Data Center Construction Market Report by Construction Type (Electrical Construction, Mechanical Construction), Data Center Type (Mid-Size Data Centers, Enterprise Data Centers, Large Data Centers), Tier Standards (Tier I & II, Tier III, Tier IV), Vertical (Public Sector, Oil and Energy, Media and Entertainment, IT and Telecommunication, Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, and Others), and Region 2026-2034

Data Center Construction Market Overview:

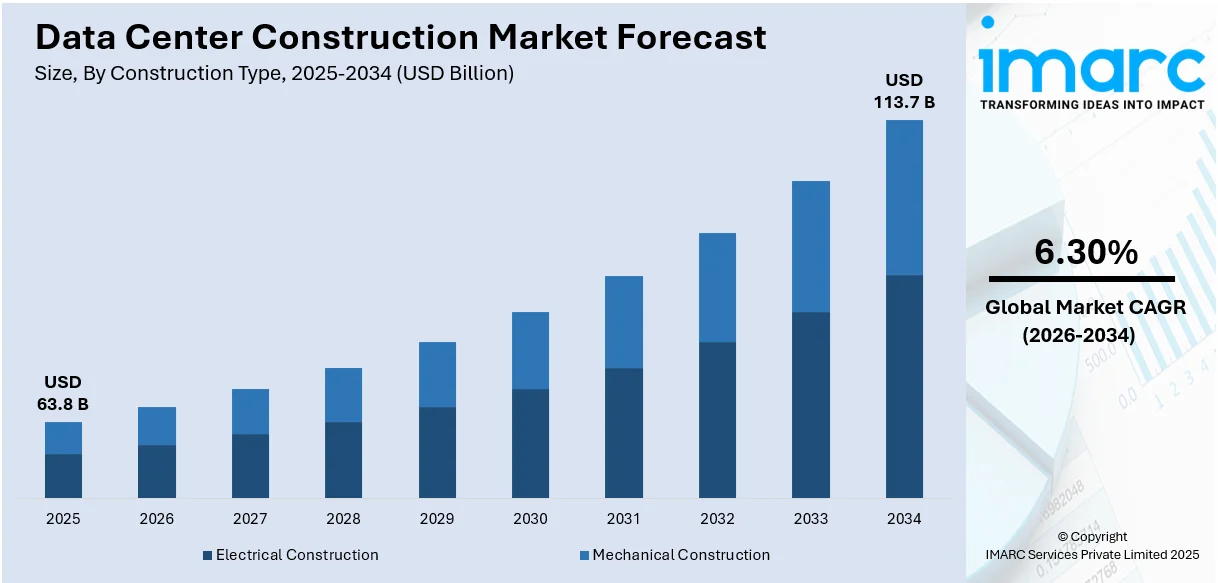

The global data center construction market size reached USD 63.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 113.7 Billion by 2034, exhibiting a growth rate (CAGR) of 6.30% during 2026-2034. The escalating demand for robust digital infrastructure and rising investments in electrical and mechanical construction to enhance efficiency, reliability, and sustainability across various regions are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 63.8 Billion |

|

Market Forecast in 2034

|

USD 113.7 Billion |

| Market Growth Rate 2026-2034 | 6.30% |

Data Center Construction Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth because of the rising demand for data storage and cloud-based services. Furthermore, the demand for larger and more advanced data centers is being driven by technological breakthroughs like 5G, artificial intelligence (AI), and the Internet of Things (IoT).

- Key Market Trends: The growing focus on sustainability, as many companies prioritize green construction practices and energy-efficient designs, is offering a favorable market outlook. This involves using cutting-edge cooling systems and switching to renewable energy sources in order to lessen the impact on the environment.

- Geographical Trends: North America dominates the market attributed to the increasing concentration of technology companies and early adoption of cloud services in the region.

- Competitive Landscape: Some of the major market players in the data center construction industry include AECOM, Clark Construction Group, LLC, Collen Construction, Corgan, DPR Construction, Holder Construction Group, LLC, ISG, Jacobs Solutions Inc., Linesight, Mercury Engineering, PCL Constructors Inc, Turner Construction Company, among many others.

- Challenges and Opportunities: The high costs associated with constructing and maintaining state-of-the-art data centers are influencing the data center construction market revenue. Nevertheless, opportunities for companies specializing in modular data centers, which can be set up more quickly and at a reduced expense in comparison to conventional data centers, is supporting the market growth.

