Die Casting Market Size, Share, Trends and Forecast by Process, Raw Material, Application, and Region, 2026-2034

Die Casting Market Size and Share:

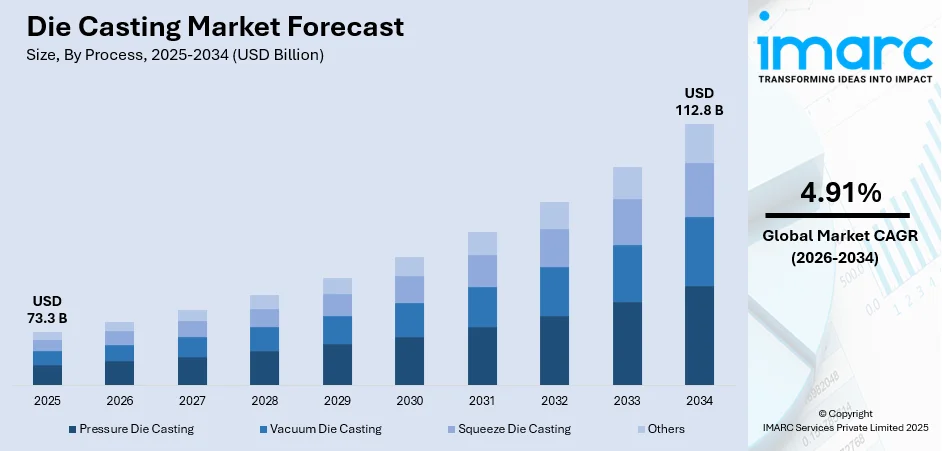

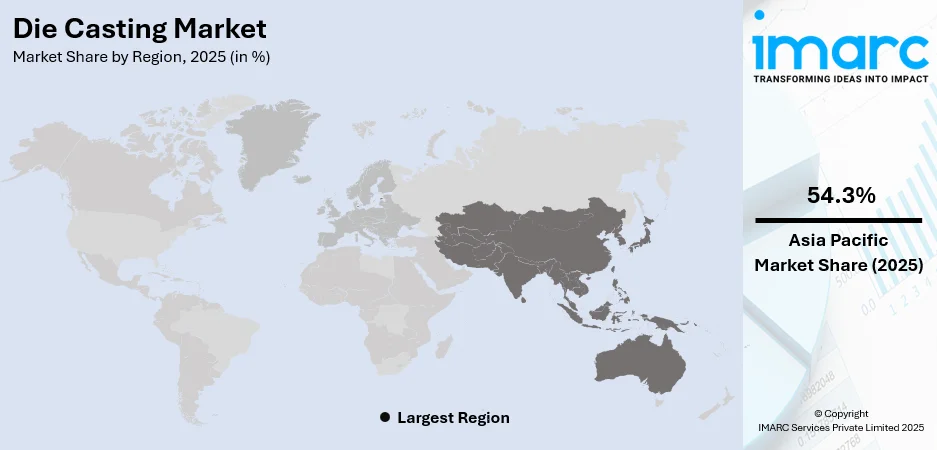

The global die casting market size was valued at USD 73.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 112.8 Billion by 2034, exhibiting a CAGR of 4.91% during 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 54.3% in 2025. The die casting market share in the region is driven by rising demand for lightweight automotive components, rapid technological advancements, growing consumer electronics sector, escalating aerospace sector expansion, increasing sustainability initiatives, and manufacturing growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 73.3 Billion |

|

Market Forecast in 2034

|

USD 112.8 Billion |

| Market Growth Rate (2026-2034) | 4.91% |

The global die casting market demand is largely driven by strong growth in the automotive industry, where die casting is used to produce components for chassis, transmission, engines, brakes, power steering, and interiors. Additionally, the increasing use of aluminum die casting for manufacturing lightweight vehicle parts to reduce fuel consumption is further fueling market growth. As the production of vehicles increase globally, the demand is likely to surge as well. For instance, the motor vehicle production in India was recorded at 5,851,507.000 units in December 2023. This records a hike from the previous number of 5,457,242.000 units for December 2022. Furthermore, increasing product utilization in the electronics industry to produce flexible, light, heat-resistant, and highly durable precision parts for smartphones, laptops, home appliances, and drones is providing a considerable boost to the market growth.

