Decorative Laminates Market Size, Share, Trends, and Forecast by Product Type, Application, End-Use, Texture, Pricing, Sector, and Region, 2025-2033

Decorative Laminates Market 2024, Size and Trends:

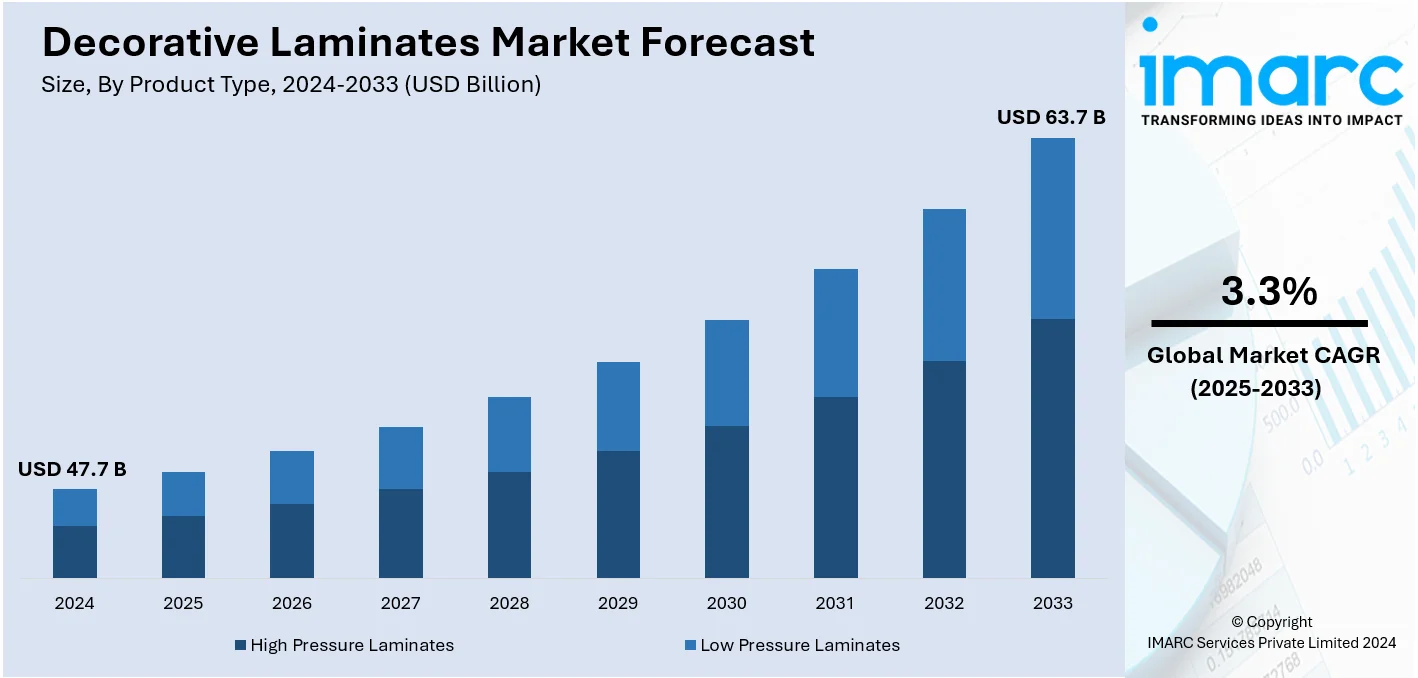

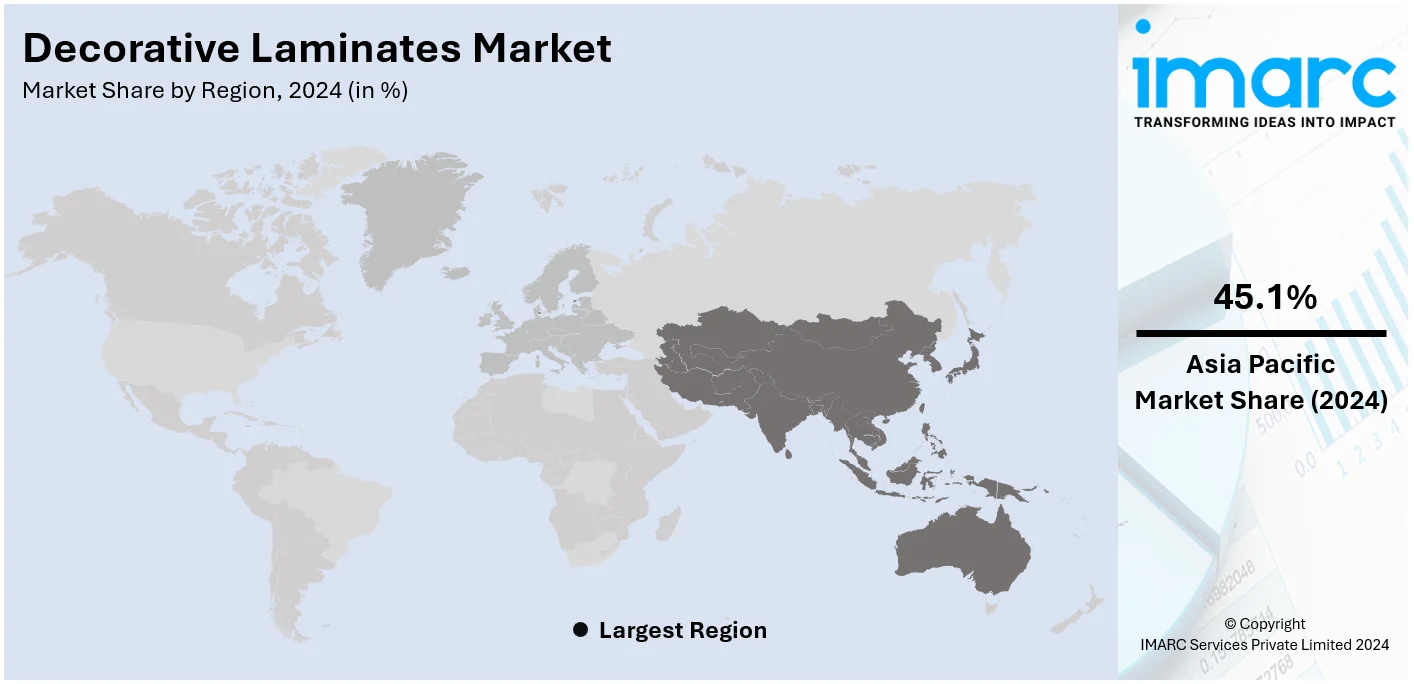

The global decorative laminates market size was valued at USD 47.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 63.7 Billion by 2033, exhibiting a CAGR of 3.3% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 45.1% in 2024. This dominance is driven by rapid urbanization, booming construction activities, and increasing consumer demand for cost-effective and stylish interior solutions are major factors bolstering the decorative laminates market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 47.7 Billion |

|

Market Forecast in 2033

|

USD 63.7 Billion |

| Market Growth Rate 2025-2033 | 3.3% |

The growing consumer inclination toward aesthetically pleasing as well as user-friendly interior design is one primary drivers of the decorative laminates market growth. Driven by rising urbanization and growing disposable incomes, consumers are seeking cost-effective yet stylish solutions for household and office furnishings. Decorative laminates present a practical choice, offering an extensive range of designs and textures while replicating the appearance of premium materials such as wood, stone, and metal. For example, in December 2024, SkyDecor Laminates Pvt. Ltd. exemplified innovation in the laminates industry by launching two new product lines: 'Design Master 1 MM+ Decorative Laminates' and 'Acrylish – Volume 2.' The Design Master range introduced over 300 unique laminates, focusing on aesthetics and functionality, while Acrylish offered 111 high-gloss designs crafted with 100% virgin PMMA for enhanced surface stability and scratch resistance. Such advancements in laminate technology drive the growing popularity of these products, offering durable, low-maintenance, and customizable solutions for evolving consumer needs in high-traffic areas.

