Crop Protection Chemicals Market Size, Share, Trends and Forecast by Product Type, Origin, Crop Type, Form, Mode of Application, and Region, 2025-2033

Crop Protection Chemicals Market Size and Share:

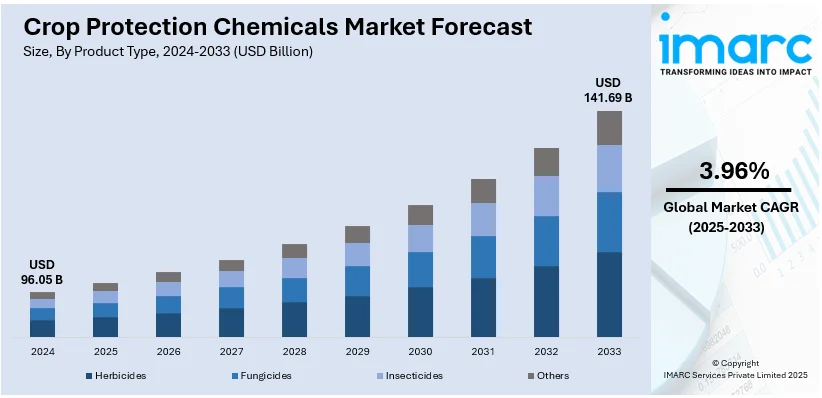

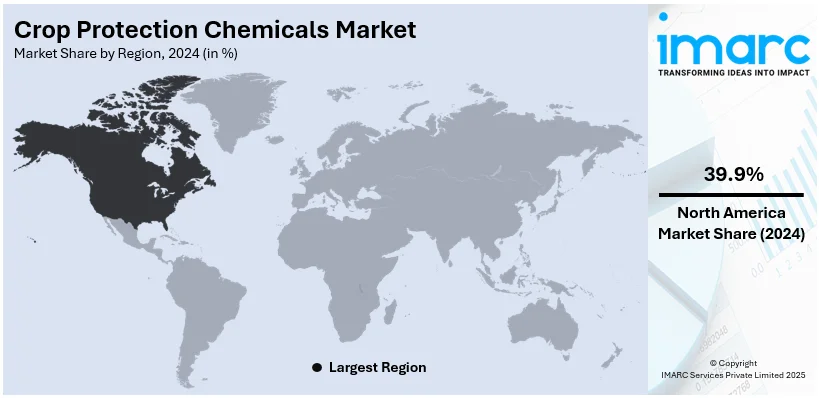

The global crop protection chemicals market size was valued at USD 96.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 141.69 Billion by 2033, exhibiting a CAGR of 3.96% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.9% in 2024. Some of the key drivers driving the market are the growing global population, expanding agricultural practices, the demand for improved crop yields, changing consumer preferences, technology improvements, government assistance and regulations, and pest pressure brought on by climate change.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 96.05 billion |

| Market Forecast in 2033 | USD 141.69 billion |

| Market Growth Rate (2025-2033) | 3.96% |

Key drivers in the crop protection chemicals market include the increasing global population and the corresponding demand for higher agricultural productivity. For instance, in 2024, the UN projects the global population at 8.2 billion rising to 9.7 billion by 2050 peaking at 10.3 billion in the mid-2080s. Limited arable land and soil degradation have amplified the requirement for effective pest and disease management solutions. Technological advancements in formulations, precision farming and integrated pest management are contributing to market growth. Heightened awareness among farmers about the benefits of agrochemicals and supportive government policies further boost demand. Consumer preferences for organic produce and stringent regulatory frameworks influence market dynamics pushing manufacturers to develop sustainable and bio-based alternatives that balance efficacy with environmental and health considerations.

Key drivers in the United States crop protection chemicals market include the rising adoption of advanced farming technologies and the need to maximize yield on limited arable land. Climate variability has increased pest and disease outbreaks, thus fueling the demand for effective chemical solutions. Genetically modified crops requiring specific herbicides also play a significant role. Supportive agricultural policies, investments in research for innovative formulations and a growing understanding of integrated pest management drive market growth. For instance, in May 2024, FMC Corporation announced a multi-year research agreement with AgroSpheres to develop sustainable bioinsecticides using RNA interference technology. This collaboration aims to enhance market entry for AgroSpheres' innovations while reinforcing FMC's leadership in insecticides promoting advanced agricultural practices and sustainability in crop protection. The shift toward sustainable farming practices has encouraged the development of bio-based crop protection products addressing consumer concerns about environmental safety while maintaining agricultural productivity.

