Customer Data Platform Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Application, Vertical, and Region, 2025-2033

Customer Data Platform Market 2024, Size and Trends:

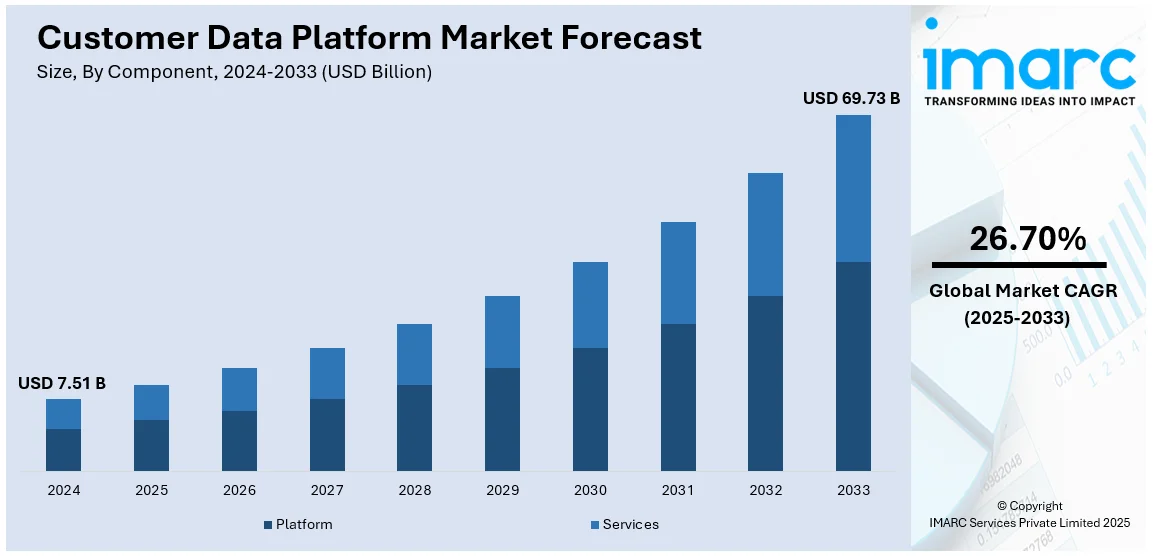

The global customer data platform market size was valued at USD 7.51 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 69.73 Billion by 2033, exhibiting a CAGR of 26.70% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.0% in 2024, driven by technological infrastructure, widespread adoption of customer data platforms, robust investment in AI and analytics, and strong regulatory frameworks promoting data privacy and security. The global customer data platform market share is growing rapidly due to the increasing demand for personalized customer experience, widespread integration of artificial intelligence and machine learning, rising adoption of privacy-first solutions, and elevating demand for real-time data processing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.51 Billion |

|

Market Forecast in 2033

|

USD 69.73 Billion |

| Market Growth Rate (2025-2033) | 26.70% |

One major driver of the customer data platform market share is the enhancing requirement for personalized customer experiences. Businesses are prioritizing tailored marketing strategies to enhance customer engagement and loyalty, necessitating advanced platforms that integrate and analyze multi-channel data in real time. CDPs enable organizations to unify customer data from various sources, creating comprehensive profiles that inform targeted campaigns and personalized interactions. The rising consumer expectations for customized experiences, coupled with competitive pressures, are compelling companies to invest in CDP solutions. For instance, in 2024, Tealium, recognized as a Strong Performer in Forrester Wave for B2C CDPs, leverages 2,500+ partners to enhance personalization, data-driven CX, and strategic customer data activation globally. This is further reinforced by advancements in AI and analytics, which enhance the platform’s ability to deliver actionable insights.

The United States plays a pivotal role in advancing the customer data platform market growth through technological innovation, a robust digital infrastructure, and a thriving ecosystem of technology providers. U.S.-based companies lead in developing cutting-edge CDP solutions that leverage AI and machine learning for advanced customer analytics and personalized marketing. SAS estimates that by 2026, over 75% of organizations will leverage generative AI to create synthetic customer data, revolutionizing data-driven strategies and customer insights. SAS empowers innovation by providing accessible, high-quality data, reinforcing its leadership in AI and advanced analytics. The country’s strong focus on data privacy compliance, such as adherence to CCPA regulations, has driven the evolution of secure and transparent CDP functionalities. Moreover, high adoption rates across industries, including retail, finance, and healthcare, position the U.S. as a global leader in shaping trends and providing the custom data platform market outlook.

