Dental 3D Printing Market Size, Share, Trends and Forecast by Material, Technology, Application, End User, and Region, 2025-2033

Dental 3D Printing Market Size and Share:

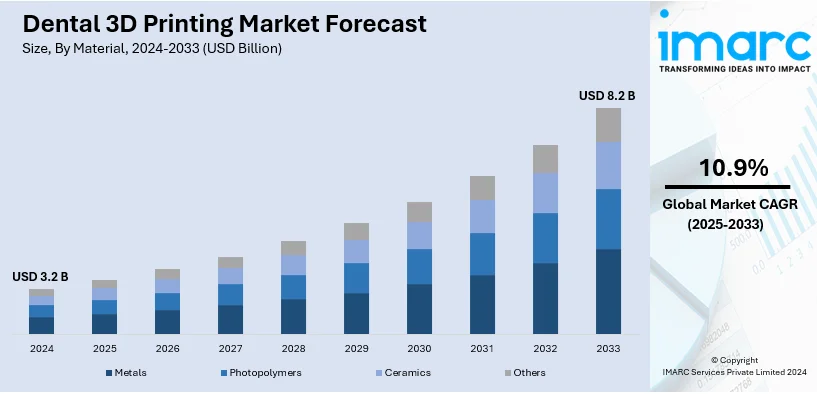

The global dental 3D printing market size was valued at USD 3.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.2 Billion by 2033, exhibiting a CAGR of 10.9% from 2025-2033. North America currently dominates the market, holding a market share of over 38.8% in 2024. The rising popularity of new biocompatible materials for dental applications, along with the growing demand among individuals for personalized treatment solutions, are bolstering the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.2 Billion |

|

Market Forecast in 2033

|

USD 8.2 Billion |

| Market Growth Rate 2025-2033 | 10.9% |

Continued progress in digital dentistry due to the increasing need for personalized dental products is a significant factor that is fueling the expansion of the dental 3D printing industry. In line with this, the growing capacity to produce accurate, personalized implants, crowns, and dentures in a fast and effective manner is positioning 3D printing as a desirable choice for dentists. Additionally, rapid utilization of this technology to reduce waste materials and production time, cost savings, and sustainability is creating a positive market outlook. Moreover, the increasing usage of prosthetics and orthodontics by dental labs is driving market growth. On November 21, 2024, Planet DDS made significant strides with the launch of DentalOS and an open API program, enhancing interoperability. Their innovations, such as Denticon’s growth and strategic partnerships, is reinforcing their leadership in cloud-based dental solutions, further driving industry progress.

To get more information on this market, Request Sample

The United States is emerging as an important regional market, where the increasing popularity of advanced dental treatments and growing number of dental issues are major factors contributing to the market growth. According to a 2024 U.S. Centers for Disease Control and Prevention (CDC) report, a substantial number of people are impacted by untreated cavities, with 1 in 10 adolescents aged 12–19 years and 1 in 5 adults aged 20–64 years being affected. Also, the increasing adoption of 3D printing technology to produce precise and personalized dental restorations, such as crowns, bridges, and aligners, is driving improvements in treatment accuracy and patient outcomes, thereby impacting the market positively. Furthermore, market growth is driven by the rising utilization of digital workflows, integration of CAD/CAM, and minimally invasive procedures, which aid in simplifying treatment procedures, reducing operating expenses, and improving patient satisfaction. Moreover, continual advancements in the manufacturing of new materials and advanced printing techniques are further accelerating growth of the dental 3D printing market, supporting improved treatment efficiency and dental care experiences across the U.S.

