Dehumidifier Market Size, Share, Trends and Forecast by Product, Technology, Distribution Channel, End Use, and Region, 2025-2033

Dehumidifier Market Size and Share:

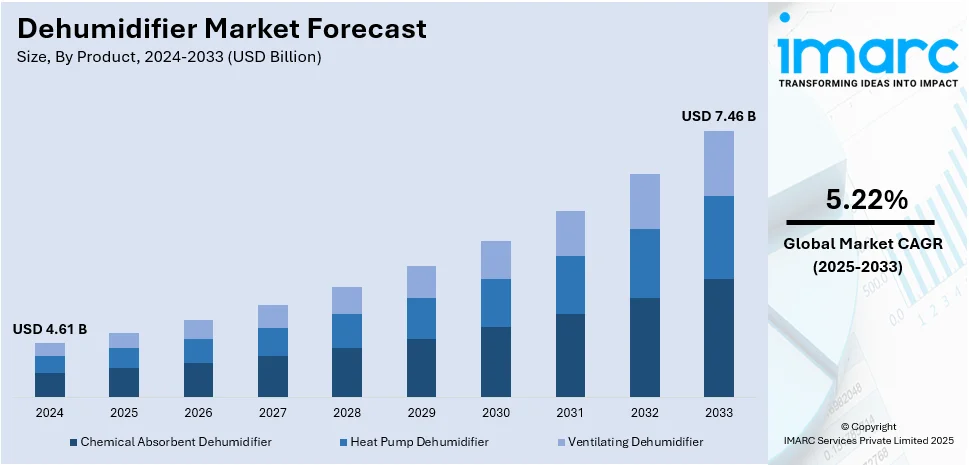

The global dehumidifier market size was valued at USD 4.61 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.46 Billion by 2033, exhibiting a CAGR of 5.22% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.3% in 2024. The rising awareness about air quality, the increasing construction and infrastructure development, and ongoing technological advancements are primarily increasing the dehumidifier market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.61 Billion |

|

Market Forecast in 2033

|

USD 7.46 Billion |

| Market Growth Rate (2025-2033) | 5.22% |

The dehumidifier market is driven by increasing humidity levels due to climate change, rising demand for indoor air quality improvement and growing awareness of health issues linked to excess moisture such as mold and allergens. Expanding residential and commercial construction particularly in humid regions is boosting adoption. Energy-efficient and smart dehumidifiers with IoT integration are gaining traction. For instance, in November 2023, Quest Climate launched the new Quest 225 208/230V dehumidifier featuring advanced M-CoRR technology for improved energy efficiency and performance. With enhanced digital controls, integrated hang points and superior MERV-13 filtration this compact model targets sustainable practices. Industrial applications in food storage, pharmaceuticals and data centers are fueling demand along with stringent regulations on indoor environmental quality.

To get more information on this market, Request Sample

The United States dehumidifier market is driven by rising concerns over indoor air quality, increasing cases of mold-related health issues and growing demand for energy efficient appliances. For instance, in August 2023, Drynamic Inc. of Minneapolis launched the Titan Series desiccant dehumidifier a portable unit that significantly cuts dehumidifying costs by up to 80% using a built-in generator. This compact design features dual compliant fuel tanks for extended run time and operates at a noise level comparable to a normal conversation. Climate variations especially in high-humidity regions are boosting residential and commercial adoption. Technological advancements such as smart dehumidifiers with IoT connectivity are enhancing convenience and efficiency. Expanding applications in industrial sectors including food processing, pharmaceuticals and data centers are further fueling demand. Stringent environmental regulations on moisture control in buildings are supporting market growth.

Dehumidifier Market Trends:

Rising Humidity Levels

Global climate change is leading to shifts in weather patterns, resulting in higher temperatures and increased moisture levels in many regions. As warmer air holds more moisture, regions that previously had moderate humidity levels are now experiencing higher and more frequent humidity. For example, industry reports indicate that during a heatwave in May 2022, some areas of India recorded Wet Bulb Globe Temperatures (WBGT) reaching 33°C. Additionally, despite stable temperatures in certain cities since 2001, relative humidity levels have increased by 8% in Delhi and 10% in Hyderabad. This has driven the demand for dehumidifiers, especially in regions with extreme weather changes. These factors are expected to propel the dehumidifier market share in the coming years.

Expanding E-Commerce Sector

The expanding e-commerce sector is one of the key factors contributing to the market's growth. For instance, according to IMARC, the global e-commerce market size reached USD 21.1 Trillion in 2023. Looking forward, IMARC Group expects the market to reach USD 183.8 Trillion by 2032, exhibiting a growth rate (CAGR) of 27.16% during 2024-2032. The growth of e-commerce has made it easier for consumers to purchase dehumidifiers, providing wider access to product options, reviews, and price comparisons. These factors further positively influence the dehumidifier market size.

