Diagnostic Imaging Equipment Market Size, Share, Trends and Forecast by Modality, Application, End User, and Region, 2025-2033

Diagnostic Imaging Equipment Market Size and Share:

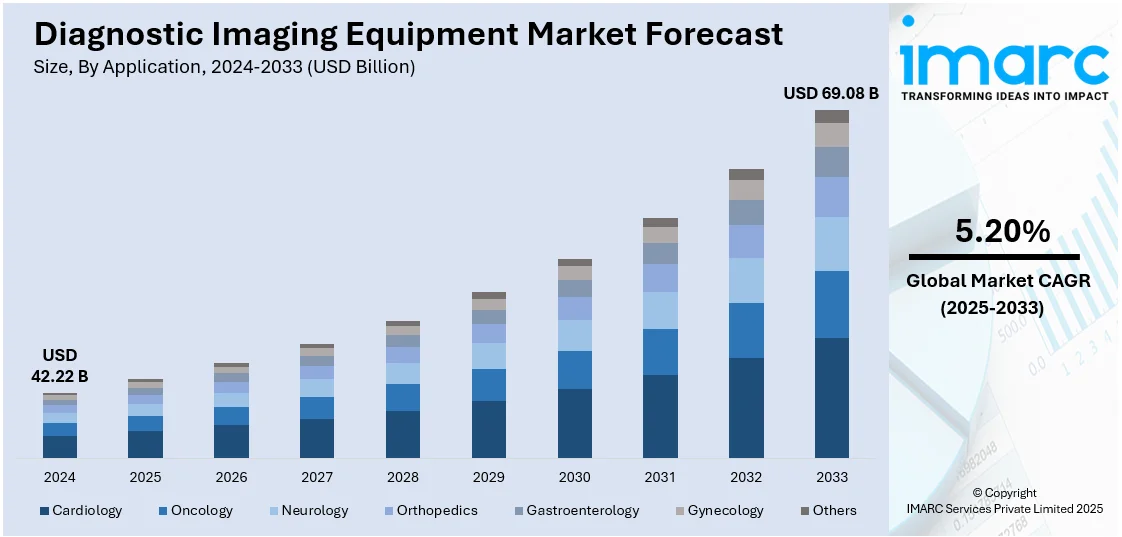

The global diagnostic imaging equipment market size was valued at USD 42.22 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 69.08 Billion by 2033, exhibiting a CAGR of 5.20% from 2025-2033. North America currently dominates the market, holding a market share of 33.7% in 2024. Enhanced medical infrastructure, significant healthcare expenditure, extensive implementation of cutting-edge technologies, and strong presence of key industry players are influencing the diagnostic imaging equipment market share positively in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 42.22 Billion |

| Market Forecast in 2033 | USD 69.08 Billion |

| Market Growth Rate 2025-2033 | 5.20% |

A global increase in conditions, such as cardiovascular diseases, cancer, stroke, and neurological disorders, is a vital factor impelling the market growth. These conditions frequently necessitate imaging at various stages, including screening, diagnosis, treatment strategy, and monitoring. In addition, the growing aging global population, which is more susceptible to conditions, requires regular imaging, including osteoporosis, arthritis, and age-related cancers. This demographic trend is contributing to sustained demand for diagnostic imaging solutions. Besides this, advancements in high-definition 3D and 4D imaging, AI-powered image analysis, contrast-free MRI, low-dose radiation CT, and portable ultrasound devices are revolutionizing the precision and speed of diagnostics. These technologies facilitate earlier and more precise identification of irregularities, enhance diagnostic reliability, and shorten scan durations, making them appealing to hospitals and diagnostic facilities.

