Dairy Packaging Market Size, Share, Trends and Forecast by Packaging Material, Packaging Type, Product Type, Application, and Region, 2025-2033

Dairy Packaging Market Size and Share:

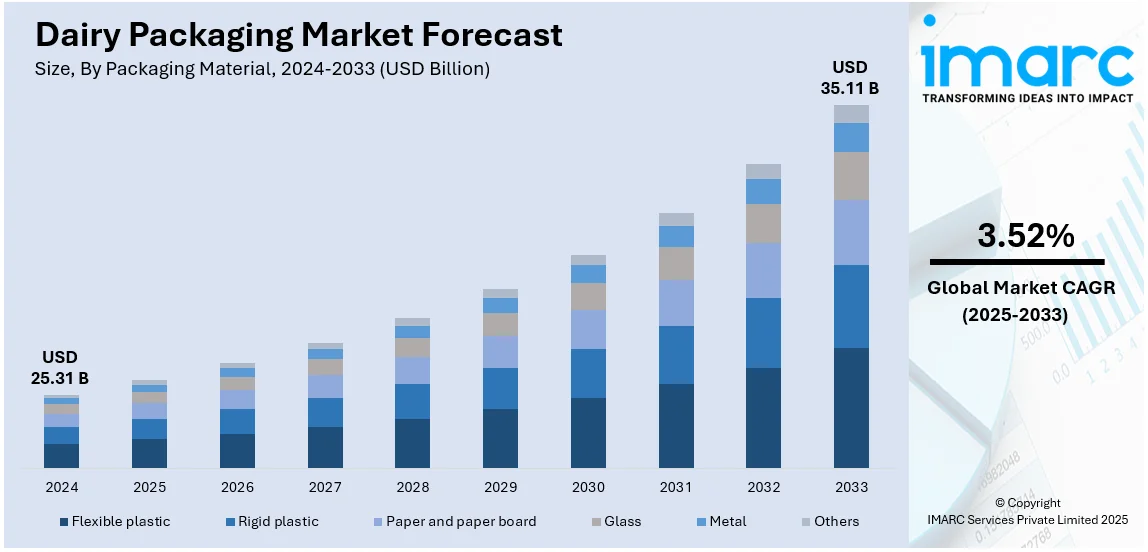

The global dairy packaging market size was valued at USD 25.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.11 Billion by 2033, exhibiting a CAGR of 3.52% from 2025-2033. North America currently dominates the market, holding a market share of over 35.4% in 2024. The dairy packaging market share is propelling due to the increasing dairy consumption, demand for sustainable materials, advancements in protective packaging, innovations in recyclable and biodegradable solutions, and expanding e-commerce and convenience-driven products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 25.31 Billion |

|

Market Forecast in 2033

|

USD 35.11 Billion |

| Market Growth Rate (2025-2033) | 3.52% |

The dairy packaging market is driven by increasing dairy consumption, rising demand for convenient and sustainable packaging and stringent food safety regulations. According to the report published by Press Information Bureau, India's total milk production for 2022-23 reached 230.58 million tons with per capita availability at 459 grams daily. NSSO reported rural consumption at 164 grams and urban at 190 grams daily. The National Programme for Dairy Development, approved 10 projects in Punjab for ₹27,907.38 lakh, enhancing infrastructure and quality standards. Growth in ready-to-drink milk, yogurt and cheese products fuels innovation in packaging materials. Advancements in biodegradable and recyclable solutions address environmental concerns. Extended shelf-life requirements boost demand for aseptic and barrier packaging. Urbanization and changing consumer preferences toward single-serve and on-the-go dairy products further accelerate market expansion making packaging a critical component of the dairy supply chain. These factors are collectively creating a positive dairy packaging market outlook across the globe.

The United States dairy packaging market is driven by increasing demand for convenient, sustainable and extended-shelf-life solutions. Growth in single-serve dairy products including flavored milk, yogurt and cheese snacks fuels innovation in flexible and rigid packaging. Rising consumer preference for ecofriendly materials boosts adoption of biodegradable and recyclable options. Stringent FDA regulations on food safety and labeling drive advancements in protective and tamper-evident packaging. Expanding ecommerce and ready-to-drink dairy products further accelerate market growth strengthening packaging requirements across the industry. According to the report published by the US Census Bureau, U.S. retail e-commerce sales for Q4 2024 reached $308.9 billion up 2.7% from Q3 and 9.4% year-over-year. Total retail sales were $1,883.3 billion, increasing 1.8%. For 2024, e-commerce sales totaled $1,192.6 billion rising 8.1%, accounting for 16.1% of total sales.

