Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End Use Industry, and Region, 2026-2034

Cyber Insurance Market Size & Trends:

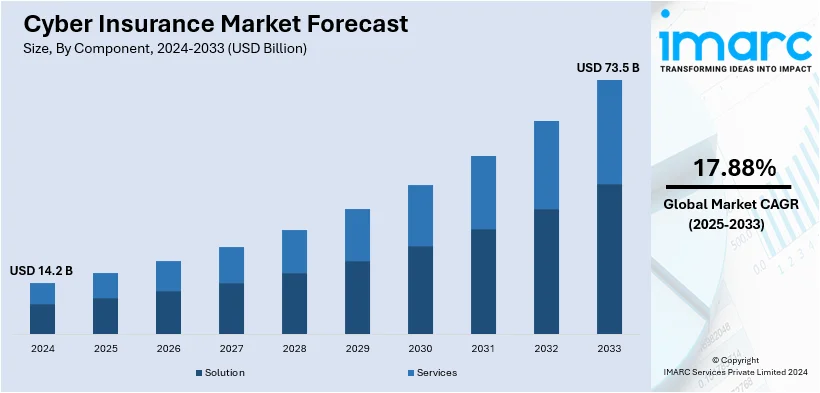

The global cyber insurance market size was valued at USD 14.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 73.5 Billion by 2034, exhibiting a CAGR of 17.88% from 2026-2034. In 2024, North America leads the market, accounting for more than 36.9% of the cyber insurance market share. This leadership is attributed to its strict regulatory adherence needs, cutting-edge digital infrastructure, and elevated cyber threat incidence. The cyber insurance industry is growing due to rising cyber threats, stricter data protection regulations, and increasing financial risks associated with breaches. Businesses are prioritizing cyber coverage to meet compliance requirements, protect sensitive data, and mitigate potential losses. Regulatory fines, legal liabilities, and the need for robust risk management strategies are further driving market expansion and policy adoption across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.2 Billion |

| Market Forecast in 2034 | USD 73.5 Billion |

| Market Growth Rate 2026-2034 | 17.88% |

The worldwide cyber insurance sector is fueled by the rising incidence and complexity of cyberattacks, compelling organizations to seek robust financial protection. Growing regulatory requirements mandating cybersecurity measures and data breach reporting are further accelerating market adoption. Moreover, the rising dependence on digital infrastructure, coupled with the proliferation of cloud computing and IoT, has heightened exposure to cyber risks, boosting demand for tailored insurance solutions. In addition to this, heightened awareness of reputational and financial impacts caused by cyber incidents is prompting businesses across industries to prioritize comprehensive cyber risk coverage.

The United States has emerged as a crucial market within the global cyber insurance industry, driven by the widespread adoption of digital technologies and increasing cyber threats. As one of the most targeted regions for cyberattacks, including ransomware and data breaches, U.S. businesses face heightened risks, prompting strong demand for comprehensive cyber insurance policies. For instance, as per industry reports, ransomware incidents are increasing across the United States, accounting for 59% of all such attacks globally. Moreover, the regulatory landscape, including state-level data protection laws and federal cybersecurity initiatives, further encourages organizations to prioritize insurance coverage. In addition, major insurers in the U.S. are leveraging advanced analytics and tailored solutions to address the unique risk profiles of various industries, solidifying the country’s position as a key player in the global market.

Cyber Insurance Market Trends:

Increase in Cyber Threats and Attacks

The increasing incidents of cybersecurity risks and data breaches are a major contributor to the expansion of the cyber insurance market. The Annual Data Breach Report indicates that in 2023, phishing and social engineering were the most prevalent, constituting 438 out of 2,365 documented cyberattacks. Moreover, the emergence of advanced technologies is leading to an increased complexity of cyber threats, as hackers utilize more refined techniques, rendering traditional security measures less effective. This is prompting businesses to pursue extensive coverage via cyber insurance. In addition to this, the increasing trend of remote work setups is generating fresh vulnerabilities in cyber security and boosting the demand for cyber insurance to guard against possible breaches. Moreover, the growing dependence of consumers on the flourishing e-commerce sector to manage significant quantities of sensitive customer information is boosting the need for cyber insurance.

