Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2026-2034

Cryptocurrency Market Size and Share:

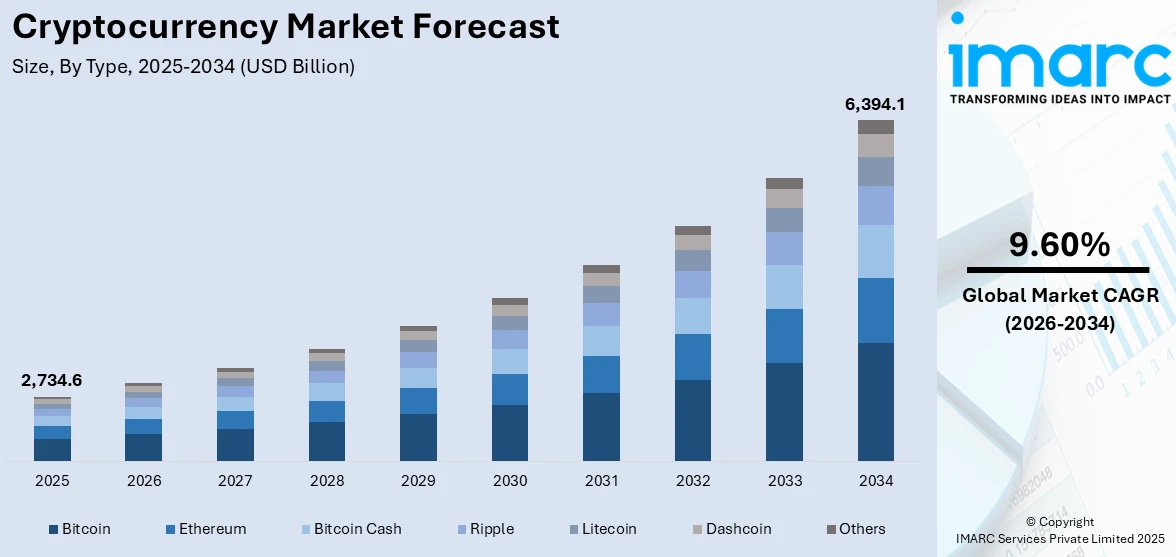

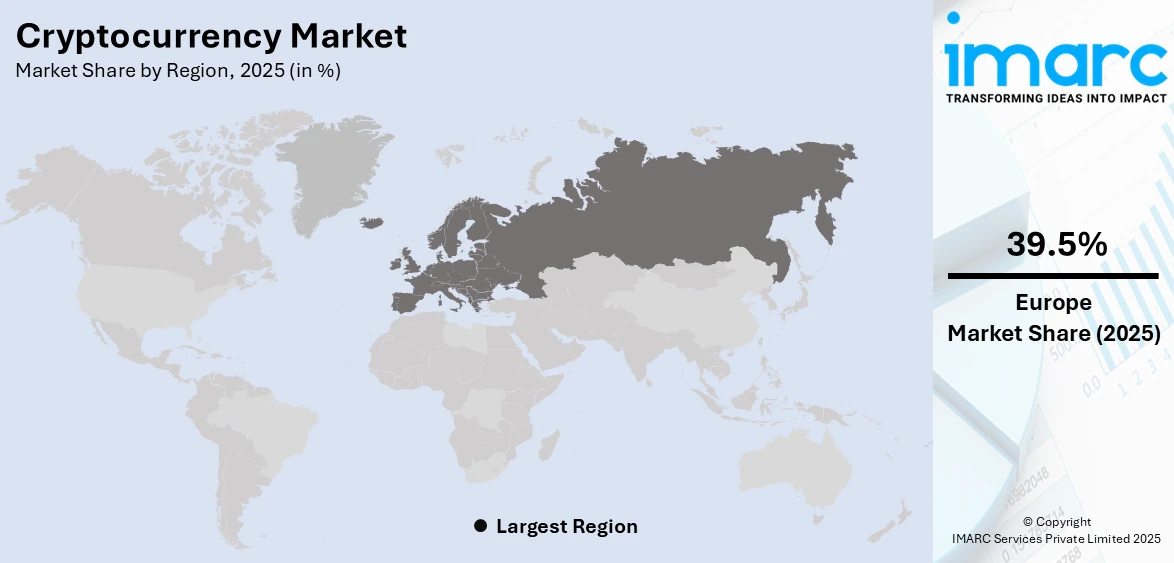

The global cryptocurrency market size reached USD 2,734.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6,394.1 Billion by 2034, exhibiting a growth rate (CAGR) of 9.60% during 2026-2034. Europe currently dominates the market, holding a significant cryptocurrency market share of over 39.5% in 2025. The market is propelled by the widespread adoption of blockchain technology, demand for decentralized finance (DeFi), institutional investments, regulatory advancements, and growing interest in digital assets as inflation hedges. Technological innovations, global remittance needs, and expanding use cases in payments, smart contracts, and tokenization further fuel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,734.6 Billion |

| Market Forecast in 2034 | USD 6,394.1 Billion |

| Market Growth Rate (2026-2034) |

9.60%

|

The market is driven by the growing industry usage of blockchain technology for safe, transparent transactions. The rise of decentralized finance (DeFi) platforms enables peer-to-peer financial services, attracting users seeking alternatives to traditional banking. Institutional investments from hedge funds and corporations give cryptocurrency legitimacy, which increases the market confidence and the cryptocurrency market demand. User experience and adoption are improved by developments in crypto infrastructure, such as scalable blockchain networks and safe wallets. Furthermore, involvement is encouraged by growing worldwide knowledge of digital currencies as a hedge against inflation and economic instability. The market expansion is supported by favorable regulatory developments in places such as North America and Europe. For instance, in November 2024, a consortium of including Robinhood, Kraken and Galaxy Digital, the financial technology and cryptocurrency companies, introduced a joint stablecoin pegged to the U.S. dollar. The newly formed Global Dollar Network intends to facilitate the usage of stablecoins worldwide and foster an asset that offers proportionate economic assistance to its partners. The popularity of tokenized assets and non-fungible tokens (NFTs) is increasing, which helps make cryptocurrencies more widely accepted.

To get more information on this market Request Sample