Dental 3D Printing Market Trends:

Technological Innovations

The introduction of advanced computer-aided manufacturing (CAM) and computer-aided design (CAD) systems, as well as high-resolution 3D printers, is propelling the market. Additionally, these technologies assist in enhancing the efficiency and precision of dental restorations, which is also catalyzing the overall market. For example, in March 2024, DOF Inc. introduced several innovations by adopting the Craft X5 milling machine and 3D scans for more effective crown production. According to a survey conducted by the Government of UK, in 2021, adults had on average 4.3 filled teeth and 0.8 crowned teeth. Besides this, in April 2024, an article published by the Oral Health Group stated that how CAD and CAM technology can be utilized to restore a case where smile esthetics had been compromised due to wear and tooth loss. Apart from this, the rising shift towards digital workflows in dentistry, as they allow for the creation of intricate dental prosthetics with improved accuracy, ensuring enhanced patient comfort and better fit, is further catalyzing the dental 3D printing market demand. For instance, in May 2024, on account of the emerging popularity of oral appliances for sleep apnea and snoring therapies, Glidewell launched Silent Nite 3D Sleep Appliance, a fully digital sleep appliance for prescription by dental professionals. Moreover, the elevating number of facilities equipped with advanced equipment and treatment facilities, including navigation implant surgery and intraoral cameras, further stimulates the market. For example, in April 2024, Sri Ramakrishna Dental College & Hospital (SRDCH) inaugurated a digital dentistry clinic in Tamil Nadu. Besides this, several awareness programs and events to promote the usage of digital dentistry are expected to propel the overall market in the coming years. For instance, in October 2023, Align Technology, Inc., one of the global medical device companies that manufactures, designs, and sells Exocad CAD/CAM software for digital orthodontics, hosted specialized events to encourage the usage of digital dentistry in the Middle East. Approximately 200 dental professionals attended the events held across Jeddah, Riyadh, Dubai, and Kuwait.

Demand for Personalized Treatment

The growing inclination among individuals towards dental solutions tailored to their unique needs and preferences is contributing to the market growth. Besides this, 3D printing technology enables the creation of custom-made dental implants, bridges, crowns, etc., which aids in ensuring a precise fit and natural appearance. For example, in April 2024, KLOwen Orthodontics led the innovation in the orthodontic industry by developing the only custom metal self-ligating (SL) solution available. According to a survey conducted by the Government of UK, in 2021, adults mentioned that they had crowns ranged from 30% in the Northeast and Yorkshire to 40% in the Southeast. In addition to this, makeO also collaborates with dental professionals to provide Clear aligners, the discreet and convenient solution to misaligned teeth. Moreover, customization treatment solutions improve patient satisfaction, which represents one of the dental 3D printing market's recent opportunities. For instance, in October 2023, Quip, one of the oral care brands, added custom-fit sports guards, night guards, and whitening solutions to their product portfolio. Besides this, the inflating demand for online platforms to promote customized oral health self-care among dental patients is further propelling the market. For example, in June 2023, a study by Chloe Meng Jiang of the University of Hong Kong developed a new strategy to promote customized oral health self-care by utilizing an online platform to connect dental patients and professionals. Additionally, customized 3D-printed dental solutions find extensive application, as they provide optimal comfort, aesthetics, and functionality to individuals. For instance, in October 2023, Brentwood Dental Spa launched a wide array of customized dental solutions aimed at enhancing smiles and promoting self-confidence among patients.

Development of Training Tools

The usage of 3D printed models in dental training and education is expanding, helping professionals and students to better understand complex anatomical structures and surgical procedures. In December 2023, a study was published that evaluated the impact of virtual reality haptic simulation (VRHS) in improving the learning experience of students in pre-clinical restorative dentistry. Moreover, the increasing number of dental labs is also positively impacting the market. For example, in September 2023, the dental lab in the Kornberg School of Dentistry equipped simulators that allowed students to work on 3D teeth and experience the feeling of drilling a tooth. Besides this, the rising inclination towards student-centered learning (SCL) has been observed in higher education settings, including dentistry, which is further elevating the dental 3D printing market revenue. For instance, in January 2024, a study involving a total of 255 dental students at the Universiti Malaya, a public research university located in Kuala Lumpur, was published to facilitate SCL application in dentistry. Furthermore, the rising investments in surgical procedures and dental equipment are projected to drive the market in the coming years. For example, in December 2023, the University of Portsmouth invested USD 6.2 Million for the upgradation of its dental training center. According to Centers for Medicare & Medicaid Services, spending for dental services increased just 0.3% in 2022 to USD 165.3 Billion following much faster growth of 18.2% in 2021.

