Deep Fryer Market Size, Share, Trends and Forecast by Type, Capacity, End User, Distribution Channel, and Region, 2025-2033

Deep Fryer Market Size and Share:

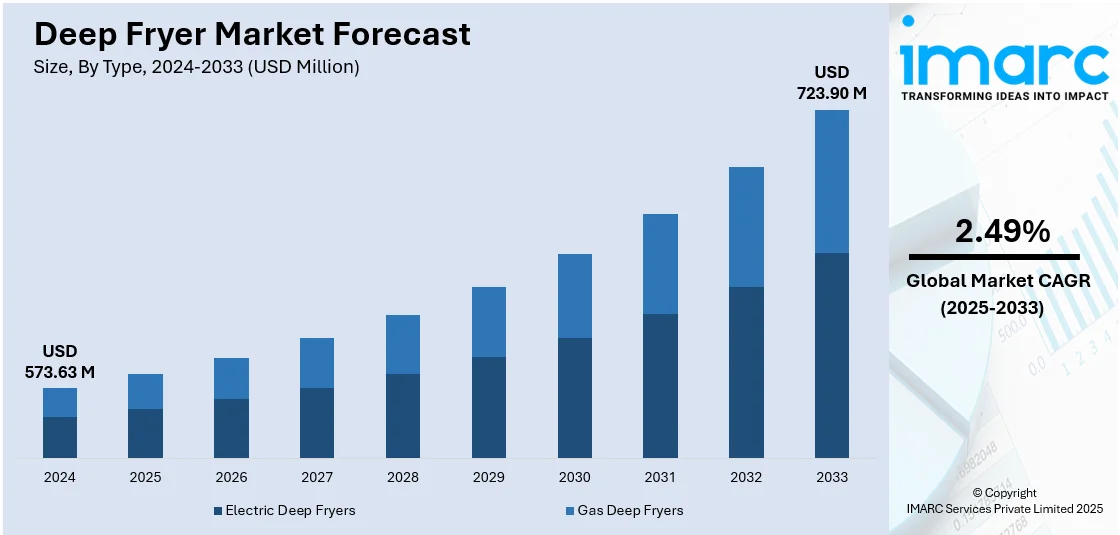

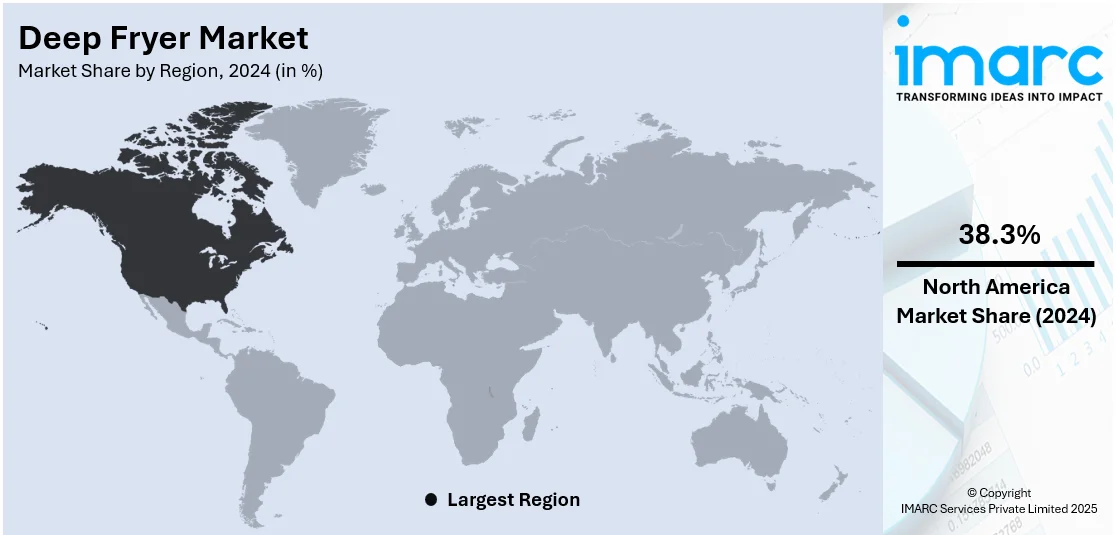

The global deep fryer market size was valued at USD 573.63 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 723.90 Million by 2033, exhibiting a CAGR of 2.49% from 2025-2033. North America currently dominates the market, holding a market share of 38.3% in 2024. The market share in North America is growing because of the strong presence of fast-food chains, high consumer spending on dining out, and a well-established foodservice industry. The high adoption of advanced kitchen appliances and the growing demand for convenience foods further drive deep fryer sales across commercial and residential sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 573.63 Million |