In the US, institutional adoption, the purchase of digital assets by large organizations and financial institutions, legitimizes cryptocurrencies and draws in mainstream investors. This represents one of the key cryptocurrency market trends in the country. For instance, in December 2024, cryptocurrency payments solution provider Triple-A announced an interface with Coinbase, which is done with the aim to enable Coinbase customers to pay specific Triple-A network businesses. By enabling merchants to provide a Coinbase-specific payment option, Triple-A's integration with Coinbase Commerce would improve Coinbase consumers' ease and enable Coinbase to reach a larger network of merchants, hence promoting the wider adoption of bitcoin payments. Coinbase customers in the US, Europe, and other countries are expected to benefit from the partnership's enhanced payment experience. The market is more confident when regulatory bodies such as the SEC and CFTC provide clear guidance. Users can now avoid traditional banking systems owing to the growth of decentralized finance (DeFi) platforms, which have increased the use of cryptocurrencies. Furthermore, the growing recognition of cryptocurrencies as an alternative investment and inflation hedge motivates private investors. The cryptocurrency market growth is further driven by the emergence of non-fungible tokens (NFTs) and advancements in blockchain technology, which increase the demand for digital assets.

Cryptocurrency Market Trends:

Increasing Adoption of Digital Assets

The cryptocurrency market overview exhibits a rise in the adoption of digital assets. According to industry reports, the market capitalization of digital assets doubled in 2023, rising from around USD 830 Billion to almost USD 1.6 Trillion. Cryptocurrencies are becoming more and more popular as more people and companies realize how safe, effective, and inflation-hedging they can be. The market is becoming more credible as financial institutions integrate cryptocurrency services more frequently. This wider acceptability encompasses a range of altcoin and tokens, providing a variety of investment opportunities, and is not simply restricted to Bitcoin and Ethereum. Particularly in underbanked regions, the decentralized character of cryptocurrencies provides benefits over conventional financial systems, including reduced transaction costs and enhanced access to financial services. As technology advances and legal frameworks solidify, this tendency is probably going to continue, further integrating cryptocurrencies into the global financial system.

