Cybersecurity Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Region, 2025-2033

Cybersecurity Market Size and Share:

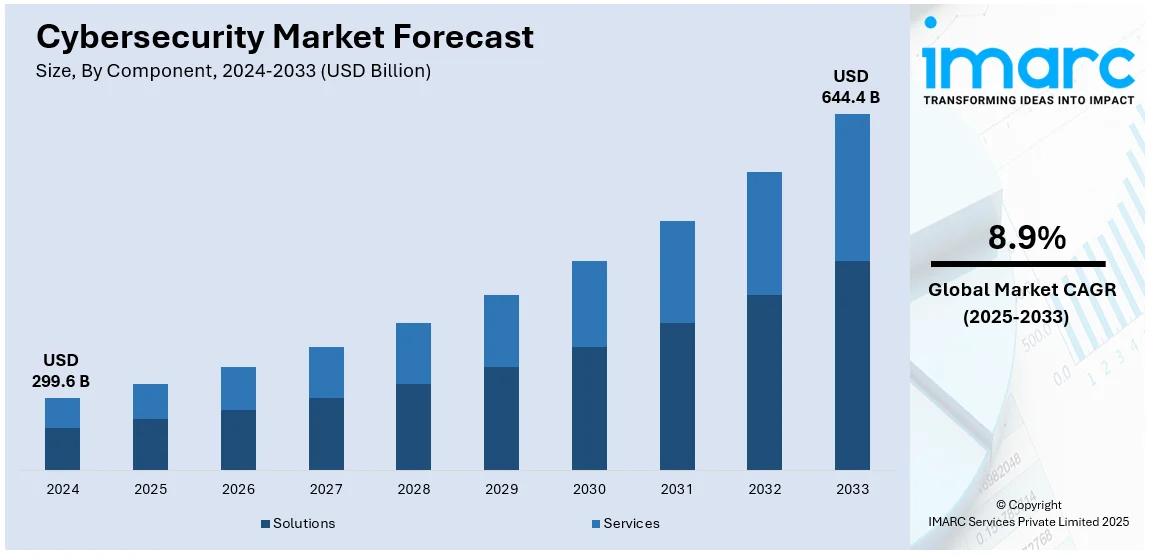

The global cybersecurity market size reached USD 299.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 644.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.9% during 2025-2033. North America currently dominates the market, holding a market share of over 35.0% in 2024. The cybersecurity market share is driven by increasing cyber security incidents and risks, rapid adoption of digital transformation and Internet of Things (IoT), imposition of new strict data privacy laws, and growing acceptance of new advanced security solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 299.6 Billion |

| Market Forecast in 2033 | USD 644.4 Billion |

| Market Growth Rate (2025-2033) | 8.9% |

The frequency and severity of cyberattacks have been increased by the rise of ransomware, phishing, and advanced persistent threats, which represents one of the key cybersecurity market trends. Fast adoption of digital technologies across industries has also augmented the attack surfaces associated with cloud computing, IoT, and AI- leading to the realization for a robust level of cybersecurity. Besides, the increased demand for telework and hybrid work models is escalating the need for cybersecurity solutions. The continuous upsurge in the government's cyber infrastructure investment has attracted funding from corporate entities that will further drive cybersecurity market growth. Another factor is the increasing public interest in data privacy and security issues, which results in an increased demand for secure applications and services. These new security areas, which include zero-trust architecture and extended detection and response (XDR), offer a variety of new solutions to changing threats that drive up the potentials for market growth.

The United States has emerged as a key regional market for cybersecurity as the region experienced rapid growth in the number of outlets that had high-speed Internet from the 1990s to the 2000s. Digital transformation has enabled rapid business processes due to wide-reaching and fast reaching Internet. The rapid spread of Internet technology worldwide gives a great challenge to companies in maintaining a fast pace to keep up with market needs. Additionally, stringent regulatory frameworks like the Cybersecurity Information Sharing Act (CISA) and state-level data protection laws push organizations to prioritize cybersecurity compliance. The growing adoption of cloud computing, Internet of Things (IoT) devices, and remote work models has expanded the attack surface, fueling the demand for advanced solutions like AI-powered threat detection and endpoint protection. Furthermore, increased investments in cybersecurity infrastructure and services by both the public and private sectors underscore its critical role in national security and business continuity, sustaining market growth in the United States.