|

Market Forecast in 2033

|

USD 723.90 Million |

| Market Growth Rate 2025-2033 | 2.49% |

Fried foods remain among the most popular menu items globally, ranging from French fries and onion rings to tempura and fried chicken. This preference spans across cultures and age groups, making fried items a staple in both home-cooked meals and restaurant menus. The consistent craving for crispy, flavorful textures keeps demand for deep fryers strong, encouraging commercial kitchens and households alike to invest in efficient frying appliances. Additionally, restaurants, cafes, food trucks, and catering services rely heavily on deep fryers to serve popular fried dishes quickly and consistently. As the foodservice industry expands in urban and semi-urban areas worldwide, the need for durable, high-capacity, and fast-heating fryers grows. These appliances help manage peak-hour demand, maintain food quality, and support large-volume cooking operations.

The United States represents an essential part of the market, supported by the significant presence of fast food and quick service restaurant (QSR) chains. These businesses depend greatly on deep fryers to produce a steady, high-volume supply of fried products, such as French fries, nuggets, and onion rings. As these chains grow and update their menus, the need for dependable, efficient fryers continues to be consistent. Furthermore, the growing initiatives by restaurant brands are catalyzing the demand for deep fryers. As these chains expand their operations, they need professional-grade frying equipment to ensure uniformity across locations, boosting equipment sales. In 2025, Jollibee introduced its franchising initiative in the US, targeting multi-unit franchisees to aid in growing its footprint. The brand, famous for its Chickenjoy and various menu offerings, intends to expand its presence to 350 locations throughout North America.

Deep Fryer Market Trends:

Expansion of QSR Ecosystem

The swift rise of QSRs is a vital factor supporting the growth for the deep fryer industry. These businesses emphasize rapidity, uniformity, and quantity, factors that closely correspond with the usefulness of deep fryers. With fried foods like French fries, nuggets, onion rings, and chicken strips still leading QSR menus globally, the need for dependable and high-capacity fryers continues to be robust. Many chains also require multi-basket or programmable fryers to manage peak-hour operations effectively. The sector's rapid growth, in terms of location and menu diversity, directly boosts fryer sales. For example, in 2024, there were around 199,931 QSRs worldwide, highlighting both the size of the market and the inherent demand for equipment that ensures food quality and efficient production. Developing nations are experiencing an increase in QSR openings fueled by inflating disposable incomes, changing eating habits, and franchise systems. Moreover, legacy chains are enhancing their kitchens with automated and energy-efficient fryers to reduce operational expenses and boost employee efficiency. These trends, along with the growing consumer desire for budget-friendly, quick fried meals, are reinforcing the importance of deep fryers as essential equipment in the changing QSR environment, enhancing both replacement needs and new installations.

E-Commerce Acceleration

The deep fryer market is gaining momentum from the rising efficiency and reach of e-commerce platforms, which are making product discovery, comparison, and purchasing more accessible for users. As digital retail becomes the go-to channel for home appliances, brands are optimizing their online storefronts with detailed product information, client reviews, and visual demonstrations, which is building trust and influencing buying decisions. The steady improvement in online shopping performance metrics directly supports this trend. For instance, the average conversion rate in the Kitchen & Home Appliances e-commerce market increased by 3.79%, from 3.22% to 3.35%, in February 2025 compared to February 2024. This uptick reflects not just more traffic, but more decisive buyers completing purchases after evaluating features and pricing. Deep fryers, particularly air fryers and compact models, are benefited from this shift due to their wide availability across digital channels. Aggressive promotions, influencer content, and bundled deals further enhance online sales appeal. Additionally, the convenience of doorstep delivery and return policies lowers barriers for first-time appliance buyers. In regions where physical appliance showrooms have limited penetration, e-commerce provides a critical distribution bridge, expanding market access and driving sales for both established brands and emerging players in the industry.

Deep Fryer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global deep fryer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, capacity, end user, and distribution channel.

Analysis by Type:

- Electric Deep Fryers

- Gas Deep Fryers

Electric deep fryers capture a considerable portion of the market because of their user-friendliness, energy efficiency, and appropriateness for residential and commercial kitchens. These fryers frequently come with accurate temperature settings, timers, and safety features, making them easy to use and suitable for different cooking requirements. They are particularly preferred in indoor settings wherein gas lines might not be accessible or allowed. Their small dimensions, ease of transport, and ability to connect to standard power outlets render them a favored option for home users, cafes, and smaller foodservice venues.

