Cryogenic Pump Market Report by Type (Centrifugal Pumps, Positive Displacement Pump), End Use Industry (Energy and Power Generation Industry, Healthcare Industry, Electricals and Electronics Industry, Metallurgy Industry, Chemicals, and Others), and Region 2025-2033

Market Overview:

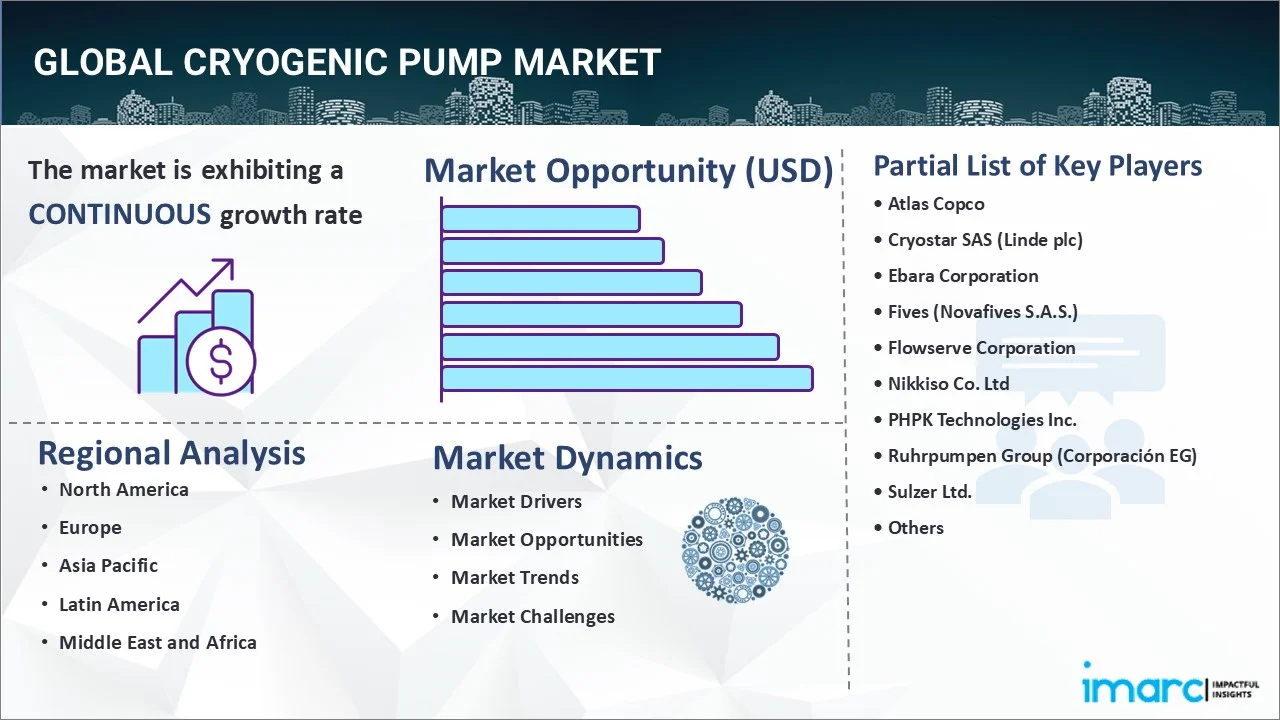

The global cryogenic pump market size reached USD 771.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,216.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The global demand for liquefied natural gas (LNG) to generate power and support transportation, improvements in pump design, materials, and safety features, and rapid industrial development are major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 771.9 Million |

| Market Forecast in 2033 | USD 1,216.2 Million |

| Market Growth Rate (2025-2033) | 5.2% |

Cryogenic Pump Market Analysis:

- Major Market Drivers: The global cryogenic pump market is experiencing moderate growth. It is because of the rising demand for liquified natural gas (LNG), where these pumps are essential for transportation.

