Data Center Generator Market Size, Share, Trends and Forecast by Product, Capacity, Tier, and Region, 2025-2033

Data Center Generator Market Size and Share:

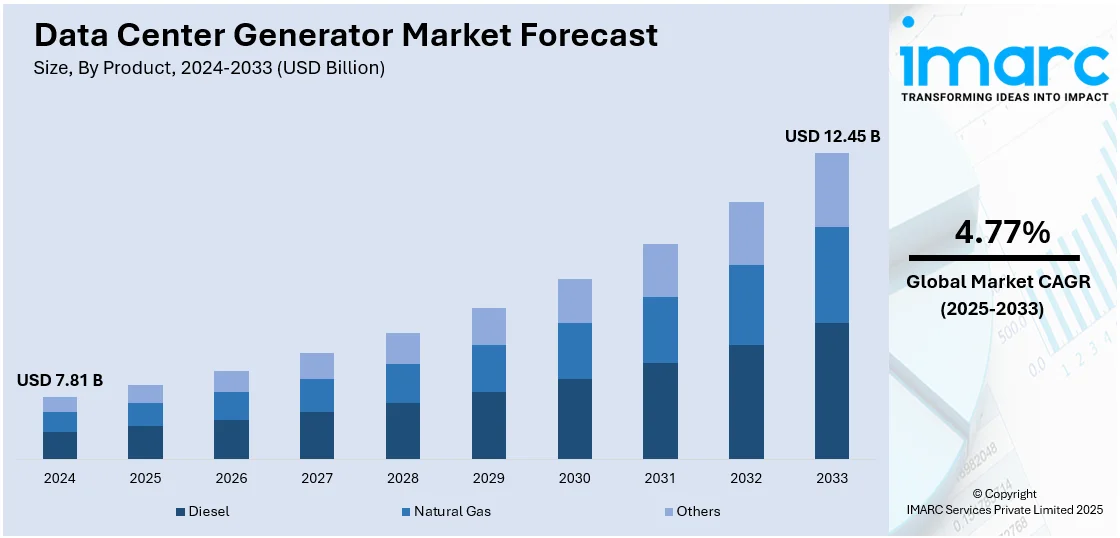

The global data center generator market size was valued at USD 7.81 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.45 Billion by 2033, exhibiting a CAGR of 4.77% during 2025-2033. North America currently dominates the market, holding a significant market share of around 37.5% in 2024. The increasing demand for uninterrupted power supply and growing reliance on cloud computing are propelling market expansion, as businesses require robust backup solutions to ensure operational continuity. Additionally, as organizations prioritize reliability and cost-effectiveness in their energy management strategies, there is a rising need for energy-efficient infrastructure, which is a significant factor augmenting data center generator market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.81 Billion |

|

Market Forecast in 2033

|

USD 12.45 Billion |

| Market Growth Rate (2025-2033) | 4.77% |

The market is witnessing significant growth due to the growing demand for uninterruptible power supply in data centers. With companies shifting to digital platforms, the dependency on data centers for storing and processing vital information has increased, making backup power solutions a necessity. Additionally, stringent government policies for data privacy and uptime availability are compelling companies to invest in high-performance generators. According to an industry report, cloud infrastructure services spending rose 20% year over year to USD 86 Billion in Q4 2024. This growth marks the shift towards cloud-based operations, which further drives the need for data center generators. As per data center generator market research report, the growing trend of edge computing adds to the rising demand for localized power solutions. With enterprises increasingly setting up micro data centers in remote locations to improve latency and processing speed, the reliance on consistent and immediate backup power has become essential. This is driving demand for compact and high-performance generator systems designed specifically for edge environments

The United States market is driven by the swift growth in cloud services, especially in areas such as e-commerce, finance, and healthcare, where the slightest downtime would mean huge economic losses. The increased danger of cyber-attacks further highlights the need for robust backup systems to protect critical data infrastructure. According to industry reports, APT detections rose 136% during the first quarter of 2025 over the fourth quarter of 2024, reflecting a major spike in targeted attacks within the United States. This escalation of cyber attacks is fueling the need for data center generators that will ensure continuous power in times of emergency, so data is protected even in case of power outages. Apart from this, the growing use of hybrid cloud deployments and the need for high-density computing facilities are further accelerating the demand for reliable and efficient backup power solutions.

