Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2026-2034

Debt Collection Software Market Size and Share:

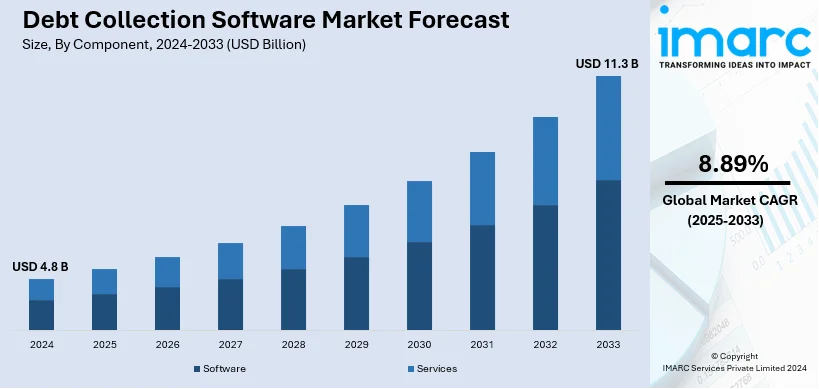

The global debt collection software market size was valued at USD 4.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 11.3 Billion by 2034, exhibiting a CAGR of 8.89% from 2026-2034. North America currently dominates the market, holding a market share of over 30.7% in 2024. The increasing need to improve customer relations, the emergence of various technologies in the financing sector, and the growing software demand to enhance the transparency of payments and money management in businesses are some of the factors propelling the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.8 Billion |

|

Market Forecast in 2034

|

USD 11.3 Billion |

| Market Growth Rate 2026-2034 | 8.89% |

The global market is witnessing significant growth, primarily driven by the rising demand for efficient management of overdue payments across numerous end-use industries. For example, on December 18, 2023, Alternative Payments launched Collections Assist, a cutting-edge solution integrated into its B2B payments platform. It features automated activation for overdue invoices, two-click collections management, and faster recovery techniques, enhancing cash flow and operational efficiency for U.S. service companies. The rising adoption of automation to minimize manual errors, combined with AI-driven analytics, is enhancing decision-making and streamlining customer communication. Compliance with changing legal standards and the increasing volume of consumer debt are also driving demand for scalable, secure, and cloud-based debt collection software globally.

The United States is a key region in the market, primarily driven by the increasing complexity of debt management, driving businesses to adopt advanced, streamlined solutions. The rise of digital payment methods significantly influences this growth, with Forrester reporting in 2024, that 69% of U.S. online adults used digital payments in the past three months of 2023, surpassing credit card and cash usage. This shift emphasizes the need for software integrating payment tracking and analytics. Also, the demand for compliance with changing federal and state debt recovery regulations is fostering innovation in customizable solutions. Economic fluctuations and rising consumer debt levels is further fueling adoption of these services. Additionally, the growing integration of cloud technology and mobile platforms is enabling real-time updates, improving accessibility, efficiency, and portfolio management capabilities.

Debt Collection Software Market Trends:

Increasing demand for data analytics and insights

The growing need for data analytics and insights is majorly driving the adoption of debt collection software. Organizations seek to leverage data to enhance their collection strategies. Solutions from debt collection software are highly advanced and use various analytics techniques in processing huge volumes of data that concern debtor behavior, payment patterns, and economic trends. This is done through analyzing historical payment data and debtor profiles to identify patterns and trends in order to come up with the most effective collection approach, which leads to a 15-25% increase in recovery rates. Data analytics is also used to assess the overall health of debt portfolios, as 45% of companies are adopting predictive analytics to forecast debtor payment behavior. This helps businesses efficiently allocate resources by targeting high-priority accounts and proactively mitigating losses. Hence, the trend of analytics capability to shape the future of debt recovery strategies further promotes an expansive debt collection software market.

Rising demand for AI-powered automation

Artificial intelligence (AI) is a positive influence on the growth of debt collection software. AI-powered automation renders repetitive and time-consuming tasks easier, freeing up human resources for more complex and strategic activities. Debt collection software utilizes AI technologies such as natural language processing, machine learning, and robotic process automation to automate several aspects of the collection process. For example, AI algorithms will analyze customer interactions, understand sentiment, and provide debtor communications strategies that are tailored to them. This promotes positive relationships with debtors and increases the chances of recovering debts from them. AI chatbots and virtual assistants can handle frequent customer inquiries, remind about payments, and offer a self-service option, all of which increases the debtor experience. Further, AI algorithms can classify debtor risk profiles, forecast payment behavior, and prioritize collections according to the probability of recovery. This way, it is possible for debt collectors to target high-value accounts while having specific strategies for different segments of debtors. Through the automation and intelligence of AI-based debt collection software, there is an increase in the operational efficiency and thus effectiveness of debt recovery, thereby fueling the market growth.

