Diesel Generator Market Report by Capacity (0-100 kVA, 100-350 kVA, 350-1000 kVA, Above 1000 kVA), Application (Standby Backup Power, Prime Power, Peak Shaving Power), Mobility (Stationary, Portable), End User (Residential, Commercial, Industrial), and Region 2025-2033

Diesel Generator Market Size:

The global diesel generator market size reached USD 18.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 32.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6% during 2025-2033. Increasing demand for reliable power supply across industries like healthcare and telecommunications, frequent power outages, advancements in engine efficiency, versatile product applications in remote areas, government initiatives promoting electrification, integration with renewable energy sources, and robust demand from emerging economies are some of the factors facilitating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.8 Billion |

|

Market Forecast in 2033

|

USD 32.6 Billion |

| Market Growth Rate 2025-2033 | 6% |

Diesel Generator Market Analysis:

- Major Market Drivers: The global diesel generator market share is continually boosted by the burgeoning demand for continuous power supply across industries, such as manufacturing, healthcare, and automation. This is further supported by the rapid urbanization and industrialization in developing countries, which has further led to the growing demand for energy. In line with this, the burgeoning cases of natural disasters have considerably surged power outages, which is further creating a positive outlook for the market. Additionally, the construction sectors rapid expansion and the development of diesel generators with lower emissions and upgraded fuel efficiency, is another factor bolstering the diesel generator demand. Other factors, such as government efforts to improve the access of electricity, especially in rural areas, and the integration of hybrid power systems with diesel generators, are providing a thrust to the market growth.

- Key Market Trends: The key diesel generator market trends include the shifting preference towards hybrid generators as they combine renewable energy sources, which further helps minimize fuel utilization. The market is also driven by the growing demand for portable product variant’s due to their flexibility in various applications. Moreover, the key market players are also integrating diesel generators with the Internet of Things (IoT) to improve operational efficiency and boost their consumer base, which is another factor stimulating the diesel generator market growth. They are also investing heavily in research and development (R&D) activities to increase their product portfolio, which is fueling the market growth. In line with this, the escalating environmental awareness has further surged the demand for eco-friendly product variants, which is creating a positive outlook for the market.

- Geographical Trends: In the diesel generator market, Asia-Pacific leads the market as the region is backed by the presence of countries, such as India, Japan, and China that have robust infrastructure development, which is further driving the energy demand. The region is also witnessing rapid industrialization and urbanization, which has provided a significant boost to the market growth. Furthermore, the escalating cases of power outages and outdated grid infrastructure have bolstered the demand for diesel generators, which is providing a boost to the diesel generator market outlook.

- Competitive Landscape: The competitive landscape of the market is characterized by the presence of key diesel generator companies, such as Aksa Power Generation, Atlas Copco AB, Briggs & Stratton Corporation, Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kirloskar Electric Company Limited, Kohler Co., Mitsubishi Heavy Industries Ltd., MTU Onsite Energy (Rolls-Royce plc), Wartsila Corporation, Yanmar Co. Ltd., etc.

- Challenges and Opportunities: The diesel generator market has umpteen challenges and opportunities. One immense challenge is the increasing regulatory pressure to reduce emissions and environmental impact, which has further burgeoned the investments in cleaner technologies. The rising cost of diesel and fuel price fluctuations is another challenge to the market growth. Moreover, the availability of alternative power solutions like natural gas generators and renewable energy systems is a competition to diesel generators, which represents another crucial challenge for the market. These challenges also bring opportunities for innovation and development of hybrid systems that combines diesel with renewable sources. The growing demand for power backup in critical sectors like healthcare, data centers and telecommunication is a significant opportunity for the market.

Diesel Generator Market Trends:

Increasing Demand for Reliable Power Supply

The global diesel generator market is majorly fueled by the increasing demand for reliable and uninterrupted power supply across various sectors. Power supply disruptions can lead to loss of productivity, which further affects the profitability of industries. As a result, industries like healthcare, telecommunication, and mining require continuous power for operational continuity, further necessitating the use of diesel generators for back-up power. Frequent power outages due to natural disasters and grid infrastructure aging are prevalent in several areas, which is further boosting the market growth. These generators can methodologies grid failure by robustly continuing the operations with minimum downtime and without destroying sensitive equipment and processes. Additionally, advancements in diesel engine technology have enhanced reliability, efficiency, and durability, while reducing maintenance costs, further strengthening the market.

