Dental Caries Treatment Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Dental Caries Treatment Market Size and Share:

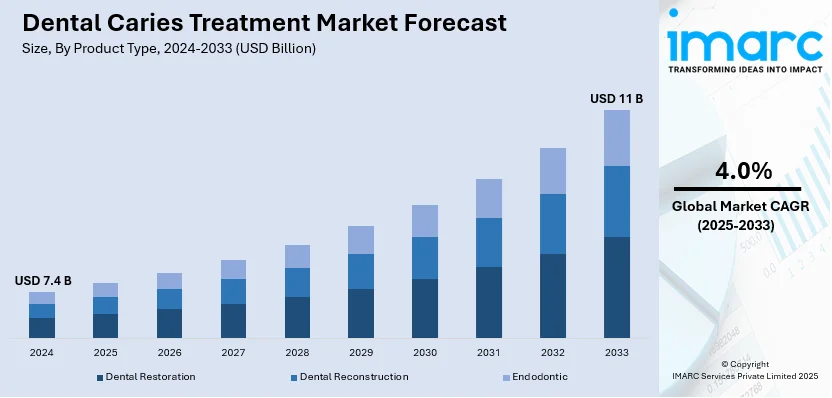

The global dental caries treatment market size was valued at USD 7.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11 Billion by 2033, exhibiting a CAGR of 4.0% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.6% in 2024. The increasing prevalence of dental caries or tooth decay, the growing consumer awareness regarding the availability dental restoration operations, and rising geriatric population represent some of the key factors driving the dental caries treatment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.4 Billion |

|

Market Forecast in 2033

|

USD 11 Billion |

| Market Growth Rate (2025-2033) | 4.0% |

The market for dental caries treatment is driven mainly by the rising global incidence of dental caries, especially among developing nations with altered lifestyles and diets. Due to an increase in the consumption of sweets and failure to maintain proper oral hygiene, dental caries is also spreading, which is driving demand for treatments. Furthermore, increased awareness regarding maintaining oral health, along with technological advancements in dentistry, is playing a key role in driving growth for the market. The growth of disposable incomes and the growing middle-class population in the emerging markets also contribute to increased access to dental care. Additionally, growing access to dental insurance is helping in making dental procedures more affordable, and as a result, more individuals are receiving timely care. Advancements in minimally invasive procedures like laser therapy and restorative products have further broadened the market by providing improved and more comfortable solutions to traditional procedures. The future of dental care, as it continues to advance, will see further caries treatment innovations driving market expansion.

The United States stands out as a key market disruptor, driven by innovation, research, and the adoption of advanced treatment methods. The nation is the world leader in dental technologies for care, with ongoing progress being made in minimally invasive treatment, laser dentistry, and regenerative care. Companies in the United States are in the lead regarding innovative dental products, including bioactive and nanocomposite fillings, with superior durability and higher healing capability. In addition, the focus on preventive treatment and early intervention in the US has encouraged the creation of sophisticated diagnostic equipment, including digital imaging and artificial intelligence-based caries detection systems. In addition, the U.S. market boasts a strong dental insurance system, which makes caries treatments accessible to a significant percentage of the population, encouraging early treatment and care. The constant emphasis on research and increasing awareness regarding oral health makes the US a prime disruptor in the international dental caries treatment market.

Dental Caries Treatment Market Trends:

Increased Use of Laser Technology

Laser technology is revolutionizing dental caries treatment market outlook by offering a precise, minimally invasive alternative to traditional drilling. According to industry reports, the global laser technology market is expected to reach USD 37.7 Billion by 2033, growing at a CAGR of 7.44% during 2025-2033. Using specific wavelengths, lasers effectively remove decayed tissue while preserving healthy tooth structure. For instance, in November 2023, Convergent Dental launched Solea® Protect™, a new application for its Solea® All-Tissue Dental Laser, designed to inhibit tooth decay. Utilizing a 9.3-micron wavelength, this treatment enhances enamel strength and reduces mineral loss significantly when combined with fluoride. It aims to improve dental practices and patient experiences. This method significantly reduces or eliminates the need for anesthesia, enhancing patient comfort and experience. Additionally, laser therapy minimizes bleeding and swelling, promotes faster healing, and lowers the risk of infection due to its antibacterial properties. The procedure is typically quicker and less painful, making it especially appealing to anxious patients and children. As technology advances and costs decrease, rising adoption of laser therapies, are driving the dental caries treatment market growth.