Data Center Generator Market Trends:

Rising Data Consumption

The rising data consumption is a significant growth-inducing factor for the market. The proliferation of digital content, including streaming services, online gaming, social media, and remote working tools, has dramatically increased the load on data centers. To manage this growing demand, data centers are expanding their capacities and enhancing their infrastructure. Additionally, as more businesses and consumers rely on cloud-based services, the demand for large-scale data centers with robust power backup systems continues to grow. This data center generator market trend is further amplified by the increasing number of smart devices and the expansion of the Internet of Things (IoT), all of which contribute to higher data generation and consumption. As per industry reports, by the end of 2024, there are projected to be more than 207 billion devices connected to the worldwide network of tools, toys, devices and appliances that make up the Internet of Things (IoT).

Growing Investments by Major Tech Companies

The increasing investments in data center infrastructure by major IT businesses is a crucial driver of growth for the data center generator industry. Leading technological companies like Amazon, Google, Microsoft, and Facebook are constantly expanding their data center capacity to meet their ever-increasing data storage and processing demands. Major technology businesses are working on developing data centers that are not only larger in size but also more technologically advanced and sustainable, which is creating a positive data center generator market outlook. Companies are also implementing cutting-edge generating technologies that improve efficiency, reduce emissions, and integrate with renewable energy sources. According to industry reports, data centers have attracted the interest of investors, often due to the steady, utility-like cash flows and risk-adjusted yields.1 In 2021, there were 209 data center deals, with an aggregate value of more than USD 48 Billion, up some 40 % from 2020, when the deals were worth USD 34 Billion. In the first half of 2022, there were 87 deals, with an aggregate value of USD 24 Billion. From 2015 to 2018, private equity buyers accounted for 42 % of the deal value. Their share increased to 65 % from 2019 to 2021 and to more than 90 % in the first half of 2022.

Government and Regulatory Compliance

Regulatory compliance and industry standards are critical factors in driving the data center generator market growth. Governments and regulatory agencies around the world have set strict criteria for data center operations, including specific requirements for power backup systems. In 2023, the UK government launched a new consultation, protecting and enhancing the security and resilience of UK data infrastructure. The government said a new set of laws would make minimum requirements mandatory to ensure data center operators are taking appropriate steps to boost their security and resilience. Compliance with these standards is critical for data centers to operate legally and avoid fines. For example, standards such as the Uptime Institute's Tier Classification System require data centers to have dependable power backup solutions in order to attain specific certification levels. These requirements ensure that data centers are ready to endure power disruptions and continue operations. Furthermore, environmental rules aiming at lowering carbon emissions promote the use of more efficient and environmentally friendly generator systems.

Data Center Generator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global data center generator market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, capacity, and tier.

Analysis by Product:

- Diesel

- Natural Gas

- Others

Diesel leads the market with around 72.6% of market share in 2024. Diesel generators are known for their dependability and robust performance, which makes them the ideal choice for critical applications such as data centers. They can provide a continuous and dependable power supply during outages, allowing data centers to operate uninterrupted. Furthermore, diesel generators have a short startup time, which is critical in emergency situations where electricity must be restored fast. This rapid response capability is critical for ensuring data center uptime. Despite the growing interest in alternative energy solutions, diesel remains a preferred choice due to its proven track record and scalability to meet the energy demands of large data center operations. Apart from this, diesel generators are designed to comply with various industry standards and regulations, which is also creating a favorable market outlook.

Analysis by Capacity:

- Less than 1MW

- 1MW–2MW

- Greater than 2MW

Less than 1MW leads the market with around 56.5% of market share in 2024. As the trend toward edge computing continues, there is a growing demand for smaller, more localized data centers. As per IT Executives Council, by 2026, the market for edge computing is estimated to be valued at USD 317 Billion, with its footprint expected to expand to 21.7% by 2028. These edge data centers frequently require generators with less than 1MW capacity to offer dependable backup power in geographically dispersed locations. These smaller generators' scalability and flexibility make them perfect for edge data centers, which seek to minimize latency and enhance data processing rates by bringing data closer to end users. Generators with capacities less than 1MW are often more cost-effective for small to medium-sized data centers. They require less initial investment than larger generators and have lower operational and maintenance costs, thus enriching market appeal.

