Dental Imaging Market Size, Share, Trends and Forecast by Technology, Method, Application, End User, and Region, 2025-2033

Dental Imaging Market Size and Share:

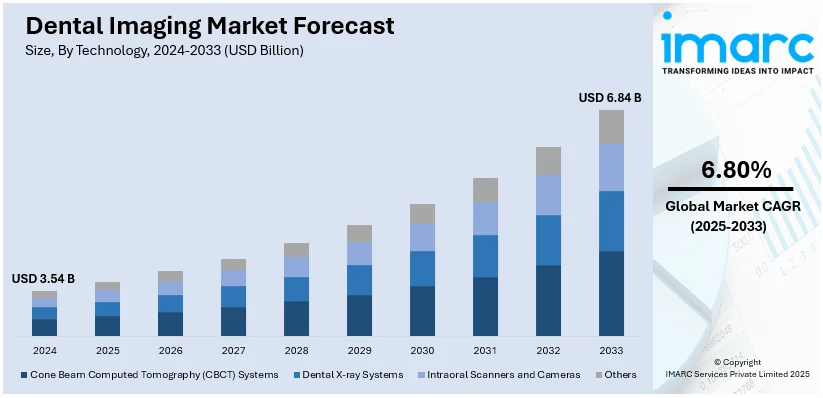

The global dental imaging market size was valued at USD 3.54 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.84 Billion by 2033, exhibiting a CAGR of 6.80% from 2025-2033. North America currently dominates the market. The report discusses the anticipated growth of the market driven by a growing demand for cosmetic dentistry and technological advancements in dental solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.54 Billion |

|

Market Forecast in 2033

|

USD 6.84 Billion |

| Market Growth Rate 2025-2033 | 6.80% |

One major driver of the dental imaging market is the growing demand for accurate diagnosis and treatment planning. As dental procedures become more complex, the need for precise imaging technology is critical for successful outcomes. Advanced dental imaging solutions, such as three-dimensional (3D) imaging and cone beam computed tomography (CBCT), offer detailed views of teeth, bones, and soft tissues, enabling dental professionals to diagnose issues earlier and plan treatments more effectively. This enhances patient care and reduces the risk of complications. The rising awareness of oral health and advancements in imaging technologies are fueling the demand for these solutions globally.

The United States represents a significant market for dental imaging, bolstered by its advanced healthcare infrastructure and increasing adoption of innovative technologies like 3D imaging, CBCT, and digital X-rays. However, approximately 57 million Americans live in dental health professional shortage areas, with 67% of these areas located in rural communities. This creates a demand for more accessible and efficient diagnostic solutions. The U.S. market benefits from favorable reimbursement policies, aiding the adoption of cutting-edge dental technologies. Major companies like Carestream Dental and Dentsply Sirona are expanding their presence, driving growth and addressing the rising prevalence of dental diseases across the nation.

Dental Imaging Market Trends:

Advanced 3D imaging technologies:

The growing shift from traditional 2D X-rays to advanced 3D imaging technologies is expanding the dental imaging market. Offering detailed views of dental structures, bones, and soft tissues, 3D imaging is critical for complex procedures such as orthodontics, implant placement, and oral surgeries. In May 2024, Detection Technology, a global leader in X-ray detector solutions, launched IGZO-TFT flat panel detectors (FPDs) to enhance dental imaging capabilities. These innovations include panoramic imaging, the X-Panel 1717z FDM for cone beam computed tomography (CBCT), and the X-Panel 3030z FDM-TG-X, providing superior imaging solutions for dental professionals and contributing to the market's growth trajectory.

Growing popularity of digitalization

The emerging trend of digital dentistry is another significant trend, with more dental practices integrating their imaging systems with practice management software. According to McKinsey, healthcare digitalization, driven by AI, traditional machine learning, and deep learning, is projected to generate up to USD 360 Billion in net savings, revolutionizing the industry. This integration allows for better patient record management, seamless data transfer, and more efficient workflows. In May 2024, DEXIS introduced a dental intraoral sensor, the DEXIS Ti2 Sensor. The DEXIS digital ecosystem is a comprehensive, AI-powered platform for dental imaging designed to streamline and connect digital workflows for enhanced productivity. This is elevating the dental imaging market size.

Increasing focus on handheld imaging devices

The growing demand for convenience and flexibility in various clinical settings is driving the dental imaging market. Portable imaging solutions are especially advantageous for mobile or remote dental clinics, where traditional equipment may be impractical. These technologies enhance accessibility and efficiency, meeting the unique needs of underserved areas. In January 2024, Calcivis introduced its innovative preventive dental technology in the United States, showcasing advancements aimed at early dental care. The company also submitted a PMA supplement to the FDA, incorporating improvements into its imaging system. These enhancements reflect the industry's focus on combining mobility with advanced technology, supporting better patient outcomes and expanding the adoption of dental imaging solutions in diverse clinical environments.

