Dental Insurance Market Size, Share, Trends and Forecast by Type, Coverage, Demographics, End User, and Region, 2025-2033

Dental Insurance Market Size and Share:

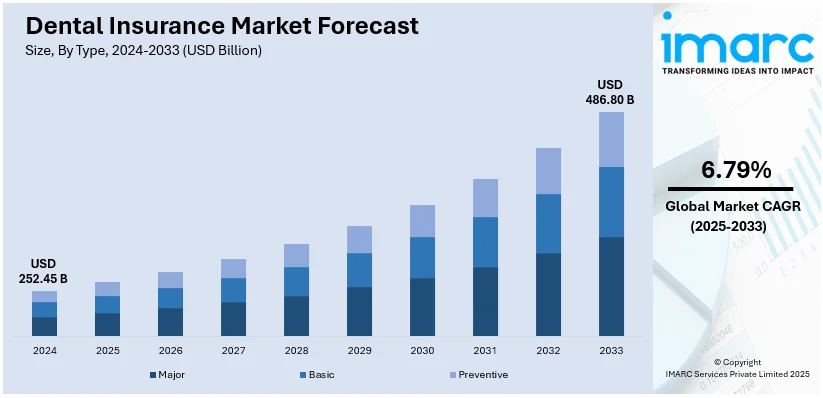

The global dental insurance market size was valued at USD 252.45 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 486.80 Billion by 2033, exhibiting a CAGR of 6.79% during 2025-2033. North America currently dominates the market, holding a significant market share of over 42.8% in 2024. The market is experiencing steady growth driven by rising dental care costs, increasing awareness among individuals about the importance of maintaining oral health, and innovations in dentistry, such as digital imaging and laser dentistry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 252.45 Billion |

|

Market Forecast in 2033

|

USD 486.80 Billion |

| Market Growth Rate (2025-2033) | 6.79% |

The growing need for preventative dental care, increased prevalence of dental illnesses, and increased awareness of oral health are the main factors propelling the global market. Along with this, expanding urbanization, higher disposable incomes, and the inclusion of dental services in health insurance plans are propelling the market growth. Besides this, continual advancements in dental technologies and treatments are also encouraging individuals to seek insurance coverage to offset costs. On 18th September 2024, The largest dental practice network in Canada, Dentalcorp Holdings Ltd., indirectly invested in the Dental Innovation Alliance VC Fund I, LP to promote dental technology innovation. The 2024 Fund supports those early-stage companies focused on clinical outcomes, access to care, and efficiency. This initiative leverages advancements like AI in diagnostics and treatment planning, reinforcing Dentalcorp's dedication to innovation and delivering long-term value. Additionally, the increasing emphasis on employer-sponsored dental benefits and government initiatives to promote affordable healthcare contribute to the market’s expansion. Moreover, the aging population, which requires more frequent dental care, further supports the demand for dental insurance.

To get more information on this market, Request Sample

The United States stands out as a key regional market, primarily driven by the increasing focus on overall healthcare, with dental health being recognized as a vital component. Employers play a significant role by offering dental benefits as part of comprehensive employee health packages, driving enrollment rates. In addition, the rise in dental awareness campaigns, coupled with advancements in dental care accessibility, is encouraging individuals to seek insurance coverage. On 8th April 2024, Align Technology, Inc. recently introduced the "Better Way" campaign across the United States and Canada, featuring the "Invis is for Kids" program. This campaign highlights a new innovative approach called Invisalign® Palatal Expander System, offering a safe, effective means of expanding a child's narrow palate that replaces the use of other methods. Digital platforms, social media, and professional materials are being utilized to make early orthodontic intervention better known to the public. Furthermore, regulatory frameworks support affordable healthcare options and tax benefits for employers offering dental insurance to further fuel growth. Additionally, the growing adoption of telehealth and digital tools in dental services is enhancing convenience and enhancing US dental insurance market share.

