Dairy Herd Management Market Size, Share, Trends and Forecast by Product, Application, Farm Size, and Region, 2025-2033

Dairy Herd Management Market 2024, Size and Trends:

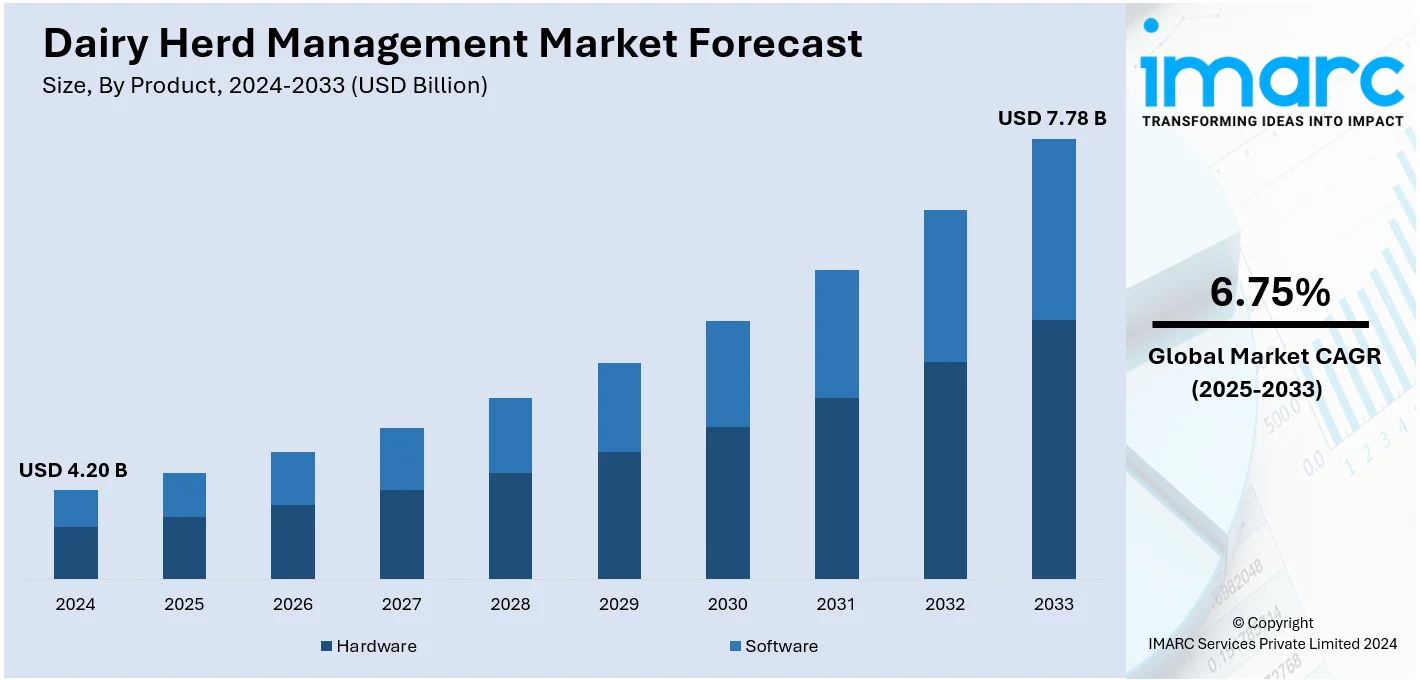

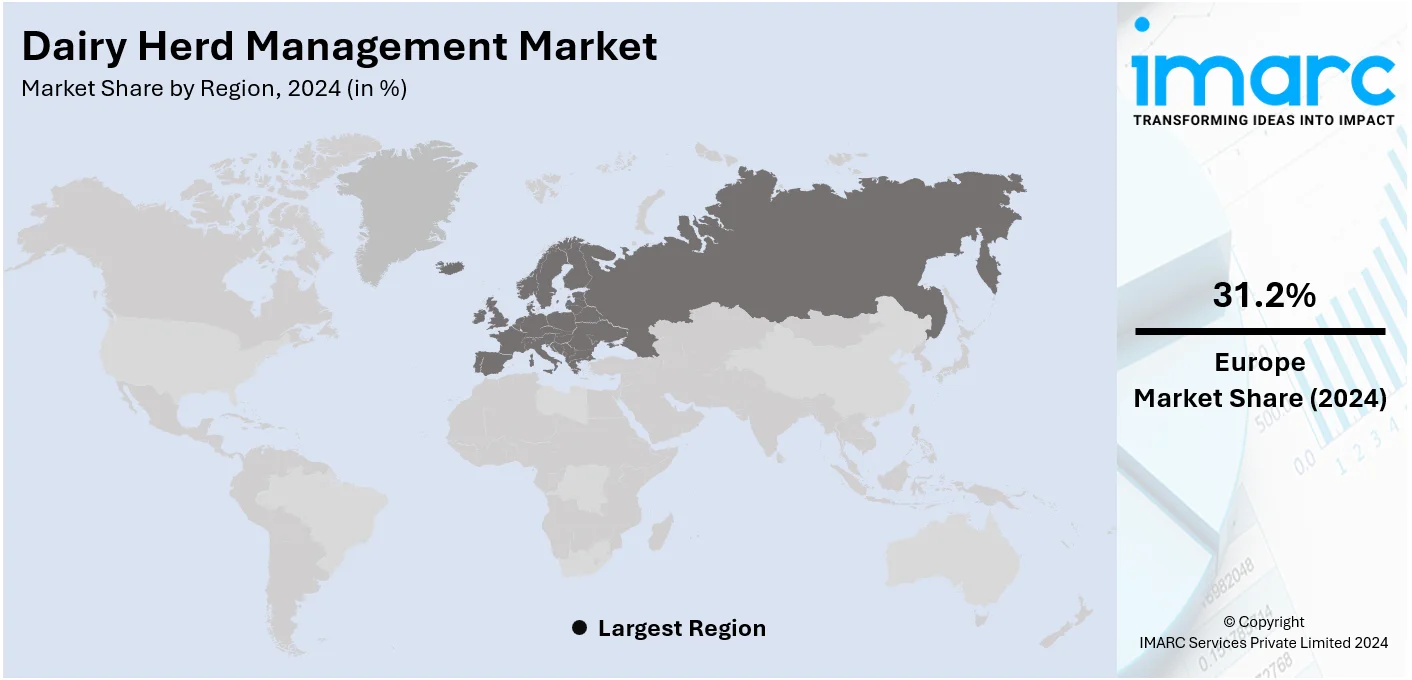

The global dairy herd management market size was valued at USD 4.20 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.78 Billion by 2033, exhibiting a CAGR of 6.75% during 2025-2033. Europe currently dominates the market, holding a significant dairy herd management market share of over 31.2% in 2024. The increasing milk production, supportive government subsidies and programs, emerging technological advancement, and the rising demand for dairy products due to rapid urbanization and growth, are major factors bolstering the dairy herd management market share.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.20 Billion |

| Market Forecast in 2033 | USD 7.78 Billion |

| Market Growth Rate (2025-2033) | 6.75% |

The dairy herd management market demand is propelled by advancements in automated technologies such as milking systems, health monitoring tools, and data analytics. Increasing global demand for high-quality milk and dairy products drives the adoption of precision farming and smart farming practices. Government incentives and funding for modernizing dairy operations further accelerate the dairy herd management market growth. For instance, in September 2024, the Odisha government under Chief Minister launched the Mukhyamantri Kamdhenu Yojana a five-year program with a budget of Rs 1,423.47 crore aimed at boosting milk production. This initiative is expected to assist more than 15 lakh dairy farmers and includes multiple support initiatives for cattle farming. Sustainability initiatives and the need for efficient resource utilization encourage the use of automated feeding and monitoring systems to reduce labor dependency and enhance herd health. Rising urbanization and disposable incomes in developing regions amplify the demand for innovative herd management solutions making it a vital market for global agriculture.

