Digestive Health Products Market Size, Share, Trends and Forecast by Ingredient, Form, Product, Distribution Channel, and Region, 2025-2033

Digestive Health Products Market 2024, Size and Trends:

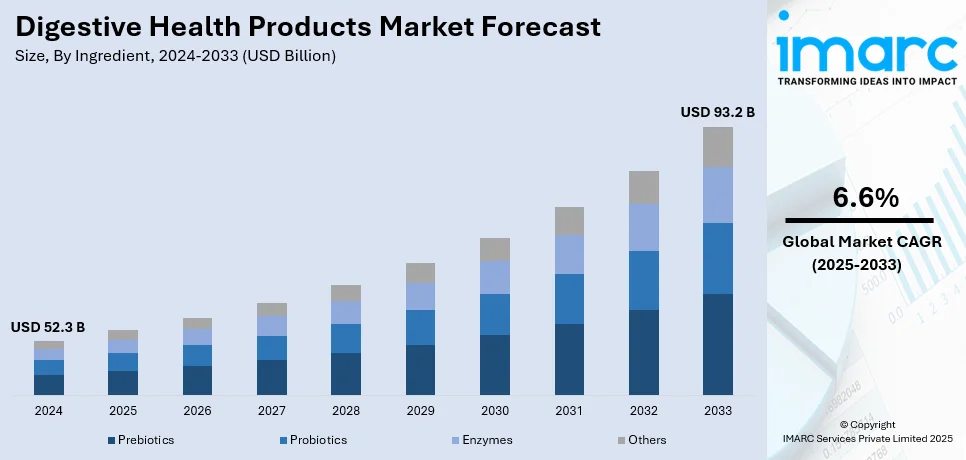

The global digestive health products market size was valued at USD 52.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 93.2 Billion by 2033, exhibiting a CAGR of 6.6% during 2025-2033. North America currently dominates the digestive health products market share by holding over 33.8% in 2024. The rising prevalence of gastrointestinal diseases, along with the increasing consumer health consciousness, is primarily bolstering the market, aiding in increasing the digestive health products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.3 Billion |

| Market Forecast in 2033 | USD 93.2 Billion |

| Market Growth Rate (2025-2033) | 6.6% |

The digestive health products market demand is driven by several factors. Growing consumer awareness about gut health and its link to overall well-being has increased the demand for probiotics, prebiotics, and dietary supplements. Rising prevalence of gastrointestinal disorders, such as irritable bowel syndrome (IBS) and inflammatory bowel diseases (IBD), is fueling the need for targeted solutions. The aging population, with a higher susceptibility to digestive issues, further boosts the market. Additionally, increasing adoption of healthy lifestyles and dietary habits is promoting functional foods and beverages. Technological advancements in product formulation and packaging, coupled with clean-label trends, are enhancing consumer trust. Expanding the availability of products through e-commerce platforms and widespread marketing campaigns also play a significant role in the digestive health products market growth.

The digestive health products market growth in the United States is driven by rising consumer awareness about gut health and its connection to immunity and overall wellness. The high prevalence of gastrointestinal disorders such as irritable bowel syndrome (IBS) and acid reflux has increased the demand for probiotics, prebiotics, and dietary supplements. The rising adoption of plant-based diets and functional foods is fueling interest in natural and organic digestive solutions. For instance, in April 2024, Bayer Consumer Health launched IberogastTM, a plant-based digestive aid, in the US after more than 60 years of studying the benefits of plants in Germany. Iberogast, made with a proprietary, clinically proven six-herb blend, uses nature's power to help those who occasionally have digestive problems by restoring digestive function and relieving stomach troubles. The aging population, more prone to digestive issues, also represents one of the key digestive health products market trends. Additionally, increasing healthcare costs are prompting consumers to focus on preventive health through diet. E-commerce platforms and retail giants are expanding accessibility, while robust marketing efforts emphasizing clean labels and scientifically backed products further propel the market forward.

