CubeSat Market Size, Share, Trends and Forecast by Size, Application, End User, Subsystem, and Region, 2026-2034

CubeSat Market Size and Share:

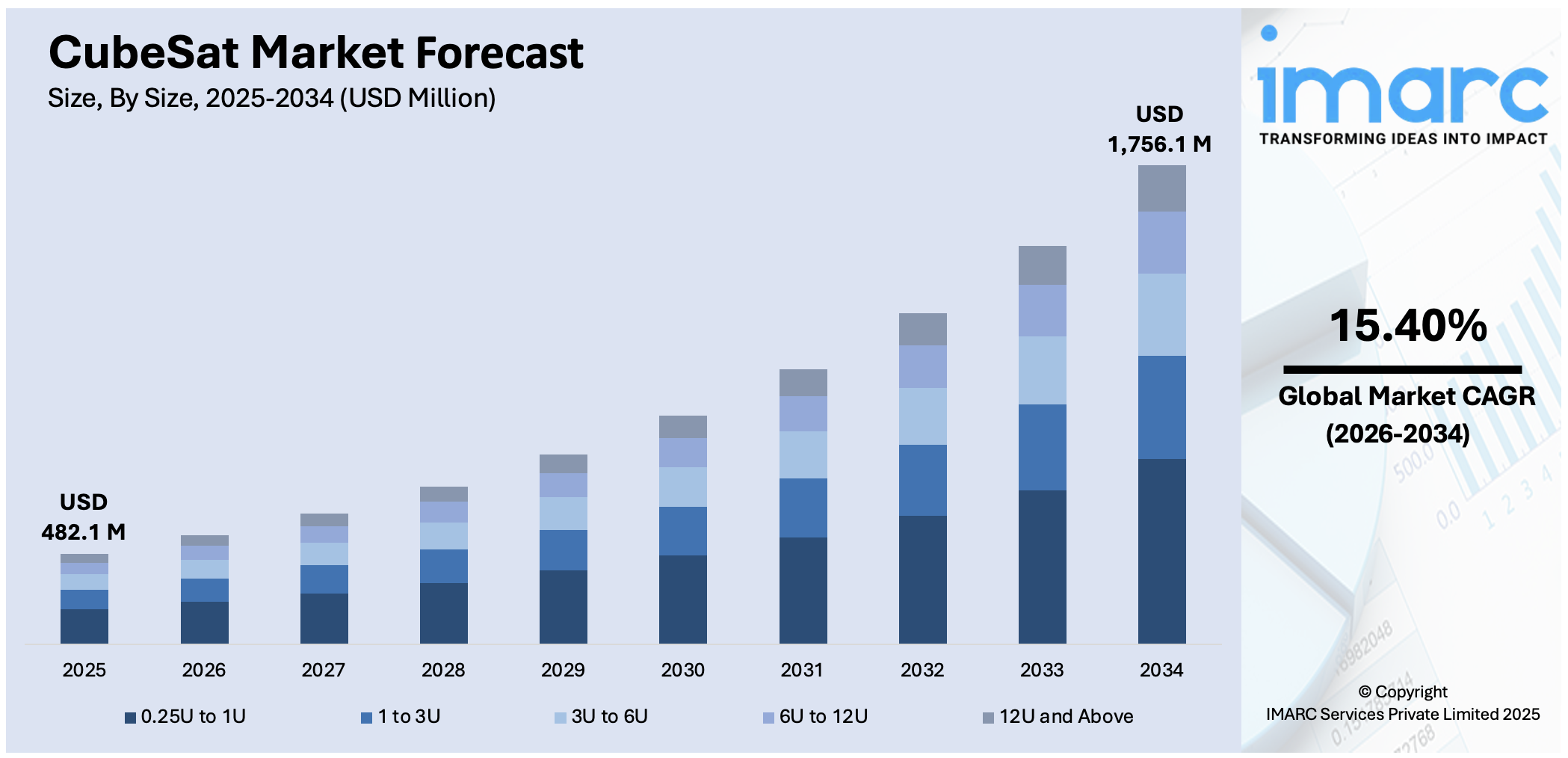

The global CubeSat market size was valued at USD 482.1 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,756.1 Million by 2034, exhibiting a CAGR of 15.40% from 2026-2034. North America currently dominates the market, holding a market share of 76.3% in 2025. The CubeSat market share is expanding, driven by the growing commercial applications, increasing investments by governing agencies, and technological advancements in electronic components.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 482.1 Million |