The United States plays a vital role in the market, fueled by its advanced healthcare system that provides extensive access to hospitals, specialized clinics, and diagnostic facilities. These facilities are well-prepared to implement and incorporate the newest imaging technologies, such as MRI, CT, and hybrid systems like PET-CT. Moreover, top manufacturers in the US are focusing on AI integration, internal innovation, and next-generation hardware improvements to enhance diagnostic accuracy, shorten scan durations, and broaden imaging capabilities. This focus on domestic production of high-tech and precision-oriented diagnostic imaging equipment is impelling the market growth. In 2024, Canon Medical USA launched the AI-powered Vantage Galan 3T/Supreme Edition MRI system ahead of RSNA 2024. The system integrated Canon’s Altivity AI suite to enhance image quality and reduce scan times. It featured a fully in-house design, including a Japan-made magnet for a wider field of view.

Diagnostic Imaging Equipment Market Trends:

Growing Prevalence of Chronic Diseases

The increasing prevalence of chronic conditions like cardiovascular diseases, cancer, and respiratory disorders is driving the need for diagnostic imaging devices. As the population ages and lifestyles evolve, marked by poor diet, lack of exercise, and increased stress, conditions like heart disease and diabetes become more common. Timely and precise diagnosis is essential in treating these diseases, and imaging techniques, such as computerized tomography (CT), magnetic resonance imaging (MRI), and positron emission tomography (PET) scans are vital. In 2025, Ezra launched its AI-powered full-body MRI cancer screening service in the UK, starting in London through a partnership with Alliance Medical. The 60-minute, non-contrast scan screens 13 organs and uses AI to reduce scan time and improve diagnostic efficiency. Ezra’s E-SCORE system helps prioritize findings, aiming to shift cancer detection to earlier stages. These innovations are expected to significantly influence the diagnostic imaging equipment market forecast, driving growth through advanced, patient-centric solutions.

Sustainability and Energy Efficiency

Healthcare facilities face pressure to minimize their environmental footprint while enhancing efficiency and cost-effectiveness. As a result, there is a transition towards imaging systems that use less energy, demand little maintenance, and incorporate resource-efficient technologies like helium-free cooling and low-power electronics. These improvements assist in decreasing operational expenses and minimizing reliance on limited resources. Moreover, streamlined system designs and automated processes aid in space efficiency and quicker patient transitions, directly boosting clinical productivity. Hospitals and diagnostic facilities are focusing on equipment that supports eco-friendly healthcare initiatives while maintaining high image quality and diagnostic precision. With sustainability gaining importance as a strategic focus within the healthcare sector, eco-friendly and efficient imaging solutions are becoming crucial differentiators, influencing purchasing choices. In 2024, Siemens Healthineers introduced the Magnetom Flow MRI platform at the European Congress of Radiology. It featured helium-free technology, reduced energy usage, and AI-driven image reconstruction for faster, higher-quality scans. The system also improved efficiency with a compact design and automated workflows, enhancing sustainability and patient experience.

Rising Demand for Point-of-Care Imaging Solutions

The escalating demand for portable and imaging solutions at the point of care, particularly in emergencies, rural locations, and outpatient centers, is offering a favorable diagnostic imaging equipment market outlook. Point-of-care ultrasound (POCUS), portable X-ray machines, and mobile CT scanners are favored for their ease of use, quicker processing times, and capacity to deliver prompt diagnostic information. These compact systems are particularly beneficial in critical care units, operating theatres, ambulances, and in field diagnostics where standard imaging configurations are unfeasible. Additionally, the rising move towards decentralizing diagnostics is fostering innovation in lightweight, battery-operated, and wireless imaging technologies. Producers are reacting by creating compact, AI-augmented systems specifically designed for point-of-care applications, which is broadening the user base and generating new income opportunities within the diagnostic imaging sector. In 2025, HCAP Partners launched Integrated Diagnostic Services, a mobile diagnostics company aimed at expanding access to imaging and lab services for skilled nursing, long-term care, and home health providers. The services include mobile x-ray, ultrasound, and echocardiography.

Diagnostic Imaging Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global diagnostic imaging equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on modality, application, and end user.

