Crystal Oscillator Market Size, Share, Trends and Forecast by Type, Crystal Cutting Type, Mounting Scheme, End User, and Region, 2025-2033

Crystal Oscillator Market 2024, Size and Share:

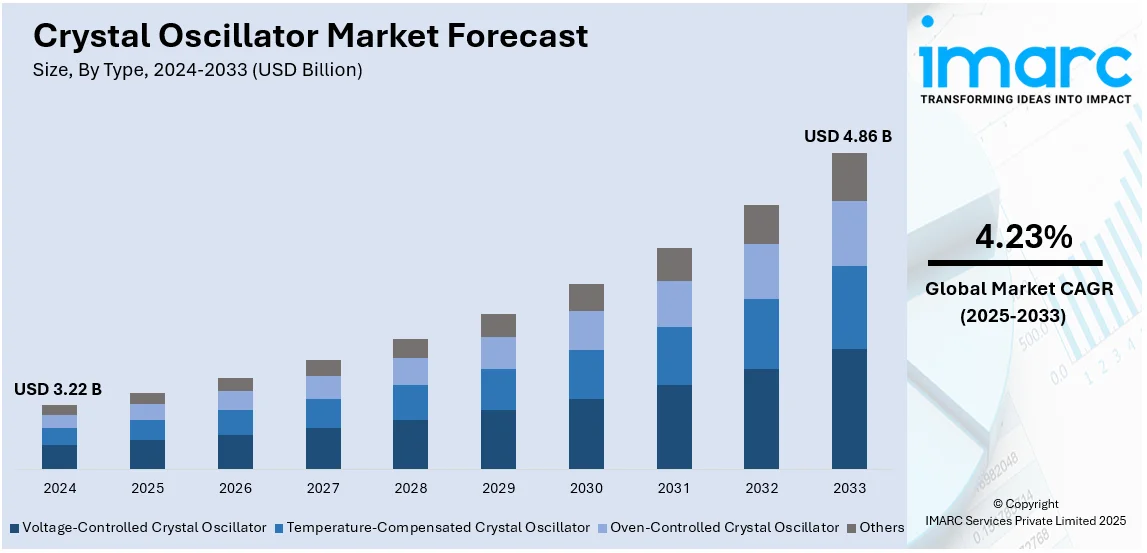

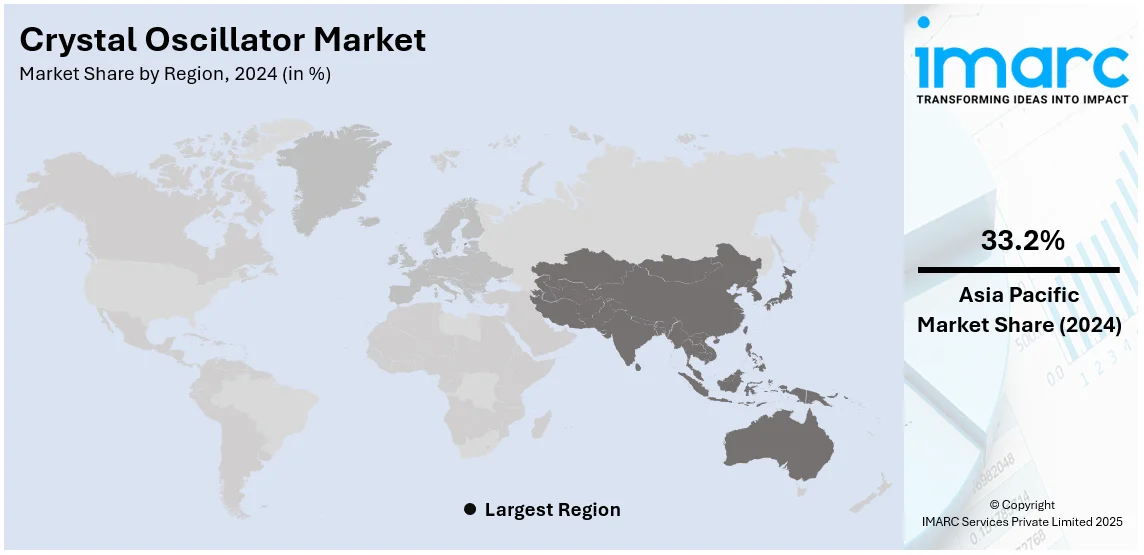

The global crystal oscillator market size was valued at USD 3.22 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.86 Billion by 2033, exhibiting a CAGR of 4.23% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 33.2% in 2024. The region’s crystal oscillator market share is experiencing significant growth driven by continual technological advancements in miniaturization, rising demand in automotive and industrial sectors, the expansion of telecommunication infrastructure, increasing adoption in consumer electronics, and augmenting product demand for the manufacturing of medical and healthcare devices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.22 Billion |