Gas deep fryers are commonly favored in high-volume commercial kitchens because of their quicker heat-up times and reliable high-temperature operation. These units are ideal for tasks that need ongoing frying and rapid recovery, such as large restaurants, fast-food chains, and catering services. Their ability to reach and maintain high temperatures makes them efficient for bulk frying, often resulting in crisper textures and faster service. Their durability and lower operational costs over time make them a reliable investment for large-scale foodservice operations.

Analysis by Capacity:

- 2L

- 2L-5L

- 5L-8L

- 8L-14L

- Over 14L

2L-5L represents the largest segment, accounting 49.5% market share, because it is ideal for both small business operations and home use. This size range provides an optimal balance of space efficiency and adequate cooking capacity, making it a favored option for QSRs, cafes, food stalls, and home kitchens. Users experience quicker heating, reduced oil usage, and simpler cleaning than with larger units, leading to its popular use. The space-saving design enables these fryers to be accommodated in kitchens with restricted counter space while maintaining their functionality. Their cost-effectiveness and functionality appeal to a wide range of individuals looking for dependable frying options for average batch cooking. Moreover, producers are providing models in this category equipped with enhanced features such as digital controls, timers, and automatic shut-off, which further boost their attractiveness. The adaptability and ease of use offered by 2L–5L deep fryers establish this category as a prominent market leader in multiple end-use scenarios.

Analysis by End User:

- Households

- Quick Service and Full-Service Restaurants

- Others

Quick service and full-service restaurants stand as the largest component in 2024, holding 76.6% of the market. Quick service and full-service restaurants dominate the market owing to their consistent demand for efficient, high-capacity cooking appliances that support large-scale food preparation. These establishments rely on deep fryers to maintain fast service speeds and meet client expectations for fried menu items, which are often high in demand. Deep fryers help streamline operations, reduce preparation time, and ensure consistent food quality, which is critical for maintaining brand reputation and client satisfaction. Full-service restaurants also benefit from the versatility of deep fryers, using them to prepare a wide variety of dishes across diverse cuisines. The ability to deliver high output during peak hours without compromising taste or texture makes deep fryers an essential tool. Additionally, ongoing menu innovation and consumer interest in fried food offerings drive continuous investment in advanced frying equipment across these foodservice segments.