Stringent Regulations and Compliance Requirements

Governments of various countries are imposing stringent data protection regulations, which is pushing businesses to adopt cyber insurance to ensure compliance and manage legal risks. Additionally, the rising adoption of insurance policies by the healthcare and finance sectors to meet compliance standards and protect sensitive information is positively influencing the market. The global health insurance market size reached USD 1,949.8 Billion in 2024. Apart from this, regulatory bodies are imposing heavier fines and penalties for data breaches, making cyber insurance a critical tool for financial protection. Furthermore, the availability of cyber insurance policies is motivating them to allocate greater resources towards cyber coverage in order to sustain customer trust and demonstrate responsibility. These factors are contributing to the cyber insurance market growth projections, with analysts anticipating a significant expansion driven by increasing regulatory mandates, rising cyber threats, and growing awareness among businesses.

Technological Advancements and Innovation in Insurance Products

The advent of advanced technologies is making cyber insurance more affordable and accessible to small and medium-sized enterprises. Additionally, insurers are using artificial intelligence (AI) and analytics to assess risks more accurately, making policies more targeted and appealing. A PwC study revealed that 63% of insurance companies have either implemented AI in their operations or plan to do so soon. The integration of insurance with existing cybersecurity tools and services is offering comprehensive protection and attracting more businesses to invest in cyber insurance. Apart from this, many insurers are providing educational resources and preventive tools along with insurance policies, which is offering a favorable cyber insurance market outlook. Moreover, collaborations between governments and insurers to develop robust cyber insurance products are creating a positive outlook for the market.

Cyber Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cyber insurance market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, insurance type, organization size, and end use industry.

Analysis by Component:

- Solution

- Services

Solution represents the leading component segment. The escalating need for insurance policies that provide businesses with an all-encompassing strategy that includes prevention, risk management, response planning, and recovery, is driving the demand for cyber insurance solutions that offer customized coverage aligned with the specific risks and needs of an organization. Additionally, solutions in the cyber insurance market include collaboration with cybersecurity experts. This holistic approach ensures the coverage of financial aspects and supports minimizing risks through technical assessments, regular monitoring, and ongoing support. Apart from this, cyber insurance solutions are designed to align with global regulations and standards, which aids in easing the compliance burden on companies. This comprehensive cyber insurance market overview highlights the growing demand for tailored solutions that integrate risk mitigation strategies, regulatory compliance support, and expert-driven cybersecurity collaboration to enhance organizational resilience.

Analysis by Insurance Type:

- Packaged

- Stand-alone

Stand-alone leads the market with around 68.3% of cyber insurance market share in 2024. Stand-alone cyber insurance refers to policies specifically designed to cover cyber risks. They ensure that the specific needs of different industries and sectors are met, and they provide comprehensive protection against an array of cyber threats. Apart from this, stand-alone cyber insurance includes immediate access to cybersecurity experts and legal assistance following a breach, which assists policyholders with financial coverage and a complete support system that aids in swift response and recovery. Furthermore, regulatory pressures and compliance requirements are driving businesses towards specialized coverage. Stand-alone cyber insurance ensures that organizations meet specific regulatory standards related to cyber risk management.

Analysis by Organization Size:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises lead the market with around 73.8% of market share in 2024. Large enterprises operate across international boundaries, subjecting them to various regulatory environments. Cyber insurance helps in navigating these complex regulations, ensuring compliance, and protecting against legal liabilities. Additionally, the increasing adoption of cyber insurance policies by large enterprises as they offer a financial safety net by covering the costs associated with breaches, including legal fees, recovery expenses, and potential fines. Apart from this, large enterprises are prime targets for sophisticated cyber-attacks. This is driving the demand for cyber insurance policies to ensure businesses have access to specialized expertise and support and a comprehensive strategy for prevention and response. Furthermore, the increasing reliance of large businesses on advanced technologies is catalyzing the demand for cyber insurance policies.