Dental Imaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dental imaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, method, application and end user.

Analysis by Technology:

- Cone Beam Computed Tomography (CBCT) Systems

- 2D

- 3D

- Dental X-ray Systems

- Analog

- Digital

- Intraoral Scanners and Cameras

- Others

Cone beam computed tomography (CBCT) systems as the largest component in 2024, as technology provides detailed, 3D imaging of dental structures, including teeth, soft tissues, and bone, which is crucial for complex procedures like implant placements, orthodontics, and oral surgeries. Unlike traditional 2D X-rays, CBCT offers higher accuracy and a clearer view, reducing the risk of errors and improving treatment planning. The increasing demand for precise diagnostics, along with advancements in CBCT technology that offer lower radiation doses and faster imaging, contributes significantly to its dominance in the market. This makes CBCT a preferred choice among dental professionals globally.

Analysis by Method:

- Intraoral

- Extraoral

Intraoral leads the market in 2024 due to their widespread use, cost-effectiveness, and efficiency. These systems capture high-resolution images of teeth and surrounding tissues, thus providing dental professionals a detailed view for accurate diagnoses and proper treatment planning. Intraoral X-rays are regarded as vital for routine dental exams for the early identification of cavities, infections, among other dental conditions. Thus, an increased preference for digital intraoral imaging systems due to faster output, high-quality images compared to the traditional film-based X-rays, and significantly reduced exposure to radiation helped in boosting their market strength. Moreover, the ease of use, compact design, and affordability of intraoral devices make them highly accessible for both private practices and dental clinics, further cementing their leadership in the market.

Analysis by Application:

- Implantology

- Endodontics

- Oral and Maxillofacial Surgery

- Orthodontics

- Others

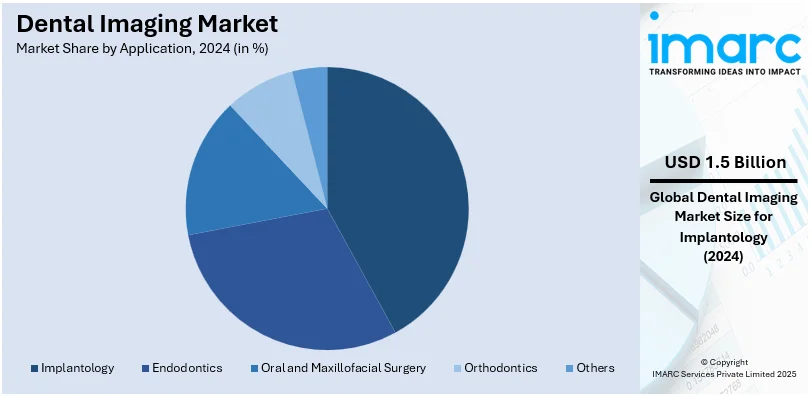

In 2024, implantology accounts for the majority of the market, driven by the increasing demand for dental implants and advanced imaging technologies that support implant procedures. Dental implants require precise planning and positioning, making accurate imaging essential for ensuring successful outcomes. Cone Beam Computed Tomography (CBCT) and 3D imaging technologies are widely used in implantology to obtain detailed, three-dimensional views of bone structures, teeth, and soft tissues. This helps dental professionals assess bone density, plan implant placement, and minimize complications. With the rising prevalence of edentulism, an aging population, and growing awareness of dental aesthetics, implantology is a key driver of market growth in 2024.

Analysis by End User:

- Dental Hospitals and Clinics

- Dental Diagnostic Centers

- Dental Academic and Research Institutes

Dental hospitals and clinics represented the leading market segment, as these healthcare facilities are the primary settings for dental imaging, where advanced technologies like Cone Beam Computed Tomography (CBCT) and intraoral X-rays are widely used for diagnostics and treatment planning. The demand for precise imaging solutions is particularly high in dental hospitals and clinics due to the increasing prevalence of dental procedures, including implants, orthodontics, and oral surgeries. Moreover, these facilities benefit from a higher volume of patients, enabling them to invest in state-of-the-art imaging systems. The growing number of dental practices and the rising focus on oral health further contribute to the dominance of dental hospitals and clinics in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share driven by advanced healthcare infrastructure, high adoption of innovative technologies, and increasing awareness of oral health. The region's strong focus on preventive dental care, coupled with a high prevalence of dental disorders, has boosted the demand for advanced imaging solutions. Favorable reimbursement policies and the presence of key market players such as Envista Holdings Corporation and Dentsply Sirona further strengthen the market. Additionally, the growing trend of digitalization in dental practices and advancements in 3D imaging technologies contribute significantly to market growth. Continuous product launches, regulatory approvals, and investments in research and development further solidify North America's leading position in the dental imaging sector.