To get more information on this market Request Sample

The United States is leading the die casting market share in North America with 87.60%. With growing concerns over environmental impact, many industries in the country are turning to more sustainable manufacturing processes. As such, by 2025, 11-15 percent of U.S. investment managers will put 40 percent of their portfolios in environmental, social, and governance (ESG) investments. This leads to increased investment in die casting as well. Die casting is inherently more environmentally friendly compared to traditional casting methods. It generates less waste, and the metals used in die casting, particularly aluminum, are highly recyclable. Recycling aluminum and zinc decreases the demand for primary production, which requires significant energy and has a high environmental impact. Furthermore, the precision and low material wastage of die casting help manufacturers conserve resources. As sustainability becomes an even higher priority for industries and governments alike, die casting offers a compelling solution for manufacturers seeking to reduce their carbon footprint and environmental impact.

Die Casting Market Trends:

Increasing Demand for Lightweight Components

The increasing need for lightweight, durable components in the automotive, aerospace, and electronics industries is seen to be driver for the die casting market growth. Thus, die-cast aluminum and magnesium alloys are integral in producing lightweight yet strong components that do not compromise on performance, given that manufacturers are emphasizing fuel efficiency and reduced emissions. The automotive market is one segment that is leading the way on die-casting adoption, and over 85.4 million motor vehicles are produced worldwide yearly, according to the ACEA 2023 report. To meet this level of demand, aluminum and magnesium die casting has been accelerated into components such as engine blocks, transmission cases, and structural parts. These types of alloys ensure higher strength-to-weight ratios than other materials do, which enables better fuel efficiency and vehicle performance. This would shift the die casting market into further expansion as the automotive industry changes its trend toward lightweight, high-performance materials that are fuel efficient and more environmentally friendly.

Advancements in Die Casting Technology

As per the die casting market trends, innovations in its technology are significantly pushing the market and improving both productivity and quality in production. Improvements in high-pressure die casting (HPDC), advanced designs of dies, and the adoption of robotics and automation allow more complex and more precise components at lower costs for manufacturers. Advancements are enabling die casting for a wide scope of applications such as automotive, consumer electronics, and industrial machinery. One such innovation is UBE Corporation's ultra-large die casting machine that was developed in March 2023, targeting EV parts. This reflects the industry's commitment to improving die casting technology to meet the growing demand for high-performance and lightweight parts in electric vehicles. With the evolution of these innovations, they will be crucial in supporting the need that industries have for more efficient, cost-effective, and versatile manufacturing solutions - the driving force behind the expansion of the die casting market.

Rapid Growth in Automotive and Electric Vehicle Production

Growing demand for die-cast parts for the automotive industry mainly comes from the shift to electric vehicles, as EVs demand parts that are light weight, high performance, and capable of executing consistent, homogenous flows. Large parts like battery housing, chassis, and engine parts are increasingly cast through die casting processes to meet the rigorous specifications of EVs. As automobile companies focus more on achieving efficiency in vehicles, the requirement for advanced die-casting technologies is increasing. To illustrate, in February 2021, MG Motors invested USD 173.20 Million at its Gujarat-based Halol plant to expand and localize its business and increase the production capacity. The similar incident is that Great Wall Motors Co. Ltd. GWM committed a USD one Billion investment to expand its operations in India. It also signed a memorandum of understanding (MoU) with the Maharashtra government for supporting its growth. These investments highlight the push in the automotive sector toward innovation and expansion of its capacity of production, thereby fueling the need for die-cast components.

Die Casting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global die casting market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on process, raw material, and application.

