Dental Implants Market Size, Share, Trends and Forecast by Material, Product, End Use, and Region, 2025-2033

Dental Implants Market 2024, Size and Share:

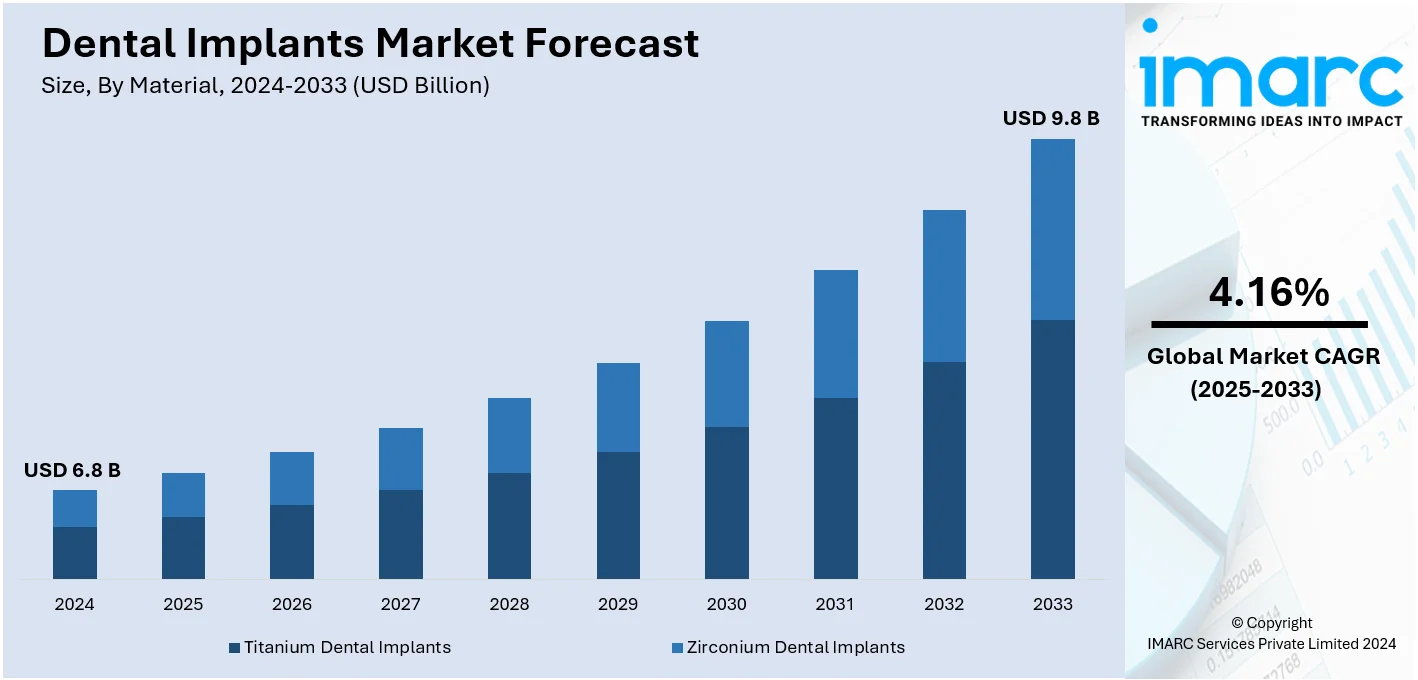

The global dental implants market size was valued at USD 6.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.8 Billion by 2033, exhibiting a CAGR of 4.16% from 2025-2033. North America currently dominates the market, holding a market share of over 36.8% in 2024. This is due to significant advancements in implant technologies, growing awareness about aesthetic dentistry, shifting preference from removable to permanent dental solutions, and growing dental tourism.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 9.8 Billion |

| Market Growth Rate (2025-2033) | 4.16% |

The rapid growth of the dental implants market can be attributed to a increase in the symptoms of dental disorders like tooth-decay and periodontal diseases which creates an impetus to restorative treatment demand. Geriatric patients present more cases for the need for dental implants due to tooth loss for oral functionality. Technology has advanced many things from implant materials through procedures that affected the success rates and outcomes of patients undergoing such treatments. Modern innovations such as 3D imaging combined with computer aided design and computer-aided manufacturing will reportedly streamline the planning and placement process of implants hence making treatment more precise and accessible.