Growing software integration with the financial ecosystem

The integration capabilities of debt collection software with the broader financial ecosystem contribute significantly to the market growth. In the interconnected business landscape today, organizations depend on different financial tools and systems to operate their business. Integration with systems such as accounting software, payment gateways, and customer management platforms render the debt collection software extremely valuable. Integration with accounting software allows automatic tracking and reconciliation of debtor accounts to keep debtor records up-to-date and accurate. This will enable the efficient processing of invoices, payment, and debt management to reduce errors and manual effort. In addition to this, payment gateways can be integrated with the application to process payments in real time, allowing debtors to easily settle their debts quickly. Payment collection is simplified, improving cash flow, while reducing time and resources required to handle the manual processing of payments. Integrating customer management platforms also gives an all-around view of customer interactions and histories that debt collectors can tailor and target for the debtor. This will increase the quality experience for debtors and obviously enhance the possibility of successful recovery. Debt collection software, thereby, becomes part of the overall financial ecosystem and, by integrating smoothly with the existing financial system, enhances operational efficiency, data accuracy, and, as a result, overall effectiveness of debt collection. Integration capabilities are what drives the growth of the debt collection software market as organizations pursue holistic solutions that integrate well with their existing infrastructure.

Debt Collection Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global debt collection software market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, deployment mode, organization size, and end user.

Analysis by Component:

- Software

- Services

Software leads the market with around 65.2% of market share in 2024. The software segment represents the comprehensive range of data and operational plans for debt recovery programs, including application programming interfaces (APIs). It provides the necessary infrastructure and functionalities to effectively manage and streamline debt collection processes. The rapid transformation of banking institutions towards digital technology adoption is another crucial factor contributing to the increasing product demand. As financial institutions embrace digitalization, they recognize the need for advanced software solutions to handle the complexities of debt recovery in a digital landscape. Debt collection software offers automated reminders, multi-channel communication, and data analytics, enabling banks and other financial entities to manage their debt portfolios and improve recovery rates efficiently.

Moreover, the integration of debt collection software with other digital systems within banking institutions further enhances operational efficiency. APIs facilitate seamless integration with existing core banking systems, customer relationship management platforms, and payment gateways, creating a unified ecosystem for debt collection activities. This streamlines data flow, improves accuracy, and enables real-time information exchange, enhancing the overall effectiveness of debt recovery efforts. As the demand for digital transformation continues to grow in the banking sector, the adoption of debt collection software is expected to increase significantly. These software solutions provide financial institutions with the necessary tools and capabilities to adapt to the changing landscape, optimize debt recovery processes, and improve overall efficiency in managing outstanding debts.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises leads the market, attributed to the inherent security and control advantages offered by these solutions compared to cloud-based software. Organizations that prioritize data security and want full control over their debt collection software often opt for on-premises deployments. Furthermore, on-premises debt collection software allows organizations to install and run the software within their IT infrastructure. This level of control ensures that sensitive debtor data remains within the organization's premises, reducing the risk of unauthorized access or data breaches. The organization can implement robust security measures, tailor the software to their needs, and maintain compliance with internal policies and industry regulations.

Additionally, on-premises software offers ease of use and accessibility for organizations. With the software residing within their IT infrastructure, staff members can conveniently access and utilize it without relying on an external internet connection. This can be particularly advantageous for organizations with limited or unreliable internet connectivity. Moreover, on-premises solutions often seamlessly integrate existing internal systems, such as customer databases and financial platforms. This integration streamlines data flow, enhances efficiency, and promotes a cohesive workflow across various departments involved in debt collection activities.