Cybersecurity Market Trends:

Rising Cyber Threats and Attacks

Increased frequency and advancement in cybercrimes are the major factors that are significantly impacting the cybersecurity market. Recent events such as the SolarWinds cyber-attack and ransomware attack on the Colonial Pipeline Co depict the growing threats. The U. S. Government Accountability Office (GAO) revealed that, in 2022, federal agencies reported more than thirty thousand IT security incidents. The rates of threats have been increasing and there is a need to create better security and spend more on buying better cybersecurity. The U.S. federal government’s cybersecurity budget is projected to grow from $15.8 billion in FY 2023 to $20.1 billion by FY 2027. This cybersecurity market forecast represents the urgent need to protect sensitive data and national security interests from increasingly sophisticated adversaries.

Government Regulations and Policies

Requirements in laws and policies to protection of information and financial frauds significantly influence the cybersecurity market dynamics. A total of 1.13 Million cases of financial cyber fraud were reported in 2023 in India, according to a Lok Sabha. For instance, regulations such as the 2021 White House Cybersecurity Executive Order require agencies to undertake high levels of security necessary to include the use of zero trust architectures where applicable and supply chain risk management measures. The National Cybersecurity Strategy reinforces securing federal networks as well as critical infrastructure, thus generating cybersecurity market demand and need for compliant security solutions and services. The users should make sure their organizations respect GDPR, CCPA, and others not to be exposed to massive penalties and legal actions. These frameworks ensure that cyber security remains on the agenda of organizations, hence the continued application of resources in enhanced security.

Technological Advancements and Adoption

Cybersecurity market drivers include ongoing advancement and proliferation of technologies including Artificial Intelligence, Cloud Computing, and Data Analytics have a huge influence on cybersecurity market. These technologies improve threat detection and response; nonetheless, they bring about emerging vulnerabilities. According to reports, over 70% of cybersecurity professionals believe AI is highly effective in detecting threats that would have otherwise gone unnoticed. The NSA has set up an AI Security Center, an action that reveals the need to protect AI within security measures pertaining to a country. Since the federal agencies as well as private enterprise have adopted the use of cloud platform and AI for purposes of multiplicity, there is need to develop standard cybersecurity to protect these technologies.

Cybersecurity Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cybersecurity market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment type, user type, and industry vertical.

Analysis by Component:

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

Solutions stand as the largest component in 2024, holding around 54.7% of the market due to increased efficiency in the identification, prevention, and combating of threats. Hence, AI and machine learning based solutions are centrally important for security solutions in the current generation because they relay real time analysis of threats. Strategic acquisitions and partnerships also drive the deployment of security solutions for the cloud workload and the infrastructure of the on-premises model. For instance, as per latest reports, federal cybersecurity spending is expected to increase from $15.8 billion in FY 2023 to $20.1 billion by FY 2027. This increase is attributed to the fact that organizations are now trying to address the increasing threats of cybercrime. These offer the most advanced technological features that enable the valid integration of these solutions in the market to offer essential protection to organizations from emerging sophisticated cyber threats.

Analysis by Deployment Type:

- Cloud-based

- On-premises

On-premises leads the market due to their high level of security and availability of IT control of the data. They are preferred by companies that are sensitive to data localization and legal requirements. Such solutions enable organizations to physically control security and address threats regarding their protection, thus creating a favorable cybersecurity market outlook. However, on-premises solutions may not be due to their high costs of the initial installation and hardware, software and maintenance costs to the company.

Analysis by User Type:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises lead the market with around 68.9% of market share in 2024. Large enterprises have a profound impact on the market due to their extensive resources and economic footprint. They contribute significantly to innovation, driving advancements through substantial investments in research and development. This fosters technological progress and competitive advantages, thus influencing the cybersecurity market overview. Furthermore, such a major consumer group affects supply chains and markets, dictating trends within industries, or even establishing them. These firms help in employment and economic stability since they are large-scale firms and dominant the market. As the key drivers of growth and trendsetters, large enterprises have dominating roles in determining the course of the economy and many sectors. Strategic flexibility and responsibility in the innovation process confirm their crucial importance in the market processes.