Customer Data Platform Market Trends:

Integration of Artificial Intelligence and Machine Learning

The merger of AI and machine learning is boosting the customer data platform market demand, allowing businesses to use predictive analytics with automation. AI-based CDPs process data in better ways by determining trends that help them figure out customers' future actions and personalize customer interactions in real-time. These technologies improve segmentation and targeting accuracy and enable business concerns to deliver the right marketing message at the right time. As the demand grows for actionable insight, CDP providers are becoming increasingly equipped to offer more mature data analytics along with decision-making tools-advancing industry innovation and the adoption of newer technologies. For instance, more than four-fifths (80%) of organizations have adopted artificial intelligence in some capacity, with nearly 35% of them leveraging AI solutions across several departments. Over 80% of executives believe automation has the potential to be applied to any business decision, highlighting its growing importance across industries.

Growing Adoption of Privacy-First Solutions

As data privacy regulations continue to be enforced, including the General Data Protection Regulation in Europe and the California Consumer Privacy Act in the United States, compliance is now being given top priority in data management strategies. For instance, in 2024, Salesforce's Data Cloud, powering Agentforce and Customer 360, achieved 130% growth, adding AI-driven insights, unstructured data processing, semantic models, real-time activations, enhanced search, and robust security features. CDPs are changing the way they approach privacy-first solutions that allow secure handling of customer data to ensure there is full transparency. Capabilities like managing user consent, anonymizing data, and ensuring compliance with regulatory reporting are increasingly becoming standard practices. These improvements allow businesses to establish trust with customers and reduce the risk of non-compliance, which makes CDPs a critical component in privacy-conscious markets.

Rising Demand for Real-Time Data Processing

As customer expectations for instant and personalized experiences grow, the demand for real-time data processing within CDPs is surging. Businesses are seeking solutions capable of analyzing and responding to customer interactions as they happen, enabling dynamic adjustments to marketing strategies. Real-time capabilities empower companies to engage customers through timely and contextually relevant communications, boosting retention and satisfaction. CDPs equipped with real-time data processing are becoming critical for industries such as e-commerce, finance, and telecommunications, where rapid decision-making and agility are essential to maintain a competitive edge. This trend is driving continuous development and adoption of advanced CDP functionalities. According to industry reports, the BFSI sector is projected to experience the highest rise in software investments, with a growth rate of 13.5% anticipated for 2023.

Customer Data Platform Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global customer data platform market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, organization size, application, and vertical.

Analysis by Component:

- Platform

- Services

The platform component of the Customer Data Platform (CDP) market serves as the core infrastructure for data collection, integration, and management. It enables businesses to unify customer data from multiple sources, create comprehensive profiles, and generate actionable insights. Cutting-edge capabilities such as artificial intelligence-powered insights and instantaneous data analysis significantly improve tailored marketing approaches and boost customer interaction initiatives.

The services component in the CDP market includes implementation, customization, consulting, and support. These services help businesses optimize platform utilization by tailoring solutions to unique requirements. They ensure seamless integration with existing systems, enable ongoing maintenance and provide training to maximize ROI. Professional and managed services play a critical role in ensuring effective adoption and sustained performance.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

As per the latest customer data platform market forecast, cloud-based leads the market in 2024. This is fueled by their scalability, flexibility, and cost efficiency. Businesses prefer more cloud-based CDPs for their integration capability with existing systems as well as the management of a massive volume of customer data spread over multiple channels. These enable the processing of data in real-time and analytics capabilities, empowering the organization to efficiently deliver the customer experience as intended. Strong security features and compliance capabilities from major cloud providers have mitigated increasing data privacy concerns and regulatory requirements. In addition, the emergence of remote work and digital transformation is accelerating the use of cloud-based CDPs because business entities focus on user-friendly, centralized, and collaborative tools that optimize marketing strategy and customer engagement activities.