The United States has emerged as a key regional market for dental implants. The dental implants industry in the US is propelled with the increasing awareness regarding oral health, as well as rising incidences in dental diseases such as decay, periodontal disease, and loss of teeth, as met with the availability of prosthetic replacement. An increasing elderly population also increase edentulism and therefore escalate the demand for dental implants, which are very reliable solutions for tooth replacement. Intra-oral implant technology becomes more advanced with the development of 3D printing and computer-aided design (CAD), which allow a more exact tailorization for greater patient satisfaction and a good outcome of treatment. Besides, the increasing acceptance of cosmetic dentistry and aestheticism of dental implants, as well as enhanced disposable income and better insurance coverage facilitating the procedures of dental care, also contribute to the market segment.

Dental Implants Market Trends:

Surging prevalence of dental disorders

The increasing incidence of dental ailments has given an impetus to the market revenue from dental implants. Dental diseases are generally found common among the elderly population, including tooth decay, periodontal disease, and tooth loss. Such diseases significantly affect individuals' oral health in general and quality of life in particular; hence the demand for dental implants increases as a treatment modality. For instance, as reported by WHO in 2023, oral diseases are affecting almost 3.5 billion people worldwide, with almost 3 out of 4 people affected from middle-income countries. The leaving of teeth makes way for long-lasting teeth solutions for their patients and improves both oral function and dental aesthetics beyond. Increased incidence of dental diseases makes a difference in increased demand for dental implants, which is predicted to happen in the future, which will help drive dental implants market growth. For instance, a global strategy was established on oral health by the World Health Assembly in 2022, with the aim of providing universal health coverage for oral health to all individuals by 2030.

Growing awareness about aesthetic dentistry

The increasing penetration of aesthetic dentistry is one of the key factors influencing the dental implants market growth. Patients now seek tooth replacement options that not only restore oral function but also provide a natural-looking smile. For instance, the American Academy of Cosmetic Dentistry (AACD), in 2020, estimated that 96% of female patients chose cosmetic dentistry, and over 70% of these patients were between the ages of 31 and 50. Dental implants offer a unique advantage in this aspect, as they are designed to replicate the color, shape, and contour of natural teeth. The restoration of both oral function and aesthetics through dental implants has become a pivotal factor in patient decision-making. As awareness grows regarding the transformative impact of dental implants on enhancing self-esteem and overall well-being, more individuals are opting for these implants over traditional solutions that may compromise visual appeal. For instance, according to the report published by the National Library of Medicine in 2022, more than 60% of dentists confirmed that they had received inquiries for aesthetic procedures after being influenced by social media trends. This heightened awareness about aesthetic dentistry aligns seamlessly with the market's expansion and underscores the pivotal role of dental implants in meeting evolving patient expectations.

Continuous technological advancements

One of the prominent dental implant market developments includes the advent of novel technologies that led to significant improvements in the design, materials, and techniques used in dental implant procedures, resulting in higher success rates and better patient outcomes. Moreover, the integration of digital technologies, such as 3D imaging, computer-aided design or computer-aided manufacturing (CAD/CAM), and intraoral scanners, are revolutionizing the planning and placement of dental implants. For instance, according to the National Library of Medicine, the 3D imaging system is one of the pillars in the modern era of dentistry and dental application. Furthermore, Cone-Beam Computed Tomography (CBCT) has also come as a one step forward in the diagnostic imaging protocols. These technologies enable more accurate treatment planning, reduced treatment times, and improved aesthetic outcomes. Moreover, for instance, one of the prominent AI-powered solutions that can evaluate 3D dental photos is Diagnocat. It gives AI a new dimension, enhancing the already exceptional diagnostic utility of 3D imaging. Diagnocat uses a CBCT to generate an AI-based report that lists the anatomical regions, typical findings, and past treatments for every single tooth. It also looks for over 65 conditions on CBCT images, including rare pathology, and non-dental findings like sinus and bone structure, as well as 35 conditions in 2D images, bitewings, FMX, panoramic views, etc.

Dental Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dental implants market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on material, product, and end use.

