Data Quality Tools Market Size, Share, Trends and Forecast by Data Type, Functionality, Component, Deployment Type, Organization Size, Vertical, and Region, 2025-2033

Data Quality Tools Market Size and Share:

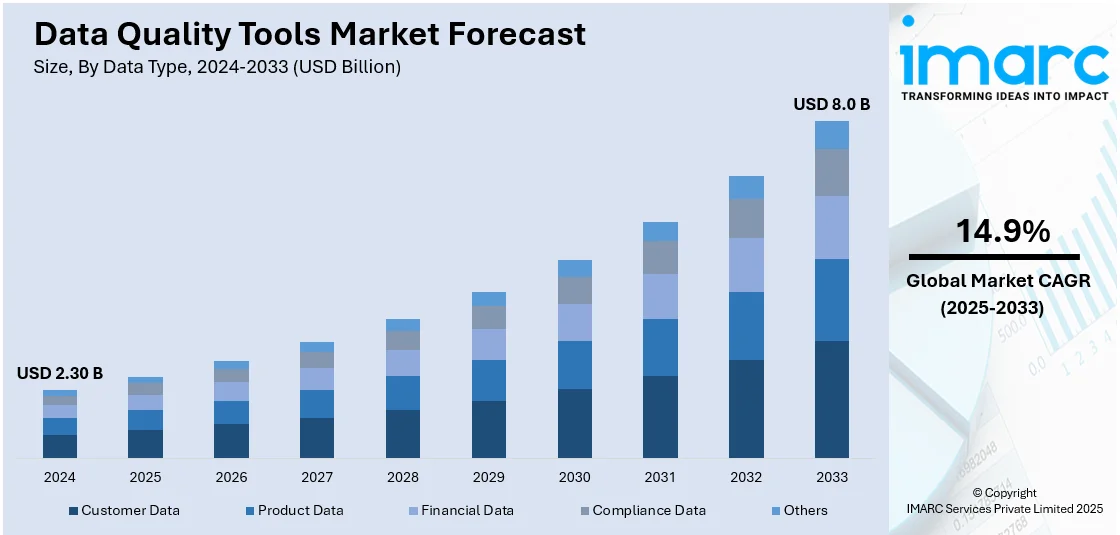

The global data quality tools market size was valued at USD 2.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.0 Billion by 2033, exhibiting a CAGR of 14.9% from 2025-2033. North America currently dominates the market, holding a market share of 38.7% in 2024. The growing usage of data-driven approaches to inform business decisions, streamline operations, and improve customer experiences, increasing implementation of stricter data management regulation, and rising size and complexity of digital ecosystems are some of the factors influencing the data quality tools market share positively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.30 Billion |

|

Market Forecast in 2033

|

USD 8.0 Billion |

| Market Growth Rate 2025-2033 | 14.9% |

One of the most dominant trends in the market for data quality tools is the convergence of artificial intelligence (AI) and machine learning (ML) technologies. These newer technologies are upgrading the functionality of data quality tools by automating activities like data profiling, cleansing, and anomaly detection. AI and ML algorithms can scan vast amounts of data to detect patterns and inconsistencies, allowing organizations to address data quality issues proactively. This consolidation not only enhances efficiency but also guarantees that data is accurate and reliable in the long term. Organizations are increasingly implementing cloud-based data quality solutions because they are scalable, flexible, and cost-effective. Cloud deployments enable companies to remotely access data quality solutions, making it easier to integrate with other cloud services and minimizing the requirement for large on-premises infrastructure, thereby impelling the data quality tools market growth.

The United States data quality software market is seeing remarkable growth owing to various important trends and factors that are transforming the way organizations process and leverage their data. Cloud-based data quality tools are becoming increasingly popular in United States organizations as they offer flexibility, scalability, and cost savings. Cloud-based deployments enable organizations to remotely access data quality solutions, making integration with other cloud-based services simpler and minimizing the requirement for on-premises infrastructure. This shift aligns with the broader trend of digital transformation, where companies are moving their operations to the cloud to enhance agility and responsiveness. The IMARC Group predicts that the global cloud managed services market size is expected to reach USD 171.11 Billion by 2033.