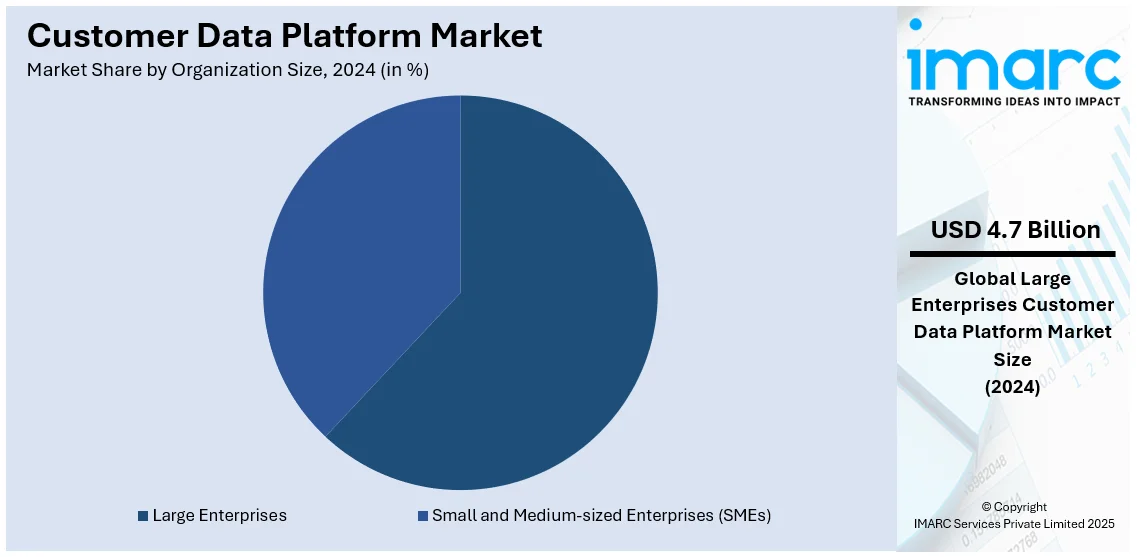

Analysis by Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Large enterprises lead the market with around 62.2% of the market share in 2024. Their leadership is driven by the need to manage vast volumes of customer data generated from diverse channels and operations. Large enterprises leverage CDPs to unify fragmented data, enabling comprehensive customer profiles and facilitating personalized marketing strategies at scale. Their substantial budgets and advanced IT infrastructure support the adoption of sophisticated CDP solutions, including AI-driven analytics and real-time data processing. Additionally, compliance with stringent data privacy regulations and the growing emphasis on improving customer retention further boost CDP adoption in large enterprises, positioning them as key contributors to market growth and technological advancements in the sector.

Analysis by Application:

- Personalized Recommendations

- Predictive Analytics

- Marketing Data Segmentation

- Customer Retention and Engagement

- Security Management

- Others

Predictive analytics leads the market with around 33.4% of market share in 2024. Its growth is due to the increasing desire for data-centric insights that may predict customer behaviors, preferences, and purchasing trends. Advanced algorithms and machine learning models in predictive analytics enable a business to make predictive decisions, optimal marketing efforts, and help engage customers. With the predictive capabilities integrated in real-time, organizations can identify trends, segment audiences, and deliver personal experiences. Increasing competition across various industries leads to the increased adoption of predictive analytics, supported by its proven capability to enhance customer retention, maximize ROI, and align business strategies with future market demands, which are helping it gain the top position in the CDP market.

Analysis by Vertical:

- Retail and E-commerce

- BFSI

- Media and Entertainment

- IT and Telecommunication

- Others

Retail and e-commerce leads in 2024 as both of these industries require personalized shopping experiences and customer engagement. These industries generate much more data by involving touchpoints like online stores, mobile applications, and physical retail outlets. A CDP helps retailers gather this data, unify customer profiles, and send real-time tailored marketing campaigns. The growing trend of omnichannel strategies and the rising significance of customer loyalty also push the adoption of CDPs. Moreover, the competitive environment of the retail and e-commerce sectors forces companies to implement CDPs to analyze purchase behavior, enhance customer retention, and increase sales. These capabilities position retail and e-commerce as market leaders in the CDP market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0%, driven by its advanced digital infrastructure, high adoption of marketing automation technologies, and emphasis on personalized customer experiences. Companies across all sectors, such as retail, finance, and healthcare, are using CDPs to unify customer data, enhance engagement, and create loyalty. The California Consumer Privacy Act and other supportive regulatory frameworks have fueled the demand for secure and compliant data management solutions. Moreover, many leading CDP providers and technology innovators are based in North America, thus fostering continuous advancement in AI-driven analytics and real-time data processing, thereby consolidating the region's leadership position in the global CDP market.