Analysis by Material:

- Titanium Dental Implants

- Zirconium Dental Implants

Titanium dental implants stand as the largest segment in 2024, holding around 92.7% of the market. Titanium dental implants are used extensively due to their biocompatibility, strength, and durability. Titanium can be well treated by the body and integrates with the surrounding bone tissue. Moreover, these dental implants have a high success rate and can last for many years with proper care and maintenance. They are considered a reliable and effective treatment option for replacing missing teeth. For instance, titanium is the material of choice for dental implants because, according to an NCBI research report published in May 2022, it is bioinert and has little to no negative effect on the surrounding tissue.

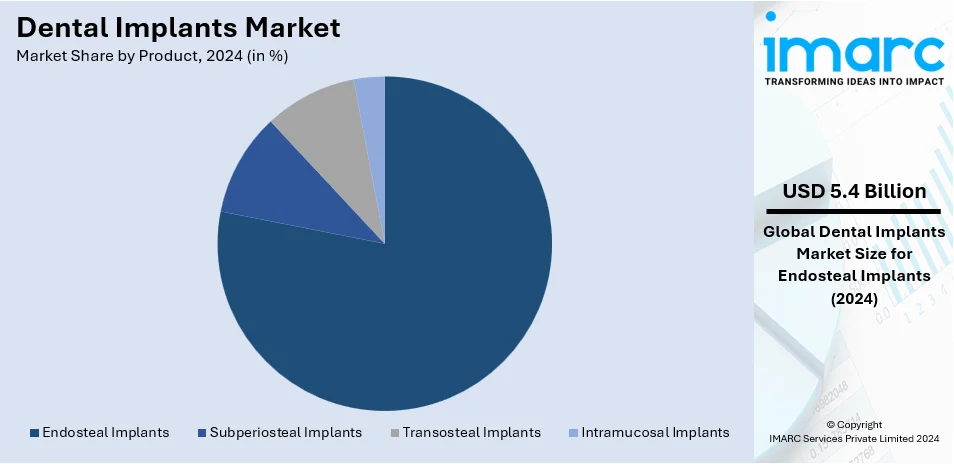

Analysis by Product:

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

- Intramucosal Implants

Endosteal implants leads the market with around 78.8% of dental implants market share in 2024. These implants are designed to be placed directly within the jawbone, offering a secure and stable foundation for artificial teeth. The popularity of endosteal implants can be attributed to their suitability for various clinical scenarios, including single-tooth replacement, multiple-tooth restorations, and even full-mouth rehabilitations. Endosteal implants come in various shapes and sizes, allowing dental professionals to tailor their selection based on individual patient anatomy and oral health conditions. The surgical procedure for placing endosteal implants is well-established and has demonstrated consistently high success rates. Additionally, the ability to use endosteal implants in patients with adequate jawbone density as well as in cases of bone augmentation further contributes to their widespread adoption.

Analysis by End Use:

- Hospitals

- Dental Clinics

- Academic and Research Institutes

- Others

Hospitals dominate the market as they offer a controlled environment with cutting-edge technologies required for complex dental implant procedures. This setting allows for thorough preoperative evaluations, precise surgical interventions, and postoperative care, ensuring optimal patient outcomes. Dental implant procedures often require coordination among various medical disciplines, and hospitals offer a multidisciplinary approach that can address any potential complications or medical considerations.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America leads the market with 36.8% share. According to the dental implants market statistics, various factors, including advanced healthcare infrastructures, the growing disposable income levels, the rising awareness towards aesthetic dentistry, and the presence of market players, are positively influencing the market growth. Additionally, countries across Europe have well-regulated healthcare systems that promote patient access to quality dental care, including implant procedures, which is further propelling the market demand. Besides this, the expanding dental care infrastructure, especially in countries like China and India, contributes to the market growth in the Asia Pacific.

Key Regional Takeaways:

United States Dental Implants Market Analysis

The increasing prevalence of oral health problems, including oral disease, tooth decay, and injuries, is fuelling the demand for dental implants. For instance, the United States faces USD 45 Billion in annual productivity losses and 37 Million missed school hours due to untreated oral disease, driving demand for dental implants as a one of the solution. These dental implants offer a durable and aesthetically pleasing solution for replacing missing teeth, restoring functionality, and enhancing overall dental health. Their ability to provide a long-lasting and natural-looking alternative to traditional dentures has made them increasingly popular. Additionally, the growing awareness about oral hygiene, coupled with advancements in implant materials and techniques, is further driving their adoption. As more individuals prioritize oral health and aesthetics, the appeal of implants as a reliable and effective solution continues to rise. The availability of advanced procedures and growing acceptance among patients are accelerating this trend, reflecting an increasing focus on improving quality of life through enhanced oral care solutions.