The United States is a highly significant player in the global market for decorative laminates, since it has established advanced manufacturing capability and strong demand for high-quality interior solutions. United States-based producers use cutting-edge technology to provide innovative laminates with enhanced strength, aesthetics, and environmental sustainability. The strong domestic demand that is fueled by construction and renovation activities across all residential, commercial, and institutional sectors supports consumption. For example, in 2024, the Formica Corporation added five additional designs to their DecoMetal Laminates line, extending the options it offers architects and designers to update commercial spaces such as hospitality and retail with modernized Art Deco-inspired elegance. In addition, the country is a main exporter, supplying international high-end products designed by global design visions. The use of environmentally friendly materials along with strict environmental regulations strengthens the position of U.S. manufacturers in the global market.

Decorative Laminates Market Trends

Increasing Demand for Aesthetic Interiors

The increasing demand for aesthetic interiors is a significant factor strengthening the decorative laminates market share. Globally, interior design services generated a staggering USD 150.7 Billion in 2020. It is estimated that by 2027, this sector will be valued at USD 255.4 Billion. Furthermore, in developing nations like India, the interior design industry is expected to grow at 8.81% annually, reaching USD 67.4 Billion by 2032. Decorative laminates offer an exhaustive range of colors, designs, and textures, which may change a mundane interior into a classy, modern, and stylish place. Additionally, owners are looking at distinctive and customized interior designs, which in turn means classy and personal laminates have a growing demand. Apart from this, businesses, stores, and hotels look after aesthetic and style settings in order to gain and retain the customer base. In this case, decorative laminates are a good alternative because they can be versatile and at a lower cost mimic more expensive materials like wood and stone.

Growth in Construction and Real Estate

In the growth of construction and real estate, demand for decorative laminates has gone significantly higher. The growth rate of construction sectors is phenomenal, especially in the developing regions that see the surge in urbanization and infrastructure. This sector in India is predicted to be worth USD 1.4 Trillion by 2025. Furthermore, the building construction sector is expected to develop at a 5.13% annual rate between 2024 and 2032. Aside from that, the real estate industry is expected to reach USD 8,654 Billion by 2032, growing at an annual rate of 1.9%. This growth covers residential, commercial, and industrial projects that require modern, long-lasting, and aesthetic interior solutions. In addition, renovation and refurbishment activities of existing buildings are also contributing to the decorative laminates market demand because property owners look to upgrade the interiors with contemporary and stylish materials.

Advancements in Technology

Technology, according to the latest decorative laminates market forecast, is being taken as a catalyst for growth. Manufacturing processes have been improvised to produce high-quality, versatile, and incredibly durable laminates with aesthetic appeal. Digital printing has revolutionized the laminate business to the extent that almost any type of look and feel could be produced in laminates akin to granite, marble, and wood, thanks to some astonishingly realistic textures and intricate designs. The global digital printing market size reached USD 30.5 Billion in 2024. Another positive implication of these advances is that laminates' scope of possible designs has broadened, hence making them appealing to customers as well as designers. More so, through technological advancement, laminate performance properties have been enhanced through scratch, stain, heat, and moisture resistances, and this has ensured their use in various applications like kitchen counters, and office furniture among others.

Decorative Laminates Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global decorative laminates market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, end use, texture, pricing, and sector.

Analysis by Product Type:

- High Pressure Laminates

- Low Pressure Laminates

As per the decorative laminates market forecast, low pressure laminates stand as the largest product type in 2024, holding around 80.5% of the market. Low pressure laminates hold market dominance because of low prices and wide availability. The laminates produced are less intensive compared to high pressure laminates and thus are more economical for a wider range of applications. LPL is quite used in home and commercial furniture, cabinetry, interior design, and the like, mainly because it gives an excellent balance of strength and beauty. Their popularity comes from their adaptability and ability to provide a wide range of finishes and textures, making them an excellent alternative for consumers and businesses looking for economical yet elegant interior solutions.