- Key Market Trends: Technological innovations in materials science and engineering are enhancing the design and efficiency of cryogenic pumps.

- Geographical Trends: The Asia Pacific region is dominating the market owing to the growing investment in LNG infrastructure and favorable government policies.

- Competitive Landscape: Some of the major market players in the cryogenic pump industry include Atlas Copco, Cryostar SAS (Linde plc), Fives (Novafives S.A.S.), Sulzer Ltd., Weir Group PLC., Nikkiso Co. Ltd, among many others.

- Challenges and Opportunities: Challenges include high initial investment costs and the need for technical expertise in handling cryogenic substances. Nonetheless, cryogenic pump market opportunities are presented by key players through innovation and the development of cost-effective, user-friendly solutions.

Cryogenic Pump Market Trends/Drivers:

Rising demand for liquefied natural gas (LNG)

The increasing use of liquefied natural gas (LNG) in numerous countries as a cleaner substitute to coal for electricity generation is impelling the cryogenic pump market growth. According to the statistics from Natural Gas Monthly, in 2023, the United States emerged as the leading exporter of liquefied natural gas (LNG), with an average daily cargo of 11.9 billion cubic feet (Bcf/d), which is a 12% increase from 2022. Cryogenic pumps are essential for supporting several activities in the LNG value chain, such as distribution, liquefaction, production, and storage. These pumps support the overall integrity and efficacy of the process by safely and effectively delivering LNG at the necessary low temperatures. The rising demand for liquefied natural gas (LNG) influences the cryogenic pump market price, as increased LNG usage necessitates more efficient and scalable cryogenic pumping solutions.

Rising healthcare and biomedical applications

The rising usage of cryogenic pumps in healthcare and biomedical applications is strengthening the market growth. Cryogenic pumps play an essential role in enabling the long-term storage of biological materials at very low temperatures, such as blood, tissues, and small organs, in a variety of cryopreservation procedures. The rising medical research is driving the demand for biobanking and organ preservation ecoservices, which depend on cryogenic storage systems. Based on the data provide by the IMARC group, the biobanking market was valued at US$61.0 billion in 2023. The market is predicted to expand at a CAGR of 5.4% from 2024 to 2032.

These pumps are also used by the pharmaceutical sector to preserve drugs and vaccines that need to be stored at low temperatures. The need for high-quality cryogenic pumps is increasing due to the strict safety and dependability requirements in the healthcare industry. The cryogenic pump market revenue is projected to see moderate growth due to increasing applications across various industries, including healthcare.

Significant technological advancements

Sophisticated cryogenic pumps are emerging because of developments in materials science and engineering. Modern pumps are evolving to become more reliable, strong, and efficient. They are easy for operators to use because of their sophisticated seals, computerized control systems, and other safety features. These improvements in technology not only prolong the life of the pumps but also save running costs. As a result, cryogenic pumps are used in different industries, including petrochemicals and aerospace. Moreover, according to the report presented by the Aerospace Industries Association (AIA), the aerospace and defense sector export increased by 4.4% in 2022, reaching a total value of $104.8 billion.

Besides this, the cryogenic pump market statistics reveal a trajectory of moderate growth, driven by technological advancements and expanding applications across key industries.

Cryogenic Pump Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cryogenic pump market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type and end use industry.

Breakup by Type:

- Centrifugal Pumps

- Positive Displacement Pump

Centrifugal pumps represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes centrifugal pumps and positive displacement pump. According to the report, centrifugal pumps represented the largest segment.

Centrifugal pumps can easily handle large flow volume and are suitable for industries requiring high-volume transfer of cryogenic fluids like LNG. Centrifugal pumps have fewer moving parts compared to other types, such as reciprocating pumps, which results in lower maintenance costs and downtime, a crucial factor in industries where operational continuity is vital. These pumps can handle a broad range of cryogenic fluids, including liquid nitrogen and liquid oxygen, making them versatile for multiple industries, such as healthcare, aerospace, and manufacturing. As per the data provided by IMARC Group, in 2023 the liquid nitrogen market size was valued at US$ 19.4 billion worldwide. The market is predicted to expand at a growth rate of 5.2% from 2024 to 2032.