Analysis by Process:

- Pressure Die Casting

- Vacuum Die Casting

- Squeeze Die Casting

- Others

As per the die casting market forecast, pressure die casting leads the market with around 45.0% of market share in 2025. This process involves injecting molten metal at high pressure into a mold, producing highly precise and intricate parts with smooth surfaces and minimal defects. It is widely used in industries such as automotive, electronics, and aerospace due to its efficiency in producing complex shapes with excellent dimensional accuracy, low material waste, and high production speed. The increasing demand for lightweight and durable components in high-volume applications, along with advancements in automation and materials, is fueling the growth of high-pressure die casting, making it the dominant method in the market.

Analysis by Raw Material:

- Aluminum

- Magnesium

- Zinc

Based on the die casting market outlook, aluminum leads the market with around 64.6% of market share in 2025. Aluminum is highly favored for its superior strength-to-weight ratio, resistance to corrosion, and strong thermal and electrical conductivity, making it perfect for demanding applications in multiple industries. It is commonly used in automotive, aerospace, and electronics for manufacturing lightweight, durable, and heat-resistant components. Aluminum die casting offers superior precision, reduced machining requirements, and cost-effectiveness, further driving its adoption. The growing demand for fuel-efficient vehicles, electronic devices, and sustainable manufacturing processes has solidified aluminum as the dominant raw material in the die casting market.

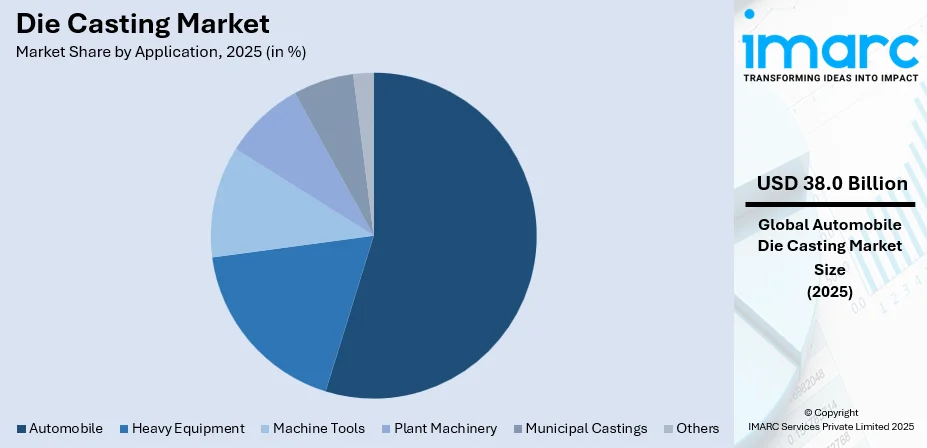

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Automobile

- Body Parts

- Engine Parts

- Transmission Parts

- Others

- Heavy Equipment

- Construction

- Farming

- Mining

- Machine Tools

- Plant Machinery

- Chemical Plants

- Petroleum Plants

- Thermal Plants

- Paper

- Textile

- Others

- Municipal Castings

- Valves and Fittings

- Pipes

- Others

Automobile leads the market with around 54.5% of market share in 2025. The automotive industry relies heavily on die casting for producing lightweight, durable, and high-strength components such as transmission housings, structural parts, engine blocks, and safety features. Aluminum and magnesium die casting, in particular, are favored for their ability to reduce vehicle weight and improve fuel efficiency without compromising strength or performance. The increasing demand for electric vehicles (EVs) and stringent fuel efficiency regulations further boost the adoption of die-cast components in automotive manufacturing. As the automotive sector continues to prioritize sustainability, performance, and safety, die casting remains essential in meeting these evolving demands.

Regional Analysis

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 54.3%. Its dominance is fueled by industrialization, growing manufacturing base, and increasing demand for automotive, consumer electronics, and industrial parts. China, India, and Japan are ahead in die casting production, helped by a powerful automotive industry and expansion of the electronics sector besides large investments in infrastructure. Availability of cheap labor, high technology manufacturing, and good business environment contribute to the overall dominance of Asia Pacific. Going forward, its share in the die casting market will only rise as the region develops further technologically and economically.