Technological Advancements

Significant technological advancements are thrusting the market forward, thereby creating a positive cryptocurrency market outlook. The development of more robust and efficient blockchain technologies underpins this growth, enhancing the scalability, security, and speed of crypto transactions. Innovations like DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) have opened new avenues for investment and application, attracting a diverse range of users beyond traditional investors. These technologies facilitate unique use cases such as smart contracts, decentralized apps (DApps), and tokenization of assets, broadening the appeal of cryptocurrencies. As blockchain technology continues to evolve, it is expected to foster more innovative applications, potentially disrupting various industries including finance, real estate, and digital content creation, further offering a favourable cryptocurrency market outlook. Research by a leading consulting firm reveals that globally, 317 blockchain startups were established in 2018, whereas only 66 were launched in 2012.

Rising Awareness Among the Masses

One of the main factors facilitating the market growth is the increase in public awareness and interest in cryptocurrencies. The user base grows as more people learn about and feel at ease using digital currencies, which raises demand. Private citizens are not the only ones adopting cryptocurrencies; companies and retailers are now incorporating them into their payment systems after realizing the advantages of reduced transaction costs, quicker transfers, and access to a worldwide clientele. The long-term survival and expansion of the bitcoin business depend heavily on this expanding widespread acceptance. According to industry reports, record-breaking levels of cryptocurrency awareness and ownership have been reached in the recent years, 40% of American adults now possess cryptocurrency, which is an increase from 30% in 2023.

Cryptocurrency Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cryptocurrency market, along with forecast at the global, regional, and country levels from 2026-2034. Our report has categorized the market based on type, component, process, and application.

Analysis by Type:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Bitcoin leads the market with around 72.9% of market share in 2025. Bitcoin, as the pioneer and dominant cryptocurrency, constitutes the largest segment in the market. It attracts every type of investor, from the large institutional body that uses it as a store of value to regular retail traders or those who believe in the long term. Bitcoin, given its market capitalization and fame, is a favorite entry point into the crypto world for many investors. It is generally regarded as a digital form of gold for those seeking protection against economic uncertainty.

Analysis by Component:

- Hardware

- Software

Software leads the market with around 70.0% of the market share in 2025. The software represents the main pillar of the cryptocurrency ecosystem and allows many applications, protocols, and platforms for designing, trading, or managing digital assets. It is therefore possible to encompass all cryptocurrency wallets, trading platforms, decentralized applications (DApps), smart contracts, and blockchain protocols like Bitcoin or Ethereum and numerous altcoins under this segment. Software solutions are the interface for users of cryptocurrencies: they allow transactions and manage assets and smart contracts. Because of end-user usability, user experiences increase innovation via blockchain technology, and drive the development of decentralized finance (DeFi), non-fungible tokens (NFTs), and other future applications under the umbrella of the cryptocurrency ecosystem - this has made software probably the biggest segment and, undoubtedly, the most vibrant part of the market that propels its growth and its evolution forward.

Analysis by Process:

- Mining

- Transaction

Transaction lead the market with around 67.6% of market share in 2025. The transaction segment in the cryptocurrency markets is the crux and center of the cryptocurrency market representing its prime function, which is as a medium of exchange. It embraces all transactions indexed with the use of cryptocurrencies, including peer-to-peer transfers, online purchases, remittances, and trading activities on cryptocurrency exchanges. As the uptake of virtual currencies for various forms of financial and non-financial transactions makes the segment the largest and most active part of the market, it is characterized by very high liquidity, fast settlement times, and use for cross-border payments, smart contract executions, or token swaps. Thus, with increasing mainstream adoption, the transaction segment will keep growing and further entertain easy and secure digital transactions in the world.

