Dairy Alternatives Market Size, Share, Trends and Forecast by Source, Formulation, Nutrient, Distribution Channel, Product Type, and Region, 2025-2033

Dairy Alternatives Market 2024 Size, Share and Growth:

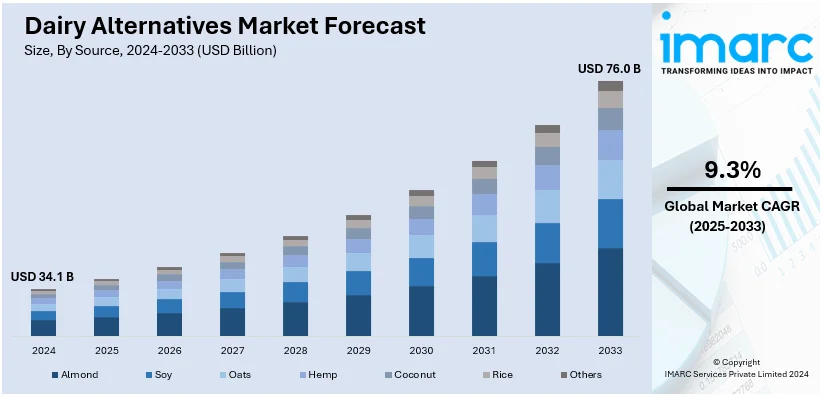

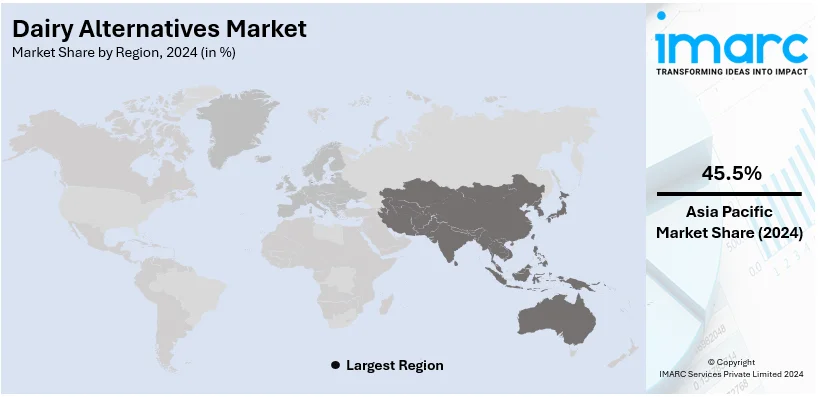

The global dairy alternatives market size was valued at USD 34.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 76.0 Billion by 2033, exhibiting a CAGR of 9.3% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.5% in 2024. The dairy alternatives market size is driven by the increasing consumer focus on health, sustainability, and the introduction of innovative product offerings, with plant-based options gaining popularity worldwide in response to changing dietary preferences and environmental concerns in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 34.1 Billion |

|

Market Forecast in 2033

|

USD 76.0 Billion |

| Market Growth Rate (2025-2033) |

9.3%

|

One major driver in the dairy alternatives market is the growing consumer demand for plant-based products. As more individuals adopt vegan, lactose-free, or flexitarian diets, there is a significant shift towards plant-based alternatives to traditional dairy products. This shift is driven by health concerns, such as lactose intolerance and cholesterol management, as well as environmental considerations, as plant-based products typically have a lower carbon footprint compared to animal-derived dairy. The increasing availability of a wide variety of plant-based milk, yogurt, cheese, and other dairy substitutes is further fueling this market growth.

In the U.S., the dairy alternatives market growth is driven by rising consumer awareness about health, sustainability, and dietary preferences. The increasing prevalence of lactose intolerance and milk allergies is prompting more consumers to opt for plant-based alternatives like soy milk, almond and oat. Approximately 36% of Americans experience lactose malabsorption, which can lead to lactose intolerance and digestive discomfort when consuming dairy products. Avoiding dairy is a simple solution to prevent these painful symptoms. Additionally, concerns over the environmental impact of dairy farming, such as water usage and greenhouse gas (GHG) emissions, are contributing to the shift towards eco-friendly plant-based options. The U.S. market is also fueled by innovation in dairy alternatives, with a wide range of products now available, catering to diverse tastes and dietary needs.