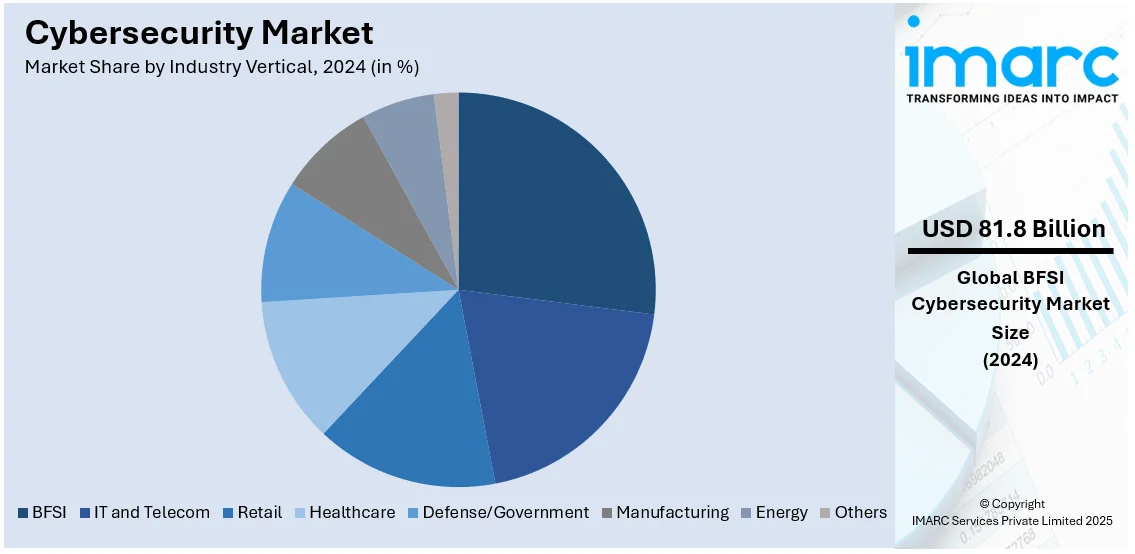

Analysis by Industry Vertical:

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

BFSI leads the market with around 27.3% of market share in 2024. BFSI holds the highest market share in the cybersecurity market as this sector is heavily regulated and must safeguard financial data. For fiscal year 2023, institutions put a lot of capital into progressive cybersecurity measures to fight off continually emerging cyber dangers. The advancement made in this sector is the emphatic adoption of biometric authentication technologies. For instance, JPMorgan Chase has implemented new measures by incorporating biometrics such as fingerprints and facial identities to ensure customer’s transactions and access. This innovation goes further in enhancing security and the quality of the service being offered in that users are provided with better and more secure ways of authentication and identification. This massive investment by the BFSI sector highlights its indispensability for the growth of these advanced technologies that require much-improved security solutions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0% due to its significant investments in advanced technologies and innovations. For instance, in 2023, Palo Alto Networks, a leading cybersecurity firm based in the U.S., introduced its next-generation firewall technology with enhanced AI-driven threat detection capabilities. This innovation allows for more accurate identification and neutralization of cyber threats, setting a new benchmark for the industry. North America's leadership is bolstered by a strong regulatory environment, high adoption rates of new technologies among businesses, and robust government support for cybersecurity. This focus drives the region to double its efforts in researching and developing cybersecurity technologies and protecting strategic infrastructure, maintaining its position as a leading market in the world.

Key Regional Takeaways:

United States Cybersecurity Market Analysis

In 2024. the United States accounts for 80.00% of cybersecurity market in North America driven by its increasing reliance on digital infrastructure and heightened exposure to sophisticated cyber threats. The increasing usage of cloud computing and IoT technologies has increased the attack surface, thus resulting in rising need of robust security solutions. In 2023, over 80% of U.S. businesses reported at least one cyberattack, prompting higher investments in advanced cybersecurity frameworks. According to reports, the most-Googled type of cybersecurity threat in 2024 is phishing, with an average of 75,600 searches made for the term every month in the US. In addition, governing agencies in the country are implementing regulations and initiatives, which is propelling the market growth. Laws like the Cybersecurity Information Sharing Act (CISA) and sector-specific standards such as HIPAA for healthcare and NERC CIP for energy utilities mandate stringent cybersecurity practices. Additionally, the Cybersecurity and Infrastructure Security Agency's (CISA) partnerships with private entities benefit in enhancing collective threat management capabilities. Apart from this, the rapid adoption of AI and machine learning-based cybersecurity tools is another key driver. These technologies help detect anomalies in real-time, preventing breaches before they escalate. Lastly, the growing awareness of cybersecurity's importance in small and medium-sized enterprises (SMEs) is fueling demand for cost-effective solutions. Federal programs such as grants and tax incentives encourage SMEs to prioritize cybersecurity, ensuring market growth across business scales.