Data Quality Tools Market Trends:

Increasing Reliance on Data-Driven Decision-Making

Organizations from various industries are increasingly using data-driven approaches to inform business decisions, streamline operations, and improve customer experiences. With data emerging as a key asset, companies are realizing the importance of maintaining its accuracy, completeness, and reliability. Organizations are constantly gathering large volumes of structured and unstructured data from diverse sources such as customer interactions, Internet of Things (IoT) sensors, and digital platforms. As this data is being used to inform critical decisions, any inconsistencies or errors are leading to poor outcomes, financial losses, and damaged reputations. Due to these reasons, companies are putting in strong data quality tools for anomaly detection at automatic levels, for cleaning the data, and achieving consistency among different systems. The growing complexity of business environments is demanding real-time analytics and predictive modeling, both of which require high-quality data. As a result, data quality tools are becoming essential for businesses striving to remain competitive and agile in a data-centric world. The IMARC Group predicts that the predictive analysis market size is expected to reach USD 104.7 Billion by 2033.

Stringent Regulatory and Compliance Requirements

Governments and regulatory agencies are implementing stricter data management regulations, which are forcing companies to enhance the quality of data. In India, Ministry of Electronics and Information Technology has prepared the Digital Personal Data Protection Rules, 2025 to enable the operationalization of the Digital Personal Data Protection Act, 2023 (DPDP Act). It seeks to further the legal framework for the protection of digital personal data through the supply of requisite details and an operational framework. Stakeholders are requested to submit feedback/comments on the draft Rules. In the US, legislations coupled with the international reach of General Data Protection Regulation (GDPR), are increasing focus on the accuracy, transparency, and accountability of data. Firms are being forced to prove compliance by having traceable, consistent, and accurate data in all their systems. Consequently, organizations are deploying data quality tools to automatically apply data governance rules, detect inconsistencies, and generate audit-ready reports. Financial institutions, healthcare organizations, and government contractors are particularly impacted, as they deal with vast amounts of sensitive data.

Expansion of Big Data and IoT Ecosystems

The sudden growth in big data and IoT ecosystems is considerably raising the amount, diversity, and speed of data being processed by organizations, thereby offering a favorable data quality tools market outlook. Companies are continuously gathering information from a diverse set of sources such as mobile phones, smart sensors, connected machines, social media, and business applications. With the growing amount of information continuing to come in, keeping its quality is becoming more difficult and expensive. Firms are using sophisticated data quality tools to automate validation, deduplication, and cleansing across heterogeneous data streams. These tools are taking on a key role in enabling organizations to derive reliable insights from massive datasets in real time. Further, with predictive analytics and AI gaining traction, high-quality data is becoming necessary to train accurate and unbiased models. The increasing size and complexity of digital ecosystems are rendering legacy data management techniques obsolete, compelling companies to move to next-gen data quality solutions that can keep pace with their data infrastructure. The big data software market size is expected to reach USD 456.01 Billion by 2033, according to the predictions of the IMARC Group.

Data Quality Tools Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global data quality tools market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on data type, functionality, component, deployment type, organization size, and vertical.

Analysis by Data Type:

- Customer Data

- Product Data

- Financial Data

- Compliance Data

- Others

Consumer data stand as the largest component in 2024, holding 33.7% of the market. Consumer data is playing an increasingly vital role in shaping business strategies, marketing campaigns, and customer experiences. Companies are continuously collecting consumer data from multiple sources, including websites, mobile apps, social media platforms, loyalty programs, and in-store interactions. This data includes various types of information such as demographics, purchase history, preferences, behavior patterns, and feedback. Businesses are using this data to understand customer needs, predict future buying behaviors, and personalize their offerings in real time. As technology is advancing, organizations are leveraging consumer data to create highly targeted advertisements and tailor communication to specific audience segments. Marketers are continuously analyzing this data to optimize campaigns, improve engagement, and drive conversions.