|

Market Forecast in 2034

|

USD 1,756.1 Million |

| Market Growth Rate 2026-2034 | 15.40% |

As several industries and government agencies are turning to small satellites for economical space missions, the demand for CubeSats is rising. CubeSats are super handy for research, planet observation, communication, and tech demonstrations. Their small size and lower launch costs make them popular among universities, startups, and defense agencies. Besides this, advancements in miniaturized electronics and satellite components are making CubeSats more capable. Additionally, companies use them for tracking assets, monitoring weather, and collecting environmental data. The rise of commercial space companies and rideshare launch options makes it easier to get CubeSats into orbit.

To get more information on this market Request Sample

The United States has emerged as a major region in the CubeSat market owing to many factors. The rising interest in space exploration is offering a favorable CubeSat market outlook. The increasing number of space missions is driving the demand for CubeSats because of their cost-effectiveness and versatility. As per industry reports, the 2024 count featured 88 SpaceX missions in the US, out of which 62 were launched from Cape Canaveral Space Force Station and 26 from Kennedy Space Center, along with five United Launch Alliance (ULA) missions, totaling 93 launches, up from 74 in 2023. Additionally, the commercial sector is investing heavily in CubeSats for applications, such as Earth observation, communication, and technology demonstrations, leveraging advancements in miniaturized electronics and standardized components. The growing requirement for real-time data and worldwide connectivity is creating the need for CubeSat constellations.

CubeSat Market Trends:

Growing commercial use in telecommunications

The rising commercial usage of CubeSats in telecommunications is positively influencing the market. Companies look for smarter and cheaper ways to boost worldwide connectivity. CubeSats are being employed to build satellite networks that support Internet access in remote or underserved areas. These small satellites assist with data relay, communication backhaul, and satellite phones, making them valuable for industries like maritime, aviation, and emergency services. Startups and tech giants are investing in CubeSat constellations to deliver reliable and fast communication services without the massive cost of large satellites. They are easier to launch, quick to replace, and can be scaled as needed. Moreover, they play a growing role in expanding 5G connectivity by supporting low-latency data networks. According to the Ericsson, in 2024, in the US, more than 300 Million individuals (90%) resided in regions covered by low-band 5G from all three major service providers, whereas 210–300 Million had access to 5G mid-band.

Rising academic and research projects

The increasing number of academic and research projects is fueling the CubeSat market growth. Universities and research institutes are employing CubeSats to give students hands-on experience in space tech, science, and engineering. Owing to the high Internet access and better connectivity, students and researchers can easily collaborate, share data, and control CubeSats from anywhere. For instance, in 2024, there were around 5.52 Billion Internet users worldwide, equating to 67.1% of the total population. CubeSats offer a low-cost way for educational programs to test new ideas in real space missions. CubeSats are being launched for experiments in physics, biology, Earth science, and technology development. Many academic projects also get support from government space programs or international partnerships.

Increasing adoption of Internet of Things (IoT)

The rising adoption of IoT is impelling the market growth. As more devices connect to the Internet, there is a high need for reliable and widespread data coverage, especially in remote or hard-to-reach areas. CubeSats help to fill those gaps by offering low-cost satellite communication that supports IoT networks across the globe. They can collect and relay data from sensors employed in agriculture, shipping, oil and gas, environmental monitoring, and more. Since CubeSats are small and can be deployed in large numbers, they are perfect for building satellite constellations that keep IoT systems running smoothly. This kind of connectivity is super useful for real-time tracking and smart decision-making. As IoT continues to expand, the demand for CubeSats keeps rising, making them an important part of the whole ecosystem. According to the IMARC Group, the global IoT market is set to attain USD 3,486.8 Billion by 2033, showing a growth rate (CAGR) of 14.6% during 2025-2033.

CubeSat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global CubeSat market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on size, application, end user, and subsystem.