Asia Pacific Cybersecurity Market Analysis

With the growth of e-commerce, digital payments, and smart city initiatives, the demand for robust cybersecurity solutions is surging. Countries like India, China, and Japan are leading this growth. In addition, government regulations play a significant role in driving the market. For instance, China's Cybersecurity Law and India's CERT-In guidelines mandate strict data protection measures, compelling organizations to invest in advanced security frameworks. Moreover, regional collaborations like the ASEAN Cybersecurity Cooperation Strategy aim to foster collective defense against cyber threats. The region’s shift to remote work and hybrid business models following the COVID-19 pandemic has intensified the need for endpoint security solutions. Another key driver is the integration of AI and blockchain technologies into cybersecurity solutions. These innovations enhance threat detection and data integrity, making them highly popular among enterprises. In line with this, higher spending on advanced technologies like AI, Ml, and others are supporting the market growth. According to the latest Worldwide AI and Generative AI Spending Guide by the International Data Corporation, investments in AI and Generative AI (GenAI) in the region are expected to reach USD 110 Billion by 2028. Furthermore, the increasing number of cybersecurity startups and collaborations between public and private sectors are contributing to market development.

Europe Cybersecurity Market Analysis

Europe's cybersecurity market is bolstered by stringent regulatory frameworks and a growing focus on data protection. The General Data Protection Regulation (GDPR) has set a global benchmark for data privacy, compelling organizations to adopt rigorous cybersecurity measures. Additionally, the EU Cybersecurity Act reinforces the importance of standards and certifications, boosting demand for robust solutions. In addition, rising cases of cyberattacks in the region is a major driver of the market. According to reports, 50% of UK businesses experienced some form of cyberattacks in 2023. This is prompting governments and private enterprises to strengthen their cybersecurity defenses. For example, the European Cybersecurity Industrial, Technology, and Research Competence Centre (ECCC) facilitates funding and collaboration to address these challenges. Apart from this, technological advancements, including the adoption of 5G networks, are reshaping Europe's cybersecurity landscape. While 5G accelerates digital transformation, it also introduces vulnerabilities that require enhanced security measures. The region's emphasis on AI and machine learning integration further fuels the market. These technologies allow real-time threat detection and response, thus minimizing the impact of cyberattacks. Lastly, cross-border initiatives such as the European Cybersecurity Skills Framework address workforce shortages and enhance the region’s preparedness against evolving threats. This collaborative approach strengthens Europe’s position as a leader in the global cybersecurity market.

Latin America Cybersecurity Market Analysis

Latin America's cybersecurity market is driven by increasing digitization and favorable government. With the region’s digital transformation accelerating, the need for advanced security solutions has become critical. Brazil invested USD 30.1 Billion in digital transformation, as stated by the Brazilian NR. Besides this, government initiatives and regulations play a pivotal role in driving the market. Countries like Brazil and Mexico are implementing data protection laws, such as Brazil's LGPD, which require robust cybersecurity measures to safeguard sensitive information. Regional collaborations, such as the Organization of American States' (OAS) cybersecurity programs, further enhance threat response capabilities. Furthermore, the growing adoption of cloud computing and IoT devices across industries is expanding the attack surface, necessitating innovative security solutions. This trend, coupled with increasing awareness among SMEs, ensures a positive cybersecurity market outlook.

Middle East and Africa Cybersecurity Market Analysis

The rise of e-commerce platforms and the adoption of digital payment systems in the Middle East and Africa have increased the risk of financial cybercrime. Saudi Arbia’s e-commerce industry generated USD 10 Billion in revenue in 2023, as per reports. To combat issues like phishing and transaction fraud, businesses are investing heavily in cybersecurity. Moreover, digital transformation initiatives, such as Saudi Arabia's Vision 2030 and the UAE's Smart Dubai program, are significantly increasing the demand for cybersecurity solutions. Government-led initiatives and regulations are key drivers. The UAE's National Cybersecurity Strategy and South Africa's Cybercrimes Act mandate stringent measures, compelling organizations to enhance their cybersecurity frameworks. In line with this, partnerships between governments and global tech firms foster innovation and capacity-building. Furthermore, there is a rise in the need for real-time threat detection and scalable solutions in various organizations.