Key Regional Takeaways:

United States Dental Imaging Market Analysis

The adoption of dental imaging has been significantly increasing in the United States, driven by substantial investments in the healthcare sector. According to reports, US healthcare companies in 2024, reporting at least USD 15 million in venture capital deals have reported flat or down rounds; however, rising health care investment continues to push the envelope for developments in dental imaging, with high precision in diagnostics and improved treatment. Advances in new technologies and improving infrastructure have seen more high-end medical equipment, of which dental imaging systems take the forefront. With health care now becoming a priority, investments in the private and public sectors are trying to improve the quality of services, better patient outcomes, and more importantly access the latest treatments. This increase in healthcare investment has thus created a favorable environment for dental imaging technology, giving opportunities for dentists and healthcare providers to use digital solutions for diagnosis, treatment planning, and monitoring. The government initiatives for technological development in healthcare have also enhanced the accessibility of high-quality dental imaging equipment, hence enhancing the dental care landscape as a whole. With the increased integration of these technologies, the adoption rate continues to rise, improving patient satisfaction and the efficiency of dental procedures across the nation.

Europe Dental Imaging Market Analysis

In Europe, a rising prevalence of dental issues has significantly contributed to the increased adoption of dental imaging technologies. For instance, over 50% of the European population may suffer from periodontitis, with over 10% facing severe cases, driving the growing demand for advanced dental imaging technologies to address increasing dental health concerns. As the population ages, the incidence of dental problems such as cavities, gum diseases, and oral cancers has escalated, prompting an increased demand for advanced diagnostic tools. Dental imaging plays a crucial role in diagnosing these issues at early stages, allowing for timely intervention and more effective treatment. With the growing awareness of oral health, dental professionals are turning to digital imaging systems to enhance their diagnostic capabilities and improve treatment outcomes. Moreover, the increased focus on preventive care and the integration of dental imaging in routine check-ups have fueled the demand for more advanced imaging technologies. This shift toward more precise diagnostic tools is not only improving patient care but also boosting the overall adoption of dental imaging in the region. As the healthcare sector focuses on providing efficient and high-quality services, the expansion of dental imaging technology continues to grow in response to these evolving demands.

Asia Pacific Dental Imaging Market Analysis

In the Asia-Pacific region, digitalization in healthcare trends have been on the upsurge. This has ensured the adoption of dental imaging in the region. Significantly, the highest is that of India, at 76% for health professionals, using digital health technologies in oral care, leading to great improvements in dental imaging-in accuracy, speed, and quality care for the patient. There have been easier adoptions by the dental clinics and hospitals through rapid transition into more digitally orientated healthcare systems. This, in turn, increases the accuracy and speed of diagnoses, and saves time that would have otherwise been wasted in image processing. With the development of electronic health records, cloud storage, and telemedicine solutions, this makes it possible to maintain an easy dental imaging system in healthcare settings. Better access to electronic healthcare solutions nowadays puts dental specialists in the most advanced imaging tools available. In turn, these advance imaging tools ensure quality care for patients. More than that, digitalization brings equipment to the reach of more people with their decreasing prices, and the region is seeing widespread use of dental imaging equipment.

Latin America Dental Imaging Market Analysis

In Latin America, the growing private healthcare sector has been a driving force behind the rising adoption of dental imaging technology. According to International Trade Administration, Brazil, the largest healthcare market in Latin America, allocates 9.47% of its GDP (USD161 Billion) to healthcare, with 62% of its 7,191 hospitals being private, driving advancements in dental imaging through increased investment and innovation. With the expansion of private healthcare facilities offering advanced medical services, there is a noticeable push towards the inclusion of modern diagnostic tools, including dental imaging systems. These private institutions are increasingly investing in the latest technologies to meet patient expectations and enhance their competitive edge. As dental care becomes a priority among the growing middle class, dental imaging offers the precision and efficiency needed for effective diagnosis and treatment. The increasing number of private healthcare providers adopting advanced imaging equipment reflects the rising demand for higher-quality dental care. This growing market has encouraged the integration of dental imaging systems, ensuring that both practitioners and patients benefit from improved diagnosis and treatment plans.

Middle East and Africa Dental Imaging Market Analysis

In the Middle East and Africa, the expansion of healthcare facilities is a key factor driving the adoption of dental imaging technology. According to Dubai Healthcare City Authority report, by 2022, Dubai saw 4,482 private medical facilities and 55,208 licensed professionals, with the Dubai Health Authority projecting a 10-15% growth in professionals and 3-6% in facilities, fostering increased adoption of dental imaging technologies. As healthcare infrastructure continues to develop in both regions, there is a growing emphasis on modern medical equipment to ensure quality care. Dental imaging has become essential for accurate diagnostics, treatment planning, and patient monitoring. With increased investment in healthcare facilities, both public and private institutions are increasingly incorporating advanced imaging technologies into their dental practices. This expansion of facilities, particularly in urban areas, has made high-quality dental imaging equipment more accessible. As the healthcare landscape continues to evolve, the adoption of dental imaging is expected to increase, further enhancing the quality and efficiency of dental care in the region.