Versatility in Applications

Diesel generators offer superior flexibility as they can be used in a number of different applications for both residential and commercial/industrial sectors. They are especially prevalent in isolated and off-the-grid areas with limited access to dependable power infrastructure. Their all-in-one package and ease of providing backup power solutions make them necessary tools for construction, events, or emergency response sites, which is further boosting the market growth. Additionally, diesel generators are the preferred choice for critical facilities like hospitals and data centers as they keep offerings to critical services intact. The versatility of diesel generators in terms of extensively supporting varied operational requirements makes them even more appealing to various industries and applications, which continues to drive their market growth.

Technological Advancements and Efficiency

Advancements in diesel engine technology have transformed the efficiency and performance of diesel generators, which is further driving growth in this market. The advanced diesel generator is equipped with features that provide better fuel efficiency, reduced emissions, and noise reduction. Additionally, these features adhere to strict environmental and operation standards, which is further stimulating the market growth. The innovations in emission control systems make diesel generators more environmentally friendly, thereby attracting environmentally sensitive industries and governments promoting green practices. Apart from this, development of smart and hybrid diesel generator solutions that integrate renewable energy sources, like solar and wind power, further drive efficiency, sustainability, and lower operational costs, and create various opportunities for the market growth.

Diesel Generator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the capacity, application, mobility, and end user.

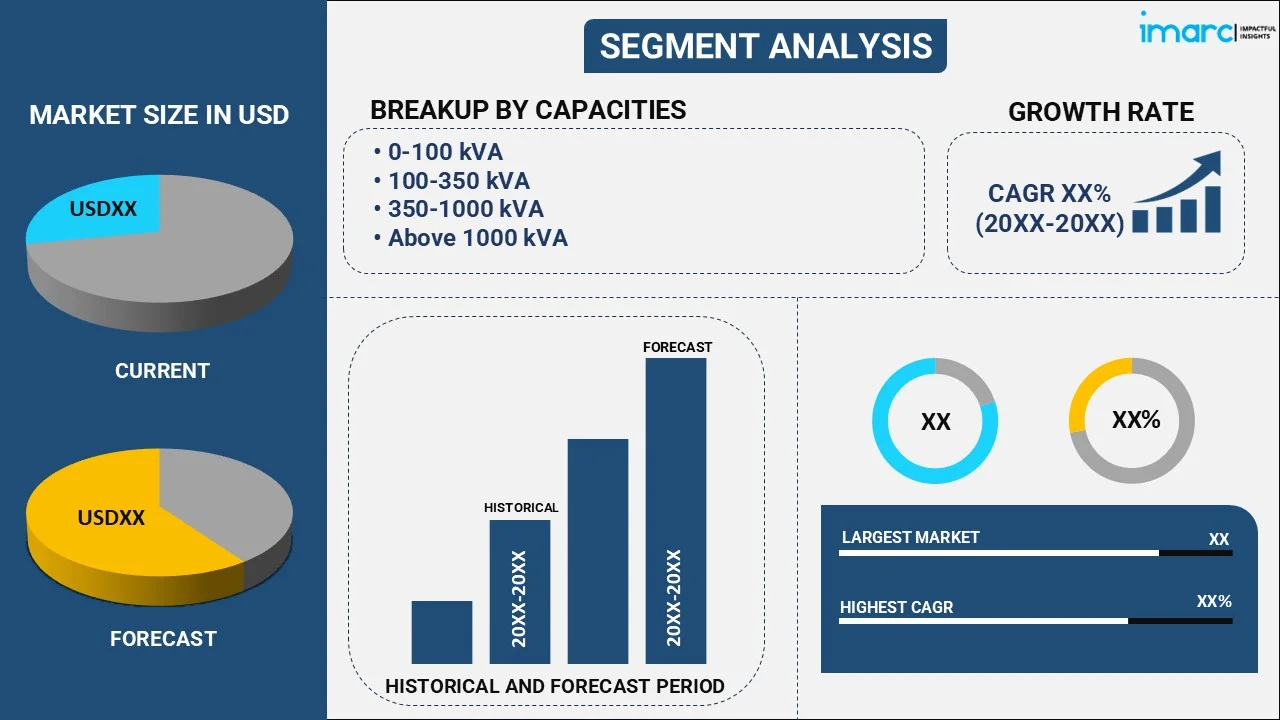

Breakup by Capacity:

- 0-100 kVA

- 100-350 kVA

- 350-1000 kVA

- Above 1000 kVA

0-100 kVA accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes 0-100 kVA, 100-350 kVA, 350-1000 kVA, and above 1000 kVA. According to the report, 0-100 kVA represented the largest segment.