To get more information on this market Request Sample

Data Center Construction Market Trends:

Sustainability Initiatives and Regulatory Compliance

Efforts to promote sustainability and stringent regulatory demands play a key role in shaping the data center construction market. There is a noticeable shift towards green data centers, utilizing renewable energy and efficient cooling to reduce carbon footprints, as environmental issues become more prominent. Laws concerning energy efficiency and environmental effects are becoming more stringent, leading businesses to focus on sustainable construction methods and technologies. This trend not only lowers operational expenses of companies but also improves their reputation for corporate social responsibility (CSR). In November 2023, Vertiv Group Corporation introduced TimberMod, a modular data center made mostly of wood to lower carbon footprints and meet sustainability goals. Despite initial skepticism, timber data centers have been proven to be resilient and able to withstand fires, aligning with the industry's sustainability objectives. Furthermore, Fujitsu is at the forefront of creating energy-efficient CPUs and photonics smart NIC for future green data centers as part of Japan's NEDO program in February 2022. The goal of the project is to make substantial energy reductions in data centers by 2030, helping create an eco-friendly digital infrastructure.

Technological Advancements and Infrastructure Demand

The use of fiber optics and faster networking technologies requires data centers to be redesigned and built to accommodate higher data traffic and offer high-speed connectivity. The increasing dependence of businesses on AI, machine learning (ML), and blockchain technology is driving the demand for advanced data centers that can handle intensive computational tasks and offer extensive storage capacities. For instance, in February 2024, Eaton Corporation Inc. introduced its SmartRack modular data center, offering quick deployment in days, catering to the rising demand for edge computing and AI. Created for different buildings, it can handle a load of up to 150kW of equipment and incorporates cooling systems, in line with Eaton's complete power management solutions. Moreover, attempts to vary the sites of data centers to uphold data sovereignty and reduce latency are leading to an increase in construction projects across various locations. These elements ensure a continual demand for cutting-edge data center solutions that can support future technological advancements.

Increasing Cybersecurity Concerns

Growing concerns about cybersecurity are encouraging businesses to increase their investment in secure and strong data center infrastructures. The Identity Theft Resource Center report in 2023 claimed that 343,338,964 people were the victims of 2,365 cyberattacks in 2023. Data breaches and cyber-attacks are on a rise, causing companies to focus on building data centers with enhanced security features. This consists of improvements in physical security such as biometric access controls and defenses in cyberspace like firewalls and intrusion detection systems. Industries such as finance, healthcare, and government have a high need for highly secure data storage and processing facilities to safeguard sensitive information.

Data Center Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional and country levels for 2026-2034. Our report has categorized the market based on construction type, data center type, tier standards and vertical.

Breakup by Construction Type:

- Electrical Construction

- Mechanical Construction

Electrical construction represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes electrical construction and mechanical construction. According to the report, electrical construction represented the largest segment.

Electrical construction is the largest sector due to the increased need for reliable power distribution systems, backup generators, and connectivity solutions in data centers. This part is crucial for ensuring a steady power supply and managing the high electricity demands of modern data centers that house large server arrays and cooling systems. As data centers increase in size and complexity, the electrical infrastructure must advance to prevent interruptions and maintain operational consistency. Advancements in energy-efficient power solutions, modular power units, and smart grid technology are important factors propelling the data center construction demand in this sector, demonstrating the industry's commitment to lowering energy usage and promoting sustainability. The worldwide smart grid market size was valued at US$ 63.0 billion in 2023. The IMARC Group projects the market will reach US$ 253.5 billion by 2032. Furthermore, increasing technological advancements and rising investments in data center operations are enhancing the dominant position of the electrical construction industry, underscoring the crucial need for achieving optimal energy efficiency and dependability.

Breakup by Data Center Type:

- Mid-Size Data Centers

- Enterprise Data Centers

- Large Data Centers

Large data centers exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the data center type has also been provided in the report. This includes mid-size data centers, enterprise data centers, and large data centers. According to the report, large data centers accounted for the largest market share.

Large data centers take up the significant portion, mainly serving big corporations, cloud providers, and big internet companies. These facilities are built to manage large amounts of data, providing significant computational power and storage capabilities that surpass those of smaller installations. The expansion of this sector is driven by the growing dependence on advanced data analysis and large-scale cloud services that demand strong, flexible infrastructure. Large data centers are frequently at the forefront of embracing new technologies like advanced cooling mechanisms, energy efficiency solutions, and automation powered by AI to improve efficiency and sustainability. Their large size also helps achieve notable cost savings, resulting in more efficient information technology (IT) resource management in the long run, ultimately enhancing the data center construction market value.

Breakup by Tier Standards:

- Tier I & II

- Tier III

- Tier IV

Tier III dominates the market

The report has provided a detailed breakup and analysis of the market based on the tier standards. This includes tier I and II, tier III, and tier IV. According to the report, tier III represented the largest segment.