Asia Pacific Dental Implants Market Analysis

The rapid growth of healthcare systems and the rising accessibility of advanced medical technologies are creating a conducive environment for the adoption of dental implants. For instance, healthcare investments reached USD 5.33 Billion across 57 deals in the first 11 months of 2024, reflecting a 14% decline from 2023's USD 6.26 Billion. Rising funding in the sector supports advancements in dental implant services, enhancing accessibility and innovation. This growth is complemented by increasing investments in research and development, leading to innovations that make implant procedures more efficient and minimally invasive. With improving access to trained professionals and modern treatment facilities, the appeal of implants as a reliable choice for tooth replacement is on the rise. Furthermore, increasing health awareness and the willingness to invest in restorative treatments contribute to expanding the demand. As healthcare services evolve and offer specialized care, the integration of advanced oral solutions like implants continues to gain momentum among patients seeking effective, long-term outcomes.

Europe Dental Implants Market Analysis

The increase in gum-related issues and dental decay is leading to a growing need for restorative solutions. For instance, rising cases of gum disease in the UK is driving an increase in tooth loss and decay, creating higher demand for dental implants. Currently gum disease affecting 42% of the population, this figure is projected to rise to 54% by 2050. This trend highlights the growing importance of advanced dental solutions. Dental implants are emerging as a crucial option for those impacted by oral health challenges. Dental implants, known for their ability to replace missing or damaged teeth effectively, are gaining traction among individuals suffering from chronic dental conditions. These implants not only improve oral function but also provide a cosmetic advantage, encouraging patients to choose them over other options. Advances in implantology have further improved success rates, making this treatment method more reliable and appealing. The focus on preventive dental care and the availability of modern implant technologies are significantly contributing to this rising demand.

Latin America Dental Implants Market Analysis

Higher disposable incomes are enabling individuals to spend more on advanced dental treatments, including implants. For instance, disposable income in Latin America is anticipated to grow by 60% from 2021 to 2040, driven by technological advancements, reduced regional differences and a shift to higher value-added sectors. As affordability increases, more people are prioritizing their oral health, leading to greater adoption of durable and aesthetically pleasing implant solutions. These implants are perceived as a valuable investment due to their long-lasting benefits, which include improved confidence and enhanced quality of life. The shift toward premium dental care services highlights the growing preference for treatments that provide both functional and cosmetic advantages.

Middle East and Africa Dental Implants Market Analysis

Development in infrastructure, particularly in healthcare facilities, is broadening the accessibility of dental implants. According to Dubai Healthcare City Authority report, Dubai’s healthcare sector is expanding rapidly, with 4,482 private medical facilities, 56 hospitals, and over 55,000 licensed professionals reported in 2022. The Dubai Health Authority forecasts a 10-15% increase in medical professionals and 3-6% growth in facilities, fostering improved access to dental care. This expansion is driving higher adoption rates for dental implants in the region. Improved availability of modern clinics equipped with advanced dental technologies ensures that patients can easily access high-quality implant services. As healthcare systems expand and become more patient-centric, individuals are increasingly opting for implants as a reliable solution for dental restoration. The emphasis on upgrading medical infrastructure is not only improving the overall healthcare experience but also creating opportunities for the adoption of innovative dental treatments.

Competitive Landscape:

Key players in the dental implants market are employing strategic initiatives to strengthen their market position. These include product innovation, mergers and acquisitions, and expansion into emerging markets. Companies are leveraging advancements in materials science and 3D printing technology to develop implants with superior durability, biocompatibility, and customization capabilities. Additionally, partnerships with dental clinics and training programs for professionals are helping enhance product adoption. Mergers and acquisitions remain a critical strategy, allowing companies to broaden their portfolios and geographical reach. For instance, acquisitions of regional manufacturers or distributors help penetrate untapped markets and gain competitive advantages. Moreover, many firms are investing in digital dentistry solutions, including CAD/CAM systems, to streamline procedures and improve patient outcomes.

The report provides a comprehensive analysis of the competitive landscape in the dental implants market with detailed profiles of all major companies, including:

- Bicon LLC

- Biohorizons Implant Systems Inc.