The 0-100 kVA segment is driven by the increasing demand for compact and versatile power solutions across diverse applications. These generators are particularly favored in residential settings, small businesses, and for backup power in critical facilities where space is limited but reliability is crucial. The segment benefits from technological advancements that enhance fuel efficiency and reduce emissions, aligning with stringent environmental regulations and operational efficiency requirements. Additionally, the rising frequency of power outages due to aging grid infrastructure and natural disasters boosts the adoption of these generators for uninterrupted power supply. Moreover, the integration of digital monitoring and control systems enhances their appeal by providing real-time performance data and remote management capabilities, improving operational reliability. Apart from this, government initiatives promoting electrification in rural and remote areas drive market growth, expanding access to reliable power sources. The affordability and cost-effectiveness of 0-100 kVA generators compared to higher capacity models also contribute to their widespread adoption, especially in emerging economies undergoing rapid industrialization and urbanization.

Breakup by Application:

- Standby Backup Power

- Prime Power

- Peak Shaving Power

Standby backup power accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes standby backup power, prime power, and peak shaving power. According to the report, standby backup power represented the largest segment.

The standby backup power segment is driven by the increasing need for uninterrupted power supply in critical applications across various sectors. Industries such as healthcare, data centers, telecommunications, and manufacturing rely heavily on standby backup power to ensure continuous operations during grid failures or planned maintenance. These sectors prioritize reliability and continuity of power to safeguard sensitive equipment, maintain service delivery, and prevent financial losses due to downtime. Additionally, stringent regulatory requirements and safety standards mandate the installation of backup power systems, further boosting demand in the segment. Technological advancements in backup power solutions, including improvements in energy storage, automatic transfer switches (ATS), and monitoring systems, enhance reliability and operational efficiency, driving adoption. Moreover, the rising frequency and severity of natural disasters, coupled with aging grid infrastructure in many regions, underscore the importance of robust standby backup power systems. The segment also benefits from innovations in renewable energy integration, allowing hybrid systems that combine backup generators with solar or wind power, thereby reducing operational costs and environmental impact.

Breakup by Mobility:

- Stationary

- Portable

Stationary accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the mobility. This includes stationary and portable. According to the report, stationary represented the largest segment.

The stationary segment is driven by the increasing need for reliable and continuous power supply in critical infrastructure and commercial settings. Industries such as healthcare, data centers, telecommunications, and manufacturing rely heavily on stationary diesel generators for uninterrupted operations during power outages. These generators serve as primary and backup power sources, ensuring business continuity and protecting sensitive equipment from voltage fluctuations and grid failures. Additionally, advancements in diesel engine technology have enhanced the efficiency, durability, and environmental performance of stationary generators, reducing operational costs and emissions. The segment also benefits from the rising deployment of diesel generators in off-grid locations where access to electricity is limited, providing essential power for rural electrification projects and remote industrial operations. Apart from this, government initiatives aimed at improving infrastructure resilience and electrification rates further drive demand in the stationary segment. The integration of smart technologies and automation features in modern stationary diesel generators enhances their reliability and efficiency, appealing to industries seeking sustainable and cost-effective power solutions.

Breakup by End User:

- Residential

- Commercial

- Industrial

Industrial accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial. According to the report, industrial represented the largest segment.

