This advancement streamlined processes, increasing accessibility to high-quality sound editing.

The report provides a comprehensive analysis of the competitive landscape in the digital audio workstation market with detailed profiles of all major companies, including:

- Ableton AG

- Acoustica Inc.

- Adobe Inc.

- Apple Inc.

- Avid Technology Inc.

- Bitwig GmbH

- Harrison Consoles

- MAGIX Software GmbH

- Native Instruments GmbH

- PreSonus Audio Electronics Inc.

- Reason Studios AB

- Steinberg Media Technologies GmbH (Yamaha Corporation)

Latest News and Developments:

- November 2024: The release of Zrythm 1.0 marked a significant achievement for the open-source DAW, providing sophisticated features for novices and experts alike. The DAW boasted an easy-to-use interface, improved mixing options, and extensive plug-in compatibility for smooth audio production. Aiming to switch from GTK to Qt6 for Zrythm 2.0, the updates guaranteed enhanced performance and adaptability.

- October 2024: PreSonus unveiled Studio One Pro 7, its most sophisticated DAW, combining production, mixing, mastering, and live performance within one platform. This release brought more than 30 new functionalities, featuring AI-based Stem Separation, Splice Integration, and the Deep Flight One™ virtual instrument. Through improved workflow features and refined sound libraries, Studio One Pro 7 transformed music production for beat makers and artists.

- May 2024: Apple Inc. released Logic Pro for Mac 11 and Logic Pro for iPad 2, featuring AI-oriented tools for songwriting, beat creation, and mixing. These updates to DAW offered artists enhanced studio assistant functionalities, all while preserving complete creative control. The latest versions aimed to improve workflow efficiency and transform professional music creation.

- February 2024: Ableton introduced Live 12, a significant upgrade to its DAW, featuring new devices and advanced MIDI transformation tools. The MIDI editor enabled users to rearrange note selection based on velocity, pitch, or duration, thereby enhancing workflow efficiency. These enhancements offered music producers refined creative freedom and accuracy.

Digital Audio Workstation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Type Covered |

|

| Types Covered | Cloud-based, On-premises |

| Operating Systems Covered | Android, Mac, Windows, Linux |

| End Users Covered | Artist/Performers, Education Institutes, Music Studios, Professionals/Audio Engineers and Mixers, Songwriters and Production Teams, Electronic Musicians, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ableton AG, Acoustica Inc., Adobe Inc., Apple Inc., Avid Technology Inc., Bitwig GmbH, Harrison Consoles, MAGIX Software GmbH, Native Instruments GmbH, PreSonus Audio Electronics Inc., Reason Studios AB, Steinberg Media Technologies GmbH (Yamaha Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital audio workstation market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global digital audio workstation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital audio workstation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital audio workstation market was valued at USD 3.3 Billion in 2025.

The digital audio workstation market is projected to exhibit a CAGR of 6.65% during 2026-2034, reaching a value of USD 6.1 Billion by 2034.

The surge in content creation across platforms like podcasts, gaming, and video production is creating the need for advanced audio editing software. Besides this, technological advancements, such as improved user interfaces, enhanced virtual instruments, and AI integration for automated audio processing, are improving workflow efficiency and attracting users. Moreover, the expanding music streaming industry is encouraging artists to adopt efficient production tools to meet the rising content demands.

North America currently dominates the digital audio workstation market, accounting for a share of 32.5% in 2024, because of its strong M&E industry, rising demand for professional audio production tools, and increasing adoption of DAW systems in gaming, podcasts, and independent music production across the region.

Some of the major players in the digital audio workstation market include Ableton AG, Acoustica Inc., Adobe Inc., Apple Inc., Avid Technology Inc., Bitwig GmbH, Harrison Consoles, MAGIX Software GmbH, Native Instruments GmbH, PreSonus Audio Electronics Inc., Reason Studios AB, Steinberg Media Technologies GmbH (Yamaha Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)