Key Regional Takeaways:

United States Customer Data Platform Market Analysis

US accounts for 83.3% share of the market in North America. The adoption of customer data platforms (CDPs) is accelerating in large enterprises, particularly due to the increasing reliance on cloud services, which provide the infrastructure necessary for handling vast amounts of data. According to survey, over 51% of businesses now leverage cloud services. As the volume of data grows within major organizations, the need for unified systems that can integrate, analyze, and manage this information efficiently becomes critical. Cloud technologies have enabled these organizations to scale their data management capabilities, allowing them to improve customer experiences and drive growth. CDPs offer a central hub where all customer information can be accessed and utilized across various departments, providing a single view of the customer. With cloud capabilities ensuring data accessibility and security, these enterprises are empowered to leverage their customer insights for personalized services, better decision-making, and a more tailored approach to customer relationship management. The availability of scalable cloud-based CDP solutions makes them an ideal fit for businesses of large scale, further driving their adoption in this sector.

Asia Pacific Customer Data Platform Market Analysis

In the Asia-Pacific region, the increasing adoption of customer data platforms is being propelled by the rapid growth of small and medium-sized enterprises (SMEs). According to India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. SMEs are leveraging CDPs to enhance customer engagement, improve marketing effectiveness, and optimize data-driven decision-making. As these businesses expand and compete in an increasingly digital marketplace, they face the challenge of managing customer data from diverse sources. CDPs offer a solution by centralizing this data into a single platform, enabling SMEs to gain better insights and make more informed decisions. The growing digitalization and internet penetration in this region are further accelerating the adoption of CDPs, as SMEs seek to capitalize on customer data to drive business growth. With the increased availability of affordable CDP solutions tailored for smaller enterprises, the demand for such platforms is expected to continue growing, empowering SMEs to compete on a more level playing field with larger organizations.

Europe Customer Data Platform Market Analysis

The growing adoption of customer data platforms (CDPs) in Europe is largely driven by the expansion of the banking, financial services, and insurance (BFSI) sector. Reports indicate that in 2021, the European Union housed 784 foreign bank branches, with 619 originating from other EU Member States and 165 from non-EU countries. This industry is undergoing a digital transformation, with a stronger focus on leveraging customer data to enhance personalization, improve operational efficiency, and ensure regulatory compliance. CDPs offer a centralized data solution that allows organizations to integrate customer information from various channels, providing a 360-degree view of the customer. This enables BFSI institutions to provide more targeted products, services, and communication while maintaining data privacy and security. With the increasing regulatory focus on data protection and customer rights, CDPs also help ensure compliance with stringent regulations. As the BFSI sector continues to digitalize and adopt more advanced technologies, the need for robust data management solutions like CDPs will continue to rise, driving their adoption across the region.

Latin America Customer Data Platform Market Analysis

In Latin America, the rise in the adoption of customer data platforms is fuelled by the expanding retail and e-commerce sector. According to reports, the Latin America market currently boasts over 300 Million digital buyers. With a growing emphasis on digitalization and improved customer experiences, businesses are looking for ways to streamline their operations and better understand consumer behavior. CDPs enable companies to gather and analyze data from various touchpoints such as online purchases, website interactions, and social media, creating a unified customer profile. This provides businesses with the insights needed to personalize their marketing strategies, boost customer loyalty, and improve sales. As e-commerce continues to grow in the region, the demand for solutions that can centralize and manage customer data efficiently is increasing. CDPs are essential tools for retailers, enabling them to refine their marketing strategies and leverage data insights to drive better business outcomes and improve overall efficiency.

Middle East and Africa Customer Data Platform Market Analysis

In the Middle East and Africa, the growing adoption of customer data platforms is being driven by the IT and telecommunications sector. For instance, total expenditure on information and communications technology (ICT) in the Middle East, Türkiye, and Africa (META) region is projected to exceed USD 238 billion in 2024, reflecting a 4.5% growth compared to the previous year. These industries generate vast amounts of customer data through multiple touchpoints, such as mobile devices, online platforms, and customer service interactions. CDPs help these organizations aggregate, analyze, and leverage this data to improve customer satisfaction, deliver personalized services, and optimize marketing efforts. The increasing demand for digital services in these regions has made it crucial for telecom and IT companies to find ways to manage and make use of customer data efficiently. By consolidating data across various channels into a single platform, CDPs allow companies to create more targeted offerings, enhance customer engagement, and improve overall business performance. As the region continues to embrace digital transformation, CDPs are becoming a key solution for improving data management and maximizing customer insights.