Dental 3D Printing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dental 3D printing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, technology, application, end user, and region.

Analysis by Material:

- Metals

- Photopolymers

- Ceramics

- Others

Photopolymers stand as the largest component in the market, due to their precision, ability to produce detailed and accurate dental models, and customization options. These resins offer excellent mechanical properties like durability and biocompatibility, essential for creating crowns, bridges, and dentures. Photopolymers also enable faster production, improving efficiency in dental practices. Ongoing advancements in resin technology further enhance their appeal, making photopolymers the preferred material for dental 3D printing applications. Photopolymers also demonstrate superior adaptability for complex dental restorations, ensuring a seamless fit and optimal patient outcomes. Their widespread adoption is further supported by continuous innovations that expand their applications across various dental procedures, reinforcing their dominance in the market.

Analysis by Technology:

- Vat Photopolymerization

- Polyjet Technology

- Fused Deposition Modelling

- Selective Laser Sintering

- Others

Vat Photopolymerization leads the market with around 53.2% of market share in 2024. Vat photopolymerization is gaining traction, as it provides precision and speed. In line with this, polyjet technology is recognized for its capability to produce multi-color and multi-material dental components. According to the dental 3D printing market statistics, it is utilized for creating dental models, realistic dental prototypes, diagnostic wax-ups, etc. This technology is also playing a key role in enhancing patient-specific treatments by allowing for more personalized and detailed dental solutions.

Analysis by Application:

- Prosthodontics

- Orthodontics

- Implantology

Orthodontics leads the market with around 38.8% of market share in 2024. According to the report, orthodontics represented the largest segment. Orthodontists utilize 3D printing to produce precise models of the teeth of patients, facilitating treatment planning and the design of orthodontic devices. The technology allows for the mass production of clear aligners tailored as per patients, making orthodontic treatment more efficient and comfortable. Moreover, orthodontists are generating awareness among individuals regarding dental practices, thereby stimulating the segmentation growth. For instance, in April 2024, the specialist orthodontic group Smile Team and the creative agency Keep Left launched the New Smile Campaign.

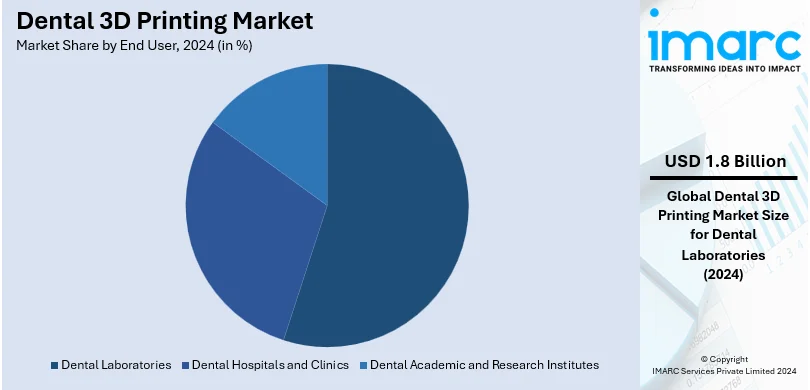

Analysis by End User:

- Dental Laboratories

- Dental Hospitals and Clinics

- Dental Academic and Research Institutes

Dental laboratories lead the market with around 55.5% of market share in 2024. According to the report, dental laboratories represented the largest segment. Dental laboratories benefit from the precision and customization offered by 3D printing, allowing them to create high-quality restorations that meet the unique needs of patients. 3D printing also streamlines the workflow in dental laboratories, thereby minimizing production times and costs while maintaining the quality of dental components. For example, in April 2024, DDS Lab (DDS), one of the largest full-service dental laboratories across the globe, announced the commencement of operations out of its new state-of-the-art, full-service dental laboratory based in Grecia, Costa Rica.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.8%. According to the report, North America accounted for the largest market share. The development of a well-developed and advanced healthcare infrastructure, including several hospitals, dental clinics, and dental laboratories, is primarily driving the dental 3D printing market outlook. Besides this, various collaborations among key players are also acting as significant growth-inducing factors. For example, in November 2023, Eplus3D successfully completed a joint development project with Eisenbacher Dentalwaren to develop the metal 3D printing of dental solutions. Additionally, in February 2023, Stratasys Ltd., one of the leaders in polymer 3D printing, signed an agreement with Ricoh U.S., Inc. to offer on-demand 3D-printed anatomic models for clinical settings. Apart from this, the easy availability of suitable reimbursement policies and government support for quality healthcare in Canada and the U.S. is also increasing the dental 3D printing market's recent price in North America. For example, the Patient Protection and Affordable Act (PPACA), also known as Obamacare, in the U.S. provides affordable and quality health insurance schemes to its citizens.

Key Regional Takeaways:

United States Dental 3D Printing Market Analysis

In 2024, United States accounted for 83.60% of the North America dental 3D printing market. The dental 3D printing market in the United States is expanding rapidly as advanced technologies are increasingly enabling dental professionals to provide more personalized and precise care. Manufacturers are focusing on developing highly accurate and faster 3D printers, which are significantly improving efficiency in creating dental models, crowns, bridges, and orthodontic devices. This continuous evolution in hardware is allowing dental labs and clinics to reduce turnaround times while maintaining high-quality output. In parallel, the adoption of biocompatible 3D printing materials is on the rise, enabling the production of dental implants and prosthetics that closely resemble natural teeth in appearance and function. Dental professionals are adopting 3D printing for its cost-effectiveness, especially for complex, customized solutions that would otherwise be more expensive using traditional methods. According to American Dental Association, as of 2023, there were 202,304 professionally active dentists in the U.S. Moreover, the integration of 3D printing with computer-aided design (CAD) and computer-aided manufacturing (CAM) systems is enhancing precision in procedures like implant planning and surgical guides. With patient demands for faster, more customized treatments growing, dental clinics and laboratories are investing heavily in 3D printing technologies to meet these expectations. Additionally, ongoing developments in education and training are accelerating the skills of dental professionals, further driving market growth.

Europe Dental 3D Printing Market Analysis

The dental 3D printing market in Europe is experiencing significant growth as dental professionals are increasingly adopting advanced technologies for prosthetics, implants, and orthodontics. Rising demand for customized and precise dental products is driving the use of 3D printing, with practitioners using the technology to create patient-specific solutions more efficiently. According to the International Federation of Dental Hygienists, the number of dentists practising across Italy are 62000. Additionally, ongoing advancements in 3D printing materials are enabling the production of more durable and biocompatible dental parts, further encouraging adoption. Leading dental clinics and labs are integrating 3D printing systems into their workflows to reduce turnaround times and costs associated with traditional methods, enhancing operational efficiency. Dental professionals are also embracing the technology due to its potential for improving patient outcomes, as 3D-printed solutions are providing superior fit and comfort compared to conventional alternatives. As the European healthcare sector is increasingly focusing on digital transformation, dental 3D printing is gaining traction among practitioners looking to innovate and streamline their services. Moreover, European governments are promoting digital dentistry through funding initiatives, contributing to market growth. With rising awareness about the benefits of 3D printing, the dental industry in Europe is rapidly shifting toward more sustainable, cost-effective, and patient-centric solutions.