Tier III data centers are the top players within the tier standards in the market. This is mainly due to their ability to find a perfect equilibrium between affordability and dependability, rendering them extremely appropriate for various businesses. These data centers provide a high level of redundancy and fault tolerance, guaranteeing at least N+1 availability so that any part can be shut down for maintenance without affecting IT functions. Furthermore, tier III data centers are designed with durability and availability as top priorities and are commonly used by big corporations and companies. Additionally, they achieve equilibrium between dependability and affordability, which makes them an appealing option for businesses seeking a budget-friendly solution that does not sacrifice uptime. In addition, these data centers provide various power and cooling distribution paths, like one active and one passive, to facilitate maintenance without interrupting operations. They include a variety of redundant components, such as uninterruptible power supply (UPS) systems, backup generators, and advanced cooling mechanisms. In 2023, the market for uninterrupted power supply (UPS) systems was valued at US$ 8.1 billion. The IMARC Group projects that the market would grow to US$ 12.3 billion by 2032.

Breakup by Vertical:

Access the comprehensive market breakdown Request Sample

- Public Sector

- Oil & Energy

- Media & Entertainment

- IT & Telecommunication

- Banking, Financial Services and Insurance (BFSI)

- Healthcare

- Retail

- Others

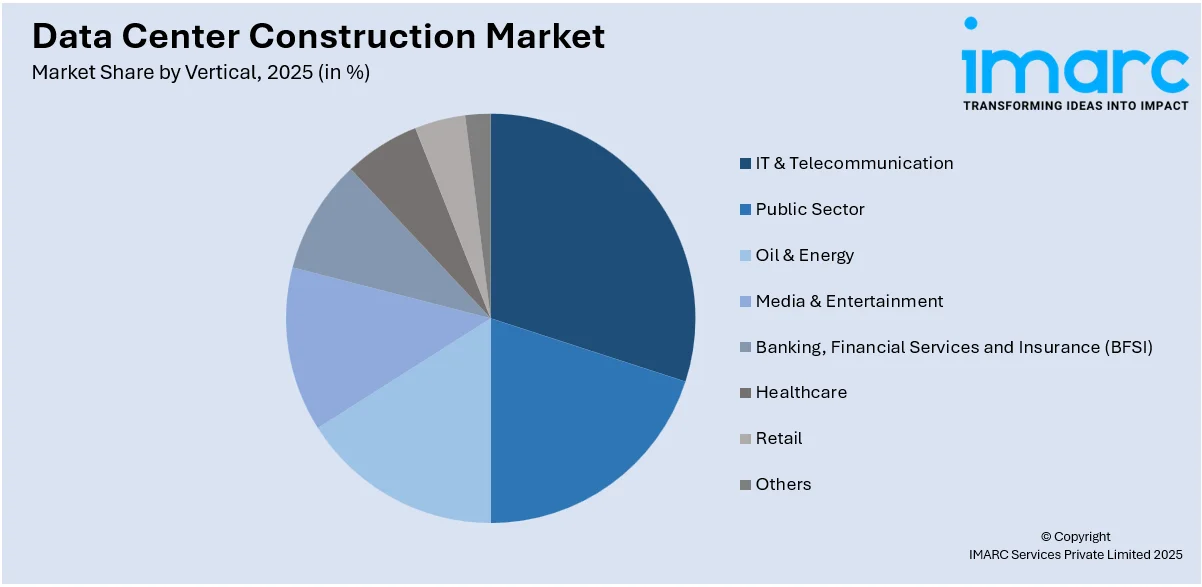

IT and telecommunication are the predominant market segment

A detailed breakup and analysis of the market based on the vertical has also been provided in the report. This includes public sector, oil and energy, media and entertainment, IT and telecommunication, banking, financial services and insurance (BFSI), healthcare, retail, and others. According to the report, IT and telecommunication accounted for the largest market share.

IT and telecommunication are the largest segment, driven by the relentless expansion of data communication and storage needs within these industries. As telecommunications companies and IT service providers grapple with the massive influx of data from increased internet usage, cloud computing, and mobile services, they are heavily investing in building robust data center infrastructures. This segment is characterized by a high demand for cutting-edge data center solutions that ensure high-speed connectivity, maximum uptime, and stringent security measures. The shift towards digital transformation, necessitating substantial data processing and storage capabilities to support new technologies like 5G, IoT, and smart technology solutions is supporting the data center construction market growth. In 2023, the size of the global IoT market was estimated to be US$ 887.6 billion. The IMARC Group projects that the market would expand at a compound annual growth rate (CAGR) of 15.21% from 2024 to 2032, reaching US$ 3,174.2 billion in 2032.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Others

North America leads the market, accounting for the largest data center construction market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Others). According to the report, North America represents the largest regional market for data center construction.

