Current Sensor Market Size, Share, Trends and Forecast by Type, Current Sensing Technology, Sensing Method, Application, End Use, and Region, 2025-2033

Current Sensor Market Size and Share:

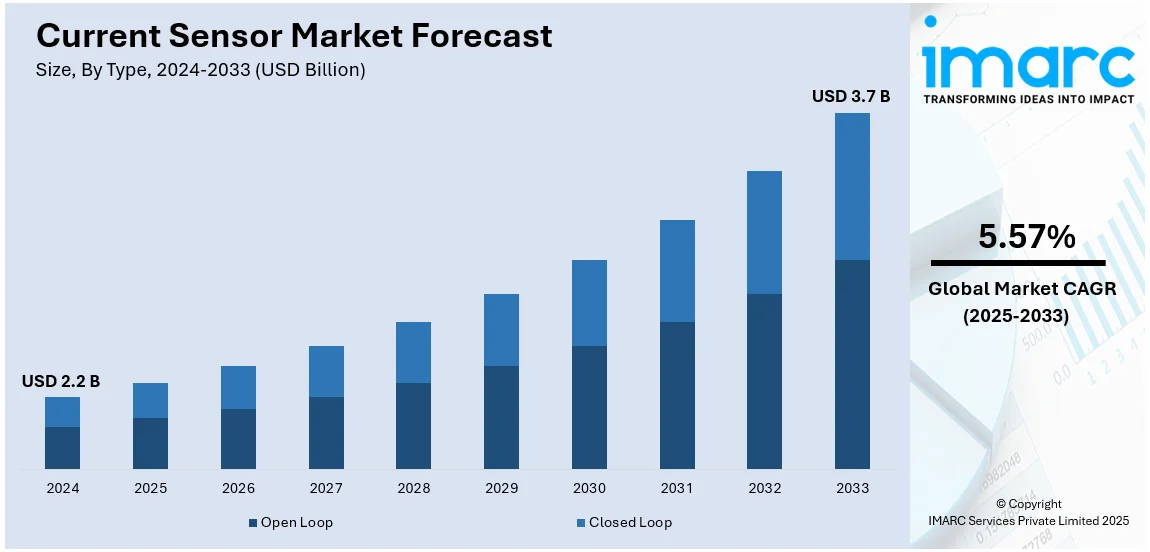

The global current sensor market size was valued at USD 2.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.7 Billion by 2033, exhibiting a CAGR of 5.57% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 32.0% in 2024. The growing demand for energy-efficient devices, increasing adoption of electric vehicles, and advancements in sensor technology are factors driving the global current sensor market share across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.2 Billion |

|

Market Forecast in 2033

|

USD 3.7 Billion |

| Market Growth Rate (2025-2033) | 5.57% |

With the escalating demand for energy-efficient systems across various industries like consumer electronics, automotive, and industrial automation, there has been a positive impact on current sensor industry. Electric vehicles (EVs) and hybrid electric vehicles (HEVs) have extensively increased the requirement for accurate current sensing solutions for battery management and motor control. With the integration of renewable sources such as solar and wind, more advanced current sensors are being implemented to optimize power monitoring for proper grid integration. The current sensor market growth increases further due to increased demand from the adoption of smart grids and energy storage systems as correct current measurement is important in maximizing energy utilization. In the consumer electronics domain, expansion of the IoT devices, smartphones, and wearables calls for the use of compact, high-performing current sensors for better battery optimization. According to the IMARC Group, the global smartphone market is expected to reach 1,998.2 Million Units by 2033.

Industrial automation and robotics also drive the current sensor market demand, since real-time monitoring of current will improve efficiency and safety in the operation. Improvements in technological aspects, including Hall-effect and magneto-resistive sensors, are yielding better accuracy and response time while miniaturization is making it more suitable for various applications. Stringent government regulations on energy efficiency and the electrical safety standard are also making industries opt for advanced current sensing solutions. Increased attention in predictive maintenance and condition monitoring within industries is further building the adoption of current sensors to ensure reliability and efficiency in other applications as well.