|

Market Forecast in 2033

|

USD 4.86 Billion |

| Market Growth Rate (2025-2033) | 4.23% |

The increasing demand for precise frequency control in sectors, such as telecommunications, consumer electronics, automotive, and aerospace, is fueling the global crystal oscillator market growth. With the rise of 5G technology, IoT devices, and advanced automotive systems, the need for reliable and high-performance oscillators has intensified. Miniaturization trends in electronics have further boosted the adoption of compact and surface-mount oscillators, which offer space-saving advantages and enhanced functionality. Additionally, advancements in crystal oscillator technologies, such as temperature-compensated and oven-controlled designs, are addressing the demand for improved stability and performance in high-frequency applications. The growing emphasis on energy-efficient devices also propels market innovation, making crystal oscillators a key component in modern electronic systems.

In the United States, the crystal oscillator market share is poised for significant expansion due to its leadership in technological innovation and strong demand from key sectors like defense, aerospace, and telecommunications. For instance, in October 2024, Statek Corporation, a U.S. based company, announced the ULPXO oscillator product family, which combines advanced ULP circuitry with high-shock packaging technology to ensure outstanding performance in harsh operating conditions. Additionally, the rapid deployment of 5G infrastructure, coupled with advancements in autonomous vehicle systems, has accelerated the need for high-precision oscillators. Furthermore, government investments in defense and space exploration have bolstered the development of robust and reliable oscillator technologies. With a thriving ecosystem of R&D and manufacturing, the U.S. continues to be a pivotal market for oscillator innovation and application.

Crystal Oscillator Market Trends:

Technological Advancements and Miniaturization

The changing trend towards miniaturization and continual technological improvements is consequently driving the crystal oscillator market demand. An industry report indicates that the consumer electronics market is expected to see an annual growth rate of 2.9% between 2025 and 2029. As electronic devices become increasingly compact, the demand for smaller, more efficient components has increased. Crystal oscillators help control the frequencies accurately due to which they are widely used in various electronic equipments, including modern smartphones, laptops, and wearables. The combination of the superior material and enhanced manufacturing technology resulted in smaller oscillators that enhances the performance of the device or machine. This trend helps increase market demand and expands the fields of application from the traditional wearable devices to the new application fields such as IoT and medical equipment which require compact size and low power consumption. More transistor nodes are being able to fit on smaller integrated circuits (ICs) as part of the miniaturisation trend. As a result, cutting-edge semiconductor technologies like FinFET and 3D stacking have been developed, allowing for improved performance at lower power consumption. Furthermore, the trend towards smaller components is supported by the increased capacity to produce intricate designs rapidly and affordably through the use of 3D printing technology in electronics production.

Rising Demand in Automotive and Industrial Sectors

In the automotive sector, these crystals are widely utilized for multiple purposes, such as in ADAS, infotainment systems, and V2X systems. As per an industry report, last year witnessed global consumers purchasing 68 million new vehicles, representing a notable increase in year-over-year growth that moves the sector nearer to the pre-pandemic level of 73 million sold in 2019. For 2024, the common perspective is that sales will attain approximately 70 million. According to figures from the International Organisation of Motor Vehicle Manufacturers, the industry has grown by 30% in the last ten years (1995-2005), further bolstering the market growth. These components help in the determination of accurate time and of synchronization which are significant in enhancing the safety and functions of current generation vehicles. Similarly, in industrial applications, crystal oscillators are found in automation, robotics control sections and systems where precision is core. Several emerging and growth sectors, such as consumer electronics, telecommunications and automotive industries requires smarter technologies and automation, and this coupled with the need for quality crystal oscillators further creates a positive crystal oscillator market outlook.

