Data Preparation Market Size, Share, Trends and Forecast by Platform, Tools, Deployment Model, Enterprise Size, End User, and Region, 2025-2033

Data Preparation Market Size and Share:

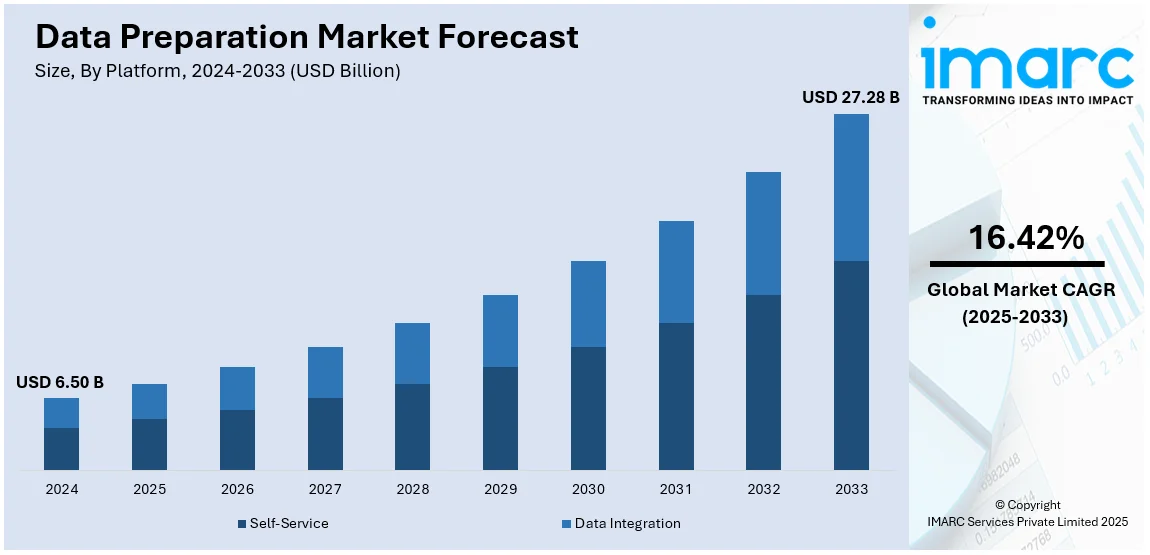

The global data preparation market size was valued at USD 6.50 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 27.28 Billion by 2033, exhibiting a CAGR of 16.42% during 2025-2033. North America currently dominates the market, holding a significant market share of 35.8% in 2024. The market is evolving rapidly due to the increasing volume of data and the widespread adoption of big data analytics. Besides this, the data preparation market share is experiencing growth because of the growing need for data-driven decision making.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.50 Billion |

| Market Forecast in 2033 | USD 27.28 Billion |

| Market Growth Rate (2025-2033) | 16.42% |

Organizations are increasingly adopting automation to streamline and speed up data management tasks across the industry. Automated preparation of data minimizes manual interventions and reduces human errors and inefficiencies in data workflows. Tools for automated data preparation help businesses prepare larger datasets faster, saving precious time for analysis. Businesses are able to ensure higher accuracy and consistency in data and thus avoid repetition of tasks like data cleaning, transformation, and integration. Automation also frees resources, allowing teams to focus on more strategic work, which has the effect of increasing productivity. As businesses deal with the growing volumes of complex data, automation tools simplify and optimize the process, making it more scalable. The need for real-time insights further drives automation, enabling faster data preparation for timely decision-making. Automation supports better data governance in ensuring compliance with regulatory requirements without manual oversight. With machine learning (ML) and artificial intelligence (AI), automation tools are continuously improving data processing efficiency with time.