Crop Protection Chemicals Market Trends

Increasing Global Population

According to the United Nations, the world is projected to reach 9.8 billion by 2050, hence posing a huge pressure on the food production systems. As this population expands, the demand for food becomes so high that it necessitates crop protection chemicals in terms of agricultural productivity. The chemicals protect crops from pests, diseases, and weeds, which may cause immense yield losses otherwise. This way, crop protection products will prevent such losses and enable the farmers to produce enough food to feed a larger population. Such demand will push for continued need for proper crop protection solutions around the globe.

Expanding Agricultural Practices

As cited by the Food and Agriculture Organization (FAO) agricultural land represents 38% of global land surfaces. In fact, one-third of the agricultural land area comprises cropland. With commercial farming becoming more widespread demand for crop protection chemicals becomes essential for managing pests, diseases, and weeds. In high-intensity farming systems where turnover and density of crops are high there exists an increased risk of infestations by pests and diseases and weed growths. Crop protection chemicals are the tools that allow farmers to protect their crops, optimize production and remain economically viable. It is through these means that larger-scale agricultural practices become feasible.

Rising Need for Higher Crop Yields

Crop protection chemicals have, according to a Food and Agriculture Organization report, the ability to reduce the effects of yield losses associated with pests, diseases and weeds thus enabling farmers to gain an increase in crop yields of as much as 50%. Besides boosting the economic returns to farmers this improvement in productivity is crucial to answering global food security needs. With a growing population and scarce arable land maximizing crop yields is the only way to ensure adequate food supply. Crop protection chemicals contribute to both local and global food security by protecting crops from various threats thus ensuring that enough food can be produced to meet growing demands.

Crop Protection Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global crop protection chemicals market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on product type, origin, crop type, form, and mode of application.

Analysis by Product Type:

- Herbicides

- Fungicides

- Insecticides

- Others

Herbicides leads the market with around 44.0% of market share in 2024. In agriculture, weeds are a common and enduring issue that compete with crops for vital resources like sunshine, water, and nutrients. Herbicides offer an effective solution for weed control making them a critical tool for farmers. Herbicides that selectively target, suppress, or eradicate weeds assist farmers in preserving the yield and quality of their crops. Herbicides also make controlling weeds easier and more effective. Herbicides provide a faster and more economical alternative to mechanical or manual weed control techniques. Large-scale farming operations can effectively manage weeds due to their ability to be administered over a wide region. Herbicides are a popular choice among farmers, especially in commercial agriculture, due to their time-saving advantages and ease of application. In addition, the creation of crops resistant to herbicides, such as genetically modified herbicide-tolerant cultivars, has raised the demand for herbicides. These crops are designed to withstand specific herbicides allowing farmers to apply herbicides without harming their crops. The adoption of herbicide-resistant crops has led to a significant increase in herbicide usage further driving the growth of the herbicides segment.

Analysis by Origin:

- Synthetic

- Natural

Synthetic leads the market with around 80.0% of crop protection market share in 2024. Synthetic chemicals offer a broad spectrum of effectiveness against various pests, diseases and weeds. These chemically synthesized compounds can be formulated to specifically target and control specific pests or diseases providing a reliable solution for farmers to protect their crops. This versatility and efficacy make synthetic pesticides highly desirable for crop protection. Additionally, synthetic pesticides often exhibit greater stability and longer shelf life compared to natural or bio-based alternatives. They can withstand various environmental conditions and retain their effectiveness over an extended period ensuring reliable and consistent crop protection. Other than this, synthetic pesticides can be manufactured at a large scale and are relatively more cost-effective compared to natural or organic alternatives. The production processes for synthetic pesticides are well-established allowing for efficient mass production which contributes to their availability and affordability for farmers. Besides this, synthetic pesticides often undergo rigorous testing and regulation to ensure their safety and efficacy. They are subjected to extensive research, development and evaluation processes which provides confidence to farmers and regulatory bodies regarding their performance and compliance with safety standards.