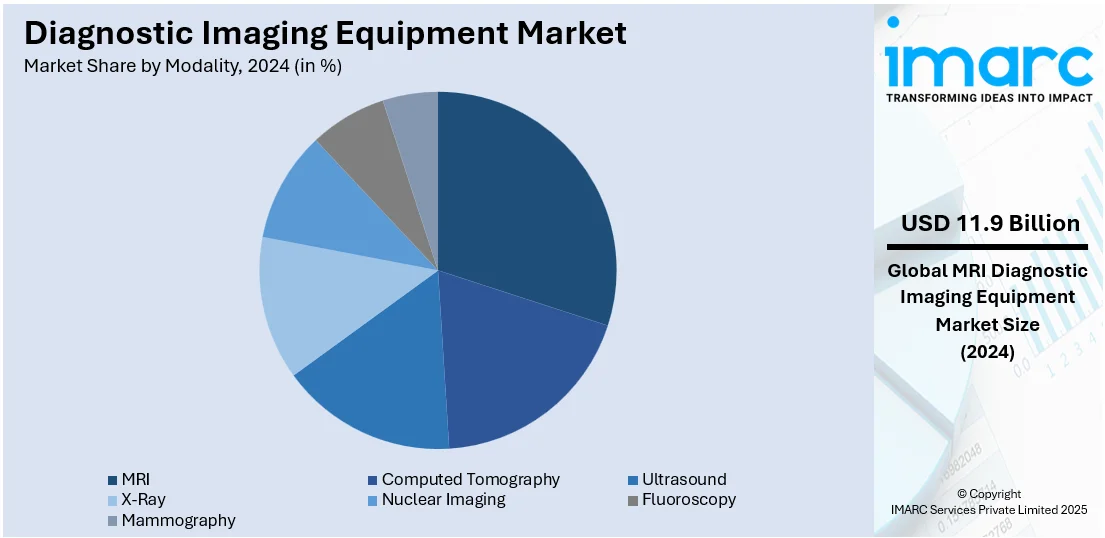

Analysis by Modality:

- MRI

- Computed Tomography

- Ultrasound

- X-Ray

- Nuclear Imaging

- Fluoroscopy

- Mammography

MRI stands as the largest component with 28.2% of market share, because of its exceptional capacity to provide detailed, non-invasive images of soft tissues, organs, and internal structures without the use of ionizing radiation. Its ability to diagnose neurological issues, spinal injuries, musculoskeletal disorders, and vascular ailments makes it essential in various medical fields. The rising demand for timely and precise diagnosis, particularly in scenarios with intricate anatomical features, bolsters the expanding use of MRI systems. Technological progress, like increased Tesla power, functional MRI (fMRI), and real-time imaging features, are improving the clinical usefulness of MRI. Moreover, incorporating AI for image evaluation and process automation enhances diagnostic productivity and scanning efficiency. Hospitals and diagnostic facilities emphasize MRI setups to provide complete imaging solutions in a single location. Ongoing research and advancements focused on decreasing scan durations and enhancing patient comfort further support the growing demand for MRI as a leading imaging technique.

Analysis by Application:

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

Orthopedics dominates the market because of the growing need for precise visualization of the musculoskeletal system, which encompasses bones, joints, and soft tissues. Diagnostic imaging is crucial for evaluating fractures, joint dislocations, degenerative conditions, sports-related injuries, and results after surgery. Technologies such as X-ray, MRI, and CT scans are commonly employed in orthopedic environments to offer precise anatomical information, inform treatment strategies, and assess recovery advancement. The increasing occurrence of age-related bone diseases like osteoporosis and arthritis, combined with more frequent traumatic injuries and lifestyle-associated ailments, is catalyzing the demand for accurate diagnostic instruments. Orthopedic surgeons depend significantly on imaging for pre-operative planning and post-operative evaluation, making imaging systems essential to their workflow. The creation of mobile and real-time imaging technologies further improves their usefulness in trauma and emergency medicine.