The demand for data preparation in the United States is fueled by an increasing necessity for real-time analytics. Organizations need rapid access to precise data to make prompt decisions, encouraging tool utilization. Organizations need fast access to precise information to make prompt decisions, encouraging tool usage. Real-time analytics allows companies to respond quickly to shifts in the market, improving their competitiveness in ever-changing settings. Data preparation tools are essential for converting raw data into a format suitable for immediate analysis. They guarantee that the data is precise, tidy, and uniform prior to real-time analysis. The growing demand for immediate insights in sectors like retail, finance, and healthcare promotes adoption. US companies are putting resources into sophisticated tools to facilitate smooth, ongoing data processing. According to the information released on the IMARC Group’s website, the market size for data analytics in the United States is anticipated to show a growth rate (CAGR) of 26.80% from 2024 to 2032. Due to swift technological progress, data preparation tools are now enhancing immediate performance. The increasing significance of customer experience is yet another reason driving the demand for real-time analytics. Rapid decisions based on data that affect customer interactions are essential, particularly in competitive markets.

Data Preparation Market Trends:

Increasing volume of data

The increasing volume of data is one of the primary factors influencing the data preparation market value. Data is being created at an unprecedented rate by a variety of sources including social media platforms, Internet of Things (IoT) devices, workplace apps, and more. In 2020, users created 64.2 ZB of data, which is predicted to increase to 147 ZB by the end of 2024. Furthermore, social media networks like Facebook generated approximately 4,000 TB per day, ranking first among the most visited sites globally in 2023. Similarly, IoT devices, ranging from smart household appliances to industrial sensors, constantly create data that must be gathered, processed, and evaluated. Organizations have both opportunities and challenges as data volume grows. Efficient data preparation solutions help businesses manage this data flow by automating data cleaning and transformation operations, ensuring that the data is accurate, consistent, and ready for analysis.

Adoption of big data and analytics

The adoption of big data and analytics is another crucial factor driving the data preparation market revenue. Across various industries, organizations are increasingly leveraging big data technologies and analytics to gain insights, improve decision-making, and enhance operational efficiency. According to the most recent IMARC Group analysis, the big data software market is increasing at a rate of 8.6% per year. It is estimated to reach USD 410.5 Billion by 2032. Big data analytics entails processing big and complicated datasets that typical data processing techniques cannot handle effectively. This involves the use of advanced data preparation technologies capable of cleaning, transforming, and organizing data so that it is ready for analysis. However, the success of big data analytics is strongly reliant on the quality of data. As a result, data preparation tools play an important part in the big data analytics process by ensuring that data is correct, consistent, and ready for analysis. These solutions automate data cleansing, transformation, and enrichment procedures, which saves time and effort when preparing data for analysis.

Demand for data-driven decision making

The growing adoption of data-driven decision-making is a significant factor influencing data preparation demand across various sectors. Organizations are increasingly relying on data to inform their decisions, optimize operations, and achieve strategic objectives. Data-driven decision-making involves using data analysis and interpretation to guide business strategies rather than relying solely on intuition or experience. The global data analytics market size reached USD 74.26 Billion in 2024. This approach enables organizations to identify opportunities, mitigate risks, and make informed decisions that are backed by empirical evidence. For data-driven decision-making to be effective, the quality of the data used is paramount. Therefore, robust data preparation tools are essential to ensure that data is accurate, clean, and in a usable format. Additionally, data preparation tools often come with features that allow for the automation of repetitive tasks, enabling data analysts and business users to focus on more strategic activities.

Data Preparation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global data preparation market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on platform, tools, deployment model, enterprise size, and end user.

Analysis by Platform:

- Self-Service

- Data Integration

Self-service stand as the largest component in 2024, holding 54.5% of the market. Based on the recent data preparation market forecast, the self-service platform segment holds the majority of the share due to the increasing demand for user-friendly tools that allow business users and data analysts to prepare data without extensive reliance on IT departments. Self-service data preparation platforms offer intuitive interfaces and automation capabilities, enabling users to clean, transform, and analyze data efficiently. These platforms empower users to manage data preparation tasks independently, reducing the time and cost associated with traditional data preparation processes. The rise of self-service analytics tools has further fueled the adoption of self-service data preparation platforms, as organizations strive to enhance their data-driven decision-making capabilities.