Dairy Packaging Market Trends:

Rising Demand for Convenience Foods

The growing consumer interest in ready-to-eat (RTE) foods is a key factor driving market expansion. With busy lifestyles becoming more common, the demand for RTE food products has significantly increased, fueling the market's growth. According to the IMARC Group, the global convenience food market, valued at USD 511.1 Billion in 2024, is anticipated to reach USD 810.2 Billion by 2033, with a compound annual growth rate (CAGR) of 5.25%. Additionally, major companies are launching new product variations such as resealable pouches, single-serve containers, and easy-to-open caps, which further support market development. These innovations allow consumers to take only what they need, keeping the remaining product fresh. Furthermore, the rising health awareness among consumers has increased the demand for portioned packaging, which significantly boosts the value of the dairy packaging sector.

Increasing Consumer Awareness about Food Safety and Quality

Growing consumer awareness regarding food safety and quality is a key factor driving market expansion. The increasing emphasis on food safety and freshness has spurred the creation of innovative packaging solutions, such as aseptic packaging, which ensures safety and prolongs shelf life. This trend is reflected in the development of secure and sustainable packaging options. For example, in 2024, Sole Mizo enhanced its dairy packaging capabilities by installing the SIG Midi 12 aseptic filling machine. Designed specifically for dairy products, this advanced aseptic filler improves precision and enhances filling quality. The upgrade not only extends the shelf life of dairy items but also boosts their safety, meeting consumer demand for high-quality and secure packaging. These technologies are effective in sterilizing both the product and the container, helping to eliminate microbial contamination and further increasing their popularity.

Expansion of the Global Dairy Industry

The rapid expansion of the global dairy sector is a key factor driving market growth. According to IMARC, India's dairy industry is expected to reach INR 49,953.5 billion by 2032, with a compound annual growth rate (CAGR) of 13%. The increasing demand for dairy products, particularly in emerging markets, necessitates versatile and scalable packaging solutions to cater to diverse market requirements. Additionally, the rise in dairy exports from major producing countries has significantly influenced the demand for packaging, further contributing to market growth.

Dairy Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dairy packaging market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on packaging material, packaging type, product type, and application.

Analysis by Packaging Material:

- Flexible plastic

- Rigid plastic

- Paper and paper board

- Glass

- Metal

- Others

Flexible packaging stand as the largest packaging material in 2024, holding around 45.0% of the market. Based on the dairy packaging market overview, flexible plastic segment is driven by the increasing demand for convenience packaging, which has become a significant consumer trend. As busy lifestyles continue to rise globally, consumers seek packaging solutions that offer ease of use and portability. Flexible plastics, such as pouches and sachets, meet these needs by providing lightweight, resealable, and easy-to-handle options. This packaging type not only facilitates on-the-go consumption but also allows for efficient storage and disposal. The versatility of flexible plastics enables manufacturers to design packaging that accommodates various product formats, from single-serve portions to larger sizes, enhancing convenience for diverse consumer preferences. Moreover, flexible plastics can be designed to include features such as spouts, zippers, and tear notches, further improving user-friendliness.

Analysis by Packaging Type:

- Single-pack

- Multi-pack

As per the dairy packaging market research report, the single packs segment is driven by the increasing demand for convenience among consumers. As modern lifestyles become busier, there is a growing preference for individually packaged products that offer ease of use and portability. Single packs cater to this need by providing ready-to-consume portions that are ideal for on-the-go consumption, whether for quick meals, snacks, or beverages. Additionally, single packs are favored for their portion control benefits, helping consumers manage their intake and reduce food waste. Besides this, the popularity of single-serve packaging is further fueled by its appeal to households and individuals who value simplicity and minimal cleanup. Concurrent with this, manufacturers are continuously introducing convenient, resealable, and easy-open designs that enhance user experience, which is strengthening the dairy packaging market growth.