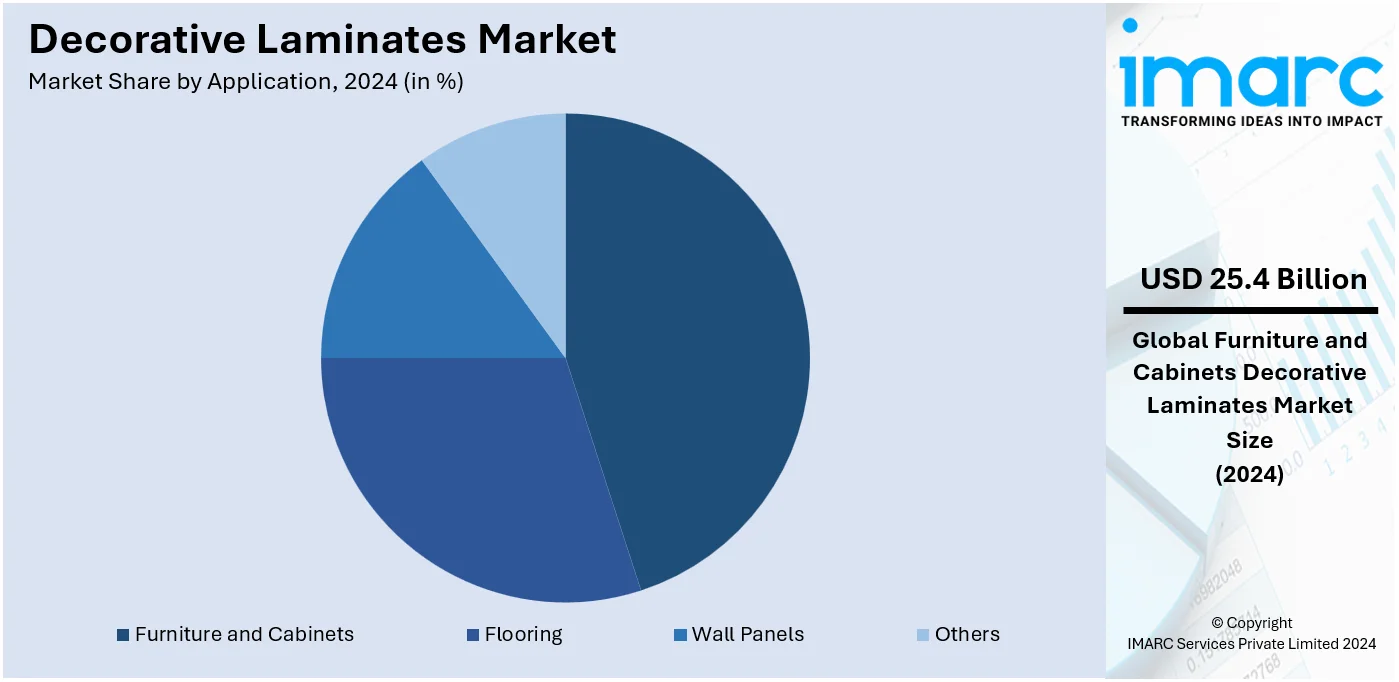

Analysis by Application:

- Furniture and Cabinets

- Flooring

- Wall Panels

- Others

According to the decorative laminates market outlook, furniture and cabinets lead the industry with around 53.2% of the market share in 2024. Furniture and cabinets are the most common application segment, reflecting the growing demand for visually beautiful, long-lasting, and cost-effective surface materials in the furniture industry. Decorative laminates are highly versatile. They come in a wide variety of colors, patterns, and textures that can be used to beautify furniture and cabinets. Because of their scratch-resistant, stain-resistant, and moisture-resistant properties, they are ideal for use in high-traffic locations such as kitchens and living rooms. Thus, manufacturers and consumers opt for these laminates in furniture and cabinet constructions, thereby increasing the size of the decorative laminates market.

Analysis by End-Use:

- Non-Residential

- Residential

- Transportation

Non-residential leads the market with around 56.4% of the market share in 2024. The major market share holders are non-residential sectors that include commercial, retail, hospitality, and healthcare. These types of spaces need interior materials of high quality that are durable, aesthetically pleasing, and create attractive as well as functional surroundings. Office furniture, retail fixtures, hotel interiors, and hospital surfaces largely use decorative laminates due to its versatility, maintenance ease, and cost-effectiveness. In addition, increasing commercial construction and renovation projects are leading to a rising demand for decorative laminates in non-residential applications, hence solidifying its leading market position.

