Dental Cement Market Size, Share, Trends and Forecast by Product, Material, Application, End User, and Region, 2025-2033

Dental Cement Market Size and Share:

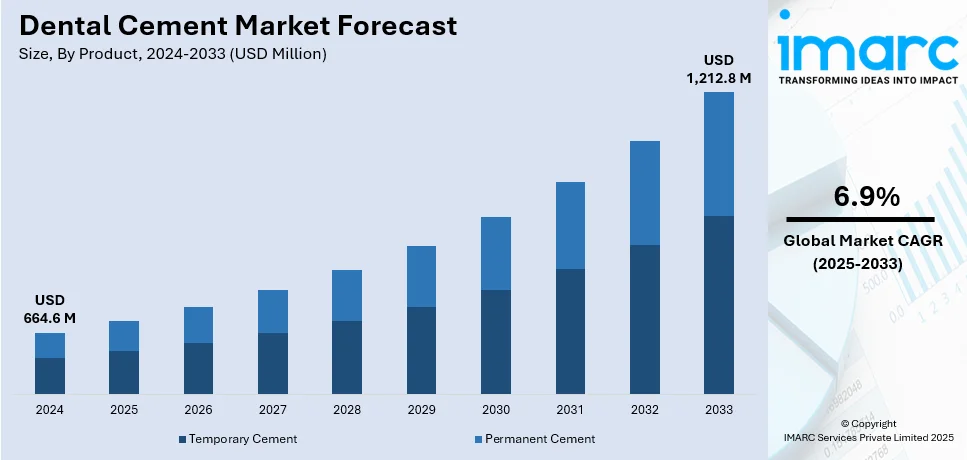

The global dental cement market size was valued at USD 664.6 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,212.8 Million by 2033, exhibiting a CAGR of 6.9% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.5% in 2024. The global market is expanding due to the rising prevalence of dental disorders, advancements in cement technology enhancing product quality, and the growing popularity of cosmetic dentistry, which collectively drive the demand for innovative and effective dental cementing solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 664.6 Million |

|

Market Forecast in 2033

|

USD 1,212.8 Million |

| Market Growth Rate (2025-2033) | 6.9% |

Key drivers for the dental cement market are increasing dental disorders including cavities and periodontal diseases and the growing geriatric population around the world. According to the data published by the World Health Organization (WHO), By 2050, the global population aged 60 and over will rise from 1 billion in 2020 to 2.1 billion. Those aged 80 and older will triple to 426 million highlighting the rapid pace of population aging worldwide. The rising awareness of oral hygiene and the demand for advanced dental procedures also add to the dental cement market demand. Technological advancements in dental materials such as better adhesion, aesthetics and biocompatibility are further fueling the market. The widespread adoption of cosmetic dentistry and more number of dental clinics and professionals are facilitating the demand in the global market.

The key drivers in the United States dental cement market are the increasing prevalence of dental caries and other oral health issues driven by changing dietary habits and an aging population. A Centers for Disease Control and Prevention report divulges that 11% of children aged 2–5 and 18% of those aged 6–8 have untreated tooth decay. Among 6–9-year-olds, 17% have untreated cavities with higher rates in high poverty (26.3%) and Mexican American groups (70.3%). For adults 21% aged 20–64 have untreated decay. The rising demand for cosmetic dentistry procedures driven by aesthetic awareness further supports market growth. Technological advancements in dental materials offering enhanced durability and ease of application are also contributing significantly. The growing dental care spending, favorable insurance coverage and the availability of a well-developed healthcare infrastructure are further driving the market growth.

Dental Cement Market Trends:

Increasing prevalence of dental disorders

One of the primary factors fueling the market for cements used in dentistry is the growing incidence of dental conditions such as cavities, periodontal diseases, and tooth decay. The WHO Global Oral Health Status Report (2022) estimated that nearly 3.5 billion people around the world are affected by oral diseases with 75% of those individuals residing in middle-income countries. Approximately 2 billion people are estimated to be suffering from caries in their permanent teeth while 514 million children have caries in their primary teeth. This rise is attributed to changing dietary habits, increased consumption of sugary foods and beverages and aging populations more susceptible to dental issues. As these materials are essential for restorative procedures including fillings and crowns the rising need for dental restoration treatments directly impacts the demand for high-quality cementing agents. The growing awareness about oral hygiene and regular dental check-ups contributes to the frequent detection and treatment of dental ailments thereby influencing the market positively.

