Dewatering Pumps Market Size, Share, Trends and Forecast by Type, Capacity, Application, and Region, 2025-2033

Dewatering Pumps Market Size and Share:

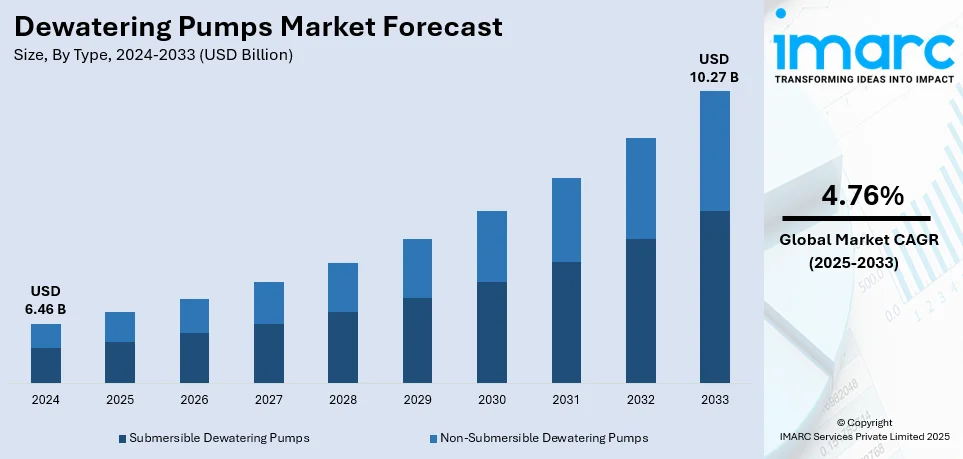

The global dewatering pumps market size was valued at USD 6.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.27 Billion by 2033, exhibiting a CAGR of 4.76% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 35.9% in 2024. The market is growing rapidly driven by increasing construction activities across the globe, rapid expansion of the mining industry, ongoing urbanization and infrastructure development, increasing product utilization in the agricultural sector, and escalating climate change and increasing weather-related events.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.46 Billion |

|

Market Forecast in 2033

|

USD 10.27 Billion |

| Market Growth Rate (2025-2033) | 4.76% |

The growing construction activities, infrastructure development, and industrial expansion worldwide drive the dewatering pumps market growth. The combination of fast-paced urban growth along with increasing water management requirements in mining operations, construction sites and flood prevention are fueling the demand for dewatering pumps. Natural disasters including heavy rains and floods have intensified the necessity for dewatering pumps to handle waterlogging and defend against damage. Technological advancements, including energy-efficient and portable pump designs, further enhance market growth. Expanding investments in irrigation systems and agricultural drainage in emerging economies also drive demand. Environmental regulations and the focus on sustainable water usage have propelled the adoption of advanced dewatering solutions, solidifying their importance across various industrial and municipal applications, thereby representing some of the key dewatering pumps market trends.

Robust construction and infrastructure development activities, including roadways, bridges, and residential projects, drive the dewatering pumps market in the United States. Growing urbanization and industrial expansion necessitate efficient water management solutions, fueling the demand for dewatering pumps in the construction and mining sectors. The frequency of natural disasters such as hurricanes and flooding has increased the need for dewatering solutions to manage waterlogging and mitigate property damage. According to industry reports, the United States was ravaged by storms, Helene and Milton. In late September 2024, Hurricane Helene devastated the Southeastern United States and killed many people. The devastation caused by Hurricane Helene was less than two weeks before Hurricane Milton hit Florida. In addition to bringing flooding and power outages, Milton also resulted in fatalities and extensive damage in Florida and Mexico. Such calamities necessitate investments in irrigation systems and agricultural drainage, which, in turn, drive the dewatering pumps market demand, especially in water-scarce regions. Additionally, advancements in pump technology, including energy-efficient and portable designs, meet regulatory demands for sustainability.

Dewatering Pumps Market Trends:

The increasing construction activities

The surge in construction activities, owing to the rapid urbanization across the globe, is propelling the market growth. The global buildings construction market size reached USD 6.8 Trillion in 2024. Dewatering pumps play a vital role in construction projects, as they are used to remove excess water from construction sites, ensuring a dry and safe environment for construction activities. It is highly crucial in areas with high groundwater levels or those prone to heavy rainfall. The use of dewatering pumps not only ensures the structural integrity of the foundations but also significantly speeds up the construction process by preventing delays caused by waterlogged sites. Furthermore, the growing trend of constructing large-scale underground structures like basements, parking lots, and subways, which require extensive dewatering, is contributing to the market growth.