Analysis by Texture:

- Matte/Suede

- Glossy

Matte/suede leads the market with around 65.6% of the market share in 2024. Matte/suede textures are leading the segment as highlighted in the recent decorative laminates market outlook. This is attributed to their contemporary look and practical benefits. These textures provide a subtle, understated finish, in line with modern design trends, offering a non-glossy, smooth surface that minimizes glare and fingerprints. The matte/suede finish is popular both in residential and commercial environments, since it combines aesthetic appeal with functionality: surfaces are easy to clean and maintain. In addition, the increasing preference for sleek, minimalist interior designs further propels the demand for matte/suede textured laminates, ensuring them to be dominant in the market.

Analysis by Pricing:

- Premium

- Mass

Mass products lead the market with around 71.8% of the market share in 2024. Mass pricing segments hold the majority of the market share, driven by affordability and wide accessibility. These laminates offer a cost-effective solution for consumers and businesses seeking quality surface materials without premium costs. The mass segment includes a variety of designs and finishes, catering to a broad audience with different aesthetic preferences and budget constraints. Furthermore, the high demand for budget-friendly interior solutions in both residential and commercial sectors, which ensures that mass-priced laminates remain the leading choice, is boosting the decorative laminates market size.

Analysis by Sector:

- Organised

- Unorganised

Organised leads the market with around 80.2% of the market share in 2024. Organised laminates are dominating the market due to their consistent quality, reliability, and adherence to industry standards. These laminates are produced by established manufacturers with advanced production facilities, ensuring high-quality products that meet consumer expectations. Furthermore, organised sector laminates offer a wide range of designs, superior durability, and better after-sales service, making them a preferred choice for both residential and commercial applications. Additionally, the trust and reputation associated with organised brands contribute to their majority market share, as consumers seek dependable and long-lasting interior solutions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, Asia-Pacific accounted for the largest market share of over 45.1%. The Asia Pacific region holds the majority of the decorative laminates market share, owing to rapid urbanization, booming construction activities, and increasing disposable incomes. Countries like China and India are major contributors, with their expanding real estate and infrastructure sectors demanding high volumes of decorative laminates for residential, commercial, and industrial applications. Furthermore, the region's large population base and the growing middle class is also fueling the demand for stylish and affordable interior materials. Additionally, the presence of numerous laminate manufacturers in Asia Pacific, which supports local production and supply, is positively influencing the market growth.

Key Regional Takeaways:

United States Decorative Laminates Market Analysis

The United States accounted for 89.80% of the market share in North America. The US decorative laminates market is experiencing significant growth, driven by the increasing demand for innovative and visually appealing interior design solutions in both residential and commercial sectors. The market's expansion is closely tied to the growing construction industry, with the US construction equipment market reaching USD 43.53 Billion in 2023. This surge in construction activity, particularly in residential and office spaces, is contributing to a heightened need for decorative materials. Decorative laminates are becoming increasingly popular due to their affordability, durability, and versatility, offering a cost-effective alternative to traditional materials. Furthermore, the rising focus on sustainability is influencing market dynamics, as consumers and manufacturers alike shift toward eco-friendly laminate options made from recycled materials and low-VOC processes. The increasing popularity of DIY home improvement projects is boosting demand, as homeowners look for cost-effective and stylish options for upgrading their living spaces. Additionally, technological advancements such as digital printing and embossing are expanding the design possibilities for laminates, allowing for greater customization. With shifting consumer preferences favoring contemporary designs and eco-friendly options, the decorative laminates market in the United States is set to experience sustained growth in the years ahead.

North America Decorative Laminates Market Analysis

The North American decorative laminates market is driven by robust demand from residential and commercial construction sectors. The region's preference for cost-effective and visually appealing surface solutions has positioned decorative laminates as a preferred choice for countertops, cabinetry, and furniture. For instance, in 2024, 70% of homeowners consider laminate countertops for affordability and aesthetics, preferences vary by generation. Advancements in manufacturing technology, such as precision printing and texturing, have enabled the production of laminates that closely mimic premium materials like stone, wood, and metal. Key players focus on sustainability, introducing eco-friendly products that meet stringent environmental regulations. The market benefits from strong consumer interest in remodeling activities and the rise of multifunctional workspaces. Additionally, growth in e-commerce has enhanced product accessibility, bolstering market expansion across the region.

