Data Center Chip Market Report by Chip Type (GPU, ASIC, FPGA, CPU, and Others), Data Center Size (Small and Medium Size, Large Size), Industry Vertical (BFSI, Manufacturing, Government, IT and Telecom, Retail, Transportation, Energy and Utilities, and Others), and Region 2026-2034

Global Data Center Chip Market:

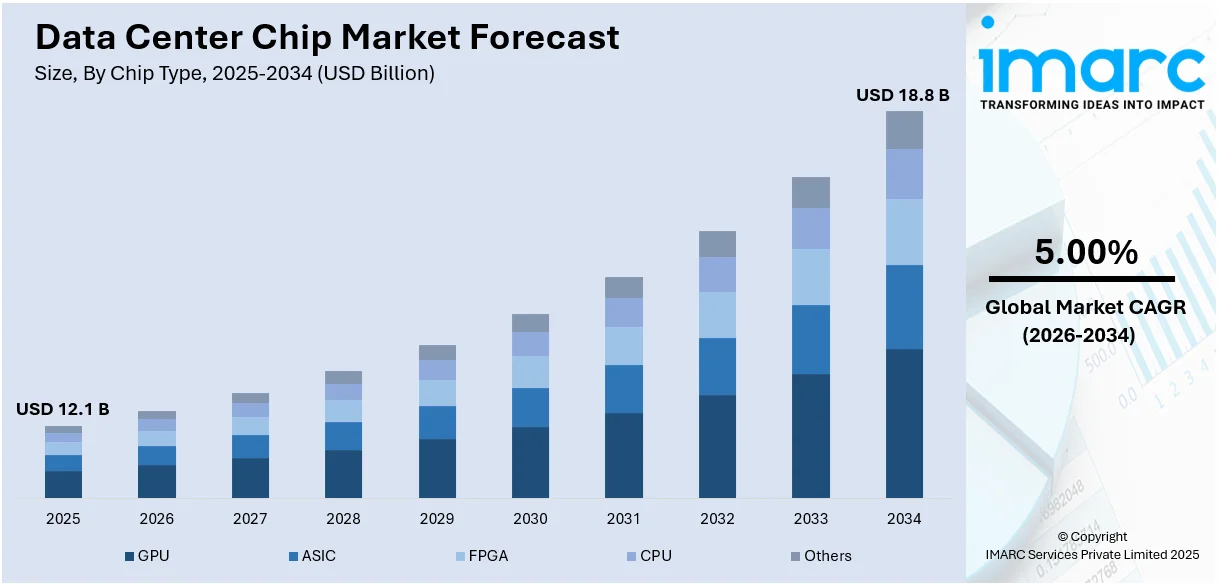

The global data center chip market size reached USD 12.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 18.8 Billion by 2034, exhibiting a growth rate (CAGR) of 5.00% during 2026-2034. The market is primarily driven by the expanding information technology (IT) industry, the continuous technological advancements, the extensive research and development (R&D) efforts by the leading players, and the introduction of the five-nanometer process for semiconductor manufacturing.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 12.1 Billion |

|

Market Forecast in 2034

|

USD 18.8 Billion |

|

Market Growth Rate 2026-2034

|

5.00% |

Data Center Chip Market Analysis:

- Major Market Drivers: The extensive utilization of cloud computing services by businesses and consumers is among the primary factors driving the data center chip market outlook. Moreover, the escalating demand for powerful and energy-efficient chips to support virtualization, storage, networking, and other critical workloads is also catalyzing the market growth.

- Key Market Trends: The integration of specialized hardware accelerators, such as GPUs (Graphics Processing Units), TPUs (Tensor Processing Units), and FPGAs (Field-Programmable Gate Arrays) to optimize the performance of AI workloads is propelling the data center chip market trends. Additionally, the growing popularity of advanced semiconductor process nodes, such as 7nm and 5nm, to enable higher transistor density, improved performance, and lower power consumption is also catalyzing the global market.

- Competitive Landscape: Some of the major market players in the data center chip industry include Achronix Semiconductor Corporation, Advanced Micro Devices Inc., Arm Limited, Broadcom Inc., Fujitsu Limited, Intel Corporation, Marvell, Micron Technology, Inc., NVIDIA Corporation, among many others.