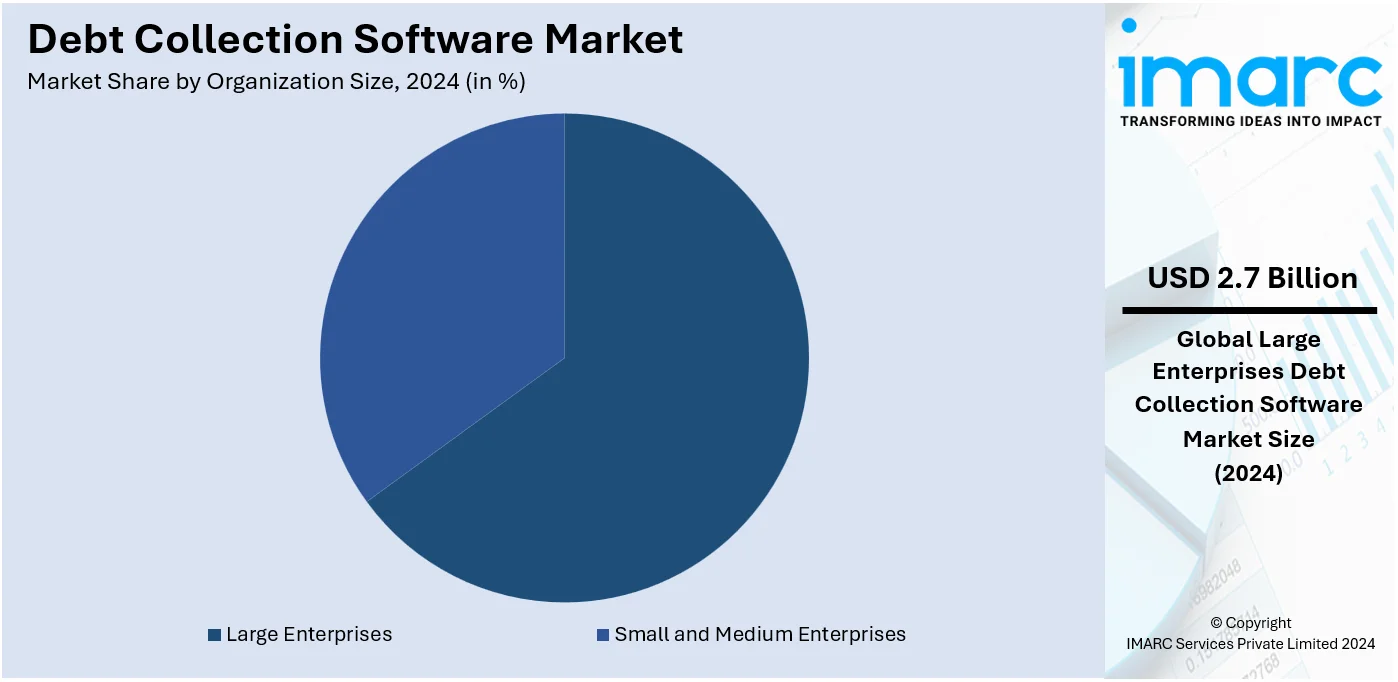

Analysis by Organization Size:

- Small and Medium Enterprises

- Large Enterprises

Large Enterprises leads the market with around 55.0% of market share in 2024. This can be due to large enterprises' specific needs and requirements in managing vast amounts of financial data securely and efficiently. Large enterprises typically deal with significant debts and have complex debt collection processes. They require robust and secure platforms to handle and maintain their extensive financial data. Debt collection software provides the tools and capabilities to manage and recover debts at scale while ensuring data security and compliance with regulatory standards. In line with this, large enterprises are investing substantially in debt collection systems. They understand the importance of utilizing interconnected hardware, servers, and software to streamline their debt collection operations. These investments enable them to efficiently handle the enormity of their data, implement sophisticated analytics, and optimize their debt recovery strategies.

Furthermore, debt collection software offers automated workflows, integrated communication channels, and advanced reporting and analytics. These capabilities help large enterprises streamline their debt collection processes, improve operational efficiency, and enhance overall recovery rates. Moreover, large enterprises often have a wide customer base and diverse debt portfolios. Debt collection software provides the scalability and flexibility to handle varying debtor profiles, debt types, and collection strategies. This adaptability allows large enterprises to customize their debt collection approach based on debtor segments and prioritize high-value accounts for more focused recovery efforts.

Analysis by End User:

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom and Utilities

- Others

Financial institutions lead the market, driven by its significant customer database and their need to manage debtors and defaulters efficiently. Financial institutions deal with numerous customers, ranging from individuals to businesses, and this customer base often includes borrowers who may default on their payments. Effectively managing and recovering debts is crucial for financial institutions to maintain a healthy financial ecosystem. Debt collection software provides the necessary tools and functionalities to streamline the entire collection process for financial institutions. By leveraging debt collection software, financial institutions can improve cash flow by accelerating debt recovery and reducing the number of delinquent accounts. The automation and optimization features offered by the software enable more efficient and consistent follow-ups, payment reminders, and collection strategies. This leads to reduced write-offs and provisioning for bad debts, thus positively impacting the institution's financial performance.