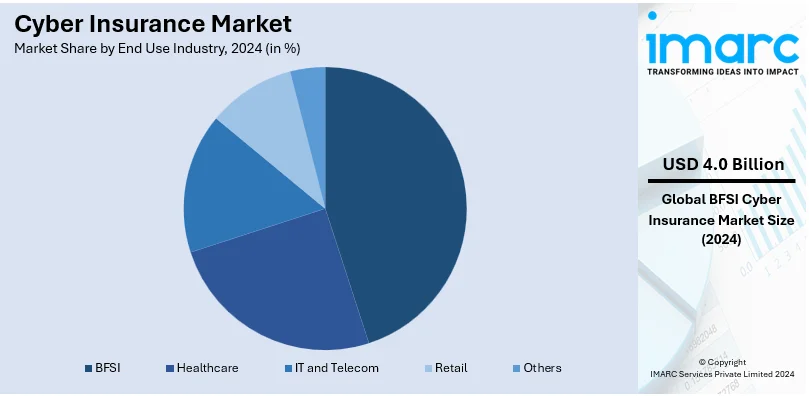

Analysis by End Use Industry:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

BFSI leads the market with around 28.2% of market share in 2024. The increasing reliance on digital platforms for daily operations and managing vast amounts of sensitive customer data is making the BFSI sector a prime target for cybercriminals, which is leading to the rising need for robust cyber protection. Cyber insurance policies offer financial coverage against potential breaches, alleviating significant financial risks. Additionally, the expanding complex and interconnected financial ecosystem is catalyzing the need for specialized coverage. Cyber insurance providers are offering tailored policies that recognize the unique risks and operational intricacies of the BFSI sector, ensuring comprehensive protection. Apart from this, innovation in financial technology (FinTech) is resulting in new vulnerabilities and exposures. Cyber insurance offers the flexibility to adapt to emerging threats and provides ongoing relevance and assurance.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

-

Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.9%. North America accounted for the largest market share as it is home to a significant number of large corporations and technology companies, which are prime targets for cyber-attacks. For instance, as per industry reports, North America recorded 58% of the ransomware attacks in the second quarter of 2024. Additionally, compliance requirements, such as those mandated by the New York Department of Financial Services and the California Consumer Privacy Act, encourage businesses to invest in cyber insurance as a part of their comprehensive risk management strategy. Apart from this, the culture of awareness and education around cybersecurity risks in North America promotes the understanding and acknowledgment of the need for protection. Moreover, technological advancement and investment in cybersecurity research in North America create a dynamic environment wherein insurance products can continually adapt to emerging threats and trends.

Key Regional Takeaways:

United States Cyber Insurance Market Analysis

In 2024, United States accounted for 87.60% of the market share in North America. Cyberattacks have become more common and complex, which has a major impact on the cyber insurance market in the U.S. An AAG article reports that cybercrimes affected 53.35 Million individuals in the U.S. during the H1 2022. This shows how crucial it is to have strong cybersecurity and financial protection. Because of this worrying trend, businesses now see cyber insurance as a key tool to manage risks and protect against money losses and damage to their reputation. Laws like the California Consumer Privacy Act (CCPA) also push companies to protect data more. Fields that deal with sensitive info such as healthcare, finance, and retail, face higher risks. The increased use of IoT devices and cloud computing has made the cyber threat scene bigger leading to more demand for full insurance coverage. Insurance companies are also making their products more attractive by adding extras like risk checks and plans for dealing with incidents. Team-ups between public and private groups to boost cybersecurity knowledge and toughness help grow the market too. As more people realize the possible dangers of cyber incidents, the U.S. stays ahead in using and expanding cyber insurance options.

Europe Cyber Insurance Market Analysis

Stringent rules, tech upgrades, and more cyberattacks push the European cyber insurance scene. AAG's article shares that in 2023, 32% of UK companies experienced a cyber incident, with the number jumping to 59% for medium firms and 69% for bigger ones. This worrying pattern shines a light on the need for solid cyber risk handling methods. Cyber insurance is becoming key to deal with money and operational harm. GDPR enforces harsh follow-the-rules or pay-the-price for leaks pushing firms to get cyber insurance. With more Industry 4.0 stuff like IoT and automated tech in fields like making stuff, selling, and money stuff weak spots get bigger. Plus, working from home and online buying and selling after the sickness made cybersecurity risks even worse. Insurance folks are stepping up their game giving services like checking out risks helping when bad stuff happens, and always keeping an eye out, which is a big plus for businesses. Joint projects between government and business peeps are making sure more people know about staying safe online and beefing up our digital defenses. As companies are looking into staying safe online, Europe is going strong as a top place for taking up cyber insurance.