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Trading

- Remittance

- Payment

- Others

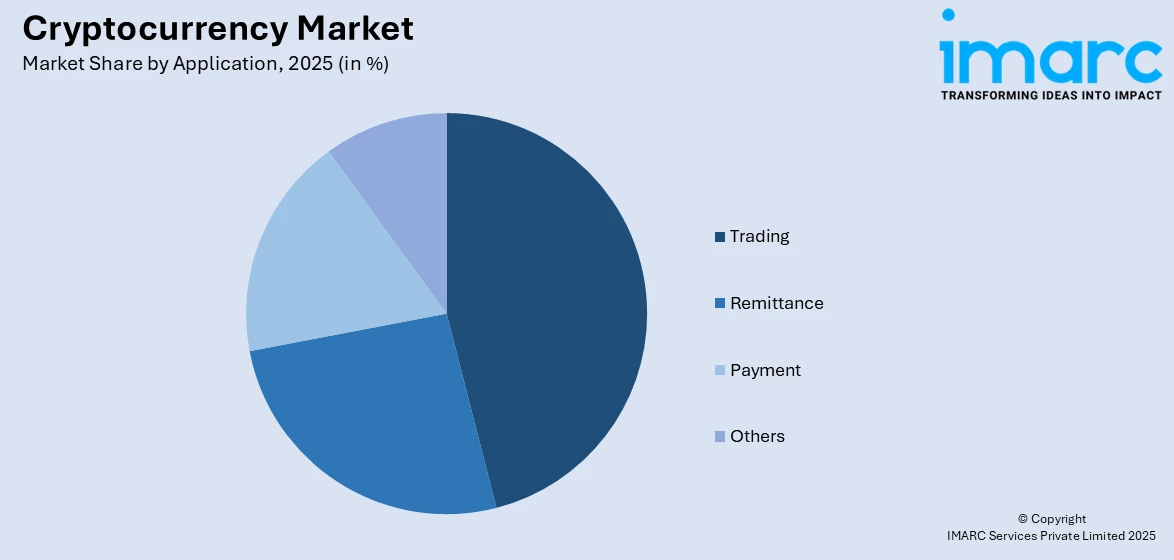

Trading leads the market with around 40.6% of market share in 2025. The trading segment within the cryptocurrency market is the largest and most dynamic. This includes everything in between activities like cryptocurrency exchanges, over-the-counter (OTC) trading, and speculative endeavors. Traders buy and sell cryptocurrencies to profit from price fluctuations. With dynamic liquidity and volatility, they find use not only for individual retail traders but also for institutional investors. It has very high trading volumes and continues to be dynamic with the introduction of new trading pairs, derivatives, and trading strategies.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Europe accounted for the largest market share of over 39.5%. Europe stands as the largest segment in the global cryptocurrency market. The European Union's Markets in Crypto-Assets (MiCA) regulation, launched in 2023, provides a single regulatory framework that promotes innovation and protects investors. Banks offering crypto-related services are at the forefront of institutional adoption in countries like Germany and Switzerland. The increase of blockchain-based companies in the UK, France, and Nordics is speeding up decentralized technology adoption. According to Chainalysis, which provides blockchain analytics, between July 2023 and June 2024, on-chain value in Eastern Europe rose by USD 499.14 Billion as the region witnessed a high digital wallet adoption rate. With the integration of cryptocurrency into e-commerce systems such as Shopify, retail customers use it more frequently now. The increase in the use of NFTs has added to the growth potential, particularly in gaming and art. Interest in environment-friendly cryptocurrencies such as Cardano is being encouraged by Europe's focus on sustainability issues.

Key Regional Takeaways:

North America Cryptocurrency Market Analysis

In North America, several factors are driving the cryptocurrency market. Institutional adoption is a significant driver, with major financial institutions, hedge funds, and corporations investing in and offering cryptocurrency services, lending credibility to the market. Regulatory clarity in countries like the U.S. and Canada has helped build investor confidence, with agencies like the SEC and CFTC providing guidelines for cryptocurrency trading and operations. The increased accessibility offered by decentralized finance platforms, which enables participants to engage in lending, borrowing, or trading without intermediaries, encourages demand. The possibility of blockchain technology for fields such as supply chain management, real estate, and healthcare will generate even more interest. Cryptocurrencies are understood more either to be inflation-hedging mechanisms or as alternate investment options, and this is gaining even further momentum within the regional market.