Analysis by Size:

- 0.25U to 1U

- 1 to 3U

- 3U to 6U

- 6U to 12U

- 12U and Above

3U to 6U held 88.1% of the market share in 2025. The 3U to 6U CubeSats offer a good balance between size, cost, and capability. They are small enough to remain affordable for universities, startups, and small space agencies, but large enough to carry more advanced instruments and payloads compared to smaller units like 1U or 2U. With more volume and power, they can support better cameras, communication systems, and scientific tools, making them ideal for a wide range of missions, such as Earth observation, remote sensing, and communication. They also fit well into standard launch deployers, making them easy to integrate as secondary payloads on larger missions. This size range provides flexibility and performance without the complexity of larger satellites. As the need grows for smarter and more capable space missions, the 3U to 6U CubeSats meet the need while staying efficient and compact, which helps them to stay in high demand across the industry.

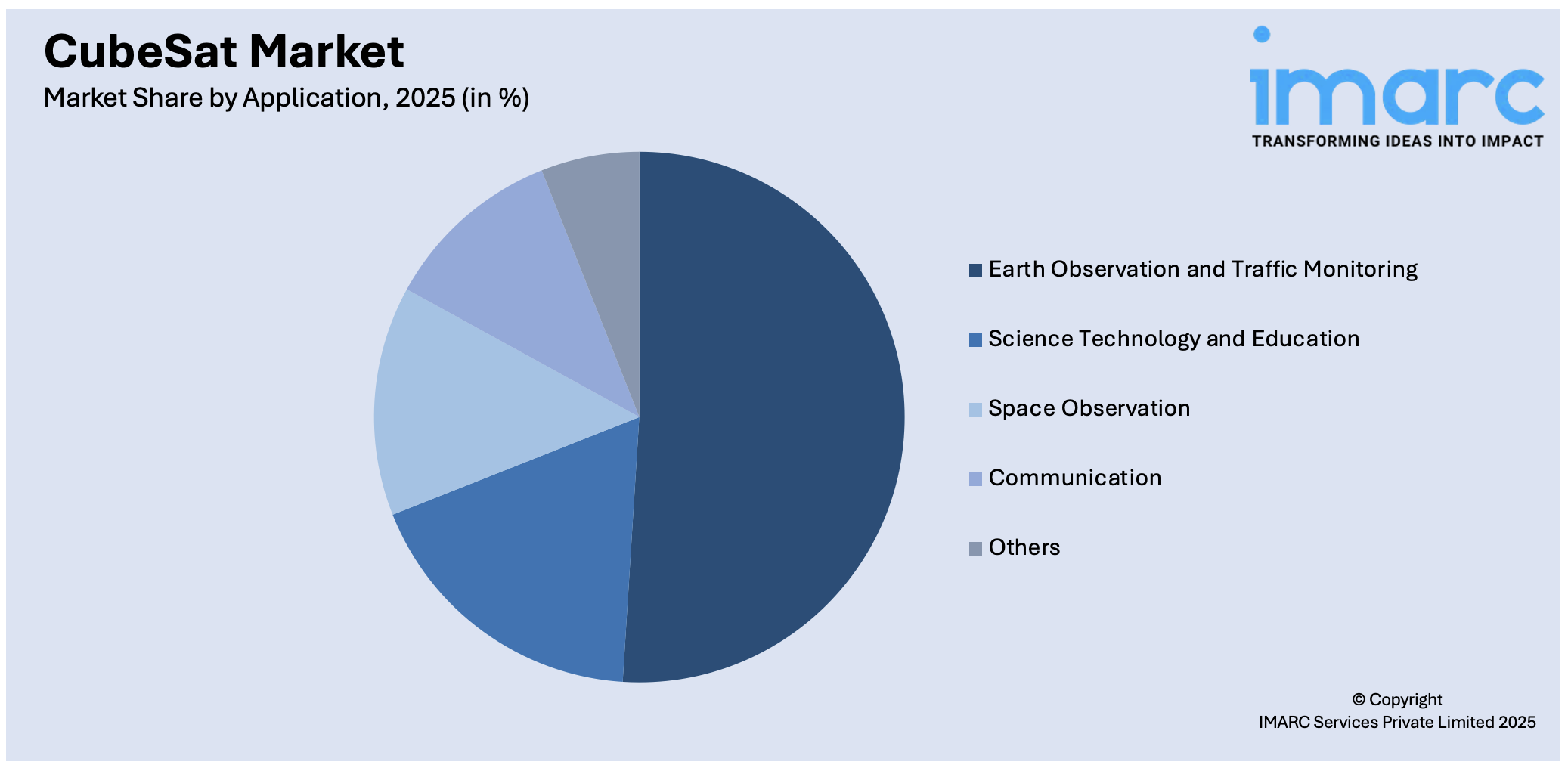

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Earth Observation and Traffic Monitoring

