Dark Chocolate Market Size, Share, Trends and Forecast by Distribution Channel, and Region, 2025-2033

Dark Chocolate Market Size and Share:

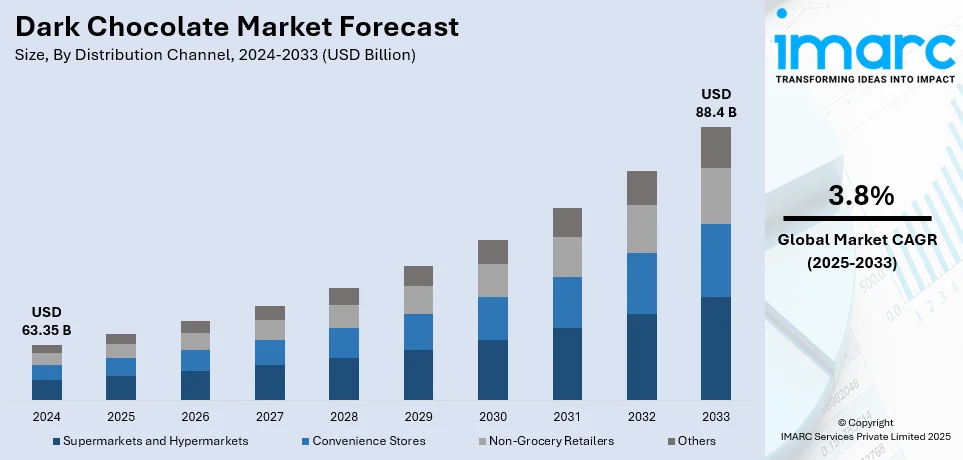

The global dark chocolate market size was valued at USD 63.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 88.4 Billion by 2033, exhibiting a CAGR of 3.8% from 2025-2033. North America currently dominates the market, holding a market share of over 30.0% in 2024. The market is driven by strong consumer demand for premium and organic products, rising health consciousness, innovative flavor offerings, and extensive retail and e-commerce distribution networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 63.35 Billion |

|

Market Forecast in 2033

|

USD 88.4 Billion |

| Market Growth Rate (2025-2033) | 3.8% |

The global dark chocolate market share is witnessing strong growth, driven by heightening consumer awareness of its health benefits. Dark chocolate is rich in antioxidants, flavonoids, and polyphenols, which support heart health, improve cognitive function, and reduce inflammation. With rising concerns over obesity and diabetes, many consumers are shifting toward dark chocolate due to its lower sugar content and higher cocoa concentration compared to milk chocolate. Moreover, this functional food movement has compelled producers to add more dark chocolates rich in superfoods, probiotics, and adaptogens for better health-related needs. In this direction, a rise in the clean-label organic and plant-based segments also influences innovation toward developing dairy-free or natural dark chocolate products. For instance, in January 2024, Justin’s launched its USDA-certified organic Dark Chocolate Candy Pieces, expanding its chocolate portfolio with ethically sourced, non-GMO treats in Dark Chocolate Peanut and Dark Chocolate Peanut Butter varieties. Moreover, when the disposable incomes of people continue to rise with consumers searching for guilt-free indulgence, dark chocolate in all premium shades also boosts its acceptability. These health-conscious trends are expected to fuel the steady growth of the global market in the coming years.

This is due to the amplified demand for premium and responsible chocolate types coming from U.S. consumers, making the dark chocolate market boom in the region. To illustrate, Americans prefer clarity, where they prefer brands committed to sustainably sourced cocoa and fair trade to promote equitable labor practice. This has forced big chocolate producers to take responsible sourcing seriously and to communicate sustainability efforts. This also includes premiumization, which consumers are ready to pay more for artisanal dark chocolates that include high cocoa content, unique flavors, and gourmet ingredients like sea salt, chili, and exotic fruits. For example, in October 2024, DEFI Snacks launched its protein-packed dark chocolate line, featuring a Dark Chocolate with Pink Himalayan Sea Salt variant, blending indulgent flavors with clean, functional ingredients for health-conscious consumers. Furthermore, the direct-to-consumer (DTC) and specialty chocolate brands are on the upswing as companies tap into niche markets using online sales and subscription models. Additionally, the gifting culture in the U.S. is also pushing demand for high-quality dark chocolate, especially around holidays and special occasions. These factors together are contributing to strong growth and changing preferences in the U.S. dark chocolate market.