Asia Pacific Cyber Insurance Market Analysis

The cyber insurance market in Asia-Pacific (APAC) is growing fast due to quick digitization and more IoT tech use. Microsoft's IoT Signals report shows Australia leads in IoT use, with 96% of companies using IoT in their work. This wide use has made the cyber threat scene bigger pushing businesses to look for strong ways to cut risks, like cyber insurance. Key areas like finance, healthcare, and IT now focus more on staying safe from cyber threats as they face more data breaches and ransomware attacks. Rules like China's Cybersecurity Law and Singapore's Cybersecurity Act make businesses want to get cyber insurance to follow rules and manage risks. Plus, the fast growth of online shopping and digital payments in places like India and Southeast Asia shows the need for better cybersecurity. As people learn more about cyber risks more APAC businesses are getting cyber insurance.

Latin America Cyber Insurance Market Analysis

The cyber insurance market in Latin America is gaining momentum as businesses face rising cybercrime and data breaches. In February 2022, StrikeForce Technologies partnered with Zentek Corporation to integrate GuardedID and MobileTrust into personal cyber insurance policies for Brazil’s banking and financial sectors, with a launch expected by mid-2022. Brazil, as one of the largest economies in Latin America, is particularly vulnerable to cyber threats such as identity theft and online fraud, driving the need for advanced cybersecurity solutions. As digital transformation accelerates across the region, demand for cyber insurance solutions to mitigate these risks continues to grow.

Middle East and Africa Cyber Insurance Market Analysis

The cyber insurance market in the Middle East and Africa (MEA) is driven by the rapid digitalization of industries and increasing cyberattacks. According to Edge Middle East, 82% of organizations in the Middle East and Türkiye reported experiencing at least one cybersecurity incident between 2022 and 2024, with most facing multiple attacks. This surge in cybercrime, targeting critical sectors like energy, finance, and healthcare, highlights the need for comprehensive risk mitigation. As governments and businesses invest in stronger cybersecurity frameworks, the demand for cyber insurance solutions to manage financial and operational risks is rapidly growing in the region.

Competitive Landscape:

The competitive landscape is represented by the presence of established insurers and emerging firms offering specialized policies. Major providers are actively emphasizing on proliferating their portfolios to mitigate the transforming cyber risks, incorporating leading-edge analytics and risk assessment tools to improve underwriting precision. In addition to this, tactical collaborations between technology firms, insurers, and cybersecurity companies are rapidly becoming prevalent, facilitating advancements in risk controlling solutions. For instance, in December 2024, CyberCube announced a strategic partnership with St. Andrews Insurance Brokers to deploy its platform for Broking Manager. This move targets to aid St. Andrews in improving cyber insurance portfolio for its customers and assessing feasible cyber losses. Besides this, industry giants are also investing heavily in customized services to address the varying business requirements across key sectors. Furthermore, both international and regional insurers are utilizing digital platforms to optimize policy claims and distribution management, fortifying their competitive dominance. Intense competition continues to bolster innovations in coverage options and consumer-centric solutions.

The report provides a comprehensive analysis of the competitive landscape in the cyber insurance market with detailed profiles of all major companies, including:

- Allianz Group

- American International Group Inc.

- AON Plc

- AXA XL

- Berkshire Hathaway Inc.

- Chubb Limited (ACE Limited)

- Lockton Companies Inc.

- Munich ReGroup or Munich Reinsurance Company

- Lloyd's of London

- Zurich Insurance Company Limited

Latest News and Developments:

- January 2025: TATA AIG introduced CyberEdge, an all-inclusive cyber insurance product for Indian companies, providing protection against cyber threats like forensic investigations, data recovery, and ransom payments. The policy seeks to secure 25% of India's cyber insurance sector in five years, responding to the increasing need caused by escalating cyber threats.

- January 2025: WTW introduced CyCore Asia, a cyber insurance solution specifically designed for companies in Hong Kong and Singapore, backed by QBE Insurance Group and AXA XL. The facility provides coverage of up to USD 15 million, tackling emerging cyber threats, particularly those heightened by artificial intelligence. It additionally offers companies access to cybersecurity experts and risk management services to boost resilience.