Asia Pacific Dental 3D Printing Market Analysis

The dental 3D printing market in the Asia-Pacific region is experiencing significant growth due to several specific drivers. Advancements in 3D printing technology are enabling dental professionals to offer more accurate and customized solutions, which is attracting more patients seeking personalized care. Leading dental clinics and laboratories in the region are adopting 3D printing for faster, more cost-effective production of dental implants, crowns, bridges, and orthodontic devices. The increasing prevalence of dental disorders, particularly in countries like China, India, and Japan, is driving demand for efficient treatment options, and 3D printing is fulfilling this need by streamlining workflows. Rising disposable incomes, along with greater awareness of dental aesthetics, are leading more individuals to opt for cosmetic dentistry, further augmenting the adoption of 3D printing in dental practices. According to the government of India, the gross national income between 2021 to 2022 is USD 281 Billion. In addition, the expanding network of dental education institutes and workshops across the region is facilitating the training of new professionals in 3D printing technologies, contributing to market growth. Regulatory support in several countries is also fostering innovation and encouraging local players to enter the market. As dental professionals continue embracing digital workflows, the demand for 3D printed dental products in the Asia-Pacific region is expected to intensify in the coming years.

Latin America Dental 3D Printing Market Analysis

The dental 3D printing market in Latin America is expanding rapidly due to the increasing adoption of advanced technologies by dental professionals across the region. Dental clinics and laboratories are upgrading their equipment to incorporate 3D printing, enabling them to offer more precise and customized solutions to patients. As patients in Latin America are becoming more aware of the benefits of personalized dental care, the demand for tailored dental implants, crowns, bridges, and orthodontic devices is growing. The region is also witnessing an increase in the number of dental schools integrating 3D printing into their curriculum, further promoting the technology’s use. According to reports, in 2018, there were 374 active dental schools in Brazil, of which 307 were private and 67 public. Moreover, advancements in 3D printing materials, such as biocompatible resins and metals, are allowing dental professionals to produce high-quality, durable dental products that are better suited to patient needs. The affordability of 3D printing equipment is also driving adoption, as dental practitioners are increasingly able to justify the initial investment by reducing production costs over time. Additionally, growing governmental support for dental care innovation and the rise of private healthcare investments in Latin American countries are facilitating the growth of the dental 3D printing market, making it a key component in the region's evolving dental care landscape.

Middle East and Africa Dental 3D Printing Market Analysis

The dental 3D printing market in the Middle East and Africa (MEA) is experiencing rapid growth due to several key factors. The increasing adoption of digital dentistry technologies is enabling dental professionals to streamline workflows and improve precision, with more clinics and labs implementing 3D printing solutions. Advanced 3D printers are gaining popularity for their ability to produce highly accurate dental models, crowns, bridges, and implants, driving demand across the region. Growing awareness of aesthetic dentistry is encouraging patients to opt for customized and high-quality dental solutions, which 3D printing is uniquely positioned to provide. In countries like the UAE and Saudi Arabia, rising disposable incomes are allowing a growing middle class to invest in advanced dental care, further propelling the market. According to the Federal Competitiveness and Statistics Centre, the disposable income for the year 2019 across UAE is USD 352.37 Billion. Additionally, dental professionals are actively seeking cost-effective solutions to address the increasing number of dental procedures, with 3D printing offering significant savings in material costs and production time. Moreover, ongoing government initiatives in healthcare innovation are fostering the adoption of advanced technologies in the dental sector, particularly in countries like South Africa and Egypt. As these factors continue to influence the market, the demand for dental 3D printing technology is expected to expand rapidly throughout the region.

Competitive Landscape:

The market is highly competitive, with key players investing heavily in research and development (R&D) activities to develop innovative technologies, materials, and software for the dental industry. They are improving the precision, speed, and versatility of 3D printers and developing new biocompatible materials for dental applications. In line with this, companies are developing new 3D printing systems, such as high-resolution printing, multi-material capabilities, and user-friendly software interfaces, that are tailored as per the requirements of dental professionals. Moreover, they are working on developing and enhancing dental-specific materials that are biocompatible, durable, and capable of producing aesthetically pleasing dental restorations. Furthermore, dental 3D printing market companies are adhering to regulatory standards to ensure the safety and quality of their products.

The report provides a comprehensive analysis of the competitive landscape in the dental 3D printing market with detailed profiles of all major companies, including:

- 3D Systems Inc

- Carbon Inc.

- Desktop Metal, Inc.