Product Innovations

Continuous innovations, such as compact and portable dehumidifiers, quieter models, and smart dehumidifiers units with lower global warming potential, are driving market growth by offering consumers and businesses more options that suit their specific needs. For instance, in May 2024, Nature's Miracle Holdings Inc., a provider of vertical farming technology and infrastructure, introduced the efinity brand smart dehumidifier. These dehumidifiers comply with the R-32 AIM (American Innovation and Manufacturing Act) standard, which minimizes the dependence on hydrofluorocarbons (HFCs) and features a lower global warming potential (GWP), thereby boosting the market growth.

Dehumidifier Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dehumidifier market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product, technology, distribution channel, and end use.

Analysis by Product:

- Chemical Absorbent Dehumidifier

- Heat Pump Dehumidifier

- Ventilating Dehumidifier

According to the dehumidifier market outlook, chemical absorbent dehumidifiers can function effectively in environments with low temperatures and low humidity levels. This makes them ideal for cold storage, freezers, and other low-temperature environments where refrigerant dehumidifiers struggle to work efficiently. In line with this, cold regions or industries that require precise humidity control at low temperatures, such as pharmaceuticals, food processing, and electronics, prefer chemical dehumidifiers because of their superior performance under such conditions.

Analysis by Technology:

- Cold Condensation

- Sorption

- Warm Condensation

- Others

According to the dehumidifier market overview, sorption-based dehumidifiers perform efficiently in environments with low temperatures and low humidity levels, where traditional refrigerant-based systems may fail. This makes sorption technology ideal for applications such as cold storage, freezers, and industries that operate in colder climates. Moreover, many pharmaceutical products are sensitive to moisture, requiring precise humidity control during production and storage. Sorption technology is commonly used to ensure compliance with industry standards and maintain product quality.

Analysis by Distribution Channel:

- Offline

- Online

The offline segment dominates the dehumidifier market, driven by strong consumer preference for in-store purchases, where they can physically inspect products and receive expert guidance. Home improvement stores, appliance retailers, and specialty HVAC outlets play a crucial role. Bulk purchases by commercial and industrial users further support sales through direct dealer networks and wholesalers.

The online segment is expanding due to increasing e-commerce penetration, convenience, and competitive pricing. Platforms like Amazon, Walmart, and manufacturer websites offer a wide range of products with customer reviews and doorstep delivery. Rising digital adoption and frequent discounts are attracting consumers, especially for residential dehumidifiers. Additionally, direct-to-consumer (DTC) sales strategies are helping brands reach a broader customer base efficiently.

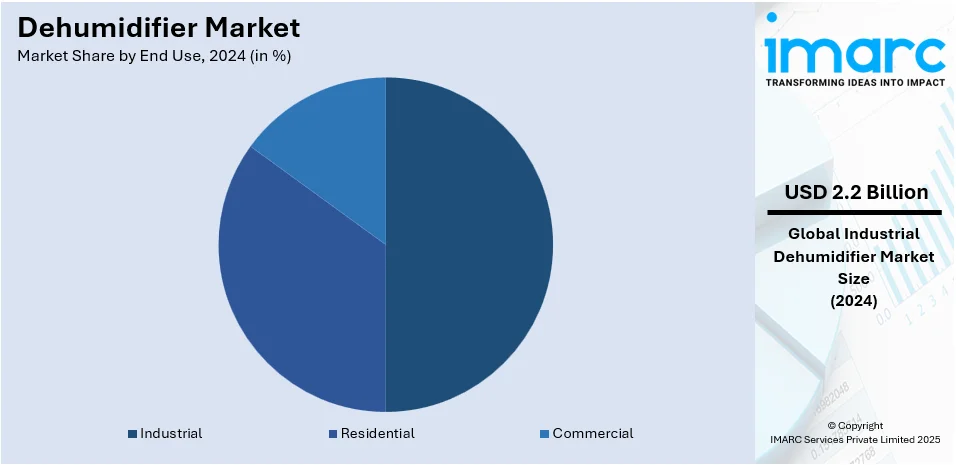

Analysis by End Use:

- Residential

- Commercial

- Industrial

Industrial leads the market with around 47.0% of market share in 2024. Industrial dehumidifiers are critical for maintaining product quality in industries where moisture can affect the texture, taste, stability, or shelf life of products. For instance, in the food and beverage sector, high humidity can cause mold growth, spoilage, and product degradation, particularly for items like dried foods, powdered products, and packaging materials. Moreover, many industrial environments use machinery and equipment that are vulnerable to corrosion and rust when exposed to high humidity levels. Dehumidifiers help prevent moisture-related damage to industrial machinery, reducing maintenance costs and extending equipment lifespan.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.3%. According to the dehumidifier market statistics, the increasing awareness about the impact of indoor air quality on health is a major driver of dehumidifier demand in North America. Poor indoor air quality, coupled with excess humidity, can lead to mold growth, dust mites, and other allergens, which exacerbate respiratory conditions such as asthma and allergies. Moreover, the commercial sector, including hotels, offices and retail spaces, is increasingly adopting dehumidifiers to ensure comfortable and healthy indoor environments for employees and customers. Indoor air quality and climate control have become priorities, particularly in spaces like gyms, hotels, and spas, which are prone to excess moisture.

Key Regional Takeaways:

United States Dehumidifier Market Analysis

In 2024, the United States accounted for over 88.70% of the dehumidifier market in North America. The expansion in the food and beverage processing industry is a major source of expansion for the United States dehumidifier market. In 2022, the U.S. Department of Commerce reported that there were 42,708 facilities in the food and beverage processing sector, highlighting the industry's size and growth. Maintaining the perfect levels of humidity within food processing facilities is necessary to prevent moisture-borne spoilage, mold, and contamination in accordance with rigorous FDA and USDA regulations. Moreover, industries like dairy, meat processing, and confectionery need accurate humidity control to ensure product quality and shelf life. The rising demand for energy-efficient dehumidifiers with high-end filtration systems also underpins market expansion. With food processing plants still expanding, fueled by growing consumer demand and export markets, demand for industrial-strength dehumidification solutions is likely to increase. Technological advancements in smart dehumidifiers with IoT also drive market growth through the provision of automated humidity management and energy efficiency.

Europe Dehumidifier Market Analysis

The European Commission's Renovation Wave aims to renovate 35 million buildings by 2030, which would more than double the current annual energy renovation rate in the EU. This initiative is likely to create strong demand in the European dehumidifier market since better insulation and tighter buildings can contribute to higher indoor humidity rates, which may lead to the need for efficient moisture control measures. The demand for energy-efficient buildings is in sync with the increasing use of advanced dehumidifiers to improve indoor air quality, suppress mold growth, and provide occupant comfort. Furthermore, the EU's vision to at least double renovation rates by 2050 is likely to further fuel dehumidifier market growth, as existing buildings are renovated to conform to strict energy efficiency requirements. With growing awareness of indoor air quality and sustainability, energy-efficient and smart dehumidifier technologies are picking up speed. As Europe carries on with its green transition, the market for dehumidifiers is likely to grow in line with changing building regulations and environmental objectives, the European Commission has stated.

Asia Pacific Dehumidifier Market Analysis

Rising temperatures present a health risk to over 243 million children in the East Asia and Pacific region, leading to a heightened need for effective climate control systems, according to UNICEF. With increasing levels of extreme heat and humidity, there is heightened anxiety about indoor air quality, particularly in residential homes, schools, and hospitals. Excessive humidity promotes the growth of mold, aggravates respiratory diseases, and affects general well-being, fueling demand for dehumidifiers in the region. Governments and institutions increasingly give importance to indoor climate management in order to safeguard vulnerable people, favoring the implementation of energy-efficient and intelligent dehumidification technologies. Rapid urbanization and infrastructure developments in Asia-Pacific also add to indoor humidity levels, which grow higher due to which the market improves more. China, India, and Japan are all seeing more investments in HVAC systems, including dehumidifiers, aimed at maintaining cleaner air quality in residential, commercial, and industrial premises. As global warming continues to escalate, there will be greater demand for effective dehumidifier technology to provide cleaner indoor spaces.

Latin America Dehumidifier Market Analysis

According to industry reports, Mexico and Uruguay have robust pharmaceutical sectors that fulfil 46% and 42% of their respective domestic medicine requirements. The pharmaceutical sector requires strict humidity control to maintain drug stability, prevent contamination, and comply with stringent regulatory standards. As production facilities expand to meet rising healthcare demands, the need for industrial-grade dehumidifiers is increasing across Latin America. Proper humidity control is essential in pharmaceutical manufacturing, packaging, and storage to prevent moisture-related degradation of active ingredients. Additionally, Latin America’s humid climate poses challenges for maintaining controlled environments in laboratories and clean rooms, further driving demand for dehumidification solutions. With growing investments in pharmaceutical infrastructure and modernization, manufacturers are adopting advanced HVAC and dehumidifier systems to ensure compliance with international quality standards. As the region continues to strengthen its pharmaceutical production capabilities, the dehumidifier market is expected to witness significant growth, supporting the industry's efficiency, safety, and product integrity.