Additionally, the design of centrifugal pumps inherently allows for safer operation, especially when dealing with volatile substances at extreme temperatures. This makes them compliant with the stringent safety regulations often seen in the healthcare and energy sectors.

Breakup by End Use Industry:

- Energy and Power Generation Industry

- Healthcare Industry

- Electricals and Electronics Industry

- Metallurgy Industry

- Chemicals

- Others

Energy and power generation industry holds the largest market share

A detailed breakup and analysis of the market based on the end use industry has also been provided in the report. This includes the energy and power generation industry, healthcare industry, electricals and electronics industry, metallurgy industry, chemicals, and others. According to the report, the energy and power generation industry accounted for the largest market share.

The cryogenic pump plays a pivotal role in the energy and power generation industry, specifically in applications that involve extremely low-temperature fluids. Moreover, cryogenic pumps are indispensable for the efficient transfer, storage, and distribution of LNG, which is increasingly being used as a cleaner fuel for power generation. These pumps ensure that LNG is moved safely from production facilities to storage tanks and onward to power plants. In aerospace applications, cryogenic pumps are used for fueling rocket engines with cryogenic propellants like liquid oxygen and liquid hydrogen, thereby offering a favorable cryogenic pump market outlook. As hydrogen becomes a key element in renewable energy strategies, cryogenic pumps are needed for handling liquefied hydrogen in fuel cell systems. Cryogenic pumps are used in the production and distribution of industrial gases, such as liquid nitrogen and oxygen, which have applications in power generation plants for processes like cooling. In some power generation facilities, cryogenic pumps are used in refrigeration systems to achieve the extremely low temperatures required for specific operations.

The growing focus on cleaner energy sources and technological advancements in power generation significantly contribute to the cryogenic pump market demand in the energy and power generation industry. On the basis of the data provided by Central Electricity Authority (CEA) of India, the electricity generation target for 2023-24, including renewable energy, is set at 1750 billion Units (BU), indicating a growth of approximately 7.2% over the actual generation of 1624.158 BU in the previous year (2022-23). In comparison, the generation during 2022-23 was 1624.158 BU, up from 1491.859 BU in 2021-22, reflecting a growth of about 8.87%.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific holds the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest cryogenic pump market share.

The Asia Pacific region exhibits a clear dominance in the cryogenic pump industry due to increasing industrialization and urbanization, driving high energy needs, particularly for cleaner fuel alternatives like liquefied natural gas (LNG). Cryogenic pumps are vital for the efficient storage and distribution of LNG. Moreover, regulatory bodies are investing heavily in healthcare infrastructure. This is driving the demand for cryogenic pumps for storing biological samples at extremely low temperatures. Apart from this, the region is a hub for various manufacturing sectors, including petrochemicals, metallurgy, and electronics, where cryogenic pumps are used for handling liquid nitrogen and oxygen. For instance, according to the Department of Chemicals & Petro-Chemicals of India, the chemical and petrochemical (CPC) industry of the country commands a notable global market value of 178 billion USD. This figure will rise to approximately 300 billion USD by the year 2025, indicating significant growth potential within the sector. Additionally, favorable government policies and incentives to promote clean energy and advanced healthcare services are propelling the market growth in the Asia Pacific region.