- Geographical Trends: According to data center chip market overview, North America accounted for the largest share in the data center chip market analysis, owing to the development of advanced telecommunications infrastructure and reliable power supply. Besides this, the increasing number of leading companies, the inflating investments in cloud computing, and the extensive utilization of data-intensive applications are stimulating the data center chip market statistics in the region.

- Challenges and Opportunities: The extensive processing of complex workloads, including AI/ML, high-performance computing, and big data analytics, while minimizing power consumption and latency may hamper the data center chip market price. However, the development of customized chip solutions, including application-specific integrated circuits (ASICs) and domain-specific architectures (DSAs) for specific uses presents significant growth opportunities for the data center chip market share.

To get more information on this market Request Sample

Data Center Chip Market Trends:

The Increasing Demand for Cloud Services and Big Data Analytics

The expanding infrastructure of cloud service providers, such as Microsoft Azure, Amazon Web Services (AWS), and Google Cloud is propelling the market growth. Besides this, the escalating demand for data centers to store, manage, and process large amounts of information is further stimulating the data center chip market growth. For instance, Amazon Web Services Inc. has launched a supply chain management application that would eliminate the requirement for businesses to utilize multiple systems and vendors to access critical network data. AWS Supply Chain is a machine learning-powered application that automatically combines and analyzes data across numerous supply chain systems, creating a “unified data lake.” Moreover, in May 2023, IBM unveiled IBM Hybrid Cloud Mesh, a SaaS offering that was developed to facilitate enterprises to obtain management to their hybrid multi-cloud infrastructure.

Expanding IoT and Edge Computing

The growing popularity of edge data centers to process and analyze the data generated from IoT devices, such as smart wearables, sensors, and connected appliances in real-time is positively influencing the data center chip market demand. Moreover, the extensive utilization of these components to enhance data security, reduce latency, and enable faster decision-making is acting as another significant growth-inducing factor. For instance, according to the data from GSMA Intelligence, the 5G market penetration worldwide is expected to increase from 3% in 2020 to 64% in 2030. Additionally, as part of the Digital India initiative, the Government of India has planned to give IoT a push in the country. The government has allocated INR 7,000-crore funds to develop 100 smart cities in the country powered by IoT devices. The government intends to control traffic, efficiently use water and power, and collect data using IoT sensors for healthcare and other services.

Growth of AI and Machine Learning Applications

The escalating demand for advanced data center chips in AI and ML algorithms to process and analyze vast amounts of datasets is positively influencing the market growth. Besides this, the incorporation of AI and ML across various industries, such as healthcare, retail, finance, and autonomous vehicles to improve efficiency and make data-driven decisions is also bolstering the market growth. For instance, in April 2023, Oracle Corporation and GitLab Inc. announced the availability of a new offering that expands ML and AI functionalities. Customers can run AI and ML workloads with GPU-enabled GitLab runners on Oracle Cloud Infrastructure (OCI) and get access to deploy cloud services wherever needed, including on-premises and multi-cloud environments. Moreover, Inflection AI secured one of the largest artificial machine learning funding rounds, totaling US$ 225 Million. It is referred to as a machine learning and AI startup. It is expected to improve machine learning, allowing for intuitive human-computer interfaces in the near future.

Data Center Chip Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on chip type, data center size, and industry vertical.

Breakup by Chip Type:

- GPU

- ASIC

- FPGA

- CPU

- Others

The report has provided a detailed breakup and analysis of the market based on the chip type. This includes GPU, ASIC, FPGA, CPU, and others. According to the report, GPU represented the largest segment. These processors are widely used in data centers for artificial intelligence, data analytics, machine learning, and scientific simulations. Moreover, GPUs handle matrix operations and calculations required by neutral networks effectively. For instance, Acer has launched new NVIDIA Tesla GPU-powered servers in India. The server can host up to eight NVIDIA Tesla V100 32GB SXM2 GPU accelerators. GPU pair includes one Peripheral Component Interconnect (PCIe) slot for high-speed interconnect. Additionally, in Japan, KDDI, one of the prominent telecom companies, has partnered with NVIDIA to offer GeForce Now game-streaming service to customers. It would place NVIDIA's RTX gaming servers in a new data center in Tokyo.