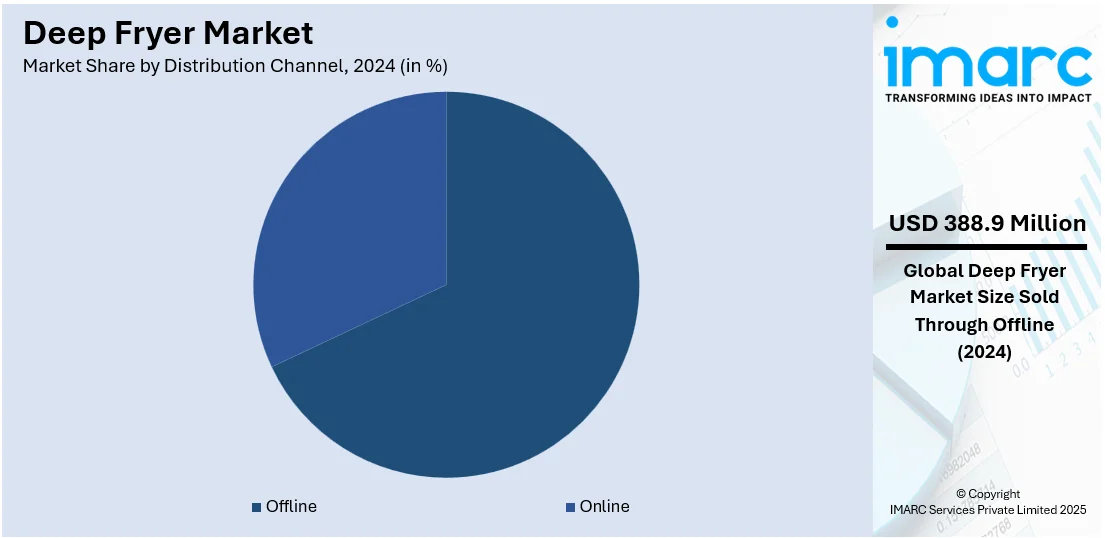

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with 67.8% of market share in 2024, as consumers prefer to physically inspect products prior to buying, particularly for high-cost kitchen appliances. Retail stores, specialty shops, and brand showrooms offer practical product demonstrations, individualized support, and immediate stock availability, impacting buying choices. These channels provide the benefit of coordinating after-sales service and facilitating simple return or exchange options, which boosts buyer confidence and convenience. Numerous shoppers appreciate the capacity to evaluate models, features, and prices instantly, enhanced by in-store offers and seasonal markdowns. Offline retail remains particularly influential in the commercial segment, where bulk purchases and equipment consultations are common. Additionally, collaborations between producers and retail networks guarantee increased visibility and a robust brand presence in local markets. The hands-on shopping experience, along with personalized client service, maintains offline distribution as the favored option for both business purchasers and individual shoppers.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the largest market share of 38.3% owing to the growing presence of fast-food restaurants, a prevalent culture of fried food consumption, and regular menu innovations from leading food brands. The region’s established foodservice sector depends significantly on efficient fryers for reliable quality and quick service. The increasing demand for commercial fryers is also fueled by consumer fascination with distinctive fried options and experiential dining. For instance, in 2024, McCain Foods launched the Happy Frydays Café in Toronto, honoring French fries with an extravagant menu and communal experiences. The café operated until November 24th, providing distinct fry-inspired meals and exclusive merchandise. These brand-driven experiences highlight the strong cultural ties to fried foods in the region and promote investment in frying equipment. Moreover, the presence of sophisticated appliances in both online and offline retail channels facilitates household uptake, which further enhances North America’s dominant role in the global deep fryer market.

Key Regional Takeaways:

United States Deep Fryer Market Analysis

In North America, the market portion held by the United States was 88.30%. The United States experiences rising deep fryer adoption driven by the expanding network of cafes and hotels. For example, there are 166,272 hotel and motel establishments in the US in 2023, reflecting a 7.1% rise from 2022. This growth is supported by a surge in consumer preference for fried snacks and meals available at dine-in and fast-casual outlets. As cafes and hotels increase their offerings of fried appetizers and entrees, commercial kitchens are investing in efficient deep fryers to meet demand. The hospitality sector is also focusing on improving food preparation speed and consistency, where deep fryers play a central role. Technological enhancements in fryer models, including oil filtration and automated timers, are further encouraging adoption. Moreover, the rising trend of breakfast and brunch menus in hotels is leading to the inclusion of deep-fried items, reinforcing the growing cafes and hotels segment's impact on deep fryer demand.

Europe Deep Fryer Market Analysis

Europe's food processing sector significantly contributes to the increased adoption of deep fryers across the region. Food manufacturers and large-scale processors integrate industrial fryer systems to manage consistent batch production of fried products. Rising consumption of pre-cooked and ready-to-eat items demands reliable deep-frying solutions that ensure shelf-stability and taste retention. With evolving dietary trends and convenience-based eating patterns, processors require efficient systems to meet supply chain expectations. Deep fryer integration supports large-volume production and uniformity in processed food items, enhancing distribution efficacy. Technological improvements in fryer design support energy efficiency and waste oil reduction, aligning with sustainability goals in the sector. Regional food companies are scaling up automation to improve throughput and product quality, making deep fryers vital to production lines. As processing capabilities expand, the necessity for commercial fryers remains consistent with output expectations.

Asia Pacific Deep Fryer Market Analysis

Asia-Pacific is witnessing an increased demand for deep fryers, primarily attributed to the rapid expansion of QSRs. For instance, in 2023, India had over 104 thousand QSRs outlets. The growth of urban populations and shifting consumer lifestyles have led to a preference for convenient and fast meals, boosting the QSR industry. As these restaurants scale operations, deep fryers become essential for consistent preparation of fried offerings. Many QSR chains are investing in energy-efficient and high-capacity fryer models to handle large volumes and reduce operational costs. Enhanced focus on kitchen automation and food safety also supports the integration of modern deep fryers in QSR kitchens. Furthermore, the popularity of snackable fried items in the region adds momentum to this demand, reinforcing the connection between quick service restaurants and rising deep fryer adoption.

Latin America Deep Fryer Market Analysis

Latin America shows growing deep fryer installations driven by increased usage of online retail channels offering commercial kitchen equipment. For instance, online retail sales as a percentage of total retail sales in Latin America will increase from 12.3% in 2023 to 15.9% in 2028. Restaurants and small businesses utilize digital platforms to access a wider variety of deep fryer models at competitive prices. The ease of comparing product specifications and consumer reviews encourages fryer acquisition among food service operators. Online retail simplifies logistics for buyers in remote or semi-urban areas, enhancing market reach. As more businesses adopt e-commerce procurement, deep fryer availability and visibility rise, boosting sales and adoption.