Increasing adoption in consumer electronics

With the increased use of smart devices, such as smart phone, tablets, smartwatches, and video games there is a growing demand for components that can provide accurate tuning and frequency stability. Timing devices such as crystal oscillators are an essential component of these gadgets for performing and linking functions. With the increasing trend in consumer purchasing for electronic goods that can perform multiple functions at high performance, manufacturers are shifting to integrate sophisticated crystal oscillators into their products. This massive demand in consumer electronics increases the requirement for crystal oscillators further contributing to the crystal oscillator market growth. The market's growth is being further supported by the expansion of consumer electronics sales brought on by the growing popularity of e-commerce. According to industry forecasts, e-commerce is predicted to generate 46% of the USD 1.1 Trillion in revenue from the consumer electronics market by the end of 2024.

Crystal Oscillator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global crystal oscillator market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, crystal cutting type, mounting scheme, and end user.

Analysis by Type:

- Voltage-Controlled Crystal Oscillator

- Temperature-Compensated Crystal Oscillator

- Oven-Controlled Crystal Oscillator

- Others

According to the crystal oscillator market trends, temperature-compensated crystal oscillator represented the largest segment. Temperature-compensated crystal oscillator (TCXO) is widely used in high precision applications such as telecommunications, GPS systems, and mobile devices. The demand for TCXOs is escalating as they can provide stable performance even under severe environmental conditions to meet the needs of industrial and automotive applications. The market is also increasing due to TCXOs ability to deliver accurate timing solutions suitable for temperature fluctuations making them ideal for industrial and automotive applications. Additionally, constant advancements in temperature compensation techniques and miniaturization further increase the demand for TCXOs across high-performance electronic applications.

Analysis by Crystal Cutting Type:

- AT Cut

- BT Cut

- SC Cut

- Others

According to the crystal oscillator market forecast, AT cut accounted for the largest market share attributed to their excellent frequency stability and temperature characteristics, making them ideal for a wide range of applications, including consumer electronics, telecommunications, and industrial devices. Their ability to provide precise frequency control over a broad temperature range makes AT cut crystals highly reliable and versatile. The widespread adoption of AT cut crystals is driven by their cost-effectiveness and superior performance in maintaining frequency accuracy, which is crucial for the efficient functioning of modern electronic devices. As technological advancements continue to demand higher precision and stability, AT cut crystals remain the preferred choice, ensuring their leading position in the crystal oscillator industry.

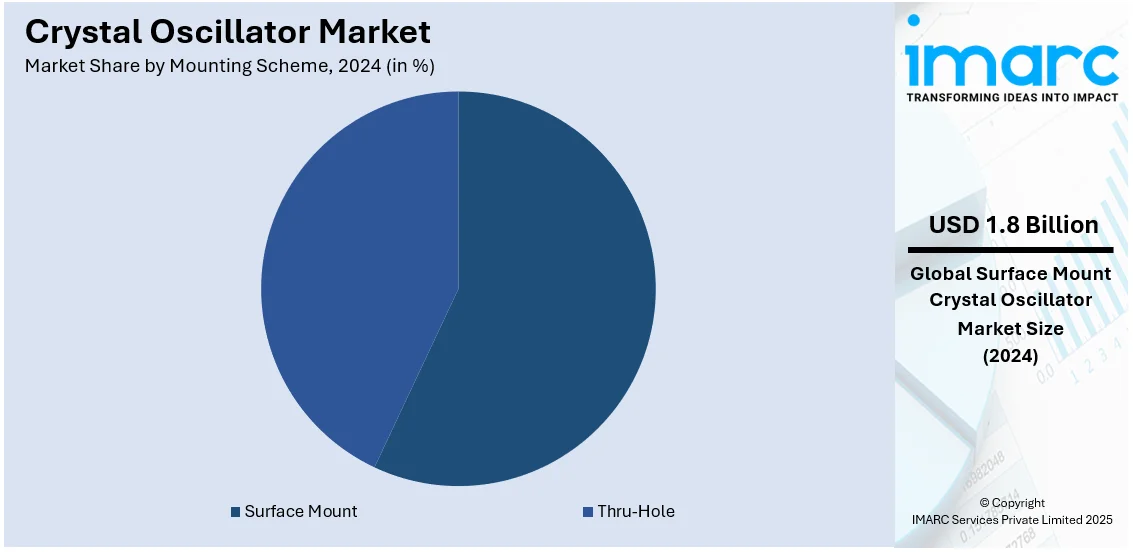

Analysis by Mounting Scheme:

- Surface Mount

- Thru-Hole

Surface mount lead the market with around 57.0% of market share in 2024. The segment’s domination is driven by its efficiency, compactness, and compatibility with high-density circuit designs. SMT supports automated assembly, reducing manufacturing costs and enhancing scalability. Its prominence is bolstered by rising demand in sectors such as consumer electronics, automotive, and telecommunications, where miniaturized and reliable components are critical. SMT’s ability to meet modern electronics' performance and space-saving requirements ensures its dominance in crystal oscillator applications worldwide.

Analysis by End User:

- Electronics

- IT and Telecommunication

- Military and Defense

- Automotive and Transport

- Others

The report highlights that electronics held the largest market share due to the widespread demand for accurate timing solutions. Crystal oscillators are vital components in electronic circuits, ensuring precise synchronization and signal processing. The growing complexity and miniaturization of electronic devices drive the need for higher-performance oscillators. Additionally, continuous progress in electronics, including the rise of wearable tech, smart home products, and advanced computing systems, further boosts the demand for reliable crystal oscillators. As the electronics sector evolves with new technologies and expanding uses, its leading role in the crystal oscillator market is anticipated to persist, sustaining steady demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 33.2%. The Asia Pacific region dominates the market, driven by its robust manufacturing sector, especially in countries like China, Japan, and South Korea, which are key producers of consumer electronics, telecommunications devices, and automotive parts. The demand for crystal oscillators is particularly high due to swift industrial growth and technological progress. Additionally, the region’s expanding population and rising disposable income are boosting consumer electronics sales, further supporting market growth. With continued innovation and manufacturing leadership, the region is expected to reinforce its dominance in the crystal oscillator market.

Key Regional Takeaways:

United States Crystal Oscillator Market Analysis

In 2024, United States accounted for 87.90% of the market share in North America. Advances in electronics and telecommunication industries propel the crystal oscillator industry in the US. With over 85% of adult smartphone penetration predicted by 2023, this country will experience the highest percentage globally. These mobile devices rely most on crystal oscillators for the purpose of time and frequency control. More than 300 million 5G subscriptions are expected by 2025, according to industrial reports, and this is a significant demand for 5G rollout. The automobile industry is also adopting advanced driver-assistance systems (ADAS) and electric vehicles. According to reports, about 17 million EVs are sold each year, and 1 million sold alone in the US, and most of them have crystal oscillators within them for infotainment and sensor systems.

The aerospace and defense industries are specifically critical in view of the United States spending almost USD 850 Billion on defence expenditures according to the data from US Department of Defense, fueling the need for oscillators in satellite communication, radar systems, and navigation. Moreover, the growing IoT sector, which is expected to link billions of devices by 2025, raises the need for small and efficient crystal oscillators.

North America Crystal Oscillator Market Analysis

The North America crystal oscillator market is driven by advancements in technology-intensive industries such as telecommunications, aerospace, and defense. The rapid deployment of 5G networks and the growth of autonomous vehicles have heightened demand for high-precision oscillators. Strong government investments in defense and space exploration further contribute to market expansion. Additionally, the region's robust R&D ecosystem and the presence of key manufacturers enhance innovation and production capabilities. For instance, in December 2024, Q-Tech Corporation, a leading North American manufacturer of space-qualified crystal oscillators, introduced the AXTAL GHz Series in the U.S. market. These ultra-low noise crystal oscillators, developed by Q-Tech's European affiliate AXTAL, improve radar, communication, and RF measurement systems. Moreover, increasing adoption of miniaturized and energy-efficient oscillators aligns with the growing demand for compact, high-performance devices. With a focus on reliability and advanced applications, North America remains a critical player in the global crystal oscillator market.