The United States dairy herd management market outlook is influenced by key factors, including advancements in automated technologies such as milking systems, RFID-based herd monitoring and precision farming tools. Increased demand for high-quality and environmentally sustainable milk production fuels adoption. Federal incentives and government support for digitization and smart farming encourage investment in modern solutions. For instance, in May 2024, the USDA allocated $824 million in emergency funds to protect livestock health in response to the H5N1 outbreak. A new Voluntary H5N1 Dairy Herd Status Pilot Program enables dairy producers to facilitate cow movement faster with confirmed negative tests improving monitoring and containment while aiding ongoing research and surveillance efforts. The need to enhance efficiency, reduce labor dependency, and improve herd health further boosts the market demand. Additionally, the U.S.'s leadership in dairy innovation positions it as a hub for advanced herd management practices.

Dairy Herd Management Market Trends:

Increased Milk Production

The use of dairy herd management results in a notable improvement in the efficiency of milk production. According to the United States Department of Agriculture’s (USDA’s) NASS milk production report, milk yield per cow increased steadily between 2000 and 2020, averaging 1.53% per year. By 2020, the amount per cow has increased from 18,197 pounds in 2000 to 23,777 pounds. There was an increase in the size of the national herd, which went from 9,199,000 in 2000 to 9,388,000 in 2020, representing an annual growth rate of only 0.10%. Moreover, for the total milk produced in 2000, dairy enterprises with less than 100 milk cows provided 14.26%, while those with more than 1,000 milk cows supplied 34.53%. Larger businesses with more than 1,000 milk cows had an increase in their proportion to 63.29% by 2016. These numbers demonstrate a discernible trend over time toward larger herds producing better milk yields as well as a noticeable shift in milk production toward larger-scale dairy enterprises. Furthermore, the sector has profited greatly in recent decades from the enhanced efficiency of milk production achieved via dairy herd management. This expansion is indicative of improved breeding procedures, better disease control, and more effective feeding methods made possible by herd management systems thus propelling the dairy herd management market share.

Government Subsidies and Support Programs

Government initiatives play a crucial role in facilitating the adoption of advanced dairy herd management systems. As per the Union Budget 2017-18 announcement, the Dairy Processing & Infrastructure Development Fund (DIDF) was established with a total corpus of INR 8,004 crores under the administration of the National Bank for Agriculture and Rural Development (NABARD). Approved by the Cabinet Committee on Economic Affairs (CCEA) in its meeting on 12 September 2017, the scheme aims to provide subsidized loans at a rate of 6.5% to financially strained milk cooperatives. The primary objective is to replace outdated chilling and processing plants and to introduce new facilities for value-added products. Of the total financial outlay amounting to INR 10,881 crores for project components of the DIDF, Rs. 8,004 crores will be allocated as loans from NABARD to NDDB/NCDC. Additionally, the NDDB/NCDC contributed INR 12 crores, the DAHD contributed INR 864 crores, and the end borrowers contributed INR 2,001 crores for interest subvention. The project's main goal is to increase the effectiveness of milk procurement systems by installing electronic milk adulteration testing equipment at the village level and building processing and cooling facilities. Farmers are encouraged to use creative solutions that improve sustainability and production through these government-funded initiatives. Consequently, more farms can increase their operational effectiveness and market competitiveness, which greatly aids in the expansion and modernization of the dairy industry.

Rising Demand for Dairy Products

As per the Food and Agriculture (FAO), global milk production expanded by 1.1% in 2021, reaching approximately 887 Million Tonnes (Mt). In India, the world's largest milk producer, production grew by 2.2% to 195 Mt. As a result of China's growing demand, the worldwide dairy imports in 2021 totaled 10 Mt, mostly due to cheese, milk powders, and whey powder increasing demand. There is a growing need for effective herd management systems due to this rising demand. Moreover, the market is growing due to the need to produce more dairy products while upholding strict sustainability and quality requirements as populations increase and dietary habits change. Besides this, dairy farms may easily scale up output to satisfy this expanding demand by using efficient herd management technologies. These systems also aid in maintaining the safety and uniformity of milk and other dairy products, which is essential for satisfying the demands of a global market that is becoming more and more quality conscious. Hence, this increasing demand is a major driver of the dairy herd management market, as producers strive to optimize their operations and output across the region.

Dairy Herd Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, application, and farm size.

Analysis by Product:

- Hardware

- Software

Hardware in dairy herd management typically includes milk meters, fertility monitors, radio-frequency identification (RFID) tags, and health monitoring sensors. These devices are essential for the automated collection of data regarding milk yield, animal health, and reproductive status, directly influencing the efficiency and productivity of dairy operations. They allow farmers to make immediate adjustments in feeding, milking, or medical treatment, enhancing overall herd management.