The industrial segment is driven by the increasing need for robust and uninterrupted power solutions to support critical operations. Industries such as manufacturing, mining, oil & gas, and construction rely heavily on diesel generators to maintain continuous production and ensure operational efficiency. These sectors often operate in remote or off-grid locations where reliable grid power may be unavailable or unreliable, making diesel generators essential for powering heavy machinery, equipment, and processes. The scalability and capacity of diesel generators to meet varying power demands in industrial settings further enhance their appeal. Moreover, stringent regulatory requirements regarding emissions and environmental sustainability drive the adoption of advanced diesel generator technologies that offer improved fuel efficiency and lower emissions, aligning with industry standards and environmental mandates. Additionally, the resilience of diesel generators in withstanding harsh environmental conditions, including extreme temperatures and weather events, makes them a preferred choice in industrial applications where reliability is critical.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

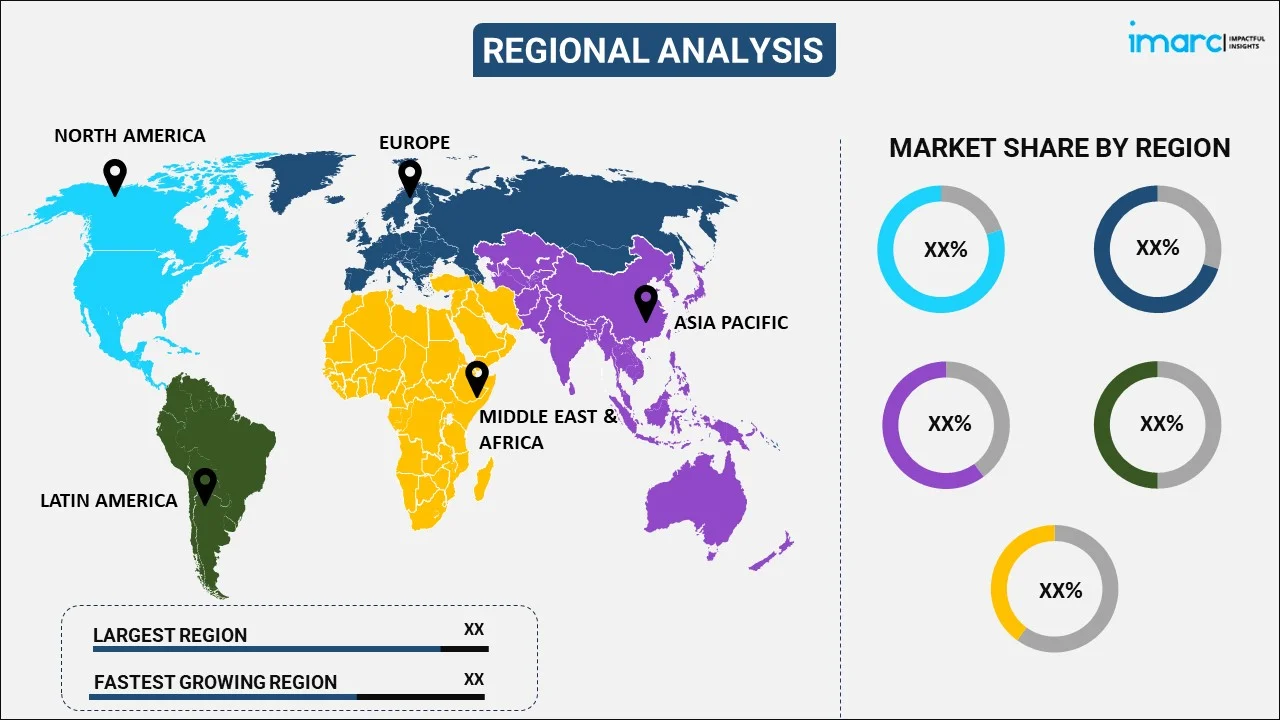

Asia Pacific leads the market, accounting for the largest diesel generator market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific regional market is driven by the increasing demand for reliable power infrastructure in rapidly industrializing nations such as China, India, and Southeast Asian countries. These nations heavily rely on diesel generators to ensure uninterrupted power supply amidst infrastructural challenges and frequent power outages. The versatility of diesel generators in catering to diverse applications across residential, commercial, and industrial sectors further fuels their demand in the region. Moreover, technological advancements in diesel engine efficiency and emission control systems play a crucial role in enhancing market growth by reducing operational costs and environmental impact. Government initiatives aimed at improving electrification rates in rural areas also contribute significantly to market expansion, driving the adoption of diesel generators. Apart from this, the Asia Pacific region's robust construction and infrastructure development activities necessitate reliable backup power solutions, further boosting market demand. The integration of diesel generators with renewable energy sources, such as solar and wind power, to create hybrid power solutions is another key factor propelling market growth in the region.