Current Sensor Market Trends:

Increasing demand for data centers and cloud computing

The rapid growth in the expansion of data centers and cloud computing infrastructure is an important driver for the global current sensors market. Data centers need efficient power management and monitoring solutions to ensure an uninterrupted operation with the exponential growth of digital data, artificial intelligence, and high-performance computing. Current sensors play an important role in data centers to enable real-time monitoring of the current, as well as facilitate load balancing and fault detection for preventing system failure and efficient use of energy. High-precision current sensors also become critical components in hyperscale data centers of Amazon, Google, and Microsoft, in controlling massive electrical loads. As energy prices and environmental factors continue to climb, data center operators are turning to advanced current sensing solutions for power efficiency improvements, strict compliance with regulatory standards, and decreased carbon footprints. The increased adoption of edge computing and distributed data centers create a positive current sensor market outlook.

Growth in industrial electrification and smart manufacturing

Another significant driver for the current sensors market is the growing trend towards industrial electrification and smart manufacturing. With industries switching to electrically powered machines and automated production lines, it becomes essential to monitor current in real time for efficiency, safety, and reliability. Industry 4.0 has resulted in the development of smart factories with interconnected devices, robotics, and automation systems requiring accurate current sensing for operational stability. Predictive maintenance, with current sensors working real-time, also helps avoid a lot of the equipment failure with reduced downtime to save on time and costs for improved productivity. In addition, the installation of current sensors into industrial motors, drives, and control systems boosts energy management to optimize power supply. The demand for highly accurate, miniaturized current sensors with wireless connectivity is going to increase rapidly in the wake of companies becoming increasingly focused on sustainability and energy efficiency.

Advancements in medical devices and healthcare equipment

Fuelling the health care industry's high-precision current sensors requirements is the steadily rising need for advanced, complex medical devices and equipment. Modern medial technologies, such as MRI scanners, CT machines, ventilators, and robotic surgical systems, are highly dependent on stable and efficient power management to ensure that all devices function correctly and failure-free. Current sensors are a critical component in these applications, monitoring power consumption, fault detection, and preventing electrical malfunctions. With the rising adoption of wearable health monitoring devices, such as smartwatches and biosensors, compact and low-power current sensors are increasingly becoming a requirement for battery optimization and real-time data collection. According to the IMARC Group, the global wearable medical devices market is expected to reach USD 149.08 Billion by 2033.

Current Sensor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global current sensor market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, current sensing technology, sensing method, application, and end use.

Analysis by Type:

- Open Loop

- Closed Loop

Open loop dominates the market in 2024, due to their cost effectiveness, simplicity, and applicability for a wide variety of applications, the open-loop current sensors segment still reigns large in the market. Open-loop sensors based on Hall-effect or magneto-resistive technology are preferable because of their high feasibility, low power consumption, small size, and ease of integration into electronic circuits. These sensors offer the required accuracy in applications such as battery monitoring, electric vehicle power management, industrial automation, and consumer electronics. Their high frequency operation and tolerance to external electromagnetic interference also add to their advantages in high-speed power electronics and renewable energy systems.

Analysis by Current Sensing Technology:

- Hall Effect

- Current Transformer

- Flux Gate

- Rogowski Coil

Hall effect holds the maximum number of shares on account of its superior advantages in accuracy, reliability, and versatility across various applications. These sensors do not wear out easily and are highly durable as they can measure AC and DC currents without physical contact, unlike shunt resistors or transformers. They are relatively small in size, inexpensive, and can function in harsh environments, such as high temperatures or electromagnetic interference, which makes them very popular. Furthermore, advancements in semiconductor technology improve the sensitivity of semiconductors and integration with digital signal processing, thus making them much more efficient for smart grids, data centers, and IoT applications. All these advantages place Hall-effect sensors as the leader in the current sensing market.

