Database Management System (DBMS) Market Report by Type (Linux, MacOS/iOS, Windows), Database Type (Relational DBMS, Non-relational DBMS), Deployment Mode (Cloud-based, On-premises), Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), Application (BFSI, Defense and Government, Healthcare, Oil and Gas, Retail and Manufacturing, and Others), and Region 2025-2033

Global Database Management System (DBMS) Market:

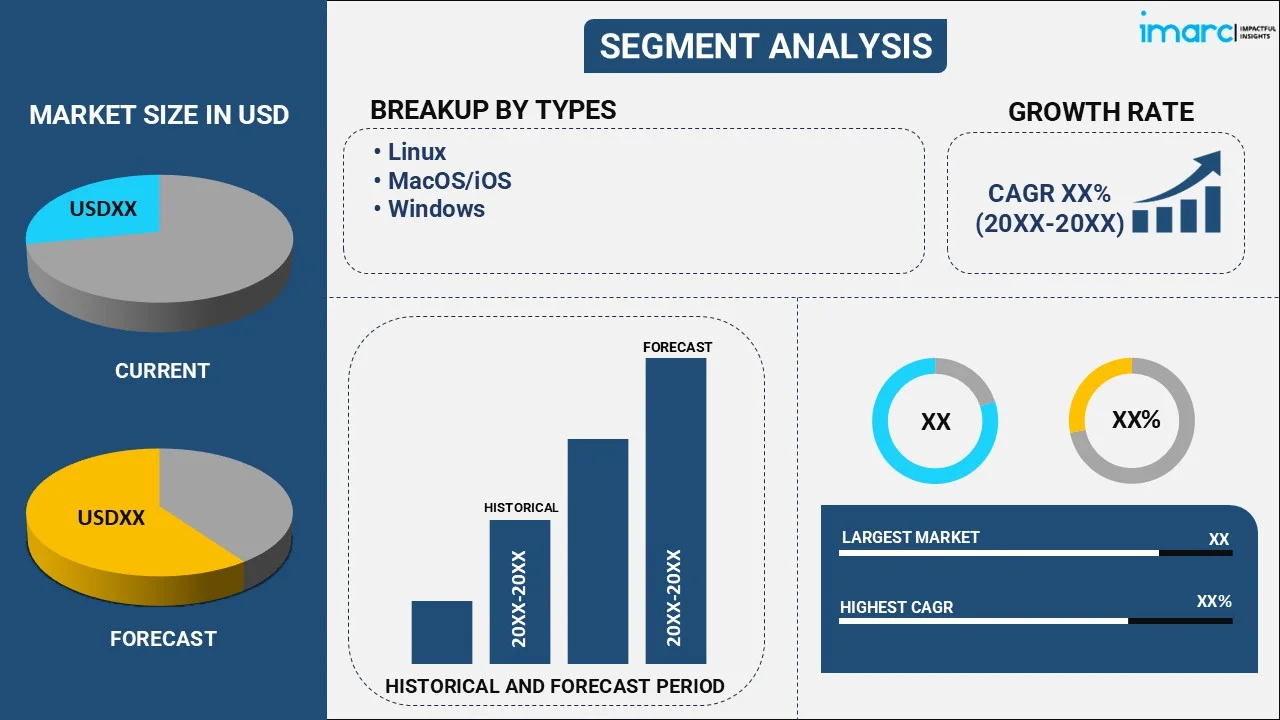

The global database management system (DBMS) market size reached USD 117.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 367.0 Billion by 2033, exhibiting a growth rate (CAGR) of 12.42% during 2025-2033. The proliferation of big data across various industries, adoption of cloud computing technologies, growing demand for IoT devices, and heightened concerns over data security are primarily driving the industry's growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 117.4 Billion |

| Market Forecast in 2033 | USD 367.0 Billion |

| Market Growth Rate (2025-2033) | 12.42% |

Database Management System (DBMS) Market Analysis:

- Major Market Drivers: The increasing demand for flexible and cost-effective data management solutions across industries is one of the key factors driving the market growth. Moreover, the widespread adoption of relational, distributed, hierarchical, object-oriented and network-based DBMS solutions is providing a thrust to the market growth.