Dental Insurance Market Trends:

Rising awareness about oral health

The growing demand for dental insurance coverage due to the increasing awareness among individuals about oral health is creating a positive market outlook. In addition, individuals are becoming more aware of the importance of oral health in maintaining overall well-being. Individuals are recognizing the need for regular dental check-ups, preventive care, and timely treatments to prevent dental problems and maintain optimal oral health. According to a research report, in 2023, almost 66% of adults in the UK had visible dental plaque. Besides this, the rising awareness about the benefits of preventive dental care is bolstering the market growth. Furthermore, individuals are seeking dental insurance plans that cover preventive services, such as routine exams, cleanings, and fluoride treatments. In line with this, insurance companies are offering comprehensive coverage for preventive care, often with minimal or no out-of-pocket costs, to incentivize regular dental visits and promote early detection of oral health issues among individuals. Insurance coverage assists in mitigating the financial burden associated with dental treatments while encouraging individuals to take preventive measures.

Technological advancements

Innovations in dentistry, such as digital imaging, computer-aided design or computer-aided manufacturing (CAD or CAM) technology, and laser dentistry, assist in improving the quality and efficiency of dental treatments. Apart from this, tele-dentistry allows for remote consultations and diagnosis, enabling patients to receive advice from dental professionals without physically visiting a clinic. The IMARC Group reports that the global teledentistry market reached USD 1.9 Billion in 2024. Moreover, dental insurance companies are incorporating coverage for tele-dentistry services, providing policyholders with convenient access to dental care, especially in remote or underserved areas. Furthermore, electronic health records (EHRs) systems streamline administrative processes, facilitate communication between dental providers and insurers, and improve accuracy in claims processing. In line with this, insurance companies leverage EHR systems to enhance efficiency, reduce paperwork, and ensure timely and accurate reimbursement for dental services covered under insurance plans. Besides this, data analytics tools enable insurance companies to analyze trends, patterns, and utilization rates in dental care, allowing them to render informed decisions.

Rising dental care costs

The escalating demand for dental insurance due to the increasing dental care costs is propelling the growth of the market. From 1978 to 2023, dental prices reportedly climbed by 78% for complete dentures and 236% for single surface amalgam, according to inflation-adjusted figures. In addition, individuals and families are seeking dental insurance coverage to help manage the financial burden associated with dental treatments and procedures. Apart from this, dental insurance provides financial protection by covering a portion of dental care expenses, making it more affordable for individuals to access necessary dental services. Moreover, insurance companies are adjusting their coverage options, cost-sharing structures, and premium rates to make dental insurance more accessible and affordable for consumers, especially those facing financial constraints, which is supporting the dental insurance market expansion. Furthermore, they are expanding their coverage options to address the rising costs of dental care. This includes offering supplemental dental insurance plans with enhanced benefits for major treatments, orthodontic care, and cosmetic procedures to provide comprehensive coverage for policyholders. Apart from this, the increasing focus on preventive dental care to avoid costly treatments and maintain oral health is strengthening the market demand.

Dental Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dental insurance market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, coverage, demographics, and end user.

Analysis by Type:

- Major

- Basic

- Preventive

Preventive stand as the largest type in 2024, holding around 43.3% of the market. Preventive coverage includes routine dental care aimed at maintaining oral health and preventing dental problems. This includes services, such as regular dental exams, cleanings, X-rays, and fluoride treatments. Preventive care plays a crucial role in maintaining oral health by identifying and addressing issues in their early stages, which can prevent more serious and costly dental problems in the future. Dental insurance encourages individuals to seek regular dental check-ups, promoting early detection of dental issues and helping to maintain optimal oral health, thereby impelling growth in the segment.

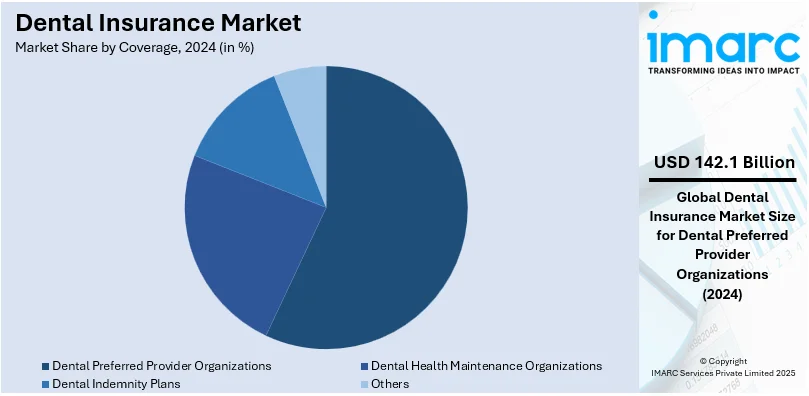

Analysis by Coverage:

- Dental Preferred Provider Organizations

- Dental Health Maintenance Organizations

- Dental Indemnity Plans

- Others

Dental preferred provider organizations lead the market with around 56.3% of the share in 2024. Dental preferred provider organizations (DPPOs) are managed care plans that contract with a network of dentists who agree to provide services to plan members at negotiated rates. Dental PPO plans offer flexibility and choice in selecting a dentist, even outside the network, although benefits are maximized when using in-network providers. They often cover a wide range of preventive, basic, and major dental services. Members usually pay a deductible, coinsurance, and copayments for covered services. These factors are collectively driving expansion of this segment.

Analysis by Demographics:

- Senior Citizens

- Adults

- Minors

Dental insurance plans for senior citizens are specifically designed to address the unique oral health needs of older adults. Elderly individuals often encounter dental issues, such as gum disease, tooth decay, and tooth loss, along with potential complications from chronic health conditions and medications. Plans for senior citizens focus on comprehensive coverage for preventive care, including regular dental exams, cleanings, X-rays, and periodontal treatments to manage gum disease. They also provide coverage for major dental procedures, such as dentures, dental implants, and root canal therapy.

Dental insurance plans for adults encompass individuals, ranging from their late teens to middle age. These plans aim to address the oral health needs of working-age adults, balancing preventive care with coverage for common dental issues and treatments. Plans for adults often prioritize preventive services, such as dental exams, cleanings, and fluoride treatments, to maintain oral health and prevent decay and gum disease. They also provide coverage for basic and major dental procedures, including fillings, crowns, root canals, and extractions.

The minor's dental insurance plan is designed for the child and the adolescent since the earlier treatment is the heart of prevention for lifetime oral health practices. Preventive care remains the most prominent attention for such plans concerning minors. Such preventive measures include routine dental checkups, cleaning, fluoride treatment, and application of sealants to avert dental cavities. Other vital dental treatments incorporated within such plans are fillings, orthodontics, and emergency services.

Analysis by End User:

- Individuals

- Corporates

Individual dental insurance plans are designed for individuals who want to cover themselves individually outside of employer-sponsored or group plans. The individual plans provide the individual with the flexibility and control to enable decisions over their dental care. Individual plans offer a range of coverage alternatives to accommodate people's demands and financial constraints. They include preventive care such as routine exams, cleanings, X-rays, coverage, for fillings, root canals, crowns, and other basic and major dental procedures.

Corporate dental insurance is given by the employer to its employees as part of their employee benefits package. These corporate dental plans aim to enhance the satisfaction level of employees, attract talent, and increase overall wellness within the workforce. Corporate dental plans are highly comprehensive, covering all services related to preventive, basic, and major dental services. They offer a range of benefits including dental exams, cleanings, fillings, crowns, orthodontic treatment, and in some cases, even cover for dental implants.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.8% due to the presence of a well-developed healthcare infrastructure, including advanced dental facilities and highly skilled professionals. In addition, the rising focus on preventive care among individuals is impelling the market growth. The region benefits from widespread employer-sponsored insurance plans and a large population with disposable income to invest in dental care. Government programs aimed at increasing lower-cost health care services added dental benefits within comprehensive insurance plans, and technological advancements and simplifications in dental treatments and insurance processing also aid the growth of the market. Furthermore, consumers are attracted to increasing the number of individuals suffering from oral disorders and the aging population that needs frequent dental care visits, making North America the largest regional segment.