Digestive Health Products Market Trends:

Increasing Focus on Gut Health

The increasing awareness among consumers about digestive health is stimulating the market. Moreover, with research linking gut health to overall wellness, including immune function and mental health, they are becoming more proactive in seeking items that promote a healthy digestive system. For example, in March 2024, Morinaga Milk unveiled new Foods with Function Claims (FFCs) that target the major health concerns of individuals in Japan and meet the escalating demand for multifunctional products, thereby emphasizing gut health. Besides this, probiotic-rich foods like kefir and yogurt have become household staples, which are also bolstering the market. For instance, in September 2023, packaging specialists SIG collaborated with nanotechnology experts AnaBio to launch the long-life probiotic yogurt within shelf-stable aseptic packaging. Additionally, in October 2023, Biotful Gut Health announced a novel range of Oat Kefir yogurts made with fruit, gluten-free oats, and various live vegan cultures. Apart from this, companies are further introducing educational campaigns to inform consumers about the benefits of maintaining a balanced gut microbiome, which is expected to fuel the digestive health products market outlook over the foreseeable future. For instance, in May 2024, Friso, one of the leading nutrition formula milk brands, developed its latest campaign aimed at promoting gut health in children.

Various Product Launches

As individuals are looking for natural ways to improve their digestive health, the usage of probiotics and prebiotics is continuously rising, which, in turn, is facilitating the digestive health products market demand. For instance, in April 2024, using machine learning and artificial intelligence, Seed Health introduced a new CODA platform that targets the discovery and development of next-generation precision probiotics and microbiome-directed interventions. Moreover, in March 2024, Pendulum Therapeutics, one of the biotech companies pioneering the next frontier of metabolic health through its microbiome-targeted products, launched a GLP-1 Probiotic that is an effective, powerful, and science-backed tool to help naturally boost GLP-1 production and naturally help maintain a healthy weight. Besides this, the inflating popularity of functional drinks is also acting as another significant growth-inducing factor. For example, in January 2024, Brew Dr. unveiled Sipjoy at Sprouts Farmers, flavored with organic ingredients. It also contains 5g of organic cane sugar, gut-friendly probiotics, and no artificial sweeteners, thereby delivering an enjoyable, clean, and guilt-free refreshment.

Rising Demand for Natural Supplements

The elevating focus on simplicity and transparency is elevating the digestive health products market trends, with minimally processed and natural ingredients. For example, in August 2023, a health and wellness company, Herbalife Nutrition, launched the Herbalife V line that features kosher, certified organic, and non-GMO verified products, including two protein shake offerings and a variety of dietary supplements designed to improve gut and immune health. Similarly, in October 2023, Brightseed announced that its first bioactive-containing ingredient, Brightseed Bio Gut Fiber, was Upcycled Certified. Apart from this, individuals are increasingly adopting labels and products with recognizable as well as plant-based components. For instance, in March 2024, Garden of Life, a Nestlé Health Science brand and prominent player in supplements made from traceable, clean, and non-GMO ingredients, developed sports nutrition products that are made to deliver clean and clinically studied performance support to individuals.

Digestive Health Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the ingredient, form, product, and distribution channel.

Analysis by Ingredient:

- Prebiotics

- Probiotics

- Enzymes

- Others

Probiotics leads with around 88.2% of digestive health products market share in 2024. Probiotics hold the largest share of the market due to their proven efficacy in supporting gut health and overall well-being. These beneficial bacteria help restore the natural balance of the gut microbiota, addressing common digestive issues like bloating, diarrhea, and constipation. Rising consumer awareness about the gut's role in immunity and mental health has further boosted demand for probiotics. Their versatility in being incorporated into various products, such as yogurts, supplements, and beverages, makes them widely accessible. Additionally, ongoing research and product innovation, combined with strong endorsements from healthcare professionals, have solidified probiotics as a preferred choice in the market.

Analysis by Form:

- Capsules

- Tablets

- Powders

- Liquid

- Others

Capsules leads the market with around 39.0% of market share in 2024. Capsules hold the largest share in the digestive health products market due to their convenience, precision, and efficacy in delivering targeted relief. They offer an accurate dosage, ensuring consistency in nutrient intake, which appeals to consumers seeking reliable solutions for digestive health. Capsules are easy to consume, portable, and have a longer shelf life compared to liquid or powdered forms. Their ability to encapsulate probiotics, enzymes, and herbal blends protects sensitive ingredients from degradation, ensuring potency. For example, in May 2024, Bio-K Plus introduced shelf-stable, multi-benefit, vegan, and gluten-free probiotic capsules catering to consumers' specific needs. This innovative line of specialized wellness features Bio-K+'s proprietary strains and scientifically supported extra ingredients for women's health.