Key Regional Takeaways:

United States Diesel Generator Market Analysis:

The US diesel generator market is on a steady growth curve as the demand for backup power increases across residential, commercial, and industrial applications. Recurring weather-related power interruptions and an aging grid infrastructure are compelling investments in standby and portable diesel generators. The industrial segment, especially oil & gas, mining, and manufacturing, is still a dominant end user with high power consumption and a necessity for continuous operations. Meanwhile, data centers and hospitals are major adopters, spurred by stringent regulation requirements for backup power. Environmental policies are driving gradual transition toward cleaner technologies as manufacturers are turning to innovation in low-emission and hybrid variants. Rental services are also growing in the construction and event industries. Technological innovations like remote monitoring and automation are optimizing operational efficiency. Key players on the U.S. market include Caterpillar Inc., Cummins Inc., and Generac Holdings. Generally, the market prospects are good, underpinned by infrastructure development, emergency preparedness requirements, and robust industrial activity.

Europe Diesel Generator Market Analysis:

The Europe diesel generator market is dictated by increasing energy requirements, growing incidence of grid outages, and strict emissions regulations. Though conventional diesel generators are largely utilized in industrial and commercial applications, stricter EU emission standards are leading towards the adoption of fuel-efficient and lower-emissions variants. The construction, telecommunications, and healthcare markets are the prime drivers, requiring reliable backup power. Also, for greater stress on energy security and emergency readiness, which is growing in areas that are disaster-prone, demand is escalating, primarily in Western and Northern Europe. There is growing take-up of hybrid solutions combining diesel generators with power from renewables. Market growth is somewhat tempered by increasing environmental pressures and regulatory support for cleaner options. Major companies include Atlas Copco, Himoinsa, and Kohler-SDMO. In spite of these setbacks, mobile and standby diesel generator demand remains steady in permanent critical applications as well as in temporary uses.

Asia Pacific Diesel Generator Market Analysis:

The Asia Pacific diesel generator market is growing strongly, boosted by industrialization, urbanization, and inconsistent power supply in emerging economies. India, China, and Indonesia are key drivers, with growth in manufacturing, construction, telecom, and residential applications. Rural electrification plans and infrastructure development add to the market growth. Environmental regulations are rising, but cost effectiveness and high performance ensure diesel generators' popularity. Technological advancements and integration of hybrid systems are also picking up pace. Kirloskar, Cummins, and Mitsubishi Heavy Industries are major players. The market scenario is robust with continued development activities and increasing energy requirements.

Latin America Diesel Generator Market Analysis:

In Latin America, the diesel generator market is driven by unstable grid infrastructure and frequent power outages. Sectors such as mining, oil & gas, and construction rely heavily on diesel generators for consistent power supply. Countries like Brazil and Mexico are the key markets, supported by industrial expansion and urban growth. However, environmental regulations and economic instability can pose challenges. Despite this, diesel generators remain crucial in ensuring energy reliability, especially in remote and underserved regions.

Middle East and Africa Diesel Generator Market Analysis:

The Middle East and Africa diesel generator market is growing due to rising energy demand, inadequate grid infrastructure, and widespread use in off-grid and remote areas. The construction, oil & gas, and telecom sectors are primary drivers. High temperatures and challenging terrains make diesel generators a reliable choice. The UAE, Saudi Arabia, South Africa, and Nigeria are significant markets. Although renewable alternatives are emerging, diesel generators continue to dominate due to their reliability and quick deployment capabilities.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the diesel generator include Aksa Power Generation, Atlas Copco AB, Briggs & Stratton Corporation, Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kirloskar Electric Company Limited, Kohler Co., Mitsubishi Heavy Industries Ltd., MTU Onsite Energy (Rolls-Royce plc), Wartsila Corporation, Yanmar Co. Ltd., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the diesel generator market are actively engaged in enhancing product innovation and technological advancements to maintain competitiveness and meet evolving consumer demands. They focus on developing more efficient diesel engines with improved fuel efficiency and reduced emissions to comply with stringent environmental regulations globally. These efforts also include integrating advanced monitoring and control systems into their generators to enhance reliability and performance. Additionally, market leaders are expanding their product portfolios to offer a wider range of power capacities and application-specific solutions, catering to diverse industrial and commercial sectors. Strategic partnerships and collaborations with technology providers are also prevalent among key players to leverage expertise in hybrid power solutions that integrate renewable energy sources. Moreover, there is a notable emphasis on expanding their geographical presence through acquisitions and joint ventures, particularly in emerging markets like Asia Pacific and Latin America, where demand for reliable power solutions is growing rapidly.