Dairy Alternatives Market Trends:

Health and wellness trends

Growing consumer awareness of health and wellness, including lactose intolerance, dairy allergies, and concerns about animal welfare, is a major driver for the dairy alternatives market. In addition, consumers increasingly opt for plant-based options because they consider them to be healthier. The preference of consumers is being led by the desire for products that are low in saturated fats, cholesterol-free, and often fortified with essential vitamins and minerals. Furthermore, the growth of veganism has further boosted the market on a global level. According to the U.S. Department of Agriculture (USDA), India was the largest population of vegetarians in the world, with about 30% of its population following a vegetarian diet.

Environmental sustainability

The environmental impact of dairy production has become a key driver in the outlook for the dairy alternatives market. The dairy industry is linked to high levels of greenhouse gas emissions, water usage, and land usage. Environmentally conscious consumers are opting for alternatives as a more sustainable choice, and plant-based options generally have a lower environmental footprint, leading to increased adoption. In addition, the fact that some dairy alternative manufacturers embrace regenerative and sustainable farming practices promotes the notion that these products are an environmentally friendly alternative. For example, in October 2023, the Germany-based organic oat drink producer Velike launched NOT M'LK, which is a vegan milk. The specialty of the drink is that the oats are sourced exclusively from the farms in the Black Forest and other regions of Baden-Wurttemberg, which helps in feeding the local economy and makes it a lower carbon-footprint product.

Innovative product offerings

Continuous innovation in the sector is also supporting the dairy alternatives market growth. The leaders in the dairy free space continue to introduce plant-based innovations that better reflect the texture and taste of daily dairy products. Beyond milk, it has reached even the creamiest and crispiest dairy-free cheese, yogurt, ice cream, and even butter alternatives. Being able to offer these many options which closely mimic dairy versions of themselves opened wider the consumers for these products. In addition, the constant innovation in food technology - new ingredients and new processing techniques-increases the nutritional levels of such products, therefore making them attractive to a health-conscious consumer. An example of this is in June 2022; Danone, a French multinational food-products corporation unveiled Vanilla Denette Vegan Mousse from coconut milk, France. The mission of the company through this innovation is to extend its Denette range of products and further enhances the vegan lifestyle with great-tasting products.

Dairy Alternatives Market Challenges:

The dairy alternatives market faces several challenges, primarily related to consumer perceptions and production costs. Many individuals remain hesitant to switch to plant-based options, often due to unfamiliarity with their taste, texture, or nutritional content. Traditional dairy products are deeply ingrained in various cultures, making widespread adoption of alternatives a slow process. In addition, production costs for dairy alternatives may be greater, partly because of raw material sourcing and processes involved in manufacturing. This will come at a higher cost to consumers, perhaps slowing down market growth. The supply chain for plant-based ingredients is also subject to variability, which can affect availability of the product and stability of price. Another challenge will be product consistency, particularly regarding flavor and texture since brands tend to be variable. In meeting demand, sustainability in the midst of maintaining consumer expectations will be essential for players in the industry.

Dairy Alternatives Market Opportunities:

Consumer demands for plant-based products, for health and sustainability factors and ethical considerations mean that the dairy alternatives market is in a growth phase. The product shift has been due to skyrocketing concerns over lactose intolerance, dairy allergies, and animal farming's effects on the environment. The market provides an endless variety of plant-based products-from milk to yogurt, cheese to butter-mass-produced from ingredients such as almonds, soy, oats, and coconuts. The requirement for fortified or organic alternatives also provides an opportunity for innovation in nutritional profiles and clean labels. As more consumers focus on plant-based diets, new entrants and existing brands can look to take advantage of this trend with products that satisfy a variety of tastes and dietary needs. The market for dairy alternatives is promising, with respect to growth prospects in regions where plant-based eating habits are becoming increasingly mainstream, given the added availability and consumer awareness due to increasing retail presence.

