Dehydrated Vegetables Market Report by Type (Potato, Tomato, Onion, and Others), Form (Powder and Granules, Slices and Cubes, Minced and Chopped, Flakes), Nature (Organic, Conventional), Technology (Vacuum Drying, Air Drying, Spray Drying, Freeze Drying, Drum Drying), End User (Food Manufacturer, Food Service, Retail), and Region 2025-2033

Market Overview:

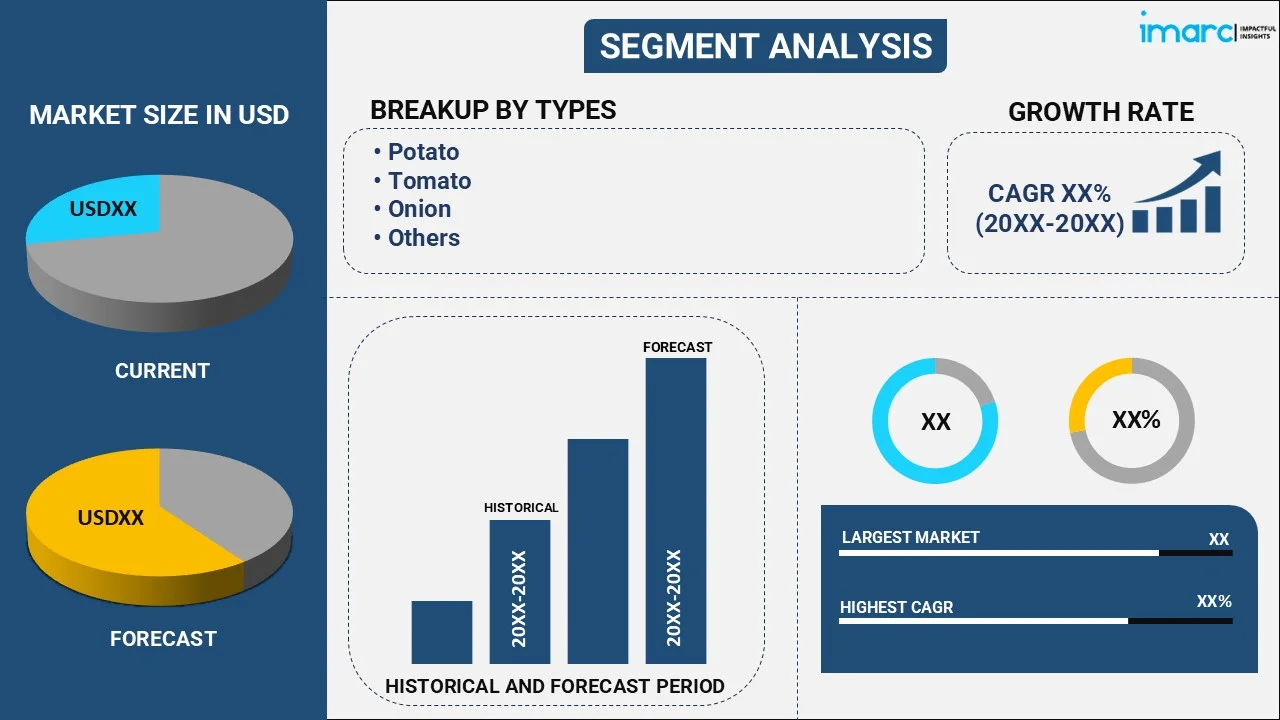

The global dehydrated vegetables market size reached USD 78.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 114.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.24% during 2025-2033. The increasing inclination toward dehydrated vegetables-based ready-to-eat (RTE) food products, rising health consciousness, and the growing sales of baby food represent some of the key factors driving the market toward growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 78.8 Billion |

| Market Forecast in 2033 | USD 114.5 Billion |

| Market Growth Rate (2025-2033) | 4.24% |

Dehydrated vegetables comprise carrots, tomatoes, bell peppers, onions, mushrooms, and corn. They are dried using various methods, such as sun drying, oven drying, and commercial dehydrators, to remove moisture and retain nutrients like vitamins, minerals, and fiber. They are lightweight, compact, easy to store, and have a longer shelf life. They are a good source of plant-based protein and commonly used in ready to eat (RTE) food products like soups and instant noodles. At present, due to the rising adoption of veganism, product manufacturers operating worldwide are introducing plant-based food variants to meet the nutritional requirements of individuals and expand their product portfolio.