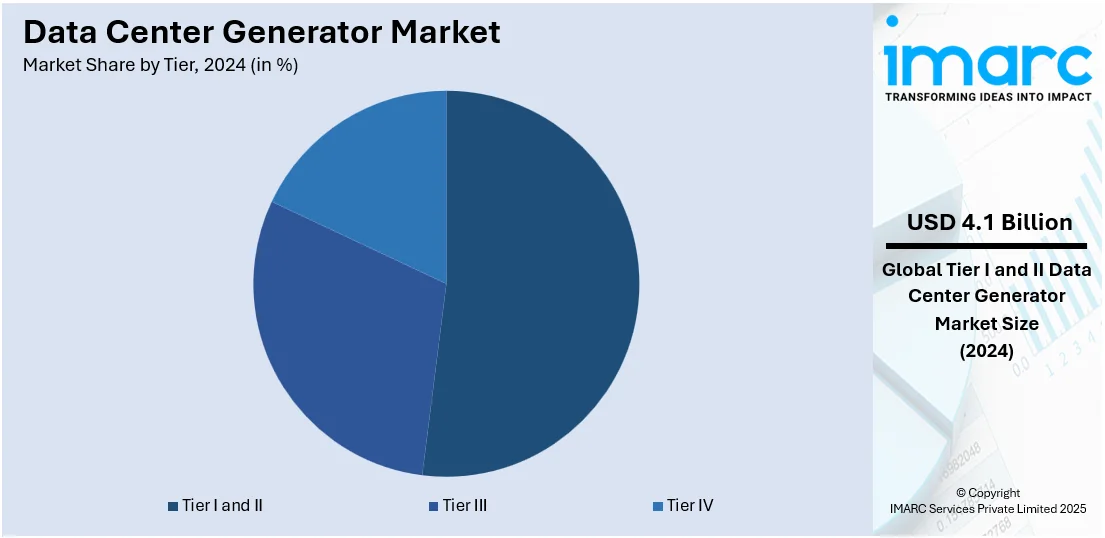

Analysis by Tier:

- Tier I and II

- Tier III

- Tier IV

Tier I and II lead the market with around 52.3% of market share in 2024. These data centers are widely used in a variety of industries, including small and medium-sized businesses (SMEs), educational institutions, and local government offices. Due to their reduced initial setup and operational expenses, they are much more commonly deployed than higher-tier data centers. Hence the increasing number of small businesses is driving the need for tier I and II data centers. According to World Economic Forum, small businesses make up 90% of businesses globally, create two out of every three jobs worldwide. This extensive usage increases the overall demand for generators to assure operational continuity during power shortages. Furthermore, the continued expansion of digital infrastructure, particularly in emerging economies, has resulted in the rapid construction of Tier I and II data centers. These locations frequently begin with lower-tier data centers due to their price and ease of implementation. As digital services proliferate in these locations, the demand for dependable power backup solutions for Tier I and II data centers grows, driving up generator sales.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.5%. North America, particularly the United States, is home to several of the world's leading technology companies, including Google, Amazon, Microsoft, and Facebook. As per industry report, 72 of the world's largest tech companies are based in the United States. These companies operate extensive data center networks to support their cloud services, digital platforms, and massive data storage needs. Besides, the region is at the forefront of innovation, with continuous investments in research and development to improve generator technologies. This includes integrating renewable energy sources, IoT, and AI for predictive maintenance and enhanced performance. These factors are collectively driving the data center generator market revenue in North America.

Key Regional Takeaways:

United States Data Center Generator Market Analysis

In 2024, the United States holds a substantial share of around 87.60% of the market share in North America. The market in the region is primarily driven by the proliferation of artificial intelligence (AI) and machine learning (ML) applications significantly increasing energy demands. In line with this, the growing deployment of 5G infrastructure necessitating localized data processing and greater backup power capacity, is propelling market growth. As per an industry report, by early 2024, over 75% of U.S. subscribers had 5G access, led by Verizon, AT&T, and T-Mobile. The U.S. government plans to invest USD 65 Billion to enhance broadband and 5G connectivity, especially in rural areas, in coming years. Similarly, heightened regulatory scrutiny on data privacy and uptime mandating compliance with strict operational continuity standards, is fostering market expansion. The rising investment in edge computing requiring decentralized, reliable power sources, is strengthening market demand. Furthermore, increased reliance on hybrid cloud architecture fueling the escalation of on-premises and colocation facilities, is impelling the market. The growing vulnerability of aging electrical grids to cyberattacks and natural disasters compelling data centers to enhance energy resilience, is stimulating the market appeal. Moreover, rise in environmental and sustainability goals accelerating interest in low-emission generator technologies, including biofuel and hydrogen-ready systems, is impacting the market trends.