Rapid expansion of the mining industry

The expansion of the mining industry is a significant factor contributing to the market growth. Mining operations, particularly open-pit and underground mining, require extensive use of dewatering pumps to manage water levels. They are essential for removing water that infiltrates mine shafts, ensuring the safety of the miners and the efficiency of the mining operations. The global mining equipment market size reached USD 156.2 Billion in 2024. Additionally, the growing demand for minerals and metals, driven by various industries, such as electronics, automotive, and construction, which necessitates more robust and efficient dewatering solutions, is propelling the market growth. Furthermore, the imposition of stringent environmental regulations in the mining industry regarding water management, which pushes for more sustainable and efficient dewatering methods, is catalyzing the market growth.

Ongoing urbanization and infrastructure development

Rapid urbanization, leading to a growing need for new urban infrastructure, including roads, bridges, sewage systems, and stormwater management systems, is contributing to the market growth. By 2050, 68% of the world's population is expected to live in urban regions, up from 55% at the present time, according to the UN. Dewatering pumps are essential in urban infrastructure projects for managing groundwater and surface water, ensuring that construction sites remain dry and work can proceed efficiently. Furthermore, redevelopment and expansion of projects as the existing infrastructure is often inadequate to meet the demands of the growing population, is supporting the market growth. Additionally, the shifting trend towards building underground infrastructure, such as subways and underground parking facilities, which further amplifies the need for effective dewatering solutions, is bolstering the market growth.

Rising product utilization in the agricultural sector

Dewatering pumps are crucial for irrigation and managing water levels in agricultural fields. They are used to draw water from sources like rivers, lakes, and reservoirs for irrigation purposes, playing a critical role in ensuring adequate water supply for crops, especially in arid regions or during dry seasons. According to the International Labour Organization (ILO), approximately 1 Billion people worldwide are employed in the agricultural sector, accounting for around 28% of the global workforce. Furthermore, dewatering pumps are widely used in regions prone to heavy rainfall or flooding to remove excess water from agricultural fields, preventing crop damage and soil erosion. This dual functionality makes them indispensable in modern agriculture. Moreover, recent advancements in agricultural practices, such as precision agriculture and sustainable farming, leading to the adoption of more efficient and automated dewatering systems, are positively influencing the market growth. Besides this, the shifting trend towards modernization and increased efficiency in agriculture is further driving the market growth.

Escalating climate change and increasing weather-related events

Climate change and the consequent increase in extreme weather events significantly impact the dewatering pump market. In line with this, the rising frequency and severity of events like floods, hurricanes, and extended periods of heavy rainfall, necessitating effective water management solutions, is boosting the market growth. According to CDP, the floods impacted over 133,000 people across 146 villages in Hebei Province. Dewatering pumps are critical in emergency response and recovery efforts, as they are used to quickly remove excess water from flooded regions, helping to prevent property damage and loss of life. Additionally, the changing climate patterns, leading to unpredictable weather conditions, which makes it essential for various sectors, including construction, mining, and agriculture, to have robust dewatering capabilities, is fueling the market growth.

Dewatering Pumps Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dewatering pumps market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, capacity, and application.

Analysis by Type:

- Submersible Dewatering Pumps

- Non-Submersible Dewatering Pumps

Non-submersible dewatering pumps represent the larger segment in the market because they excel in multiple applications including site construction operations, industrial facilities, and floodwater extraction. A convenient installation spot channels the pumps to minimum costs for setup along with servicing and maintenance. Non-submersible dewatering pumps include centrifugal pumps among their designs because they ensure easy operation and high efficiency for efficient water handling.

Analysis by Capacity:

- 0.5-3 HP

- 3-10 HP

- 10-50 HP

- Above 50 HP

0.5-3 HP dewatering pumps are used for light-duty applications, often in residential or small-scale commercial settings. They are ideal for removing water from basements and small ponds or for garden and landscape irrigation. They function best in situations with low water volume requirements along with limited pumping range requirements.

3-10 HP dewatering pumps serve multiple purposes in residential buildings and commercial facilities. The size range of these pumps enables them to execute draining operations for swimming pools and small to medium construction sites alongside agricultural field purposes. These devices maintain excellent water processing capabilities across big-volume removal tasks while keeping themselves affordable and easy to operate.

10-50 HP dewatering pumps are designed for more demanding applications, such as large construction sites, industrial settings, and extensive agricultural operations. They are powerful enough to handle high volumes of water, making them suitable for scenarios like major floodwater removal, large-scale irrigation, and heavy-duty industrial water management. They are also equipped to handle water with higher levels of debris and sediment.

High-demand industrial operations require dewatering pumps that have a capacity larger than 50 HP. These heavy-duty pumps enable the control of massive water quantities during large-scale mining operations, municipal water management and major flood control operations. They are designed for maximum efficiency and durability under strenuous conditions, often featuring advanced technology for optimal performance.