Analysis by Product Type:

- Liquid cartons

- Bottles and jars

- Pouches

- Cans

- Cups and Tubes

- Others

The liquid cartons segment is driven by the increasing demand for convenience and portability. As consumer lifestyles become more fast-paced, there is a rising preference for packaging solutions that offer ease of use and on-the-go consumption. Liquid cartons provide an ideal solution by offering lightweight, compact, and user-friendly packaging. Their resealable features and single-serve formats make them particularly attractive for beverages and liquid food products, allowing consumers to enjoy their products with minimal effort. Furthermore, the growing trend of portion control and health-conscious eating habits is also driving the demand for liquid cartons, as they allow for precise servings and better management of product consumption.

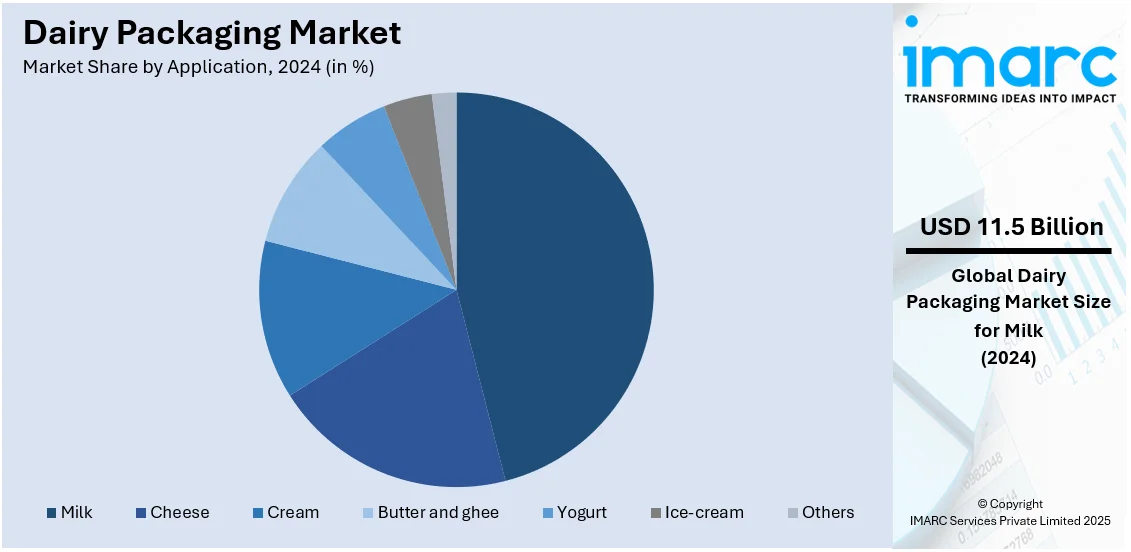

Analysis by Application:

- Milk

- Cheese

- Cream

- Butter and ghee

- Yogurt

- Ice-cream

- Others

Milk leads the market with around 45.6% of market share in 2024. As per the dairy packaging market report, the milk segment is driven by the surging demand for ready-to-consume and easy-to-prepare products. As modern lifestyles become more hectic, consumers are seeking dairy options that offer convenience without compromising on quality. This has led to a rise in the popularity of single-serve milk packs, resealable cartons, and portable packaging solutions that cater to on-the-go consumption. Additionally, innovations in packaging technology, such as those improving shelf life and ease of use, are enhancing the appeal of milk products. The growth of convenience-oriented packaging not only meets consumer needs but also drives higher consumption rates, as it allows for easier integration of milk into daily routines. Furthermore, the expansion of retail channels and the increasing availability of milk products in various formats contribute to this trend, as consumers can conveniently access milk products at multiple points of sale.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 35.4%. North America leads the market driven by the increasing demand for health-conscious products. As consumers become more aware of their health and wellness, there is a growing preference for products that offer nutritional benefits and support a healthy lifestyle. This shift in consumer behavior is prompting companies to innovate and adapt their product offerings to meet these demands. Moreover, there is also a surge in demand for low-sugar, organic, and functional dairy products which has led to the development of new packaging solutions that preserve freshness and extend shelf life while meeting health standards, which is presenting lucrative opportunities for market expansion.