Early Detection

The early detection of dental caries through AI algorithms is transforming oral healthcare by enabling dentists to identify decay at its nascent stages. As per the National Institutes of Health (NIH), a survey conducted in 2023 revealed that 51.3% of respondents believed that AI integration can enhance overall dental practices, while 57.3% believed that AI can significantly boost the effectiveness and success of dentists. These advanced AI systems analyze dental images, such as X-rays and 3D scans, with high precision, detecting subtle changes that may be invisible to the human eye. For instance, in October 2023, Denti.AI received FDA 510(k) clearance for its AI-powered imaging solution, Denti.AI Detect, enhancing the detection of dental diseases in panoramic and intraoral x-rays. Integrated with Denti.AI Auto-Chart, it optimizes dental workflows, significantly improving disease identification and opening up additional treatment opportunities for dental professionals. By accurately pinpointing early carious lesions, AI enhances diagnostic accuracy, allowing for timely and minimally invasive interventions. This proactive approach prevents the progression of cavities while reducing the need for extensive treatments, ultimately improving patient outcomes and oral health. Additionally, the early detection fosters personalized treatment plans and enhances overall dental care efficiency.

Growing Geriatric Population

As the global population ages, there is a significant rise in dental caries treatment demand tailored to maintaining the oral health of elderly individuals. According to report published by World Health Organization (WHO), by 2030, 1 in 6 people globally will be aged 60 or over, with that population rising from 1 billion in 2020 to 1.4 billion. By 2050, this group will double to 2.1 billion, and those aged 80 and older will triple to 426 million. Older adults are more susceptible to dental caries due to factors such as dry mouth, reduced dexterity, and underlying health conditions. In response, the field of geriatric dentistry is expanding to offer comprehensive care specifically for the elderly. This includes specialized caries management and restorative treatments that address their unique needs, ensuring effective prevention and treatment of decay. Additionally, geriatric dental practices incorporate techniques and technologies that enhance comfort and accessibility, thereby improving overall oral health outcomes for aging populations.

Dental Caries Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dental caries treatment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and end user.

Analysis by Product Type:

- Dental Restoration

- Dental Reconstruction

- Abutments

- Bridges

- Crowns

- Dentures

- Implants

- Endodontic

- Files

- Obturator Devices

- Permanent Sealers

- Others

Dental restoration stands as the largest component in 2024, holding around 58.1% of the market. Dental restoration is the leading product type segment in the dental caries treatment market, as it directly addresses the damage caused by dental caries. Restorative dental procedures, such as fillings, crowns, and bridges, are commonly used to restore the functionality and aesthetics of teeth affected by decay. Fillings, including traditional amalgam and modern composite materials, are the most widely used restorative treatment for dental caries, offering both durability and a natural appearance. As the demand for more aesthetic solutions grows, composite resins and ceramic restorations are gaining popularity due to their tooth-like appearance and resistance to staining. Additionally, the development of advanced materials, such as bioactive and nanocomposite resins, has improved the long-term success and health benefits of restorations. The growing preference for minimally invasive procedures and the rising focus on preventive care are further driving the market for dental restorations. With an increasing awareness about oral health and advancements in dental technology, dental restoration continues to dominate the caries treatment market.