United States Cryptocurrency Market Analysis

In 2025, the United States accounted for the market share of over 86.40%. Strong institutional investment, changes in regulations, and technology breakthroughs have made the US a prominent market for cryptocurrencies. The electricity demand related to cryptocurrency mining activities in the United States has increased significantly over the past few years, according to the U.S. Energy Information Administration. The annual electricity consumption from cryptocurrency mining most likely accounts for between 0.6% and 2.3% of all electricity use in the United States. The most traded assets in the U.S. are Ethereum and Bitcoin. The growing acceptance of crypto-related technologies in mainstream banking is evident in the incorporation of blockchain technology into financial services, such as JPMorgan's Onyx platform.

Due to businesses like Tesla and PayPal accepting cryptocurrencies as a form of payment, their usefulness has increased. Finally, decentralized finance (DeFi) platforms are disrupting traditional banking services; in 2023, their locked value surpassed USD 50 Billion. Investor confidence and regulatory landscapes are being driven by the U.S. Securities and Exchange Commission (SEC). States that have passed crypto-friendly legislation, such as Wyoming and Texas, have attracted miners and entrepreneurs. Chances for a U.S. Central Bank Digital Currency (CBDC) and the expansion of blockchain infrastructure enhance the attractiveness of the market view even further.

Asia Pacific Cryptocurrency Market Analysis

With strong adoption rates in places like China, Japan, South Korea, and India, the Asia-Pacific region is a prominent market within the cryptocurrency business. In 2023, the region accounted for over 30% of worldwide crypto transaction volumes, which means demand for digital assets was still going strong despite a crackdown from regulators in China. Retail adoption and interest in blockchain have propelled a rise in cryptocurrency investments in India, from USD 923 Million in 2020 to over USD 6.6 Billion in 2023. The exchanges like Binance and BitFlyer have added vibrancy to the market. South Korea and Japan are now setting the benchmark for crypto innovation and regulatory clarity. Other factors that can contribute are the growth of NFTs and blockchain-based gaming, especially in Southeast Asia. In addition, access is now also being enhanced across the region due to increased cryptocurrency ATMs and integration among exchanges and payment companies.

Latin America Cryptocurrency Market Analysis

In Latin America, demand for financial inclusion, high inflation rates, and instability of the economy are fueling growth of cryptocurrencies. Crypto has been adopted as an avenue for hedging currency devaluation by countries such as Venezuela, Argentina, and Brazil. Chainalysis, a blockchain data platform, reports that Argentina has now become the largest cryptocurrency user in the region for the June 2023–June 2024 period. The study found that stablecoin-related cryptocurrency transactions in Argentina were over USD 91.1 Billion, and those in Brazil came to USD 90.3 Billion. The creative use of digital currencies by El Salvador is seen in the country's adoption of Bitcoin as legal money. The other significant factor is remittances; cryptocurrencies facilitate faster and cheaper cross-border payments. Due to fintech company collaborations and increasing cellphone penetration, the unbanked population can now access digital assets.

Middle East and Africa Cryptocurrency Market Analysis

The usage of cryptocurrencies is increasing in the Middle East and Africa area due to technology developments and economic diversification. By 2024, the UAE has more than 400 crypto-focused businesses based in Dubai, making it a leader in blockchain innovation. Government-backed platforms such as Dubai's Kiklabb have made it possible for companies to pay for permits with Ethereum or Bitcoin. According to the data from Creditcoin, over 30% of African adults, including Nigeria, use or own cryptocurrencies as of 2023, mainly because of the need for peer-to-peer transactions and inexpensive remittances. Another proof of the potential in the region is the development of central bank digital currencies (CBDCs), such as eNaira in Nigeria.