Moreover, software solutions provide user-friendly interfaces through which farm managers can track and analyze the performance of individual cows and the herd. They include features for feeding management, milk production analysis, breeding programs, and health management. These software tools help in making informed decisions, forecasting productivity trends, and managing day-to-day dairy operations more effectively by consolidating data in a centralized system. This integration of data and analytics is essential for optimizing the profitability and sustainability of dairy farms.

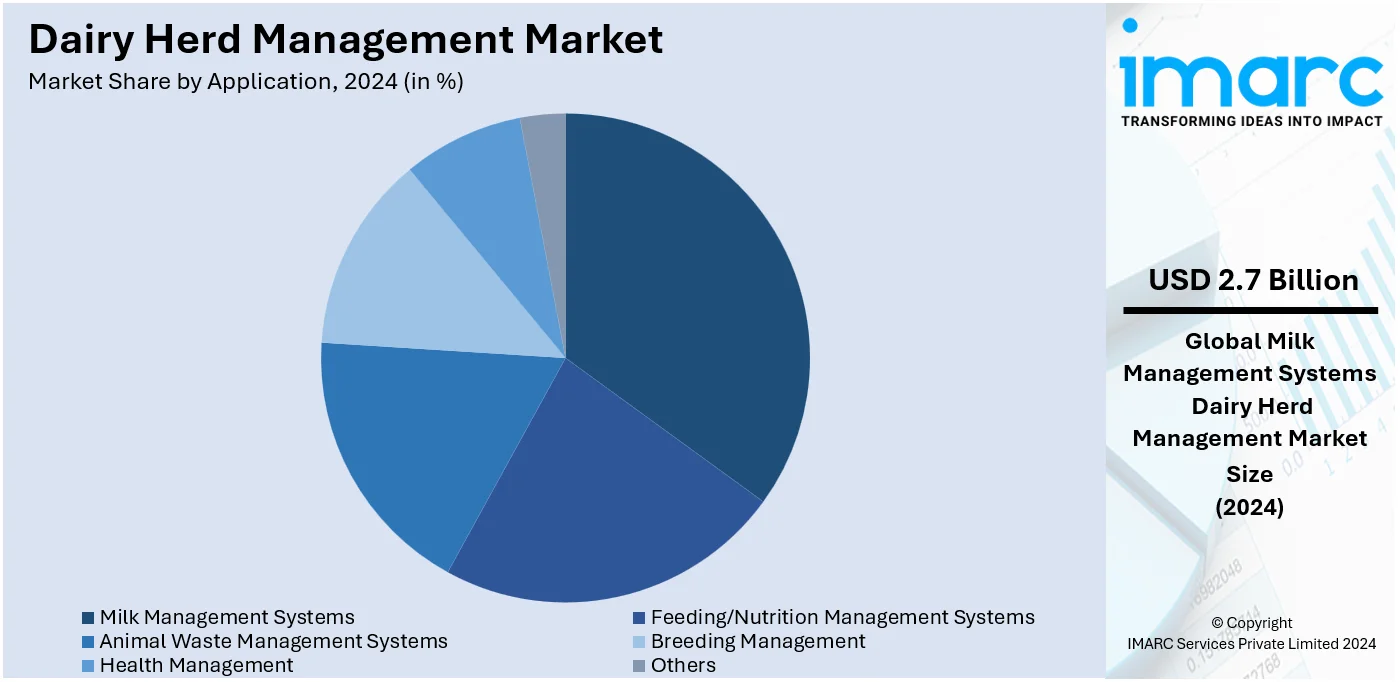

Analysis by Application:

- Milk Management Systems

- Feeding/Nutrition Management Systems

- Animal Waste Management Systems

- Breeding Management

- Health Management

- Others

Milk management systems leads the market with around 63.3% of the dairy herd management market share in 2024. Milk management systems are increasing the adoption of advanced technologies by dairy farmers aiming to enhance milk production efficiency and quality. Milk management systems provide comprehensive solutions for monitoring milk yield, analyzing quality parameters, and managing dairy production schedules effectively. These systems integrate data analytics and real-time monitoring tools to optimize the milking process and improve overall farm profitability. As dairy operations worldwide strive for operational efficiency and higher output, the reliance on sophisticated milk management systems continues to grow, driving the expansion within the broader dairy herd management market outlook. Hence key players are introducing advanced product variants to meet these needs. For instance, on 27 March 2023, DeLaval, in Tumba, Sweden, specializing in dairy and farming equipment, introduced the OptiWagon, an autonomous feed distribution robot. This new technology integrates essential functions like weighing, cutting, mixing, and precise delivery of feed directly to designated feeding areas. The OptiWagon enables farms to schedule up to twelve feed distributions per day, promoting consistent and optimized feeding routines that improve animal nutrition and overall farm efficiency.

Analysis by Farm Size:

- Small-Scale Dairy Farms

- Large-Scale Dairy Farms

- Co-Operative Dairy Farms

As per the dairy herd management market forecast, in 2024, large-scale dairy farms accounted for the largest market share of over 64.3%. These farms typically operate on a commercial scale, often housing hundreds or thousands of cows. Due to their size, large-scale farms require sophisticated management solutions to ensure efficient operations, maximize milk production, and maintain animal health and welfare. These farms tend to adopt advanced technologies, such as automated milking systems, precision feeding, and data analytics tools, to optimize performance and streamline operations. As they often have significant financial resources, large-scale dairy farms can afford high-tech solutions, making them the dominant segment in the market. Additionally, the demand for traceability and sustainability practices, coupled with the need to meet regulatory standards, drives the growth of dairy herd management solutions tailored for these large operations.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 31.2%. Europe is emerging as the largest segment due to the strong emphasis on enhancing dairy farm productivity through technological integration and sustainable practices. Additionally, European countries are keen on adopting advanced herd management software and equipment to improve milk quality, animal health, and productivity. Moreover, the robust infrastructure for dairy farming in Europe, coupled with government support for modernizing agricultural practices, further propels the dairy herd management market growth. Additionally, the presence of major market players who are continually innovating dairy management solutions contributes significantly to the region's leading position in the global market. For instance, in April 2023, Romania's allocation of the European Union (EU) funds for milking robots and farm automation. The Minister for European Investments and Projects (MIPE), Marcel Bolos, unveiled the financial instruments under the National Resilience and Recovery Programme (NRRP) aimed at supporting farmers. These funds will enable farmers to invest in milking robots, feeding robots, and other automated farm systems, fostering digitization across agricultural operations.

Key Regional Takeaways:

North America Dairy Herd Management Market Analysis

North America's dairy herd management market trend is driven by technological advancements and a strong focus on productivity and sustainability. The region witnessed significant investments in automated milking systems, herd health monitoring tools, and precision farming techniques. Canada is playing a key role in innovative practices in dairy farm management supported by government incentives for modernized agricultural technologies. The rising adoption of RFID-based tracking, data analytics, and feeding automation systems is helping farms optimize operations and reduce labor dependency. Companies like DeLaval and GEA Group are at the forefront of providing cutting-edge solutions tailored to the region’s requirements. Increased consumer demand for premium dairy products and sustainable farming practices positions North America as a leading market for dairy herd management innovation.

United States Dairy Herd Management Market Analysis

In 2024, the United States accounted for a share of 75.80% of the North American market. Advanced technologies and rising efficiency in milk production have led to growth in the U.S. dairy herd management market. According to the USDA, the country produced 226 billion pounds of milk in 2023, driven by automated systems and precision farming tools. Dairy farmers are using herd monitoring technologies, including RFID tags and automated milking systems, to enhance productivity. Such organizations like DeLaval and GEA Group are advancing automated milking and feeding system innovation. The demand for higher-quality milk and better and environmentally friendly dairy practices is driving several advanced herd management solutions. Federal incentives that embrace digitization and smart farming drive greater penetration. Technologies reduce dependence on labor while improving herd health. Asia and Europe are additional growth opportunities for export. It places the U.S. as a leader in dairy innovation globally.