Furthermore, debt collection software helps financial institutions enhance customer relationships. Financial institutions can maintain positive interactions with debtors by leveraging personalized communication, targeted reminders, and flexible payment options. This customer-centric approach improves the chances of successful debt recovery and fosters customer loyalty and satisfaction. In addition to these factors, debt collection software offers comprehensive reporting and analytics capabilities. Financial institutions can gain valuable insights into their debt portfolio, debtor behavior, and collection performance. This data-driven approach enables institutions to make informed decisions, optimize collection strategies, and allocate resources effectively.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 30.7%. The market in North America is driven by the growing adoption of advanced technologies. Businesses and financial institutions in the region recognize the importance of leveraging innovative solutions to streamline debt recovery processes and enhance operational efficiency. Moreover, the integration of cloud-based platforms is gaining prominence in the North America debt collection software market. Organizations can efficiently manage and take control of mounting bad debt rates by adopting cloud-based solutions. Another contributing factor is the presence of several key players in North America. The region consists of a robust ecosystem of software vendors, debt collection agencies, and financial service providers, offering a wide range of debt collection software solutions. The competition among these key players drives innovation and leads to the development of comprehensive and feature-rich debt collection software offerings in the market. Besides, the region comprises developed countries with advanced technological capabilities and extensive connectivity, enabling seamless implementation and integration of debt collection software into existing systems. This supports the efficient operation and utilization of debt collection software, further driving the market growth.

Key Regional Takeaways:

United States Debt Collection Software Market Analysis

In 2024, the United States holds 78.70% in the North America debt collection software market. The market is growing amid the increasing demand of all businesses to manage outstanding payment and meet regulatory standards in terms of the collection process. As per 6sense, companies using debt collection technology software are mainly from the United States, with 6,564 (90.04%) of companies in the industry leveraging these tools. The digital payments and e-commerce growth have resulted in a growing need for more advanced debt collection tools. Companies like FIS Global and Experian are major players, offering platforms that integrate automation, AI, and predictive analytics. The need for better debt recovery efficiency and consumer protection laws will further push the adoption of software. U.S. businesses, from small enterprises to large corporations, are increasingly using debt collection software to improve their operations, ensuring that the U.S. market remains at the top in the world for debt collection software.

Europe Debt Collection Software Market Analysis

Europe's debt collection software market is growing at a steady pace due to more attention given to compliance with strict regulations such as GDPR. In the UK, Germany, and France, automation and AI-driven solutions are changing the entire collection process. For example, Lowell is one of the largest credit management companies in Europe. Recently, it signed a 3-year extension of its contract with Tietoevry Banking for Collection Suite Nova, the market-leading end-to-end collection solution. The SaaS model allowed Lowell to streamline operations, improve scalability, and enhance their service offerings in Sweden. They have achieved faster time to market for new functionalities and client onboarding due to this move. The need for efficient debt management amidst economic challenges and rising consumer debts is propelling the adoption of software, positioning Europe as one of the significant players in the global debt collection software market.

Asia Pacific Debt Collection Software Market Analysis

Asia Pacific debt collection software is highly dynamic, given increasing levels of debt and rapid technological adoption to manage a swelling debt burden. According to the Economic and Social Survey of Asia and the Pacific 2023, 19 countries in the region have a high risk of debt distress, with many heavily relying on external debt, which they cannot avoid as their local capital markets are underdeveloped. Public debt in the region has increased, and in 2021, it reached an average government debt-to-GDP ratio of 49.5% versus 40.6% in 2019. As of 2021, private creditors constituted 30% of the debt of Mongolia, implying that the country is shifting away from concessional loans towards high-cost debt. This rise in debt, combined with fiscal deficits and the pandemic, makes governments and businesses implement modern advanced debt collection software to optimize recovery processes. For example, the Collection Suite Nova by TietoEVRY is allowing Lowell and other similar firms to collect efficiently. As companies are looking for the automation and scalability of their debt management, this sector is creating huge opportunities in the region for the debt collection software market. The government has also been using such platforms as ESCAP's Public Debt Dashboard to enhance the level of debt management and ensure transparency, thus providing good statistics for decision-making and sustainable debt practices.