Middle East and Africa Dehumidifier Market Analysis

The Middle East is experiencing temperature increases that are double the global average and is projected to be 4°C hotter by 2050, according to industry reports. Temperature rise and growing humidity levels are fueling the need for dehumidifiers in the Middle East and Africa, especially in residential, commercial, and industrial applications. Excessive humidity has the potential to damage structures, encourage mold growth, and have adverse effects on indoor air quality, making effective moisture control critical. In pharmaceuticals, food processing, and data centers, optimal humidity is essential for product quality and efficient operation. Urbanization and development of infrastructure in the region are also driving HVAC and climate control adoption, thereby boosting dehumidifier demand . Governments and companies are investing in climate-resilient infrastructure to minimize the effects of extreme weather conditions, setting the dehumidifier market for significant growth. As global warming increases, dehumidification solutions will become an important factor in enhancing indoor conditions and safeguarding precious assets throughout the region.

Competitive Landscape:

The dehumidifier market is highly competitive, with numerous players offering a range of residential, commercial, and industrial solutions. Companies focus on technological advancements, integrating smart features like IoT connectivity, energy efficiency, and advanced filtration to enhance performance. Pricing strategies, product differentiation, and after-sales services are key competitive factors. Manufacturers are expanding their distribution networks, leveraging both offline and online channels to reach a broader customer base. Strategic partnerships with retailers, HVAC service providers, and e-commerce platforms are strengthening market positioning. R&D investments in eco-friendly refrigerants and low-energy consumption models are increasing due to stringent environmental regulations. Additionally, companies are adopting mergers, acquisitions, and product portfolio expansions to gain market share and cater to evolving consumer preferences.

The report provides a comprehensive analysis of the competitive landscape in the dehumidifier market with detailed profiles of all major companies, including:

- Bry-Air (Asia) Pvt. Ltd.

- Condair Group

- Danby Appliances

- De’Longhi Appliances S.r.l.

- DST America

- Honeywell International Inc.

- LG Electronics

- Midea Group

- Munters Group AB

- Panasonic Corporation

- SHARP Corporation

- TCL Electronics Holdings Limited

- Therma-Stor LLC

Latest News and Developments:

- In January 2025, Home appliance brand Sterra launched two new dehumidifiers the Sterra Ray and Sterra Titan to address Singapore's humidity issues. The Ray targets smaller spaces, while the Titan features industrial-grade performance for larger areas.

- In September 2024, Meaco unveiled the MeacoDry Arete Two, their most advanced dehumidifier to date. This model features a new LCD display and can be controlled via a mobile app, effectively enhancing air quality and minimizing dampness while operating quietly and efficiently.

- In February 2024, Xiaomi launched the MIJIA Smart Dehumidifier 22L in China. This dehumidifier is equipped with a five-layer noise reduction system and a 4.5L water tank, capable of removing up to 22 liters of moisture per day.

Dehumidifier Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Chemical Absorbent Dehumidifier, Heat Pump Dehumidifier, Ventilating Dehumidifier |

| Technologies Covered | Cold Condensation, Sorption, Warm Condensation, Others |

| Distribution Channels Covered | Offline, Online |

| End Uses Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bry-Air (Asia) Pvt. Ltd., Condair Group, Danby Appliances, De’Longhi Appliances S.r.l., DST America, Honeywell International Inc., LG Electronics, Midea Group, Munters Group AB, Panasonic Corporation, SHARP Corporation, TCL Electronics Holdings Limited, Therma-Stor LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dehumidifier market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global dehumidifier market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the dehumidifier industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dehumidifier market was valued at USD 4.61 Billion in 2024.

IMARC estimates the dehumidifier market to reach USD 7.46 Billion by 2033, exhibiting a CAGR of 5.22% during 2025-2033.

The dehumidifier market is driven by increasing demand for moisture control in residential, commercial, and industrial spaces to prevent mold growth and improve air quality. Rising awareness of health benefits, expanding construction activities, and stringent regulations on humidity levels in industries like food processing and pharmaceuticals further propel market growth.

North America currently dominates the dehumidifier market. In 2024, the region accounted for the largest market share of over 36.3%, driven by robust construction activities, increasing consumer awareness of indoor air quality, and stringent environmental regulations that support moisture control solutions.

Some of the major players in the dehumidifier market include Bry-Air (Asia) Pvt. Ltd., Condair Group, Danby Appliances, De’Longhi Appliances S.r.l., DST America, Honeywell International Inc., LG Electronics, Midea Group, Munters Group AB, Panasonic Corporation, SHARP Corporation, TCL Electronics Holdings Limited, Therma-Stor LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)