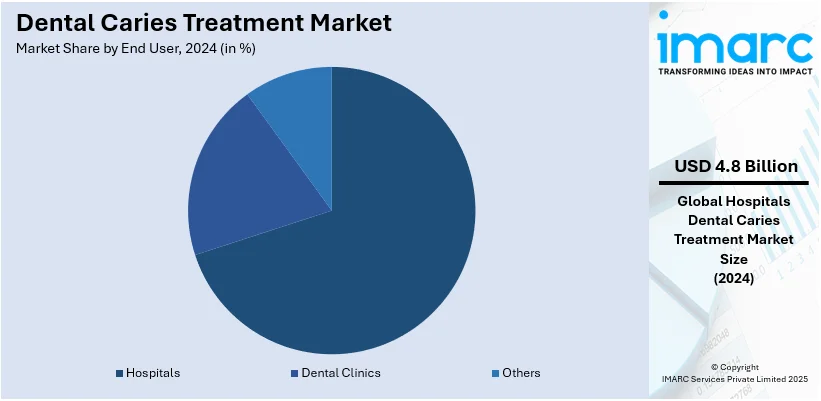

Analysis by End User:

- Hospitals

- Dental Clinics

- Others

Hospitals leads the market with around 65.0% of market share in 2024. Hospitals are the leading end-user segment in the dental caries treatment market due to their comprehensive dental care services and advanced treatment facilities. Hospitals provide a wide range of specialized services, from basic dental care to complex procedures for treating dental caries. They are equipped with state-of-the-art diagnostic and treatment technologies, including digital X-rays, laser therapy, and advanced restorative materials, enabling effective management of dental caries. The demand for hospital-based treatments is further driven by the increasing prevalence of dental caries, particularly in urban populations, where access to healthcare services is more widespread. Hospitals also benefit from a well-established infrastructure, including dental specialists, such as orthodontists and prosthodontists, who can provide advanced restorative procedures like root canals, crowns, and bridges. Additionally, hospitals cater to a larger patient base, including individuals with severe or complicated cases of dental caries. This makes hospitals the primary setting for delivering comprehensive, high-quality dental treatments, solidifying their position as the dominant end-user segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.6%. According to the report, North America holds the largest dental caries treatment market share. Some of the factors driving the North America dental caries treatment market included the increasing establishments of well-equipped dental clinics, rising geriatric population, and increasing awareness regarding oral hygiene.

Key Regional Takeaways:

United States Dental Caries Treatment Market Analysis

In 2024, the United States accounted for over 87.80% of the dental caries treatment market in North America. The United States dental caries treatment market is primarily driven by the rising prevalence of dental caries, particularly among children and the growing geriatric population. As the incidence of cavities increases, there is a greater need for effective treatments, thus expanding market opportunities. Moreover, growing public awareness about the importance of oral hygiene and the long-term consequence of untreated dental caries is another key driver, prompting more individuals to seek preventative care and early treatment. In addition, advancements in dental technologies, such as laser treatments, air abrasion, and artificial intelligence, have significantly improved the precision and comfort of procedures, making treatments more appealing and accessible. These innovations have also led to quicker recovery times and reduced discomfort, further encouraging patient uptake. Other than this, the robust healthcare system in the United States, including widespread dental insurance coverage and extensive access to dental professionals, ensures that individuals can receive timely care. According to industry reports, dental expenditure in the United States increased by USD 4 Billion in 2023, recording a 2.5% growth in comparison to the previous year. Moreover, the national spending on dental procedures in 2023 accounted for 3.6% of total healthcare expenditure, equating to USD 174 Billion. Besides this, the focus on preventive measures, combined with improvements in treatment efficacy, is further contributing to a growing demand for dental services.

Asia Pacific Dental Caries Treatment Market Analysis

The Asia Pacific dental caries treatment market is greatly expanding due to a combination of increasing awareness about oral hygiene and the rising prevalence of dental caries across the region. Rapid urbanization, changing diets, and the consumption of processed foods high in sugar have contributed to a higher incidence of dental issues, particularly caries. As per recent industry reports, in 2024, 52.9% of the total population of Asia lived in urban areas. Additionally, there is a growing demand for cosmetic dental treatments, particularly in emerging markets where individuals are more conscious of their appearance. Increased disposable incomes in countries such as China and India are leading to higher spending on dental care. Moreover, government initiatives aimed at improving oral health awareness and expanding access to dental care are fostering market growth. The expansion of dental care infrastructure, particularly in rural areas, and the availability of affordable treatments also play a major role in driving the market.