Companies in the dairy alternatives industry have turned their attention to these opportunities because of the following:

- Surging demand for lactose-free and plant-based products

- Emerging concern about the ecological footprint of dairy farming

- Increasing consumer health concern for low-fat and cholesterol-free options

- Growing base of vegan and vegetarian consumers

- Product innovations improving taste and texture

- Increased accessibility and affordability of raw materials like oats, almonds, and soy

- Advances in production technologies, bringing down costs and enhancing efficiency

- Increasing global health patterns and dietary trends towards plant-based consumption

Dairy Alternatives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dairy alternatives market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on source, formulation, nutrient, distribution channel, and product type.

Analysis by Source:

- Almond

- Soy

- Oats

- Hemp

- Coconut

- Rice

- Others

Soy stands as the largest component in 2024, holding around 35.3% of the dairy alternatives market share. The most important reason for this prevalence is soy's nutritional balance. Soy is rich in both protein, vitamins, and minerals that makes the dairy-free product popular among customers. Soy milk is more accessible and has been used for many years as the cornerstone for the plant-based milk market. Soy's also multipurpose and can be adapted in multiple product such as yogurts, cheese, ice creams etc. Cost-effective and very well-known over a long period, that leads it to a prime market. Soaring demand for soy with lactose-free dieting has become one of the leading causes for popularity in recent times.

Analysis by Formulation:

- Plain

- Sweetened

- Unsweetened

- Flavored

- Sweetened

- Unsweetened

Plain leads the market in 2024 due to their versatility and widespread consumer preference for simple, unflavored options. These products are often seen as more natural and healthier, as they do not contain added sugars or artificial flavorings. It tends to be a simple varieties of plant-based milk and yogurt or other dairy-based alternatives. They are primarily used as a base variant for those who want more control over their products when it comes to sweetening, flavoring, and adding various toppings. Simple dairy alternatives also cater well to consumers with sugar-free or allergen-free diet choices, hence contributing to being best-selling items in the industry. This simplicity, with the growth in awareness about the health benefits of diets based on plants, keeps the increase in the dairy alternatives market for plain variants going on.

Analysis by Nutrient:

- Protein

- Starch

- Vitamin

- Others

In 2024, protein accounts for the majority of the market due to the rising consumer demand for higher-protein, plant-based options. The increased awareness about health, fitness, and maintenance of the muscles leads the consumers toward plant-based dairy products that come with sufficient protein content. Soy, pea, and almond milk fortified with added protein products are popularly consumed among athletes, sports people, health-conscious individuals, and for high-protein dietists. Protein-enriched alternatives come as a relief for vegan and lactose-intolerant consumers also, in the form of nutrition from dairy. As plant-based diets go mainstream, nutrition will always be a source of vital energy coming from protein-fortified products, making them a huge component in the dairy alternatives market in 2024.