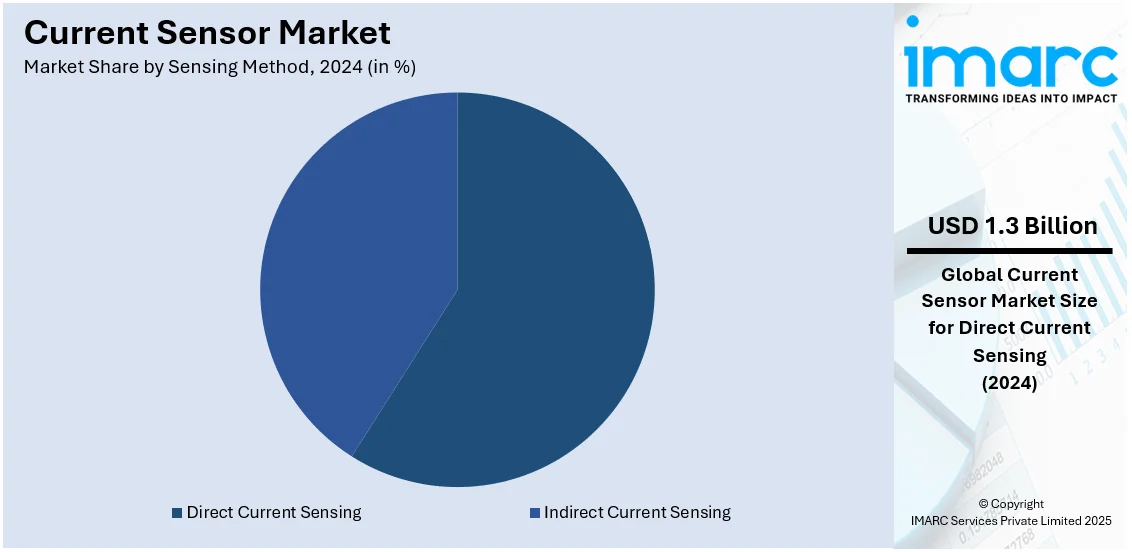

Analysis by Sensing Method:

- Direct Current Sensing

- Indirect Current Sensing

Direct current sensing dominates the market holding 58.7% of market shares, due to its paramount role in several high-growth applications, such as electric vehicles (EVs), renewable energy systems, industrial automation, and consumer electronics. This is because DC sensing is highly critical for efficient battery management in EVs and energy storage systems to ensure proper charging/discharging and health of the batteries. This in itself fuels demand because DC sensors are required for monitoring photovoltaic (PV) panels and optimizing energy conversion. Furthermore, DC-powered systems in industrial automation need constant monitoring of current for efficiency, safety, and predictive maintenance.

Analysis by Application:

- Motor Drive

- Converter and Inverter

- Battery Management

- Uninterrupted Power Supply (UPS) and Switched-Mode Power Supply (SMPS)

- Starter and Generators

- Grid Infrastructure

- Others

Motor drive dominates the market in 2024, on account of the widespread use in automotive, industrial automation, consumer electronics, and HVAC systems. Electric motors form an integral part of many applications, ranging from factory machinery to robotics, home appliances, and electric vehicles (EVs). Present-day current sensors significantly play a key role in the application of motor drives by permitting an accurate tracking and control of the electric current flowing through an apparatus, while achieving energy efficiency and performance enhancement. Moreover, an increasing implementation of variable frequency drives (VFDs) for controlling industrial motors' operating speeds to raise productivity levels drives up the usage of current sensors.

Analysis by End Use:

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Telecom

- Renewable Energy

- Others

Industrial hold maximum number of shares on account of the high penetration of automation, electrification, and smart manufacturing technologies. Industries rely on current sensors for power monitoring, motor control, and predictive maintenance to enhance operational efficiency and prevent equipment failures. With the evolution of Industry 4.0, smart factories, and industrial IoT (IIoT), industries are including sophisticated current sensors that help reduce downtime, increase efficiency, and increase productivity as a whole. Additionally, an increase in concerns related to sustainability and energy efficiency drives industries toward utilizing high-precision current sensors to effectively manage power in machinery, robotics, and control systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 32.0%, primarily due to rapid industrialization, a strong electronics manufacturing base, and increasing adoption of electric vehicles. Countries like China, Japan, South Korea, and India are major hubs for consumer electronics, automotive, and industrial automation, all of which require advanced current sensing solutions. The semiconductor and battery manufacturing sectors further dominate this region, which boosts demand for accurate current monitoring in various power management applications. Asia Pacific is also seeing a great shift towards renewable energy sources, especially in solar and wind energy, where current sensors play an important role in the energy conversion mechanism and even in grid stability.

Key Regional Takeaways:

United States Current Sensor Market Analysis

The U.S. sensor market is poised for robust growth, driven by several key factors. A major contributor is the increasing adoption of the Industrial Internet of Things (IIoT), with the U.S. industrial IoT market valued at USD 135.6 Billion in 2024. According to IMARC Group, it is projected to reach USD 568.9 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 17.1% from 2025 to 2033. This surge is largely attributed to the growing demand for sensors to enable connectivity and data exchange across industries, such as manufacturing, healthcare, and consumer electronics. The automotive sector’s transition to electric and autonomous vehicles further amplifies sensor demand, especially in safety and performance systems. Additionally, the healthcare industry’s reliance on wearable devices and medical equipment using sensors for monitoring and diagnostics plays a significant role in market expansion. Government investments in smart infrastructure and defense technologies are also spurring sensor development and deployment. Furthermore, the integration of sensors with artificial intelligence (AI) and machine learning is driving innovation and creating new opportunities, cementing the U.S. as a key player in the global sensor market.