Analysis by Product:

- Dairy Products

- Bakery Products and Cereals

- Non-Alcoholic Beverages

- Others

Dairy products lead the market with around 75.0% of market share in 2024. Dairy products hold the largest share in the digestive health products market due to their natural compatibility with probiotics, which thrive in dairy-based formulations like yogurts, kefir, and fermented milk. These products are widely recognized for their gut health benefits and enjoy high consumer trust. Dairy's versatility as a functional food carrier enhances its appeal, while its rich nutrient profile supports overall health. Additionally, strong marketing, established consumption habits, and widespread availability make dairy products a dominant segment in the market. For example, in January 2024, Nuchev launched its first bovine product for older children and adults aimed at enhancing their digestion and immunity.

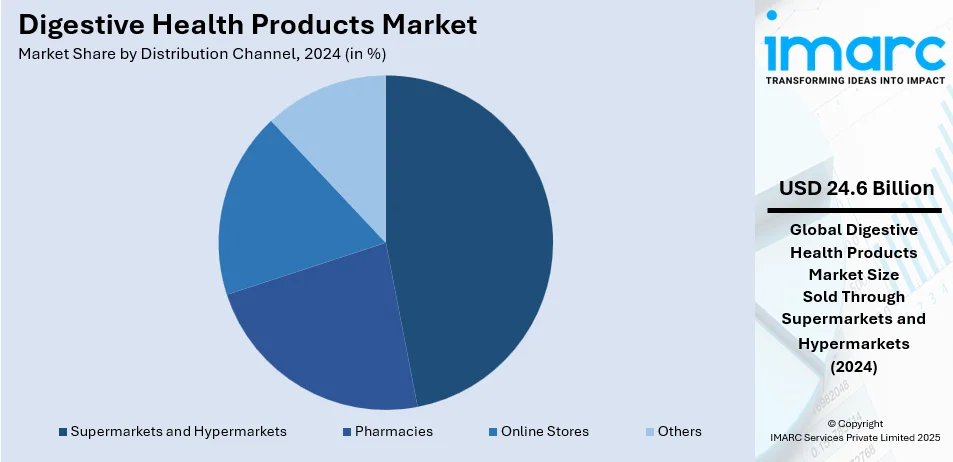

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 46.9% of market share in 2024 due to their widespread accessibility and ability to cater to diverse consumer needs. These retail formats offer a wide range of digestive health products, including probiotics, prebiotics, and functional foods, all under one roof, making shopping convenient for consumers. Their strategic locations and extensive networks attract high foot traffic, while frequent promotions and discounts encourage purchases. Supermarkets and hypermarkets also provide ample shelf space for branded and private-label products, enhancing visibility. Additionally, their trustworthiness and established reputation make them the preferred choice for consumers seeking health-related products.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.8% due to the increasing consumer awareness of gut health and its impact on immunity and overall well-being. The rising prevalence of digestive disorders, such as irritable bowel syndrome (IBS) and acid reflux, fuels demand for probiotics, prebiotics, and dietary supplements. A growing aging population with a higher susceptibility to digestive issues contributes significantly to market growth. Additionally, the adoption of clean-label, plant-based, and functional foods aligns with consumer preferences. The expansion of e-commerce platforms and retail availability enhances accessibility. Innovations in product formulations and strong marketing campaigns emphasizing scientific efficacy further support the market’s growth. For instance, in November 2020, Kerry acquired Bio-K Plus, one of the manufacturers of probiotic supplements and beverages in Canada, to strengthen its leadership position in the growing probiotics segment.

Key Regional Takeaways:

United States Digestive Health Products Market Analysis

In 2024, the United States accounted for the largest market share of over 85% in North America. The U.S. digestive health products market is witnessing high growth, with consumers increasingly aware and demanding solutions related to digestive health issues. As reported by the U.S. National Institutes of Health, approximately 60-70 million Americans suffer from some form of digestive disease every year, thereby pointing towards the vast potential for digestive health products. This is backed further by demographics which are increasingly older and where an increased level of gastrointestinal disease leads to higher expansion in this market. These dynamics are such that the markets shall continue changing while leading market participants like Nestle Health Science, as well as Procter & Gamble, pursue product-line expansion in hopes to better leverage that growing focus towards health. In addition, consumer preference is increasingly focusing on natural and organic ingredients because consumers want clean, sustainable products. This shift will drive product innovation in probiotics, digestive enzymes, and supplements as the market dynamics are reshaped and the market continues to grow.