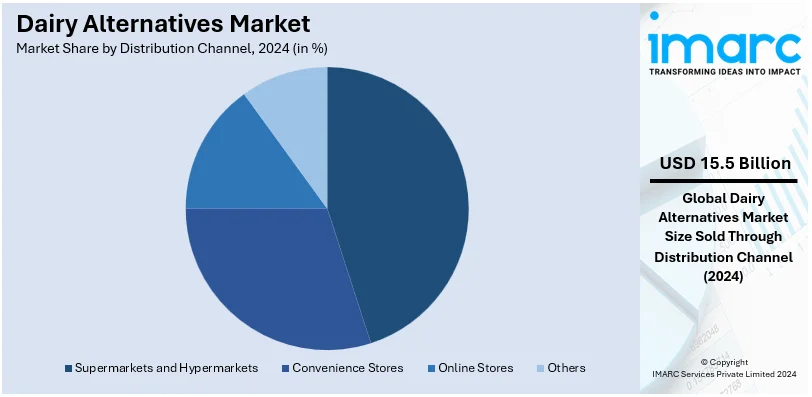

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets represented the leading market segment, holding 45.3% of the total share. These retail channels offer a wide range of plant-based dairy products, making them the preferred shopping destination for consumers. The extensive product variety, including various plant-based milk, yogurt, and cheese brands, caters to diverse consumer preferences and dietary needs. Supermarkets and hypermarkets also benefit from their convenience, large-scale operations, and established distribution networks, ensuring that dairy alternatives are readily available to a broad audience. Additionally, these stores often feature attractive promotions and in-store displays, further driving consumer awareness and sales. As more consumers shift towards plant-based diets, supermarkets and hypermarkets continue to play a pivotal role in meeting the growing dairy alternatives market demand.

Analysis by Product Type:

- Cheese

- Creamers

- Yogurt

- Ice Creams

- Milk

- Others

Milk leads the market with around 43.5% of market share in 2024. This dominance is driven by the increasing popularity of plant-based diets and the growing number of consumers seeking lactose-free, dairy-free options. Plant-based milk, including soy, almond, oat, and coconut milk, offers a versatile, nutritious substitute for traditional dairy milk. It caters to various dietary needs, including lactose intolerance, veganism, and health-conscious preferences. Additionally, the wide availability of plant-based milk in supermarkets and online platforms has further boosted its market share. Flavours and formulation available from the brands range from unsweetened to fortified to organic options. Thus, with such variety and difference, it is bringing along more improved taste and nutrition profiles that increase this trend.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 45.5%. This is majorily driven by the rising prevalence of lactose intolerance in various APAC countries, including China, India, and Japan, where a significant portion of the population experiences difficulty digesting dairy. As a result, plant-based alternatives like soy milk, almond milk, and rice milk have become popular choices. Additionally, the region’s traditional use of plant-based ingredients, such as soy and coconut, further supports the growth of dairy alternatives. With rising health awareness, urbanization, and increasing adoption of plant-based diets, the demand for dairy alternatives continues to soar in APAC, making it the leading market globally.

Key Regional Takeaways:

North America Dairy Alternatives Market Analysis

The North America dairy alternatives market is experiencing significant growth, driven by increasing consumer preference for plant-based products due to health, sustainability, and ethical considerations. A growing awareness of lactose intolerance, with nearly 36% of the U.S. population affected, has led to rising demand for dairy-free alternatives such as almond, soy, oat, and coconut milk. The market is further bolstered by environmental concerns, as plant-based products typically have a lower carbon footprint than traditional dairy. In addition, advancements in product innovation, such as Danone North America's creation of plant-based milk with a neutral taste profile, are attracting more consumers. Major brands like Silk and So Delicious Dairy Free are leading the way by offering a wide variety of plant-based products that cater to diverse dietary needs, further expanding market opportunities. With increasing availability and improved formulations, the North American Dairy Alternatives market is poised for sustained growth.

United States Dairy Alternatives Market Analysis

Consumers residing across the United States are increasingly seeking plant-based options due to concerns over sustainability, lactose intolerance, and ethical considerations surrounding animal products. According to the National Institutes of Health (NIH), In the United States, approximately 36% of the population experiences lactose malabsorption, a condition characterized by a diminished ability to digest lactose. While infants typically have the capacity to digest lactose, many individuals begin to develop lactose malabsorption as they age beyond infancy. Additionally, in 2021, Danone North America, based in Broomfield, Colo. and White Plains, N.Y., developed a plant-based "milk" that eliminated the typical plant-based flavor profile. Leveraging its expertise in both dairy and plant-based beverages through its Silk and So Delicious Dairy Free brands, the company deconstructed key dairy attributes and sensory experiences. By blending high-quality, familiar plant-based ingredients, Danone North America created a new segment of plant-based products that did not resemble the taste of any specific plant ingredient, such as almond, oat, or soy.