Breakup by Data Center Size:

- Small and Medium Size

- Large Size

The report has provided a detailed breakup and analysis of the market based on the data center size. This includes small and medium size and large size. According to the report, the large size accounted for the largest market segment. Large data centers are extensively utilized for managing huge amounts of data, infrastructure requirements, and computing power. For instance, Power Grid Corporation India Ltd and Tele India Datacenter, also known as "Datasamudra," India's first On-demand and On-requirement datacenter based in Bangalore, offering globally aligned colocation, hosting & cloud services, signed a Memorandum of Understanding to combine their resources to improve user experience. Moreover, in the upcoming years, a wide variety of new data center operators will transform the Indian data center landscape by offering innovative concepts and scalability across cities. Additionally, Karnataka is projected to become a premier data center destination in India and take the lead as one of the leading digital economies in the nation, supported by its most recent dedicated data center (DC) strategy.

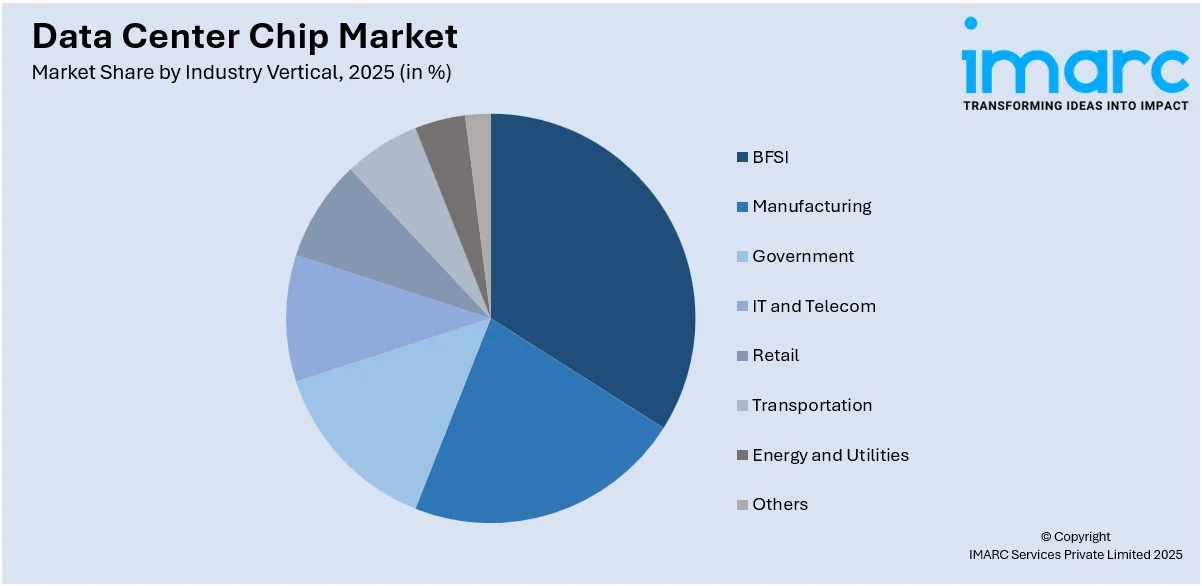

Breakup by Industry Vertical:

Access the comprehensive market breakdown Request Sample

- BFSI

- Manufacturing

- Government

- IT and Telecom

- Retail

- Transportation

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, manufacturing, government, IT and telecom, retail, transportation, energy and utilities, and others. According to the report, BFSI accounted for the largest market share. The extensive utilization of data centers in the BFSI industry to analyze and process financial transactions, customer data, and sensitive information securely. For instance, McAfee, a global leader in online security, announced a partnership with Mastercard to provide online security software to cardholders. The collaboration will allow Mastercard Cardholders to purchase McAfee internet security software. Moreover, BPER Banca Group, one of Italy's largest banking groups, announced a four-year partnership with IBM Corporation to assist in accelerating the bank's development into a completely digital corporation. The four-year agreement will expand the bank's hybrid cloud strategy to modernize its technology infrastructure and applications by combining the security, scalability, and reliability of IBM Cloud for Financial Services with the resiliency of IBM z16 and Red Hat OpenShift, a leading Kubernetes platform, to help meet the compliance requirements of the heavily regulated industry.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share, owing to the increasing urbanization and industrialization activities and the development of efficient and reliable telecommunications infrastructure. Besides this, the strict adherence of consumers and businesses to data privacy and security standards is also propelling the data center chip market growth in this region. For instance, with the introduction of faster network alternatives, such as 5G and extensive fiber connectivity supporting technologies like FWA, data consumption through smartphones increased from 1.8 GB to about 8.5 GB. This consumption is expected to further increase to more than 64 GB by 2029. Moreover, NetIX, the Bulgarian global platform, partnered with data center company eStruxture to provide global connectivity solutions in Canada. According to eStruxture, the collaboration would enable customers to access all of NetIX’s global locations, Internet Exchange Points (IXPs), and NetIX’s Global Internet Exchange (GIX) peering solutions directly from any one of eStruxture’s data centers through the Tunnelling over Internet (ToI) service.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the major market players in the Data Center Chip industry include:

- Achronix Semiconductor Corporation

- Advanced Micro Devices Inc.

- Arm Limited

- Broadcom Inc.

- Fujitsu Limited

- Intel Corporation

- Marvell

- Micron Technology, Inc.

- NVIDIA Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Data Center Chip Market News:

- January 2023: Huawei Technologies Co. Ltd. launched Industry-First 50G POL Prototype for Next-Generation Wi-Fi 7 Campus Networks. It upgrades campus networks from 10G PON to 50G PON and allows campus customers to enjoy an ultra-broadband network experience. Also, customers can build networks on demand and smoothly upgrade networks to 50G PON in the future, protecting initial network construction investments.

- March 2023: Marvell Technology Inc. launched the Marvell Nova 1.6 Tbps PAM4 electro-optics platform. It enables the highest speed of data movement in cloud artificial intelligence (AI) / machine learning (ML) and data center networks.

- March 2024: ORCA Computing, Pixel Photonics, Sparrow Quantum, and the Niels Bohr Institute (NBI) announce their collaboration on the Eurostars project 'SupremeQ.' This landmark initiative brings together quantum experts from the United Kingdom, Germany, and Denmark with a shared goal of accelerating the development and commercialization of photonic quantum computing technologies to deliver quantum advantage.

Data Center Chip Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Chip Types Covered | GPU, ASIC, FPGA, CPU, Others |

| Data Center Sizes Covered | Small and Medium Size, Large Size |

| Industry Verticals Covered | BFSI, Manufacturing, Government, IT and Telecom, Retail, Transportation, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Achronix Semiconductor Corporation, Advanced Micro Devices Inc., Arm Limited, Broadcom Inc., Fujitsu Limited, Intel Corporation, Marvell, Micron Technology, Inc., NVIDIA Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the data center chip market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global data center chip market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the data center chip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data center chip market was valued at USD 12.1 Billion in 2025.

We expect the global data center chip market to exhibit a CAGR of 5.00% during 2026-2034.

The rising demand for data center chips across various industries, such as manufacturing, transportation, IT and telecommunication, etc., as they assist in improving energy efficiencies, redundancy, and flexibility, while enhancing operations and productivity, is primarily driving the global data center chip market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for data center chips.

Based on the chip type, the global data center chip market can be categorized into GPU, ASIC, FPGA, CPU, and others. Currently, GPU accounts for the majority of the global market share.

Based on the data center size, the global data center chip market has been segregated into small and medium size and large size, where large size currently holds the largest market share.

Based on the industry vertical, the global data center chip market can be bifurcated into BFSI, manufacturing, government, IT and telecom, retail, transportation, energy and utilities, and others. Currently, BFSI exhibits a clear dominance in the market

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global data center chip market include Achronix Semiconductor Corporation, Advanced Micro Devices Inc., Arm Limited, Broadcom Inc., Fujitsu Limited, Intel Corporation, Marvell, Micron Technology, Inc., and NVIDIA Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)