Technological advancements in dental materials

The market is experiencing growth driven by significant advancements in the composition and properties of materials used in dental procedures. In 2022, more than 64% of adults attended at least one dental check-up or cleaning. The American Dental Association (ADA) advises scheduling a dental exam and cleaning annually with twice-yearly visits being even more beneficial. Modern cements offer enhanced aesthetic appeal, superior bonding strength and improved durability making them ideal for a variety of dental restorations. Innovations in material science have led to the development of bioactive cements with properties such as moisture tolerance and antimicrobial activity which not only provide better clinical outcomes but also improve patient comfort and satisfaction. This also represents one of the key dental cement market trends across the globe. Furthermore, this continuous evolution in product quality and functionality encourages dentists to opt for advanced products thus expanding the market reach.

Growing cosmetic dentistry trends

The increasing focus on aesthetic dentistry is another critical driver of the market. As more individuals seek cosmetic dental procedures like veneers, implants, and cosmetic fillings to improve dental appearance the demand for specialized cements that offer aesthetic compatibility with natural teeth has risen. These materials are integral to ensuring the longevity and visual appeal of cosmetic dental work. According to industry reports, India's gross national disposable income grew by 8.9% in FY24 and 14.5% in FY23. This rising disposable income and the desire for better aesthetic appearance fuel the expansion of cosmetic dentistry thereby indirectly providing a boost to the demand for advanced cementing agents used in these procedures.

Dental Cement Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dental cement market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, material, application, and end user.

Analysis by Product:

- Temporary Cement

- Permanent Cement

Permanent cement stand as the largest component in 2024, holding around 83.3% of the market. Permanent cement is crucial in dental treatments offering long-term solutions for restorations and prosthetics. Its high durability and strength are key factors driving its demand especially in procedures like crowns and bridges. The rise in cosmetic dentistry where long-lasting results are desired significantly contributes to the dental cement market growth. Furthermore, advancements in cement technology improving biocompatibility and reducing post-operative complications enhance its appeal.

Analysis by Material:

- Glass Ionomer

- Zinc Oxide Eugenol

- Zinc Phosphate

- Polycarboxylate

- Composite Resin

- Others

Composite resin leads the market with around 27.2% of market share in 2024. Composite resin dominates the dental cement market because of its superior aesthetic and functional properties. It offers high strength excellent adhesion to tooth structures and the ability to match natural tooth color which makes it highly suitable for restorative and cosmetic dentistry. The versatility of applications such as crowns, veneers, and inlays further enhances its demand. It has lower polymerization shrinkage and improved durability than traditional materials. Advances in nanotechnology have enhanced its mechanical properties which has increased its acceptance among dental professionals. The preference of patients for minimally invasive procedures and natural-looking results has driven the dominance of composite resin in the market.

Analysis by Application:

- Pulpal Protection

- Luting

- Restorations

- Surgical Dressing

Luting leads the market with around 36.0% of dental cement market share in 2024. Luting agents are essential in dental prosthetics securing crowns, bridges, and other fixtures. Their critical role in ensuring the longevity and stability of dental restorations drives their market demand. The increasing number of dental prosthetic procedures globally fueled by rising dental disorders and cosmetic dentistry trends significantly contributes to the market growth. Advancements in luting agent formulations improving their bonding strength and ease of use are key market drivers. The rising focus on aesthetic outcomes in dentistry also underscores the importance of high-quality luting agents. The growing geriatric population needing more frequent dental restorations further bolsters the market. The expansion of dental healthcare infrastructure globally facilitating access to advanced dental treatments enhances the market for luting agents.

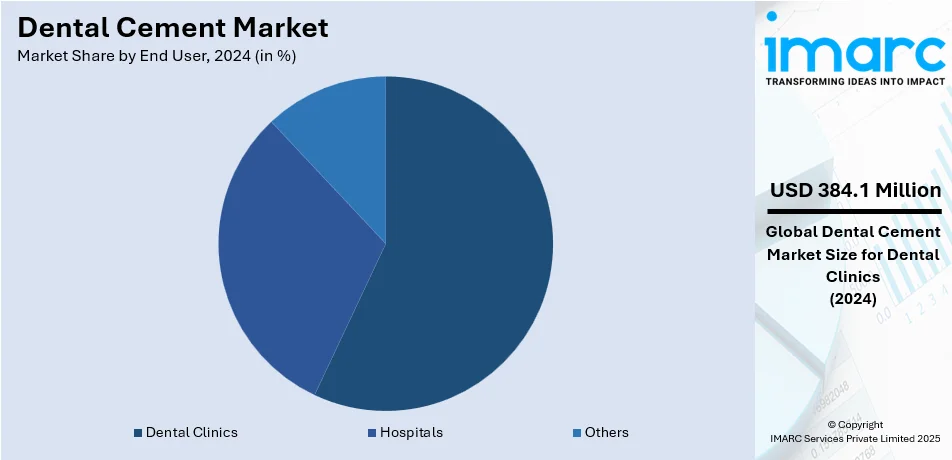

Analysis by End User:

- Hospitals

- Dental Clinics

- Others

Dental clinics leads the market with around 57.8% of market share in 2024. Dental clinics, being more specialized and accessible for routine dental care play a crucial role in the dental cement market. Their focus on specific dental treatments like restorations and cosmetic procedures drives the demand for specialized cements. The increasing number of dental clinics globally especially in urban areas contributes to market growth. However, their market share is somewhat limited compared to larger healthcare facilities like hospitals. The ongoing trend of private dental practices and boutique dental clinics also influences the market catering to specific patient demographics.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.5%. North America leads the market for dental cements driven by its advanced healthcare system and high emphasis on dental health. The region's significant investment in dental care infrastructure coupled with a high rate of dental disorders substantially contributes to market growth. The strong presence of leading dental material manufacturers and their continuous R&D efforts in the region underpin market expansion. The growing popularity of cosmetic dentistry and the increasing demand for aesthetic dental treatments significantly influence market dynamics. These factors create a positive dental cement market outlook across the region.

Key Regional Takeaways:

United States Dental Cement Market Analysis

In 2024, the United States captured 87.30% of revenue in the North American market. The prevalence of oral diseases such as tooth decay and gum disease which are among the most common dental issues in the country significantly influence the dental cement market in the United States. According to the National Institute of Dental and Craniofacial Research (NIDCR) in the US tooth decay affects 90% of adults aged 20 to 64 years while gum disease impacts nearly 50% of adults aged 45 to 64 years. These high rates of dental conditions drive the demand for restorative procedures which often require dental cements for effective treatment. An ageing population, retaining more of their natural teeth and pursuing restorative treatments also fuel the growth. Advances in technological development as well as newer dental cement formulations with increased bonding strength and better biocompatibility help these gain a firmer place in clinical applications. Increased popularity for aesthetic dentistry with the increasing use of minimally invasive techniques promote more widespread usage of dental cements in terms of both aesthetic and functional repair.

Asia Pacific Dental Cement Market Analysis

The Asia-Pacific (APAC) region is being driven by a growing middle class, expanding access to healthcare and rising disposable incomes. Gross national disposable income is projected to grow by 8.9% in FY24 following a 14.5% increase in FY23 which boosts purchasing power and enables greater access to dental treatments. As the income levels increase the demand for advanced dental care including restorative procedures that require dental cements also increases. Increased awareness of oral health and innovation in dental materials that provide better durability and aesthetics are also driving the market. The growth in dental tourism and cosmetic dentistry in countries like India China and Thailand also supports the expansion of the dental cement market. The rise in urbanization along with the growing number of dental clinics across the region also increases the demand for advanced dental solutions.

Europe Dental Cement Market Analysis

The European dental cement market is mainly propelled by an aging population increased oral health awareness and advancements in dental technologies. According to reports, as of 2023, the population of the European Union was estimated at 448.8 Million with over one-fifth (21.3%) aged 65 years and older. This demographic shift increases the demand for restorative dental procedures like crowns, bridges and dentures that must use dental cement. Increasing cases of dental diseases including cavities and gum diseases, are a further push for restoratives. New technologies and innovations in dental cement formulations include higher bonding strength and aesthetic appeal are aiding these increases. The rising demand for cosmetic dentistry such as veneers and teeth whitening also drives the market. The increasing number of dental clinics along with skilled dental professionals and advanced equipment further supports the adoption of dental cements which is further driving the market expansion in the region.

Latin America Dental Cement Market Analysis

The Latin America dental cement market is increasing with the improved accessibility of healthcare services, increased oral hygiene awareness, and a rising middle class. In 2020, nearly 58.5 Million people over the age of 65 resided in Latin America and the Caribbean (LAC), representing 9% of the region's population. The Organisation for Economic Cooperation and Development (OECD) predicts that this demographic will double by 2050, reaching about 18% of the region's population. This shift toward an aging population is fueling the demand for dental restorative procedures, driving the use of dental cements. Moreover, expanding access to dental insurance and services further supports market growth in the region.

Middle East and Africa Dental Cement Market Analysis

The dental cement market in the Middle East and Africa is expanding due to rising awareness about oral hygiene and increased access to dental services. A 2019 study conducted in Riyadh revealed that caries prevalence in primary and permanent teeth was 86% and 65%, respectively, highlighting the significant need for restorative dental procedures. As disposable incomes rise, particularly in the Gulf Cooperation Council (GCC) countries, individuals are increasingly investing in dental care, including treatments that require dental cements. The region’s aging population, growing dental tourism, and advancements in dental materials further contribute to the market's growth.