Europe Dairy Alternatives Market Analysis

The European market is showing increasing concerns about sustainability, leading consumers to opt for dairy alternatives that have a lower environmental footprint compared to traditional dairy products. For instance, in 2021, EFKO Group, one of Russia's leading producers of mayonnaise and oil, announced that it had commenced the production of soy milk. The company invested 600 million rubles (USD 8 Million) in the initiative, with the objective of reaching a monthly production capacity of 1,000 Tons. In line with this, ethical reasons, such as animal welfare concerns, are fueling the dairy alternatives market growth, across the European countries. For instance, in 2023, Plenish, recognized as one of the UK’s fastest-growing plant-based drinks brands, expanded its dairy alternatives portfolio with the introduction of three organic Barista Milks – Oat, Almond, and Soya. Additionally, health concerns such as cholesterol and obesity are driving consumers across the European region towards plant-based options. According to the government of UK, in the year ending November 2022, 63.8% of adults aged 18 and over were classified as overweight or living with obesity, reflecting a 0.5% increase compared to the previous year.

Asia Pacific Dairy Alternatives Market Analysis

Asian countries are representing the largest markets for dairy alternatives due to their high lactose intolerance rates. It has been reported that Asian populations have decreased amounts of lactase in adulthood compared to Caucasian populations. In line with this, in Japan and South Korea, there is a growing demand for plant-based milk and dairy products, driven by the health-conscious youth and urban population. According to the Central Intelligence Agency (CIA), in 2023, Japan's urbanization rate reached 92% of the total population. Additionally, according to the Central Intelligence Agency (CIA), in 2023, South Korea’s urbanization rate reached 81.5% of the total population. Moreover, in countries like China, India, and Thailand, plant-based alternatives such as soy milk and coconut milk are playing an integral role in culinary traditions, offering lactose-free options that complement local flavors and dietary preferences.

Latin America Dairy Alternatives Market Analysis

The Latin America dairy alternative market is being largely driven by shifting consumer preference towards plant-based diets. Also, the rising dairy price in the region is further demanding the consumers to shift to plant-based dairy alternatives. In line with this, a growing interest in veganism, plant-based diets, and healthy eating habits, especially in urban areas in Latin America, is propelling the dairy alternatives market. According to the U.S. Department of Agriculture (USDA), in 2018, approximately 30 million individuals in Brazil identify themselves as vegetarians.

Middle East and Africa Dairy Alternatives Market Analysis

Within the Middle East and Africa, consumer preferences are shifting with changing cultural and dietary trends in the region. In turn, this has positively triggered growth within the market, thereby helping the demand for dairy alternatives increase in the region due to increasing consumer awareness over lactose intolerance, in countries such as Saudi Arabia, Egypt and UAE. Lactose intolerance was found present in 45.3% of 274 Saudi patients according to a cross-sectional analytic study. The reasons for the growing demand of dairy alternatives across MEA are the increased availability of a wider variety of plant-based milk, yogurts, and cheeses; and the increase in consumers having higher disposable incomes. So, as more consumers today are opting for healthier as well as more sustainable consumption options, dairy alternatives would stand out as an important facet of the regional food and beverage landscape.

Competitive Landscape:

The dairy alternatives market is competitive, and this industry has a mix of the older, established dairy companies with newer, innovative plant-based startups. Major players offer a large number of plant-based milk, yogurt, and cheese products. They have used strong distribution networks and brand recognition to capture market share. In addition, new entrants have driven innovation through unique formulations catering to niche segments like organic, barista-style, and protein-enriched dairy alternatives. The market is very competitive, in which brands focus on product diversification, sustainability, health-conscious offerings, and the growing consumer base. Strategic partnerships, acquisition, and investment in research & development (R&D) are common strategies for expansion in the market.

The report provides a comprehensive analysis of the competitive landscape in the dairy alternatives market with detailed profiles of all major companies, including:

- Blue Diamond Growers

- Döhler gmbh

- Earth’s Own Food Company Inc.