- Key Market Trends: An increase in the demand for efficient DBMS to manage the data generated by employees working from home and to provide remote access to enterprise resources is expected to propel the market growth. In addition, the rising integration of connected devices with the Internet of Things (IoT) and artificial intelligence (AI), along with extensive improvements in the IT infrastructure, is anticipated to drive the market demand.

- Competitive Landscape: Some of the prominent database management system (DBMS) market companies include Amazon.com Inc., Cloudera Inc., Embarcadero Technologies Inc. (Idera Inc.), EnterpriseDB, International Business Machines Corporation, MariaDB Corporation, MarkLogic Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and Software AG., among many others.

- Geographical Trends: According to the database management system (DBMS) market dynamics, North America is a mature market for DBMS, driven by technological advancements, high IT spending, and early adoption of digital transformation initiatives. Apart from this, Europe exhibits a diverse market landscape with varying adoption rates across Western and Eastern Europe. Moreover, Asia-Pacific is experiencing rapid growth in DBMS adoption, fueled by expanding IT infrastructure, increasing internet penetration, and digitalization initiatives.

- Challenges and Opportunities: The rising data privacy concerns and high cost associated with licensing, and maintenance are hampering the industry's growth. However, the increasing adoption of cloud-based DBMS solutions and hybrid cloud strategies offer scalability, flexibility, and cost-efficiency advantages.

Database Management System (DBMS) Market Trends:

Increasing Trend of Digital Transformation

The increasing digital transformation initiatives are significantly driving the growth of the Database Management System (DBMS) market. For instance, according to IMARC, the global digital transformation market size reached US$ 692 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 2,845 Billion by 2032, exhibiting a growth rate (CAGR) of 16.9% during 2024-2032. Also, according to an article published by Accenture, nearly 75% of IT leaders believe that their firms prioritize digital transformation, up from 56% in 2021. DBMS solutions play a critical role in supporting digital transformation efforts by enabling real-time data processing, enhancing customer experiences, and improving operational efficiency. These factors are further contributing to the database management system (DBMS) market share.

Growing E-Commerce and Online Transactions

The growing e-commerce and online transactions sector significantly drives the growth of the Database Management System (DBMS) market. There has been a significant increase in the number of e-commerce users. For instance, according to an article published by Forbes, there will be 501.6 million e-commerce consumers by 2029. By 2029, it is expected that user penetration will increase to 34.0% from the forecasted 22.1% in 2024. E-commerce platforms generate vast amounts of transactional data, including customer orders, payments, inventory updates, and customer interactions. Moreover, DBMS solutions are essential for efficiently storing, managing, and processing these large volumes of structured and unstructured data in real time. These factors further positively influence the database management system (DBMS) industry forecast.

Adoption of Cloud Computing

The adoption of cloud computing is a significant driver behind the growth of the Database Management System (DBMS) market. For instance, according to an article published by Edge Delta, nearly 94% of companies adopt cloud computing. Also, in 2023, corporate data garnered 60% of data stored in the cloud. Cloud-based DBMS provide elastic scalability, allowing organizations to expand storage and processing capabilities dynamically based on demand. This scalability is crucial for handling large-scale data growth and peak workloads without upfront investment in hardware infrastructure, thereby boosting the database management system (DBMS) market revenue.

Global Database Management System (DBMS) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global database management system (DBMS) market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type, database type, deployment mode, organization size, and application.

Breakup by Type:

- Linux

- MacOS/iOS

- Windows

The report has provided a detailed breakup and analysis of the database management system (DBMS) market based on the type. This includes linux, macOS/IOS, and windows.

Linux is widely preferred for server deployments due to its stability, security features, and open-source nature. Moreover, macOS is favored by developers, designers, and creative professionals for its user-friendly interface and integration with development tools. Furthermore, windows also acquire a prominent share in operating systems in enterprise environments, influencing the choice of DBMS solutions. Many organizations leverage Windows Server and Microsoft SQL Server for seamless integration, support, and compatibility.