Competitive Landscape:

Major companies in the cryogenic pump industry are concentrating on a variety of strategies to keep a competitive edge and drive growth. Technological innovation is a key area of focus where businesses are making large investments to build cryogenic pumps that are more dependable, user-friendly, and efficient. Features like real-time monitoring and enhanced safety mechanisms are also becoming standard offerings. Moreover, mergers and acquisitions (M&As) are prevalent, allowing companies to expand their product portfolios and enter new markets. Collaborations with industries that are significant users of cryogenic pumps, such as healthcare, energy, and manufacturing, are also rising, aiming to meet the specific needs and standards of these sectors. Companies are concentrating on geographic expansion, particularly in emerging markets where rapid industrialization and healthcare advancements create substantial demand for cryogenic pumps. These strategies are complemented by efforts to meet stringent regulatory requirements, which ensures broader market acceptance.

Apart from this, the cryogenic pump market recent developments reveal that leading players are prioritizing strategic collaborations to expand their footprint and enhance their offerings in the rapidly evolving market landscape.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Atlas Copco

- Cryostar SAS (Linde plc)

- Ebara Corporation

- Fives (Novafives S.A.S.)

- Flowserve Corporation

- Nikkiso Co. Ltd

- PHPK Technologies Inc.

- Ruhrpumpen Group (Corporación EG)

- Sulzer Ltd.

- Sumitomo Heavy Industries Ltd

- Weir Group PLC.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- In July 2023, Atlas Copco completed the acquisition of the cryopump service and distribution business of ZEUS Co., Ltd. The business provides service and sales distribution for the Vacuum Technique business area’s CTI and Polycold products in South Korea.

- In April 2021, Nikkiso Cryo Inc. (NCI), Las Vegas NV, a member of Nikkiso Clean Energy and Industrial Gases Group (Group), a part of Nikkiso Co., Ltd (Japan) announced their new facility which increases their cryogenic pump production efficiency and capability.

- In December 2021, Edwards Vacuum launched a new cryopump for semiconductor applications, the CTI-Cryogenics On-Board IS 320F XVS Cryopump, which aims to deliver the most reliable and best-performing cryopump on the market.

- In November 2021: Ebara Corporation's Elliot Group completed a new US$60 million cryogenic pumps testing facility in Jeannette, Pennsylvania, featuring two cryogenic pump test stands and a dedicated expander test stand. The state-of-the-art facility aims to enhance testing capabilities for cryogenic equipment.

Cryogenic Pump Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Centrifugal Pumps, Positive Displacement Pump |

| End Use Industries Covered | Energy and Power Generation Industry, Healthcare Industry, Electricals and Electronics Industry, Metallurgy Industry, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Copco, Cryostar SAS (Linde plc), Ebara Corporation, Fives (Novafives S.A.S.), Flowserve Corporation, Nikkiso Co. Ltd, PHPK Technologies Inc., Ruhrpumpen Group (Corporación EG), Sulzer Ltd., Sumitomo Heavy Industries Ltd, Weir Group PLC. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cryogenic pump market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cryogenic pump market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cryogenic pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cryogenic pump market was valued at USD 771.9 Million in 2024.

We expect the global cryogenic pump market to exhibit a CAGR of 5.2% during 2025-2033.

The rising demand for cryogenic pumps across various industries, such as chemical, power generation, electronics, etc., as they provide high pumping speed and safety against power breakdown and oil contamination, is primarily driving the global cryogenic pump market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for cryogenic pumps.

Based on the type, the global cryogenic pump market has been segmented into centrifugal pump and positive displacement pump, where centrifugal pump currently holds the majority of the total market share.

Based on the end use industry, the global cryogenic pump market can be bifurcated into energy and power generation industry, healthcare industry, electricals and electronics industry, metallurgy industry, chemicals, and others. Currently, the energy and power generation industry exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global cryogenic pump market include Atlas Copco, Cryostar SAS (Linde plc), Ebara Corporation, Fives (Novafives S.A.S.), Flowserve Corporation, Nikkiso Co. Ltd, PHPK Technologies Inc., Ruhrpumpen Group (Corporación EG), Sulzer Ltd., Sumitomo Heavy Industries Ltd, and Weir Group PLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)