Europe Data Center Generator Market Analysis

The Europe market is majorly influenced by the region’s ambitious digitalization strategies under initiatives like the EU Digital Compass. In accordance with this, increasing reliance on renewable energy necessitating backup power systems to address intermittency, is fostering market expansion. According to the European Environment Agency, in 2023, 24.5% of the EU's total energy consumption came from renewable sources. The binding requirement is increased from 32% to at least 42.5%, with a target of 45%, under the revised Renewable Energy Directive. Furthermore, growing geopolitical tensions highlighting the need for energy security, are augmenting market demand for autonomous power generation. The rise in data sovereignty regulations prompting the construction of localized facilities, each requiring dedicated power redundancy, is impelling development in the market. Similarly, the rapid growth of smart cities and IoT ecosystems accelerating the demand for continuous data flow is enhancing market accessibility. The expansion of hyperscale cloud providers into secondary European markets necessitating scalable backup power, is expanding the market scope. Additionally, frequent extreme weather events linked to climate change driving demand for robust disaster-resilient energy infrastructure in data centers, are providing an impetus to the market.

Asia Pacific Data Center Generator Market Analysis

The market in Asia Pacific is advancing, attributed to rapid urbanization and the proliferation of digital services across emerging economies. Similarly, the region's growing e-commerce and cloud services sectors requiring resilient backup power solutions, are propelling growth in the market. Furthermore, increasing government investments in smart cities and digital infrastructure fueling the need for reliable energy, is escalating the market reach. As such, in 2024, India sanctioned 12 smart industrial cities under NICDP with INR 286.02 billion (USD 3.41 Billion), expecting INR 1.52 trillion (USD 18.12 Billion) investment and 4 million jobs. The expansion of financial institutions and critical industries driving the demand for uninterrupted power, is also strengthening the market demand. Additionally, the ongoing shift toward green data centers is accelerating the adoption of cleaner, more efficient generator technologies. Apart from this, frequent natural disasters and regional power instability compelling data centers to enhance energy security and resilience through reliable backup power systems, are influencing the market dynamics.

Latin America Data Center Generator Market Analysis

In Latin America, the market is progressing propelled by the increasing demand for cloud computing services and digital transformation in businesses. In addition to this, limited access to stable electricity in some regions heightening the need for alternative power sources, is bolstering market development. The growing investments in telecommunications infrastructure requiring robust energy solutions, are supporting market demand. Consequently, in 2024, Brazil’s V.tal announced a USD 1 Billion investment in its new subsidiary, Tecto Data Centers, to support telecom operators and technology companies. The investment will expand its data center capabilities in Brazil and Colombia, with a focus on cloud and streaming services. Moreover, the increasing extreme weather events and power outages driving demand for resilient, scalable backup power systems to ensure continuous data center operations, are creating lucrative market opportunities.

Middle East and Africa Data Center Generator Market Analysis

The market in the Middle East and Africa is experiencing growth due to rapid digital transformation and cloud adoption demanding reliable backup power. A YouGov survey commissioned by SAP reveals that 67% of UAE enterprises are already hosting their core business processes on cloud, while an additional 22% plan to do so within the coming months. Furthermore, increasing energy instability and frequent power outages driving the need for self-sustaining energy solutions, are impelling the market. Similarly, the rise of smart cities and infrastructure projects augmenting demand for dependable power systems, is supporting the market expansion. Besides this, the growing importance of data privacy and security regulations encouraging businesses to ensure uninterrupted operations through resilient power backup systems, are positively influencing the market.