- Eden Foods, Inc.

- Freedom Foods Group

- Nutriops S.L.

- Organic Valley

- Panos Brands

- Sanitarium

- Sunopta Inc.

- Hain Celestial Group, Inc.

- The Whitewave Foods Company (Danone North America)

- Triballat Noyal

- Valsoia SpA

Latest News and Developments:

- In 2024 March, South Canara Coconut Farmers' Producer Company Ltd. (FPC), Puttur, recently launched three value-added coconut products: tender coconut milkshake, tender coconut ice cream, and sprout dessert.

- In April 2024, Singapore-based Yeo Hiap Seng introduced Yeo’s Immuno Soy Milk, a fortified beverage containing vitamin B6 and zinc to support immune health. The new beverage is advertised as Healthier Choice in Malaysia and Singapore, offering a lactose-free and healthy alternative to conventional breakfast drinks.

- In May 2024, The Canadian division of French dairy leader Lactalis introduced Enjoy, a plant-based milk brand targeting health-conscious consumer. The six-product lineup is unsweetened and formulated to be high in protein, featuring oat, almond, and hazelnut milk variants. Each product delivers 8g of pea protein per 250ml serving, although they are not specifically positioned as barista-style milks.

- In September 2024, Glico, a prominent food manufacturer renowned for its flagship brand Pocky, had launched its health and wellness portfolio in Southeast Asia, debuting its leading product, Almond Koka, in Singapore. Additionally, Almond Koka had been recognized as Japan's top-selling almond milk.

Dairy Alternatives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Almond, Soy, Oats, Hemp, Coconut, Rice, Others |

| Formulations Covered |

|

| Nutrients Covered | Protein, Starch, Vitamin, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Product Types Covered | Cheese, Creamers, Yogurt, Ice Creams, Milk, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blue Diamond Growers, Döhler gmbh, Earth’s Own Food Company Inc., Eden Foods, Inc., Freedom Foods Group, Nutriops S.L., Organic Valley, Panos Brands, Sanitarium, Sunopta Inc., Hain Celestial Group, Inc., The Whitewave Foods Company (Danone North America), Triballat Noyal, Valsoia SpA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dairy alternatives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dairy alternatives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dairy alternatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Dairy alternatives are plant-based products designed to replace traditional dairy items like milk, cheese, and yogurt. Made from ingredients such as soy, almond, oat, and coconut, these alternatives cater to those with lactose intolerance, vegans, or individuals seeking healthier or more sustainable dietary options.

The dairy alternatives market was valued at USD 34.1 Billion in 2024.

IMARC estimates the global dairy alternatives market to exhibit a CAGR of 9.3% during 2025-2033.

Key factors driving the global dairy alternatives market include rising lactose intolerance, increasing vegan and plant-based diet adoption, growing health-consciousness, ethical concerns about animal welfare, and environmental sustainability. Additionally, innovations in flavor, texture, and nutritional content are expanding the appeal of dairy alternatives to a broader consumer base.

In 2024, soy represented the largest segment by source, driven by its nutritional profile, versatility, and widespread availability.

Plain leads the market by formulation owing to their versatility, simplicity, and appeal to consumers seeking natural, unflavored options.

The protein is the leading segment by nutrient, driven by growing demand for high-protein, plant-based options for health-conscious consumers.

The supermarkets and hypermarkets are leading segment by distribution channel, driven by their wide product range, convenience, and established customer base.

The milk is the leading segment by product type, driven by its widespread consumption and versatility in various applications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global dairy alternatives market include Blue Diamond Growers, Döhler gmbh, Earth’s Own Food Company Inc., Eden Foods, Inc., Freedom Foods Group, Nutriops S.L., Organic Valley, Panos Brands, Sanitarium, Sunopta Inc., Hain Celestial Group, Inc., The Whitewave Foods Company (Danone North America), Triballat Noyal, Valsoia SpA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)