Competitive Landscape:

The dental cement market is highly competitive characterized by the presence of numerous global and regional manufacturers striving to expand their market share. Companies focus on product innovation introducing advanced materials with enhanced properties such as improved adhesion, durability and aesthetics. Strategic collaborations with dental professionals and institutions are common to develop tailored solutions and gain a competitive edge. The market is also witnessing increased investment in research and development to create biocompatible and ecofriendly formulations. The growing trend of mergers, acquisitions and geographic expansion highlights efforts to strengthen distribution networks and cater to a broader customer base.

The report provides a comprehensive analysis of the competitive landscape in the dental cement market with detailed profiles of all major companies, including:

- 3M Company

- BISCO Inc.

- Dentsply Sirona

- DETAX GmbH & Co. KG

- DMG Chemisch-Pharmazeutische Fabrik GmbH

- FGM Dental Group

- Ivoclar Vivadent AG

- Kerr Corporation (Danaher Corporation)

- Medental International Inc.

- Prime Dental Products Pvt Ltd

- SDI Limited

- Shofu Dental India Pvt. Ltd.

- The Bombay Burmah Trading Corporation Limited

Latest News and Developments:

- July 2024: Shofu Dental Corporation introduced BeautiLink SA, a self-adhesive resin cement for zirconia restorations, at the California Dental Association meeting on May 16, 2024. Designed to enhance retention and marginal integrity, BeautiLink SA features bioactive Giomer Technology, which releases fluoride to reduce secondary decay and prevent crown failure. The cement's antibacterial properties also help to neutralize acids and inhibit caries-causing bacteria, offering long-term benefits for zirconia crowns.

- July 2024: SDI Limited has launched Riva Cem Automix, a resin-modified glass ionomer cement with ionglass™ technology, designed for permanent cementation of metal and ceramic restorations. The cement offers improved bond strength, durability, and color stability. A 2022 study showed it outperforms leading cements in enamel/dentin bond strength and flexural strength. The automix tip reduces wastage by 25-50%, providing greater convenience compared to hand-mixed systems.

- September 2023: Dentsply Sirona and 3Shape, a frontrunner in digital solutions for dental patient care, are taking a significant step forward in their workflow integration. By harmonizing DS Core, Primemill, and Primeprint with the 3Shape TRIOS intraoral scanner powered by 3Shape Unite, they are enhancing workflows in digital dentistry. This collaboration offers dentists and dental technicians straightforward, secure, and interconnected technology solutions for better collaboration, allowing them to deliver superior dental care with confidence.

- September 2022: Kerr Dental has relaunched Nexus RMGI, a resin-modified glass ionomer cement with Smart Response Ion Technology. Known for easy cleanup and strong bond strength, it releases fluoride, calcium, and zinc to prevent secondary caries. Recent studies show Nexus RMGI offers 50-80% better bond strength than leading brands for metal and zirconia crowns.

- November 2021: BISCO’s TheraFamily line of calcium releasing materials grew this year with the launch of TheraBase. The quality materials used in the TheraFamily allow dentists to provide their patients with the best experience and outcome possible, leading to happier and more loyal patients.

Dental Cement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Temporary Cement, Permanent Cement |

| Materials Covered | Glass Ionomer, Zinc Oxide Eugenol, Zinc Phosphate, Polycarboxylate, Composite Resin, Others |

| Applications Covered | Pulpal Protection, Luting, Restorations, Surgical Dressing |

| End Users Covered | Hospitals, Dental Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, BISCO Inc., Dentsply Sirona, DETAX GmbH & Co. KG, DMG Chemisch-Pharmazeutische Fabrik GmbH, FGM Dental Group, Ivoclar Vivadent AG, Kerr Corporation (Danaher Corporation), Medental International Inc., Prime Dental Products Pvt Ltd, SDI Limited, Shofu Dental India Pvt. Ltd., The Bombay Burmah Trading Corporation Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dental cement market from 2019-2033.

- The dental cement market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dental cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dental cement market was valued at USD 664.6 Million in 2024.

IMARC estimates the dental cement market to exhibit a CAGR of 6.9% during 2025-2033, reaching USD 1,212.8 Million by 2033.

The market is driven by increasing prevalence of dental disorders, advancements in cement technology enhancing durability and aesthetics, rising geriatric population, growing cosmetic dentistry trends, and expanding dental healthcare infrastructure.

North America leads the market, accounting for over 37.5% of the global share in 2024, supported by advanced dental care systems and an increasing demand for aesthetic dentistry. The market is further favored by the extensive research and development (R&D) activities across the region.

Some of the major players in the dental cement market include 3M Company, BISCO Inc., Dentsply Sirona, DETAX GmbH & Co. KG, DMG Chemisch-Pharmazeutische Fabrik GmbH, FGM Dental Group, Ivoclar Vivadent AG, Kerr Corporation (Danaher Corporation), Medental International Inc., Prime Dental Products Pvt Ltd, SDI Limited, Shofu Dental India Pvt. Ltd., The Bombay Burmah Trading Corporation Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)