Europe Dental Caries Treatment Market Analysis

The Europe dental caries treatment market is being majorly driven by the increasing prevalence of dental caries across various age groups, with both children and adults being significantly affected. The aging population in Europe further fuels the demand for dental care, as older individuals are more prone to dental diseases, including caries, due to factors such as reduced salivation and the use of certain medications. According to reports, individuals aged 60 years and above accounted for 21.6% of the total population in the European Union in January 2024. Additionally, technological advancements in dental procedures, including minimally invasive techniques, laser treatments, and digital diagnostic tools, have improved treatment outcomes and patient experiences, making dental care more attractive. Moreover, the growing availability of advanced materials, such as biocompatible fillings and composites, is improving treatment outcomes and attracting patients seeking durable and natural-looking solutions for dental caries. The growing focus on cosmetic dentistry and aesthetic improvements is also supporting industry expansion as individuals increasingly seek treatments to enhance their smiles. Government initiatives promoting oral health awareness and funding for dental care programs are further encouraging regular check-ups and early interventions.

Latin America Dental Caries Treatment Market Analysis

The Latin America dental caries treatment market is growing due to increased awareness about oral health and rising dental caries prevalence, particularly in emerging economies. Changes in dietary habits, such as increased consumption of sugary foods and beverages, have led to higher rates of caries, driving demand for treatments. Furthermore, improving healthcare infrastructure and expanding access to dental care, particularly in urban regions, are boosting market growth. For instance, as per the International Trade Association (ITA), Brazil is the biggest market for healthcare in Latin America, spending 9.47% of GDP, or USD 161 Billion, on healthcare. Rising disposable incomes in countries such as Brazil and Mexico are also enabling more individuals to afford preventive and cosmetic dental procedures, supporting overall market growth.

Middle East and Africa Dental Caries Treatment Market Analysis

The Middle East and Africa dental caries treatment market is significantly influenced by rising healthcare investments and the expansion of dental care infrastructure across the region. Governments are increasingly prioritizing dental health, with initiatives aimed at improving access to dental services and encouraging regular check-ups. Additionally, the growth of medical tourism in countries such as the UAE, where affordable and high-quality dental care is offered, is fueling the market. According to a report published by the IMARC Group, the Middle East medical tourism market is expected to grow at a CAGR of 8.70% during 2024-2032. Additionally, the increasing number of dental professionals and clinics in both urban and rural areas is making treatment more accessible. Economic growth is further enabling more individuals to invest in dental care, stimulating market growth.

Competitive Landscape:

Some of the key players in the dental caries treatment market are also leading the growth with ongoing innovation, strategic collaborations, and product upgrades. Large manufacturers of dental products are engaged in creating cutting-edge restorative materials, including bioactive fillings, nanocomposites, and resin-based materials with enhanced durability, aesthetic value, and long-term performance. Moreover, companies are also making investments in research and development to design minimally invasive, pain-free treatments like laser dentistry and sophisticated diagnostic devices that can detect incipient caries with greater accuracy. Association with dental professionals and institutions is also another measure, enabling incorporation of state-of-the-art technologies into treatment processes. To address the increasing need for preventive dental care, businesses are encouraging education and awareness campaigns to emphasize the significance of routine check-ups, early diagnosis, and proper interventions. Additionally, the use of digital dentistry, such as 3D printing and digital impressions, is being adopted to make the dental restoration process more efficient, enhancing the accuracy and efficiency of treatments. In addition, growth in dental insurance coverage, especially in developed countries, provides increased access to such advanced procedures, thus fueling demand.

The report provides a comprehensive analysis of the competitive landscape in the dental caries treatment market with detailed profiles of all major companies, including:

- 3M Company

- Alpha Dent Implants Ltd.

- Coltene Group

- Dentsply Sirona Inc.

- DiaDent Group International

- Essential Dental Systems Inc.

