Defoamers Market Size, Share, Trends and Forecast by Medium of Dispersion, Product, Application, and Region, 2025-2033

Defoamers Market Size and Share:

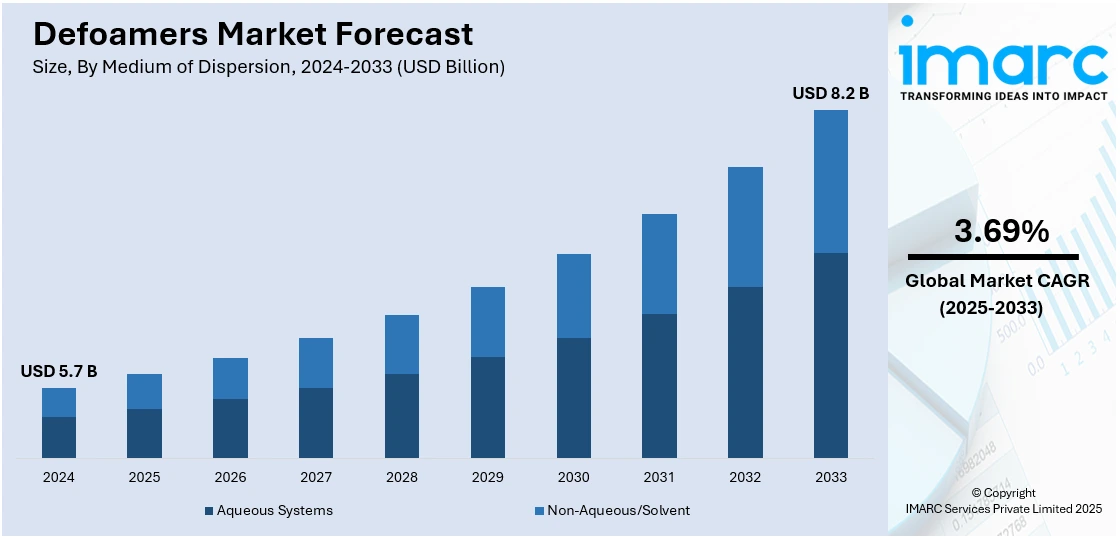

The global defoamers market size was valued at USD 5.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.2 Billion by 2033, exhibiting a CAGR of 3.69% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 36.8% in 2024. Surge in industrialization in developing countries, stringent environmental regulations leading to significant technological improvements in defoamers formulations, increased attention to water conservation, expansion of the paper and pulp industry, the escalating product demand in the paint and coating industries, strict manufacturing regulations in the pharmaceutical sector, and stringent regulations of sustainable and biodegradable defoamers are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.7 Billion |

|

Market Forecast in 2033

|

USD 8.2 Billion |

| Market Growth Rate 2025-2033 | 3.69% |

The global defoamers market is experiencing robust growth driven by the increasing need for efficient foam control in industries such as paper and pulp, water treatment, and food and beverages. These sectors rely on defoamers to optimize production processes and ensure product quality, particularly in applications where foam can disrupt operations or reduce efficiency. Rising awareness of environmental sustainability has prompted manufacturers to develop biodegradable and non-toxic defoamers that comply with stringent regulatory standards, meeting the demand for eco-friendly solutions. Furthermore, the expansion of industrial activities in emerging markets is bolstering the adoption of defoamers as companies seek to enhance operational performance. For instance, in June 2024, Allnex, a global leader in specialty chemicals, introduced the PC-4144 Defoamer, a highly efficient, silicone-free defoamer with low VOC content, tailored for metal working fluids. It is designed for uses like fabrication, industrial cleaning, and water treatment which effectively controls foam in non-aqueous systems such as lubricants and oils.

Another key driver is the surge in demand for defoamers in wastewater treatment, a result of growing concerns over water scarcity and pollution. Governments and organizations worldwide are investing in advanced water treatment infrastructure, creating consistent demand for defoamers to manage foam-related challenges effectively. For instance, in February 2024, the US government announced USD 5.8 billion in funding for clean water treatment and infrastructure under the Investing in America initiative. Part of the Bipartisan Infrastructure Law, this funding supports all states and territories in replacing lead pipes, improving wastewater systems, addressing PFAS contamination, and ensuring equitable access to safe, clean drinking water for communities nationwide. Innovations in defoamer technology, including silicone-based and polymer-based formulations, are enabling manufacturers to provide highly efficient, application-specific solutions. Additionally, the rising adoption of defoamers in sectors like paints and coatings and oil and gas further underscores their critical role in improving process efficiency and meeting industry-specific requirements, driving market growth globally.