Analysis by Functionality:

- Data Validation

- Data Standardization

- Data Enrichment and Cleansing

- Data Monitoring

- Others

Data validation leads the market. Data validation for consumer data is becoming a critical process as businesses are collecting and utilizing large volumes of customer-related information. Companies are continuously validating consumer data to ensure that it is accurate, complete, and usable before it enters core systems. This process includes checks for correct formatting, consistency across fields, duplication, and logical accuracy. For example, businesses are verifying that email addresses are correctly structured, phone numbers are valid, and names are not misspelled or misformatted. Organizations are using automated tools and validation rules to streamline this process, especially as real-time data collection is increasing through online forms, mobile apps, and e-commerce platforms. They are implementing these tools to catch errors at the point of entry, reducing the chances of poor-quality data flowing into marketing, sales, and service systems. By continuously validating consumer data, companies are improving targeting precision, customer segmentation, and personalization efforts.

Analysis by Component:

- Software

- Services

- Professional Services

- Managed Services

Software leads the market with 65.8% of market share in 2024. Software, as a critical component of modern technology infrastructure, is continuously evolving and playing a central role in driving digital transformation across industries. Organizations are developing, deploying, and updating software to automate processes, enhance productivity, and deliver innovative services. Businesses are increasingly relying on software to manage operations, analyze data, support customer interactions, and streamline workflows. From enterprise applications to mobile apps and cloud-based platforms, software is becoming more intelligent, user-friendly, and integrated. Developers are building software using agile methodologies and DevOps practices, allowing teams to release updates frequently and respond quickly to changing business needs. Companies are also incorporating artificial intelligence and machine learning into their software solutions to enable smarter decision-making and predictive capabilities.

Analysis by Deployment Type:

- Cloud-based

- On-premises

On-premises represent the largest segment. On-premises infrastructure is continuing to play a significant role in how organizations are managing their IT systems, despite the growing adoption of cloud-based solutions. Many businesses are maintaining on-premises environments to retain full control over their hardware, data, and software. They are hosting applications, databases, and critical workloads within their own physical facilities, often to meet strict security, compliance, or latency requirements. IT teams are regularly maintaining and updating these systems to ensure performance, reliability, and data protection. Companies are investing in on-premises solutions where data sovereignty or regulatory restrictions are requiring information to stay within specific geographic boundaries. Organizations in sectors like finance, government, and healthcare are continuing to operate on-premises data centers to safeguard sensitive data and ensure uninterrupted service delivery.

Analysis by Organization Size:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises lead the market with around 70.8% of market share in 2024. Large enterprises are continuously adapting to the evolving digital landscape by leveraging advanced technologies, streamlining operations, and enhancing their data strategies. These organizations are investing heavily in digital transformation, implementing tools and platforms that are improving efficiency, boosting innovation, and supporting global scalability. They are adopting cloud computing, AI, data analytics, and automation to optimize business processes and stay competitive in fast-changing markets. At the same time, large enterprises are managing vast amounts of data and are focusing on improving data governance, quality, and security. They are deploying data quality tools to ensure that their decisions are based on accurate, consistent, and trustworthy data. These enterprises are also standardizing systems across departments and geographies to enable better collaboration and seamless data flow.