Dark Chocolate Market Trends:

Rise in Health Consciousness Among the Masses

The rising emphasis on health and wellness has been a significant driver of the market for dark chocolate. Consumers are highly becoming aware of the potential health benefits associated with the regular consumption of dark chocolate. Dark chocolate contains higher quantities of cocoa solids, which are rich in antioxidants, flavonoids, and minerals. It is associated with multiple health benefits like improved heart health, antioxidant capacity, and may even help alter mood. An example of the nutrient density content of dark chocolate is a 28g portion of dark chocolate, which would contain 70-85% cocoa, that contains 5% protein, 64% fat, and 31% carbohydrates. In this respect, it aligns with dietary trends that focus on balanced nutrition and functional foods. Furthermore, the inclusion of dark chocolate in popular diets, such as the Mediterranean diet, and its recognition as a permissible treat in moderation have catalyzed its demand among health-conscious consumers who are seeking a balance between their fitness goals and indulgent cravings.

Premiumization and Indulgence

The growing demand for premium and indulgent chocolate experiences is creating a favorable outlook for the market. For example, according to an industrial report, the demand for premium chocolate in India saw a 45% rise year-on-year in the financial year 2022-2023. This was because of a growing interest in imported luxury and premium chocolates. Dark chocolate is primarily associated with sophisticated and refined taste due to its intense, strong flavor. Its premium image also arises from higher cocoa content as well as more complex flavor notes due to origin variations. Consumers who are seeking a luxurious and indulgent treat are drawn to the richness and depth of dark chocolate, augmenting the product demand. The market has responded to this rise in demand by offering a wide range of dark chocolate products with varying cocoa content, flavor infusions, and premium packaging options, catering to the desires and evolving preferences of consumers. Moreover, the emerging trend of product premiumization and increasing consumer spending on luxury chocolates for gifting purposes are contributing to market growth.

Growing Consumer Awareness About the Product Origin

Consumer awareness levels about sourcing, sustainability, and ethics involving food products have driven the market. The demand for dark chocolate products based on sustainably sourced cocoa beans and under fair trade practices is on the rise. Consumers these days are seeking dark chocolate manufacturers to be transparent and accountable regarding their products' sourcing, environmental sustainability, and social responsibility. This extends to certifications as organic, trade direct from farms, and other initiatives that take care of the cocoa farming community. Dark chocolate brands that have aligned themselves to these aspirations have been embraced by discerning consumers who want their indulgence in such items not to conflict with their sense of ethics and environmental responsibility.

Dark Chocolate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dark chocolate market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on distribution channel.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Non-Grocery Retailers

- Others

Supermarkets and hypermarkets lead the market with around 39.8% of market share in 2024. Supermarkets and hypermarkets offer a wide range of dark chocolate options to consumers, making them easily accessible and available worldwide. With dedicated confectionery sections, these stores provide a one-stop shopping experience for customers, allowing them to explore various brands and flavors of dark chocolate. Convenience stores play a vital role in the distribution of dark chocolate, particularly for impulse purchases. They offer greater convenience and accessibility to consumers looking for a quick chocolate fix on-the-go, with a selection of popular dark chocolate brands and smaller-sized bars or packets.

Non-grocery retailers, such as specialty chocolate shops, gourmet stores, and online platforms, cater to the discerning dark chocolate connoisseurs. These distribution channels provide a diverse variety of premium dark chocolate options, such as artisanal and craft brands, and often emphasize unique and exotic flavors, bean origins, and ethical sourcing, targeting consumers seeking high-quality and distinctive dark chocolate experiences.