Breakup by Database Type:

- Relational DBMS

- Non-relational DBMS

The report has provided a detailed breakup and analysis of the database management system (DBMS) market based on the database type. This includes relational DBMS and non-relational DBMS.

Relational DBMSs are structured around the relational model of data management. They store data on tables with rows and columns, and relationships between tables are defined using keys. While non-relational DBMS encompasses a diverse set of database technologies designed for flexible, schema-less data storage. They are optimized for scalability, performance, and handling unstructured or semi-structured data.

Breakup by Deployment Mode:

- Cloud-based

- On-premises

A detailed breakup and analysis of the database management system (DBMS) market based on the deployment mode has also been provided in the report. This includes cloud-based and on-premises.

Cloud-based data management systems can easily scale resources up or down based on demand, allowing organizations to handle fluctuations in data volume and processing requirements efficiently. Moreover, they provide global accessibility, enabling users to access data and applications from anywhere with an internet connection, supporting distributed teams and remote work environments. While on-premises systems allow for customization of hardware configurations, software installations, and security protocols tailored to organizational needs. Also, on-premises systems can offer lower latency and faster data processing times compared to cloud-based solutions, particularly for applications requiring real-time data access and high-performance computing.

Breakup by Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

A detailed breakup and analysis of the database management system (DBMS) market based on the organization size has also been provided in the report. This includes small and medium enterprises (SMEs) and large enterprises.

SMEs often have limited budgets and resources for IT infrastructure and software, prioritizing cost-effective solutions that deliver value without significant upfront investment. Moreover, many SMEs opt for cloud-based DMS solutions due to lower initial costs, pay-as-you-go pricing models, and reduced IT management overhead. Cloud solutions offer scalability to accommodate growth without large capital expenditures. While large enterprises manage vast amounts of data across diverse departments and locations, requiring robust DMS solutions capable of handling complex data structures, high transaction volumes, and stringent performance requirements.

Breakup by Application:

- BFSI

- Defense and Government

- Healthcare

- Oil and Gas

- Retail and Manufacturing

- Others

A detailed breakup and analysis of the database management system (DBMS) market based on the application has also been provided in the report. This includes BFSI, defense and government, healthcare, oil and gas, retail and manufacturing, and others.

BFSI institutions rely on data management systems for real-time analytics to assess market risks, manage investments, and enhance decision-making. While government agencies and defense sectors prioritize secure data storage, encryption, and access controls to protect classified information. Moreover, secure storage, management, and sharing of patient health information (PHI) across healthcare providers and systems. Furthermore, in the oil and gas sector, data management systems support exploration data, seismic surveys, reservoir modeling, and production optimization.