- Science Technology and Education

- Space Observation

- Communication

- Others

Earth observation and traffic monitoring account for 50.5% of the market share. For these applications, CubeSats offer practicality and efficiency. They are small, low-cost, and easy to launch, which makes them perfect for observing the Earth frequently and from multiple angles. They collect valuable data on weather, agriculture, forests, oceans, and natural disasters, helping governments, businesses, and researchers to make informed decisions. In traffic monitoring, CubeSats provide real-time updates on road, air, and sea traffic. This aids in improving safety, reducing congestion, and supporting smart city planning. Since CubeSats can be launched in constellations, they provide continuous coverage and fast data updates, which is essential for both applications. Their small size also allows them to be upgraded and replaced easily, keeping the data fresh and relevant. As more industries rely on accurate and real-time Earth and traffic data, CubeSats meet the need with speed and lower costs, making these applications the most popular and useful in the market.

Analysis by End User:

- Government and Military

- Commercial

- Others

Commercial holds 88.7% of the market share. Commercial entities use CubeSats for a wide range of profitable services. These include Earth imaging, communication, data collection, and IoT applications. CubeSats are cost-effective and quick to develop, making them attractive for businesses that want to enter the space market without spending too much. Commercial companies also utilize CubeSats to build satellite constellations, which provide worldwide coverage and fast data transmission. This supports services like weather tracking, asset monitoring, and broadband internet. With the growing demand for satellite-based solutions in agriculture, transportation, and environmental monitoring, commercial users continue to wager on CubeSat technology. In addition, the rise of private launch providers makes it easier for commercial firms to send CubeSats into orbit. As a result, the commercial segment stays ahead in the CubeSat market by encouraging innovations, investments, and widespread adoption across various industries.

Analysis by Subsystem:

- Payloads

- Structures

- Electrical Power Systems

- Command and Data Handling

- Propulsion Systems

- Attitude Determination and Control Systems

- Others

Payloads account for 25.2% of the market share. They are the main part of the satellite that performs the intended mission. Whether it is taking images, collecting data, or sending signals, payloads deliver value to the end user. As more CubeSats are employed for Earth observation, communication, and scientific research, the demand for advanced and specialized payloads keeps growing. These can include high-resolution cameras, sensors, antennas, and scientific instruments. Since CubeSats have limited space and power, designing efficient and powerful payloads becomes a top priority. More investment and innovations go into payload development to make CubeSats more capable while staying compact. Moreover, payloads are often customized for specific missions, which increases their share in the market. As the focus of CubeSat missions shifts from testing to real-world applications, the role of payloads has become more important. This makes them the leading subsystem, supporting both performance and purpose in CubeSat projects.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 76.3%, enjoys the leading position in the market. The region is noted for the strong presence of facilities and expertise in aerospace engineering and satellite systems. Universities and government institutions are offering aerospace engineering courses to develop interest in students, which is impelling the market growth. In January 2025, the University of Houston-Clear Lake (UHCL), based in the US, revealed the introduction of its Bachelor of Science in Aerospace Engineering (AE) program, a groundbreaking educational venture aimed at addressing the increasing needs of the aerospace sector. The initiative was intended to mold the upcoming generation of engineers and propel progress in space exploration, aviation, and aerospace technologies. Apart from this, the area is home to major space agencies like NASA and a large number of commercial space companies that actively invest in CubeSat technology. These organizations employ CubeSats for research, communication, Earth observation, and defense purposes. North America also has advanced infrastructure for satellite development, testing, and launch, which makes it easier and faster to bring CubeSat projects to life. In addition, the region’s leadership in space exploration, along with the growing demand for data services, is promoting continuous utilization of CubeSats.