Europe Crystal Oscillator Market Analysis

Europe has a lot of robust growth in the automobile, telecommunications, and industrial automation sectors, supporting the crystal oscillator industry. Germany is a leading country in Industry 4.0 and creates high demand for oscillators in robots and automated systems. According to recent reports, Germany alone has now secured more than 33% of the industrial automation market share in Europe. Another significant factor is the implementation of 5G networks; by 2030, Europe wants all urban areas to have 100% 5G coverage, as per reports. Oscillators are essential to the automobile industry, which manufactures more than 14 million vehicles a year as per the data by European Parliament, for infotainment, connection, and vehicle electronics, particularly in electric and hybrid cars. The demand for oscillators in power management and control systems is further encouraged by the Europe's strong focus on renewable energy. Oscillators are also found in the region's well-established aircraft industry, with countries like France and the UK major players, for avionics and communication systems.

Asia Pacific Crystal Oscillator Market Analysis

Because of the rising technological development and dominance of electronics manufacturing in the region, Asia-Pacific is a substantial market for crystal oscillators. The biggest electronics manufacturers in the world are based in nations like China, Japan, and South Korea, which account for more than 70% of the world's semiconductor manufacturing, as per reports. With more than 2 billion smartphones produced each year, the region's expanding smartphone market mostly depends on crystal oscillators for accurate timing. The market is also expanding due to the implementation of 5G technology, especially in China, where by 2022, there will be more than 2 million 5G base stations installed, according to reports. The demand for oscillators in car electronics is further driven by the shift of the automotive industry toward electric vehicles, which is facilitated by government subsidies in countries like China and India. IoT devices are used, which also gives an upward impetus in India's 100 Smart Cities Mission. More usage is therefore there for demand creation.

Latin America Crystal Oscillator Market Analysis

A rapid rise in the sector of telecommunication, along with the rise of smartphone penetration, and increased automation in industry sectors, further drive the market in Latin America of crystal oscillators. Market dominance is of the countries Brazil and Mexico, though by 2024 Brazil's mobile subscriber numbers were above 210 million, as per reports. A primary focus of this region is digital transformation and development of 5G networks. This significantly expands the demand for oscillators in the telecom market. Oscillators are necessary for precise control in the industrial sector, which has more than 30% of Latin America's GDP and progressively implements automation technology. The consumer electronics market also grows steadily as a result of urbanization and increased disposable income; more than 80% of people reside in cities.

Middle East and Africa Crystal Oscillator Market Analysis

The Middle East and Africa (MEA) market for crystal oscillators is propelled by investments in industrial automation, growing consumer electronics use, and developing telecommunication infrastructure. According to an industrial report, construction of 5G networks in the United Arab Emirates and Saudi Arabia, targeting 90% 5G penetration by 2030, boosts the demand for oscillators in communication devices. The growth in the energy sector, with high expenditures in smart grids and renewable energy initiatives like Saudi Arabia's Vision 2030, also boosts the need for oscillators in energy management systems. Opportunities for oscillators in consumer electronics are created by the growth of the smartphone industry in Africa, projected to reach 700 million mobile subscribers by 2025. The drive in the region to adopt IoT and digitize sectors like healthcare and agriculture expands the market.

Overview of the Crystal Oscillator Market

The crystal oscillator market is moderately consolidated, meaning that while there are big global companies, there are also specialized manufacturers in certain regions. Large companies, especially from Japan, dominate the market because of their established technology and wide range of products. These companies continue to innovate and improve their products to maintain a competitive edge. Meanwhile, regional players in places like Asia are gaining ground by offering cost-effective solutions in specific market areas. There has also been consolidation in the market through mergers and acquisitions. Companies are merging to expand into new markets or improve their technology, particularly in areas where they can increase their presence or reach new customer bases.

To succeed in the crystal oscillator market, companies need to adapt quickly to technological changes while keeping costs down. Manufacturers must develop customized solutions for specific uses while maintaining efficiency in production. Building strong relationships with customers and offering excellent technical support is key, as many applications are becoming more specialized.

In addition, companies need to ensure their manufacturing processes meet the high standards of industries like automotive and telecommunications. As competition grows, companies must focus on research and development, automation, and efficient supply chain management to stay ahead. They must also comply with regulations, especially in areas like automotive and medical products, and develop environmentally friendly products to meet increasing sustainability demands. Precision in oscillator technology is also essential for staying competitive.