Dehydrated Vegetables Market Trends:

Technological Advancements in Drying Methods

Innovations in drying methods, such as freeze-drying, vacuum-drying, and the emerging self-drying technology, are revolutionizing the dehydrated vegetables market by significantly improving product quality. In line with this, in March 2024, new dehydration technologies were introduced by BranchOut Food and True Essence Foods, which aim to revolutionize food preservation by enhancing flavor and nutrient retention. These advanced technologies preserve food quality and offer more nutritious dried food ingredients for applications like fruit powders, snacks, and MREs. BranchOut's ‘Gentle Dry’ technology and True Essence Foods' ‘Flavor Symmetry’ technology overcome the limitations of traditional dehydration methods, improving flavor and sustainability. Self-drying technology, a newer innovation, reduces energy consumption and further preserves freshness. These methods are increasingly popular, especially among consumers seeking premium, nutrient-rich, and flavorful dehydrated vegetables, driving market demand for high-quality products. As a result, the dehydrated vegetables market share for high-quality products is expanding, driving the overall product demand and positioning manufacturers to capture a larger portion of the growing consumer base interested in superior, health-focused food options.

Rising Focus on Sustainability and Energy Efficiency

As environmental concerns rise, manufacturers in the dehydrated vegetables market are increasingly adopting sustainable dehydration techniques to reduce their carbon footprint. Methods like solar drying and the use of energy-efficient equipment are becoming popular alternatives to traditional drying processes, which often require high energy consumption. For instance, in August 2024, Blendhub and Upfood formed a strategic partnership to create innovative products from food surpluses. Upfood specializes in upcycling surplus fruits and vegetables into plant-based ingredients using a solar-powered dryer. Their partnership aims to optimize the sourcing of raw materials, develop new ingredients, and create affordable food products while combatting food waste. This collaboration aligns with Blendhub's circular business model and supports the United Nations Sustainable Development Goals. Solar drying harnesses renewable energy, significantly reducing greenhouse gas (GHG) emissions, while advanced machinery optimizes energy use, lowering overall production costs. These eco-friendly practices not only align with global sustainability goals but also cater to consumer demand for products with minimal environmental impact. As a result, sustainability is becoming a key driver of innovation and competitiveness in the industry.

Growth in Plant-Based and Vegan Diets

The rising popularity of plant-based and vegan diets is driving the demand for dehydrated vegetables significantly. As more consumers seek nutritious, plant-based alternatives, dehydrated vegetables offer a versatile option that retains essential nutrients while having a longer shelf life than fresh produce. These products are increasingly used in plant-based meal preparations, snacks, and pre-packaged foods, catering to individuals looking for healthy, convenient options. Their portability, ease of storage, and ability to rehydrate quickly make them ideal for plant-based cooking. This trend is propelling the dehydrated vegetables market growth as manufacturers develop innovative dehydrated vegetable products to meet consumer preferences. According to industry reports, there are approximately 88 million vegans worldwide worldwide. In India, 11% of the population follows a vegan diet, while in the US, there are over 13.4 million vegans. About 1-2% of the global population is vegan, and 40% of consumers use dairy alternatives. Such statistics are reflective of the steadily increasing vegan population across the globe, which, in turn, is expected to be pivotal in facilitating the demand for dehydrated vegetables, and thus driving the market growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dehydrated vegetables market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, form, nature, technology, and end user.