Latin America Debt Collection Software Market Analysis

The Latin American debt collection software market is expected to grow given the increased debt levels, growing defence budgets, and security concerns. Brazil, Argentina, and Mexico are among the largest contributors to this growth. Increased credit card usage and loan delinquency rates in these countries have triggered the need for debt management solutions. Debt is escalating worldwide, and Latin America is no exception. With a total debt amount in the region of USD 5.8 trillion, which reflects 117% of GDP, IDB stated. The five largest economies in the region are affected by debt levels that touched as high as 140% of GDP. Public debt shot up to more than 70% of GDP during the pandemic, and businesses issued significant amounts to tide them over the crisis. Although it helped the region during the pandemic, rising debt is now weighing it down. The economy urgently needs efficient debt recovery solutions. Companies like Serasa Experian and Lendico are leading the march with innovative software. These government-backed initiatives and growth in the fintech sector will also drive the Latin American debt collection software market further, ensuring the region's economic recovery.

Middle East and Africa Debt Collection Software Market Analysis

The Middle East and Africa debt collection software market is still an emerging market and is driven by financial inclusion coupled with mobile banking. Rapid adoption of debt collection software is being witnessed in the UAE, South Africa, and Saudi Arabia as financial institutions and businesses seek to streamline operations and reduce credit risk. For instance, as per Center for Strategic and International Studies (2024), African countries are paying USD 130 Billion annually to service their debt. As of the end of last year, the total external debt of African countries was over USD 1.152 Trillion. An increase in consumer debt and the requirement for efficient collection strategies created a growing demand for automated debt management tools. Companies such as Softline and Xcede Solutions are providing customized software solutions that help businesses improve their debt collection efficiency. The growth of the region's digital infrastructure and increased focus on economic stability also supports the expansion of the market.

Competitive Landscape:

The top collection software companies are significantly contributing to the market growth. These companies are at the forefront of innovation, continuously developing and improving their software offerings to meet the changing needs of businesses and financial institutions. Several top companies focus on providing their clients with comprehensive and feature-rich solutions. They invest in research and development to enhance the functionality of their software, incorporating advanced features such as automation, artificial intelligence, predictive analytics, and multi-channel communication. These innovations enable organizations to streamline their debt collection processes, improve recovery rates, and optimize resource allocation. Furthermore, these companies recognize the importance of seamless integration with existing systems and platforms. They develop their software with integration capabilities, allowing for smooth data exchange with core banking systems, customer relationship management tools, accounting software, and payment gateways. This seamless integration enhances operational efficiency, eliminates data silos, and improves the overall effectiveness of debt collection efforts. Moreover, these companies understand the diverse needs of their clients, ranging from small businesses to large enterprises. They develop scalable and flexible software solutions that can adapt to the specific requirements of organizations of different sizes and industries. This scalability enables businesses to start with a smaller-scale deployment and expand as their debt collection needs to grow. Additionally, these companies offer customization options to tailor the software to their clients' unique workflows and preferences. They implement robust security measures to safeguard sensitive debtor data, ensuring compliance with data protection regulations and industry standards. Through their commitment to innovation, integration, scalability, security, and customer support, top companies are contributing to the market by providing organizations with the tools and capabilities to streamline debt collection processes, improve recovery rates, and enhance operational efficiency. Their continuous efforts to meet the shifting needs of the industry contribute to the overall expansion and advancement of the market.

The report has provided a comprehensive analysis of the competitive landscape in the global market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AgreeYa.com

- Chetu Inc.

- Debtrak

- EbixCash Financial Technologies

- Experian Information Solutions Inc.

- Fair Isaac Corporation

- Katabat Corporation (Ontario System)

- Nucleus Software Exports Ltd.

- Pegasystems Inc.

- Seikosoft

- TietoEVRY

- TransUnion LLC

Latest News and Developments:

- April 2025: Public Sector Banks (PSBs) in India are adopting Spocto X, an AI-driven debt collection platform by Yubi Group, to combat high Non-Performing Assets (NPAs) and improve recovery rates. Central Bank of India reported a drop in its Special Mention Account ratio from 8% in 2024 to 3% by February 2025 after integrating Spocto X. The platform uses predictive analytics, hyper-personalized borrower engagement, and smart automation to boost recoveries by 60%, reduce operational costs by 57%, and prevent over 9 crore accounts from becoming NPAs, saving INR 50,000 crore. This AI adoption narrows efficiency gaps with private banks and enhances India's financial resilience.