Key Regional Takeaways:

United States CubeSat Market Analysis

The United States holds 99.50% of the market in North America. The United States is witnessing a surge in CubeSat adoption due to the growing investments in science and technology, which are leading to advancements in space exploration, Earth observation, and communication. According to the National Center for Science and Engineering Statistics (NCSES), in 2021, the United States spent 15% (USD 119 Billion) of its total expenditure on basic research, 18% (USD 146 Billion) on applied research, and 67% (USD 540 Billion) on experimental development. The increasing government and private sector funding is encouraging the creation of CubeSats, enhancing research capabilities and innovative satellite missions. Expanding technological capabilities contribute to more sophisticated CubeSat designs, improving data collection and mission success rates. The ongoing collaboration between academic institutions and commercial entities accelerates CubeSat innovations, enabling cost-effective satellite solutions. The rising demand for real-time environmental monitoring, climate research, and remote sensing is further promoting CubeSat deployment. Technological miniaturization supports the development of high-performance CubeSats, optimizing payload efficiency and mission durability. The need for refined data analytics and enhanced imaging techniques fosters CubeSat employment across scientific research domains.

Europe CubeSat Market Analysis

Europe is experiencing a rise in CubeSat usage owing to the growing expenditure on the military sector, promoting advancements in defense-related satellite applications. According to the European Council, between 2021 and 2024, EU member states’ total defense expenditure rose by more than 30%. In 2024, it reached approximately USD 354 Billion, about 1.9% of EU GDP. Increasing defense budgets support CubeSat deployment for intelligence gathering, reconnaissance, and secure communication. The rising need for real-time battlefield awareness and strategic surveillance is driving the demand for CubeSats in military operations. Advancements in miniaturized satellite technology enhance CubeSat efficiency, enabling improved data transmission and encrypted communications. Strengthening military infrastructure contributes to CubeSat R&D, supporting national security initiatives. The growing demand for secure and autonomous satellite networks is encouraging investments in CubeSat-based defense solutions.

Asia-Pacific CubeSat Market Analysis

Asia-Pacific is witnessing increasing CubeSat employment on account of the increasing investments in satellite systems development and the growing applications, such as navigation, boosting its role in positioning, timing, and geolocation services. For instance, China’s BeiDou satellite navigation system (BDS) secured commitments of 12.7 Billion Yuan (USD 1.78 Billion) for upcoming projects in 2024. The high demand for precise and real-time navigation solutions supports CubeSat deployment across transportation, aviation, and maritime sectors. Advancements in satellite technology enhance CubeSat capabilities, improving accuracy, reliability, and integration with existing worldwide navigation satellite systems. The increasing need for efficient mapping, disaster management, and smart city infrastructure is positively influencing the market. The increasing investments in space-based navigation technology are encouraging innovations, enabling the development of high-resolution imaging and tracking systems.

Latin America CubeSat Market Analysis

In Latin America, the market for CubeSats is expanding due to the growing Internet penetration and high demand for wireless Internet systems, 5G network, and enhanced communication infrastructure. According to reports, from 2013 to 2023, Internet access in Latin America rose from 43% to 78%, achieving 90% in Chile, exceeding China’s rate, owing to the integration of middle and lower-income groups. Expanding digital connectivity supports CubeSat deployment for remote and underserved areas, improving Internet access. The rising demand for seamless connectivity attracts investment in CubeSat-based broadband solutions, enhancing network efficiency. Increasing focus on developing advanced telecommunication frameworks accelerates CubeSat integration with terrestrial and satellite-based Internet services.

Middle East and Africa CubeSat Market Analysis

The Middle East and Africa region is experiencing growing CubeSat usage owing to the increasing investments in the information technology (IT) and telecom sector, leading to advancements in satellite-based communication services. For instance, the total expenditure on information and communications technology (ICT) across the Middle East, Türkiye, and Africa (META) topped USD 238 Billion in 2024, equating to a rise of 4.5% over 2023. The high demand for enhanced connectivity supports CubeSat deployment for broadband and digital communication networks. Expanding telecommunication infrastructure accelerates CubeSat integration, enabling improved data transmission and coverage in remote regions. The growing need for cost-effective and scalable communication solutions is fostering CubeSat-based IT and telecom applications.