Analysis by Application:

- Construction and Agriculture

- Oil and Gas

- Municipal

- Mineral and Mining

- Others

The construction and agriculture segments account for the majority of the market since dewatering pumps are required to keep work sites dry, especially in locations with high water tables or during rainy seasons. They are utilized for operations such as foundation installation, tunneling, and groundwater management during excavation. Moreover, dewatering pumps make irrigation easier and help regulate water levels in fields, particularly in arid regions or during droughts. Furthermore, the increasing volume of construction and agricultural activities worldwide, fueled by urbanization and the requirement to feed a rising population, is boosting market expansion.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 35.9%. The dewatering pumps market in the Asia-Pacific (APAC) region is witnessing robust growth due to rapid urbanization, industrialization, and infrastructure development. According to the World Bank, With an average yearly urbanization rate of 3%, East Asia and the Pacific is the region that is urbanizing the fastest in the globe. This rapid urban growth, particularly in countries like China, India, and Japan, drives demand for effective dewatering solutions in construction and infrastructure projects. Additionally, the region’s expanding mining operations, especially in Australia and India, further enhance the need for dewatering pumps. With challenges such as seasonal flooding and water scarcity, there is a growing emphasis on flood control and groundwater management, directly boosting the demand for dewatering pumps. The region’s increasing adoption of energy-efficient and advanced pump technologies also supports market growth, ensuring sustainable solutions in various sectors.

Key Regional Takeaways:

North America Dewatering Pumps Market Analysis

The dewatering pumps market in North America is expanding because of rising construction levels coupled with expanding industrial zones and growing infrastructure development. Rapid city expansion within Toronto and New York along with Los Angeles drives increased requirements for water management solutions. The mining and construction industries use dewatering pumps to facilitate swift water extraction in their operational areas. Natural disasters that create floods and hurricanes coupled with rainstorms make dewatering pumps necessary for efficient flood prevention as well as keeping damage to a minimum. Additionally, the rising focus on environmental sustainability and the adoption of energy-efficient technologies in industrial applications further boosts the market. The rising need for dewatering solutions in North America receives support from mandatory water drainage requirements established by regulators for agriculture and mining fields.

United States Dewatering Pumps Market Analysis

The dewatering pumps market in the United States is primarily driven by the construction and mining industries, which have experienced significant growth in recent years. According to Data USA, as of February 2023, there were 8.27 Million people employed in the Mining, Logging, and Construction sector, reflecting a 3.88% increase in employment compared to the previous year. This rise in workforce numbers directly correlates with the growing market for dewatering solutions, particularly in construction, where effective groundwater management is crucial. Additionally, increased mining activities further drive the need for efficient dewatering pumps. The emphasis on water management and flood control in vulnerable areas, combined with government investments in infrastructure and water treatment systems, continues to support market growth. Technological advancements in pump efficiency, durability, and performance, alongside the shift toward energy-efficient and eco-friendly solutions, are also transforming the industry. Moreover, stricter environmental regulations are accelerating the adoption of high-performance dewatering pumps for municipal wastewater treatment plants and industrial applications. The presence of major pump manufacturers in the U.S. ensures a continuous supply of innovative solutions, further fueling market expansion.

Europe Dewatering Pumps Market Analysis

Europe's dewatering pumps market is influenced by the growing construction and infrastructure sectors across both developed and developing countries. The European construction market size reached USD 3.38 Billion in 2023, reflecting a strong demand for dewatering solutions. The expansion of construction projects, especially in countries like Germany, France, and the UK, requires efficient dewatering systems to manage groundwater across diverse terrains. In addition, the increasing focus on water management, particularly in flood-prone areas, is further driving the need for advanced dewatering pumps. Europe’s industrial sectors, including mining and wastewater treatment plants, are also adopting high-performance dewatering pumps for efficient water removal and environmental compliance. The region's stringent environmental regulations have led to a rise in the demand for energy-efficient, low-emission pumps, which are becoming the standard in many applications. Additionally, the growing preference for portable dewatering pumps, suitable for both small-scale projects and emergency response activities, contributes to market growth. The presence of established pump manufacturers, along with ongoing investments in water management infrastructure, ensures a steady supply of innovative dewatering solutions, fostering continued market expansion in Europe.

Latin America Dewatering Pumps Market Analysis

The dewatering pumps market in Latin America is driven by increasing investments in infrastructure and the mining industry, particularly in countries like Brazil, Chile, and Argentina. Between 2000 and 2023, 505 hydrological disasters were reported in the region by EM-DAT, claiming 10,694 fatalities. These events have heightened the need for effective flood control and water management systems, further boosting demand for dewatering pumps. Additionally, the rising focus on energy-efficient, environmentally sustainable solutions supports market growth as industries and governments look to mitigate the impact of such disasters while addressing water scarcity and infrastructure development.