Competitive Landscape:

Crystal oscillator companies are working on innovation and establishing strategic partnerships to stay ahead of competition. Moreover, the miniaturization conducted by several leading players are further fueling business growth due to the rise in demand for compact size components across the modern electronics sector. For instance, in July 2024, SiTime developed the SiT1811, the industry's smallest and lowest power 32.768 kHz crystal oscillator. It offers low power consumption, ±20 ppm frequency stability, and a compact 1.2 mm x 1.1 mm QFN package, making it ideal for low-power IoT devices with exceptional reliability. Furthermore, companies are widening their product horizons so they can serve multiple markets including telecommunications, automotive, health, and consumer electronics. Firms expand their market presence and incorporate leading technologies with strategic collaborations & acquisitions. The companies are also actively benchmarking key players to ensure cost-effectiveness and excellent quality in the supply chain, as well as production processes.

The report provides a comprehensive analysis of the competitive landscape in the crystal oscillator market with detailed profiles of all major companies, including:

- CTS Corporation

- Daishinku Corp.

- KYOCERA Corporation

- Microchip Technology Inc.

- Murata Manufacturing Co. Ltd.

- Nihon Dempa Kogyo Co. Ltd.

- Rakon Limited

- River Eletec Corporation

- Seiko Epson Corporation

- Siward Crystal Technology Co. Ltd.

- TXC Corporation

Latest News and Developments:

- October 2024: Epson has added new products to its inventory with a focus on innovation and sustainability. Enhancing the efficiency of its printing and imaging technologies and developing environmentally friendly solutions are the company's main priorities. These programs support Epson's objectives to lessen its impact on the environment and encourage circularity in its business operations.

- January 2024: Rakon is targeting AI, cloud, and next-generation telecom applications with its innovative MercuryX technology. This range of integrated circuit, oven-controlled crystal oscillators expand the company’s AI offerings by combining Rakon’s Mercury+ semiconductor chip with its XMEMS quartz crystal resonators.

- June 2023: CTS Corporation announced the addition of two new high-performance PLL-based quartz crystal oscillator products. The new product series additions are available in three compact hermetically sealed ceramic SMD package sizes, deliver standard HCMOS or LVPECL and LVDS differential outputs, input voltages, frequency stabilities, and temperature grades.

Crystal Oscillator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Voltage-Controlled Crystal Oscillator, Temperature-Compensated Crystal Oscillator, Oven-Controlled Crystal Oscillator, Others |

| Crystal Cutting Types Covered | AT Cut, BT Cut, SC Cut, Others |

| Mounting Schemes Covered | Surface Mount, Thru-Hole |

| End Users Covered | Electronics, IT and Telecommunication, Military and Defense, Automotive and Transport, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CTS Corporation, Daishinku Corp., KYOCERA Corporation, Microchip Technology Inc., Murata Manufacturing Co. Ltd., Nihon Dempa Kogyo Co. Ltd., Rakon Limited, River Eletec Corporation, Seiko Epson Corporation, Siward Crystal Technology Co. Ltd., TXC Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the crystal oscillator market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global crystal oscillator market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the crystal oscillator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crystal oscillator market was valued at USD 3.22 Billion in 2024.

IMARC estimates the global crystal oscillator market to reach USD 4.86 Billion in 2033, exhibiting a CAGR of 4.23% during 2025-2033.

The market is expanding due to rising demand for precision timing in telecommunications, consumer electronics, and automotive applications. Growth in 5G deployment, IoT adoption, and advanced driver-assistance systems (ADAS) is increasing demand. Additionally, miniaturization, low power consumption, and frequency stability are critical factors shaping market trends and innovation.

Asia Pacific currently dominates the market, holding a market share of over 33.2% in 2024. The region is dominating due to strong consumer electronics manufacturing, rapid 5G deployment, and increasing demand for automotive and industrial applications. Countries like China, Japan, and South Korea drive growth with advanced semiconductor production and extensive R&D. Furthermore, the region’s expanding IoT ecosystem and government initiatives further support market expansion.

Some of the major players in the crystal oscillator market include CTS Corporation, Daishinku Corp., KYOCERA Corporation, Microchip Technology Inc., Murata Manufacturing Co. Ltd., Nihon Dempa Kogyo Co. Ltd., Rakon Limited, River Eletec Corporation, Seiko Epson Corporation, Siward Crystal Technology Co. Ltd., TXC Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)