Competitive Landscape:

The dental imaging market is highly competitive, with key players focusing on technological advancements and strategic collaborations to strengthen their market presence. Major companies dominate the market with extensive product portfolios and global distribution networks. These players emphasize innovations like three-dimensional (3D) imaging systems, CBCT, and digital X-ray solutions to meet evolving customer needs. Emerging companies are contributing through niche innovations such as preventive dental technologies and advanced flat panel detectors. Strategic initiatives, including mergers, acquisitions, and FDA approvals for new products, further intensify competition, enabling companies to cater to a diverse range of clinical and patient requirements.

The report provides a comprehensive analysis of the competitive landscape in the dental imaging market with detailed profiles of all major companies, including:

- Acteon Group

- Align Technology

- Carestream Health

- Cefla s.c.

- Dentsply Sirona

- Flow Dental

- Genoray Co.Ltd.

- Midmark Corporation

- Owandy Radiology

- Planmeca Oy

- The Yoshida Dental Mfg. Co. Ltd.

- Vatech

Latest News and Developments:

- In December 2024: Medit launched the MEDIT M mobile app, designed to revolutionize digital dental workflows. The app introduces key features requested by dental professionals, enhancing collaboration and efficiency between clinics and labs. With advanced dental imaging capabilities, MEDIT M aims to streamline processes and improve overall patient care. This launch marks a significant step forward in digital dental technology.

- In July 2024: Pearl partnered with Ora to integrate its advanced AI dental imaging technology into Ora’s all-in-one cloud-based dental practice management platform. The integration includes Pearl’s Second Opinion® disease detection capabilities, enhancing Ora’s dental imaging features. This collaboration aims to streamline dental operations and improve patient care by offering comprehensive tools such as EHR management, patient scheduling, and automated reminders within a unified platform.

- In May 2024: Detection Technology, a global leader in X-ray detector solutions, introduced its indium gallium zinc oxide thin-film transistor (IGZO-TFT) flat panel detectors (FPD) for dental imaging. This innovative technology aims to enhance image clarity and precision, allowing for more accurate diagnostics. The IGZO-TFT FPD is designed to improve the quality of dental X-rays while reducing exposure to radiation. This advancement positions Detection Technology as a key player in the evolution of dental imaging solutions.

- In May 2024: DEXIS unveiled its new DEXIS Ti2 Sensor, a cutting-edge intraoral sensor designed to optimize dental imaging. Featuring AI-powered capabilities, the sensor streamlines digital workflows, offering a more efficient approach to dental diagnostics. The Ti2 Sensor aims to enhance productivity by automating several aspects of the imaging process, ultimately improving patient care. With its intuitive design and advanced technology, the DEXIS Ti2 Sensor sets a new standard for digital dentistry.

- In January 2024: Calcivis is an innovative preventive dental technology company that aims to detect early enamel demineralization in the U.S. The firm submitted a PMA supplement with the FDA for enhancements to the imaging system already in place for accuracy and functionality. It is known to help dentists monitor their patients' health in real time, making it easier to know which areas might decay before the damage appears. This is a significant step for preventive dental care, enabling the professionals to intervene early in the process and preserve oral health.

Dental Imaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Methods Covered | Intraoral, Extraoral |

| Applications Covered | Implantology, Endodontics, Oral and Maxillofacial Surgery, Orthodontics, Others |

| End Users Covered | Dental Hospitals and Clinics, Dental Diagnostic Centers, Dental Academic and Research Institutes |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acteon Group, Align Technology, Carestream Health, Cefla s.c., Dentsply Sirona, Flow Dental, Genoray Co.Ltd., Midmark Corporation, Owandy Radiology, Planmeca Oy, The Yoshida Dental Mfg. Co. Ltd., Vatech., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dental imaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dental imaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dental imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global dental imaging market was valued at USD 3.54 Billion in 2024.

IMARC Group estimates the market to reach USD 6.84 Billion by 2033, exhibiting a CAGR of 6.80% from 2025-2033.

Key factors driving the global dental imaging market include advancements in 3D imaging technologies, increasing demand for accurate diagnosis and treatment planning, and the rising prevalence of dental disorders. Additionally, growing adoption of portable imaging solutions in remote clinics and continuous innovations by manufacturers are fueling market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global dental imaging market include Acteon Group, Align Technology, Carestream Health, Cefla s.c., Dentsply Sirona, Flow Dental, Genoray Co.Ltd., Midmark Corporation, Owandy Radiology, Planmeca Oy, The Yoshida Dental Mfg. Co. Ltd., Vatech., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)