Key Regional Takeaways:

United States Dental Insurance Market Analysis

In 2024, the United States accounted for 91.70% of the North America dental insurance market, driven by increasing awareness among individuals about oral health and the high prevalence of dental issues, such as cavities, gum diseases, and orthodontic requirements. A significant trend is the growing demand for preventive dental care services, including regular cleanings and checkups, which numerous insurance plans now cover comprehensively. In line with this, technological advancements in digital platforms are revolutionizing the dental insurance landscape. Various providers now offer mobile apps and online portals for claims management, policy updates, and customer support, enhancing user convenience and engagement. Apart from this, tele-dentistry is gaining traction as it allows insured individuals to consult dentists remotely. Another notable development is the diversification of insurance products to cater to various demographics. Insurance providers are designing customizable plans for specific groups, such as senior citizens who require more coverage for restorative procedures or young professionals seeking affordable preventive care. In addition, rising costs of dental treatments are also influencing the market, prompting insurers to offer tiered coverage plans. According to the HPI review of CMS national expenditures data, overall health spending in the US grew by 3.8% in 2023, while dental spending increased by 2.5%. These allow customers to balance premium costs with benefits according to their financial capabilities and dental needs. Furthermore, strategic partnerships between insurance companies and dental care networks are expanding access to affordable services through in-network providers.

Asia Pacific Dental Insurance Market Analysis

The rising awareness about oral health, coupled with the increasing healthcare expenditure across the region, is contributing to the market growth. The market is also benefiting from a growing middle-class population, improved access to dental care, and government initiatives to promote oral hygiene and preventive dental services. Employer-sponsored dental insurance plans have also witnessed rapid expansion, mainly in Japan, South Korea, and Singapore. With increasing demand, it can be noticed that there are corporate wellness programs coming in force in this regard. Simultaneously, the increasing popularity of individual dental insurance policies can also be witnessed in emerging economies, such as urban population segments of China and India. Market dynamics are influenced by digital transformation, wherein the usage of technology allows streamlined operations along with a modern customer experience by insurers. Mobile applications, online portals, and telemedicine services are increasingly adopted to allow policyholders the convenience of accessing services on their own, track their claims, and even remotely interact with a dentist. Innovation caters to the requirements of the tech-savvy younger population, reducing challenges in rural areas. The IMARC Group states that the India telemedicine market is expected to reach USD 16.9 Billion by 2032. Apart from this, the rising costs of dental treatments, including orthodontics and cosmetic procedures, are driving demand for insurance coverage. Insurers are introducing tiered and customizable plans to cater to diverse demographics, ranging from basic preventive care to comprehensive coverage for specialized treatments.

Europe Dental Insurance Market Analysis

Individuals in the region are recognizing the long-term benefits of preventive dental care, which is encouraging insurance providers to introduce plans that include routine checkups, cleanings, and other preventive services, reducing the need for costly interventions. In addition, the growing number of dental issues among people in the region is driving the market's expansion. As per the research report, there are over 8700 new cases of mouth cancer reported in the UK each year. In line with this, one of the most significant trends is the increase in the inclusion of dental insurance under comprehensive health coverage, which shows a trend towards an all-inclusive approach to healthcare. Additionally, this is observable in countries that have national health care, such as the United Kingdom and Germany, where supplemental dental policies are becoming more popular, especially for specialized and cosmetic services not covered by public health plans. Further, digitalization is changing the market and insurers are embracing high-end technologies to simplify processes and render them more customer-centric. Online platforms and mobile applications facilitate seamless policy management, claims submission, and dentist appointments, appealing to a wider population. Moreover, customization of dental insurance plans is becoming a key focus, with insurers offering tiered plans tailored to diverse demographic needs. For example, family plans targeting households, pediatric coverage for children, and senior plans addressing age-related dental issues are increasingly common.

Latin America Dental Insurance Market Analysis

The Latin America dental insurance market is experiencing rapid growth attributed to a higher prevalence of dental diseases. More than 90% of Mexicans suffer from dental caries, making it one of the nations with the highest frequency range of oral disorders, according to the National Library of Medicine. In addition, the individuals in the region are gaining more sensitivity towards easy and affordable access to preventive as well as restorative dental health care. Apart from that, modernization in dental treatments and the implementation of digital tools like telemedicine and mobile applications for the management of claims increase the engagement of the users. On the contrary, various initiatives are undertaken by the governing agencies in the region for more healthcare coverage.

Middle East and Africa Dental Insurance Market Analysis

The Middle East and Africa dental insurance market is steadily expanding due to the increasing emphasis on preventive dental care. The need for dental services is driven by urbanization and rising personal incomes. According to the CIA, the urban population in Iran was 77.3% of total population in 2023. Besides this, technological advancements, including digital claim processing and telemedicine, are enhancing customer experiences, making dental insurance more appealing. In line with this, the region's governing bodies are encouraging healthcare coverage through a variety of measures. Insurance companies are using educational initiatives and reasonably priced, personalized plans to cater to each person's particular need.