- January 2025: Old Republic International established a new subsidiary, Old Republic Cyber, to provide Cyber and Technology Errors & Omissions (E&O) insurance solutions. This signifies the seventh specialty firm established by Old Republic over the last nine years.

- December 2024: HITRUST launched a cyber insurance consortium in collaboration with Lloyd's of London, offering enhanced coverage and lower rates for HITRUST-certified organizations. The initiative, backed by globally recognized AA-rated insurers, rewards organizations with strong cybersecurity practices. It aims to create a more stable and competitive insurance market by aligning certification with risk management.

- September 2024: Markel rolled out FintechRisk+, a fresh cyber insurance deal for FinTech companies. It covers tech issues, bosses’ mistakes, theft, and online dangers. This deal tackles new problems such as ransomware. Nick Rugg, who's in charge of FinTech Protection at Markel, pointed out this increasing worry.

- July 2024: · Resilience, one of the cyber risk solution providers, has increased the limit of the cyber insurance for clients in the U.S. to a whopping USD 20 Million, thereby doubling it. This change was brought about after the offering of so many new features to help enterprises manage cyber risks and transfer them. The increase is available through Lockton Re, which utilizes Resilience's existing Lloyd's partnership. Earlier, Resilience's coverage was up to USD 10 Million and the increased amount of USD 10 Million in excess limits is provided by Lloyd's underwriters, thus extending the total limit to USD 20 Million.

- December 2023: Chubb partnered with NetSPI to boost cyber-risk control for policyholders in the U.S. and Canada. It gave customers the option of tapping into NetSPI's security offerings like "BAS," "ASM," and "penetration testing" at special rates. The collaboration seeks to assist companies in spotting security weaknesses and hazards prior to them becoming claims thereby beefing up overall protection.

- August 2023: Zurich Holding Company of America, a subsidiary of Zurich Insurance Group, has acquired SpearTip, a cyber counterintelligence firm. This acquisition enhances Zurich's cyber insurance offerings, expanding its services to meet the increasing demand for comprehensive cyber risk management and threat mitigation.

- March 2023: F-Secure and Allianz Partners launched a cyber security suite in the second half of 2023, combining protection and insurance for devices, browsing, malware, ID monitoring, and parental controls. The solution followed a successful pilot in Switzerland, where F-Secure's Internet Security, insured by Allianz, received high ratings from 88% of respondents, with 85% acknowledging its added value to Allianz's services.

Cyber Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allianz Group, American International Group Inc., AON Plc, AXA XL, Berkshire Hathaway Inc., Chubb Limited (ACE Limited), Lockton Companies Inc., Munich ReGroup or Munich Reinsurance Company, Lloyd's of London, Zurich Insurance Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cyber insurance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cyber insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cyber insurance is a specialized policy designed to protect businesses and individuals against monetary damages resulting from cyberattacks, data leaks, and various other digital risks. It typically covers costs related to data recovery, legal fees, notification requirements, and business interruption, ensuring comprehensive risk management in the digital landscape.

The cyber insurance market was valued at USD 14.2 Billion in 2024.

IMARC estimates the global cyber insurance market to exhibit a CAGR of 17.88% during 2025-2033.

The market is driven by rising cyber threats, increasing data breaches, stringent regulatory requirements, growing reliance on digital infrastructure, and heightened awareness of financial and reputational risks, prompting businesses to adopt comprehensive coverage for safeguarding sensitive data and mitigating potential losses.

In 2024, solution represented the largest segment by component, driven by the amplifying need for tailored offerings.

Stand-alone leads the market by insurance type, driven by notable increase in comprehensive coverage demands.

The large enterprises are the leading segment by organization size, driven by higher budgets and extensive risk exposure.

In 2024, BFSI represented the largest segment by end use industry, driven by critical data protection needs.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global cyber insurance market include Allianz Group, American International Group Inc., AON Plc, AXA XL, Berkshire Hathaway Inc., Chubb Limited (ACE Limited), Lockton Companies Inc., Munich ReGroup or Munich Reinsurance Company, Lloyd's of London, Zurich Insurance Company Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)