Defoamers Market Trends:

Rapid Industrialization Across the Globe

Global industrialization is another essential driver for the defoamers market. The growth of industrial sectors in various countries leads to the natural expansion of manufacturing activities to provide food, textiles, automotive, and other products. Emerging economies are experiencing notable industrial growth. For instance, China's industrial production increased by 6.5% in 2023, while India's manufacturing sector grew by 7.4% during the same period. These surges underscore the importance of efficient manufacturing practices, including the use of defoamers, to maintain product quality and operational efficiency. Furthermore, defoamers are needed for preventing foam generation during numerous manufacturing processes to avoid product defects, decrease production time, and equipment breakdown. Emerging countries are particularly experiencing rapid industrial growth; thus, the value of new efficient manufacturing approaches is difficult to overestimate.

Stringent Environmental Regulations

Governments and international regulatory bodies are imposing strong environmental standards to minimize environmental harm and facilitate industrial sustainability. Wastewater treatment and emissions, which need defoamers to support minimize the impact of hazardous industrial activities, are common mandates for environmental treatment. The Biden-Harris Administration finalized an even more stringent air quality limit to safeguard the health of America’s families, employees, and communities from life-threatening ailments caused by fine particle pollution. The U.S. Environmental Protection Agency’s action to strengthen the annual health-based national ambient air quality standard for fine particulate matter 2.5 from 12 micrograms per cubic meter to 9 micrograms per cubic meter will save 4,500 premature deaths, resulting in up to USD 46 billion in net health benefits.

Rising Awareness of Water Conservation

Growing attention to water conservation issues has emphasized the importance of water treatment processes in efficient ways, and one of the valuable solutions is the use of defoamers. Textile and manufacturing industries, as well as internationally orientated pulp and papermaking, put increasing responsibility on those sectors as a phenomenon of water utilization and treatment. According to the UAE Water Security Strategy 2036, the first provides sustainable access to water during both usual and occasional situations. The strategy’s purposes are reducing the total demand for water sources by 21 percent, increasing the water productivity index to USD 100 per cubic meter, decreasing the water scarcity index to three degrees, increasing the reuse of treated water up to 95 percent and increasing the national water consumption capacity by 2 days. Ministry of Energy and Infrastructure unveiled the UAE Water Security Strategy 2036 in September 2017. The document’s aim is to provide sustainable access to water during ordinary and disaster situations in conjunction with local norms, standards of the World Health Organisation, and vision of achieving happiness and vitality in the UAE.

Defoamers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global defoamers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on medium of dispersion, product, and application.

Analysis by Medium of Dispersion:

- Aqueous Systems

- Non-Aqueous/Solvent

The aqueous systems segment is driven by the increasing emphasis on water-based processes across various industries, aiming to reduce the reliance on volatile organic compounds (VOCs) due to their environmental and health implications. This shift towards water-based systems necessitates the use of defoamers that are compatible with aqueous environments, capable of efficiently reducing or eliminating foam without adversely affecting the system's properties or the final product quality. The trend towards sustainability and stricter environmental regulations further bolsters the demand for aqueous-based defoamers, as industries seek to comply with regulatory standards and reduce their ecological footprint.

On the other hand, the non-aqueous/solvent segment is driven by the specific needs of industries that require solvent-based processes, such as certain types of coatings, adhesives, and oil extraction operations. These applications often involve organic solvents where water-based defoamers are not effective. The demand in this segment is fueled by the efficiency of solvent-based defoamers in suppressing foam under conditions where water is not a viable medium, and their ability to perform in high-temperature and low-water environments. Despite the move towards aqueous systems for environmental reasons, there remains a substantial market for non-aqueous defoamers in applications where their performance characteristics are unmatched.

Analysis by Product:

- Water-based

- Oil-based

- Silicone-based

- Others

Silicon-based leads the market with around 37.3% of market share in 2024. The silicone-based segment is driven by the increasing demand for high-performance and versatile defoaming solutions across various industries. Silicone-based defoamers are renowned for their exceptional efficacy in controlling foam, even at low concentrations, and their stability over a wide range of temperatures and pH levels. This versatility makes them suitable for diverse applications, from water treatment to food processing, where stringent foam control is essential. Moreover, their compatibility with multiple systems and minimal impact on the end product's quality further bolster their preference among manufacturers seeking efficient, reliable defoaming solutions. This segment's growth is also fueled by ongoing innovations aimed at enhancing environmental sustainability and reducing the ecological footprint of defoaming agents.