Asia Pacific Decorative Laminates Market Analysis

The APAC decorative laminates market is benefiting from the region's rapid urbanization, with East Asia and the Pacific being the world’s most rapidly urbanizing region, as per the World Bank, experiencing an average annual urbanization rate of 3 percent. The expansion of urban areas is fueling the need for contemporary interior design solutions, especially in rapidly developing markets such as China, India, and Japan. As urban centers expand, the need for stylish and affordable materials in residential, commercial, and hospitality spaces has led to increased adoption of decorative laminates. These materials offer an ideal combination of cost-effectiveness, durability, and aesthetic appeal. Moreover, the expanding middle class and their increasing spending capacity serve as key drivers of market expansion. With consumers increasingly prioritizing eco-friendly and sustainable products, manufacturers are focusing on producing laminates that align with these preferences. Technological advancements, such as digital printing, have also enhanced the design capabilities of decorative laminates, further driving their popularity in the region.

Europe Decorative Laminates Market Analysis

The European decorative laminates market is being driven by several factors, including the rising demand for aesthetically appealing and durable materials in construction, furniture, and interior design sectors. A key driver of this expansion is the growing awareness among consumers about the importance of sustainability. According to industry reports, in 2022, 90% of European consumers, with 91% of French consumers, were particularly attentive to the sustainability of products, especially household appliances and high-tech items. This growing focus on eco-friendly products is influencing the laminate industry, pushing manufacturers to develop sustainable options, such as laminates made from recycled materials and low-VOC processes. Additionally, the demand for premium, high-quality laminates is growing as consumers seek long-lasting, visually appealing solutions. The trend towards home renovations and remodeling is further boosting the market, with decorative laminates offering versatility and ease of installation. Technological innovations such as digital printing, new textures, and finishes are expanding the design possibilities, making laminates an attractive choice for modern interiors. As sustainability continues to shape consumer preferences, the European decorative laminates market is expected to experience continued growth in the coming years.

Latin America Decorative Laminates Market Analysis

The decorative laminates market in Latin America is driven by the increasing demand for cost-effective and aesthetically appealing interior solutions. As urbanization grows and disposable incomes rise, there is a stronger preference for high-quality home and office furnishings. The expanding construction sector, particularly in Argentina, which is projected to grow at a CAGR of 3.50% from 2024 to 2032, further boosts laminate demand. Furthermore, the emphasis on environmentally conscious solutions is driving the shift toward the use of sustainable laminates. These factors combined contribute to the overall market expansion across the region.

Middle East and Africa Decorative Laminates Market Analysis

The decorative laminates market in the Middle East and Africa is driven by rapid urbanization, with the Middle East and North Africa (MENA) region already 64% urbanized, as per the World Bank. This urban growth, particularly in countries like the UAE and Saudi Arabia, fuels demand for high-quality interior solutions in the residential, commercial, and hospitality sectors. The growing construction industry, rising disposable incomes, and a shift towards modern, luxurious interior designs are key factors propelling the market. Additionally, increasing awareness of sustainability is encouraging the use of eco-friendly laminates in the region, further supporting market growth.

Competitive Landscape:

The market for decorative laminates is intensely competitive, featuring a wide array of both international and local manufacturers. Key participants focus on innovation, introducing advanced designs, textures, and sustainable solutions to meet evolving customer preferences. Strategic partnerships, mergers, and acquisitions are prevalent as companies aim to expand their geographical reach and strengthen their product portfolios. Industry leaders allocate substantial resources to research and development, focusing on creating laminates that offer enhanced durability, cost-effectiveness, fire-resistant properties, and environmentally sustainable materials. Numerous organizations, such as the International Organization for Standardization (ISO) and European Standards, have established regulations to closely monitor and govern the industry. The vast majority of industry participants operating in this sector are adhering to the standards established by these organizations. Furthermore, regulatory standards promoting green and energy-efficient buildings are likely to fuel market expansion. As a result, companies are investing in the development of green construction materials as they place a greater emphasis on environmental friendliness and energy efficiency. Additionally, the rising influence of e-commerce platforms has intensified competition, enabling smaller players to access broader markets and challenge established brands with cost-effective offerings. For instance, in 2024, Formica Corporation introduced InDepth Surfacin, a premium laminate line featuring precision inline print technology, offering enhanced texture and visual depth for unparalleled naturalism in laminate surfaces.