Competitive Landscape:

Key players in the cybersecurity market are adopting strategic initiatives to strengthen their competitive position. They are heavily investing in research and development to create advanced solutions leveraging artificial intelligence, machine learning, and behavioral analytics for real-time threat detection and mitigation. Partnerships and collaborations are becoming common, as companies’ team up with cloud service providers, IoT firms, and governmental organizations to improve their offerings and market reach. Acquisitions of smaller, specialized cybersecurity firms are a prominent strategy, enabling market leaders to expand their technology portfolios and address specific needs like endpoint security, network monitoring, and data encryption. Additionally, companies are focusing on improving customer trust through comprehensive security-as-a-service models and robust incident response frameworks. They are also emphasizing workforce training and certification programs to address the talent gap in cybersecurity. By addressing evolving threats and regulatory requirements, key players are positioning themselves as indispensable partners in safeguarding digital ecosystems.

The report provides a comprehensive analysis of the competitive landscape in the cybersecurity market with detailed profiles of all major companies, including:

- Accenture PLC

- Broadcom Inc.

- Capgemini Service SAS

- Cisco Systems Inc.

- Cognizant Technology Solutions Corporation

- HCL Technologies Ltd.

- Infosys Limited

- International Business Machines Corporation (IBM)

- Lockheed Martin Corporation

- Palo Alto Networks, Inc.

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Trend Micro Incorporated

- Wipro Limited.

Latest News and Developments:

- January 2025: A cybersecurity solution designed for business travelers was unveiled by Boxx Insurance, an InsurTech company based in Toronto that specializes in cybersecurity and digital risk management. The launch of the product Cyber Assist is in partnership with World Travel Protection, a member of the Zurich Insurance Group.

- January 2025: Cybersecurity firm Rubrik is set for its expansion plans in India with the opening of a new facility in Bengaluru by mid of 2025 and intends to replace the operations of the company's existing two offices.

- November 2024: Cognizant introduced Cognizant Neuro Cybersecurity, a new platform to its Neuro suite. By integrating and coordinating point cybersecurity solutions throughout the organization, the most recent solution aims to increase cybersecurity resilience. Neuro Cybersecurity addresses cybersecurity issues with an intuitive, AI-powered interface that improves enterprise-wide real-time decision-making.

- August 2024: SEBI published a new cyber security framework requiring all regulated businesses to have proper security monitoring measures, which would be implemented gradually beginning in January 2025. In addition, a Cyber Capability Index (CCI) for market infrastructure institutions and qualifying regulated organizations will be developed to monitor and analyze their cybersecurity maturity and resilience on an ongoing basis.

Cybersecurity Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-based, On-premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture PLC, Broadcom Inc., Capgemini Service SAS, Cisco Systems, Inc., Cognizant Technology Solutions Corporation, HCL Technologies Ltd., Infosys Limited, International Business Machines Corporation (IBM), Lockheed Martin Corporation, Palo Alto Networks, Inc., Tata Consultancy Services Limited, Tech Mahindra Limited, Trend Micro Incorporated, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cybersecurity market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cybersecurity market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cybersecurity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cybersecurity market was valued at USD 299.6 Billion in 2024.

The cybersecurity market is expected to exhibit a CAGR of 8.9% during 2025-2033.

The market is experiencing rapid growth driven by heightening cyber security risks and incidents, rapid digital transformation and Internet of Things (IoT) adoption, the implementation of new stringent data privacy laws, and rising adoption of new advanced security solutions.

North America currently dominates the market due to its significant investments in advanced technologies and innovations.

Some of the major players in the cybersecurity market include Accenture PLC, Broadcom Inc., Capgemini Service SAS, Cisco Systems, Inc., Cognizant Technology Solutions Corporation, HCL Technologies Ltd., Infosys Limited, International Business Machines Corporation (IBM), Lockheed Martin Corporation, Palo Alto Networks, Inc., Tata Consultancy Services Limited, Tech Mahindra Limited, Trend Micro Incorporated, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)