Analysis by Tools:

- Data Collection

- Data Cataloguing

- Data Quality

- Data Governance

- Data Ingestion

- Data Curation

Data collection leads the market with 27.8% of market share in 2024. Data collection tools enable organizations to gather structured and unstructured data from diverse sources seamlessly. As data volumes grow exponentially, businesses prioritize reliable tools for efficient data ingestion. These tools ensure high-quality data capture, critical for downstream processes like cleaning and transformation. Data collection tools integrate with IoT devices, APIs, and social media platforms, enhancing versatility significantly. With digital transformation initiatives, enterprises require robust tools to consolidate data from legacy systems. Automation capabilities in modern collection tools streamline manual processes, saving time and reducing errors effectively. Industries like e-commerce and finance rely on these tools to harness customer behavior insights. Real-time data ingestion features are essential for uses needing immediate analysis and decision-making. Compliance-driven sectors prefer tools embedding privacy and security protocols during the data gathering phase. Scalability in data collection tools supports enterprise growth and evolving data requirements efficiently. Cloud-enabled collection tools enhance accessibility and collaboration across geographically dispersed teams.

Analysis by Deployment Model:

- On-premises

- Cloud-based

On-premises lead the market with 56.7% of market share in 2024. Industries like banking and healthcare prioritize on-premises solutions to manage sensitive data effectively. Organizations prefer on-premises for robust customization options, aligning tools with specific operational requirements. It eliminates reliance on third-party vendors, enhancing data ownership and operational independence significantly. Compliance-driven sectors benefit from on-premises deployments adhering to stringent local and international regulations. Large enterprises favor on-premises for processing high-volume, critical data with minimal external dependencies. These deployments offer consistent performance without relying on internet connectivity, crucial for mission-critical operations. Organizations avoid potential cloud-related downtimes, ensuring continuous data preparation and processing efficiency. On-premises solutions enable advanced firewall and network configurations, strengthening enterprise-grade security measures effectively. They are ideal for companies operating in regions with limited cloud infrastructure or bandwidth issues. Industries with long-term strategies prefer on-premises deployments to amortize costs over extended periods. Vendors are enhancing on-premises solutions with AI and automation, making them increasingly attractive.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Large enterprises dominate the market with 68.7% of market share in 2024. Large enterprises require scalable solutions capable of managing high volumes of structured and unstructured data. Large enterprises prioritize advanced tools that integrate seamlessly with existing infrastructure and enterprise systems. They invest heavily in data preparation tools to support extensive analytics and decision-making processes. Complex workflows in large businesses necessitate tools offering robust automation and customization capabilities effectively. Such enterprises demand sophisticated features like real-time processing and predictive analytics to stay competitive. Compliance with stringent data governance and security regulations drives investment in enterprise-grade preparation tools. Large enterprises often adopt hybrid deployment modes, requiring tools compatible with both cloud and on-premises infrastructures. Their global operations need tools enabling efficient cross-border data integration and standardization seamlessly. Budgetary flexibility allows these enterprises to adopt high-end, feature-rich solutions tailored to their needs, which is propelling the market growth across the globe.