Analysis by Crop Type:

- Cereal and Grains

- Fruits and Vegetables

- Oilseed and Pulses

- Others

Cereals and grains leads the market with around 41.9% of market share in 2024. Cereals and grains are staple food crops consumed globally forming the foundation of many diets. The need for these crops remains consistently strong, influenced by aspects like population increase, evolving dietary choices, and rising urbanization. As a result, the production and protection of cereals and grains receive significant attention from farmers leading to a higher demand for crop protection chemicals. Additionally, cereals and grains are prone to a wide range of pests, diseases and weeds that can significantly impact their yield and quality. Insects, fungi and weed competition pose continuous threats to these crops necessitating effective crop protection measures. Crop protection chemicals including insecticides, fungicides and herbicides are crucial tools for managing these challenges and safeguarding the productivity of cereals and grains. Furthermore, cereals and grains are often cultivated over large areas making them suitable for mechanized and intensive farming practices. These practices require efficient and effective pest and weed control methods with crop protection chemicals offering practical solutions for managing pests and ensuring high yields.

Analysis by Form:

- Liquid

- Solid

Liquid leads the market with around 70.0% of market share in 2024. Liquid formulations offer convenience and ease of application. They can be easily mixed, sprayed, and distributed over large areas, allowing for efficient coverage of crops. Liquid formulations can be applied using various equipment, such as sprayers or irrigation systems, making them suitable for different farming practices and crop types. This versatility and convenience make liquid formulations a preferred choice for many farmers. Additionally, liquid formulations provide better penetration and absorption into plant tissues compared to other forms, such as granules or powders. The liquid form allows for better distribution and adherence to the plant surface, ensuring optimal contact and uptake of the active ingredients by pests or target organisms. This enhanced efficacy contributes to the popularity of liquid formulations in crop protection. Furthermore, liquid formulations often offer better storage stability compared to other forms. They are less prone to degradation or loss of effectiveness over time, allowing for longer shelf life and reducing the risk of product wastage. This stability is particularly important for large-scale agricultural operations, where storage and inventory management are crucial considerations.

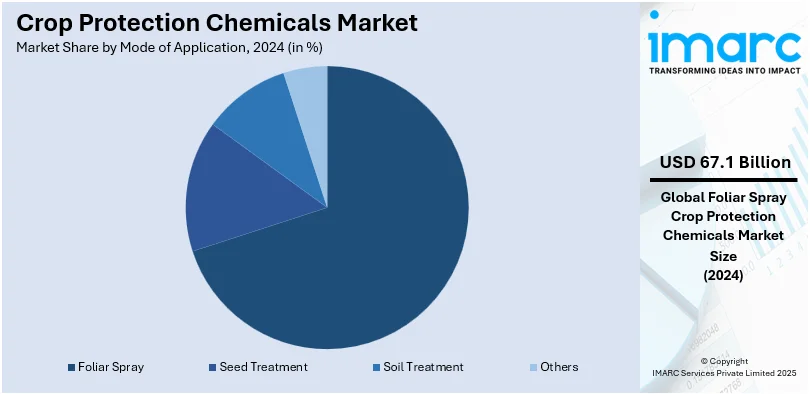

Analysis by Mode of Application:

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others

Foliar spray leads the market with around 69.9% of market share in 2024. Foliar spray offers direct and targeted application to the leaves of plants. This mode of application allows for efficient and effective delivery of crop protection chemicals to the foliage, where pests, diseases, and weeds often reside. Foliar sprays provide thorough coverage of the plant's surface, ensuring better contact with the target organisms and maximizing the efficacy of the applied chemicals. Additionally, foliar spray enables systemic movement within the plant. The spray droplets are absorbed by the leaves and can translocate to other parts of the plant, including the stems, flowers, and fruits. This systemic movement helps in protecting the entire plant from pests and diseases, even those not directly exposed to the spray. It provides a more comprehensive and holistic approach to crop protection. Furthermore, foliar sprays offer flexibility in timing and application. They can be applied at different growth stages of the plant, allowing farmers to address specific pest or disease pressures as they arise. Foliar sprays are also compatible with a wide range of crop types, making them applicable to various agricultural systems and crops.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 39.9%. North America has a significant agricultural sector, with extensive farming operations and a diverse range of crops cultivated throughout the region. The United States, in particular, is one of the largest agricultural producers globally, known for its substantial crop production and export capabilities. The high level of agricultural activity in North America drives the demand for crop protection chemicals, as farmers seek effective solutions to protect their crops from pests, diseases, and weeds. Additionally, the region has a well-developed infrastructure and advanced agricultural practices, including the adoption of modern technologies and precision farming techniques. These practices contribute to higher crop yields and productivity, and also necessitate effective crop protection measures. The region's strong emphasis on maximizing agricultural output further drives the demand for crop protection chemicals. Furthermore, North America has a robust regulatory framework that governs the use and registration of crop protection chemicals. The stringent regulations ensure the safety and effectiveness of these products, providing confidence to farmers and buyers. The compliance with these regulations enables the availability and use of a wide range of crop protection chemicals in the North American market.