Key Regional Takeaways:

United States Dairy Packaging Market Analysis

The United States dairy packaging market is driven by increasing consumer demand for sustainable and convenient packaging solutions. Rising health consciousness has boosted the consumption of dairy products such as milk, yogurt, and cheese, further propelling the dairy packaging market demand. The market is witnessing a shift toward eco-friendly materials like biodegradable plastics and paper-based cartons to reduce environmental impact. In line with this trend, regulatory policies are also shaping the industry. Reports indicate that SB 54 requires producers to provide single-use packaging and food service ware that is 100% recyclable or compostable by the year 2032. The legislation also aims for a 65% recycling rate and a 25% reduction in sales. This regulation is pushing dairy brands to adopt sustainable packaging solutions while maintaining product integrity. Additionally, the growing popularity of single-serve and on-the-go dairy products has increased the need for portion-controlled packaging. Technological advancements, including intelligent packaging with QR codes and freshness indicators, are enhancing product traceability and safety. Key players in the U.S. market continue to invest in research and development to introduce lightweight and recyclable packaging solutions. With the rise of e-commerce, dairy brands are also focusing on durable packaging to ensure product safety during transportation.

Europe Dairy Packaging Market Analysis

The European dairy packaging market is characterized by stringent sustainability regulations and growing consumer preference for eco-friendly packaging solutions. The European Union's ban on single-use plastics and focus on circular economy practices are pushing manufacturers to adopt recyclable and biodegradable materials. In line with these efforts, in the European Parliament, a provisional agreement has been reached between the parliament and the council to establish rules for reducing, reusing, and recycling packaging. This initiative aims to enhance safety and bolster the circular economy, with specific packaging reduction targets set at 5% by 2030, 10% by 2035, and 15% by 2040, promoting sustainable packaging practices in the dairy industry. Demand for aseptic packaging, particularly for UHT milk and plant-based dairy alternatives, is also rising. Lightweight and flexible packaging formats, such as pouches and cartons, are gaining traction due to their reduced carbon footprint. Advanced packaging technologies, including smart labels and antimicrobial coatings, are improving food safety and shelf life. Major companies are investing in bio-based and paper-based packaging solutions to align with regulatory requirements and consumer expectations. The increasing popularity of online grocery shopping is further influencing the development of sturdy and tamper-proof packaging. With regulatory pressures and shifting consumer preferences, the European dairy packaging market is set for continuous innovation.

Asia Pacific Dairy Packaging Market Analysis

The Asia-Pacific dairy packaging market is expanding rapidly, driven by increasing dairy consumption and urbanization. Major countries are witnessing a surge in demand for packaged dairy products, including milk, yogurt, and cheese. The growing middle-class population and changing dietary habits are fueling the need for convenient and long-lasting packaging. Sustainable packaging solutions, such as biodegradable plastics and recyclable materials, are gaining attention due to rising environmental concerns. In India, government initiatives are further boosting the dairy sector. According to the Ministry of Fisheries, Animal Husbandry & Dairying, the National Programme for Dairy Development plans to establish 10,000 new dairy cooperative societies and procure 14.20 lakh liters of milk each day, which increases the need for effective and sustainable packaging solutions. Flexible packaging formats, including pouches and stand-up packs, are preferred for their affordability and ease of use. The e-commerce boom has also increased demand for durable and protective dairy packaging. Leading market players are focusing on innovations in lightweight and high-barrier packaging materials to enhance product freshness. Government regulations on food safety and plastic waste management are also shaping packaging trends.

Latin America Dairy Packaging Market Analysis

The Latin American dairy packaging market is experiencing steady growth, fueled by increasing dairy consumption and rising demand for cost-effective packaging solutions, with consumers seeking convenience-driven dairy products like flavored milk, yogurt drinks, and cheese. Sustainability is gaining importance, prompting manufacturers to explore recyclable and biodegradable packaging options. Flexible packaging, including pouches and lightweight plastic containers, is widely used due to its affordability. Brazil, a key dairy producer in the region, is expected to see continued growth in milk and butter production. The U.S. Department of Agriculture has projected that Brazil's milk production will grow by 1% to reach 25 million metric tons in 2024 and increase further to 25.4 million metric tons in 2025. Furthermore, butter production is anticipated to rise to 780 metric tons in 2024 and 795 metric tons in 2025, thereby enhancing the demand for efficient and sustainable dairy packaging solutions. Aseptic packaging is gaining traction for extending shelf life, particularly in regions with limited cold chain infrastructure. Regulatory frameworks on plastic waste and food safety are influencing packaging innovations. Major companies are actively investing in sustainable solutions tailored to the region’s economic and environmental needs. As e-commerce and modern retail channels expand, tamper-proof and durable packaging solutions are becoming more crucial.