Middle East and Africa Dewatering Pumps Market Analysis

The Middle East and Africa's dewatering pumps market is primarily driven by large-scale construction projects and the oil and gas sector. According to the World Bank, the Middle East and North Africa (MENA) region is already 64% urbanized, with rapid urbanization fueling the demand for effective dewatering solutions in infrastructure projects. In addition, water scarcity and the region’s vulnerability to seasonal flooding have created a heightened need for reliable dewatering systems. The growing focus on water treatment and management systems in both industrial and municipal sectors further boosts market demand. Sustainability trends are also driving the adoption of energy-efficient pumps.

Competitive Landscape:

The dewatering pumps market is highly competitive, with key players like Xylem Inc., Grundfos, Sulzer Ltd., and ITT Inc. dominating the industry. The business operations of these companies emphasize their innovation efforts to develop energy-efficient portable and durable dewatering pumps targeting construction mining and flood control applications. Regional players also cater to local market needs, driving customization. Strategic partnerships and mergers along with acquisitions serve organizations as standard practices to build expanded product ranges while increasing market access. The priority status of environmental sustainability has triggered numerous companies to invest in green technologies which has boosted market competition. Additionally, advancements in IoT and automation are shaping the future of the dewatering pump industry.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Atlas Copco AB

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holding A/S

- ITT INC.

- KSB SE & Co. KGaA

- Sulzer Ltd.

- The Gorman-Rupp Company

- The Weir Group PLC

- Wacker Neuson SE

- Xylem

Latest News and Developments:

- October 2024: Franklin Electric’s Pioneer Pump® brand has launched the Minetuff® Series Electric Submersible Pumps, its first submersible dewatering solution. With pumps ranging from 8 to 140 horsepower, the series is designed for demanding environments and can handle abrasives like sand and clay. The pumps feature rugged construction and thermal overload protection for extended life.

- February 2024: Cosmos Pumps has launched the Giant Dewatering Pump, designed to tackle water seepage in deep mining operations. With a 650 HP engine, a 130-meter high head, and a capacity of 1,000,000 liters per hour, the pump offers a solution to the challenges faced by mining companies.

- March 2023: Flowserve Corporation has introduced the SIHI Boost UltraPLUS, a new dry-running vacuum pump designed to enhance efficiency in batch processes. The pump reduces cycle times by up to 50%, offers a high compression ratio of up to 100,000:1, and combines improved cooling, upgraded materials, and a new gap distribution strategy for enhanced performance. It retains features like oil-free operation and electronic synchronization from its predecessor while eliminating the need for interstage cooling.

- February 2023: Atlas Copco recently launched its electric self-priming dewatering pumps, including the PAC High Head and High Flow models. Designed for applications such as sewage bypass and mine dewatering, the E-Pump range provides a sustainable alternative to diesel-powered pumps. These pumps deliver reduced CO2 emissions, lower operational costs, and efficient, emission-free performance, catering to environmentally sensitive projects.

- May 2022: Ebara Machinery India Private Limited (EMI) launched an outsourced production line at an Indian pump manufacturer’s facility to produce 2,000 EVMS pumps annually. This initiative, part of Ebara’s E-Plan 2022, leveraged local partnerships for fabless localization to expand its standard pumps business in India’s competitive market.

Dewatering Pumps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Submersible Dewatering Pumps, Non-Submersible Dewatering Pumps |

| Capacities Covered | 0.5-3 HP, 3-10 HP, 10-50 HP, Above 50 HP |

| Applications Covered | Construction and Agriculture, Oil and Gas, Municipal, Mineral and Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Copco AB, Ebara Corporation, Flowserve Corporation, Grundfos Holding A/S, ITT INC., KSB SE & Co. KGaA, Sulzer Ltd., The Gorman-Rupp Company, The Weir Group PLC, Wacker Neuson SE, Xylem, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dewatering pumps market from 2019-2033.

- The dewatering pumps market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dewatering pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global dewatering pumps market was valued at USD 6.46 Billion in 2024.

The dewatering pumps market is projected to exhibit a CAGR of 4.76% during 2025-2033, reaching a value of USD 10.27 Billion by 2033.

The dewatering pumps market is driven by increasing construction and mining activities, rising urbanization, growing infrastructure projects, and frequent flooding incidents. Advancements in pump technology, stringent environmental regulations, expanding industrial applications, and increasing demand for efficient water management solutions further contribute to the market’s growth across various industries worldwide.

Asia Pacific currently dominates the dewatering pumps market, accounting for a share of 35.9%. Rapid urbanization, infrastructure development, mining expansion, frequent flooding, industrial growth, and rising demand for efficient water management drive Asia Pacific’s dewatering pumps market.

Some of the major players in the global dewatering pumps market include Atlas Copco AB, Ebara Corporation, Flowserve Corporation, Grundfos Holding A/S, ITT INC., KSB SE & Co. KGaA, Sulzer Ltd., The Gorman-Rupp Company, The Weir Group PLC, Wacker Neuson SE, Xylem, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)