North America, particularly the United States and Canada, represents the largest segment as per the data center construction market overview, owing largely to the early and extensive adoption of cloud technologies and the presence of major tech giants. The region benefits from advanced infrastructure, high technology penetration, and robust regulatory frameworks that support large-scale data operations. Growing investments in upgrading and expanding existing data centers, coupled with a focus on sustainability and energy efficiency, are further supporting the growth in this region. According to the IMARC Group, the data center construction market in the United States is expected to increase at a compound annual growth rate (CAGR) of 5.94% between 2024 and 2032. This innovative solution enhances efficiency and saves labor, catering to the growing demand for faster and more adaptable data center construction in the USA. Besides this, the rising adoption of digital financial services is catalyzing the demand for secure and efficient data centers to handle the rising volume of financial transactions and data in the region.

Competitive Landscape:

Key players are intensively focusing on integrating advanced technologies, such as AI machine learning (ML), and IoT to enhance the efficiency and sustainability of data centers. These major companies are investing in research and development (R&D) to pioneer energy-efficient construction methods, including the use of renewable energy sources and advanced cooling systems to reduce carbon footprints. Additionally, they are expanding their geographical presence through strategic alliances and acquisitions to capitalize on emerging growth potential of markets. In December 2023, Vertiv Group Corporation acquired CoolTera, a UK-based liquid cooling business specializing in coolant distribution units (CDUs) and secondary fluid networks (SFN). This acquisition strengthened expertise of Vertiv in high-density cooling solutions and positioned the company to better serve global data center users, particularly in supporting AI deployment at scale. Moreover, the competitive landscape is also seeing a rise in the provision of modular data centers, which offer scalability and rapid deployment benefits.

The report provides a comprehensive analysis of the competitive landscape in the global data center construction market with detailed profiles of all major companies, including:

- AECOM

- Clark Construction Group, LLC

- Collen Construction

- Corgan

- DPR Construction

- Holder Construction Group, LLC

- ISG

- Jacobs Solutions Inc.

- Linesight

- Mercury Engineering

- PCL Constructors Inc

- Turner Construction Company

Data Center Construction Market News:

- August 2022: Eaton Corporation Inc., introduced Project Center platform to enhance construction project management, aiming to boost productivity and efficiency by digitizing processes and integrating real-time data. This move addresses the need for digitalization in the construction industry and offers a centralized platform for improved collaboration and project oversight.

- January 2023: Fujitsu Limited and Sapporo Medical University collaborated on a project to enable data portability in healthcare, aiming to develop a mobile app for patients to access their electronic health records (EHRs) and personal health records (PHRs) conveniently on smartphones.

- September 2022: Schneider Electric SE collaborated with Total Power Solutions to enhance University College Dublin's data center cooling infrastructure, promoting energy efficiency and scalability for its high-performance computing clusters.

Data Center Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Construction Types Covered | Electrical Construction, Mechanical Construction |

| Data Center Types Covered | Mid-Size Data Centers, Enterprise Data Centers, Large Data Centers |

| Tier Standards Covered | Tier I & II, Tier III, Tier IV |

| Verticals Covered | Public Sector, Oil and Energy, Media and Entertainment, IT and Telecommunication, Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia |

| Companies Covered | AECOM, Clark Construction Group, LLC, Collen Construction, Corgan, DPR Construction, Holder Construction Group, LLC, ISG, Jacobs Solutions Inc., Linesight, Mercury Engineering, PCL Constructors Inc, Turner Construction Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, data center construction market forecasts, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the data center construction industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global data center construction market was valued at USD 63.8 Billion in 2025.

We expect the global data center construction market to exhibit a CAGR of 6.30% during 2026-2034.

The expanding of the IT industry, along with the widespread utilization of big data analytics, cloud- based systems, and IoT solutions for computing data, is currently driving the global data center construction market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulted in temporary halt in various construction activities pertaining to data centers, thereby negatively impacting the market growth.

Based on the construction type, the global data center construction market has been divided into electrical construction and mechanical construction. Currently, electrical construction exhibits a clear dominance in the market.

Based on the data center type, the global data center construction market can be categorized into mid-size data centers, enterprise data centers, and large data centers. Among these, large data centers hold the majority of the total market share.

Based on the tier standards, the global data center construction market has been segmented into tier I & II, tier III, and tier IV. Currently, tier III standard represents the largest market share.

Based on the vertical, the global data center construction market can be bifurcated into public sector, oil & energy, media & entertainment, IT & telecommunication, Banking, Financial Services and Insurance (BFSI), healthcare, retail, and others. Among these, IT and telecommunication currently accounts for the majority of the global market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global data center construction market include AECOM, Clark Construction Group, LLC, Collen Construction, Corgan, DPR Construction, Holder Construction Group, LLC, ISG, Jacobs Solutions Inc., Linesight, Mercury Engineering, PCL Constructors Inc and Turner Construction Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)