Analysis by End User:

- Hospital

- Diagnostic Centers

- Others

Hospital represents the largest segment, accounting for 43.5% market share, attributed to its extensive array of medical services, centralized patient care, and capability to fund expensive imaging technologies. Hospital frequently acts as referral hubs for intricate diagnostics, necessitating sophisticated imaging techniques like MRI, CT, PET-CT, and interventional radiology systems. Hospital generally has specialized divisions and skilled staff who can manage advanced diagnostic processes, facilitating the incorporation of cutting-edge imaging technologies. Its capacity to handle large numbers of patients also leads to an ongoing need for dependable and effective imaging equipment. In addition, hospital is essential in medical training and clinical studies, which further encourages the use of innovative imaging technologies. Government and private investment frequently focuses on improvements in hospital. In addition, the rising need for extensive diagnostic tools in hospital to aid surgical planning and treatment oversight guarantees ongoing equipment use is bolstering the diagnostic imaging equipment market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

North America dominates the market, holding a 33.7% market share owing to its developed healthcare infrastructure, broad research capabilities, and significant uptake of innovative medical technologies. The area gains from robust investment in healthcare innovation from both the government and private sector, along with established clinical standards that promote ongoing improvements in diagnostic equipment. A strong presence of educational and healthcare organizations promotes ongoing cooperation in imaging innovations, such as AI-based diagnostics and precision imaging. Supportive reimbursement systems motivate providers to adopt new technologies, increasing the demand for equipment. The increasing occurrence of chronic diseases, including cardiovascular and neurological conditions, further emphasizes the necessity for precise and prompt imaging. Furthermore, the rising awareness about preventive health measures and the growing preference for minimally invasive diagnostic techniques establish North America as a steady leader in the worldwide diagnostic imaging equipment industry. In 2024, Philips launched the AI-powered CT 5300 system in North America at RSNA 2024, integrating hardware, AI, and smart workflow automation. The CT 5300 included tools like Precise Cardiac and Precise Brain for improved imaging accuracy and reduced scan time.

Key Regional Takeaways:

United States Diagnostic Imaging Equipment Market Analysis

In North America, the market portion held by the United States was 78.70% because of its sophisticated healthcare system, extensive availability of imaging services, and ongoing commitment to technological advancement. The strong uptake of advanced modalities like MRI, CT, and AI-assisted ultrasound is bolstered by a favorable reimbursement framework and the increasing need for precise diagnostics in treating chronic illnesses such as cancer, heart diseases, and neurological disorders. The nation’s robust presence of leading medical technology companies and educational institutions promotes continuous research, advancement, and commercialization of cutting-edge imaging solutions. A growing transition towards outpatient diagnostic facilities and value-focused care systems is encouraging providers to invest in efficient, patient-oriented equipment. In line with this trend, GE HealthCare purchased Intelligent Ultrasound's clinical AI division for $51 million in 2024 to enhance ultrasound effectiveness in U.S. environments. The inclusion of AI technologies such as ScanNav Anatomy and ScanNav Assist in GE’s ultrasound range highlighted the increasing industry emphasis on streamlining imaging processes and minimizing clinician burden. These advancements, along with the growing need for prompt and precise diagnosis, are supporting the dominance of US in diagnostic imaging.

Europe Diagnostic Imaging Equipment Market Analysis

Europe possesses a notable portion of the market, bolstered by robust hospital networks, comprehensive healthcare access, and extensive implementation of early disease screening initiatives. Nations such as Germany, France, and the UK remain focused on enhancing imaging technologies, especially in oncology, neurology, and musculoskeletal diagnostics. Regulatory structures emphasizing radiation safety, clinical data uniformity, and quality assurance are crucial in influencing trends in procurement and usage. The region is experiencing swift incorporation of AI-driven systems and hybrid imaging technologies to enhance diagnostic speed and precision. For example, in 2024, United Imaging unveiled its new PET/CT systems, uMI Panvivo and uMI Panorama GS, at the EANM 2024 Congress in Hamburg. These next-gen systems offered high-resolution imaging and AI-powered tools for enhanced cancer diagnostics. The company also expanded installations across Europe and launched new offices in the UK and Spain. These advancements emphasize Europe’s dedication to improving diagnostic capabilities and guaranteeing wider access to advanced imaging technologies in both public and private healthcare environments.