Competitive Landscape:

Key players are increasing their scope of dental insurance plans in order to accommodate the wide range of requirements and choices of individuals. These may include different types of plans with varying levels of coverage, cost-sharing structures, and provider networks that meet the budgets and preferences of clients. Moreover, insurance companies encourage preventive care by covering comprehensive exams, cleanings, and preventive treatments at little or no cost-sharing. In addition, companies are taking advantage of technology to better the user experience, ease processes, and expand accessibility to dental care services. Examples include online enrollment, claims processing, scheduling, and tele-dentistry, which enables virtual consultation. They partner with dental providers, such as single dentists, dental clinics, and DSOs to grow their provider networks, thereby improving access to dental care services for their plan members.

The report provides a comprehensive analysis of the competitive landscape in the dental insurance market with detailed profiles of all major companies, including:

- Aetna Inc.

- Aflac Inc.

- Allianz Care

- Ameritas Mutual Holding Company

- AXA Health

- Cigna Healthcare

- Delta Dental Plans Association

- HDFC ERGO General Insurance Company Limited

- MetLife Services and Solutions, LLC

- The Guardian Life Insurance Company of America

- United Concordia Companies, Inc.

- United HealthCare Services, Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- September 2024: Delta Dental of California and Teledentistry.com partnered to provide virtual dental care, enabling over 31 million members to access dental providers anytime, especially for urgent needs outside regular hours. This collaboration allows patients to consult licensed dentists via video or photo submissions, receiving treatment recommendations and prescriptions. Additionally, a new photo analysis tool helps identify dental issues early, promoting proactive oral health management. This initiative aims to reduce reliance on emergency rooms and enhance preventive care access nationwide.

- July 2024: Delta Dental of Illinois announced the launch of expanded dental coverage tailored to support individuals with disabilities as part of its Enhanced Benefits Program.

- August 2023: Ameritas announced that it will offer a lifetime deductible at no additional charge to new tailored group dental plans. With this adjustment, members who remain with the same employment after they have met their deductible won't have to worry about doing so again. This new feature is expected to enhance retention rates for both members and policyholders.

- July 2023: Dental Door Corporation ("Dental Door") was founded by Mitsubishi Materials Corporation ("MMC") to offer health insurance operators the cloud-based dental examination service Smart Dental CheckupTM.

Dental Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Major, Basic, Preventive |

| Coverages Covered | Dental Preferred Provider Organizations, Dental Health Maintenance Organizations, Dental Indemnity Plans, Others |

| Demographics Covered | Senior Citizens, Adults, Minors |

| End Users Covered | Individuals, Corporates |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aetna Inc., Aflac Inc., Allianz Care, Ameritas Mutual Holding Company, AXA Health, Cigna Healthcare, Delta Dental Plans Association, HDFC ERGO General Insurance Company Limited, MetLife Services and Solutions, LLC, The Guardian Life Insurance Company of America, United Concordia Companies, Inc., United HealthCare Services, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dental insurance market from 2019-2033.

- The dental insurance market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dental insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dental insurance market was valued at USD 252.45 Billion in 2024.

The dental insurance market is projected to exhibit a CAGR of 6.79% during 2025-2033, reaching a value of USD 486.80 Billion by 2033.

The market is driven by the growing number of senior people, the incidence of dental diseases, the adoption of employer-sponsored dental insurance plans in both developed and developing nations, and increased awareness of oral health.

North America currently dominates the dental insurance market, accounting for a share of 42.8% in 2024. The dominance is fueled by high healthcare spending, widespread dental insurance coverage in the U.S., growing awareness of oral health, and strong consumer demand for comprehensive insurance plans.

Some of the major players in the dental insurance market include Aetna Inc., Aflac Inc., Allianz Care, Ameritas Mutual Holding Company, AXA Health, Cigna Healthcare, Delta Dental Plans Association, HDFC ERGO General Insurance Company Limited, MetLife Services and Solutions, LLC, The Guardian Life Insurance Company of America, United Concordia Companies, Inc., and United HealthCare Services, Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)