Diabetic Foot Ulcers Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

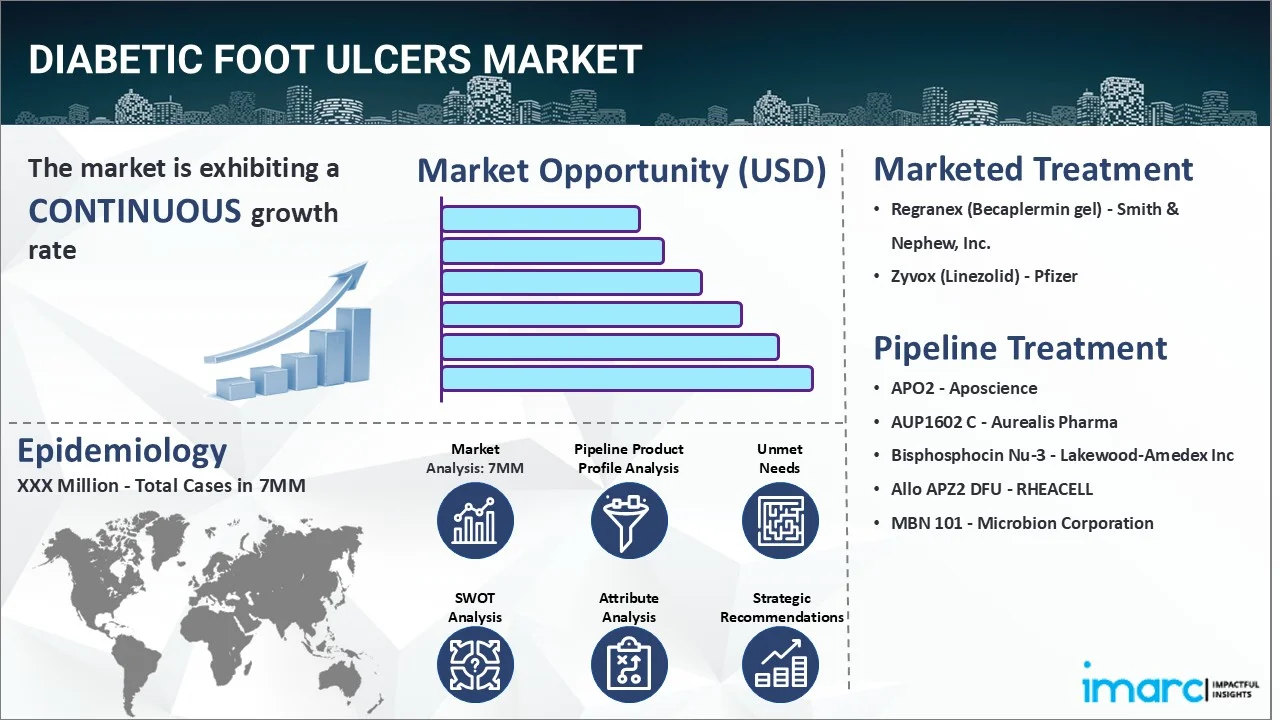

The diabetic foot ulcers market reached a value of USD 3.6 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 5.7 Billion by 2035, exhibiting a growth rate (CAGR) of 4.14% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 3.6 Billion |

|

Market Forecast in 2035

|

USD 5.7 Billion |

| Market Growth Rate 2025-2035 | 4.14% |

The diabetic foot ulcers market has been comprehensively analyzed in IMARC's new report titled "Diabetic Foot Ulcers Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Diabetic foot ulcers are a common complication of diabetes that occurs when damage to the nerves and blood vessels in the feet results in impaired blood flow. This condition can reduce blood flow and decrease sensation in the feet, making them more vulnerable to injury, open sores, or wounds, and slower to heal. The common indications of the ailment include swelling, large calluses or cracked heels, blisters, redness, sores, splinters, scrapes, pus, etc. The diagnosis of diabetic foot ulcers is typically made by reviewing the patient's medical history, clinical features, and swab tests for secondary infection. Numerous laboratory investigations, including fasting blood sugar, a complete metabolic panel, glycated hemoglobin levels, erythrocyte sedimentation rate, a complete blood count, C-reactive protein, etc., are also utilized to confirm a diagnosis. The healthcare provider may perform X-rays on patients to evaluate the involvement of the bone.

To get more information on this market, Request Sample

The rising cases of chronic diabetes due to poor glycemic control, coupled with the increasing unmet need for effective drugs to address this illness, are primarily driving the diabetic foot ulcers market. Furthermore, the growing prevalence of several associated risk factors, such as foot deformities, ill-fitting footwear, underlying peripheral neuropathy, improper foot care, inadequate blood circulation, dry skin, etc., is also propelling the market growth. In addition to this, the escalating utilization of negative pressure wound therapy, which uses sub-atmospheric pressure to minimize inflammatory exudate and encourage granulation tissue to optimize the physiology involved in wound healing, is creating a positive outlook for the market. Moreover, the inflating adoption of granulocyte-colony stimulating factors (G-CSF) for treating this ailment, since they improve clinical outcomes in patients by increasing the release of neutrophils from the bone marrow and enhancing their function, is also bolstering the market growth. Apart from this, the emerging popularity of tissue-engineered skin substitutes that are designed using living cells, like fibroblasts, keratinocytes, stem cells, etc., to replace or supplement damaged skin and promote wound healing is expected to drive the diabetic foot ulcers market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the diabetic foot ulcers market in the United States, EU4 (Germany, Spain, Italy, and France), the United Kingdom, and Japan. This includes treatment practices, in-market and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for diabetic foot ulcers and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, and unmet medical needs, etc. have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the diabetic foot ulcers market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the diabetic foot ulcers market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the diabetic foot ulcers market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current diabetic foot ulcers marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Regranex (Becaplermin gel) | Smith & Nephew, Inc. |

| Zyvox (Linezolid) | Pfizer |

| APO2 | Aposcience |

| AUP1602 C | Aurealis Pharma |

| Bisphosphocin Nu-3 | Lakewood-Amedex Inc |

| allo APZ2 DFU | RHEACELL |

| MBN 101 | Microbion Corporation |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the diabetic foot ulcers market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the diabetic foot ulcers across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the diabetic foot ulcers across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of diabetic foot ulcers across the seven major markets?

- What is the number of prevalent cases (2019-2035) of diabetic foot ulcers by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of diabetic foot ulcers by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of diabetic foot ulcers by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with diabetic foot ulcers across the seven major markets?

- What is the size of the diabetic foot ulcers patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend diabetic foot ulcers of?

- What will be the growth rate of patients across the seven major markets?

Diabetic Foot Ulcers: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for diabetic foot ulcers drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the diabetic foot ulcers market?

- What are the key regulatory events related to the diabetic foot ulcers market?

- What is the structure of clinical trial landscape by status related to the diabetic foot ulcers market?

- What is the structure of clinical trial landscape by phase related to the diabetic foot ulcers market?

- What is the structure of clinical trial landscape by route of administration related to the diabetic foot ulcers market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)