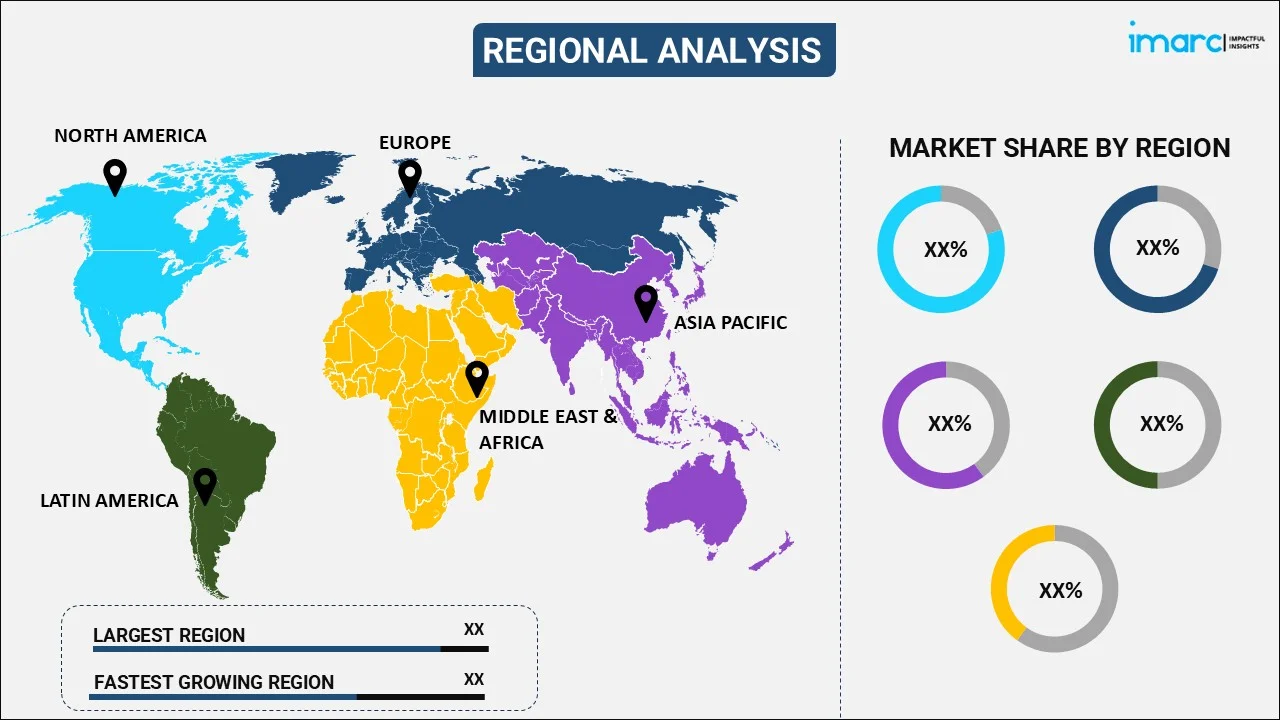

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

North America holds a significant share in the global DMS market, driven by the presence of major tech companies, high IT spending, and early adoption of advanced technologies. Moreover, the increasing focus on digital transformation initiatives in healthcare, manufacturing, and government sectors accelerates market growth in Europe. Furthermore, Asia Pacific exhibits robust growth in the DMS market, driven by expanding IT infrastructure, increasing digitalization, and rising investments in AI and IoT. Countries like China, India, and Japan lead in technology adoption across industries, such as manufacturing, retail, and telecommunications.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Amazon.com Inc.

- Cloudera Inc.

- Embarcadero Technologies Inc. (Idera Inc.)

- EnterpriseDB

- International Business Machines Corporation

- MariaDB Corporation

- MarkLogic Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Software AG

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Database Management System (DBMS) Market Recent Developments:

- May 2024: MASS launched a new centralized cyber electromagnetic activity (CEMA) database management system, which consolidates CEMA data in one location to improve battlespace spectrum management.

- March 2024: The Liberian Government, through the Liberia Electricity Regulatory Commission (LERC), launched a new software, known as the Regulatory Database Management System (RDBMS), to improve power sector efficiency.

- March 2024: Solinst Canada Ltd. launched Solinst Cloud, a cloud-based water data management platform designed to simplify the storage and management of groundwater and surface water data.

Database Management System (DBMS) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Linux, MacOS/iOS, Windows |

| Database Types Covered | Relational DBMS, Non-relational DBMS |

| Deployment Modes Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Small and Medium Enterprises (SMEs), Large Enterprises |

| Applications Covered | BFSI, Defense and Government, Healthcare, Oil and Gas, Retail and Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon.com Inc., Cloudera Inc., Embarcadero Technologies Inc. (Idera Inc.), EnterpriseDB, International Business Machines Corporation, MariaDB Corporation, MarkLogic Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Software AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global database management system (DBMS) market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global database management system (DBMS) market?

- What are the key regional markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the database type?

- What is the breakup of the market based on the deployment mode?

- What is the breakup of the market based on the organization size?

- What is the breakup of the market based on the application?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global database management system (DBMS) market and who are the key players?

- What is the degree of competition in the industry?

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the database management system (DBMS) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global database management system (DBMS) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the database management system (DBMS) industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)