Asia Pacific Diagnostic Imaging Equipment Market Analysis

The diagnostic imaging equipment market in Asia Pacific is growing, driven by improved healthcare infrastructure, increased awareness about diseases, and targeted government funding in medical technology. Nations like China, India, Japan, and South Korea are proactively expanding diagnostic capabilities to address the healthcare requirements of older populations and the increasing need for specialized services. Focus on affordable, locally sourced imaging solutions is enhancing access in underserved areas, while the implementation of AI and teleradiology is aiding in tackling workforce shortages in diagnostics. In 2024, Trivitron Healthcare launched the Terrene CT scanner in India, receiving approvals from the Bureau of Indian Standards, Atomic Energy Regulatory Board, and Central Drugs Standard Control Organization. Manufactured at Trivitron's certified facility in Visakhapatnam, the scanner offered enhanced image clarity, lowered radiation exposure, and optimized workflow for better patient care. Trivitron aimed to revolutionize diagnostics in India with this advanced technology. With the growth of innovation and local manufacturing, the Asia Pacific region is becoming an essential center for market expansion and technological progress in diagnostic imaging.

Latin America Diagnostic Imaging Equipment Market Analysis

In Latin America, the market for diagnostic imaging equipment is expanding as healthcare systems advance and the demand for non-invasive diagnostic tools rises. Many hospitals are integrating advanced imaging technologies like MRI, CT, and ultrasound to improve clinical accuracy. In 2024, Olympus Latin America launched the VISERA ELITE III endoscopic visualization platform in Mexico, with plans for broader availability across Latin America. The platform supported various specialties, including general surgery, urology, and gynecology, offering advanced imaging features like 4K and fluorescence-guided surgery. It also offered scalability and backward compatibility with previous systems. This shift toward adaptable, high-performance imaging platforms is a clear reflection of evolving diagnostic imaging equipment market trends focused on innovation, versatility, and regional expansion.

Middle East and Africa Diagnostic Imaging Equipment Market Analysis

The Middle East and Africa market is observing growth, driven by rising healthcare investments, particularly in the UAE, Saudi Arabia, South Africa, and Egypt. Governing bodies are prioritizing tertiary care expansion, medical tourism, and national screening programs, all of which are catalyzing the demand for advanced imaging technologies. Infrastructure projects are equipping public and private healthcare facilities with state-of-the-art systems, though lower-income regions continue to face challenges related to affordability and access. In 2025, Egypt’s Ministry of Health signed an MoU with Siemens Healthineers to establish the region’s first radiology equipment center. This initiative aims to enhance diagnostic capabilities and includes a national monitoring hub connected to six major hospitals, reinforcing the region’s push toward advanced, connected imaging networks.

Competitive Landscape:

Major participants in the industry are concentrating on technological advancements, product innovation, and expanding their portfolios to maintain competitiveness. Numerous individuals are putting resources into AI and ML to improve image precision, streamline workflows, and enable quicker diagnoses. They are advancing next-generation technologies to improve diagnostic precision across various medical applications, including cardiac, chest, and musculoskeletal imaging. Their efforts are centered around developing high-resolution imaging systems, enhancing detector performance, and reducing radiation exposure. For instance, in 2024, Canon launched a research collaboration with Penn Medicine to advance photon-counting CT (PCCT) technology. The partnership aimed to enhance diagnostic accuracy in cardiac, chest, and musculoskeletal imaging using Canon’s next-gen CZT detector. Besides this, firms are forming strategic alliances, merging, and acquiring others to enhance their market position and reach new geographical areas. There is a higher focus on creating affordable and portable imaging systems to support resource-constrained environments. Moreover, regulatory adherence, sustainability, and tailored diagnostic solutions are increasingly central to corporate strategies designed to address changing clinical and patient care requirements.