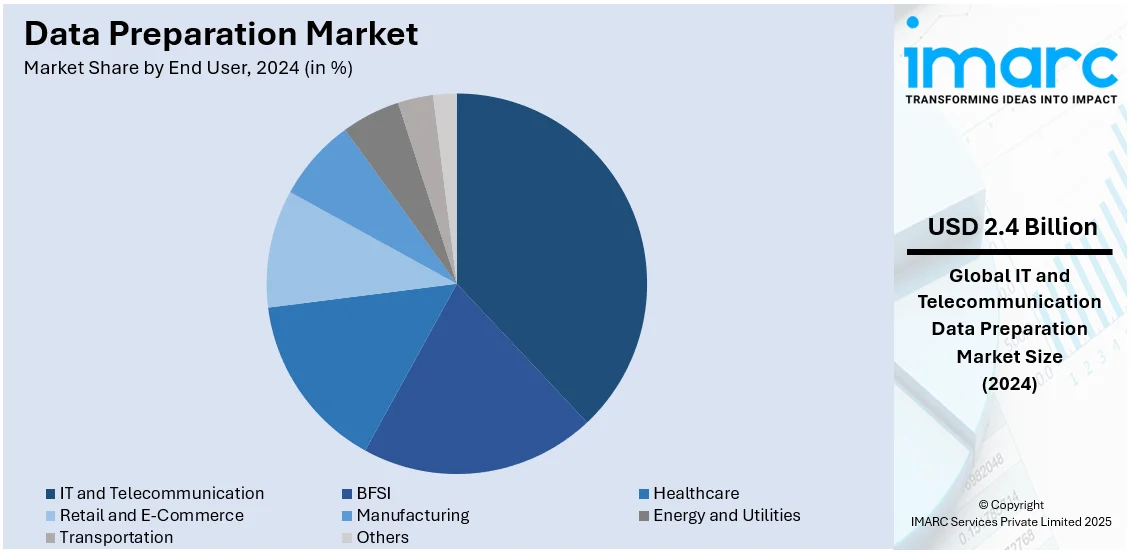

Analysis by End User:

- BFSI

- Healthcare

- Retail and E-Commerce

- Manufacturing

- Energy and Utilities

- IT and Telecommunication

- Transportation

- Others

IT and telecommunications sector leads the market with 37.5% of market share in 2024. The IT and telecommunication sector demands advanced tools to handle real-time data, critical for operations and customer experience. Telecom companies leverage data preparation for optimizing network performance, improving reliability and service delivery. IT companies utilize these tools to enhance system integrations and facilitate seamless application management efficiently. Rising adoption of IoT devices in telecom drives the demand for scalable data preparation solutions. This sector requires tools capable of addressing big data challenges like volume, variety, and velocity. Telecom firms utilize predictive analytics, necessitating robust preparation for effective machine learning applications. Security-focused data preparation tools are crucial for compliance with stringent telecom industry regulations. The shift towards 5G networks increases the need for advanced data processing to manage network loads. IT firms rely on data preparation to enhance automation in software development and operational processes. Data preparation supports customer churn analysis, a critical metric in the telecom industry's competitive landscape.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the biggest market share of 35.8%. This supremacy is ascribed to the area's sophisticated technological framework, significant uptake of data-centric technologies, and the existence of many major market participants. Organizations in North America are pioneers in utilizing big data analytics, machine learning (ML), and artificial intelligence (AI), catalyzes the need for effective data preparation tools to handle and analyze substantial amounts of data. Moreover, strict regulatory standards concerning data privacy and security in the area demand strong data preparation solutions to maintain compliance and data integrity. Strong presence of sectors like finance, healthcare, retail, construction, and telecommunications, which produce large volumes of data, is intensifying the need for data preparation tools. For example, in May 2024, Aon launches thorough risk assessment tools for brokers and risk managers across North America. These instruments offer exposure information, loss assessment, and simulations of different insurance policy choices. The package features the property risk evaluator, emphasizing the visualization and modeling of property risks.

Key Regional Takeaways:

United States Data Preparation Market Analysis

The United States hold 85.00% of the market share in North America. The data preparation market in the United States is experiencing robust growth driven by several key factors. The rising adoption of big data and analytics is a primary driver, with organizations seeking advanced solutions to streamline their data workflows and derive actionable insights from vast datasets. The growing emphasis on business intelligence (BI) and the integration of artificial intelligence (AI) and machine learning (ML) are significantly contributing to the market's expansion. According to report, the US has consistently been the breeding ground for AI innovation, with 4,633 AI startups founded between 2013 and 2022. In 2022 alone, 524 AI startups were established, attracting USD 47 Billion in non-governmental funding. These advancements in AI are further driving demand for automated data preparation tools that enable businesses to process, clean, and transform data efficiently. The escalating demand for data governance and compliance with regulations like GDPR and CCPA is fostering the need for more secure and structured data preparation solutions. Moreover, the proliferation of cloud platforms and hybrid cloud environments is creating a seamless integration of data across on-premises and cloud systems. This is further amplified by the growing trend of self-service analytics, allowing business users to manage and prepare their data independently.