Regional Analysis:

- Western Europe

- North America

- Eastern Europe

- Asia

- Latin America

- The Middle East and Africa

- Australasia

In 2024, North America dominated the market, accounting for over 30.0% of the total market share. This growth was driven by advancements in technology, a robust manufacturing sector, and increasing investments in innovative solutions across various industries. Key contributors included the automotive, healthcare, and renewable energy sectors, which have consistently embraced cutting-edge technologies to meet evolving consumer demands. Strong focus of the region towards sustainability along with regulatory support towards green initiatives was further added advantage for the growth of the market. Also, the major players along with an established supply chain infrastructure strengthened North America's competitiveness. As such, it has been continuing to attract high investment and remain one of the most prominent markets around the world.

Key Regional Takeaways:

Western Europe Dark Chocolate Market Analysis

Dark chocolate holds a significant position in Western Europe, given the well-established confectionery culture and the demand for premium products. Chocolate production in this region is considered one of the most important contributors to the regional economy, and dark chocolate continues to gain share as health consciousness amplifies. Industrial reports show that Switzerland is the biggest consumer of chocolate per capita in Europe, consuming about 11 kilograms a year. The top producers for this category are Switzerland, Belgium, and Germany. Brands like Lindt, Godiva, and Ferrero are the leaders in the market. Sustainability is the biggest market driver as consumers now have a strong preference for products that are certified by Fair Trade and Rainforest Alliance. Sales of sugar-free and high-cocoa-content dark chocolates have grown by 25 percent over the past five years, trying to meet the diabetic and fitness-conscious consumer market.

North America Dark Chocolate Market Analysis

The North America dark chocolate market is driven by robust consumer demand for high-cocoa-content and ethically sourced products. Chocolate consumption per capita in Canada has steadily increased, with premium dark chocolate witnessing the highest growth, as per Agriculture and Agri-Food Canada. Mexico, being a major cocoa producer, is also witnessing growing domestic consumption alongside export-driven demand. Premium European chocolates are still gaining in US importations, this country still holds the record in the importing list. Other information shows an industrial report mentioning 2023: Americans had nearly 2.8 billion pounds of chocolate in their meals, 77 percent of American respondents claim eating chocolate once monthly. Sustainability certifications are driving purchasing choices, such as Fair Trade, Rainforest Alliance, and for major manufacturers - organic and sugar-free dark innovations.

Eastern Europe Dark Chocolate Market Analysis

The Eastern European dark chocolate market is growing with an escalation in disposable incomes and Western consumption trends. According to IMARC, the Europe dark chocolate market size was USD 27.4 Billion in 2023. High-cocoa-content options are becoming popular among health-conscious consumers, while premium imports from Western Europe are gaining popularity. Local brands such as Wedel and Roshen compete with international giants by introducing affordable yet high-quality dark chocolate products. Market access is further enhanced by retail expansion and e-commerce penetration. For instance, an industrial report indicates that in 2023, Poland imported chocolate and other food preparations containing cocoa at a value of about USD 336 million. Germany, France, and Côte d'Ivoire were the largest importers. Additionally, Ukraine imported 12,502.52 kilograms of cocoa beans, whole or broken, raw or roasted in 2023.

Asia Dark Chocolate Market Analysis

The dark chocolate market in Asia is rapidly growing because of the heightened awareness of consumers and the change in dietary preferences. Industrial reports show that in 2023, chocolate retail sales in Japan reached the highest ever at 604 billion Japanese yen, or USD 4.1 billion, surpassing a decade-high, driven by the growth of the middle class in the country. Functional and artisanal chocolates will fuel innovation in products with matcha infusions and probiotic-enriched dark chocolate in Japan. Urbanization and greater health awareness will drive the expansion of India's dark chocolate category, where players like Amul compete with international brands such as Ferrero and Mondelez. Online sales and premium gift-giving channels are also encouraging sales across the region.

Latin America Dark Chocolate Market Analysis

Latin America, a key player in the global cocoa industry, is also seeing a sharp rise in the consumption of dark chocolate due to growing local demand and export prospects. According to the USDA, in 2023, Colombia produced 59,831 MT on 190,800 hectares of planted area. Brazil and Ecuador are collaborating to upscale high-end dark chocolate while exploring their rich cocoa history. Boosting demand for dark chocolates has motivated several domestic brands to sell organic, single-origin, and sustainably sourced dark chocolates. Spurring demand for premium and craft chocolates is the other factor through which the market for dark chocolates is growing. Government support in terms of backing cocoa farming, sustainability, and fair-trade practices enhances production quality and makes these products more globally competitive. Moreover, growing demand for sugar-free and functional chocolates is leading to product innovation, further establishing Latin America as a key player in the world dark chocolate market.