- Dentium Co. Ltd.

- Dentsply Sirona

- KYOCERA Corporation

- Nobel Biocare Services AG (Envista Holdings Corporation)

- Osstem Implant Co. Ltd.

- Straumann Group

- T-Plus Implant Tech. Co. Ltd.

- ZimVie Inc.

Latest News and Developments:

- December 2024: Pure Dental Health, has unveiled advanced All-on-X dental implants, now featuring zygomatic and pterygoid options. These innovative solutions address severe bone loss and complex dental cases, offering permanent, natural-looking results. Based in Atlanta, the clinic empowers patients with cutting-edge full-arch dental restoration. This development marks a significant advancement in dental implant technology. Patients can now access transformative care for improved oral health and aesthetics.

- December 2024: Beast Philanthropy and Nuvia Dental Implant Center have donated USD 1 Million in free dental implants, transforming smiles nationwide. Patients at seven Nuvia locations received permanent teeth within 24 hours, restoring confidence and oral health. This initiative highlights the commitment to improving lives through accessible dental care.

- December 2024: The Royal College of Surgeons of Edinburgh has introduced the Membership in Implant Dentistry to enhance global standards. Following successful launches in Edinburgh and Dubai in 2024, the program expands to Malaysia in 2025. This initiative aims to elevate professional excellence in implant dentistry. Further details about the examination are outlined in the article.

- October 2024: Emirates Health Services (EHS) has provided dental implant services to 813 patients in 2024, a notable rise from 110 in 2020. This growth reflects EHS’ focus on innovative healthcare and improving quality of life. The initiative supports the National Strategy for Wellbeing 2031 and aligns with UAE’s future healthcare goals. Dr. Essam Al Zarooni highlighted the leadership’s role in advancing these services.

- November 2024: North Vancouver's Aqua Dental Centre is revolutionizing oral care with advanced 3D-guided dental implant technology. The clinic introduces precision-driven procedures for faster healing and natural results. Led by implant specialist Dr. Zee Somji, Aqua Dental pairs cutting-edge techniques with personalized care. The innovative "Smile Restoration Guarantee" program further enhances patient confidence. This marks a new chapter in transformative dental solutions for North Vancouver residents.

Dental Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Titanium Dental Implants, Zirconium Dental Implants |

| Products Covered | Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants |

| End-Uses Covered | Hospitals, Dental Clinics, Academic and Research Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Bicon LLC, Biohorizons Implant Systems Inc., Dentium Co. Ltd., Dentsply Sirona, KYOCERA Corporation, Nobel Biocare Services AG (Envista Holdings Corporation), Osstem Implant. Co. Ltd., Straumann Group, T-Plus Implant Tech. Co. Ltd., ZimVie Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dental implants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dental implants market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dental implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Dental implants are artificial tooth roots made from biocompatible materials, such as titanium or zirconia, that are surgically placed into the jawbone to support replacement teeth. They serve as a stable foundation for fixed or removable prosthetic teeth, such as crowns, bridges, or dentures. Dental implants are commonly used to replace missing teeth caused by injury, decay, or disease. They offer a long-lasting solution compared to traditional options like dentures and bridges, providing benefits such as improved oral health, aesthetics, and functionality. Proper oral hygiene and regular dental checkups are essential for maintaining the success of dental implants.

The dental implants market was valued at USD 6.8 Billion in 2024.

IMARC estimates the global dental implants market to exhibit a CAGR of 4.16% during 2025-2033.

Significant advancements in implant technologies, growing awareness about aesthetic dentistry, shifting preference from removable to permanent dental solutions, and growing dental tourism are some of the major factors propelling the market.

In 2024, titanium dental implants represented the largest segment due to their biocompatibility, strength, and durability.

Endosteal implants leads the market due to their suitability for various clinical scenarios, including single-tooth replacement, multiple-tooth restorations.

Hospitals are the leading segment as they offer a controlled environment with cutting-edge technologies required for complex dental implant procedures.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global dental implants market include Bicon LLC, Biohorizons Implant Systems Inc., Dentium Co. Ltd., Dentsply Sirona, KYOCERA Corporation, Nobel Biocare Services AG (Envista Holdings Corporation), Osstem Implant. Co. Ltd., Straumann Group, T-Plus, Implant Tech. Co. Ltd., ZimVie Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)