- Institut Straumann AG

- Ivoclar Vivadent Inc.

- J. Morita Corporation

- Shofu Dental Corporation

- Zimmer Biomet

Latest News and Developments:

- February 2025: Swiss-based vVardis has confirmed the completion of a USD 35 Million funding deal with OrbiMed, a renowned healthcare financing company. vVardis develops and produces distinctive dental solutions, including their ground-breaking drill-free treatment for dental caries in their initial stages. The funding will help the business's expansion plans and international business ventures.

- February 2025: Aspen Dental has entered into a strategic alliance with vVardis in order to give individuals superior treatment with the Curodont products of vVardis. These cutting-edge treatments will lessen the discomfort for individuals by helping Aspen Dental doctors repair dental caries that are in the early stages using Curodont Repair Fluoride Plus, as well as assist in preventing caries with the help of Curodont Protect.

- December 2024: Pulpdent Corporation has recently introduced the ACTIVA BioACTIVE Bulk Flow, an innovative dental restoration substance that is the most recent addition to its trademark ACTIVA range. The ACTIVA BioACTIVE Bulk Flow promotes the body's internal regeneration process, protecting it from secondary caries and providing enhanced aesthetics with its ShadeFusionTM color-matching innovation.

- May 2024: GreenMark Biomedical Inc. has secured USD 200,000 in financing from the United States National Institutes of Health (NIH). The capital will enable the company to develop its cutting-edge regeneration technologies in order to provide solutions for non-invasive mineralization of tooth caries in their initial stages, as well as treatment therapies for tooth sensitivity.

- March 2024: A major clinical experiment sponsored by the National Institutes of Health (NIH) discovered that silver diamine fluoride (SDF), an externally applied liquid, can prevent dental caries in young children. According to the preliminary findings presented in Pediatric Dentistry, 54% of caries ceased to grow following SDF therapy. The research was financed by the National Institute of Dental and Craniofacial Research (NIDCR), which is a division of the NIH.

- March 2024: Overjet launched Overjet for Kids, an FDA-cleared dental AI that helps pediatric dentists accurately detect tooth decay in children aged four and above. The technology enhances parents' understanding of their children's oral health, leading to improved detection rates and increased case acceptance in dental practices.

- January 2024: Calcivis launched its innovative bioluminescent dental imaging system in the US after receiving FDA pre-market approval. The new handheld device, designed for preventive dentistry, enables real-time visualization of demineralization on teeth. With a strengthened US team, Calcivis aims to enhance patient care and transform caries management.

Dental Caries Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End Users Covered | Hospitals, Dental Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Alpha Dent Implants Ltd., Coltene Group, Dentsply Sirona Inc., DiaDent Group International, Essential Dental Systems Inc., Institut Straumann AG, Ivoclar Vivadent Inc., J. Morita Corporation, Shofu Dental Corporation, Zimmer Biomet, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dental caries treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dental caries treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dental caries treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dental caries treatment market was valued at USD 7.4 Billion in 2024.

The dental caries treatment market is projected to exhibit a CAGR of 4.0% during 2025-2033, reaching a value of USD 11 Billion by 2033.

The dental caries treatment market is driven by the rising prevalence of dental caries, increased awareness about oral health, and advancements in dental technologies. Preventive care, minimally invasive treatments, and innovations in restorative materials, such as bioactive fillings, are fueling market growth, along with greater access to dental services globally.

North America currently dominates the dental caries treatment market due to high awareness about oral health, advanced dental technologies, and access to quality dental care. Increasing adoption of preventive treatments, along with a growing emphasis on minimally invasive procedures and aesthetic restoration options, contributes to the market’s expansion in the region.

Some of the major players in the dental caries treatment market include 3M Company, Alpha Dent Implants Ltd., Coltene Group, Dentsply Sirona Inc., DiaDent Group International, Essential Dental Systems Inc., Institut Straumann AG, Ivoclar Vivadent Inc., J. Morita Corporation, Shofu Dental Corporation, Zimmer Biomet, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)