Asia Pacific Dairy Herd Management Market Analysis

Asia Pacific's dairy herd management market is growing at a fast pace as the demand for milk is on the rise and with the advancements in technology. As per the National Bureau of Statistics, the milk production in China stood at 41.97 million tons in 2023, due to large-scale dairy farms incorporating advanced herd monitoring systems. India, the world's largest milk producer, provided substantial funds under the National Dairy Plan for modernizing dairy operations and increasing productivity. Automated milking machines, health tracking, and data analytics are gaining popularity in China, India, and Australia. Companies such as Afimilk and DeLaval are partnering with local players to provide cost-effective, technology-based solutions. Government initiatives toward smart agriculture and livestock welfare further accelerate adoption. Increased disposable incomes and increased demand for high-quality milk products in urban areas make the Asia Pacific a crucial market for dairy herd management technologies.

Latin America Dairy Herd Management Market Analysis

Latin America's dairy herd management market is increasingly expanding due to the rising quantities of dairy production and embracing smart farming technologies. In 2023, the largest dairy producer in that region, Brazil, as reported by FAO produced over 35.4 billion litres of milk. Investments in automated herd management systems are on the increase to improve productivity with cost reduction. As more small and medium-sized farms of milk are looking into health monitoring and feeding automation to join the global list, programs of the Mexican and Argentine governments are gaining through their initiative on precision farming, which enables the upgrading of technology used in the dairy industry. Fullwood Packo and GEA Group are other companies strengthening through local partners. Latin America is increasingly focusing on sustainable dairy farming and better milk quality, which will continue to create a demand for innovative herd management tools.

Middle East and Africa Dairy Herd Management Market Analysis

The Middle East and Africa dairy herd management market are boosted by the increasing trend in dairy consumption and increasing investment in modern farming practices. In 2023, according to the International Trade Administration, Saudi Arabia produced 2.8 billion liters of milk. Major farms employed automation systems to meet growing local demand. Modern dairy countries, South Africa and Kenya invest more in automating feeding systems along with monitoring herds, a move expected to raise their respective milk production yields. Improved local production for decreasing government dependency on imported dairy has also added growth support. Leading companies, including DeLaval and Lely, cooperate with local partners across this region to create tailor-made solutions appropriate for small-sized farms within each regional country. Rising urbanization, increasing population, and the demand for high-quality dairy products position this region as an important future growth area for dairy herd management systems.

Competitive Landscape:

At present, key players in the dairy herd management market are actively innovating and expanding their product portfolios to meet the diverse needs of modern dairy farms. These companies focus on developing integrated software solutions and advanced monitoring equipment that enhance efficiency and productivity. They are also investing in research and partnerships to push technological boundaries, aiming to offer more comprehensive and user-friendly management systems. Moreover, they engage in strategic collaborations and acquisitions to strengthen their market presence and provide enhanced support and services to dairy farmers worldwide. For instance, on 4 April 2024, BouMatic, a leader in dairy technology, revealed its collaboration with Brolis Sensor Technology to integrate the Brolis in-line milk analyzer into the Gemini UP milking robot and other BouMatic milking systems. This partnership aims to enhance dairy farm operations by incorporating the advanced capabilities of the Brolis HerdLine concept into BouMatic's innovative milking solutions.

The report provides a comprehensive analysis of the competitive landscape in the dairy herd management market with detailed profiles of all major companies, including:

- Afimilk Ltd.

- BouMatic LLC

- Dairymaster

- DeLaval (Tetra Laval)

- Fullwood JOZ

- GEA Group AG

- Lely

- Nedap N.V.

- SUM-IT Computer Systems Ltd.

- Valley Agricultural Software Inc. (URUS Group LP)

Recent Developments:

- November 2024: Biotangents announced that they have raised Pound 2.3 Million (USD 2.92 Million) to launch its on-farm diagnostic device, which will provide results in under two hours to combat bovine mastitis. The innovation reduces unnecessary antibiotic use, tackles antimicrobial resistance, improves herd health, and enhances sustainability. Investors include Eos Advisory, British Business Investments, Kelvin Capital, and Scottish Enterprise.

- April 2024: BouMatic, a leader in dairy technology, revealed its collaboration with Brolis Sensor Technology to integrate the Brolis in-line milk analyzer into the Gemini UP milking robot and other BouMatic milking systems. This partnership aims to enhance dairy farm operations by incorporating the advanced capabilities of the Brolis HerdLine concept into BouMatic's innovative milking solutions.