The report provides a comprehensive analysis of the competitive landscape in the decorative laminates market with detailed profiles of all major companies, including:

- Abet Laminati S.p.A

- AICA Laminates India Pvt. Ltd.

- Airolam decorative laminates

- Archidply Industries Ltd

- Century Plyboards (I) Limited

- Formica Corporation

- FunderMax Gmbh

- Greenlam Industries Limited

- Merino Industries Limited

- OMNOVA North America Inc. (SURTECO GmbH)

- Stylam Industries Limited

- Wilsonart LLC

Latest News and Developments:

- June 2024: The Abet Laminati S.p.A decorative panels by Alessandro Mendini were showcased in the “Io sono un drago” exhibition at the Triennale di Milano until 13 October. The retrospective highlighted Mendini’s influence on architecture, design, and culture. In collaboration with the Alessandro Mendini Archive, Abet Laminati recreated two key installations, Interno di un Interno (1990) and Le mie prigioni (2016), along with 21 architectural models by Atelier Mendini. The exhibition also featured studies for the façades of the Posco Quarter in Seoul.

- February 2024: Skydecor Laminates has announced the opening of its new Experience Centre in Kirti Nagar, New Delhi, spanning 3,600 square feet. This showroom offers an immersive experience, showcasing the latest laminate collections and interior solutions. Customers can explore the textures, designs, and quality of Skydecor’s products to find the best fit for their needs.

- July 2023: CenturyLaminates has launched a new campaign with Wunderman Thompson India, featuring a laminate range designed by Manish Malhotra, titled "Fashion for your Furniture." The collection integrates his double M monogram into the Insignia range. The campaign highlights the laminates' colors, textures, and finishes, with films showcasing Malhotra’s designs, starting with "The Video Call."

- August 2022: Advance Decorative Laminates launched a new range of laminates at an event in Goa, which included a channel partners meet and the Club Awards to honor top performers. The collection featured contemporary designs sourced from Europe, Japan, Korea, and the U.S., produced with advanced technology.

Decorative Laminates Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High Pressure Laminates, Low Pressure Laminates |

| Applications Covered | Furniture and Cabinets, Flooring, Wall Panels, Others |

| End-Uses Covered | Non-Residential, Residential, Transportation |

| Textures Covered | Matte/Suede, Glossy |

| Pricings Covered | Premium, Mass |

| Sectors Covered | Organised, Unorganised |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Abet Laminati S.p.A, AICA Laminates India Pvt. Ltd., Airolam decorative laminates, Archidply Industries Ltd, Century Plyboards (I) Limited, Formica Corporation, FunderMax Gmbh, Greenlam Industries Limited, Merino Industries Limited, OMNOVA North America Inc. (SURTECO GmbH), Stylam Industries Limited, Wilsonart LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the decorative laminates market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global decorative laminates market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the decorative laminates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The decorative laminates market was valued at USD 47.7 Billion in 2024.

IMARC Group estimates the market to reach USD 63.7 Billion by 2033, exhibiting a CAGR of 3.3% during 2025-2033.

The global decorative laminates market is driven by rising demand for aesthetically pleasing and cost-effective interior solutions, growing construction and remodeling activities, advancements in manufacturing technologies, and increasing consumer preference for durable, low-maintenance materials. Additionally, sustainability trends and innovations in design and texture enhance market growth across residential and commercial sectors.

In 2024, furniture and cabinets represented the largest segment, driven by high demand in residential and commercial spaces for durable and aesthetically appealing surfaces.

In 2024, low pressure laminates represented the largest segment, due to their cost-effectiveness, ease of installation, and widespread use in furniture and paneling applications.

In 2024, matte/suede leads the market by texture type, owing to their modern appeal, fingerprint resistance, and growing popularity in contemporary interior designs.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the decorative laminates market include Abet Laminati S.p.A, AICA Laminates India Pvt. Ltd., Airolam decorative laminates, Archidply Industries Ltd, Century Plyboards (I) Limited, Formica Corporation, FunderMax Gmbh, Greenlam Industries Limited, Merino Industries Limited, OMNOVA North America Inc. (SURTECO GmbH), Stylam Industries Limited, Wilsonart LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)