Middle East and Africa Deep Fryer Market Analysis

Middle East and Africa register heightened deep fryer demand influenced by the growing popularity of deep-fried food items such as chicken and burgers. For instance, with a total of 206 KFC outlets in the UAE, the brand has created a notable footprint throughout the region. Food outlets increasingly include fried items in their menus to cater to evolving taste preferences. Urban expansion and changing lifestyles contribute to greater consumption of such food categories. Deep fryers become essential kitchen appliances for businesses focusing on quick meal delivery. With consumers seeking familiar, flavor-rich offerings, businesses invest in fryers that enable consistent product output and cooking speed.

Competitive Landscape:

Major participants in the market are concentrating on creating technologically advanced and energy-efficient models to align with evolving consumer demands and regulatory requirements. They are allocating resources toward research and development (R&D) to implement features like automatic temperature regulation, oil filtration systems, and quicker heating elements to improve user convenience and product efficiency. Businesses are also broadening their product ranges to serve both commercial and residential markets, ensuring alignment with contemporary kitchen needs. Moreover, players are utilizing digital platforms and e-commerce to connect with larger audiences and enhance user interaction via after-sales assistance and tailored solutions. Strategic partnerships, mergers, and acquisitions are being sought to enhance market presence and distribution channels. For example, in 2024, Hoshizaki Corporation acquired shares of two foodservice equipment companies in the Philippines, Technolux Equipment and HKR Equipment, making them subsidiaries. This move aimed to strengthen Hoshizaki's sales and service structure in the growing Philippine market. The acquisition was part of Hoshizaki's broader strategy to expand its presence in Southeast Asia.

The report provides a comprehensive analysis of the competitive landscape in the deep fryer market with detailed profiles of all major companies, including:

- Ali Group SRL

- Breville Group

- De'Longhi S.p.A.

- Electrolux AB

- Eware Appliances

- Groupe SEB

- Hamilton Beach Brands Holding Company

- Henny Penny

- National Presto Industries Inc.

- Welbilt Inc.

Latest News and Developments:

- March 2025: Kiremko unveiled the CORDA Invicta fryer with integrated EcoMiser, revolutionizing industrial deep fry technology. The system, developed with REYCO Systems, significantly reduced oil use and factory footprint. It deep fried over 30 tons of products per hour while improving sustainability. The launch marked a major leap in high-capacity food production efficiency.

- April 2024: Breville, a kitchen appliance brand, successfully integrated Algolia's AI Search into its digital platforms. The move aimed to boost online engagement and personalize the shopping journey for 15 Million global users. This enhanced experience led to a notable rise in conversions, with 20% of visitors making purchases. The upgrade strengthened Breville’s digital strategy and customer focus.

Deep Fryer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electric Deep Fryers, Gas Deep Fryers |

| Capacities Covered | 2L, 2L-5L, 5L-8L, 8L-14L, Over 14L |

| End Users Covered | Households, Quick Service and Full-Service Restaurants, Others |

| Distribution Channels Covered | Offline, Online |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ali Group SRL, Breville Group, De'Longhi S.p.A., Electrolux AB, Eware Appliances, Groupe SEB, Hamilton Beach Brands Holding Company, Henny Penny, National Presto Industries Inc., Welbilt Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the deep fryer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global deep fryer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the deep fryer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The deep fryer market was valued at USD 573.63 Million in 2024.

The deep fryer market is projected to exhibit a CAGR of 2.49% during 2025-2033, reaching a value of USD 723.90 Million by 2033.

The deep fryer market is growing because of the increasing demand for quick-service restaurants, rising consumer preference for fried foods, and the expansion of commercial food establishments. Technological advancements, including energy-efficient and automatic fryers and the growing popularity of home cooking appliances contributes to higher adoption of deep fryer across both residential and commercial segments.

North America currently dominates the deep fryer market, accounting for a share of 38.3%. The dominance of the region is because of the strong presence of fast-food chains, high consumer spending on dining out, and a well-established foodservice industry. The high adoption of advanced kitchen appliances and the growing demand for convenience foods further drive deep fryer sales across commercial and residential sectors.

Some of the major players in the deep fryer market include Ali Group SRL, Breville Group, De'Longhi S.p.A., Electrolux AB, Eware Appliances, Groupe SEB, Hamilton Beach Brands Holding Company, Henny Penny, National Presto Industries Inc., Welbilt Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)