- April 2024: Nedap announced the launch of Heat Stress, CowControl feature: real-time heat stress levels detected in dairy cows. It updates every 15 minutes, allowing fans and sprinklers to intervene, reduce heat stress, enhance cow health, and ensure the continued production of milk.

- March 2024: Gesellschaft für Entstaubungs-Anlagen mbH (GEA) acquired CattleEye Ltd., an agricultural software company from Northern Ireland known for its advanced AI solutions. This acquisition enhances GEA's portfolio with technology aimed at improving dairy farm management, specifically through early detection of lameness in cows. CattleEye's AI system combines a 2D camera and specialized software to analyze cow movement and body scores, providing crucial data for assessing animal health and welfare. This aligns with GEA's commitment to animal health under its Next Generation Farming strategy. The system's versatility allows integration into various milking systems, offering farmers actionable insights to enhance herd health and productivity by addressing issues like lameness promptly, which can impact fertility and milk production in dairy cows.

- January 2024: Dairymaster's new Swiftflo Personalised Milking Platform offers dynamic pulsation, faster milk flow rates, and reduced milking times. Peer-reviewed research has shown time savings of 1.5 minutes per cow daily without yield impact. When integrated with the DairyVue360 app, it provides real-time herd data to enhance productivity and animal welfare.

- November 2023, Sonoco announced the acquisition of Amcor Packaging’s composite can business. The intended acquisition of Amcor’s composite plants will place Sonoco on a better pedestal in the Asia Pacific region.

- June 2021, Merck & Co. Inc. entered into a partnership with LIC Automation Ltd. which is located in (New Zealand), seeking to enhance the product range of the company and its consumer traffic. LICA produces and distributes advanced and comprehensive animal tracking and monitoring systems and milk quality identifying probes to the dairy sector .

Dairy Herd Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Hardware, Software |

| Applications Covered | Milk Management Systems, Feeding/Nutrition Management Systems, Animal Waste Management Systems, Breeding Management, Health Management, Others |

| Farm Sizes Covered | Small-Scale Dairy Farms, Large-Scale Dairy Farms, Co-Operative Dairy Farms |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Afimilk Ltd., BouMatic LLC, Dairymaster, DeLaval (Tetra Laval), Fullwood JOZ, GEA Group AG, Lely, Nedap N.V., SUM-IT Computer Systems Ltd., Valley Agricultural Software Inc. (URUS Group LP), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dairy herd management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global dairy herd management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the dairy herd management industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Dairy herd management involves the systematic monitoring and care of dairy cattle to optimize milk production, health, and overall farm efficiency. It includes activities such as feeding, breeding, health monitoring, and milking processes, supported by advanced technologies and data-driven tools for improved productivity and profitability.

The dairy herd management market was valued at USD 4.20 Billion in 2024.

IMARC estimates the global dairy herd management market to reach USD 7.78 Billion by 2033, exhibiting a CAGR of 6.75% during 2025-2033.

Key market trends of the global dairy herd management market in 2024 include rising global demand for milk and dairy products, technological advancements in automated herd management solutions, increasing focus on animal health and productivity, the adoption of precision farming techniques, and government initiatives for sustainable dairy farming.

In 2024, milk management systems represented the largest segment by application, driven by the rising need for efficient milk production processes and quality control in dairy farming. Moreover, advanced technologies for automated milking, milk yield tracking, and contamination prevention fuel the adoption of these systems globally, driving the market forward.

Based on farm size, large-scale dairy farms accounted for the largest dairy herd management, with 63.4% of the market share. This is owing to their capacity to invest in advanced herd management technologies such as automated milking systems, feeding solutions, and health monitoring tools. Their focus on maximizing productivity, meeting large-scale milk demands, and maintaining operational efficiency is contributing to the market expansion.

Milk management systems leads the market by application with 63.3%.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global dairy herd management market include Afimilk Ltd., BouMatic LLC, Dairymaster, DeLaval (Tetra Laval), Fullwood JOZ, GEA Group AG, Lely, Nedap N.V., SUM-IT Computer Systems Ltd., Valley Agricultural Software Inc. (URUS Group LP), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)