Key Regional Takeaways:

North America Die Casting Market Analysis

The North American die casting market is propelled by high demand from the automotive, aerospace, and consumer electronics industries. Advanced manufacturing technologies and strict fuel efficiency and emissions regulations drive the use of lightweight, durable die-cast components, especially in automotive applications. The U.S. and Mexico are key players, with a robust supply chain and a growing focus on electric vehicles (EVs) further boosting the market. Additionally, the aerospace industry’s demand for high-performance materials and precision parts continues to drive growth in die casting applications. North America’s focus on innovation, sustainability, and technological advancements in manufacturing processes ensures continued market expansion and competitive growth in the region.

United States Die Casting Market Analysis

The United States is leading the market in North America with 87.60%. The U.S. die casting industry is prospering with improved precision agriculture equipment, which provides better efficiency in agricultural machinery by increasing productivity, as per records from the USDA. Wheat yields increased from 1.64 billion bushels in 2021 to reach 1.65 billion in 2022, partly facilitated by the better use of technologically advanced machinery. There has been an increased demand for high-performance and durable die-cast components on agricultural machinery such as engines and transmission systems. Major agricultural machinery companies are now strategically investing through acquisitions and developments in technological innovation to meet that demand. As these companies upgrade their fleets by adding more efficient and precise machinery, the requirements for advanced die-casting solutions increase. With further innovation in the agricultural sector, the demand for reliable and robust die-cast components should continue to expand, offering a significant growth driver for the U.S. die casting market.

Europe Die Casting Market Analysis

Europe's die casting market is growing strongly, driven by a significant increase in new car sales. The European Automobile Manufacturers Association (ACEA) said that new car sales in the EU jumped nearly 14% in 2023 to 10.5 million units. This growth has created a high demand for die-cast components, which are crucial in the production of automotive parts such as engine blocks, transmission housings, and structural components. As car manufacturers prioritize better fuel efficiency, lower emissions, and improved vehicle performance, lightweight die-cast materials, especially aluminum and magnesium alloys, are increasingly critical. Electric vehicles are another factor that is further increasing the demand for die-cast components used in battery housings, powertrains, and other EV-specific parts. The die casting market in Europe is likely to continue to grow as the automotive industry expands and innovates, driven by the increasing need for high-quality, durable, and lightweight components.

Asia Pacific Die Casting Market Analysis

Growth in the Asia Pacific die casting market is set to accelerate, with considerable activities underway in automotive and electric vehicle segments. GF Casting Solutions has opened the doors of a new plant in Shenyang, Northern China, in April 2023. The new facility is focused on complex aluminum and magnesium metal casting for the automotive industry. This action clearly highlights the demand for high performance die cast components in lightweight, durable, and energy-efficient automotive parts. Electric vehicle adoption is another stimulus. In February 2021, the Delhi government began setting up 100 battery charging points across the state to promote EV adoption, which is expected to drive greater demand for specialized die-casting components for EV battery housings, powertrains, and other essential parts. The Asia Pacific market will keep witnessing an ever-increasing demand for die casting solutions propelled by continued growth in the traditional automotive and electric vehicle manufacturing across the region requiring high-quality, lightweight, and sustainable components.

Latin America Die Casting Market Analysis

The Latin American die casting market is expected to grow significantly as the region's automotive industry invests heavily. According to Anfavea representatives, BRL 100 Billion (USD 20 Billion) of investment are forecasted to be injected into the Brazilian automotive sector by 2029. The added capital will focus the production on lightweight, high-performance die-cast components, which are part of the core of automotive manufacturing. As the vehicle manufacturers focus more on fuel efficiency, reduced emission, and sophisticated vehicle technology, the demand for die-casting materials like aluminum and magnesium alloy will increase primarily in the building of engine blocks, transmission houses, and chassis components. As electric vehicles emerge as a promising trend in the Latin American countries, the use of specialized die-casting for EV battery house, power trains, and key components will accelerate. These developments indicate good growth prospects for the Latin American die casting market in the coming years.