Asia Pacific Current Sensor Market Analysis

The Asia-Pacific (APAC) region is experiencing significant growth in the sensor market, driven by rapid industrialization and technological advancements. According to industry reports, over 1 Billion smartphone users in the region are fueling the demand for sensors in consumer electronics. A major factor in this growth is the widespread adoption of automation and Industry 4.0 practices, particularly in manufacturing, where sensors play a crucial role in enhancing operational efficiency. Additionally, the booming automotive sector in countries like China and Japan increases the need for sensors in vehicle safety and performance. The healthcare sector's growing reliance on sensor-enabled medical devices and wearables for monitoring and diagnostics is further driving market expansion. Government initiatives promoting smart cities and infrastructure development are also creating new opportunities for sensor applications across APAC. These factors combine to position APAC as a leading player in the global sensor market.

Europe Current Sensor Market Analysis

Europe's sensor market is witnessing substantial growth, driven by several key factors. According to the European Union, more than three-quarters of Europeans (78%) approve that environmental issues have an immediate effect on their daily lives and health. This heightened awareness is contributing to the growing demand for sensors in environmental monitoring, particularly in applications such as air quality control and waste management. Additionally, the region's strong emphasis on industrial automation and the adoption of Industry 4.0 technologies is a significant driver, as sensors are essential for improving manufacturing processes and ensuring product quality. The automotive industry’s transition to electric and autonomous vehicles is also driving sensor demand for vehicle safety and performance applications. Moreover, Europe’s commitment to sustainability is further propelling the adoption of sensors in renewable energy sectors, including wind and solar power, to optimize energy production. The healthcare sector's increasing reliance on sensor-enabled medical devices for monitoring and diagnostics is another contributing factor. Finally, the region's focus on smart cities and infrastructure development is creating new opportunities for sensor applications in urban planning, traffic management, and public safety, positioning Europe as a key player in the global sensor market.

Latin America Current Sensor Market Analysis

Latin America's sensor market is expanding, driven by increased industrialization and the adoption of automation technologies. According to UNIDO, Latin America’s manufacturing exports account for only 4% of global trade, highlighting the region's potential for growth in various sectors, including sensor applications. The shift towards smart manufacturing practices is increasing the demand for sensors to enhance operational efficiency and product quality. Additionally, the growth of the automotive sector in countries like Brazil and Mexico is driving sensor demand for vehicle safety and performance. Government initiatives promoting infrastructure development and smart cities are further boosting sensor market opportunities across the region.

Middle East and Africa Current Sensor Market Analysis

The Middle East and Africa (MEA) region is experiencing growth in the sensor market, driven by key industrial sectors. The UAE oil and gas market, anticipated to exhibit a compound annual growth rate (CAGR) of 6.30% from 2025 to 2033, is a significant driver, as sensors are vital for exploring, producing, and safety monitoring in this sector. Additionally, the region’s focus on infrastructure development and smart city projects is creating demand for sensors in urban planning, traffic management, and public safety applications. The growing adoption of renewable energy, particularly solar and wind, is also contributing to the market expansion.

Competitive Landscape:

The key players operating in the current sensors market have been driving its growth through new technologies, strategic partnerships, and increased production. Companies such as Texas Instruments, Allegro MicroSystems, Honeywell, and Infineon Technologies are engaging in high spending on R&D to develop the most precise and energy-efficient miniature current sensors dedicated to electric vehicle applications, industrial automation, and renewable energy application. Many players are focusing on the integration of advanced technologies such as Hall-effect and magneto-resistive sensing to enhance accuracy and reliability. Strategic collaborations with automotive and semiconductor companies are helping expand market reach and innovation. Major manufacturers are also increasing production capacity, particularly in Asia Pacific, to meet the rising demand from consumer electronics and automotive industries. Another factor shaping market strategies is efforts toward sustainability, including the development of environment-friendly and low-power sensors. Additionally, companies are keen on mergers and acquisitions so as to add diversity and thus remain in a strong competitive position within this market.