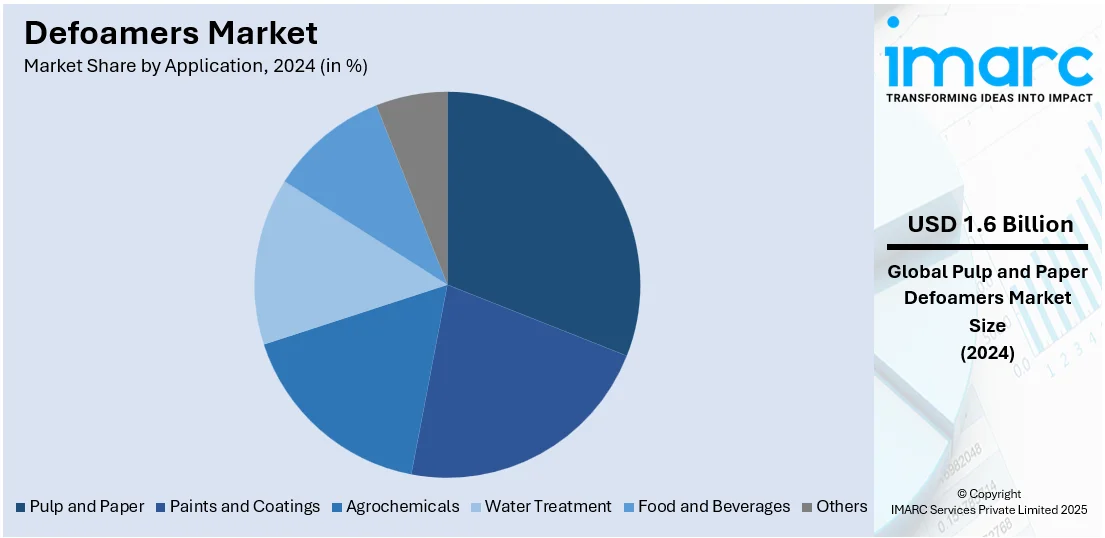

Analysis by Application:

- Pulp and Paper

- Paints and Coatings

- Agrochemicals

- Water Treatment

- Food and Beverages

- Others

Pulp and paper lead the market with around 28.6% of market share in 2024. The pulp and paper segment are driven by the increasing demand for packaging materials and hygiene products, reflecting global consumer trends and the growth of e-commerce. Enhanced environmental awareness has led to a surge in the use of recycled paper, necessitating the use of defoamers to maintain production quality and efficiency during the recycling process. Technological advancements in paper manufacturing processes also play a crucial role, as they demand sophisticated defoaming solutions to meet the industry's evolving needs. Furthermore, regulatory pressures for sustainable and eco-friendly manufacturing practices push for the development and integration of innovative, environmentally benign defoamers, aligning with the sector's commitment to reducing its ecological footprint.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 36.8%. The Asia Pacific region is driven by increasing industrialization and urbanization, particularly in emerging economies like China and India, where there's a surge in manufacturing activities across various sectors, including textiles, pharmaceuticals, and automotive. This growth is complemented by a heightened focus on environmental sustainability, leading to stricter wastewater treatment regulations. Additionally, the region's expanding construction sector, fueled by urban development and infrastructure projects, significantly boosts the demand for paints and coatings, where defoamers are crucial in ensuring product quality. These factors collectively propel the defoamers market in the Asia Pacific, positioning it as a key area of growth within the global landscape.

Key Regional Takeaways:

United States Defoamers Market Analysis

In 2024, United States accounted for 70.2% of the market share in North America. This can be attributed to robust industrial growth and increasing demand for high-performance chemicals in different industries, such as water treatment, oil & gas, and food processing. Moreover, according to industry reports, The U.S. accounted for around USD 1.1 billion in 2023. The increasing need for advanced quality and high productivity for manufactured products has caused the high demand for defoamers in recent times. Rising environmental policies of these U.S.-based businesses further increase demand for natural, biodegradable de-foaming agents as well. Furthermore, the presence of major industry players and their strategic initiatives, such as partnerships, acquisitions, and product innovations, continue to shape the U.S. defoamers market. Major consuming industries include the food and beverages industry with the primary participants being Dow Chemicals and BASF, respectively. The region’s well-established manufacturing infrastructure and access to cutting-edge technologies also contribute to its market expansion.