Key Regional Takeaways:

United States Crop Protection Chemicals Market Analysis

In 2024, United States accounted for a share of 85.00% of the North America market. The advanced agricultural practices and high crop yields support the U.S. crop protection market. As reported by the USDA, in 2023, the farm income in the United States reached about USD 150 Billion, and this pushes investment into crop protection solutions for better yield. Herbicides account for the majority of the market, followed by fungicides and insecticides, with demand for genetically modified crops. Biopesticides adoption is accelerated by the thrust towards sustainable farming and has been growing at an annual rate of 15%, as per industry reports. Corteva Agriscience and Bayer Crop Science, among other big players, drive innovation in this field, specifically with regard to digital tools that enhance precision application. Federal policies favoring IPM contribute to the market growth. Crop protection product exports from the United States are gaining traction; thus, this country is emerging as the leader globally in sustainable agriculture.

Europe Crop Protection Chemicals Market Analysis

Strict regulations and sustainability projects feed a growing European crop protection market with a strong thrust upon biocontrol solutions. The International Biocontrol Manufacturers Association estimated that the European biocontrol market was over Euro 1.6 Billion (USD 1.74 Billion) as of April 2024, more than double its value in 2016. However, growth between 2019 and 2022 slowed because the EU authorization process can take up to ten years for biocontrol products. This regulatory bottleneck is contrary to the increased demand triggered by policies in the EU Green Deal, which is trying to cut chemical pesticide use by 50% by 2030. The two big adopters are France and Germany, who account for more than 30% of biocontrol sales. The region's 17.4 million hectares of organic farmland in 2022 also drive these sales. BASF and Syngenta are trying to tackle this challenge with digital platforms to improve the efficacy of products and the safety of the environment.

Asia Pacific Crop Protection Chemicals Market Analysis

Growth is growing significantly in the Asia Pacific crop protection market on account of increasing food demands and extensive agricultural practices. As estimated by FAO, 377,000 tonnes of pesticides have been used by China during the year 2020 to maintain its position as the top user of such chemicals in that region. Its neighbouring country, India, ranks after China with usage above 61,000 tonnes with its extensive farmland along with its motivation towards increase in crop yields. Furthermore, awareness about sustainable practices has resulted in the widespread adoption of biopesticides. In this regard, countries like Japan and Australia are concentrating on eco-friendly solutions. Companies like UPL and Adama are leveraging this trend by touting advanced and sustainable products to strengthen their market presence. Collaborative efforts from governments and global players also promote the development of digital tools for precision pest management, making Asia Pacific a central hub for innovation in crop protection.

Latin America Crop Protection Chemicals Market Analysis

The large-scale agricultural activities in Latin America and its status as one of the world's leading exporters of soybeans and sugar make it an attractive market for crop protection. The National Union of the Vegetal Defense Products Industry estimated that Brazil alone accounted for over USD 13 Billion in pesticide sales in 2023, making it the largest market in the region. Herbicide-tolerant varieties have led the genetically modified crops market with more than 90% usage in soybean acreage. Biopesticides have gained momentum in countries such as Argentina and Colombia with a CAGR of 12%, helping to mitigate environmental concerns. Syngenta and FMC players dominate the region, which is capitalizing on government initiatives to enhance research and development in eco-friendly solutions. The demand of precision farming technologies in the region and international trade agreements will help sustain the trend of growth in the market.

Middle East and Africa Crop Protection Chemicals Market Analysis

The crop protection market in the Middle East and Africa is growing steadily due to increased agricultural activities and food security initiatives. The African Development Bank states that agriculture contributes over 23% to Sub-Saharan Africa's GDP, hence the need for crop protection. South Africa leads the region with a market size of USD 1.1 Billion in the pesticide market for 2023. Governments have programs targeting the increase of adoption of biopesticides by promoting sustainable farming techniques. In the Middle East, Saudi Arabia and the UAE are investing heavily in crop protection advanced technologies for controlled environment farming. Major players, including Bayer and BASF, have chosen local distributor partnerships as a key expansion of market presence, which will sustain growth for the region in the long run.