Asia Pacific Data Preparation Market Analysis

In the Asia-Pacific region, the data preparation market is driven by the increasing usage in cloud technologies, big data analytics, and digital transformation. With industries like e-commerce, finance, and manufacturing increasingly relying on data, the demand for efficient data processing and preparation tools is surging. South Korea, for instance, has 31.3 Million 5G connections, holding more than 48% of all mobile connections, while China leads with more than 700 Million 5G connections, or 41% of its total connections, according to GSMA. This widespread adoption of 5G is enabling faster data transmission, further emphasizing the need for advanced data management solutions. Additionally, governments across the region are encouraging digitalization initiatives and smart city projects, which contribute to the demand for sophisticated data preparation tools. As regulatory frameworks tighten and data privacy becomes a key concern, businesses are increasingly adopting solutions to ensure compliance and drive data-driven decision-making.

Europe Data Preparation Market Analysis

In Europe, the market is shaped by several key drivers including the increasing reliance on data analytics, artificial intelligence (AI), and the rising usage of Internet of Things (IoT) devices. As European companies seek to stay competitive in a data-driven landscape, the demand for efficient data preparation tools that streamline data extraction, cleaning, and transformation has surged. According to reports, 29% of European Union enterprises used IoT devices in 2021, primarily to secure their premises. This growing integration of IoT devices is contributing to the expansion of data sources, further influencing the requirement for efficient data management solutions. Additionally, the increasing focus on business intelligence (BI) and AI-driven insights is encouraging the adoption of automated data preparation tools. The tightening of data privacy regulations, including the GDPR, is another crucial driver, as organizations seek tools that ensure data accuracy and compliance. Moreover, the rising interest in self-service analytics platforms is empowering business users to prepare and analyze data independently. The growing sectors of fintech and healthcare in Europe are also contributing to the demand for tailored data preparation solutions that address the unique data challenges within these industries, further propelling the market growth.

Latin America Data Preparation Market Analysis

In Latin America, the market for data preparation is driven by the growing penetration of the mobile and internet sectors, alongside the increasing adoption of cloud-based solutions. The region is home to one of the fastest-growing mobile markets worldwide, with 326 Million mobile internet users in 2018, a number projected to rise to 422 Million by 2025, according to reports. This expansion of mobile internet users is fueling the demand for data-driven decision-making and efficient data preparation tools. Additionally, the region’s focus on digital transformation and technology investments is contributing to the growing need for scalable data management solutions.

Middle East and Africa Data Preparation Market Analysis

The Middle East and Africa region is witnessing significant growth in the data preparation market, driven by the increasing adoption of 5G technology and digital transformation initiatives. Saudi Arabia, for example, leads the region in 5G adoption, with over 11.2 Million subscriptions by the end of 2022, representing more than a quarter of the total mobile sector, according to reports. This rapid technological advancement is creating a demand for data preparation tools that enable businesses to leverage high-speed networks for data analysis and decision-making. Additionally, growing investments in smart cities and infrastructure further drive the need for efficient data management solutions.

Competitive Landscape:

Main contributors allocate resources to research and development (R&D) to improve the effectiveness of data preparation tools and platforms. Strategic alliances and partnerships allow them to broaden market access and enhance their services. For example, in April 2024, Altair Engineering Inc. purchased Cambridge Semantics, a contemporary data fabric provider and developer of a top analytical graph database in the industry. This acquisition seeks to improve Altair's data analytics and AI capabilities by incorporating Cambridge Semantics' graph-driven data fabric technology into Altair's RapidMiner platform. Ongoing updates and the launch of new features guarantee that their solutions meet changing customer needs. The emphasis on intuitive interfaces promotes the global uptake of self-service data preparation tools. Utilizing AI and ML features improves automation and increases the precision of data operations. Providing cloud-based data preparation solutions meets the increasing need for scalable and adaptable deployment choices. Offering strong customer support guarantees a more seamless adoption and greater satisfaction across various industries and uses. Key stakeholders assist in meeting data compliance needs through secure and dependable solutions. Participating in training programs enhances understanding and effective utilization of data preparation technologies.