Europe Defoamers Market Analysis

The European defoamers market is rising steadily with industrial expansion, as well as the positive impact of regulatory measures directed towards sustainability. It is observed that water-based and biodegradable defoamers are gaining more acceptances due to EU regulations aimed towards reducing the environmental impact of chemicals in industries. The chemical and pharmaceutical industry consumers in Germany and the UK seek high-performance defoamers for use in manufacturing operations. Increasing demand by governments for renewable energy has given a push to sustainable energy technologies, thereby further propelling the market. Evonik and Clariant lead these companies that have shown initiative in the production of clean defoaming agents. Government-led programs along with R&D spending maintain support for further market expansion. By prioritizing sustainability, technological innovation, and operational efficiency, Europe continues to be a significant contributor to the growth of the global defoamers market, addressing both current industry requirements and future challenges.

Latin America Defoamers Market Analysis

The Latin American market for defoamers is expanding gradually, supported by increased industrial sectors and the growing necessity for high-quality manufacturing processes. The chemical industry, together with the food & beverages and water treatment sectors, forms the largest consumer groups. The chemical industry of Brazil accounts for 14% of the total chemical sales of Latin America, according to ABIQUIM, the Brazilian Chemical Industry Association. Increasing demand for water treatment solutions and more sustainable manufacturing processes is fueling the growth of demand for biodegradable defoamers. Major players such as Clariant and Dow Chemical are gaining from this region's growth by offering localized solutions, and government initiatives on sustainable manufacturing are also supporting the development of the market.

Middle East and Africa Defoamers Market Analysis

The Middle East and Africa (MEA) region is seeing gradual growth in the defoamers market, with demand being driven by industrial development and the need for enhanced manufacturing efficiency. The oil & gas industry, particularly in countries like Saudi Arabia and the UAE, is a significant consumer of defoamers due to the critical role these chemicals play in refinery processes. As the region shifts towards more sustainable practices, demand for eco-friendly defoamers is expected to rise. In Africa, the food & beverage sector, especially in countries like South Africa, is adopting advanced defoaming solutions to improve production efficiency. Local manufacturers such as Sasol in South Africa are contributing to market growth, providing tailored defoaming products suited to the region's specific industrial needs.

Competitive Landscape:

Key players in the global defoamers market are actively engaging in strategic initiatives to strengthen their positions and cater to the growing demand across diverse industries. These companies are investing heavily in research and development (R&D) to innovate and introduce more effective, environmentally friendly defoamer products that meet stringent regulatory standards and customer expectations for sustainability. For instance, Evonik Coating Additives will be introducing two advanced defoamers, TEGO Foamex 16 and TEGO Foamex 11, at the American Coatings Show 2024. These siloxane-based solutions are tailored for waterborne coatings, preventing foam-related defects, and ensuring flawless finishes. Designed for low to high PVC coatings, they set new sustainability standards, highlighting Evonik’s dedication to innovative and eco-friendly defoamer technology. Moreover, they are expanding their global footprint through strategic partnerships, mergers and acquisitions, aiming to enhance their distribution networks and penetrate new markets, particularly in emerging economies. These players are also focusing on customizing their product offerings to suit the specific needs of various industries, such as paper and pulp, water treatment, and food and beverages, ensuring high performance and efficiency in foam control.

The report provides a comprehensive analysis of the competitive landscape in the defoamers market with detailed profiles of all major companies, including:

- Air Products and Chemicals Inc.

- Ashland, BASF SE

- Clariant AG

- Dow Inc.

- Elementis plc

- Elkem ASA

- Evonik Industries AG

- Basildon Chemical Company Limited (Momentive Performance Materials Inc.)

- Kemira Oyj

- Wacker Chemie AG

Latest News and Developments:

- April 2024: Kemira Oyj announced that they have entered into a sole distribution agreement with BIM Kemi to distribute its pulp defoamer product lines in Brazil. Kemira is strengthening its product portfolio, as the Brazilian pulp market continues to expand, the company said. The group is one of the world's largest suppliers of bleached market pulp and aims to provide BIM's innovative foam control and drainage technology to improve operational efficiency and the use of resources in the production of pulp for several applications.