Competitive Landscape:

The key players in the cryptocurrency market are actively engaged in several strategic initiatives to strengthen their positions and drive market growth. To meet the various needs of traders and investors, they are concentrating on broadening their product offerings to encompass a variety of cryptocurrencies and tokens. Major exchanges are also strengthening security protocols to safeguard user assets and win confidence in an industry vulnerable to cyberattacks. With the help of cryptocurrency investment products and services such funds based on Ethereum and Bitcoin, institutional players are becoming more involved. In addition, several exchanges are collaborating closely with authorities to set industry standards, and there is an increasing focus on compliance and regulatory adherence to address worries about fraud and money laundering. Overall, key players are working to provide a more secure, regulated, and user-friendly cryptocurrency ecosystem to attract a broader range of participants.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Advanced Micro Devices Inc.

- Alphapoint Corporation

- Bitfury Holding B.V.

- Coinbase Inc.

- Cryptomove Inc.

- Intel Corporation

- Microsoft Corporation

- Quantstamp Inc.

- Ripple Services Inc.

Recent Developments:

- October 2025: Citigroup announced plans to launch a cryptocurrency custody service by 2026, targeting institutional clients and asset managers. The offering, in development for 2–3 years, will support native cryptocurrencies like Bitcoin and Ethereum. Citi also revealed ongoing exploration into stablecoins and tokenized deposits as part of its broader digital asset strategy.

- October 2025: JPMorgan announced plans to offer crypto asset trading services to clients, expanding its presence in blockchain. This move reflects growing institutional interest and changing attitudes toward digital assets within traditional finance.

- October 2025: Cryptocurrency exchange Gemini launched its Australian arm, Gemini Intergalactic Australia, to offer localized crypto exchange services. The firm, led by the Winklevoss twins, aims to tap into Australia's rising crypto adoption, which reached 31% this year. The move follows Gemini’s Nasdaq debut and $425 million IPO.

- October 2025: ENDRA Life Sciences raised $4.9 million through a private placement to launch a cryptocurrency treasury managed by Arca Investment Management. The funds will primarily support digital asset operations and cryptocurrency accumulation, with some directed toward a liver disease imaging study. The company plans a long-term crypto strategy involving staking, options, and DeFi participation.

- October 2025: CME Group announced plans to offer 24/7 cryptocurrency futures and options trading starting in early 2026. This move aims to meet the growing demand for continuous crypto market access. The extended hours will allow clients to manage risk and trade digital assets anytime.

- March 2025: A new cryptocurrency called Cocoro (COCORO) was launched on Ethereum’s Base network by Own the Doge, inspired by Atsuko Sato’s newly adopted Shiba Inu. The coin pays tribute to the legacy of Dogecoin and the original Doge meme. Cocoro aims to build on meme coin popularity with official IP backing.

- January 2025: Flockerz officially launched its $FLOCK cryptocurrency, raising over $14 million in presale and introducing a Vote-to-Earn (V2E) governance model. This system allows holders to earn rewards for participating in project decisions, aiming to set a new standard in community-driven crypto governance.

Cryptocurrency Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Micro Devices Inc., Alphapoint Corporation, Bitfury Holding B.V., Coinbase Inc., Cryptomove Inc., Intel Corporation, Microsoft Corporation, Quantstamp Inc., Ripple Services Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, cryptocurrency market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cryptocurrency market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cryptocurrency market was valued at USD 2,734.6 Billion in 2025.

IMARC estimates the cryptocurrency market to exhibit a CAGR of 9.60% during 2026-2034.

The key factors driving the global cryptocurrency market include increasing adoption of blockchain technology, rising demand for decentralized finance (DeFi) solutions, growing interest from institutional investors, and enhanced transparency and security in transactions. Additionally, advancements in crypto infrastructure, regulatory acceptance, and awareness of digital assets’ potential as alternative investments fuel market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the market.

Some of the major players in the global Cryptocurrency market include Advanced Micro Devices Inc., Alphapoint Corporation, Bitfury Holding B.V., Coinbase Inc., Cryptomove Inc., Intel Corporation, Microsoft Corporation, Quantstamp Inc., Ripple Services Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)