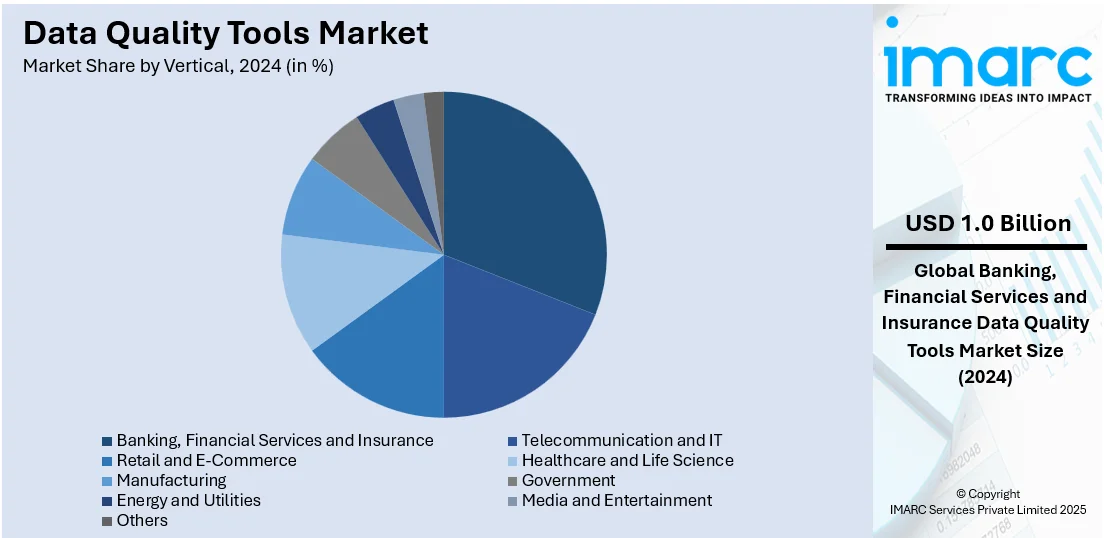

Analysis by Vertical:

- Banking, Financial Services and Insurance

- Telecommunication and IT

- Retail and E-Commerce

- Healthcare and Life Science

- Manufacturing

- Government

- Energy and Utilities

- Media and Entertainment

- Others

Banking, Financial Services and Insurance lead the market with 25.4% of market share in 2024. The Banking, Financial Services, and Insurance (BFSI) industry is transforming at a fast pace and is constantly embracing new-age technologies to improve operations, enhance customer experience, and comply with regulations. Organizations in this sector are using data analytics, AI, and machine learning (ML) to derive better insights into customer behavior, identify fraud, and customize financial products and services. They are also investing in digital platforms to enable streamlined transactions, automate repetitive processes, and provide real-time services. BFSI firms are shifting their focus more and more to data quality and accuracy, acknowledging that accurate data is essential for risk assessment, customer relationship management, and strategic decision-making. They are integrating data quality tools and governance mechanisms to maintain consistency, completeness, and compliance with changing. These organizations are confirming consumer and financial information to avoid mistakes, decrease operational risk, and enable audit preparedness.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 38.7%. North America is experiencing accelerated adoption of digital technologies across sectors. Firms are increasingly adopting cloud computing, artificial intelligence (AI), and automation into their operations. The United States, in special, is becoming a digital transformation hub with enterprises shifting IT infrastructure to the cloud to have greater flexibility and scalability. The adoption of automation, particularly in manufacturing industries such as automotive, is improving efficiency and automating processes. Moreover, the Internet of Things (IoT) is being utilized to maximize operations and improve the customer experience. The e-commerce market in North America is growing significantly. Customers are increasingly turning to online shopping due to its convenience, prompting organizations to invest in solid digital channels and effective delivery systems. The inclusion of cutting-edge technologies such as augmented reality (AR) and AI is boosting online shopping, providing personalized advice and virtual try-ons.

Key Regional Takeaways:

United States Data Quality Tools Market Analysis

The United States hold 88.10% share in North America. The United States market is experiencing strong growth, driven by the heightened need for accurate data management and analytics across sectors. Organizations are focusing on improving data integrity, which is essential for compliance, strategic decision-making, and operational efficiency. With the rise of digital transformation, enterprises are integrating data quality solutions into their workflows to manage large volumes of structured and unstructured data. The adoption of cloud-based platforms further supports this growth, offering scalable solutions for real-time data validation and monitoring. Moreover, the proliferation of data from IoT devices and customer touchpoints is contributing to the demand for sophisticated tools that ensure consistency and reliability. As industries continue to digitize operations, the emphasis on high-quality data is becoming a core business priority. This is prompting investments in automated tools capable of profiling, cleansing, and enriching data in real-time. The growing integration of AI and ML into data quality tools is also enhancing accuracy and efficiency. Notably, the U.S. Department of Commerce’s Economic Development Administration (EDA) announced an additional USD 504 Million in implementation grants for 12 Tech Hubs in 2024 to scale critical technologies and foster innovation. This initiative underscores the country's broader push toward data-driven strategies and digital infrastructure growth.