Middle East and Africa Dark Chocolate Market Analysis

Rising disposable incomes and increased interest in luxury confectionery are fueling the Middle East and Africa dark chocolate market. An industrial report has indicated that Saudi Arabia imported more than 37 million kilograms of cocoa in the first quarter of 2023. The two biggest markets are Saudi Arabia and South Africa, where the consumers prefer importing high-quality dark chocolates from European brands. The rise of specialty stores, premium gifting culture, and expanding retail infrastructure are further supporting market growth. Local players are also emerging, offering halal-certified and sugar-free dark chocolate options.

Australasia Dark Chocolate Market Analysis

Growing consumer demand in the organic and ethically sourced market has driven the dark chocolate market in Australasia. In an industrial report, it was mentioned that the revenue in chocolate manufacturing from Australia had gone beyond AUD 4.3 billion (USD 2.8 billion) in 2023, while dark chocolate also saw a higher demand due to health awareness. The artisanal chocolate industry in New Zealand is also expanding with brands such as Whittaker's and Haigh's focusing on sustainable cocoa sourcing. The preference for vegan and dairy-free dark chocolates is shaping market trends, as retailers are now focusing on premium and eco-friendly products. Growth in e-commerce and specialty chocolate boutiques further enhances accessibility and market penetration.

Competitive Landscape:

The dark chocolate market is quite dynamic, primarily because of innovation, premiumization, and consumer preference changes. Companies are responding by introducing healthier options, organic, vegan, and sugar-free dark chocolate products to meet increasing demand for indulgence that's better for the body. The niche of artisanal and craft chocolate makers comes through unique flavors, single-origin chocolates, and sustainable sourcing, targeting environmentally aware consumers. Eco-friendly packaging and ethical sourcing-including fair-trade cocoa-are becoming critical market differentiators. This competition is fired up with large product launches and innovative flavors to help fit diverse tastes. On the other hand, increasing cocoa costs and supply challenges are affecting profitability and pricing strategies across the board in the industry.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Latest News and Developments:

- January 2024: Nestlé released the first ever KitKat under the brand into the UK and Ireland market as a 70% dark chocolate. The cocoa mass used comes from farmers engaged with Nestlé's cocoa income accelerator program.

- November 2023: Milma has launched premium dark chocolate and butter biscuits under its 'Repositioning Milma 2023' initiative. According to chairman K S Mani, these new products will increase Milma's market presence and expand its product portfolio.

- February 2023: Mars Wrigley India has recently forayed into the dark chocolate space with a new product in a bid to consolidate its leadership position in the moulded chocolate segment. This step is a part of the company's expansion plan in premium products and growing consumer preference for dark chocolate.

- April 2022: Whole Truth Foods (TWT) has launched India's first date-sweetened dark chocolate. The company also inaugurated its first in-house bean-to-bar chocolate factory at Mumbai, further consolidation of clean-label product offerings. This puts the play in line with increasing consumer appetite for confectionery that is not only natural but also additive-free.

Dark Chocolate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, '000 Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Non-Grocery Retailers, Others |

| Regions Covered | Western Europe, North America, Eastern Europe, Asia, Latin America, Middle East and Africa, Australasia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dark chocolate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dark chocolate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dark chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dark chocolate market was valued at USD 63.35 Billion in 2024.

The dark chocolate market is projected to exhibit a CAGR of 3.8% during 2025-2033, reaching a value of USD 88.4 Billion by 2033.

The dark chocolate market is driven by increasing consumer preference for healthier indulgence, rising awareness of antioxidant benefits, and growing demand for premium and organic products. Expanding vegan and sugar-free options, along with innovation in flavors and sustainable sourcing, further fuel market growth. Premium gifting trends also boost demand.

North America currently dominates the dark chocolate market, accounting for a share of 30.0%. It is driven by rising health awareness, demand for premium and organic products, innovative flavors, sustainable sourcing, and strong retail distribution channels, including e-commerce and specialty stores.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)