- April 2025: Helport AI launched an advanced AI-powered software to modernize consumer financing and debt collection, focusing on efficiency, compliance, and customer engagement. The new solution, developed at its Philippines Global Center of Excellence, automates debt servicing with AI-guided conversations, real-time compliance monitoring, and data-driven optimization. Since January 2025, Helport AI secured partnerships with three Southeast Asian consumer financing firms, including two U.S.-listed companies, demonstrating improved agent productivity, regulatory adherence, and operational cost reduction in pilot deployments.

- April 2025: Tyger Capital, a leading Indian NBFC, partnered with Credgenics to enhance debt collections using AI-driven SaaS solutions. Credgenics' platform enables personalized borrower communications via WhatsApp/SMS/email, digitizes field operations via the CG Collect mobile app, and integrates Billzy for secure digital payments. The collaboration aims to boost resolution rates, reduce costs, and improve efficiency through real-time tracking and automated reconciliations. Tyger Capital emphasizes customer-centric innovation, while Credgenics highlights regulatory compliance and operational scalability. The partnership targets transformative growth in MSME-focused financial services across Tyger’s 250 branches in nine states.

- March 2025: ClearGrid, launched in 2024 with $10M funding, is revolutionizing debt collection in the MENA region by replacing outdated, manual methods with an AI-powered platform that automates borrower engagement and negotiations. Founded by Khalid Bin Bader Al Saud, Mohammad Al Zaben, and Mohammad Al Khalili, ClearGrid enhances lender recovery rates and borrower experiences, fostering economic stability. It has secured major clients, achieved profitability in the UAE, and plans to expand into KSA. Supported by top venture capital firms, ClearGrid aims to build a comprehensive, tech-driven financial infrastructure for MENA.

- February 2025: Aye Finance, a leading Indian NBFC for micro-enterprises, partnered with AI-driven debt collections platform Credgenics to digitize its recovery processes. Credgenics' SaaS tools-including omnichannel borrower communication, CG Collect field app for digital repayments, Litigation Management System, and Settlement Portfolio Management-aim to enhance operational efficiency, legal tracking, and settlement workflows. The collaboration seeks to improve recovery rates, reduce costs, and enable data-driven customer engagement, aligning with Aye Finance's tech-centric approach to serving underserved MSMEs while advancing financial inclusivity.

- February 2025: Blacksuit and Healthfinit collaborated to streamline medical debt recovery and financial services. Their tech-driven approach enhances efficiency in revenue cycle management for hospitals/clinics, offering legal tools for debt collection, patient-centric repayment plans, and regulatory compliance support. The partnership ensures financial accessibility for institutions and patients, combining structured repayment options with transparent legal processes to improve cash flow and patient well-being, while navigating healthcare debt complexities.

Debt Collection Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Users Covered | Financial Institutions, Collection Agencies, Healthcare, Government, Telecom and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AgreeYa.com, Chetu Inc., Debtrak, EbixCash Financial Technologies, Experian Information Solutions Inc., Fair Isaac Corporation, Katabat Corporation (Ontario System), Nucleus Software Exports Ltd., Pegasystems Inc., Seikosoft, TietoEVRY, TransUnion LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the debt collection software market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global debt collection software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the debt collection software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Debt collection software is a digital tool designed to streamline the management and recovery of overdue payments. It automates tasks like tracking debts, sending reminders, and generating reports. Equipped with features such as payment scheduling and compliance monitoring, it enhances efficiency, accuracy, and communication for businesses handling debt recovery processes.

The debt collection software market was valued at USD 4.8 Billion in 2024.

IMARC estimates the global debt collection software market to exhibit a CAGR of 8.89% during 2025-2033.

The market is primarily driven by rising demand for efficient debt management, growing consumer debt levels, regulatory compliance requirements, adoption of AI-powered automation, advanced analytics for decision-making, integration with financial ecosystems, and increasing reliance on cloud-based solutions for real-time updates and operational efficiency.

In 2024, software represented the largest segment by component, driven by automation, data analytics, and integration with financial systems.

On-premises leads the market by deployment mode attributed to enhanced data security, customization, and control over software within organizational infrastructure.

Large enterprises are the leading segment by organization size, driven by their need for scalable, secure platforms to manage extensive financial data efficiently.

In 2024, financial institutions represented the largest segment by end user, driven by their vast customer base, need for efficient debt management, and regulatory compliance.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global debt collection software market include AgreeYa.com, Chetu Inc., Debtrak, EbixCash Financial Technologies, Experian Information Solutions Inc., Fair Isaac Corporation, Katabat Corporation (Ontario System), Nucleus Software Exports Ltd., Pegasystems Inc., Seikosoft, TietoEVRY, and TransUnion LLC, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)