Europe Data Quality Tools Market Analysis

The Europe market is witnessing significant expansion, propelled by a strong regulatory environment and the increasing emphasis on data governance. Enterprises across various sectors are adopting advanced tools to enhance data accuracy, maintain compliance, and support digital initiatives. The widespread digitization of services has increased the reliance on clean and consistent data, prompting organizations to invest in tools that automate data profiling, cleansing, and monitoring. A notable example is the European Commission’s e-Health initiative, which targets 100% of EU citizens having access to electronic health records by 2030 highlighting the region’s commitment to secure, high-quality data infrastructure. Cloud adoption is also rising steadily, encouraging the use of scalable and integrated data quality solutions. Businesses are prioritizing data quality to gain insights, optimize workflows, and improve customer engagement. The market is further supported by the integration of AI-powered features, which enable predictive capabilities and automation. As data becomes central to strategic planning and operations, demand for comprehensive solutions that ensure integrity and consistency continues to rise.

Asia Pacific Data Quality Tools Market Analysis

The Asia Pacific market is expanding rapidly, driven by growing digitization and increasing enterprise data volumes. Organizations are leveraging data quality solutions to support business intelligence, automation, and operational decision-making. As businesses integrate digital technologies, maintaining high-quality data has become essential. The adoption of cloud-based solutions is accelerating, offering greater flexibility in managing complex data environments. Demand for tools that enable automated data cleansing and validation is growing, particularly as businesses scale. AI-driven features are also gaining traction, improving the efficiency of data quality processes. A key factor propelling this trend is the exponential rise in connected devices, as the Takshashila University projects nearly 500 million IoT devices in India will be connected to the internet by 2025, driven by initiatives like Smart Cities and Digital India. This surge in data-generating endpoints underscores the critical need for tools that ensure data integrity, consistency, and usability at scale. This dynamic growth reflects a broader shift toward data-centric strategies across the region.

Latin America Data Quality Tools Market Analysis

The Latin America market is gaining momentum as businesses increasingly recognize the value of accurate and reliable data. With the growing adoption of digital technologies, enterprises are turning to tools that help manage and streamline their data assets. The focus is on enhancing data usability for analytics, reporting, and operational efficiency. The substantial investment underscores the region’s commitment to digital advancement, directly contributing to the rising demand for data quality tools. Cloud-based platforms are becoming more prevalent, offering accessible and scalable solutions for diverse business needs. Integration of intelligent features like automation and real-time monitoring is further encouraging uptake.

Middle East and Africa Data Quality Tools Market Analysis

The Middle East and Africa market is gradually expanding in response to increasing digitalization across key industries. Businesses are investing in tools that enhance data accuracy, consistency, and usability to support growth and innovation. Cloud adoption enabling flexible deployment of data quality solutions, facilitating better management of dispersed data sources. According to the International Trade Administration, Saudi Arabia is actively promoting cloud computing, with annual expenditure on public cloud services estimated to reach USD 4.7 Billion by 2027. This growing investment in cloud infrastructure is contributing to the broader regional shift toward digital transformation. Demand for automation and real-time data monitoring is rising, reflecting the growing need for timely insights.