Competitive Landscape:

Key players are working to develop innovative solutions to meet the high CubeSat market demand. They are wagering on innovations and making access to space more affordable. Companies are leading the way by offering frequent and cost-effective launch services and building CubeSat constellations for Earth observation and data services. These firms are setting trends and showing how CubeSats can be used for real-time imaging, communication, and scientific experiments. Tech providers are also creating compact and high-performance components that are making CubeSats more powerful and reliable. In line with this, established aerospace companies and new startups are teaming up with research institutions and universities to support development and testing. Their active involvement not only boosts credibility but also encourages others to explore CubeSat missions. For instance, in July 2024, KU Aerospace Engineering achieved its initial CubeSat launch, "KUbeSat-1," into orbit during NASA's ELaNa 43 mission. The CubeSat was launched aboard Firefly Aerospace’s Alpha rocket during the ‘Noise of Summer’ event from Vandenberg Space Force Base. This represented the first Kansas organization to secure a CubeSat launch through NASA’s initiative.

The report provides a comprehensive analysis of the competitive landscape in the CubeSat market with detailed profiles of all major companies, including:

- AAC Clyde Space

- CU Aerospace

- EnduroSat

- GomSpace

- Innovative Solutions In Space B.V.

- L3Harris Technologies Inc

- Planet Labs Inc.

- Pumpkin Space Systems

- Space Inventor

- Surrey Satellite Technology Limited (Airbus Group)

- Tyvak Nano-Satellite Systems Inc. (Terran Orbital Corporation)

Latest News and Developments:

- August 2024: The DORA CubeSat from Arizona State University was launched by a SpaceX Falcon 9 rocket during a resupply mission to the International Space Station. The mission, transporting more than 8,200 pounds of cargo, featured two CubeSats as part of NASA's ELaNa 52 program. The CubeSat was intended to receive optical signals in low Earth orbit.

- July 2024: Firefly Aerospace achieved a successful launch of its Alpha rocket, which carried eight CubeSats sponsored by NASA into orbit. The rocket ascended from California's Vandenberg Space Force Base, following a prior launch attempt that was canceled because of a ground equipment problem. CubeSat deployment started roughly 35 minutes after the upper stage turned off and continued for about 11 minutes.

CubeSat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sizes Covered | 0.25U to 1U, 1 to 3U, 3U to 6U, 6U to 12U, 12U, Above |

| Applications Covered | Earth Observation and Traffic Monitoring, Science Technology and Education, Space Observation, Communication, Others |

| End Users Covered | Government and Military, Commercial, Others |

| Subsystems Covered | Payloads, Structures, Electrical Power Systems, Command and Data Handling, Propulsion Systems, Attitude Determination and Control Systems, Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | AAC Clyde Space, CU Aerospace, EnduroSat, GomSpace, Innovative Solutions In Space B.V., L3Harris Technologies Inc, Planet Labs Inc., Pumpkin Space Systems, Space Inventor, Surrey Satellite Technology Limited (Airbus Group), Tyvak Nano-Satellite Systems Inc. (Terran Orbital Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the CubeSat market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global CubeSat market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the CubeSat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The CubeSat market was valued at USD 482.1 Million in 2025.

The CubeSat market is projected to exhibit a CAGR of 15.40% during 2026-2034, reaching a value of USD 1,756.1 Million by 2034.

Organizations are investing in CubeSats because they are offering a cost-effective and flexible solution for Earth observation, communication, and scientific research. Manufacturers are developing more advanced miniaturized components, which is making CubeSats more capable. Moreover, researchers and engineers are experimenting with CubeSats to test new technologies in orbit without the high risk of large missions.

North America currently dominates the CubeSat market, accounting for a share of 76.3% in 2025, driven by the presence of strong space agencies, advanced technology, and active private companies. The region supports innovations, research, and frequent launches, making it a key center for CubeSat development, testing, and mission success.

Some of the major players in the CubeSat market include AAC Clyde Space, CU Aerospace, EnduroSat, GomSpace, Innovative Solutions In Space B.V., L3Harris Technologies Inc, Planet Labs Inc., Pumpkin Space Systems, Space Inventor, Surrey Satellite Technology Limited (Airbus Group), Tyvak Nano-Satellite Systems Inc. (Terran Orbital Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)