Competitive Landscape:

Major players are investing heavily in R&D activities to develop innovative crop protection solutions. They concentrate on developing novel active components, advancing formulation techniques, and raising the products' efficacy and safety. R&D efforts also aim to develop sustainable and environmentally friendly alternatives, aligning with growing consumer and regulatory demands for more sustainable agriculture. Additionally, key players continually expand their product portfolios through acquisitions, partnerships, and licensing agreements. This strategy allows them to access new markets, technologies, and customer segments. Companies seek to provide farmers with comprehensive solutions by expanding their product offerings to address a variety of crop kinds, pests, and diseases. Aside from this, major players are integrating sustainable practices into their operations as a result of realizing the growing significance of sustainability. They invest in research to develop bio-based or bio-inspired solutions, reduce chemical residues, and promote integrated pest management practices. Moreover, sustainability initiatives also involve providing training and support to farmers on responsible product use and minimizing environmental impacts.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- BASF SE

- Corteva Agriscience

- Sumitomo Chemical Co. Ltd.

- Syngenta AG

- Bayer Cropscience AG

- FMC Corporation

- Monsanto Company

- Nufarm Limited

- ADAMA Agricultural Solutions Ltd.

Latest News and Developments:

- December 2024: ADAMA Ltd. said it has developed a new fungicidal Active Ingredient, Gilboa™, to combat cereal and oilseed rape diseases. The company has already submitted it to the Fungicide Resistance Action Committee (FRAC) with expectations that it will be allocated to a new mode of action group for cereals.

- June 2024: Bayer's 2024 Crop Science innovation update sees the company unveiling ten blockbusters in the next ten years, peaking over Euro 32 Billion (USD 33.28 Billion) in sales. These products are to help support regenerative agriculture, increase productivity, and address climate change. Bayer focuses on connected agricultural systems through gene editing and digital solutions that will improve farming and the environment.

- June 2024: FMC Canada and Novonesis signed a commercial agreement to distribute the biosolution products of Novonesis in Canada. It is looking forward to boosting the development of biological technology and integration with synthetic crop protection and precision agriculture technologies to benefit the farmers of Canada.

- January 2024: Syngenta and Enko announced the discovery of novel chemistry for control in crops of fungal disease. Using novel digital technologies, this platform fast-tracks R&D whilst incorporating safety measures at earlier stages.

- May 2023: Corteva, Inc. showcased its innovations aimed at farmers initiatives centered on sustainability and advancements in its leading R&D pipeline during the company’s update on innovation. By introducing key products the company is reinforcing its leadership role in the worldwide seed and crop protection market consistently providing solutions that enhance and safeguard yield potential for farmers around the globe.

Crop Protection Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Herbicides, Fungicides, Insecticides, Others |

| Origins Covered | Synthetic, Natural |

| Crop Types Covered | Cereal and Grains, Fruits and Vegetables, Oilseed and Pulses, Others |

| Forms Covered | Liquid, Solid |

| Modes of applications Covered | Foliar Spray, Seed Treatment, Soil Treatment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | BASF SE, Corteva Agriscience, Sumitomo Chemical Co., Ltd, Syngenta AG, Bayer Cropscience AG, FMC Corporation, Monsanto Company, Nufarm Limited and ADAMA Agricultural Solutions Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the crop protection chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global crop protection chemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the crop protection chemicals industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crop protection chemicals market was valued at USD 96.05 Billion in 2024.

IMARC estimates the crop protection chemicals market to exhibit a CAGR of 3.96% during 2025-2033, reaching a value of USD 141.69 Billion by 2033.

The key factors driving the crop protection chemicals market include the rising global population, expanding agricultural practices, the need for higher crop yields, advancements in technology, growing pest pressure due to climate change, and government support through favorable regulations.

North America currently dominates the crop protection chemicals market, accounting for a share exceeding 39.9%. This dominance is fueled by extensive farming operations, advanced agricultural practices, and a strong regulatory framework ensuring product safety and efficacy.

Some of the major players in the crop protection chemicals market include BASF SE, Corteva Agriscience, Sumitomo Chemical Co., Ltd, Syngenta AG, Bayer Cropscience AG, FMC Corporation, Monsanto Company, Nufarm Limited and ADAMA Agricultural Solutions Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)