The report provides a comprehensive analysis of the competitive landscape in the diagnostic imaging equipment market with detailed profiles of all major companies, including:

- AGFA HealthCare N.V. (Agfa-Gevaert N.V.)

- Canon Medical Systems Corporation

- FONAR Corporation

- FUJIFILM Holdings Corporation

- GE HealthCare Technologies Inc.

- Koninklijke Philips N.V.

- Shimadzu Corporation

- Siemens Healthineers

- Carestream Health

- Hologic, Inc.

- Teknova Medical Systems Limited

- J. Morita Corporation

Latest News and Developments:

- April 2025: Siemens Healthineers and Tower Health announced a 10-year Value Partnership to upgrade imaging systems and digital tools across Tower Health's network in Pennsylvania. The collaboration aims to modernize radiology, cardiology, and oncology services with advanced equipment and AI-driven solutions. This strategic alliance supports long-term clinical excellence and operational efficiency.

- April 2025: AsiaMedic and Sunway Group launched AsiaMedic Sunway Imaging, a new medical diagnostic imaging center in Novena, Singapore. The 6,000 sqft facility features advanced technologies like 3T MRI, CT scanners, and general imaging services. This expansion doubles AsiaMedic’s imaging capacity and enhances patient care in the region.

- March 2025: NVIDIA and GE HealthCare announced a collaboration to develop autonomous diagnostic imaging systems using the new Isaac for Healthcare platform. The platform enables virtual simulation of sensors and anatomy, helping to train and test robotic imaging technologies. It aims to expand global access to imaging and address healthcare staffing challenges.

- January 2025: Precision Optics launched the Unity Imaging Platform, a modular CMOS-based system designed to streamline development of endoscopic imaging devices. The platform supports both reusable and single-use devices, reducing costs, time to market, and project risks. It also enables advanced features like 3D and fluorescence imaging for next-gen medical procedures.

Diagnostic Imaging Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modalities Covered | MRI, Computed Tomography, Ultrasound, X-Ray, Nuclear Imaging, Fluoroscopy, Mammography |

| Applications Covered | Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, Others |

| End Users Covered | Hospital, Diagnostic Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGFA HealthCare N.V. (Agfa-Gevaert N.V.), Canon Medical Systems Corporation, FONAR Corporation, FUJIFILM Holdings Corporation, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Shimadzu Corporation, Siemens Healthineers, Carestream Health, Hologic, Inc., Teknova Medical Systems Limited, J. Morita Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the diagnostic imaging equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global diagnostic imaging equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the diagnostic imaging equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diagnostic imaging equipment market was valued at USD 42.22 Billion in 2024.

The diagnostic imaging equipment market is projected to exhibit a CAGR of 5.20% during 2025-2033, reaching a value of USD 69.08 Billion by 2033.

The diagnostic imaging equipment market is driven by rising chronic disease prevalence, the growing need for timely and precise diagnosis, improvements in imaging technologies like AI integration, increasing elderly population, and healthcare infrastructure expansion across emerging economies. Government initiatives promoting healthcare access and rising awareness about preventive care also contribute significantly to the market growth.

North America currently dominates the diagnostic imaging equipment market, accounting for a share of 33.7%. The dominance of the region is because of its enhanced medical infrastructure, significant healthcare expenditure, extensive implementation of cutting-edge technologies, and strong presence of key industry players. Favorable reimbursement policies and a growing demand for early disease detection further offers a positive outlook.

Some of the major players in the diagnostic imaging equipment market include AGFA HealthCare N.V. (Agfa-Gevaert N.V.), Canon Medical Systems Corporation, FONAR Corporation, FUJIFILM Holdings Corporation, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Shimadzu Corporation, Siemens Healthineers, Carestream Health, Hologic, Inc., Teknova Medical Systems Limited, J. Morita Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)