Competitive Landscape:

The competitive landscape of the customer data platform (CDP) market is marked by the presence of established technology companies and innovative startups. Key players dominate the market with comprehensive CDP solutions integrated into their existing ecosystems. Emerging providers focus on niche functionalities, such as advanced analytics, real-time processing, and seamless multi-channel integration, to gain market traction. Strategic partnerships, acquisitions, and R&D investments are critical to gaining a competitive edge. For instance, in 2024, Adobe introduced key advancements in customer data management at its summit, emphasizing partnerships and AI tools. In collaboration with NBCUniversal, it leverages first-party data for targeted marketing. The AI Assistant enhances productivity, simplifies tasks, and improves customer engagement. Features like federated audience composition and first-party data activation in Real-Time CDP enable secure data management without third-party cookies. Compatible with platforms like AWS and Snowflake, Adobe’s solutions streamline marketing and deliver actionable insights. Additionally, increasing demand for data-driven insights, personalized marketing, and compliance with evolving data privacy regulations intensifies competition, driving continuous innovation in the CDP market.

The report provides a comprehensive analysis of the competitive landscape in the customer data platform market with detailed profiles of all major companies, including:

- Acquia Inc.

- ActionIQ

- Adobe Inc

- BlueConic

- Dun & Bradstreet

- Leadspace Inc

- Microsoft Corporation

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Tealium Inc.

- Teradata Corporation

- Twilio Inc

Latest News and Developments:

- January 2025: TurmaFinTech, a fintech startup backed by Kazakhstan's ex-Deputy PM, has launched a CRM system aimed at assisting US community banks. The system helps bridge technological gaps, boost sales, reduce customer churn, and manage customer relationships effectively. It also facilitates targeted customer communications. This launch is designed to enhance operational efficiency for community banks.

- January 2025: Klaviyo has introduced new AI-powered analytics features that help B2C marketers personalize experiences at scale and optimize performance across channels. These advancements allow brands to leverage raw customer data for smarter decision-making, leading to measurable cost savings and revenue growth. Marketers can now drive better results effortlessly through Klaviyo's unified platform.

- December 2024: Veeam Software has launched Veeam Data Platform v12.3, featuring enhanced enterprise capabilities. Key updates include support for backing up Microsoft Entra ID, proactive threat analysis tools, and Generative AI for smarter data protection. The release also expands data portability with Nutanix AHV support and integrates with Veeam Data Cloud Vault v2 for secure cloud storage access.

- September 2024: Tideworks Technology launched its new Tideworks Data Platform at the 2024 Customer Conference, celebrating its 25th anniversary. The platform provides secure, real-time data access and integrates with Tideworks’ terminal operating systems to improve data quality and decision-making. The solution aims to boost productivity and business value by optimizing data strategies for terminal operations. Tideworks continues to innovate and evolve to meet the needs of a rapidly changing industry.

- July 2024: Braze has launched the Braze Data Platform, offering a composable set of data capabilities and integrations to streamline data unification, activation, and distribution. The platform enables marketers to create relevant, memorable customer engagements by leveraging unified and contextualized data. Research highlights that only a small percentage of brands are effectively utilizing customer behavior and sentiment data. Designed for flexibility, the platform allows seamless integration with brands' existing technologies and workflows.

Customer Data Platform Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Platform, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises (SMEs) |

| Applications Covered | Personalized Recommendations, Predictive Analytics, Marketing Data Segmentation, Customer Retention and Engagement, Security Management, Others |

| Verticals Covered | Retail and E-commerce, BFSI, Media and Entertainment, IT and Telecommunication, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acquia Inc., ActionIQ, Adobe Inc, BlueConic, Dun & Bradstreet, Leadspace Inc, Microsoft Corporation, Oracle Corporation, Salesforce Inc., SAP SE, SAS Institute Inc., Tealium Inc., Teradata Corporation, Twilio Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the customer data platform market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global customer data platform market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the customer data platform industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The customer data platform market was valued at USD 7.51 Billion in 2024.

IMARC estimates the customer data platform market to exhibit a CAGR of 26.70% during 2025-2033, reaching USD 69.73 Billion in 2033.

The customer data platform (CDP) market demand is driven by increasing demand for personalized marketing, rising adoption of AI and analytics, integration of multi-channel customer data, and a growing focus on customer retention. Enhanced data privacy regulations and real-time insights further boost CDP adoption across industries for improved customer engagement and business outcomes.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the customer data platform market include Acquia Inc., ActionIQ, Adobe Inc, BlueConic, Dun & Bradstreet, Leadspace Inc, Microsoft Corporation, Oracle Corporation, Salesforce Inc., SAP SE, SAS Institute Inc., Tealium Inc., Teradata Corporation, Twilio Inc, etc.

Several key applications in the customer data platform market include personalized recommendations, predictive analytics, marketing data segmentation, customer retention and engagement, and security management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)