- November 2023: BASF announced an increase in the capacity of defoamer production at its Dilovasi plant in Turkey. This is in a bid to meet increasing demand for Foamaster and Foamstar products from South-East Europe, the Middle East, and Africa. The production line will increase customer lead times, enhance service, and cut transportation-related emissions by reducing delivery distances. Increasing plant capacity enhances the group's strength of additives business, more significantly on the paints, coatings, and inks side. For Joachim Burger, Head of Sales Additives EMEA, such growth is very relevant because regional customers need support.

- In June 2023: Evonik's Coating Additives business line announced the expansion of its TEGO® Rad range with the introduction of TEGO® Rad 2550, a novel radically crosslinkable defoaming slip additive. This addition to the TEGO® Rad portfolio signifies Evonik's commitment to providing tailored solutions to meet the evolving needs of coating manufacturers, particularly in the realm of UV- and LED-cured formulations. TEGO® Rad 2550 is characterized by several key attributes that distinguish it as a versatile and high-performance additive for coatings.

- May 2023: Elementis launched DAPRO BIO 9910, a new defoamer containing 96% biobased carbon content. The new defoamer has been developed to improve sustainability and performance in coatings, particularly in the architectural paint area. In contrast to traditional petroleum-based defoamers, DAPRO BIO 9910 is a plant-based defoamer based on renewable vegetable oil, providing an eco-friendly alternative. This defoamer outperforms mineral oil-based defoamers by having superior durability, longevity, and storage stability. Elementis is trying to support the increasing demand for greener formulations, in line with regulatory requirements and eco-conscious manufacturers in the coatings industry.

- In May 2022: Dow Inc. made a significant stride in the coatings industry by launching an innovative line of silicone-based defoamers expressly crafted for water-based industrial coatings. This unveiling marked a pivotal moment in addressing the burgeoning need for advanced additives that can effectively manage foam formation throughout the coating application process. The new silicone-based defoamers from Dow Inc. represent a breakthrough in defoamer technology, offering heightened performance and efficiency compared to conventional options. By leveraging silicone as the primary ingredient, these defoamers demonstrate superior capabilities in controlling foam formation, thereby ensuring smoother coating application and enhanced product quality.

Defoamers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Medium Of Dispersions Covered | Aqueous Systems, Non-Aqueous/Solvent |

| Products Covered | Water-based, Oil-based, Silicone-based, Others |

| Applications Covered | Pulp and Paper, Paints and Coatings, Agrochemicals, Water Treatment, Food and Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Products and Chemicals Inc., Ashland, BASF SE, Clariant AG, Dow Inc., Elementis plc, Elkem ASA, Evonik Industries AG, Basildon Chemical Company Limited (Momentive Performance Materials Inc.), Kemira Oyj, Wacker Chemie AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the defoamers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global defoamers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the defoamers industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Defoamers are chemical additives used to prevent or eliminate foam formation during industrial processes, ensuring smooth and efficient operations. Widely applied in industries like coatings, water treatment, and paper production, defoamers improve product quality by addressing foam-related issues, such as surface defects and processing delays, while meeting performance and environmental standards.

The global defoamers market was valued at USD 5.7 Billion in 2024.

IMARC estimates the global defoamers market to exhibit a CAGR of 3.69% during 2025-2033.

The global defoamers market is driven by rising demand across industries like water treatment, paper and pulp, and coatings, where foam control is critical for efficiency and quality. Increasing environmental regulations are encouraging the adoption of eco-friendly defoamers, while technological advancements and industrial expansion in emerging economies further fuel market growth.

Silicon-based leads the market by product owing to their superior performance and versatility. These defoamers effectively control foam across various industries, including water treatment, coatings, and paper and pulp. Their chemical stability, efficiency in small doses, and ability to perform under extreme conditions make them a preferred choice, driving consistent demand and solidifying their market leadership.

The pulp and paper industry leads the global defoamers market, driven by its critical need for foam control during production processes. Defoamers enhance operational efficiency, improve product quality, and prevent foam-related issues such as surface defects and reduced drainage. The industry's consistent growth and focus on optimizing manufacturing processes solidify its position as a key application segment.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global defoamers market include Air Products and Chemicals Inc., Ashland, BASF SE, Clariant AG, Dow Inc., Elementis plc, Elkem ASA, Evonik Industries AG, Basildon Chemical Company Limited (Momentive Performance Materials Inc.), Kemira Oyj, Wacker Chemie AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)