The report provides a comprehensive analysis of the competitive landscape in the data preparation market with detailed profiles of all major companies, including:

- Altair Engineering Inc.

- Alteryx Inc.

- Informatica

- International Business Machines Corporation

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- Qlik

- SAP SE

- SAS Institute Inc.

- Tableau Software LLC (Salesforce.com Inc.)

- TIBCO Software Inc.

Latest News and Developments:

- December 2024: Algolia introduced Algolia Data Transformations, a new tool aimed at simplifying data preparation for indexing in its AI-driven search platform. This solution allows developers to apply Extract, Transform, Load (ETL) functions, enhancing data quality and optimizing it for improved search and retrieval performance.

- September 2024: Zoho released Version 2.0 of Zoho DataPrep, which was first introduced in 2021 as a self-service data preparation tool. The updated version incorporates advanced AI-driven features to simplify data preparation and management, tackling challenges, such as growing data volumes and minimizing human errors.

- June 2024: Prophecy launched the Prophecy Data Transformation Copilot, the first solution designed to simplify data preparation for analytics and AI on the Databricks platform. Using generative AI, the tool streamlines the creation, deployment, and monitoring of enterprise-level data pipelines, ensuring clean and reliable data for analysis.

- August 2023: Alteryx, Inc., the Analytics Cloud Platform company, expanded its partnership with Google Cloud to offer Looker Studio users native access to a free, limited version of Alteryx Designer Cloud's AI-driven data preparation features and improved connectivity.

Data Preparation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Self-Service, Data Integration |

| Tools Covered | Data Collection, Data Cataloguing, Data Quality, Data Governance, Data Ingestion, Data Curation |

| Deployment Models Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| End Users Covered | BFSI, Healthcare, Retail and E-Commerce, Manufacturing, Energy and Utilities, IT and Telecommunication, Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Altair Engineering Inc., Alteryx Inc., Informatica, International Business Machines Corporation, Microsoft Corporation, MicroStrategy Incorporated, Oracle Corporation, Qlik, SAP SE, SAS Institute Inc., Tableau Software LLC (Salesforce.com Inc.), TIBCO Software Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, data preparation market outlook, and dynamics of the market from 2019-2033.

- The data preparation market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the data preparation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data preparation market was valued at USD 6.50 Billion in 2024.

The data preparation market is projected to exhibit a CAGR of 16.42% during 2025-2033, reaching a value of USD 27.28 Billion by 2033.

The data preparation market growth is driven by the increasing adoption of big data and analytics, and the rising demand for real-time analytics. Automation of data processes, the need for improved data quality, and integration with advanced technologies like AI and ML are also significant drivers. Additionally, data privacy and compliance regulations compel businesses to adopt secure data preparation tools. The shift toward cloud adoption and the focus on data democratization further fuels the growth of this market.

North America currently dominates the data preparation market, accounting for a share of over 35.8% in 2024 because of the advanced technological infrastructure and high adoption of analytics and big data solutions. The region's strong focus on digital transformation, data-driven decision-making, and compliance with data privacy regulations drives the demand for data preparation tools. Additionally, the presence of major tech companies, along with significant investments in AI and machine learning, propels market growth.

Some of the major players in the data preparation market include Altair Engineering Inc., Alteryx Inc., Informatica, International Business Machines Corporation, Microsoft Corporation, MicroStrategy Incorporated, Oracle Corporation, Qlik, SAP SE, SAS Institute Inc., Tableau Software LLC (Salesforce.com Inc.), TIBCO Software Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)