Type Insights:

- Potato

- Tomato

- Onion

- Others

The report has provided a detailed breakup and analysis of the dehydrated vegetables market based on the type. This includes potato, tomato, onion, and others. According to the report, onion represented the largest segment.

Form Insights:

- Powder and Granules

- Slices and Cubes

- Minced and Chopped

- Flakes

A detailed breakup and analysis of the dehydrated vegetables market based on the form has also been provided in the report. This includes powder and granules, slices and cubes, minced and chopped, and flakes. According to the report, powder and granules accounted for the largest market share.

Nature Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the dehydrated vegetables market based on the nature. This includes organic and conventional. According to the report, organic represented the largest segment.

Technology Insights:

- Vacuum Drying

- Air Drying

- Spray Drying

- Freeze Drying

- Drum Drying

A detailed breakup and analysis of the dehydrated vegetables market based on the technology has also been provided in the report. This includes vacuum drying, air drying, spray drying, freeze drying, and drum drying. According to the report, vacuum drying accounted for the largest market share.

End User Insights:

- Food Manufacturer

- Food Service

- Retail

The report has provided a detailed breakup and analysis of the dehydrated vegetables market based on the end user. This includes food manufacturer, food service, and retail. According to the report, food manufacturer represented the largest segment.

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for dehydrated vegetables. Some of the factors driving the North America dehydrated vegetables market included increasing preferences for RTE food products, innovations in drying techniques, rising marketing strategies, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global dehydrated vegetables market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- BCFoods Europe B.V.

- Catz International B.V. (ACOMO Group)

- Green Rootz

- Harmony House Foods Inc.

- Mevive International Food Ingredients

- Natural Dehydrated Vegetables Pvt. Ltd.

- Real Dehydrated Pvt Ltd

- Seawind Foods

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Dehydrated Vegetables Market Recent News:

- In January 2024, NRGene established Supree, a food-tech company specializing in self-drying fruits and vegetables. Their innovative product line features semi-dried tomatoes with enhanced taste, nutritional value, and a one-year frozen shelf-life. Supree plans to target premium B2B markets in Israel, Europe, and the Middle East and aims to create a new category within the market for dried tomatoes.

- In September 2023, Agri-Neo and BCFoods announced their partnership to enhance food safety for dehydrated vegetables and spices in China. BCFoods plans to implement Agri-Neo's Neo-Pure Organic Pasteurization system at its processing facility in Shandong, China. This system will provide an additional validated kill step in the cleaning and dehydration process, ensuring the quality and safety of ingredients, starting with dehydrated onions.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Potato, Tomato, Onion, Others |

| Forms Covered | Powder and Granules, Slices and Cubes, Minced and Chopped, Flakes |

| Natures Covered | Organic, Conventional |

| Technologies Covered | Vacuum Drying, Air Drying, Spray Drying, Freeze Drying, Drum Drying |

| End Users Covered | Food Manufacturer, Food Service, Retail |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BCFoods Europe B.V., Catz International B.V. (ACOMO Group), Green Rootz, Harmony House Foods Inc., Mevive International Food Ingredients, Natural Dehydrated Vegetables Pvt. Ltd., Real Dehydrated Pvt Ltd, Seawind Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global dehydrated vegetables market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global dehydrated vegetables market?

- What is the impact of each driver, restraint, and opportunity on the global dehydrated vegetables market?

- What are the key regional markets?

- Which countries represent the most attractive dehydrated vegetables market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the dehydrated vegetables market?

- What is the breakup of the market based on the form?

- Which is the most attractive form in the dehydrated vegetables market?

- What is the breakup of the market based on the nature?

- Which is the most attractive nature in the dehydrated vegetables market?

- What is the breakup of the market based on the technology?

- Which is the most attractive technology in the dehydrated vegetables market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the dehydrated vegetables market?

- What is the competitive structure of the global dehydrated vegetables market?

- Who are the key players/companies in the global dehydrated vegetables market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dehydrated vegetables market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dehydrated vegetables market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dehydrated vegetables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)