- EOS GmbH

- FormLabs

- Institut Straumann AG

- Nikon SLM Solutions AG

- Prodways Group

- Rapid Shape GmbH

- Renishaw plc

- Roland DGA Corporation

- SprintRay Inc.

- Stratasys

Latest News and Developments:

- April 2024: The Ivoclar Group, one of the world’s leading manufacturers of integrated solutions for high-quality dental applications with an extensive product and systems portfolio for dental technicians, dentists, and dental hygienists, entered a partnership with SprintRay, one of the 3D printing technology companies in the U.S.

- May 2024: Roland DGA’s DGSHAPE Americas dental business group announced the addition of the 3DX Dental 3D Printer Bundle which is powered by Roland DGA to its line of dental products and accessories. The 3DXPRINT 3D printer incorporated the state-of-the-art 4K LCD 3D print technology that provides fast, precise, and uniform production of 3D-printed dental applications.

- May 2024: Desktop Health and Asiga, one of the leading dental 3D printing brands, validated Flexcera Smile, Flexcera Smile Ultra+, and Flexcera Base for usage on the Asiga 3D printing platform, expanding access to the innovative nanoceramic resins.

- May 2024: SprintRay, the global leader in dental 3D printing, has unveiled the SprintRay Pro 2 dental 3D printer, as well as two new resins from the company’s BioMaterial Innovation Lab: a direct-print Retainer and a next-generation Dental Model.

- July 2024: Stratasys has launched the DentaJet XL, a new high-speed 3D printer designed to further improve dental lab productivity and reduce costs. Moreover, the new PolyJet multi-material 3D printer is designed to run in a production setting with minimal human intervention.

Dental 3D Printing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Metals, Photopolymers, Ceramics, Others |

| Technologies Covered | Vat Photopolymerization, Polyjet Technology, Fused Deposition Modelling, Selective Laser Sintering, Others |

| Applications Covered | Prosthodontics, Orthodontics, Implantology |

| End Users Covered | Dental Laboratories, Dental Hospitals and Clinics, Dental Academic and Research Institutes |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3D Systems Inc, Carbon Inc., Desktop Metal, Inc., EOS GmbH, FormLabs, Institut Straumann AG, Nikon SLM Solutions AG, Prodways Group, Rapid Shape GmbH, Renishaw plc, Roland DGA Corporation, SprintRay Inc., Stratasys, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dental 3D printing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dental 3D printing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dental 3D printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Dental 3D printing is an advanced technology that creates customized dental products, such as crowns, bridges, and implants, by building layers based on digital 3D models. It enhances precision, reduces material waste, and improves treatment efficiency. This technology is widely used in dental prosthetics, orthodontics, and surgical planning.

The dental 3D printing market was valued at USD 3.2 Billion in 2024.

IMARC estimates the global dental 3D printing market to exhibit a CAGR of 10.9% during 2025-2033.

Key factors driving the market are ongoing advancements in digital dentistry, rising demand for customized dental solutions, the ability to create precise, patient-specific restorations, reduced material waste, and faster production times. Additionally, increasing adoption by dental labs and the development of new materials and technologies are fostering market growth.

Photopolymers are the leading segment due to their precision, ability to produce detailed and accurate dental models, customization options, durability, biocompatibility, and faster production capabilities.

Vat Photopolymerization leads the market driven by its precision and speed, making it ideal for producing accurate dental components efficiently.

Orthodontics represented the largest segment by application, driven by the growing demand for custom clear aligners and precise orthodontic devices tailored to individual patient needs.

Dental laboratories lead the market by end user attributed to their ability to leverage 3D printing for producing high-quality, customized restorations efficiently, reducing production times and costs.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global dental 3D printing market include 3D Systems Inc, Carbon Inc., Desktop Metal, Inc., EOS GmbH, FormLabs, Institut Straumann AG, Nikon SLM Solutions AG, Prodways Group, Rapid Shape GmbH, Renishaw plc, Roland DGA Corporation, SprintRay Inc., and Stratasys, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)