Competitive Landscape:

The market dynamics shows that major companies in the market are investing heavily in research and development (R&D) activities to innovate and improve generator technologies. This includes developing more efficient, reliable, and environmentally friendly generators. Besides this, key market players are integrating Internet of Things (IoT) and Artificial Intelligence (AI) technologies to offer smart generator systems. These advancements allow for predictive maintenance, real-time monitoring, and enhanced performance, thereby increasing the reliability and efficiency of power backup solutions. Additionally, leading players are diversifying their product portfolios to include a wide range of generator systems that cater to different needs and scales of data centers. This includes everything from small, modular units to large-scale, industrial-grade generators. According to the data center generator market forecast, the market is expected to witness intense competition over the next few years due to new entrants and continuous developments.

The report provides a comprehensive analysis of the competitive landscape in the data center generator investment market with detailed profiles of all major companies, including:

- ABB Ltd

- Atlas Copco (India) Ltd.

- Caterpillar Inc.

- Cummins Inc.

- Deutz AG

- Generac Power Systems Inc.

- HITEC Power Protection

- Kirloskar Oil Engines Limited

- Kohler Co.

- Langley Holdings plc

- Mitsubishi Motors Corporation

- Rolls-Royce plc

- Yanmar Holdings Co. Ltd.

Latest News and Developments:

- April 2025: Generac launched five new generators for the data center market, ranging from 2.25 MW to 3.25 MW. Featuring Baudouin M55 engines, Deep Sea controllers, and modular scalability, these low-emission, high-performance units addressed hyperscale to edge data center needs with fast deployment and integrated energy ecosystem compatibility.

- October 2024: Baudouin launched a new range of diesel generator sets for data centers, offering outputs from 2000 to 5250 kVA. Featuring Uptime Institute compliance, HVO readiness, and extreme-condition adaptability, these customizable gensets delivered turnkey power solutions tailored for Tier III and IV data center operations.

- August 2024: Aurora Capital Partners acquired GenServe, a provider of backup power solutions for critical infrastructure, including data centers. GenServe served over 10,000 clients across the healthcare, utilities, and education sectors with 150+ technicians.

- May 2024: DEUTZ AG finalized its acquisition of Blue Star Power Systems, Inc., a US-based manufacturer of diesel and gas generator sets ranging from 20 kWe to 2,000 kWe. This strategic move positioned DEUTZ as a comprehensive provider of decentralized energy solutions, particularly benefiting sectors like data centers that require reliable backup power.

- February 2024: Cummins Inc. expanded its Centum™ Series with the introduction of two new generator sets, the C1750D6E and C2000D6E, offering power outputs ranging from 1750 to 2000 kW. These generators were powered by the new QSK50 engine and designed for critical applications like data centers.

Data Center Generator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Diesel, Natural Gas, Others |

| Capacities Covered | Less than 1MW, 1MW–2MW, Greater than 2MW |

| Tiers Covered | Tier I and II, Tier III, Tier IV |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Germany, France, United Kingdom, Italy, Spain, Russia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Atlas Copco (India) Ltd., Caterpillar Inc., Cummins Inc., Deutz AG, Generac Power Systems Inc., HITEC Power Protection, Kirloskar Oil Engines Limited, Kohler Co., Langley Holdings plc, Mitsubishi Motors Corporation, Rolls-Royce plc, Yanmar Holdings Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the data center generator market from 2019-2033.

- The data center generator market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the data center generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data center generator market was valued at USD 7.81 Billion in 2024.

The data center generator market is projected to exhibit a CAGR of 4.77% during 2025-2033, reaching a value of USD 12.45 Billion by 2033.

The market is driven by the increasing demand for uninterrupted power supply, growing reliance on cloud computing and big data, rising concerns over power outages, and the need for enhanced energy efficiency in data centers. These factors are pushing the adoption of reliable and efficient backup generators in the industry.

North America currently dominates the data center generator market with a market share of around 37.5%. The dominance is fueled by the region's high concentration of data centers, rapid technological advancements, and the growing demand for cloud-based services. Additionally, the increasing need for reliable power backup solutions due to frequent power disruptions further strengthens the market in this region.

Some of the major players in the data center generator market include ABB Ltd, Atlas Copco (India) Ltd., Caterpillar Inc., Cummins Inc., Deutz AG, Generac Power Systems Inc., HITEC Power Protection, Kirloskar Oil Engines Limited, Kohler Co., Langley Holdings plc, Mitsubishi Motors Corporation, Rolls-Royce plc, and Yanmar Holdings Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)