Diesel Generator Market News:

- In October 2024, Baudouin announces its new diesel generator sets tailored for data centres, featuring the M33 and M55 series. With outputs from 2000 to 5250 kVA, these turnkey solutions ensure reliable uptime and performance. Highlighting the upcoming 20M55 model—offering up to 5250 kVA—Baudouin meets the demanding needs of large-scale operators with fully type-tested, Uptime Institute-pre-approved gensets built for efficiency and resilience.

- In May 2024, Trime is set to launch a new diesel generator range from 6kVA to 670kVA, featuring engines from Kohler, Yanmar, FPT Iveco, and Perkins. Designed for the UK and Ireland hire markets, these ultra-silent units suit various applications with single and three-phase outputs. Trime will offer direct sales, full backup service, and fast delivery. The company also continues expanding its sustainable lineup with hybrid and solar-powered solutions.

- In March 2024, Recon Technologies, in partnership with Mahindra Powerol, has launched CPCBIV+ emission-compliant diesel gensets in Hyderabad. The new range, up to 625 KVA, features advanced after-treatment systems, improved fuel efficiency, remote monitoring, and grid-to-genset transition capabilities. Made in India, the gensets are produced at the Dundigal facility, serving Telangana and Andhra Pradesh. Production currently stands at 200 units monthly, with strong service support across both states.

- In 2023: Cummins Inc. launched a new line of high efficiency diesel generators, designed to meet the latest environmental standards while providing superior performance. The new models feature advanced emission control technologies, which significantly reduce nitrogen oxides and particulate matter emissions. This aligns with global efforts to minimize environmental impact from industrial operations.

- In 2021: Generac Mobile announced the launch of two new diesel generator models, the MDE330 and MDE570, designed for challenging environments. These models feature Perkins Tier 4 Final-certified engines with advanced Exhaust Temperature Management technology to prevent wet stacking. Both units offer extended runtimes, with large capacity fuel and DEF tanks allowing at least 25 hours of operation before refueling.

Diesel Generator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacities Covered | 0-100 kVA, 100-350 kVA, 350-1000 kVA, Above 1000 kVA |

| Applications Covered | Standby Backup Power, Prime Power, Peak Shaving Power |

| Mobilities Covered | Stationary, Portable |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aksa Power Generation, Atlas Copco AB, Briggs & Stratton Corporation, Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kirloskar Electric Company Limited, Kohler Co., Mitsubishi Heavy Industries Ltd., MTU Onsite Energy (Rolls-Royce plc), Wartsila Corporation, Yanmar Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the diesel generator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global diesel generator market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the diesel generator industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global diesel generator market was valued at USD 18.8 Billion in 2024.

We expect the global diesel generator market to exhibit a CAGR of 6% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for diesel generator.

The rising requirement for an uninterrupted and reliable power supply, such as diesel generator, owing to its durable, cost-effective, and hassle-free properties, is primarily driving the global diesel generator market.

Based on the capacity, the global diesel generator market has been divided into 0-100 kVA, 100-350 kVA, 350-1000 kVA, and above 1000 kVA. Among these, 0-100 kVA capacity currently exhibits a clear dominance in the market.

Based on the application, the global diesel generator market can be categorized into standby backup power, prime power, and peak shaving power. Currently, standby backup power holds the majority of the total market share.

Based on the mobility, the global diesel generator market has been segmented into stationary and portable, where stationary currently accounts for the largest market share.

Based on the end user, the global diesel generator market can be bifurcated into residential, commercial, and industrial. Currently, the industrial sector accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global diesel generator market include Aksa Power Generation, Atlas Copco AB, Briggs & Stratton Corporation, Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kirloskar Electric Company Limited, Kohler Co., Mitsubishi Heavy Industries Ltd., MTU Onsite Energy (Rolls-Royce plc), Wartsila Corporation, and Yanmar Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)