Europe Digestive Health Products Market Analysis

The European digestive health products market is growing as the incidences of digestive disorders are growing and health consciousness is on an increase. According to United European Gastroenterology, digestive disorders afflict over 300 million people in Europe, and the number is expected to rise with the increasing age factor. The leading digestive disorders diagnosed in Europe include GORD, pancreatitis, chronic liver disease, IBS, peptic ulcers, dyspepsia, Helicobacter pylori infections, and colorectal cancer. Such increased demand in these products pushes the growth in the market with major demand of probiotics, digestive enzymes, and functional food products. This is coupled with functional food and dietary supplement trends that involve consumers in an active effort for digestive health. Germany and the UK have become the markets of choice with such key players as Danone and Unilever targeting innovations and sustainability in their focus areas. Functional food and supplement developments are positively aided by Europe's regulatory climate.

Asia Pacific Digestive Health Products Market Analysis

The Asia Pacific digestive health products market is developing rapidly due to rising healthcare awareness, increased disposable incomes, and a higher prevalence of digestive disorders. According to an industrial report, millions suffer from digestive disorders in the region, with 452,000 reported cases alone in Eastern Asia, of which 331,629 cases occur in China. There is a considerable mortality rate, too, as approximately 295,000 deaths are witnessed, making it a market potential for digestive health solutions. In South-Central Asia, there are estimated to be digestive disorders in about 67,701 cases, resulting in a death toll of 59,832. South-Eastern Asia presents a case estimate of 24,142 while recording 20,106 deaths. The consumption of digestive health products is witnessing rapid growth within China, India, and Japan. This follows due to demographic factors such as the increase in aging populations along with lifestyle modifications leading to disorders such as irritable bowel syndrome, gastroesophageal reflux disease, and colorectal cancer. Amway and Yakult, among other majors, are innovating and expanding in the market through the introduction of region-specific products.

Latin America Digestive Health Products Market Analysis

Increasing awareness of gastrointestinal diseases and rising healthcare needs have led the growth of the Latin American market in digestive health products. NIH estimated 13,360 new stomach cancer cases among men in Brazil and 7,870 among women for 2020; 13,850 deaths have been reported for both sexes. Such data demonstrate a very important burden of the digestive disorders in the region that have led to an increase in demand in targeted health solutions. The market will further expand due to investments in healthcare infrastructure and treatment options for digestive diseases like colorectal cancer, gastric ulcers, and IBS by governments as well as private companies. An aging population in the region that is struggling to face rising health issues is set to further the demand for products related to digestive health, such as probiotics, functional foods, and supplements. This has been the primary cause for market leaders to emphasize innovations in the product for the changing requirements of end-users in Latin America.

Middle East and Africa Digestive Health Products Market Analysis

The Middle East and Africa digestive health products market is growing since gastrointestinal diseases, which include gastric cancer, are impacting the region. According to a research article, in the UAE, gastric cancer stands as the fifth leading cause of cancer deaths with an estimated percentage of 4.31% of all fatalities due to cancer, which surpasses global averages. This indicates an increasing demand for effective digestive health solutions. Other rather common conditions associated include irritable bowel syndrome (IBS), gastroesophageal reflux disease (GERD), and chronic liver disease. These are also quite prevalent in the region. As health care systems evolve in countries such as Saudi Arabia and South Africa, so is the desire for digestive health products, given a host of converging factors that in themselves drive awareness, lifestyle changes, and an aging population. This demand has allowed major companies to innovate their product offerings as relevant to local requirements, leading to major opportunities in the marketplace.