Middle East and Africa Die Casting Market Analysis

The Middle East and Africa die casting market is going to benefit from significant economic developments driven by the UAE government's "Projects of the 50" initiative. As part of this initiative, the UAE intends to launch several projects designed to drive economic growth and position the country as a key hub across all sectors. According to the ITA, the UAE is targeting a foreign direct investment of USD 149.8 Billion in the next nine years. This is expected to drive demand for high-performance die-cast components, especially in automotive, aerospace, and electronics sectors. As the UAE expands its infrastructure and manufacturing capabilities, demand for lightweight, durable, and cost-effective die-cast parts will increase further, driving growth in the market. The region's renewed focus on making its manufacturing sector better and nurturing technological innovation shall open up further opportunities for applications in die casting, thereby fostering the overall Middle East and Africa die casting market.

Competitive Landscape:

The key market players are focused on achieving technological innovation through strategic partnerships along with the increased production capacity required to maintain and sustain a level of competitiveness within the market. Companies are investing in higher automation, superior robotics, and AI-driven processing to enhance better production efficiency coupled with precision with die-casting components. Many are utilizing 3D printing and simulation software to increase the efficiency for mold design lead times, speeding up time to market. As companies in industries such as automotive, aerospace, and consumer electronics grow their production volume to address expanding demand in geographies such as Asia Pacific and Latin America, the current increase in the manufacturing capacity is taking place. Sustainable is also at a high spot due to efforts like using recycled material and reduced waste. Several players are also diversifying their raw material portfolios by focusing on new alloys such as magnesium and aluminum for lightweight application, working alongside OEMs to develop specialized components that power electric and other new generation technologies.

The report provides a comprehensive analysis of the competitive landscape in the die casting market with detailed profiles of all major companies, including:

- BUVO Castings

- Dynacast

- Endurance Technologies Limited

- FAIST Group

- GF Casting Solutions

- Gibbs Die Casting Corporation

- Linamar Corporation

- Martinrea Honsel

- Nemak

- Pace Industries

- Rockman Industries Ltd

- Ryobi Limited

- Sundaram Clayton Limited

Latest News and Developments:

- August 2024: the UBE Machinery Corporation, Ltd., a company at the forefront of the machinery division of the UBE Group, unveiled a giga casting machine, which refers to a new die casting machine to take advantage of aluminum alloys for molding all main body structure parts for battery electric vehicles in an integrated way.

- March 2023: The UBE Corporation unveiled its special ultra-large die casting machine exclusively developed for an electric vehicle component. The corporation is dedicated to innovation in die casting technology as it continues in the development stage.

- January 2023: General Motors announced publicly new investment worth of USD 918 million that shall be dispersed through four manufacturing plants. Funding with an amount of USD 55 million targeted was in the development of EV die casting parts.

Die Casting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Process Covered | Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Others |

| Raw Materials Covered | Aluminum, Magnesium, Zinc |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BUVO Castings, Dynacast, Endurance Technologies Limited, FAIST Group, GF Casting Solutions, Gibbs Die Casting Corporation, Linamar Corporation, Martinrea Honsel, Nemak, Pace Industries, Rockman Industries Ltd, Ryobi Limited, Sundaram Clayton Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the die casting market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global die casting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the die casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The die casting market was valued at USD 73.3 Billion in 2025.

IMARC Group estimates the market to reach USD 112.8 Billion by 2034, exhibiting a CAGR of 4.91% during 2026-2034.

Key factors driving the die casting market include the growing demand for lightweight automotive components, rapid advancements in automation and precision casting, increasing adoption in consumer electronics and aerospace, cost-effective high-volume production, sustainability initiatives, and the expansion of manufacturing in emerging markets.

Asia Pacific currently dominates the market with 54.3%, driven by rapid industrialization, strong automotive and electronics industries, and significant manufacturing growth in emerging countries.

Some of the major players in the die casting market include BUVO Castings, Dynacast, Endurance Technologies Limited, FAIST Group, GF Casting Solutions, Gibbs Die Casting Corporation, Linamar Corporation, Martinrea Honsel, Nemak, Pace Industries, Rockman Industries Ltd, Ryobi Limited and Sundaram Clayton Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)