Middle East and Africa Dairy Packaging Market Analysis

The Middle East and Africa dairy packaging market is driven by rising dairy consumption and increasing urbanization, with growing demand for packaged dairy products such as milk, cheese, and yogurt. Due to high temperatures in the region, aseptic and extended shelf-life packaging solutions are in demand. Sustainable packaging initiatives are gaining traction, encouraging the use of recyclable and biodegradable materials. Flexible packaging formats, such as pouches and lightweight plastic bottles, are preferred due to cost efficiency. Saudi Arabia, one of the key dairy markets in the region, has witnessed significant growth. According to IMARC Group, the Saudi Arabian dairy market reached USD 5.8 Billion in 2024 and is expected to grow to USD 8.4 Billion by 2033, with a CAGR of 3.8% from 2025 to 2033. This expansion is driving higher demand for innovative and sustainable dairy packaging solutions to support the growing industry. Major companies are investing in advanced packaging to enhance freshness and durability. Government regulations on food safety and plastic waste management are influencing packaging trends. As e-commerce and modern retail expand, dairy brands are focusing on protective packaging that ensures product integrity.

Competitive Landscape:

The dairy packaging market is highly competitive, with companies focusing on innovation, sustainability, and regulatory compliance. Manufacturers are investing in lightweight, recyclable, and biodegradable materials to meet consumer demand for eco-friendly solutions. Advances in smart packaging, including temperature-sensitive and tamper-evident technologies, enhance product safety and shelf life. Market players are expanding production capacities and adopting automation to improve efficiency. Strategic partnerships with dairy producers and retail chains drive market penetration. Rising e-commerce sales push companies to develop durable and protective packaging. Competition intensifies as firms seek to balance cost-effectiveness, sustainability, and functionality to gain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the dairy packaging market with detailed profiles of all major companies, including:

- Ball Corporation

- Mondi

- Bemis Company, Inc.

- Rexam

- RPC Group

Latest News and Developments:

- In 2024, Ball Corporation collaborated with CavinKare to launch two-piece aluminum cans designed for dairy items such as milkshakes. This effort aims to deliver sustainable packaging options that preserve the freshness, flavor, and nutritional value of dairy products. The cans are engineered to endure the demanding retort process, ensuring the quality of the product.

- In 2024, Mondi introduced TrayWrap, an environmentally friendly paper packaging alternative that replaces plastic shrink film for food and beverage packaging. Made from 100% renewable kraft paper, TrayWrap is recyclable, resistant to punctures, and works with existing packaging equipment. Used by a Swedish coffee brand, TrayWrap aligns with European sustainability regulations and ensures safe transportation.

- In 2023, Mondi announced its partnership with Skånemejerier to create mono-material plastic packaging for cheese. This groundbreaking solution, composed entirely of polypropylene (PP), provides excellent barrier protection against oxygen and moisture, thereby maintaining the product's freshness and shelf life. The packaging is designed to be recyclable, supporting a circular economy.

Dairy Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Materials Covered | Flexible Plastic, Rigid Plastic, Paper and Paper Board, Glass, Metal, Others |

| Packaging Types Covered | Single-Pack, Multi-Pack |

| Product Types Covered | Liquid Cartons, Bottles and Jars, Pouches, Cans, Cups and Tubes, Others |

| Applications Covered | Milk, Cheese, Cream, Butter and Ghee, Yogurt, Ice Cream, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Ball Corporation, Mondi, Bemis Company, Inc., Rexam, RPC Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dairy packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dairy packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dairy packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dairy packaging market was valued at USD 25.31 Billion in 2024.

IMARC estimates the dairy packaging market to reach USD 35.11 Billion by 2033, exhibiting a CAGR of 3.52% during 2025-2033.

Rising dairy consumption, demand for sustainable and eco-friendly packaging, and advancements in food safety regulations drive the dairy packaging market. Growth in single-serve and on-the-go dairy products fuels innovation. Extended shelf-life requirements, e-commerce expansion, and increasing adoption of recyclable materials further accelerate market growth.

North America holds the largest dairy packaging market share, driven by high dairy consumption, strong demand for sustainable packaging, and stringent food safety regulations. Growth in ready-to-drink dairy products, increasing e-commerce sales, and advancements in recyclable and biodegradable packaging materials further strengthen the region’s market dominance.

Some of the major players in the dairy packaging market include Ball Corporation, Mondi, Bemis Company, Inc., Rexam, RPC Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)