Competitive Landscape:

The digestive health products market is highly competitive, with key players focusing on innovation, strategic partnerships, and market expansion. Leading companies like Nestlé, Danone, Yakult, and Procter & Gamble dominate through strong brand presence and diversified product portfolios. Startups and regional players are gaining traction by offering niche and personalized solutions. The market is characterized by continuous product launches, emphasizing probiotics, prebiotics, and functional foods. For instance, in December 2024, BioGaia introduced BioGaia® Gastrus® PURE ACTION, a double-strength, FODMAP-friendly probiotic made with clean ingredients that help those with sensitive stomachs. Access to specialized, cutting-edge, evidence-based treatments for better digestive health and quality of life is increased by this most recent addition to BioGaia's product line for adult gut health. BioGaia® Gastrus® PURE ACTION is a vegan capsule devoid of gluten, lactose, and sugars. It is also FODMAP-friendly and made for sensitive stomachs. Manufacturers are leveraging clean-label trends and investing in research to meet evolving consumer demands. E-commerce growth has intensified competition, providing smaller brands with a wider reach. Regulatory compliance and effective marketing strategies remain crucial for sustaining a competitive edge in this dynamic market.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major digestive health products market companies have also been provided. Some of the key players in the market include:

- Abbott Laboratories

- Arla Foods

- Biogaia AB

- Cargill Incorporated

- Chr. Hansen Holding A/S

- Deerland Probiotics & Enzymes Inc.

- General Mills Inc.

- Lallemand Inc.

- Mondelez International Inc.

- Nestlé S.A.

- Pepsico Inc.

- Yakult Honsha Co. Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- December 2024: BioGaia introduced BioGaia® Gastrus® PURE ACTION, a FODMAP-friendly probiotic for sensitive digestive systems. The formulation comprises L. reuteri DSM 17938 and L. reuteri ATCC PTA 6475 strains with clinical efficacy in promoting digestive comfort. It is vegan and sweetener-free, sugar-free, lactose-free, and gluten-free, and has twice-daily dosing to alleviate discomforts associated with the digestive system.

- November 2024: Arla Foods Ingredients and Volac jointly announced their decision regarding an acquisition. The statement outlines the details of the agreement between the two companies, focusing on their strategic collaboration in the food ingredients sector. This move is expected to enhance their market position and expand their product offerings.

- June 2024: Chong Kun Dang Healthcare (CKDHC) unveiled a probiotic supplement that aids in the body's synthesis of the hunger hormone.

- May 2024: Bio-K Plus introduced digestive health products, including shelf-stable, vegan, and gluten-free probiotic capsules catering to consumers' specific needs.

- April 2024: Seed Health developed a new CODA platform that targets the discovery of next-generation precision probiotics and microbiome-directed interventions.

Digestive Health Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Ingredients Covered | Prebiotics, Probiotics, Enzymes, Others |

| Forms Covered | Capsules, Tablets, Powders, Liquid, Others |

| Products Covered | Dairy Products, Bakery Products and Cereals, Non-Alcoholic Beverages, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Arla Foods, Biogaia AB, Cargill Incorporated, Chr. Hansen Holding A/S, Deerland Probiotics & Enzymes Inc., General Mills Inc., Lallemand Inc, Mondelez International Inc., Nestlé S.A., Pepsico Inc., Yakult Honsha Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digestive health products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global digestive health products market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the digestive health products industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digestive health products market was valued at USD 52.3 Billion in 2024.

IMARC estimates the digestive health products market to exhibit a CAGR of 6.6% during 2025-2033, expecting to reach USD 93.2 Billion by 2033.

Key factors driving the digestive health products market include rising consumer awareness about gut health, increasing prevalence of digestive disorders, demand for probiotics and functional foods, growing aging population, and adoption of preventive healthcare. Clean-label trends, product innovation, and expanded availability through e-commerce and retail channels further boost market growth.

Probiotics leads the market with around 88.2% of the market share in 2024. This segment is driven by the increasing consumer awareness of gut health, rising demand for functional foods, advancements in probiotic formulations, and the growing prevalence of digestive disorders globally.

North America currently dominates the digestive health products market, accounting for a share of 33.8%. The increasing prevalence of digestive disorders, a steadily expanding aging population base, and the widespread adoption of clean-label, plant-based, and functional foods, are creating a positive digestive health products market outlook in the region. Other factors, such as the expansion of e-commerce platforms and retail availability and innovations in product formulations, are contributing to the market growth further.

Some of the major players in the global digestive health products market include Abbott Laboratories, Arla Foods, Biogaia AB, Cargill Incorporated, Chr. Hansen Holding A/S, Deerland Probiotics & Enzymes Inc., General Mills Inc., Lallemand Inc., Mondelez International Inc., Nestlé S.A., Pepsico Inc., Yakult Honsha Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)