The report provides a comprehensive analysis of the competitive landscape in the current sensor market with detailed profiles of all major companies, including:

- Aceinna Inc.

- Allegro MicroSystems Inc. (Sanken Electric Co. Ltd.)

- Asahi Kasei Microdevices Corporation (Asahi Kasei Corporation)

- Eaton Corporation Plc

- Honeywell International Inc.

- Infineon Technologies AG

- LEM Group

- Melexis NV

- Sensitec GmbH

- Tamura Corporation

- TDK Corporation

- Texas Instruments Incorporated

Latest News and Developments:

- January 2025: Allegro MicroSystems, Inc., a leader in power and sensing solutions, has introduced two new current sensor ICs, the ACS37030MY and ACS37220MZ. These sensors offer low conductor resistance, high bandwidth, and reliable performance, catering to automotive, industrial, and consumer applications.

- September 2024: Allegro MicroSystems, Inc., has introduced two new XtremeSense TMR current sensors, CT455 and CT456, designed to enhance high-power density designs with improved energy efficiency, compact size, and cost savings. These sensors deliver high bandwidth (1 MHz) and low noise for precise current measurements, addressing applications in AI data centers and automotive powertrains.

- July 2024: Infineon Technologies AG and Swoboda have partnered to develop high-performance current sensor modules for automotive applications, focusing on hybrid and electric vehicles. The collaboration combines Infineon’s TLE4973 coreless current sensor IC with Swoboda’s sensor module expertise to create compact, high-precision solutions for applications such as traction inverters and battery management systems.

- May 2024: LEM has launched a new generation of eco-friendly coreless current sensors designed to support the growing renewable energy and global electrification sectors. The Open Loop Coreless Integral (OLCI) sensors can measure high DC currents from 2kA to 42kA without surge current limitations, offering a large aperture for precise measurements on large busbars and a 1MHz bandwidth for high-frequency applications.

- February 2024: Asahi Kasei Microdevices Corporation (AKM) has commenced mass production of the CZ39 series coreless current sensors. Designed for electric vehicle (EV) applications, the CZ39 series offers a 100 ns response time, low heat generation, and strong noise immunity. Its compatibility with SiC- and GaN-based power devices enables smaller, lighter, and more efficient on-board charging systems for EVs.

Current Sensor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open Loop, Closed Loop |

| Current Sensing Technologies Covered | Hall Effect, Current Transformer, Flux Gate, Rogowski Coil |

| Sensing Methods Covered | Direct Current Sensing, Indirect Current Sensing |

| Applications Covered | Motor Drive, Converter and Inverter, Battery Management, Uninterrupted Power Supply (UPS) and Switched-Mode Power Supply (SMPS), Starter and Generators, Grid Infrastructure, Others |

| End Uses Covered | Automotive, Consumer Electronics, Industrial, Healthcare, Telecom, Renewable Energy, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aceinna Inc., Allegro MicroSystems Inc. (Sanken Electric Co. Ltd.), Asahi Kasei Microdevices Corporation (Asahi Kasei Corporation), Eaton Corporation Plc, Honeywell International Inc., Infineon Technologies AG, LEM Group, Melexis NV, Sensitec GmbH, Tamura Corporation, TDK Corporation, Texas Instruments Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the current sensor market from 2019-2033.

- The current sensor market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the current sensor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The current sensors market was valued at USD 2.2 Billion in 2024.

The current sensors market is projected to exhibit a CAGR of 5.57% during 2025-2033, reaching a value of USD 3.7 Billion by 2033.

The present sensors market is fueled by increasing need for energy-efficient solutions, the surge in electric vehicles, progress in industrial automation, the growth of data centers, and the uptake of renewable energy technologies.

Asia Pacific currently dominates the current sensors market, accounting for a share of 32.0%, propelled by swift industrialization, the emergence of electric vehicles, government funding in renewable energy and smart grid systems, and the increasing need for consumer electronics and industrial automation.

Some of the major players in the current sensors market include Aceinna Inc., Allegro MicroSystems Inc. (Sanken Electric Co. Ltd.), Asahi Kasei Microdevices Corporation (Asahi Kasei Corporation), Eaton Corporation Plc, Honeywell International Inc., Infineon Technologies AG, LEM Group, Melexis NV, Sensitec GmbH, Tamura Corporation, TDK Corporation, Texas Instruments Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)