Competitive Landscape:

Players in the global market are actively building their portfolios, initiating strategic partnerships, and making investments in technological advancements to remain competitive. Top players are forming and strengthening their technical capabilities through continuous integration of AI and ML capabilities into their products to provide smarter, real-time data cleansing and validation capabilities. They are also emphasizing cloud-based solutions to address increased demand for scalable and versatile deployment models. Most vendors are purchasing niche technology companies to strengthen their product capabilities and expand into new geographic markets. Moreover, companies are partnering with businesses in other industries to provide tailored, industry-specific data quality solutions. These companies are also focusing on compliance features to assist clients that are dealing with complex data privacy and regulatory environments.

The report provides a comprehensive analysis of the competitive landscape in the data quality tools market with detailed profiles of all major companies, including:

- Alteryx

- CDQ AG & CDQ GmbH

- Experian Data Quality

- Informatica Inc.

- International Business Machines Corporation

- KNIME

- Precisely

- SAP SE

- SAS Institute Inc.

- Syniti

- Talend, Inc.

- Tamr Inc.

Latest News and Developments:

- March 2025: Alation Inc. introduced Alation Data Quality (DQ), an AI-powered solution that identifies critical data assets, applies automated quality rules, and enables proactive monitoring. DQ can also be integrated with Alation’s platform.

- February 2025: Ataccama launched its Lineage module within the Ataccama ONE platform to enhance enterprise data visibility. Using AI, it mapped data flows and transformations, reduced manual effort, and supported compliance.

- December 2024: Wolters Kluwer launched new capabilities for its TeamMate+ audit platform, Multi-Year Audit Planning and the Business Rules Engine. These enhancements aimed to boost audit efficiency, data quality, and regulatory compliance by streamlining planning and enforcing organizational standards across internal audit teams in over 150 countries.

- October 2024: Databricks launched Databricks Apps in Public Preview on AWS and Azure, enabling simplified development and deployment of internal AI and data applications. Supporting frameworks like Streamlit and Flask, it offered secure, serverless deployment, built-in governance via Unity Catalog, and seamless integration with CI/CD tools and DevOps workflows.

- July 2024: Qlik launched the Qlik Talend Cloud platform, integrating technologies from Talend and Kyndi to enhance data management and unstructured data analysis. It introduced AI-assisted tools and formed alliances with AWS and Snowflake to boost GenAI adoption.

- June 2024: Medidata launched Clinical Data Studio to modernize clinical trial data processes using AI. The platform unified Medidata and non-Medidata data sources, reportedly enabling up to 80% faster data review and reconciliation.

Data Quality Tools Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Customer Data, Product Data, Financial Data, Compliance Data, Others |

| Functionalities Covered | Data Validation, Data Standardization, Data Enrichment and Cleansing, Data Monitoring, Others |

| Components Covered |

|

| Deployment Types Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| Verticals Covered | Banking, Financial Services and Insurance, Telecommunication and IT, Retail and E-Commerce, Healthcare and Life Science, Manufacturing, Government, Energy and Utilities, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alteryx, CDQ AG & CDQ GmbH, Experian Data Quality, Informatica Inc., International Business Machines Corporation, KNIME, Precisely, SAP SE, SAS Institute Inc., Syniti, Talend, Inc., Tamr Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, data quality tools market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global data quality tools market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the data quality tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data quality tools market was valued at USD 2.30 Billion in 2024.

The data quality tools market is projected to exhibit a CAGR of 14.9% during 2025-2033, reaching a value of USD 8.0 Billion by 2033.

The market is being driven by the growing adoption of data-driven decision-making, increasing complexity of digital ecosystems, and stricter regulatory data compliance requirements across industries. Rising use of AI and ML for automated data cleansing and real-time anomaly detection is also boosting market growth.

North America currently dominates the data quality tools market, accounting for a share of 38.7%. This is driven by strong digital transformation initiatives, increased cloud adoption, and widespread use of AI technologies in enterprises.

Some of the major players in the data quality tools market include Alteryx, CDQ AG & CDQ GmbH, Experian Data Quality, Informatica Inc., International Business Machines Corporation, KNIME, Precisely, SAP SE, SAS Institute Inc., Syniti, Talend, Inc., Tamr Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)